Thanksgiving Gifts for ALL - RXRX - BIOTECH SQUEEZE PLAYRecursion Pharmaceuticals, Inc. is a clinical-stage biotechnology company that combines automation, artificial intelligence, machine learning, and in vivo validation capabilities to discover novel medicines. Its Recursion operating system enables advanced machine learning approaches to reveal drug candidates, mechanisms of action, novel chemistry, and potential toxicity, with the eventual goal of decoding biology and advancing new therapeutics that radically improve people's lives.

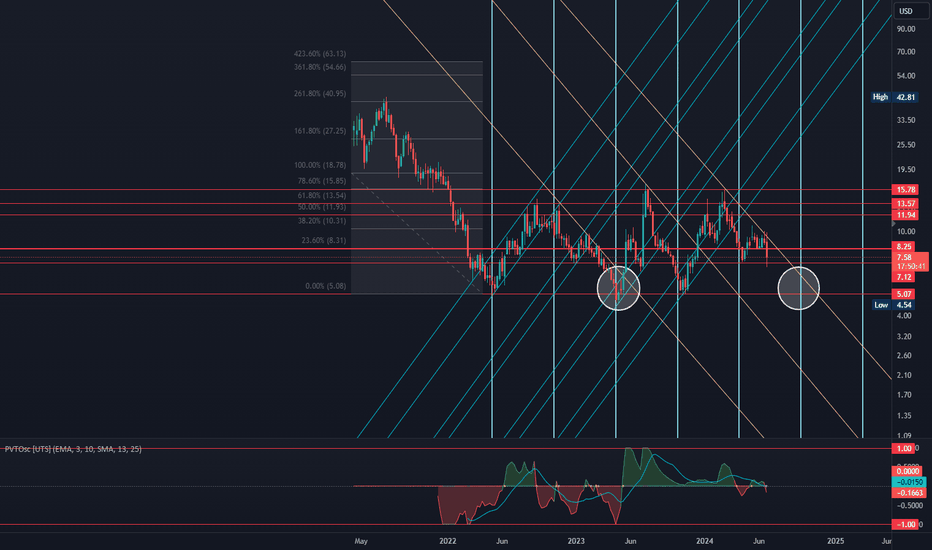

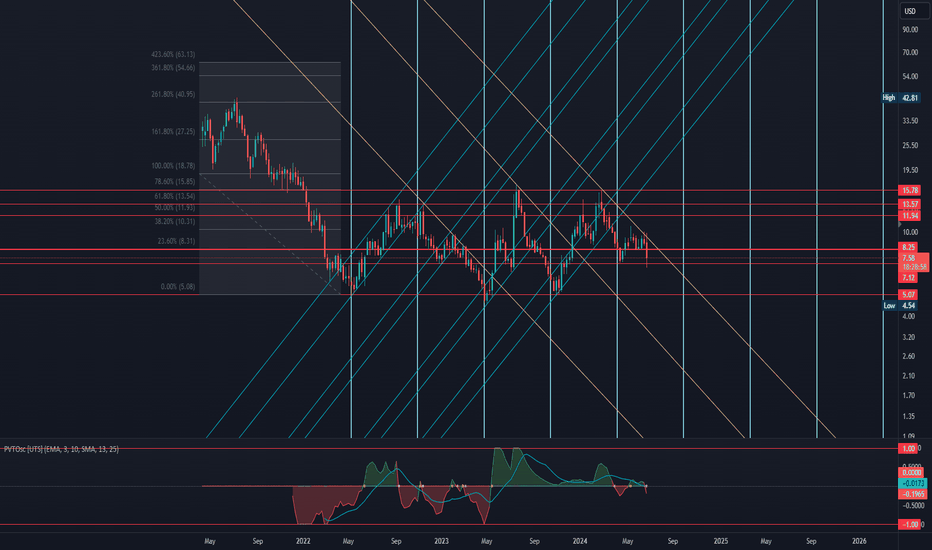

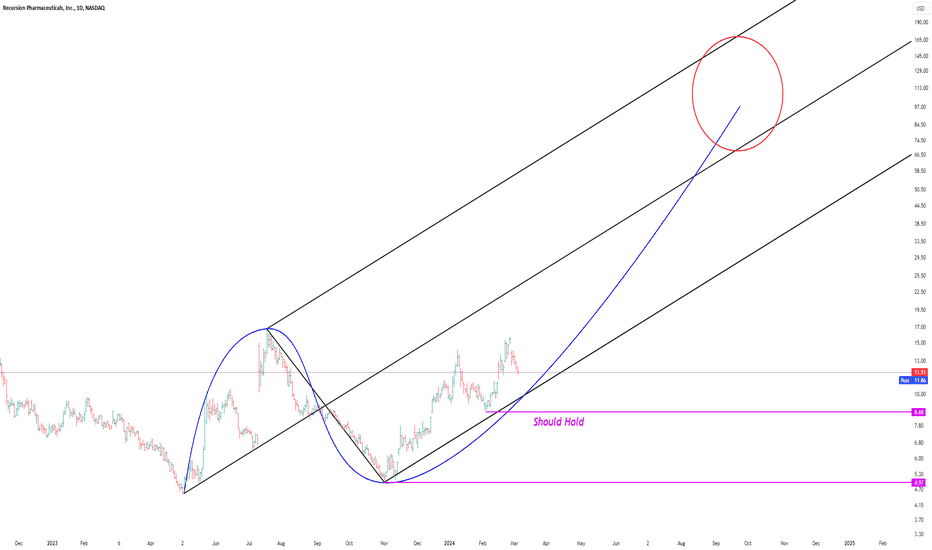

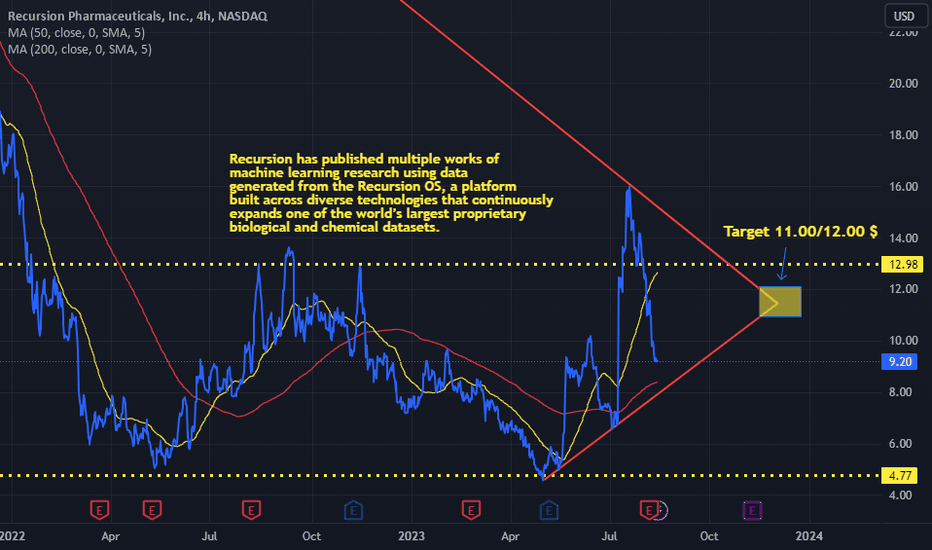

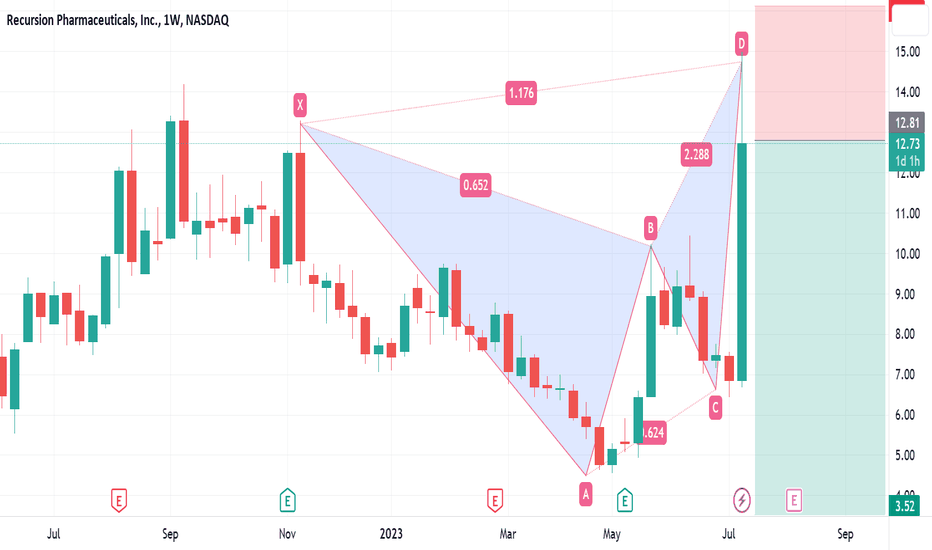

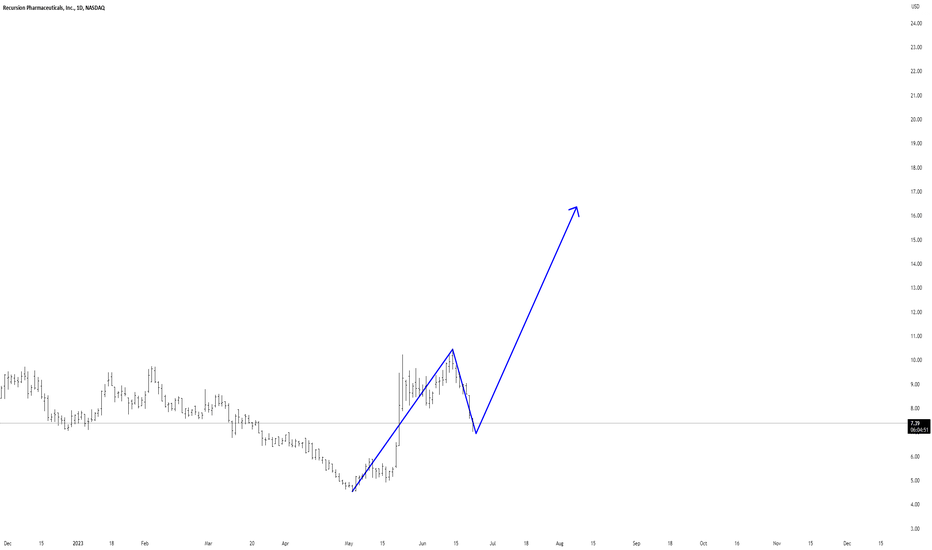

