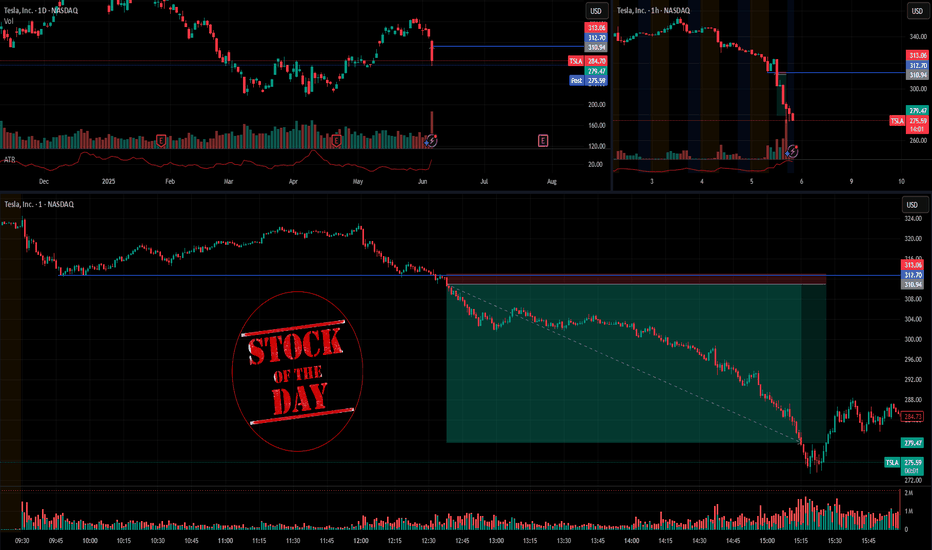

Stock Of The Day / 06.06.25 / TSLA06.06.2025 / NASDAQ:TSLA

Fundamentals. Negative background due to the conflict between Musk and Trump.

Technical analysis.

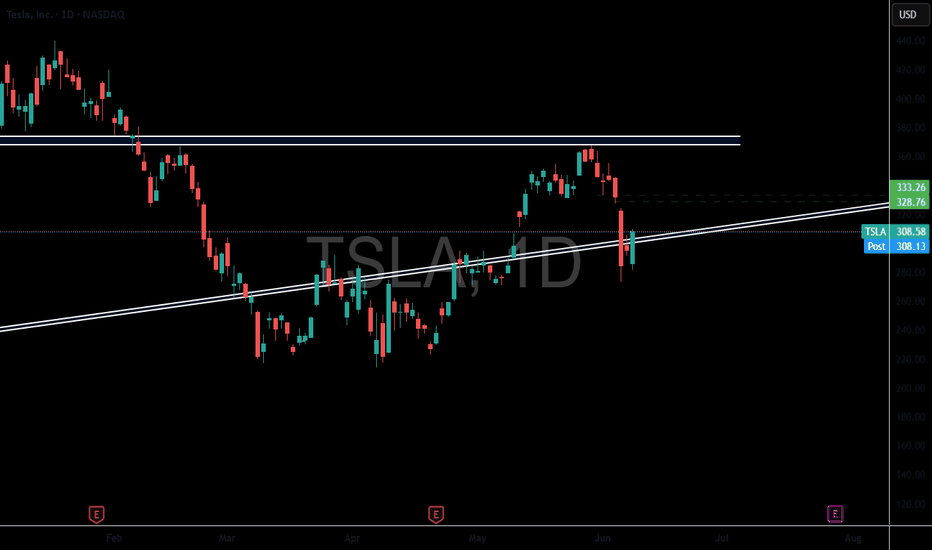

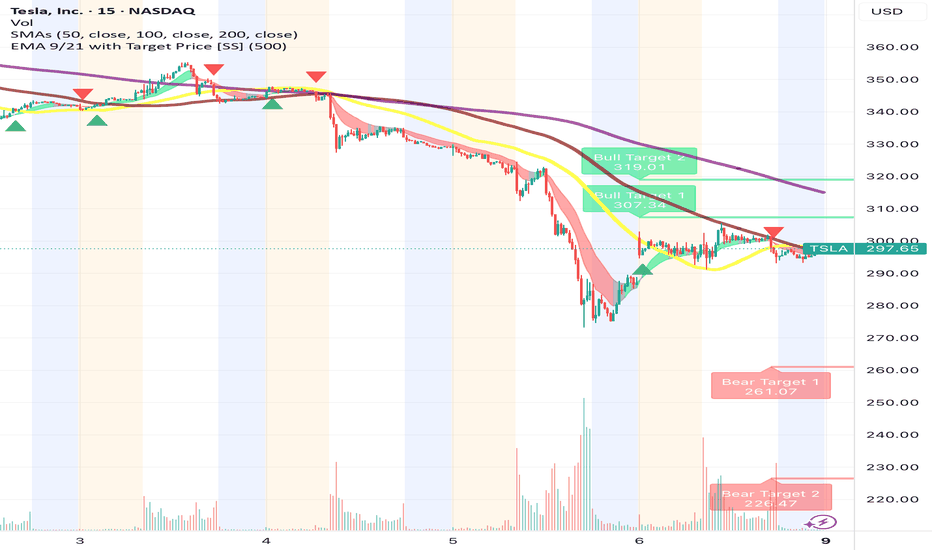

Daily chart: Pullback on an uptrend

Premarket: Gap Down on increased volume.

Trading session: The primary impulse from the opening of the session was stopped at 312.70, after which a smooth, long pullback followed. At 12:00 p.m., volumes appeared and the price sharply returned and tested the level of 312.70, and the next pullback was significantly smaller than the previous one. We are considering a short trade to continue the downward movement in case of breakdown and holding the price below the level.

