STX LONG EARNING 7/28 SEE TRADE IDEASeagate (STX) is expected to deliver a year-over-year increase in earnings on higher revenues when it reports results for the quarter ended June 2020. This widely-known consensus outlook gives a good sense of the company's earnings picture, but how the actual results compare to these estimates is a powerful factor that could impact its near-term stock price.

While management's discussion of business conditions on the earnings call will mostly determine the sustainability of the immediate price change and future earnings expectations, it's worth having a handicapping insight into the odds of a positive EPS surprise.

Zacks Consensus Estimate

This electronic storage maker is expected to post quarterly earnings of $1.28 per share in its upcoming report, which represents a year-over-year change of +48.8%.

Revenues are expected to be $2.61 billion, up 9.9% from the year-ago quarter.

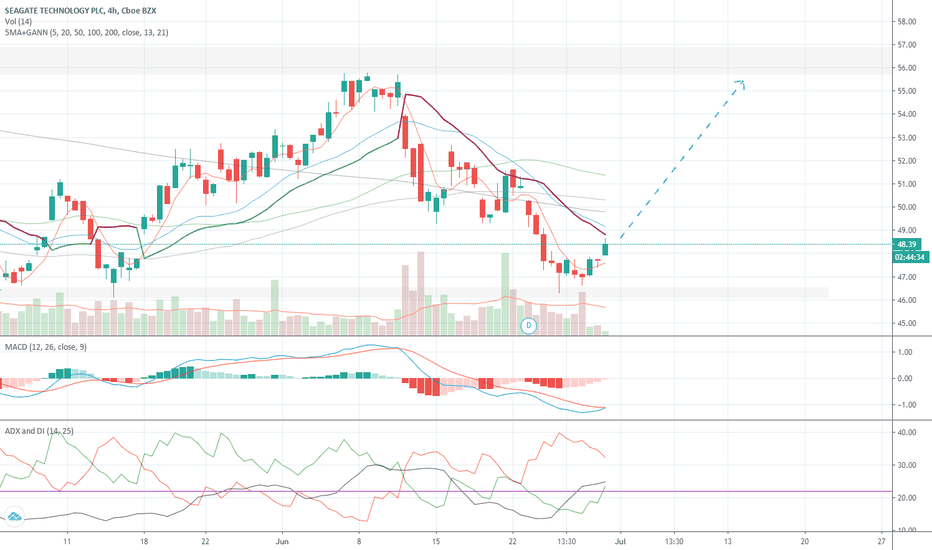

I bought the $49.5 Call expiring on 8/6 for 2.30. I got lucky the price turned red I put in my bid and the the bid/ask price were the same.

