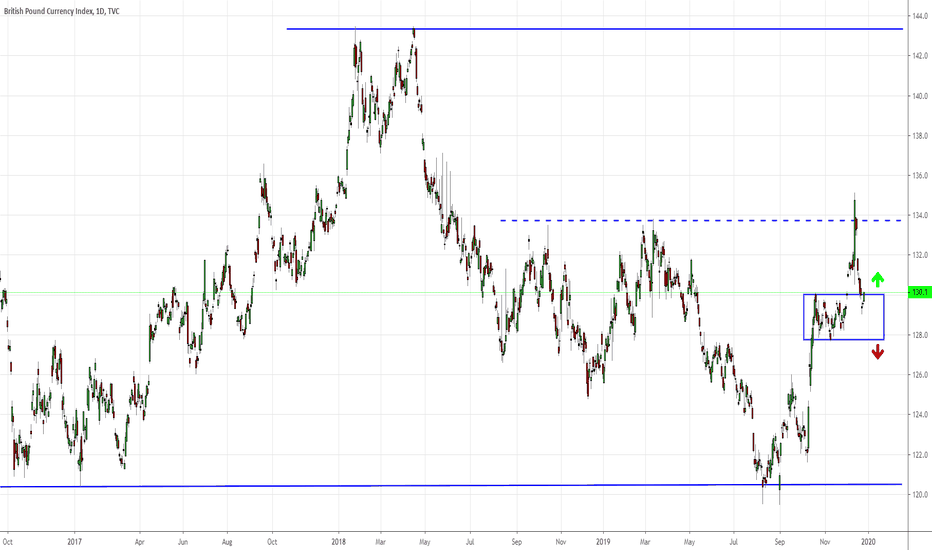

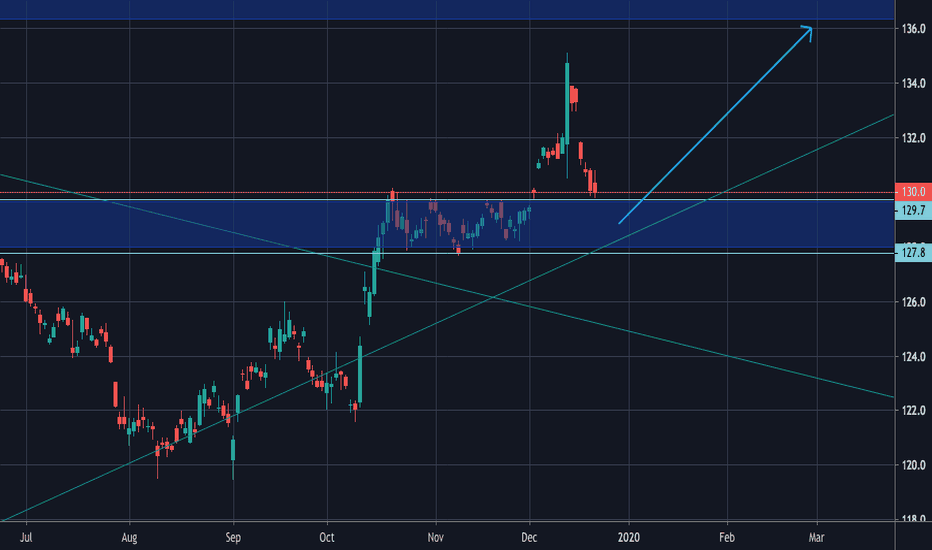

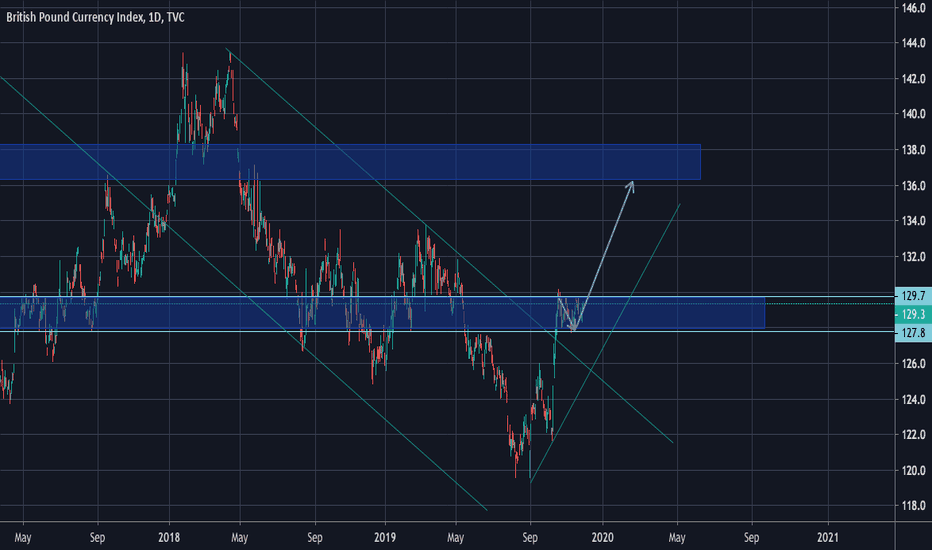

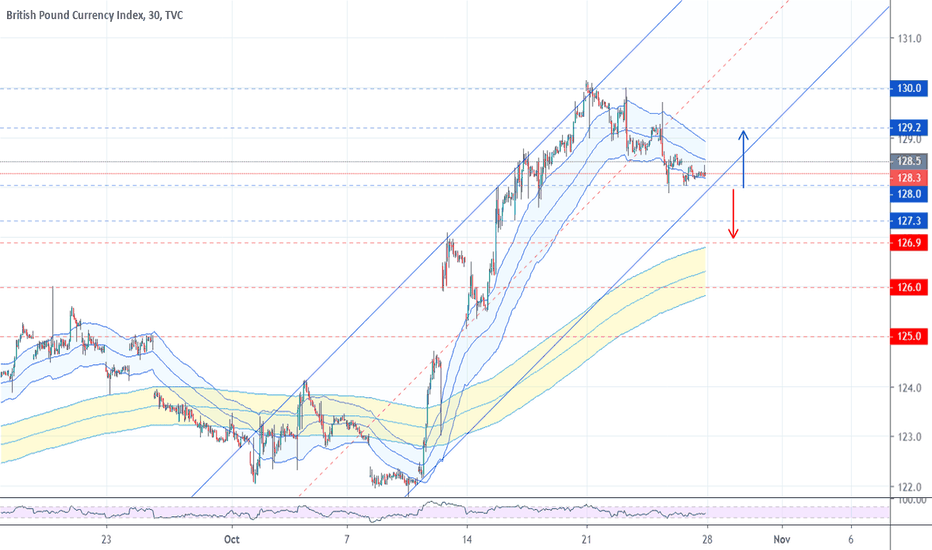

British Pound (GBP) Making Turn at Inflection PointBritish pound currency index...As of mid-day trading on Dec. 26 the pound is bouncing off the 130 level, after dipping to 129.