Trading scenario: #breakdown with retest of level 312.70

Entry: 310.94 after the breakout, retest and holding below the level.

Stop: 313.06 we hide it above the tail of the retest.

Exit: Cover the position at 279.47 when the structure of the downward trend is broken amid price acceleration and volume growth.

Risk Rewards: 1/14

P.S. In order to understand the idea of the Stock Of The Day analysis, please read the following information .

TSLA trade ideas

Everything we know about the Trump - Musk divorce (so far)

Elon Musk publicly criticised Trump’s “One Big Beautiful Bill” as a “disgusting abomination” that would explode the U.S. deficit and “bankrupt America.” The bill is projected to add $2.5 trillion to the U.S. deficit over 10 years.

Musk claimed Trump wouldn’t have won the 2024 election without his support, calling the backlash “such ingratitude.”

Musk then alleged on X that Trump appears in the Epstein files. This marks a serious escalation (but we all thought this before Musk confirmed it right?)

Trump followed up on Truth Social by calling Musk “crazy” and hinting at cancelling federal contracts with his companies. Trump wrote that cancelling subsidies for Musk’s companies “could save billions,”.

Tesla has wiped out ~$100 billion in market value. Tesla now politically exposed?

Musk floated the idea of creating a new centrist political party, criticising both Democrats and MAGA Republicans. “We need a party that actually represents the interests of the people. Not lobbyists. Not legacy donors. Not extremists.”

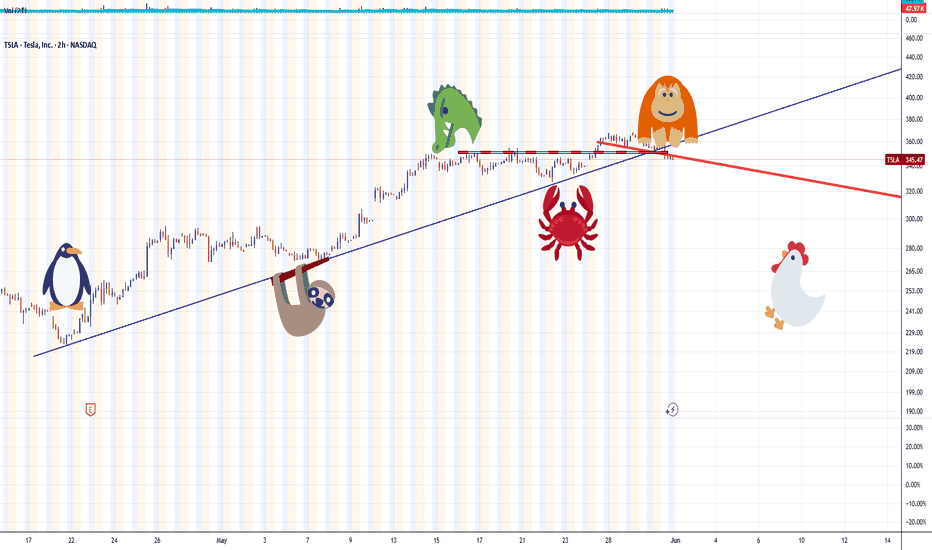

TSLA cooling offI know Tesla lovers hate to see a short post on the stock. Okay... it's cooling off... lol.

*another news report states he's leaving gov't; trump holding on tight... we shall see

*alleged new growth story incoming... check news and see what you see

*TA (technical analysis) look like a pullback in order... 330-325

Do you see what I see? Or you are feeling like it's a straight moon shot?

Have a great weekend.