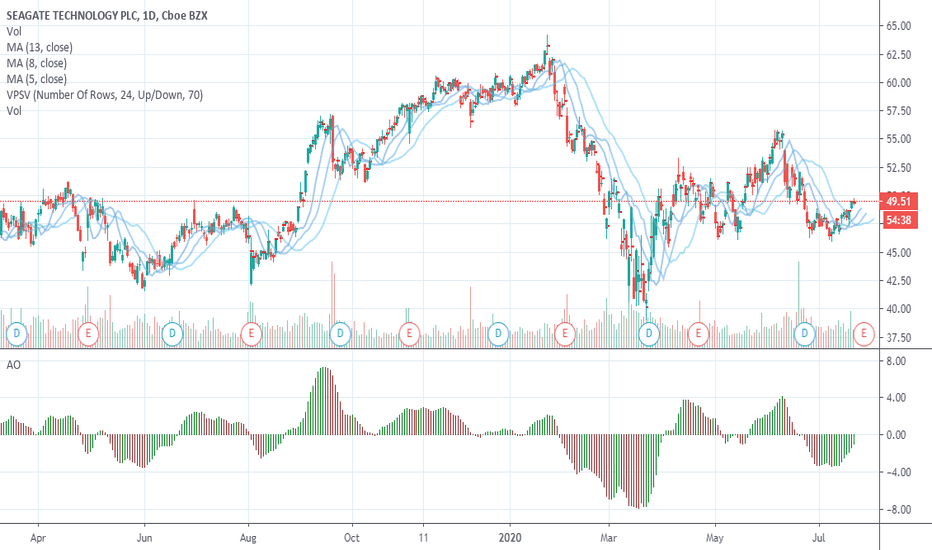

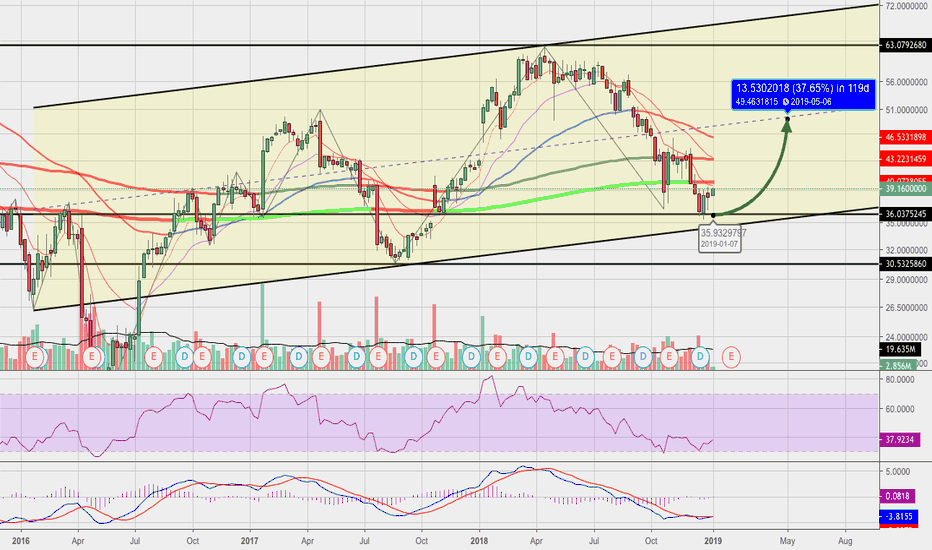

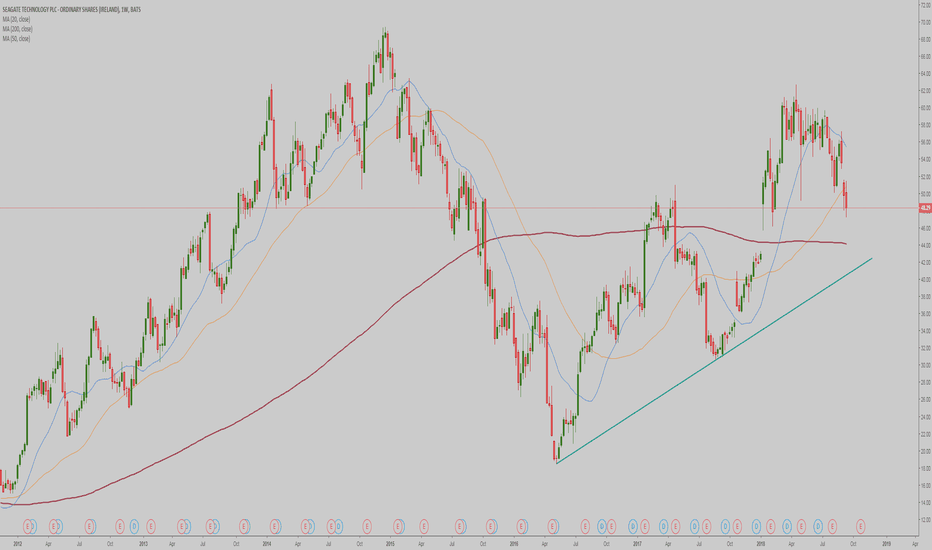

STX trade ideas

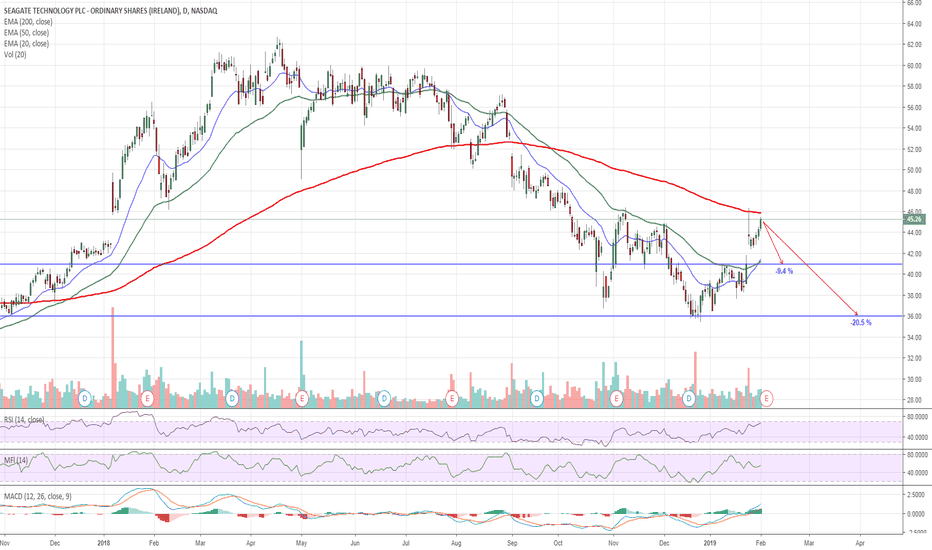

Seagate Tech Upgraded to Outperform $stx

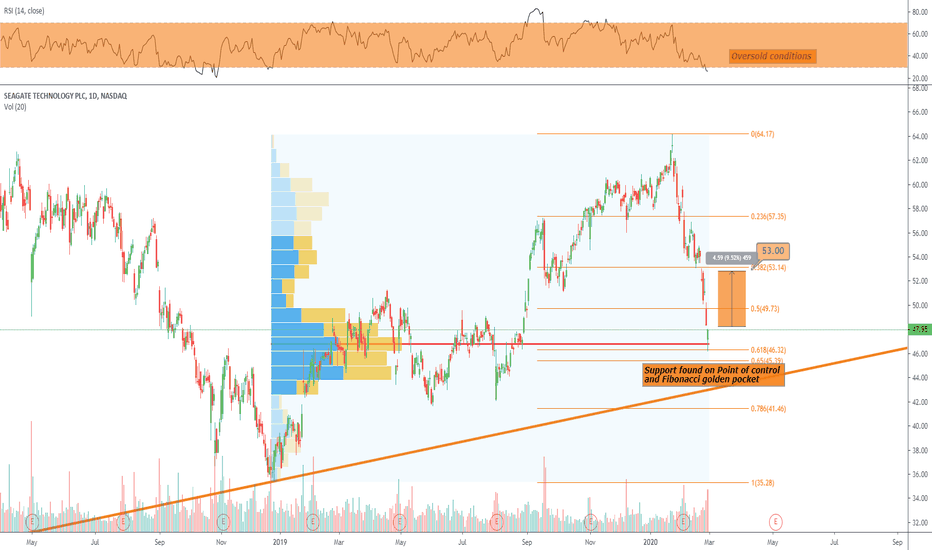

Reversal potential from oversold conditions

Strong support found on Friday.

Upside target $53

P/E ratio 7.78

Short interest 5.2%

Average analysts price target $58

Company profile

Seagate Technology Plc engages in the development, production, and distribution of data storage products and electronic data storage solutions. Its products include hard disk drives, solid state hybrid drives, solid state drives, peripheral component interconnect express cards, serial advanced technology attachment controllers, storage subsystems and computing solutions. It offers its products under the Backup Plus and Expansion product lines, and Maxtor and LaCie brands. The company was founded by Finis Conner, Syed Iftikar, Doug Mahon, David Thomas Mitchell, and Alan F. Shugart in 1978 and is headquartered in Dublin, Ireland.