Chart looks primed, bounced off 6 dollar range a few times and is peaking out of the downtrend. I fully expect to find support along that trendline and chop until news sends this thing flying.

Short squeeze potential here and fibs look like a big move could be in store before Thanksgiving which will line up with news around Earnings time.

Holding long dated calls and some shares.

Calls dated Jan 2025 or later. 8,9,10 strikes

Fibs for targets.

LFG!

RXRX trade ideas

Recursion Pharmaceuticals, Inc. (RXRX)High-Resolution Genome-Wide Mapping of Chromosome-Arm-Scale Truncations Induced by CRISPR-Cas9 Editing

CRISPR-Cas9 editing is a scalable technology for mapping of biological pathways, but it has been reported to cause a variety of undesired large-scale structural changes to the genome. We performed an arrayed CRISPR-Cas9 scan of the genome in primary human cells, targeting 17,065 genes for knockout with 101,029 guides. High-dimensional phenomics reveals a “proximity bias” in which CRISPR knockouts bear unexpected phenotypic similarity to knockouts of biologically-unrelated genes on the same chromosome arm, recapitulating both canonical genome structure and structural variants. Transcriptomics connects proximity bias to chromosome-arm truncations. Analysis of published large-scale knockout and knockdown experiments confirms that this effect is general across cell types, labs, Cas9 delivery mechanisms, and assay modalities, and suggests proximity bias is caused by DNA double-strand-breaks with cell cycle control in a mediating role. Finally, we demonstrate a simple correction for large-scale CRISPR screens to mitigate this pervasive bias while preserving biological relationships.