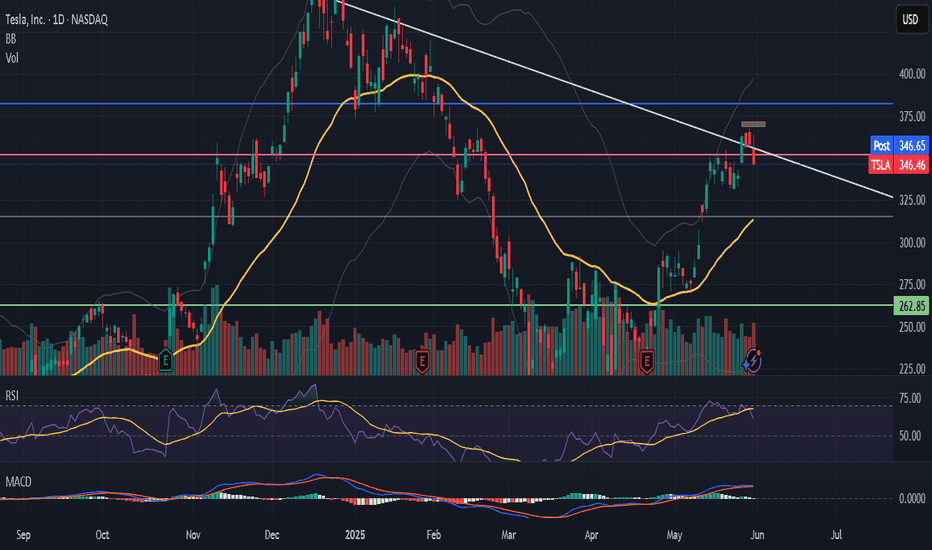

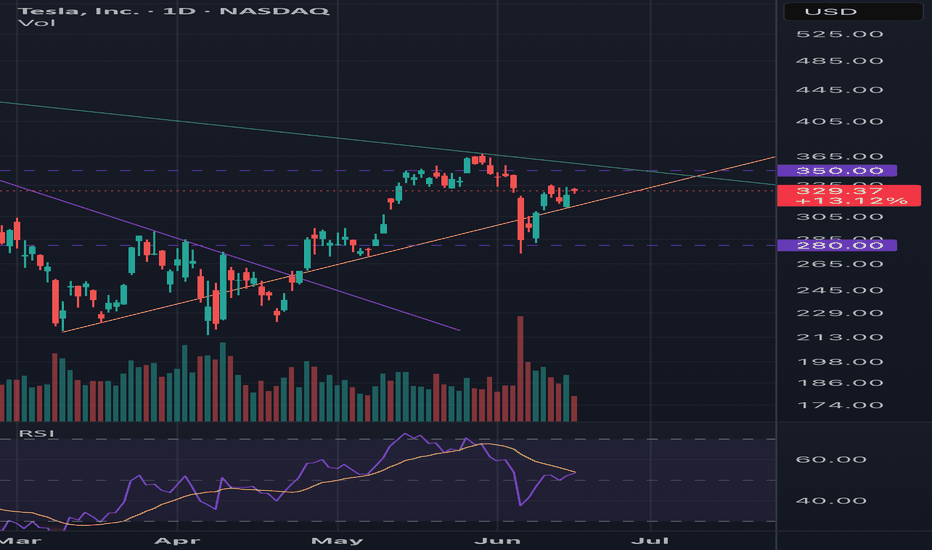

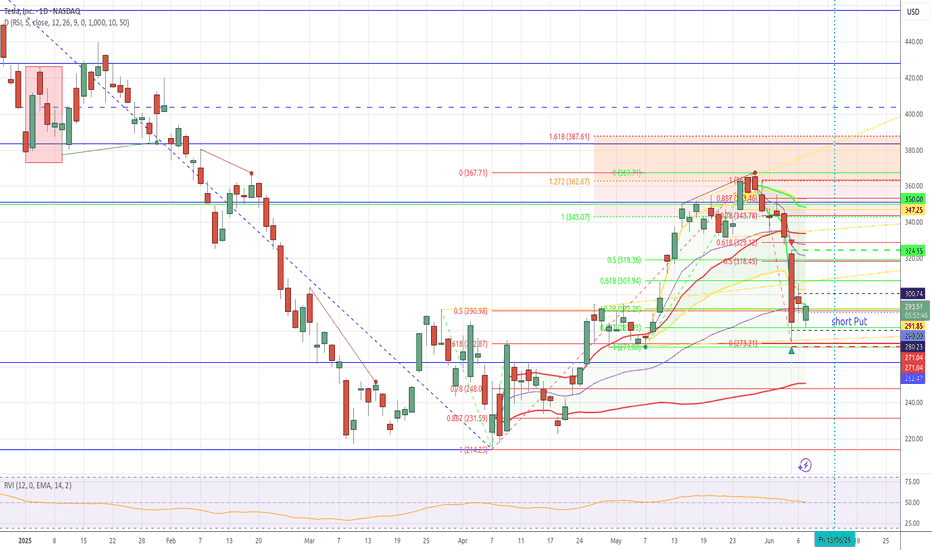

Tesla Inc. (TSLA) Technical Analysis and ForecastTSLA has demonstrated strong upward momentum since the market opened today, reaching a resistance level around the $362 zone.

From a technical perspective, there is potential for a short-term pullback to the $354 area, which aligns with the top of the support zone, also known as the "right shoulder" of the prevailing pattern.

Should this support level hold, we may anticipate a continued upward move, targeting higher price levels.

Key Levels to Watch:

Support Levels:

Primary Support: $354 zone

Secondary Support: $321 zone (as a deeper stop loss level)

Resistance/Take Profit Levels:

Target 1 (Take Profit): $440

Target 2 (Take Profit): $480 (previous all-time high)

Traders should approach this setup with caution, as always, adhering to sound risk management principles.

Market conditions can shift rapidly, and price action around these levels should be monitored closely.

If you find this analysis helpful, please consider supporting the channel by liking, commenting, and sharing this post.

Stay disciplined and trade with care.