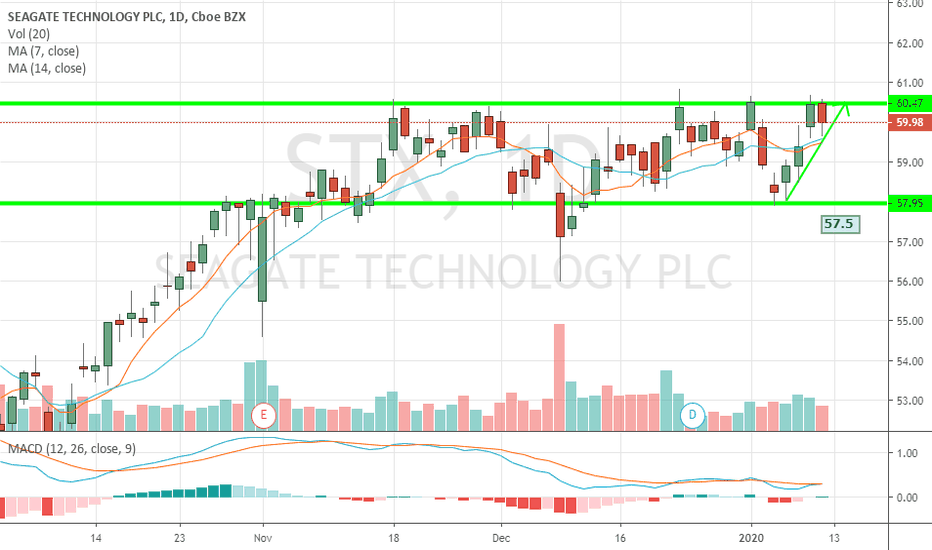

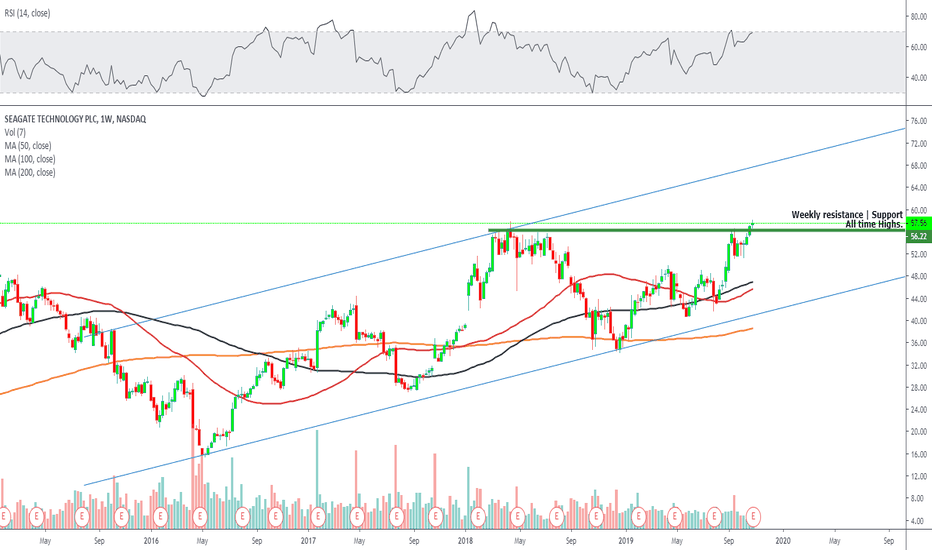

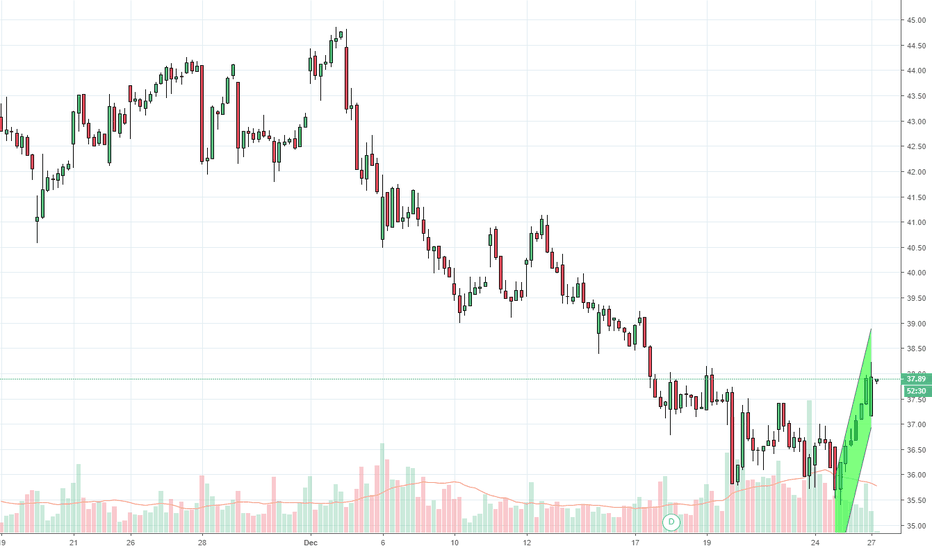

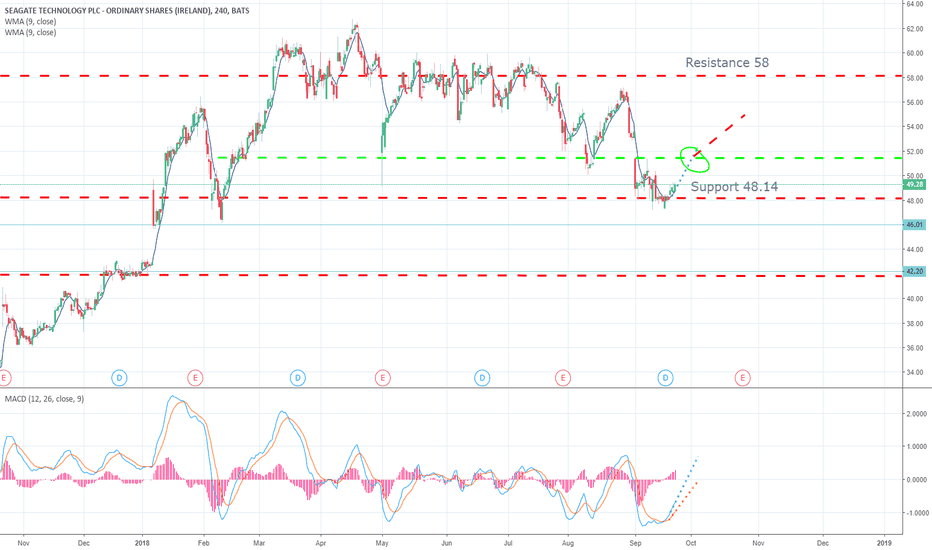

$STX Indecision in Seagate pre earnings, after WDC selloff Currently attempting a breakout to all time highs as earnings approach, but the sentiment took a hit today as Western Digital issued poor guidance for the remainder of 2019.

They bulls resolve could be tested tomorrow on earnings, wise to sit on the sidelines and possibly trade the breakout if possible.