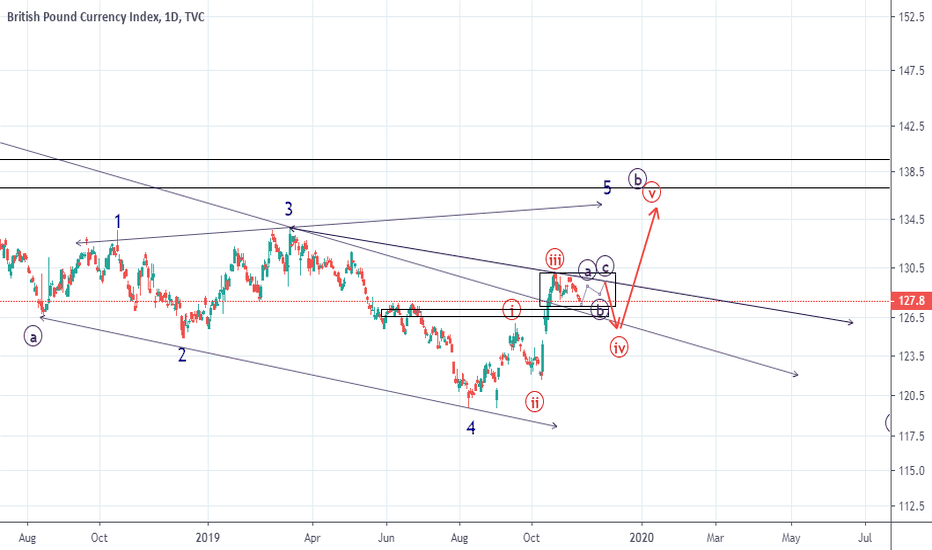

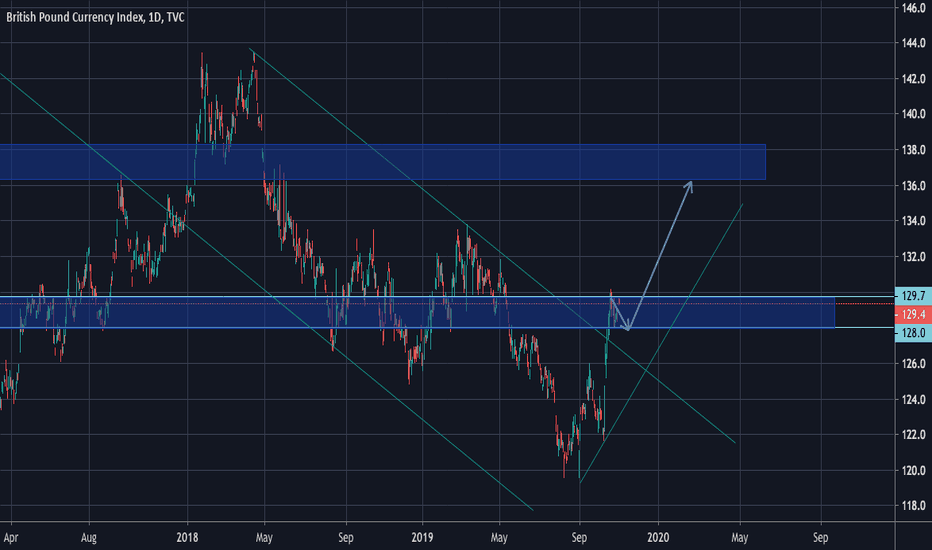

Shorter-term the upside target is 134 to 135, the area of the Dec. 12 peak. That 134 region is a longer-term resistance area, extending back to mid-2018. A continued rise above 134 and 135 would indicate that the GBP is rising to its next major resistance level near 143.