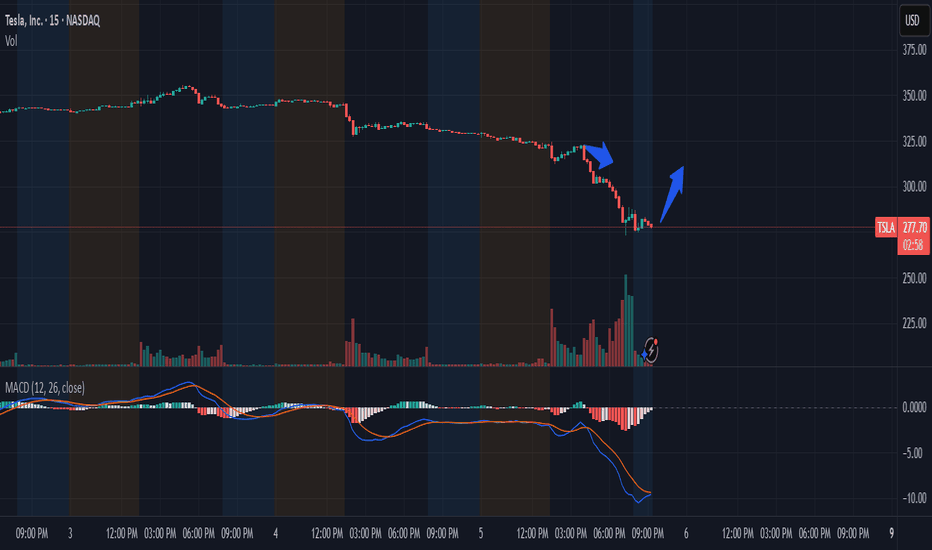

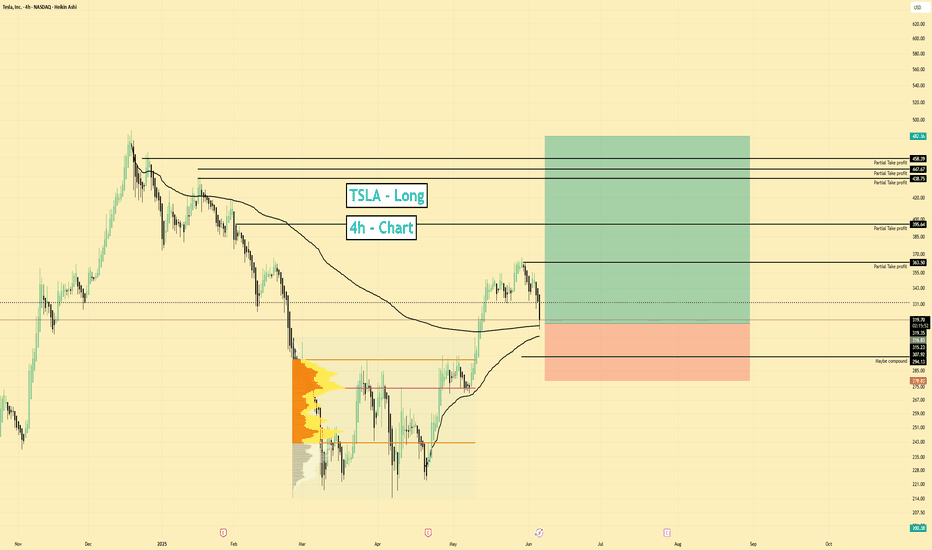

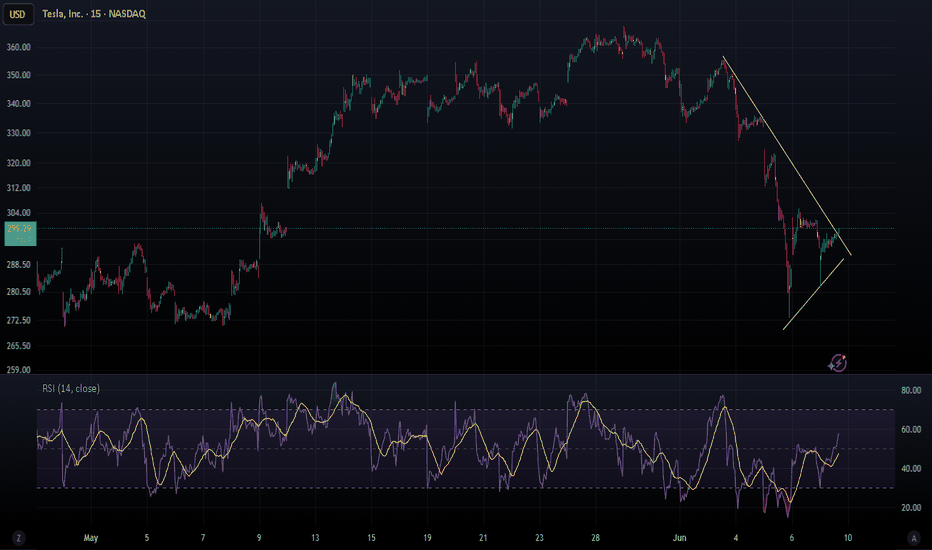

TSLA | Long Bias | Double VWAP + ABC Setup | (June 5, 2025)TSLA | Long Bias | Double VWAP + ABC Setup | (June 5, 2025)

1️⃣ Insight Summary:

Tesla is pulling back just as we anticipated, but strong technical support from a double VWAP level and a developing ABC correction is hinting at a potential bullish reversal. Momentum could build soon — this is a key area to watch!

2️⃣ Trade Parameters:

Bias: Long

Entry Zone: Current VWAP support near $230 (adjust per actual chart level)

Stop Loss: Below VWAP + liquidity zone (~$225 suggested)

TP1: $363

TP2: $395

Partial Exits: Consider profit-taking along the way; over 50% of the position to be closed around the $363–$395 range.

3️⃣ Key Notes:

✅ Support Factors: We're holding the double VWAP level and near the left-side value area high (around $294), with ABC corrective structure playing out.

✅ Money Flow: On the 4H chart, money is flowing out, but on the 30min it's stabilizing near 0 — watch for a potential turn.

❌ Risk Zone: We might see a short liquidity grab under the VWAP before the real move starts. Be patient with entries.

📰 Sentiment & Fundamentals: Tesla dropped due to new tariffs, but the news around Robotaxi services could spark a sharp rebound. Wall Street is watching closely as EPS continues to underperform forecasts.

⚠️ Valuation Caution: Despite a sky-high P/E ratio (189), Tesla remains outside normal valuation rules, like Nvidia. Keep that in mind when thinking long-term.

4️⃣ Follow-Up:

I’ll be monitoring this setup closely — especially how price reacts around VWAP and whether money flow turns green. Updates to come if conditions change!

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always conduct your own research. This content may include enhancements made using AI.

