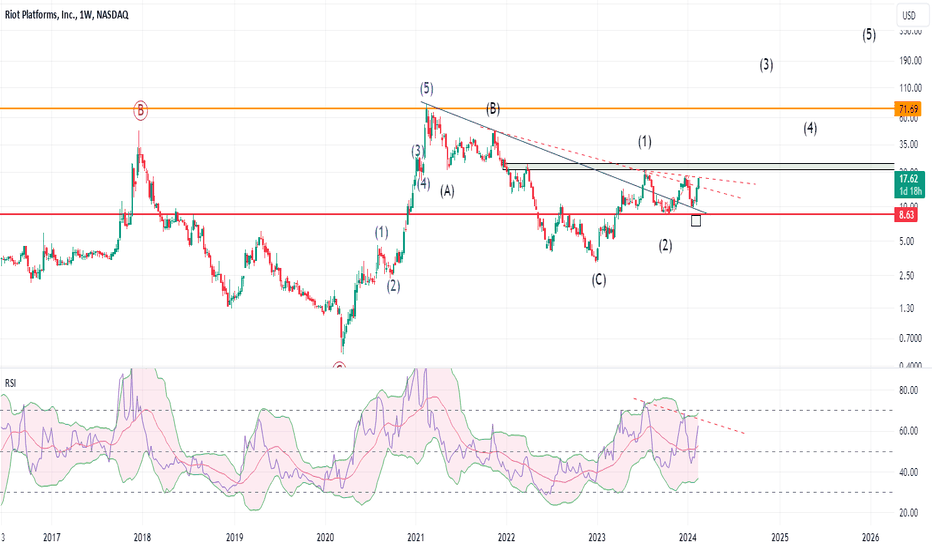

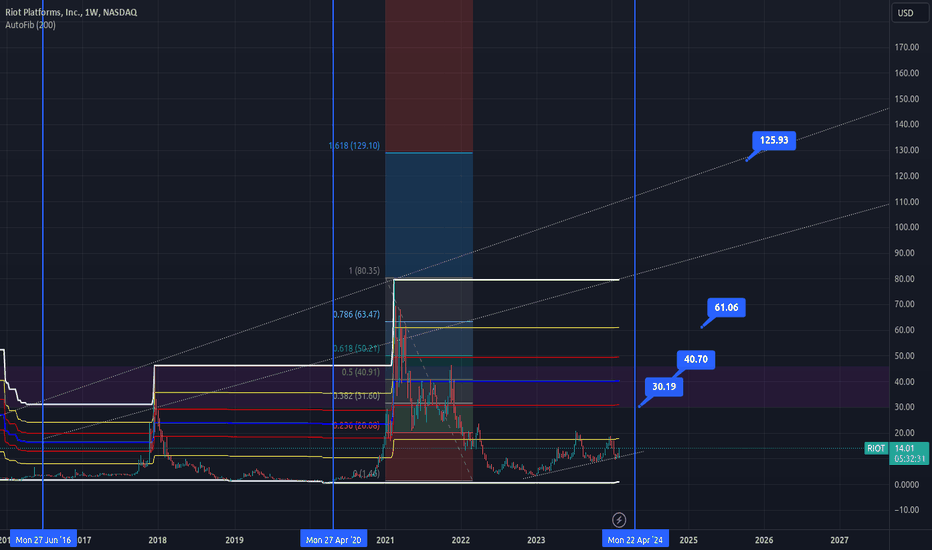

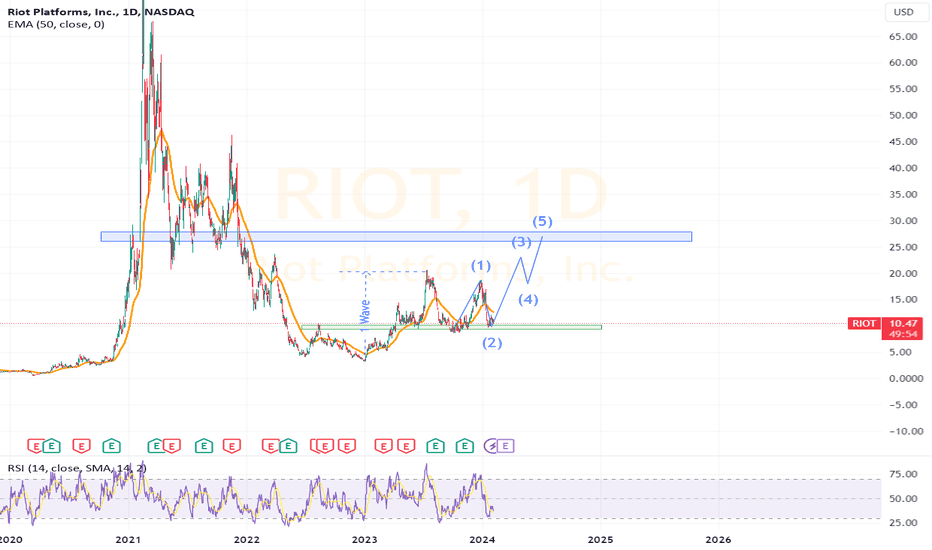

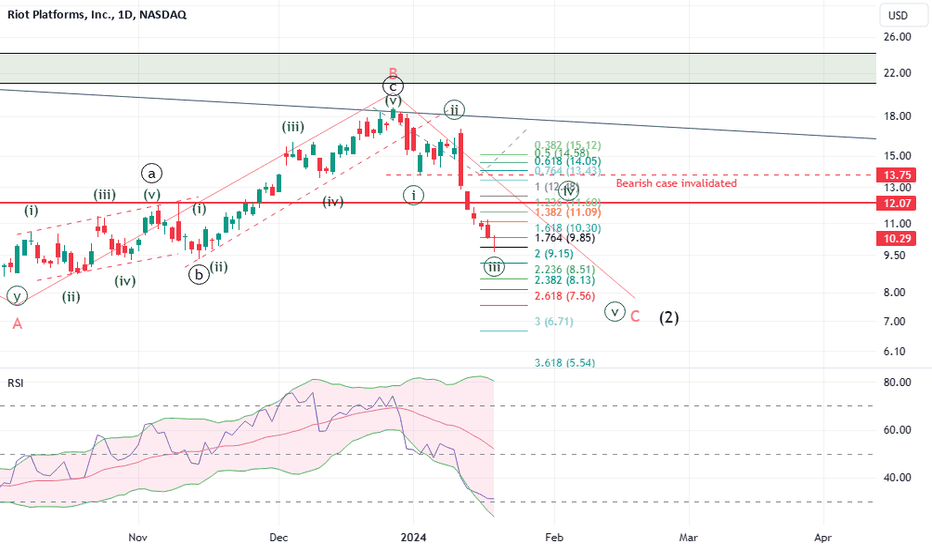

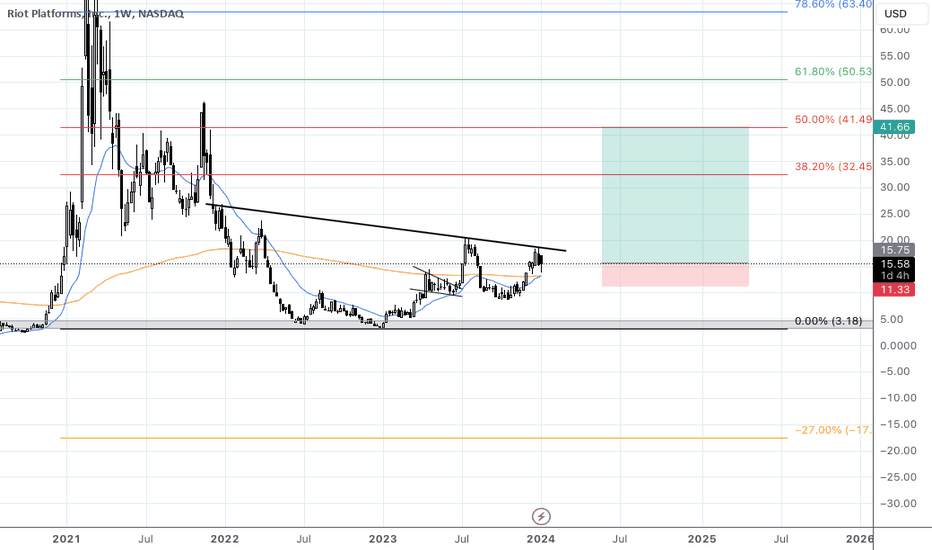

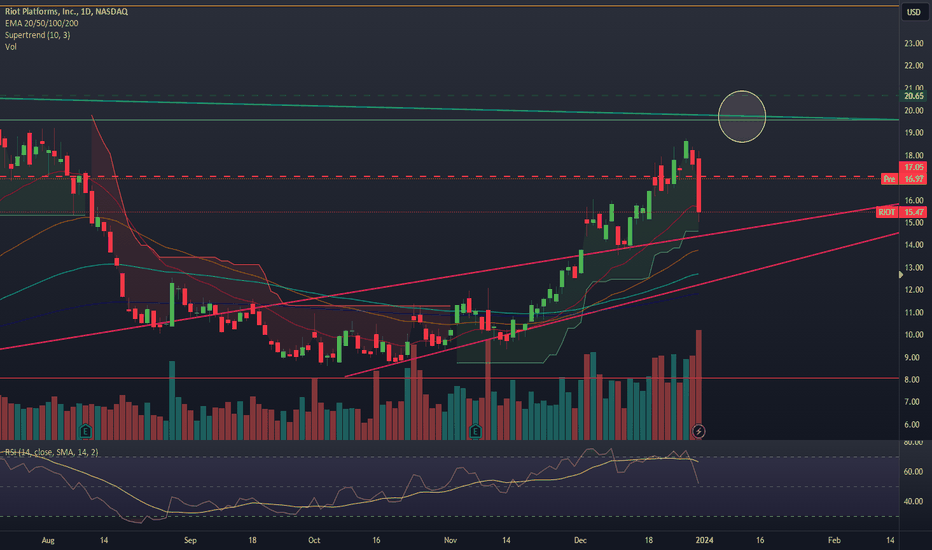

RIOT: Bull and Bear ideasRIOT has made a V recovery once again, making the bear case almost obsolete. The primary and secondary trendline resistance has been successfully broken and right on the third trendline resistance at the moment. Let's look at bull and bear case and see when to enter the rocket to the moon.

Bull case:

If this is the beginnings of intermediate wave 3, then the current price action is at the start of Minute degree wave 1. We should see a higher high above December high and then a correction. The correction or Minute degree wave 2 cannot break below $8.61. After that we should see the strongest part of the rally which will be a wave 3 of 3 of 3. Ideally, after a higher low is confirmed, entry point would be above the previous higher high. We are looking at triple digit numbers, so it is OK to wait until we see a solid support above $19.

Bear case:

Bear case would still suggest intermediate wave 2 is still in effect. The correction just got a whole lot more complex. The current price action could be part of a B wave triangle where a C wave is still in the books, or it could be part of a larger Y wave that will take things down back to previous lows. At this point these two scenarios cannot be written off. Need to let some more time pass before the bear case can be completely thrown out.

We should see a correction of the current runup in the next week or two. How that plays out will confirm which way is right. Ideally, a higher low and higher high on weekly will provide confidence on bull side.

RIOT trade ideas

RIOT: Potential Breakout or Bull Trap? Don't Chase Rainbows: RIOT's Inverse Head and Shoulders - Opportunity or Illusion?

RIOT's chart shows an interesting development with a potential inverse head and shoulders pattern. Based on technical analysis, this pattern could indicate a move towards $38. However, remember that the crypto market is volatile and reaching this target is not guaranteed.