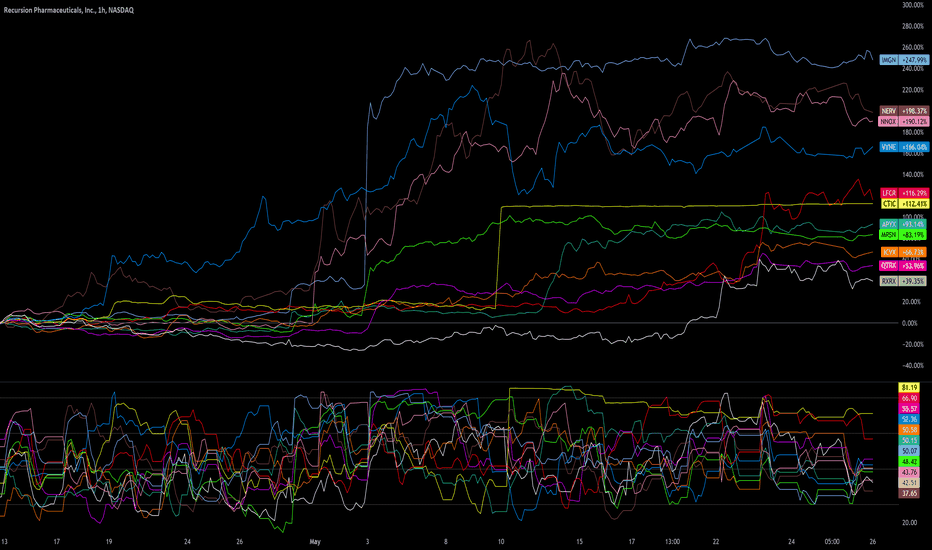

Biotechnology runnersBiotechnology companies develop therapeutics or processes that advance medicine, pharmaceuticals, genomics, food production, and the production of biofuels. Biotech stocks are risky investments, because the development stage of the asset pipeline can take a long time and usually does not even workout in the end. A good example of a long-term successful biotech company is MRNA. But the list of long-term losers is much longer. Here's a top 11 list of Biotechnology runners the past month. 1hr ext chart with the tickerTracker Oscillator set to length 13RSI color coded with it's respective ticker. Can 1 out of 11 of these biotechnology companies become a long-term winner in the future?