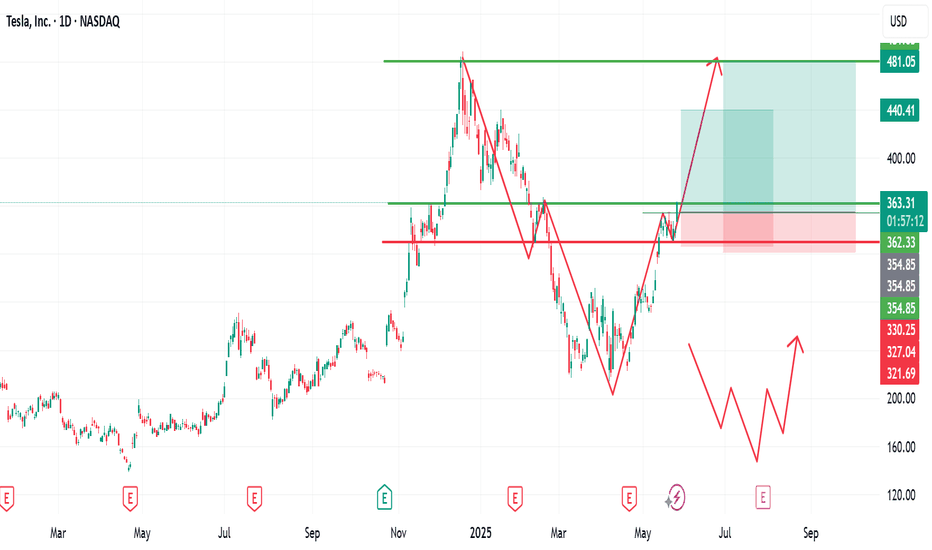

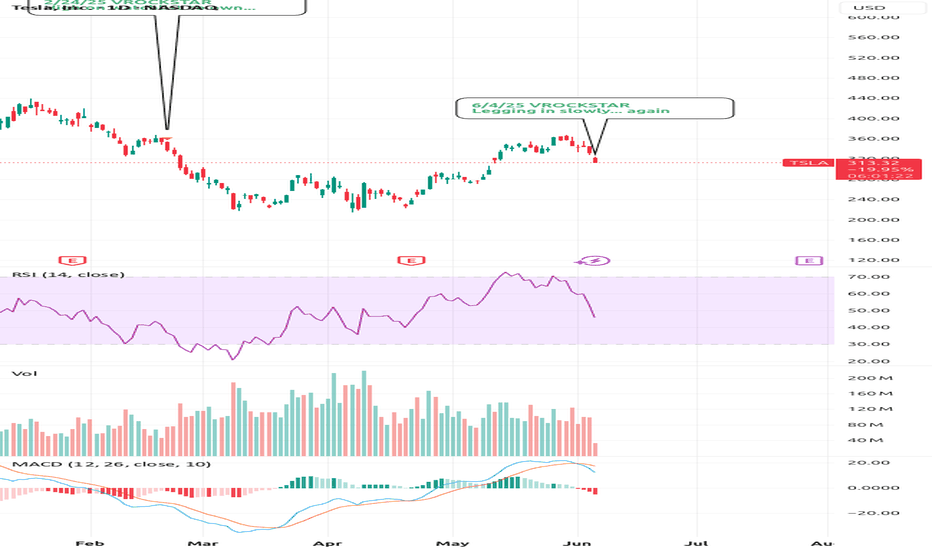

TESLA GOES READY FOR ITS NEW LEG DOWN. HERE'S WHAT WE KNOW ABOUTTesla stock declined after Elon Musk’s departure from the Trump administration due to a combination of reputational, operational, and market factors:

Political Backlash and Brand Damage. Musk’s close association with the Trump administration and his leadership of the Department of Government Efficiency (DOGE) generated widespread protests and alienated many of Tesla’s traditional, progressive customer base. This political controversy led to a decline in consumer interest and unsettled investors who were concerned about the brand’s long-term appeal.

Sales and Profit Declines. Tesla faced falling sales and profits, with deliveries dropping in key markets like China and Europe, partly due to intensifying competition and partly due to the backlash against Musk’s political activities. The company reported a 13% year-over-year decline in deliveries, and operating profits fell as well.

Investor Concerns Over Leadership Focus. Investors grew worried that Musk’s political involvement was distracting him from Tesla’s core business at a critical time. There was a perception that the company was losing its competitive edge and that Musk’s attention was divided, which amplified concerns about Tesla’s future growth.

Market Correction After “Trump Bump”. Tesla’s stock had surged after Trump’s election, buoyed by expectations of favorable policies. However, as Musk’s political involvement became a liability and operational challenges mounted, the post-election gains evaporated, and the stock corrected sharply downward.

In summary, Musk’s controversial political role, combined with operational headwinds and shifting investor sentiment, triggered a significant decline in Tesla’s stock after his exit from the Trump administration.

--

Best wishes

@PandorraResearch Team

6/4/25 :: VROCKSTAR :: $TSLA6/4/25 :: VROCKSTAR :: NASDAQ:TSLA

Legging in slowly... again

- valuation is not for this post, i've put it out there last time

- after riding in many teslas in LVN (obviously not my first time) i was AMAZED at how many ubers were using FSD at my request and talking about how it's improved light years since the few versions ahead

- this is now a humanoid-focused company, i'm entirely convinced it will happen and of the three companies out there, only one is public

- and they're coming. given progress in AI (I'm so close to this)... we'll probably see them commercially in kitchens, old ppl homes etc. in a matter of years, at most. I'd guess we see a few out in the wild in two years...

- so while it's hard to wrap my head around the "valuation" in a car context... a trillion bucks for a company in the process of disrupting the entire global services industry, is too cheap.

- send it lower.

- i'm starting my LT position here and want it it lower.