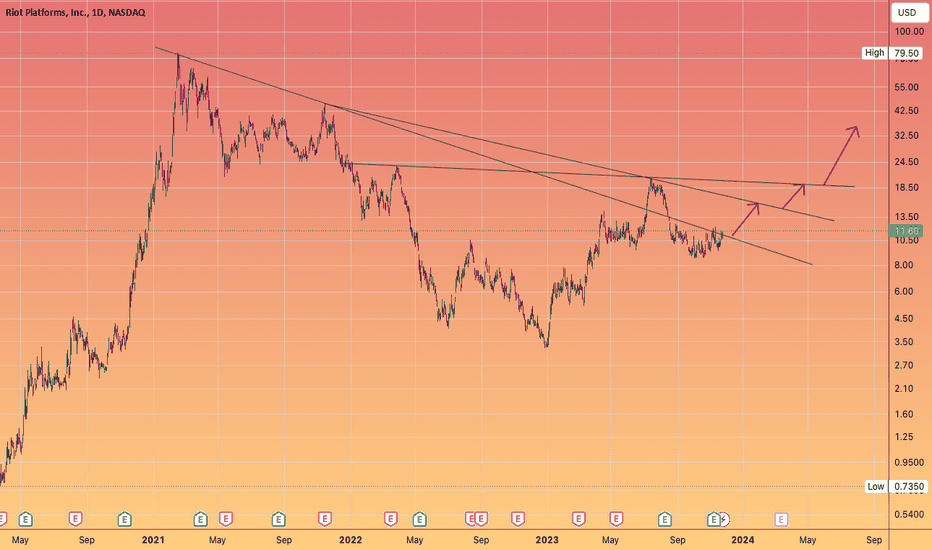

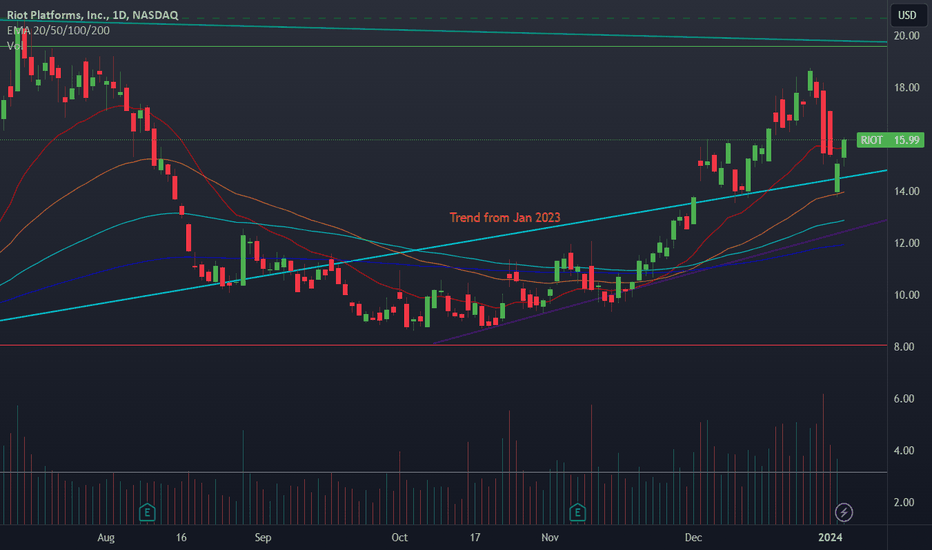

RIOTAnother Bitcoin associated runner that likely continues to ascend as long as BTC is in bull market.

If can break above 17 looks ready for a run at 22 resistance, after which it may consolidate before running higher to mid of the whole move (~$40) sometime around the halving event in April this year.

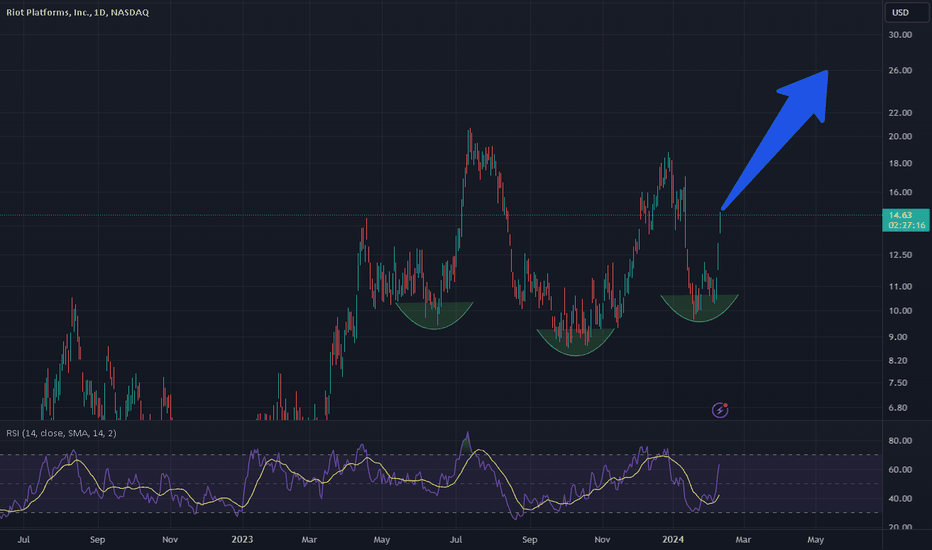

$RIOT - week of 2/12/24Short-term bullish on $RIOT. Dependent on BTC action and market conditions.