IMGN

NERV

NNOX

VYNE

LFCR

CTIC

APYX

MRSN

ICVX

QTRX

RXRX

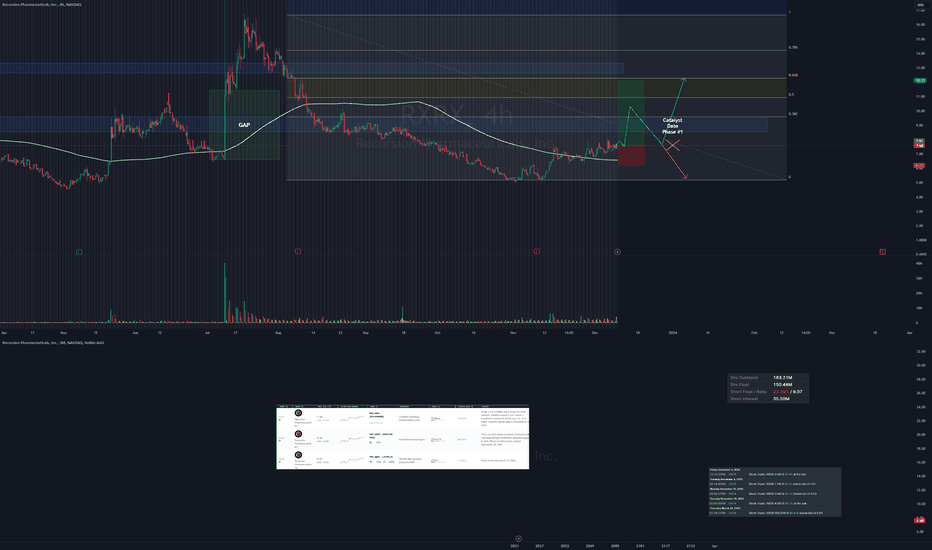

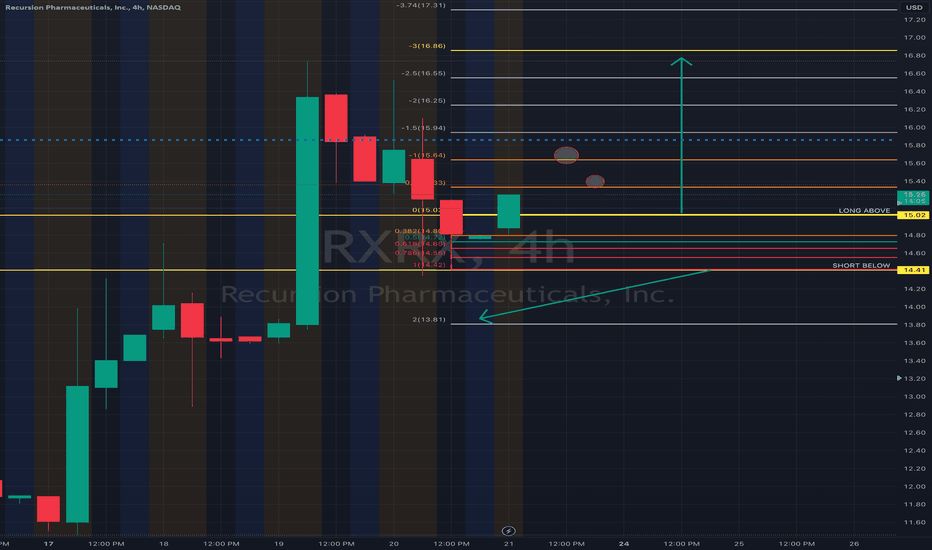

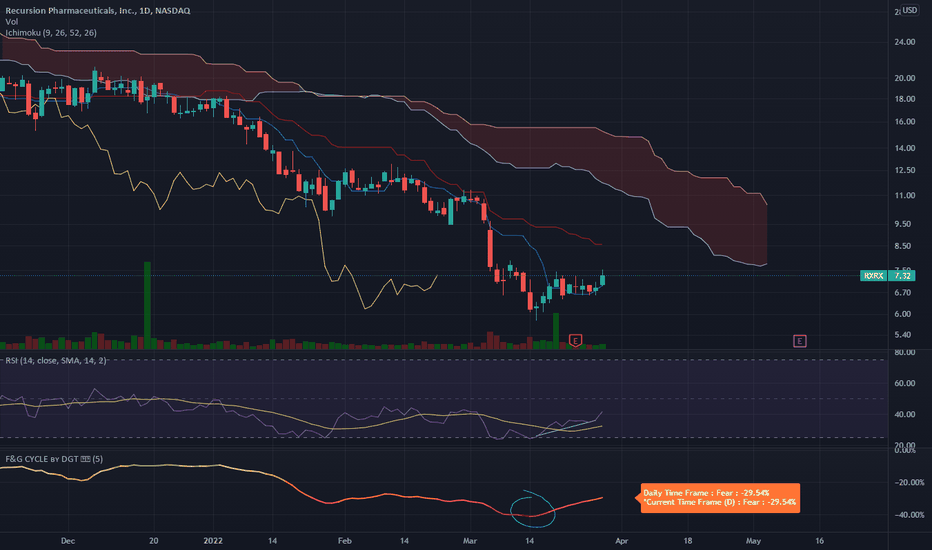

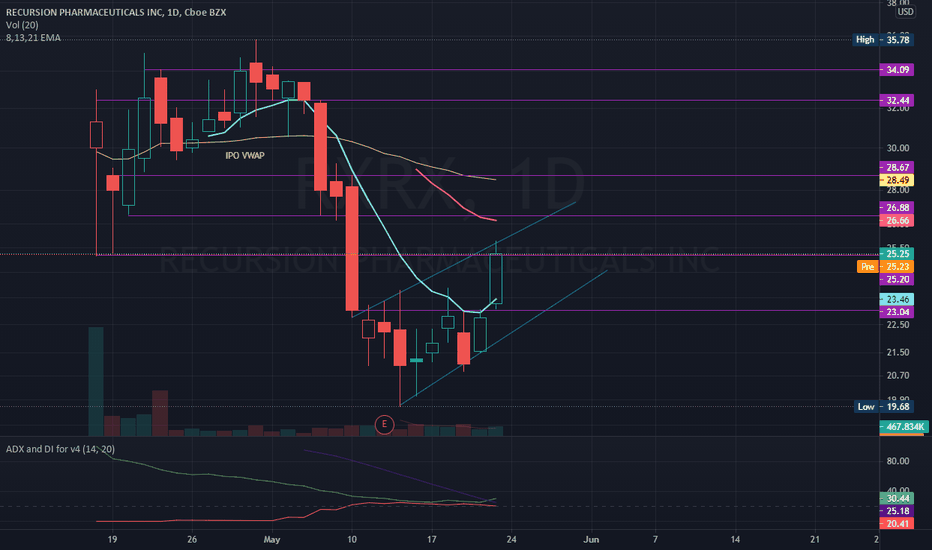

$RXRX Daily levelsReally like the fundamentals behind this company. Did some research over the weekend and I like what this company is doing. Still trying to find itself after the recent IPO but the levels are quite simple. The daily purple lines indicating clear support and resistance. Friday closed RIGHT at IPO price so we will see what this week offers. Buying pressure is increasing whilst RSI is still neutral. I would like to see this rising wedge breake to the upside but until we get some clear direction RXRX might trade sideways.