V

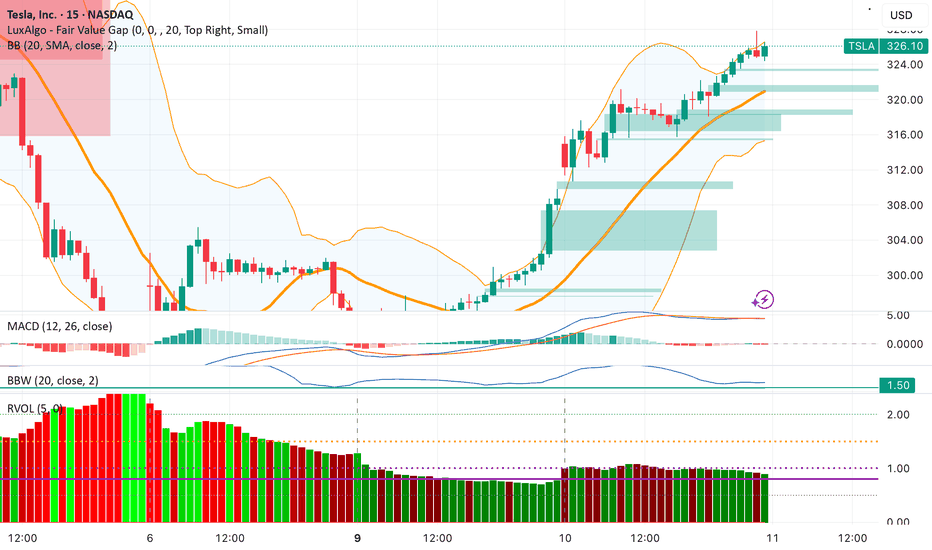

LONG entry @ $316.05 | 09:55am + LONG exit @ $321.05 | 11:20amToday goes to show what happens when you follow structure, and let mat and probability take care of the outcome. An exceptional day, remember... consistent green days are a reflection of discipline, not luck.

Some more pertinent details re price action today. I hit an algo entry at 9:55, MM's did a hard shake out of the weak hands, dropped the price significantly but there was no strong bearish FVG even though price dropped 3 points which gave me conviction to hold the position which paid off very well. There was no significant short move and the price rallied to a weekly high.

Polyanonymous.

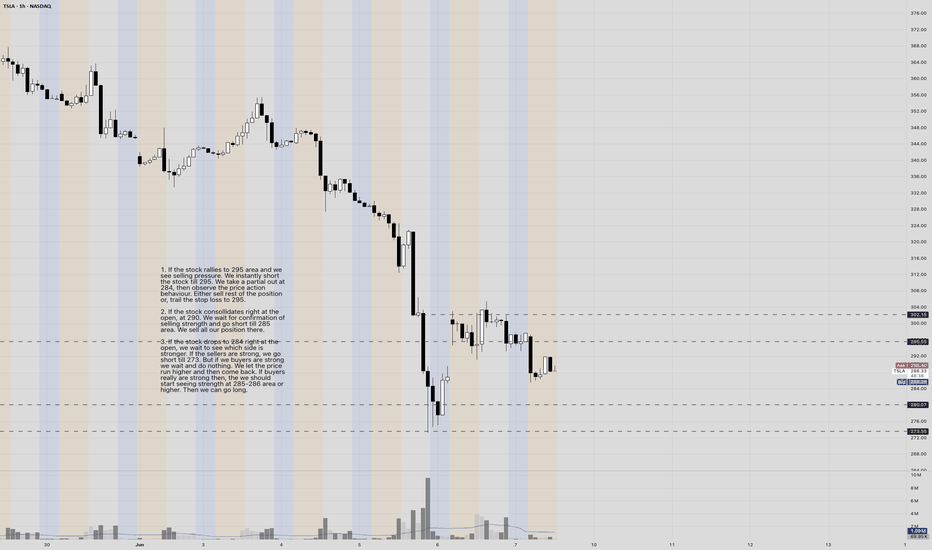

TSLA. SHORT @ 304. SHORT @ 295. LONG @ 284. LONG @ 273. INTRADAYOverview -

The economic calendar is light this week. The stocks previously have shown a trend of being affected a lot more by the news, compared to the economic data. Today, US-China are having talks regarding the trade. The volatility should come from the outcome of the trade discussion. We will not stay in the market for that long. We will only trade the predictable open and call it day.

INTRADAY PLAN -

1. If the stock rallies to 295 area and we see selling pressure. We instantly short the stock till 284. We take a partial out at 284, then observe the price action behavior. We can either sell rest of the position or, trail the stop loss to 273.

2. If the stock consolidates at the open, at 290. We wait for confirmation of selling strength and go short till 285 area. We sell all our position there.

3. If the stock drops to 284 right at the open, we wait to see which side is stronger. If the sellers are strong, we go short till 273. But if we buyers are strong we wait and do nothing. We let the price run higher and then come back. If buyers really are strong, then we should start seeing strength at 285-286 area or higher. Then we can go long.

TSLA. LONG @ 309. SHORT @ 330. PIVOT @ 318. INTRADAY 1. If stock doesn't break the 312 level in the pre-market and ends up rallying to 318, where we see a little selling strength. We wait. We let the price come down and wait for the buyers to make the following moves.

If the buyers step in at 316+, we go long till 341.

If the buyers step in at 309+, we go long till 330.

2. If the stock blows past 318 and directly rallies to the 330 area, we wait for the sellers to show themselves. If the sellers starting showing desperation in the 330 area, we go short, till 318.

3. If the stock opens, 309 support fails and the stock directly drops to the 300 zone. We wait for a good entry at 309 zone and go short from there till 295.