Looking for a hold over 14. Ideally, a retest of the ~14-14.25 range intraday

Would target 2/23, 15c or 16c. I expect some chop and/or an inside day in the beginning of the week, so want to buy some time. May even look at March cons.

TP1 @ 14.79

TP2 @ 16

TP3 runners @ 17

Recent uptrend continuation with volume, weekly bounced with strength off the TL

Strength in RSI

Daily and Weekly above all EMAs. Weekly just broke through 200ema with strength last week

9d & 20d EMA's crossed up above 200, working to continue upwards

BTC over 48k during this write up

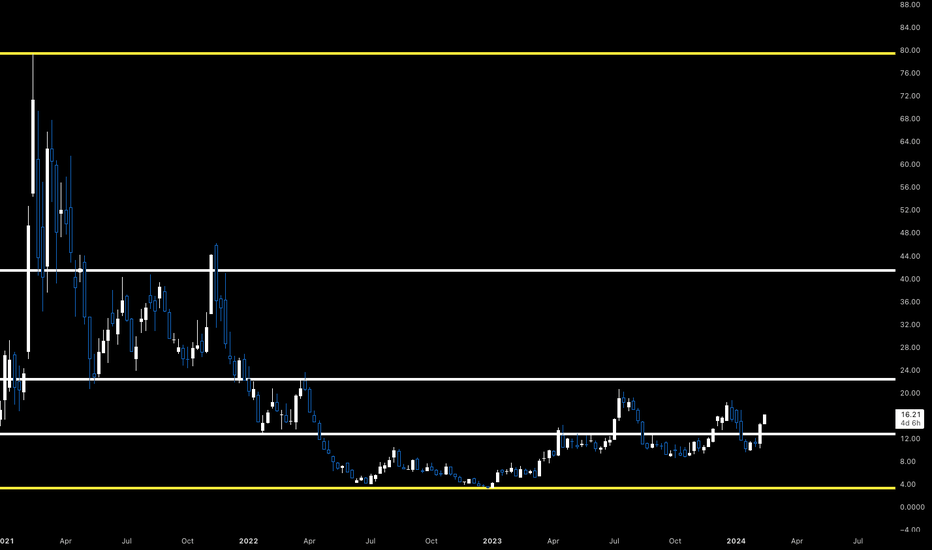