P/E ratio 8.86

Company profile

Seagate Technology Plc engages in the development, production, and distribution of data storage products and electronic data storage solutions. Its products include hard disk drives, solid state hybrid drives, solid state drives, peripheral component interconnect express cards, serial advanced technology attachment controllers, storage subsystems and computing solutions. It offers its products under the Backup Plus and Expansion product lines, and Maxtor and LaCie brands. The company was founded by Finis Conner, Syed Iftikar, Doug Mahon, David Thomas Mitchell, and Alan F. Shugart in 1978 and is headquartered in Dublin, Ireland.

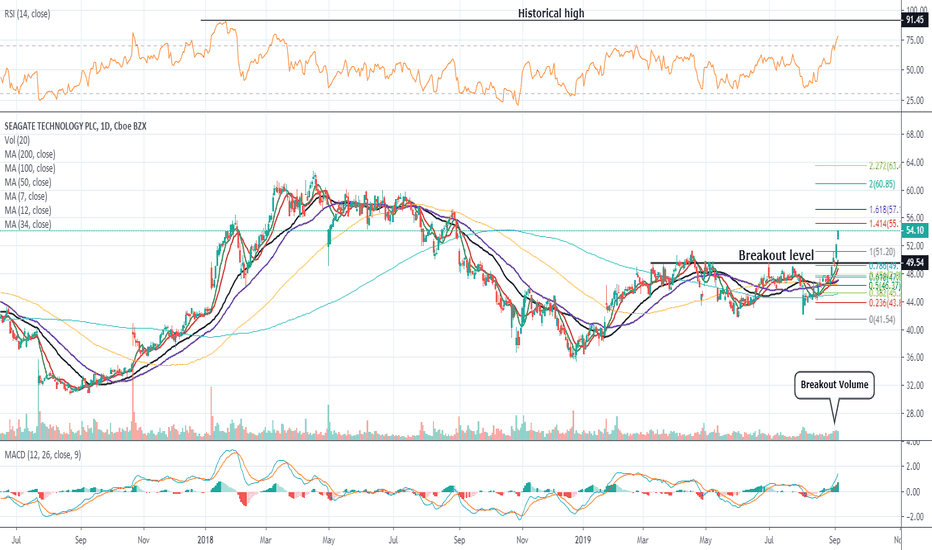

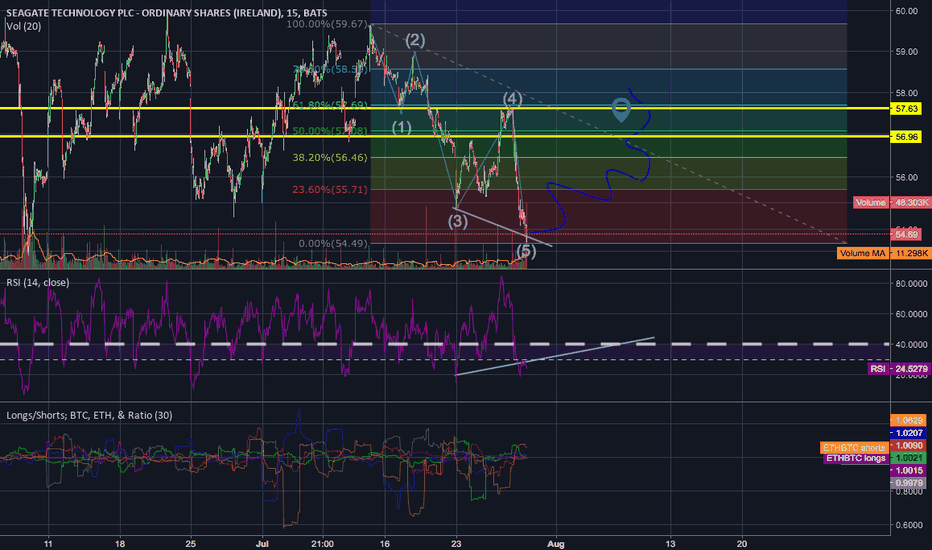

Seagate Bullish Breakout but watch RSICompany profile

Seagate Technology Plc engages in the development, production, and distribution of data storage products and electronic data storage solutions. Its products include hard disk drives, solid state hybrid drives, solid state drives, peripheral component interconnect express cards, serial advanced technology attachment controllers, storage subsystems and computing solutions. It offers its products under the Backup Plus and Expansion product lines, and Maxtor and LaCie brands. The company was founded by Finis Conner, Syed Iftikar, Doug Mahon, David Thomas Mitchell, and Alan F. Shugart in 1978 and is headquartered in Dublin, Ireland.