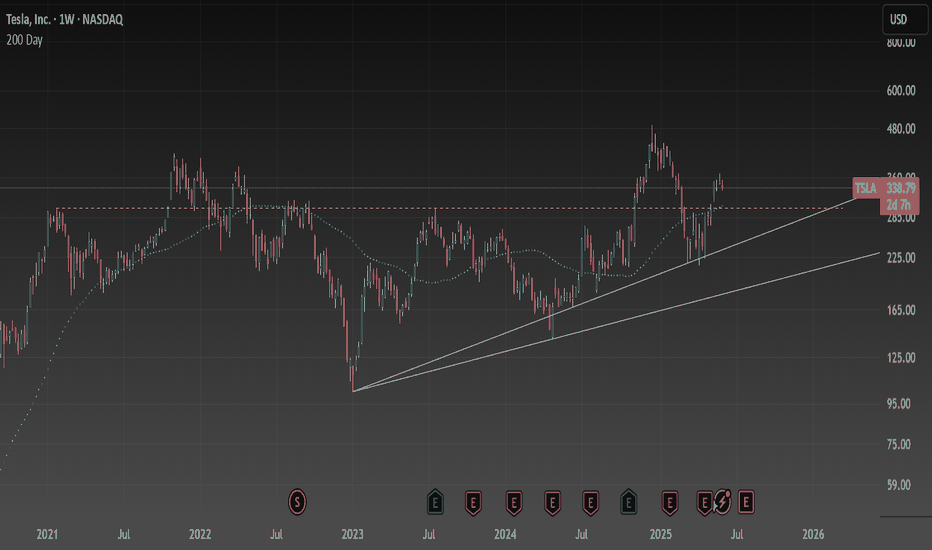

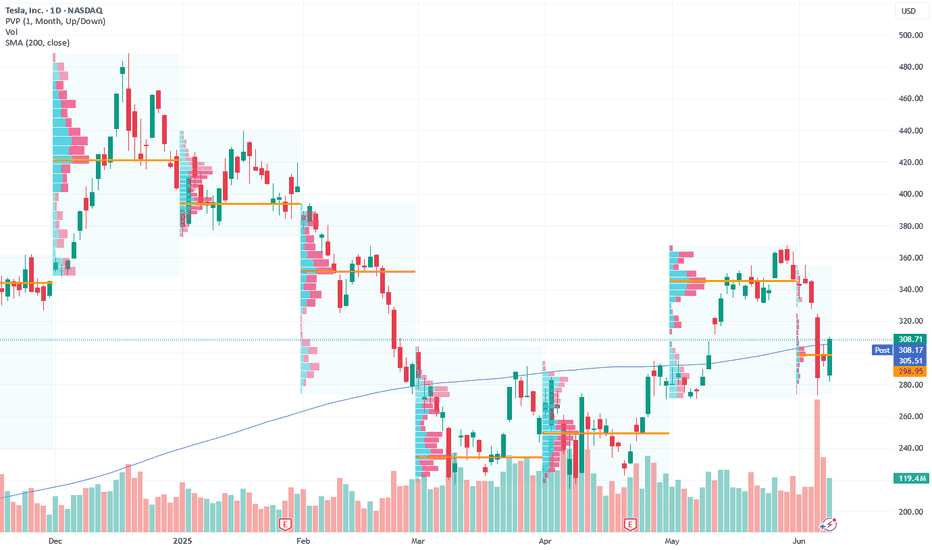

TSLA: $300 is an important numberOver the past 5 years, $300 has been a very important price point -- both in support and resistance. Only once have we converged with the 200 day at $300 mark, and that was when we were hitting it as resistance. We are now in a position to do the same from the position of support. I think a similar yet opposite pattern should unfold if we move to this range.

Outside all that, we continue to maintain a cup and handle pattern. We are also maintaining higher lows.

Bullish signals and patterns outweigh the bearish in my eyes.

Best of luck.

The Trump & Musk Friends Again - Tesla RippingAnalysts attribute the recovery to cooling tensions between Elon Musk and President Donald Trump, which had previously weighed on investor sentiment.

Additionally, Tesla's upcoming robo-taxi launch on June 12 is generating excitement, with some analysts predicting it could be a major revenue driver. However, concerns remain about Tesla's valuation, as it trades at a price-to-earnings ratio of 192, significantly higher than traditional automakers.

Tesla's Bullish Momentum Points Towards $312 Target

Current Price: $295.14

Targets:

- T1 = $304.50

- T2 = $312.90

Stop Levels:

- S1 = $289.00

- S2 = $282.50

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in Tesla.

**Key Insights:**

Tesla continues to demonstrate strong fundamentals backed by innovation in electric vehicles (EV) and sustainable energy solutions. Recent advancements in battery technology, coupled with expansion plans in international markets, are expected to drive significant growth over the next quarter. Technically, the stock shows consistent support levels formed during consolidation phases, suggesting a low-risk entry point for a bullish position. Market momentum indicators signal improving buyer strength, reinforcing the outlook for a continued rally.

**Recent Performance:**

Tesla's stock has shown resilience in the face of broader market volatility. Over the past two weeks, Tesla has moved within a tight range, suggesting accumulation by institutional investors. The recent stabilization around $290-$295 indicates that previous resistance levels have now turned into support, paving the way for further price movement towards higher targets.

**Expert Analysis:**

Analysts at major investment firms have reiterated confidence in Tesla's capacity to maintain its leadership in the EV market. Factors such as improved gross margins, strong quarterly delivery numbers, and strategic partnerships contribute to an optimistic outlook. From a technical standpoint, the stock's moving averages show bullish alignment, indicating sustained upward momentum. Volume analysis portrays strong buying activity, further validating bullish momentum.

**News Impact:**

Positive sentiment has surged following Tesla's announcement of doubling production capacity at its key Gigafactories, including its Nevada facility. Additionally, international regulatory approvals for Tesla's next-generation vehicles have fostered enthusiasm among investors. Broader sector movements, supported by potential shifts in Federal Reserve policy, also boost Tesla's trading outlook.

**Trading Recommendation:**

Tesla offers an attractive long setup for traders looking to capitalize on both fundamental and technical strength. A bullish position at current levels aligns with professional trading insights, with reasonable targets set at $304.50 and $312.90. Recommended stop levels are placed at $289 (S1) and $282.50 (S2), ensuring risk management while allowing room for volatility. With favorable macroeconomic factors improving the environment for growth stocks, Tesla remains a strong candidate for upside potential in the short-term.