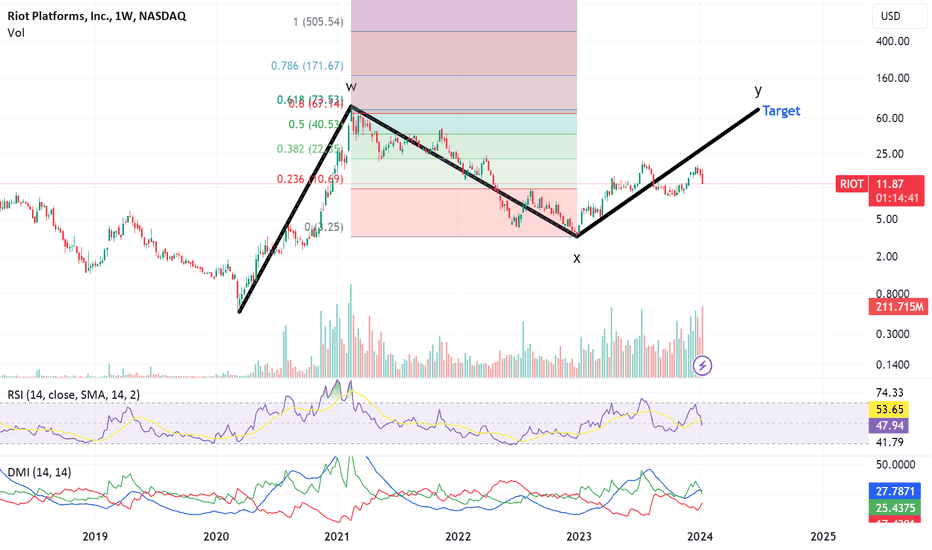

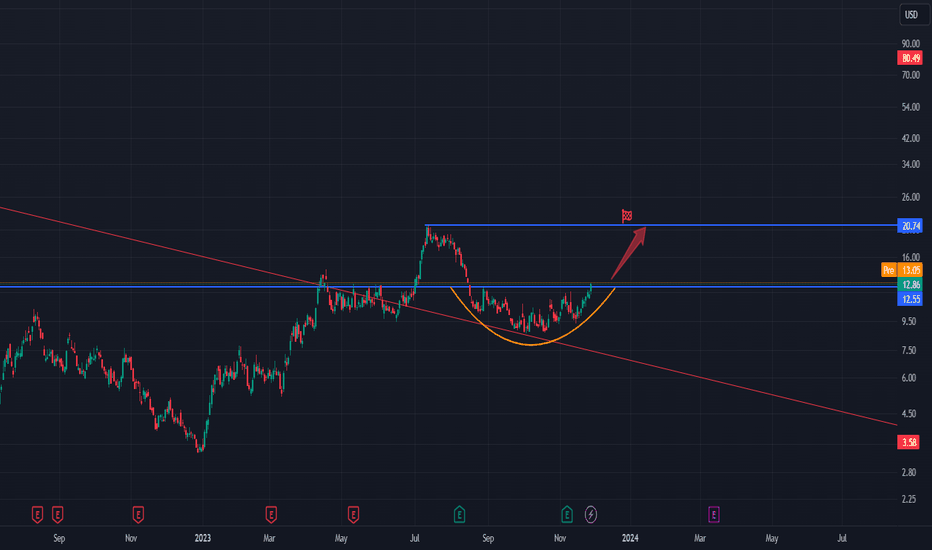

#RIOT Blockchain 3 levels of resistance to overcomeWhich I think it will slice through!

#Bitcoin miners tend to follow big technical patterns really well.

From the top you can see the massive bear flag that lasted pretty much all of 2021

all whist in the bitcoin bull market and non conforming disappointing price action

the secondary bear flag in 2022 that led to a precipitous drop

and now there is a potential,

if we get strong rally to the $20 area ...

we could form a very large inverse head and shoulders!

Looks promising.