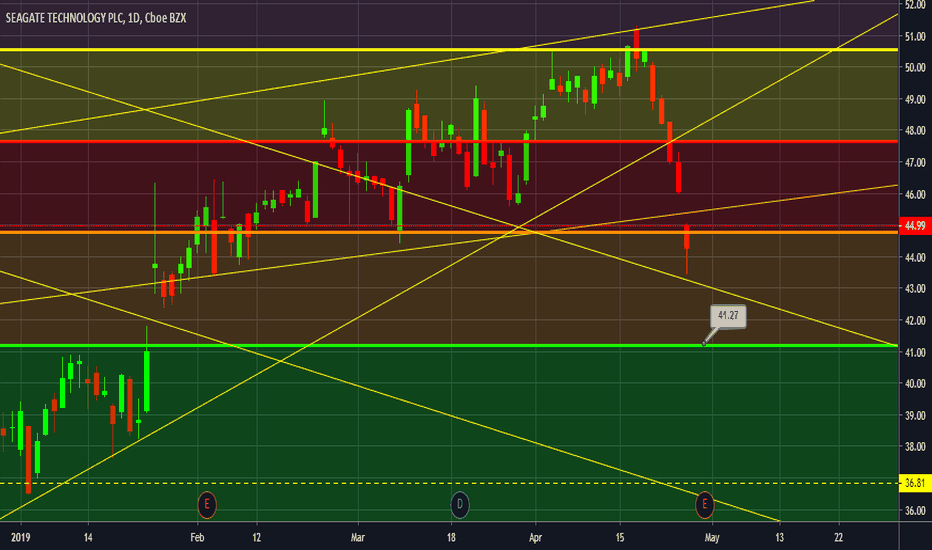

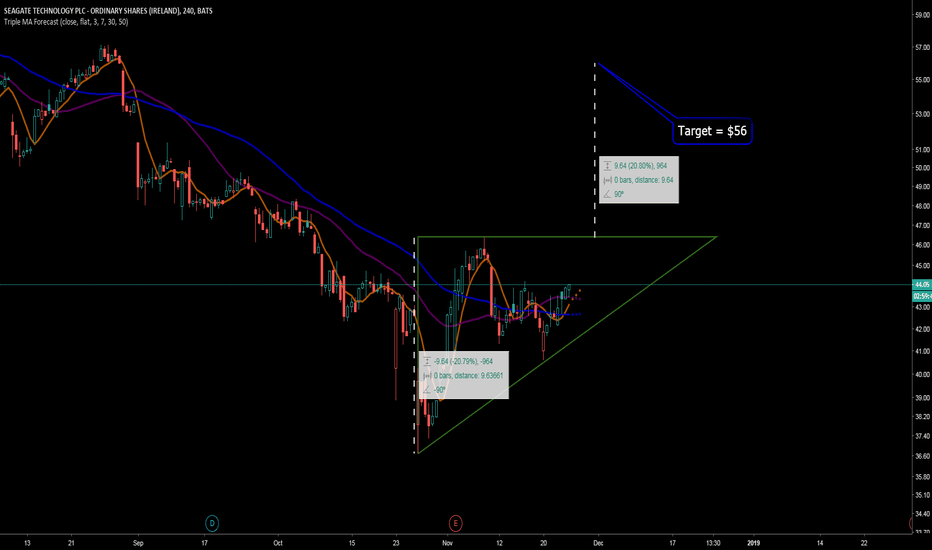

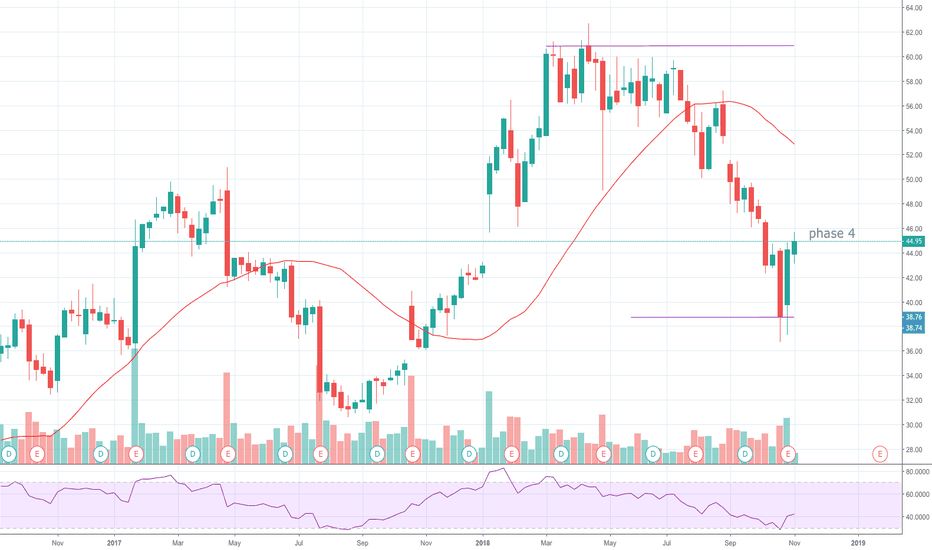

$STX Seagate Tech Earnings Next Week - Bearish Options Activity$STX Seagate Technologies Earnings Next Week - Bearish Options Activity

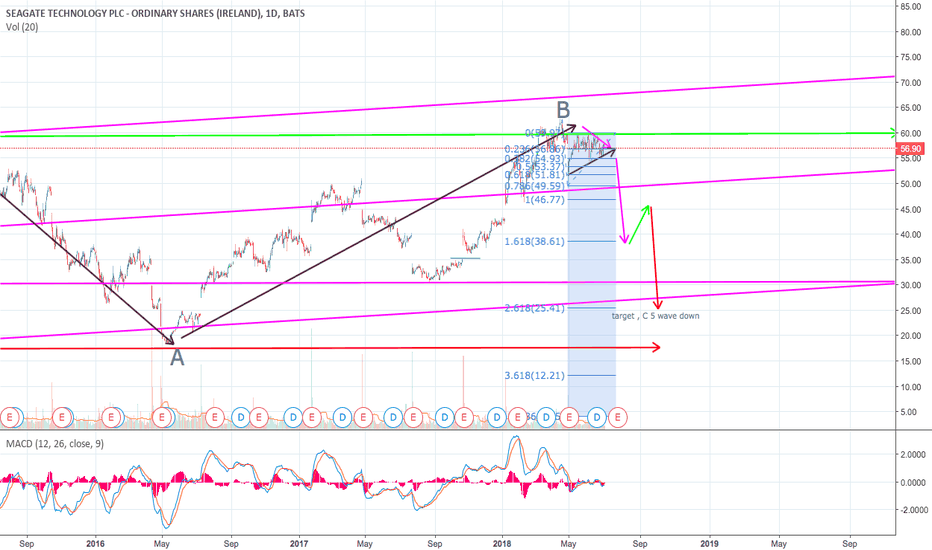

Big bearish earnings bet today on Seagate Technologies - with almost 17k $45.00 strike (ATM) March 15th puts traded vs OI of under 3k for total premium of $4.6M. See chart for near and medium term targets - assumes earnings next week is a miss and/or guidance/future outlook provided is below expectations.

Note: Informational analysis, not investment advice.