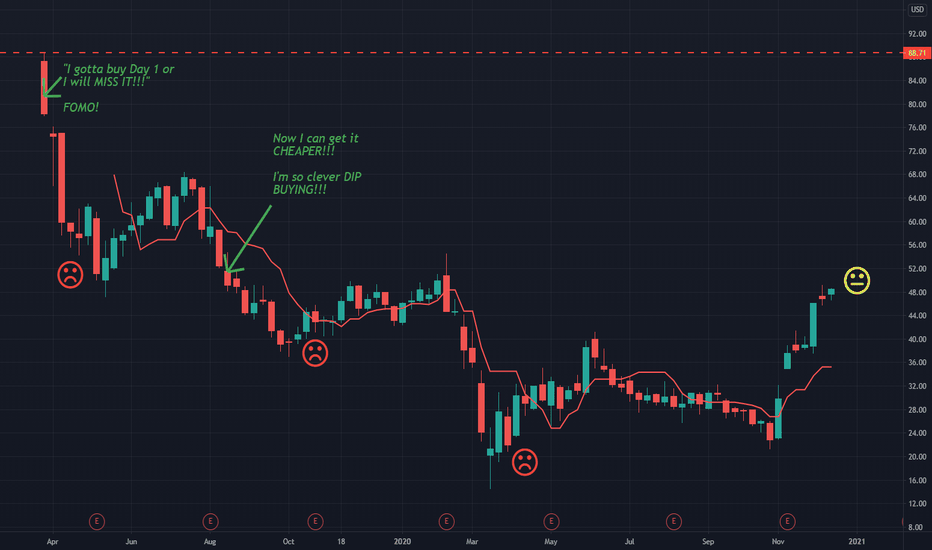

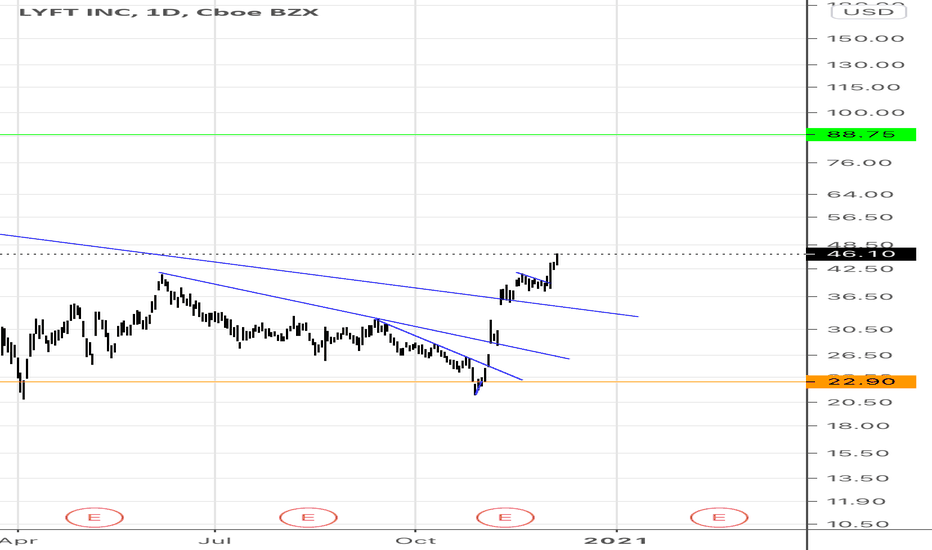

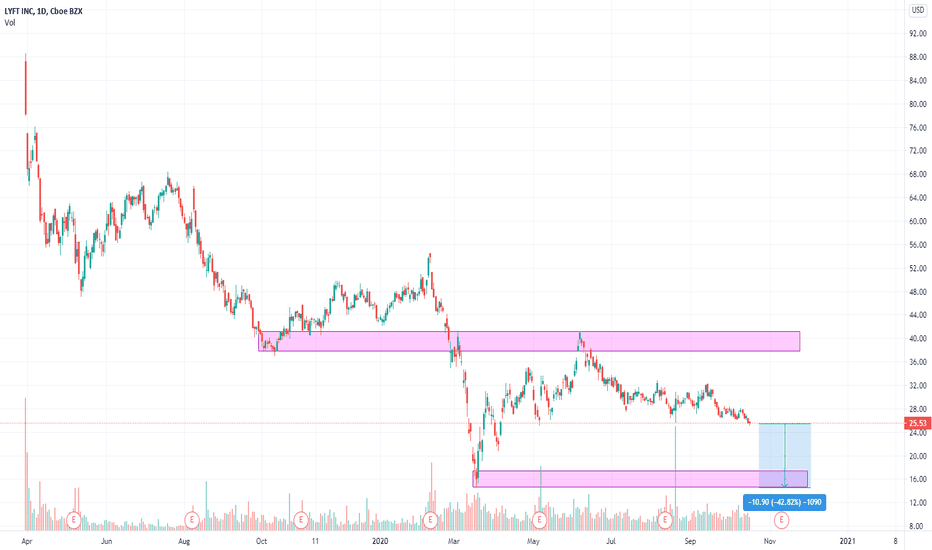

Example of a bad IPO playI drew this up for a user who asked more detail about the IPO playing strategy I have discussed before. It's important to look at the worst case scenarios (rather than the best case) when evaluating ways of trading. The guidelines are simple to base a trading strategy around:

Wait for the high of IPO week

Wait for the break

Take a pullback to that level

Risk management and trade management around these rules are up to the individual trader but those are guidelines that at least keep someone wanting to play an IPO out of trouble.

If a trader deviates from this plan they might get lucky, catch that falling knife, and be really happy at how "CLEVER" they were to get it at such a GREAT PRICE!

...But do that enough times and one time you'll become a bagholder.

Having a set SIGNAL and ENTRY keeps your trade DEFINED . It gives you something to base your risk and trade management. If you try to buy an IPO at an arbitrary price... where is your risk? Stock going to $0?

The key is for an IPO trader to avoid something like NASDAQ:LYFT which just never comes back. If you were to allocate capital to something like this it's easy for your capital to get destroyed because you really only have two hard price points of risk management:

Your maximum pain

Stock goes to $0

Neither are optimal situations for trading.

Have a plan. Trade your plan.

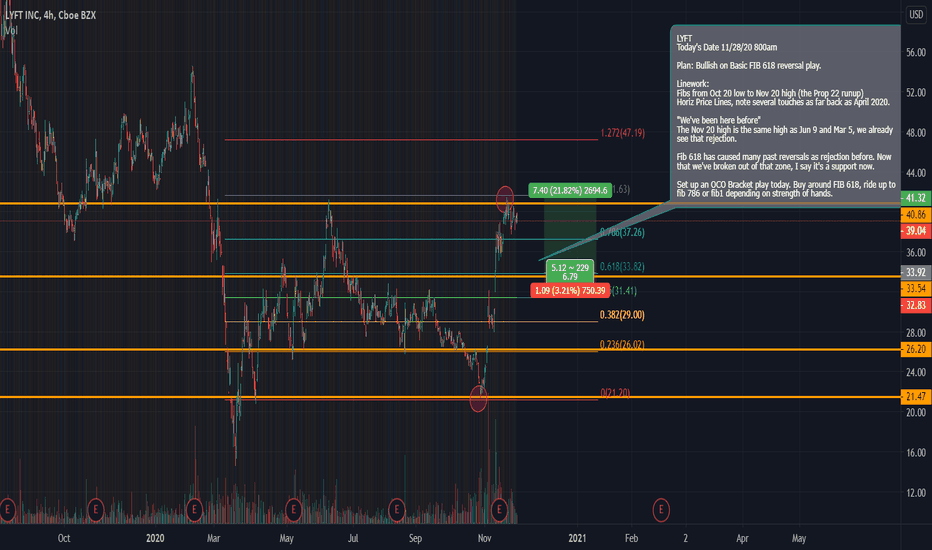

LYFT trade ideas

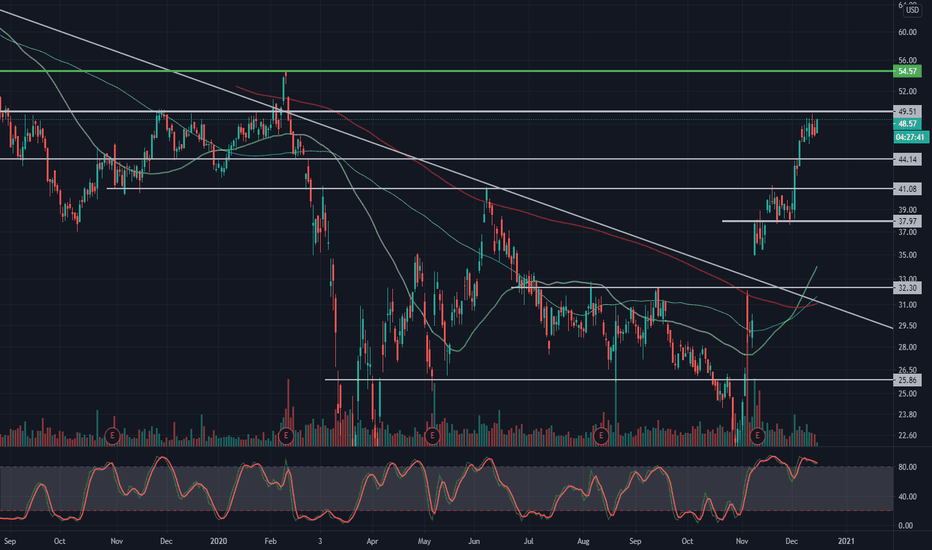

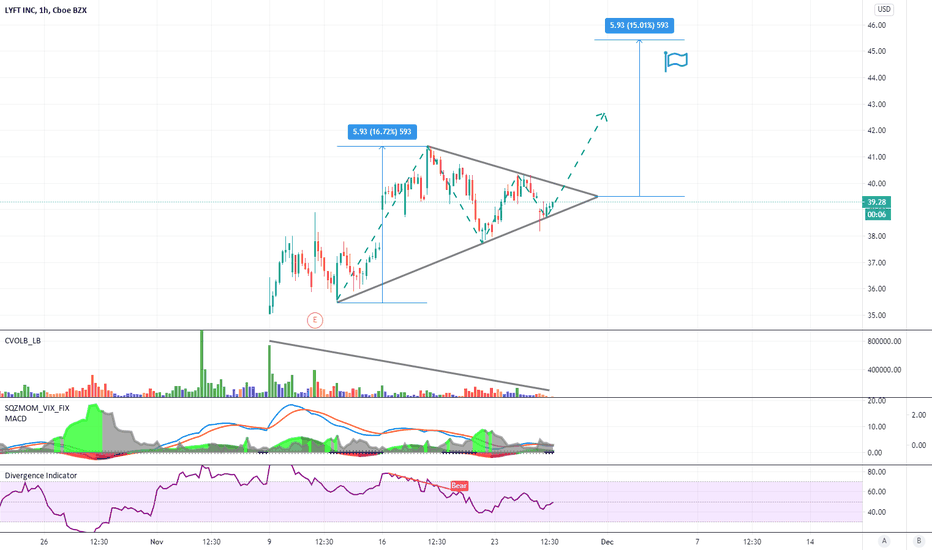

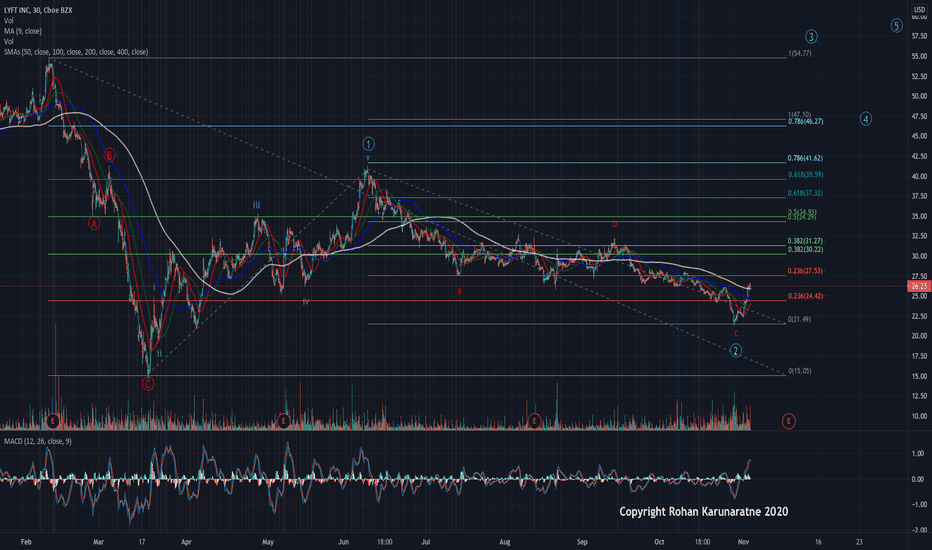

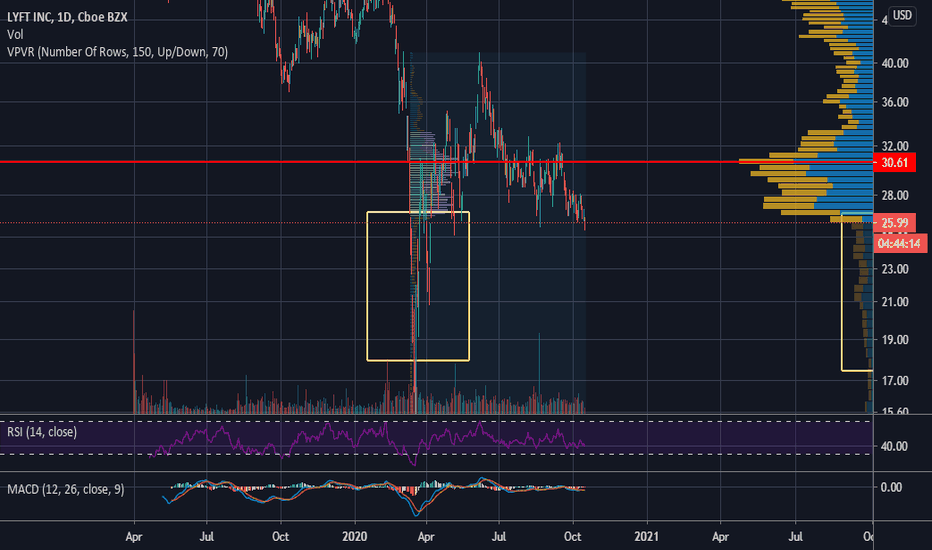

LYFT Fib 618 Reversal Play - The Basics!LYFT

Today's Date 11/28/20 800am

Plan: Bullish on Basic FIB 618 reversal play.

Linework:

Fibs from Oct 20 low to Nov 20 high (the Prop 22 runup)

Horiz Price Lines, note several touches as far back as April 2020.

"We've been here before"

The Nov 20 high is the same high as Jun 9 and Mar 5, we already see that rejection.

Fib 618 has caused many past reversals as rejection before. Now that we've broken out of that zone, I say it's a support now.

Set up an OCO Bracket play today. Buy around FIB 618, ride up to fib 786 or fib1 depending on strength of hands.