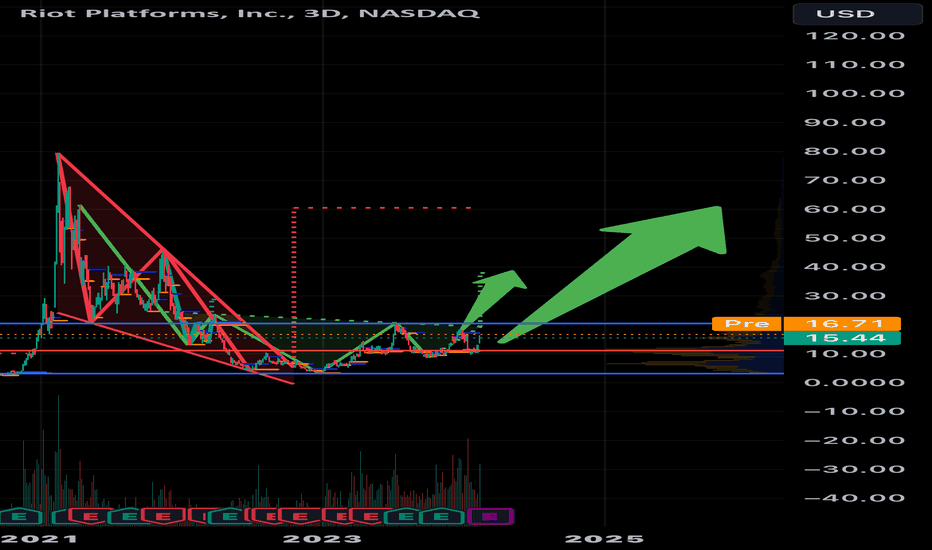

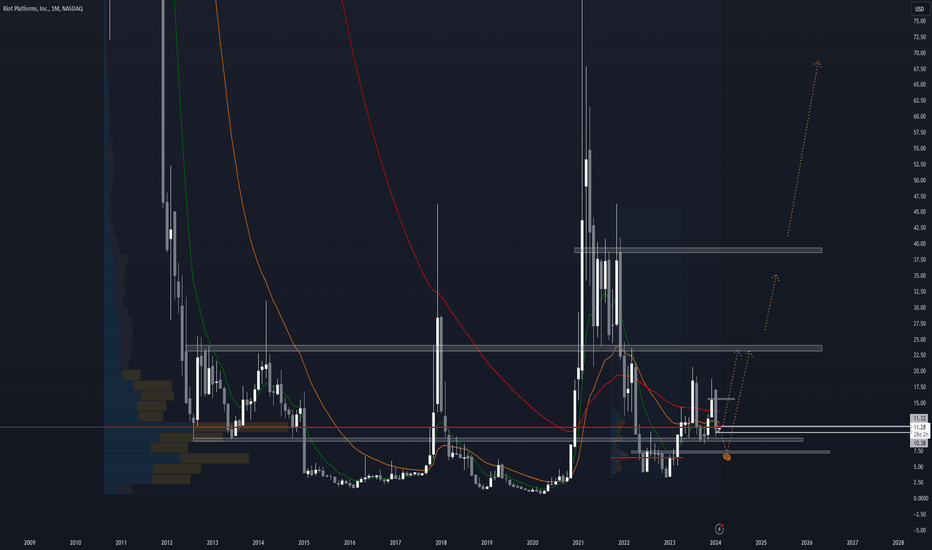

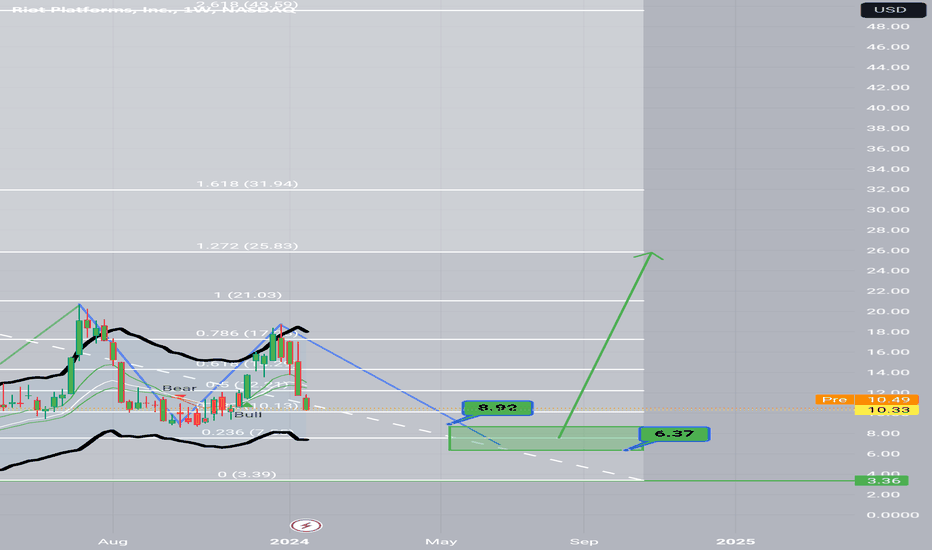

Crypto Stocks Ready to FLY?!Big boy liquidity has been building up at current support levels for crypto related stocks.

From these regions, Price can absolutely fly, or die haha.

The risk to reward to start averaging with very high probable buy positions is $6.50 (prime entry region) to current levels around $11 region

Liquidity shows all of the potential at these levels. The rewards can be extremely handsome =)