Todays Entry @ $288.45 @ 09:35am | Exit @ $293.03Pre Trade Prep:

EMOTIONAL STATE = 8

TIREDNESS = 7

Execute your edge with robot like consistency, let me the math win for you over the long term.

A surgeon doesn't not operate because his last patient died.

The battle is won before the opening bell rings.

Visualise winning and losing scenarios.

--------

1) Am i physically and mentally ready to trade?

2) Do I have clear plans for todays trades.

3) Am i prepared to walk away if there is no set up?

-------

Today, I will only trade what the system confirms.

Today, I will accept losses with composure.

Today, I will protect my emotional capital.

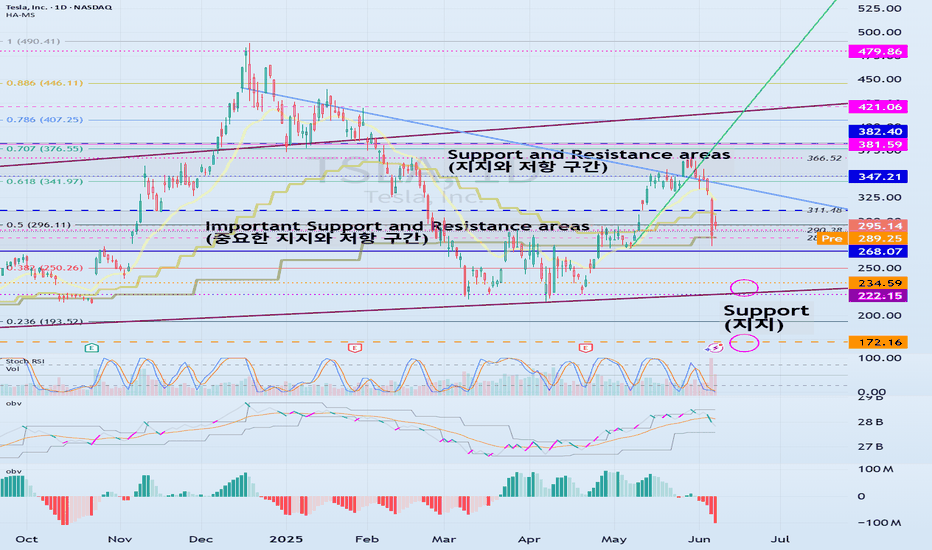

Important support and resistance sections: 267.07-311.48

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(TSLA 1D chart)

If you see support within the important support and resistance sections, it is a time to buy.

However, if a strong decline occurs, strong buying is expected around 172.6-234.59.

It is expected to be an important buying period for long-term investment.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

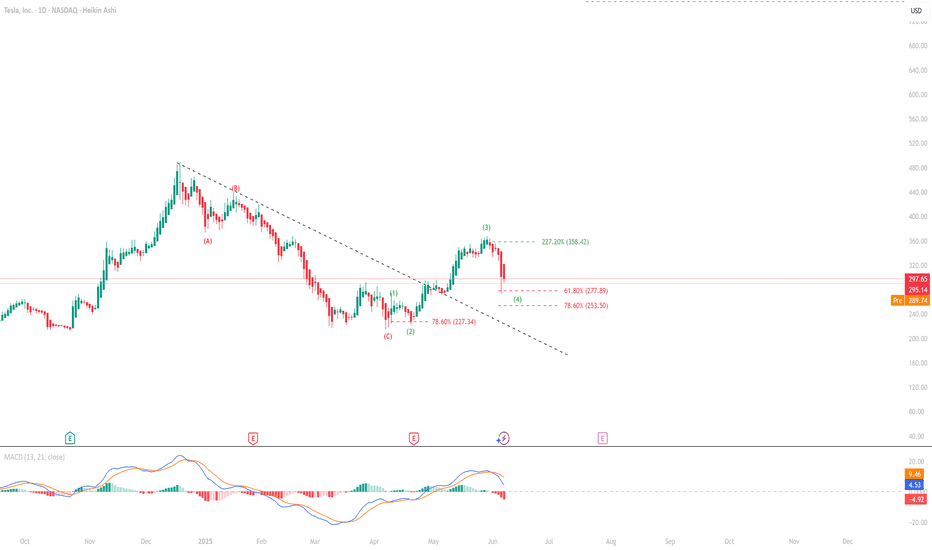

Nothing to Be Afraif Of!- Tesla has historically traded at high valuation multiples—and still does. But since its investor base is driven by excitement for the future and a love for innovation, it's unclear how much those valuation metrics really matter.

- After the first higher low structure following a corrective price wave, Tesla surged as much as 227.60%, before facing selling pressure. We're now tracking the second impulsive wave's retracement, particularly the 61.8% and 78.6% Fibonacci levels.

- Trying to catch the bottom at these levels is pointless. It's better to wait for 2–3 green Heikin Ashi candles and confirmation that these levels are holding.

- Current positions can be held. If you want to sell, go ahead—but remember this: No one has stayed optimistic about Tesla for more than two months. So, there's no need to panic.

Elon vs. Trump Drama, But the Chart Speaks LouderTesla closed at 300.63 with a strong 5.42% jump, but the rebound looks more technical than solid. RSI is at 43.90, still in bearish territory, and the stock hasn’t recovered from the recent drop from 360. The 305–310 zone is key — if it fails to break above that with volume, it might drop back to 280 or even 260.

On top of that, the growing tension between Trump and Elon Musk could weigh on market sentiment, especially with the upcoming election and possible regulatory concerns.

Bottom line: the move up doesn’t look convincing yet. Watch price action and volume closely in the next few days.

#TSLA #Tesla #TechnicalAnalysis #StockMarket #WallStreet