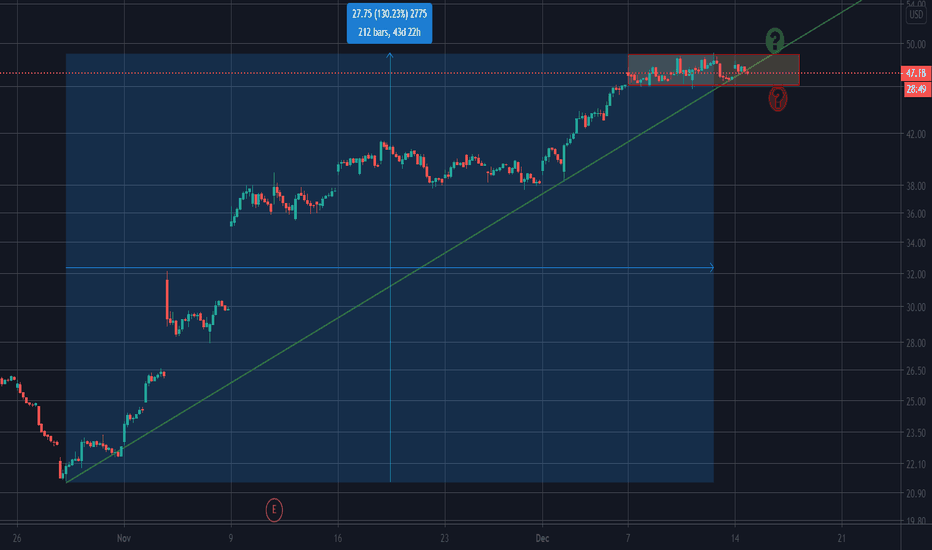

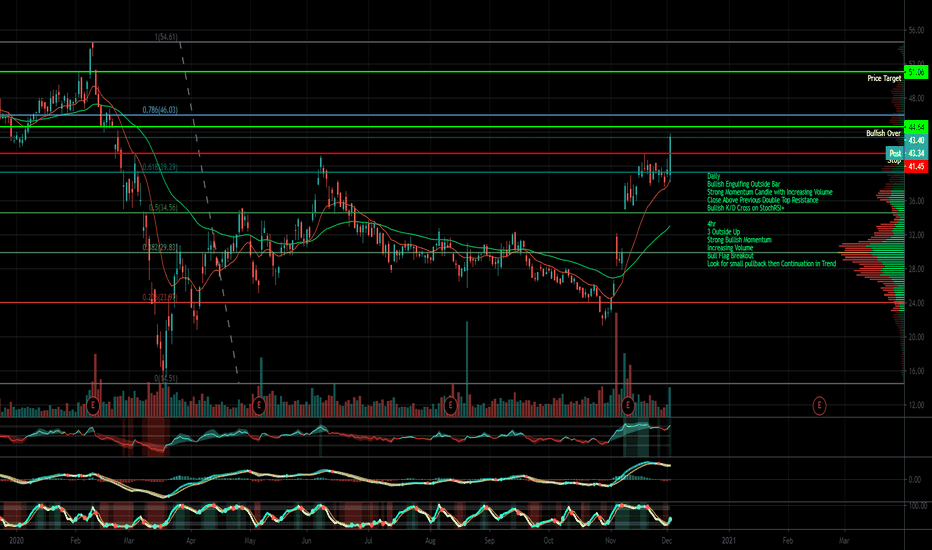

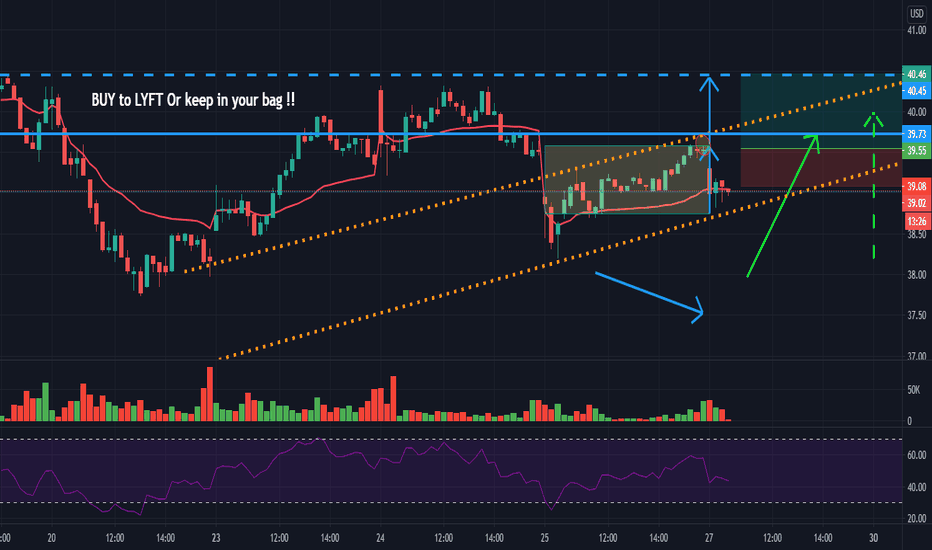

LYFT Chart Hey investors, LYFT is in a bullish channel with buy volume return and sellers wicking doji. Leaning on the TIMEFRAME M1 we see a form of doji with an unusual sales volume it is going to go to its last next lower. And turning around in this situation we can witness a test of the bullish channel with breakout of the price. While waiting for a breakout of the volume for the comfort zone and to leave the bullish channel for an aggressive buying acceleration.

Please LIKE & FOLLOW, thank you!