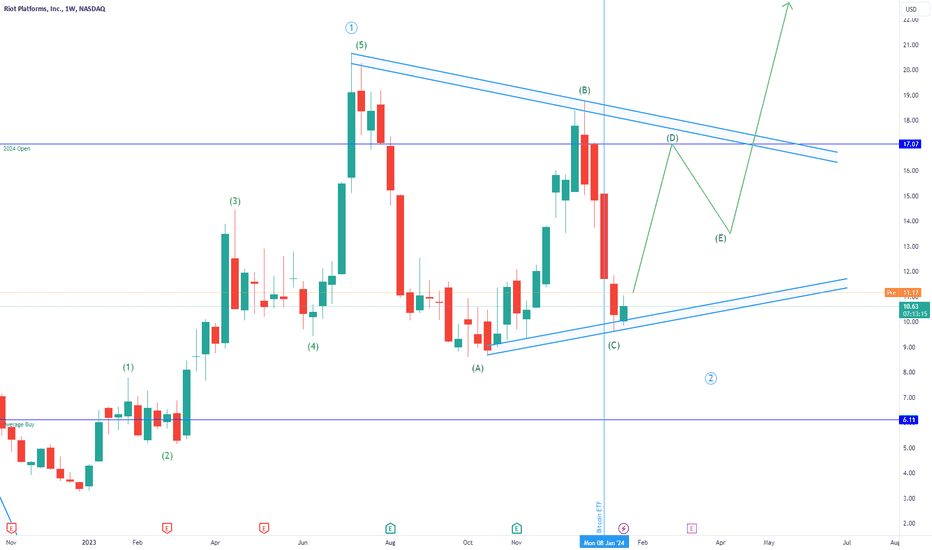

RIOT: Choppy action upwards. Brace for impact!The bounce upward this week is looking choppy and corrective, keeping the bearish count alive. If this path continues next week, we should see heavy resistance between $12 and $13. The leg down afterwards should be the last leg on this downside, and we should see the entire crypto market come alive with intense impulsive drive when that is done. Right now, if we see a break above $ 13.75 and a sustained price action above $10, then things might start to look more bullish. Until that happens, shorting the resistance area would be the next play.

RIOT: Bounce incomingRIOT is going through a major rout right now. It has fallen much harder compared to BTC. At this point we should see at least a relief rally for both. Current price action looks like a larger wave C is playing out. However, we cannot completely discount the bullish case. The way to identify would be the pace and strength of the next move. If we see a choppy wave 4 type of price action, then the expected wave 5 to around $7.5 area should play out in the next few weeks. If we see a very sharp reversal the takes price above $13.75, then something else is going on and will need to switch to the bullish count. In either case, a buy signal should present itself in the coming weeks.

Riot wait buy and waitRiot a share in every crypto portfolio. I am assuming an entry period of the next 4 weeks. Compared to many short fans who see Bitcoin in further depth, I am firmly convinced that we have been in the bull market since September, exceeding USD 25,000, and that the market will not allow a major price decline. I'm betting on Riot in this crypto bull market. I am pursuing the entry target of a bullish Gartley, and the first targets have been chosen accordingly. Wait, get in, wait and get out.

Good luck and success

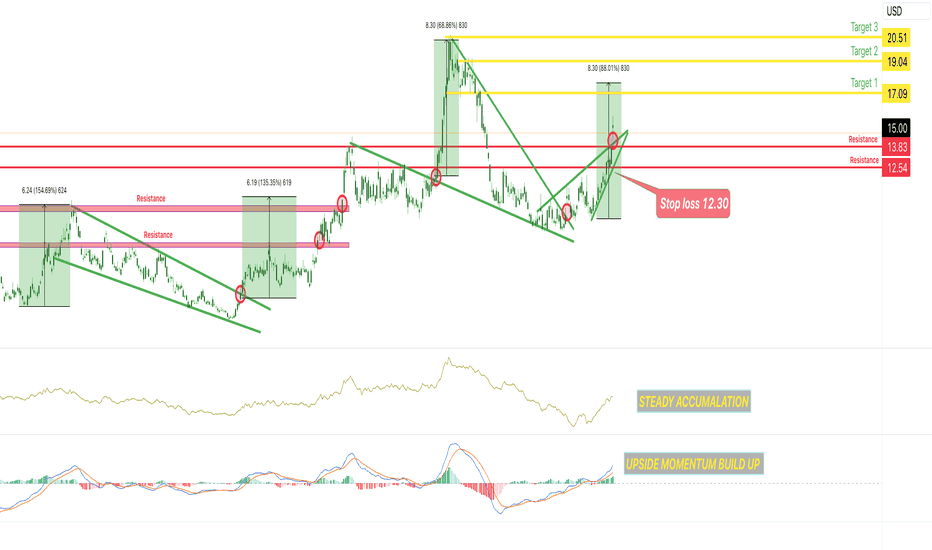

RIOT Breakout! 33% Gain potential RIOT is basically a crypto mining company.

Bitcoin right now is breaking to highest levels since 2022.

RIOT's balance sheet is positive with more assets than debt.

RIOT recently spent 290 million USD on purchasing new and advanced bitcoin mining rigs as well as a contract to buy a lot more of those in the future with MICROBT.

Technicals show breakout after breakout, with a fresh breakout recently above 13.80.

Stop loss is placed below second horizontal support around 12.50.

Take profits are allocated around key resistance levels on the way up.

Indicators show bullish momentum with plenty more fuel to go.

This is a potential swing trade.

Best of luck and feel free to ask questions!

Riot back to trendThis whip saw market is certainly flushing out leverage. I remain in my spot shares and am contemplating June 20$ calls. Riot like Coin is back to trend although this riot trend line began a full year ago. Both of my short term bearish price targets of 17$ and 15$ were hit. This ETF tease is really going to spook retail. Will we get another flash crash?