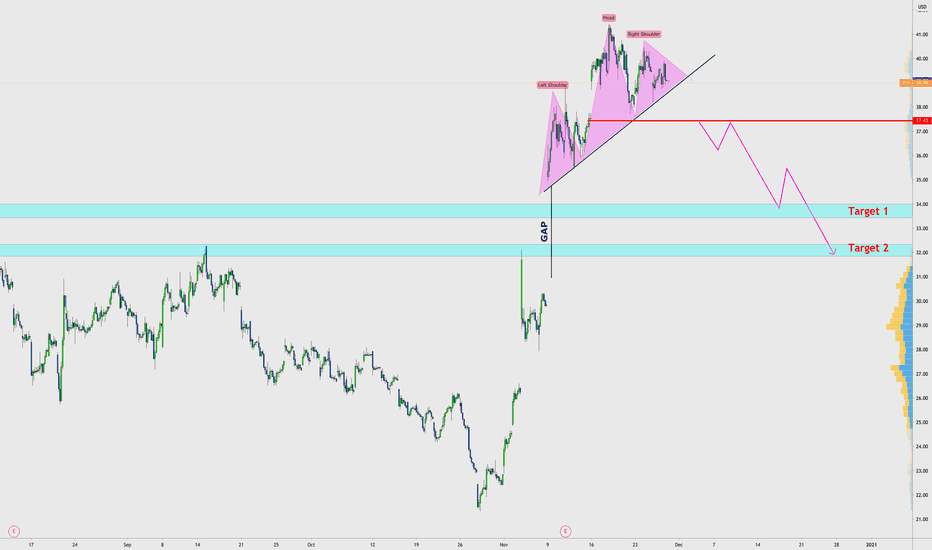

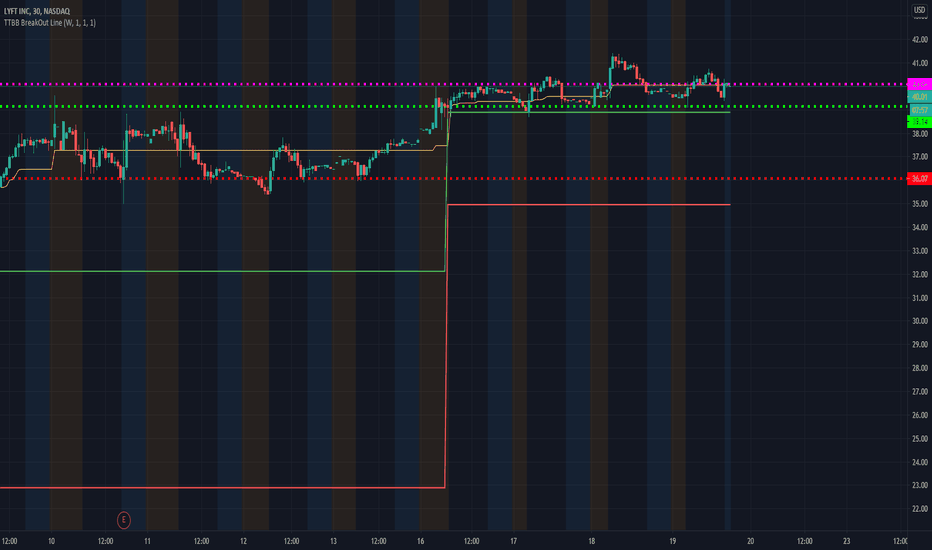

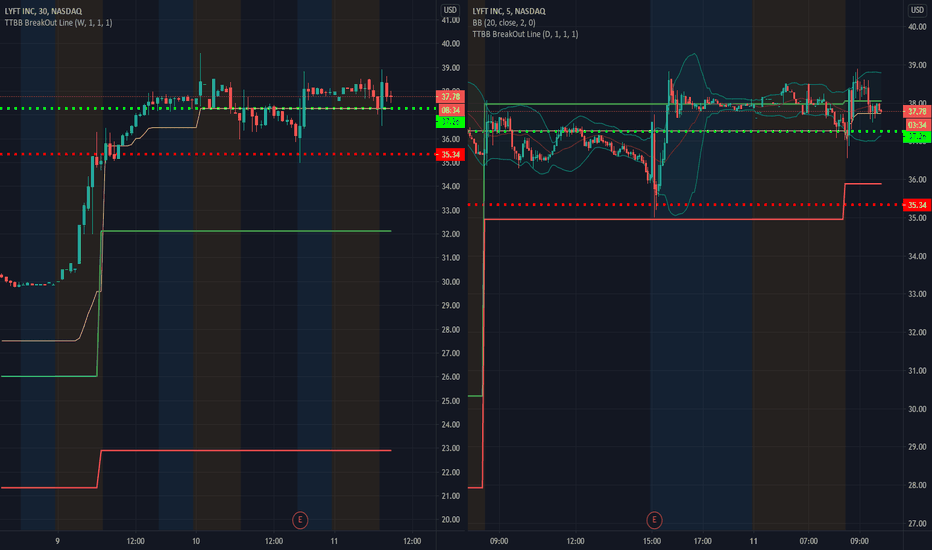

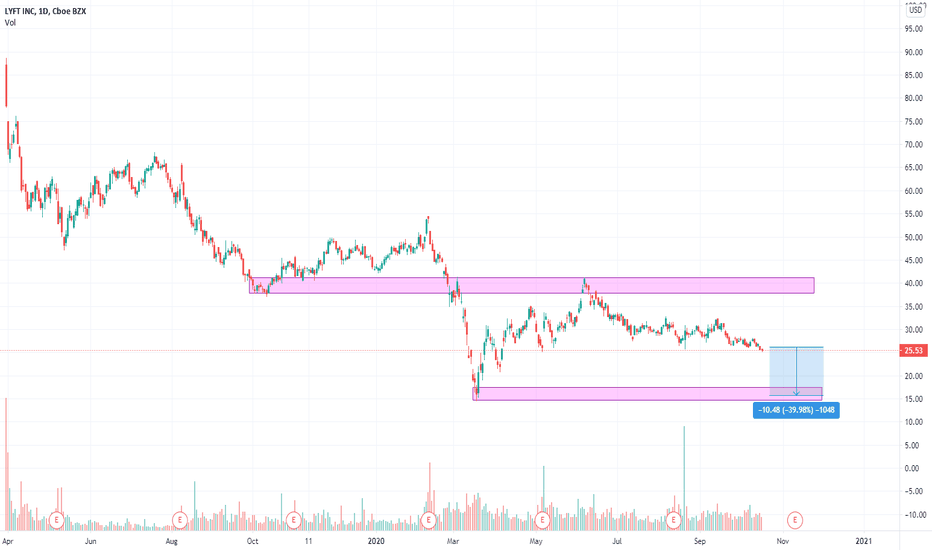

$LYFT Bearish Trade PlanGreen Line - Entry Target

Red Line - Exit Target

Pink Line - Stop-Loss

Highly suggest using Google to Search "Transparent Traders" if you're trying to get to the next level.

Transparent Traders exists to solve the critical issues facing our traders, both large and small. Our unique approach is not only what differentiates us, but also what makes us successful.

Our advanced Blackbox uses custom algorithms & predictive A.I. to locate the most accurate day or swing trades for the best chance of success.

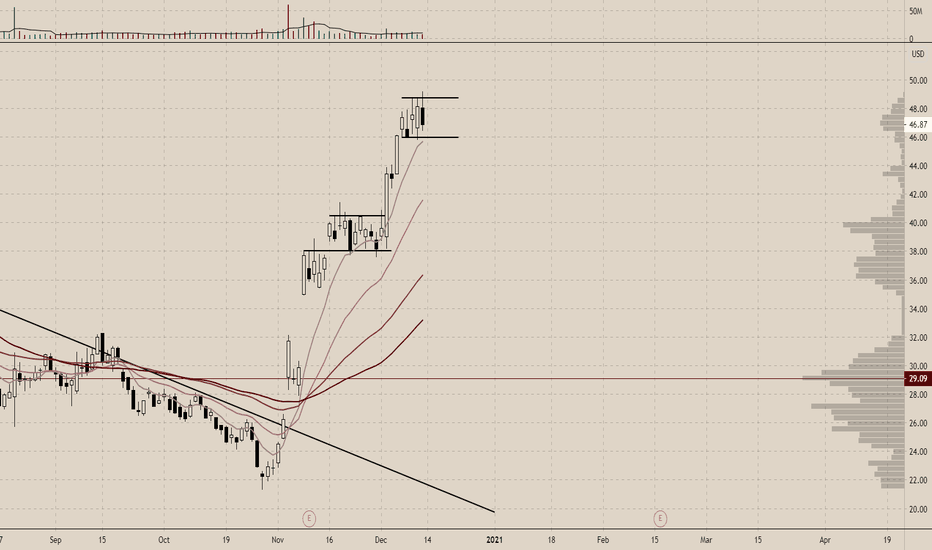

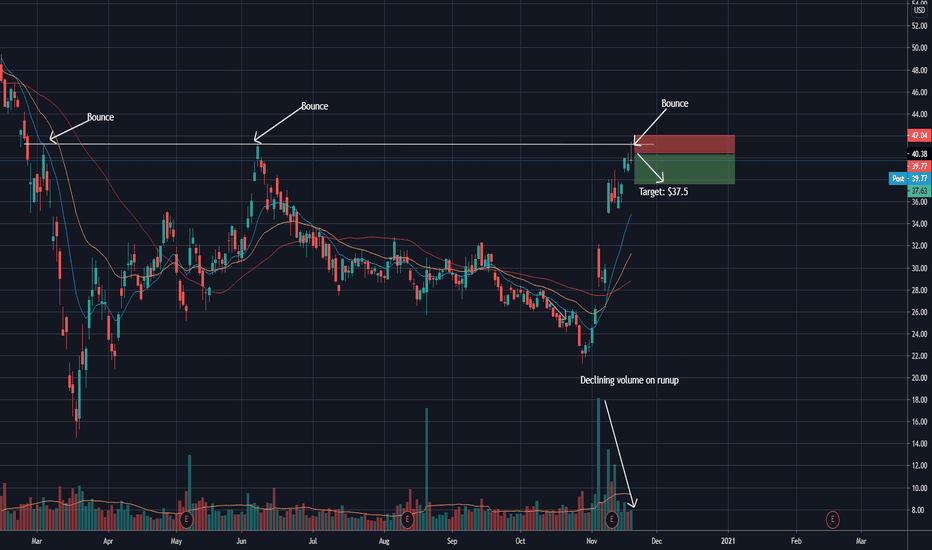

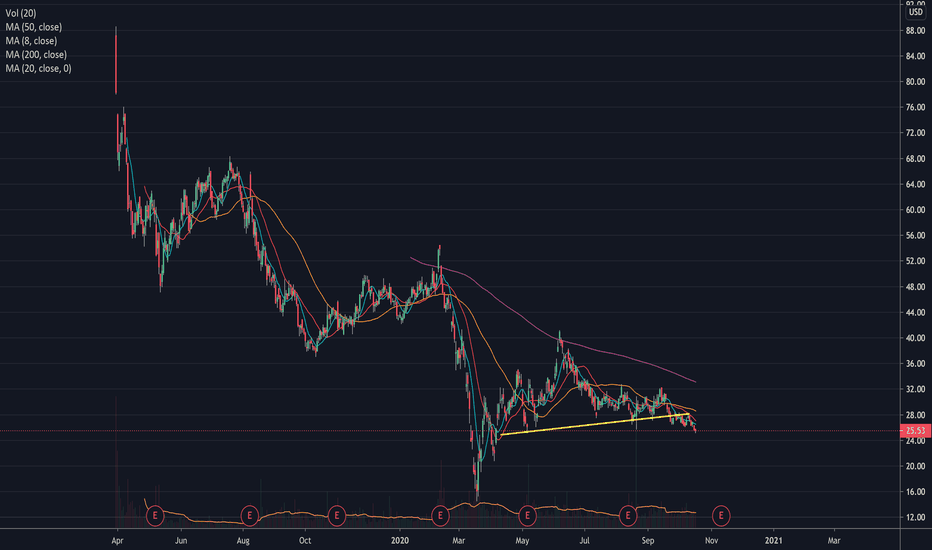

LYFT BounceLYFT has run up into resistance, which is now only its third test. Its run up into resistance was on declining volume. It also is exceeding its average true range and needs the moving averages to catch up before it can continue the trend. This points to a bounce off resistance leading to a pullback to the moving averages.

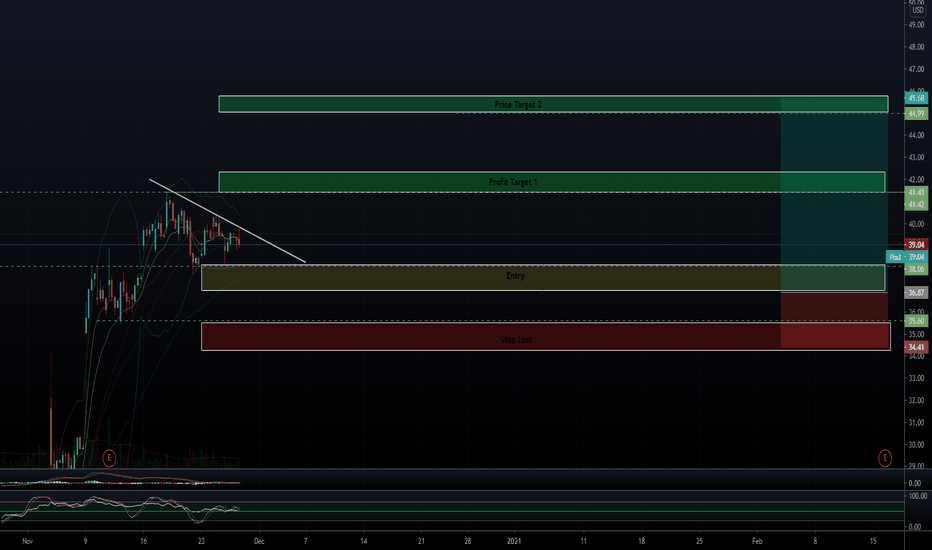

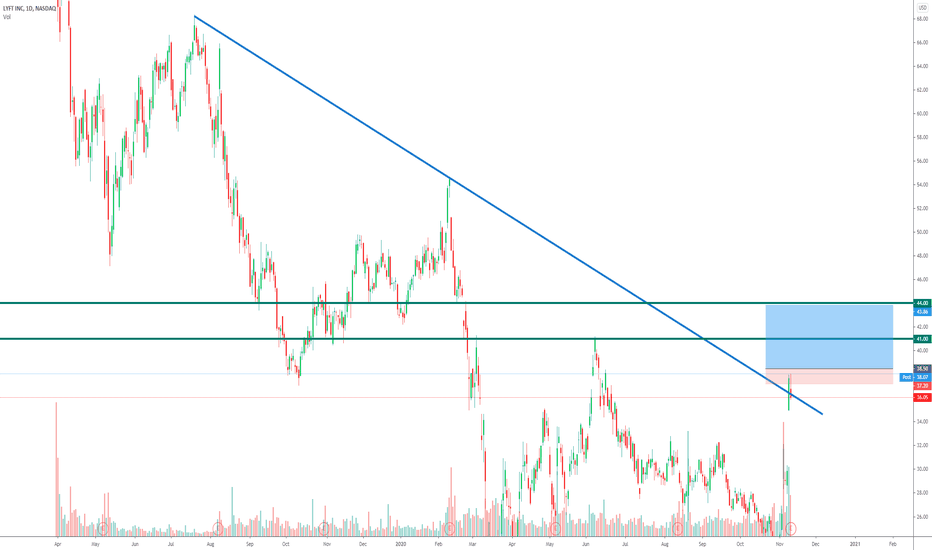

LONG LYFT POTENTIAL 30% UPSIDELYFT starting to move after a POST IPO dump.

Looks good on the long side taking into consideration UBERs recent move above its IPO level.

Entering the Food business, I believe further government regualtion will be good for the stock.

Potential double bottom, trade into $50 resistance level.