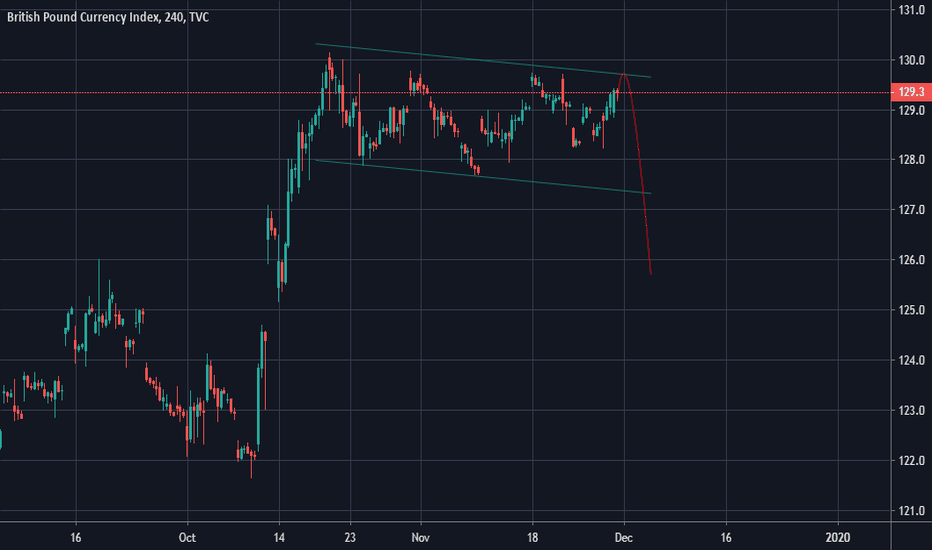

A continued decline is bearish, as all those who speculatively bought GBP on the initial upside breakout would be trapped and pressured to sell, putting further downward pressure on the GBP.

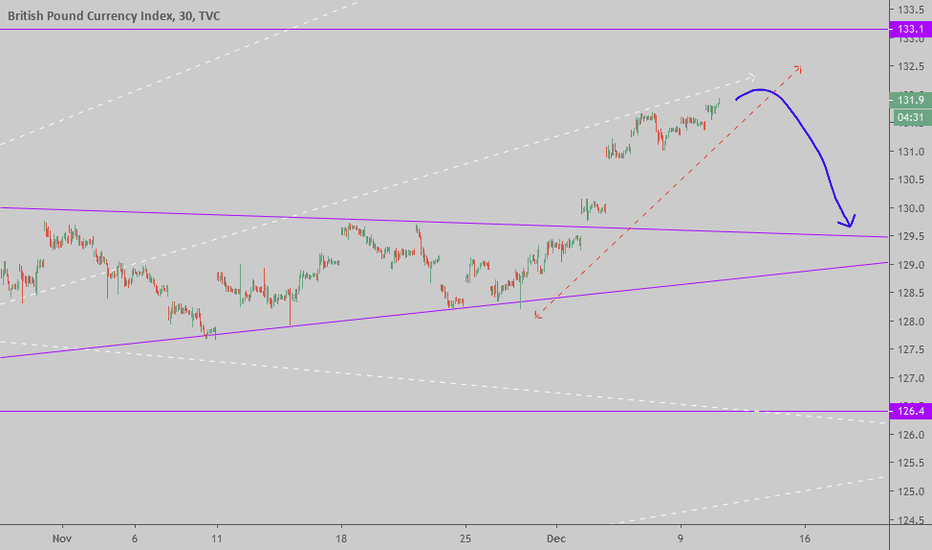

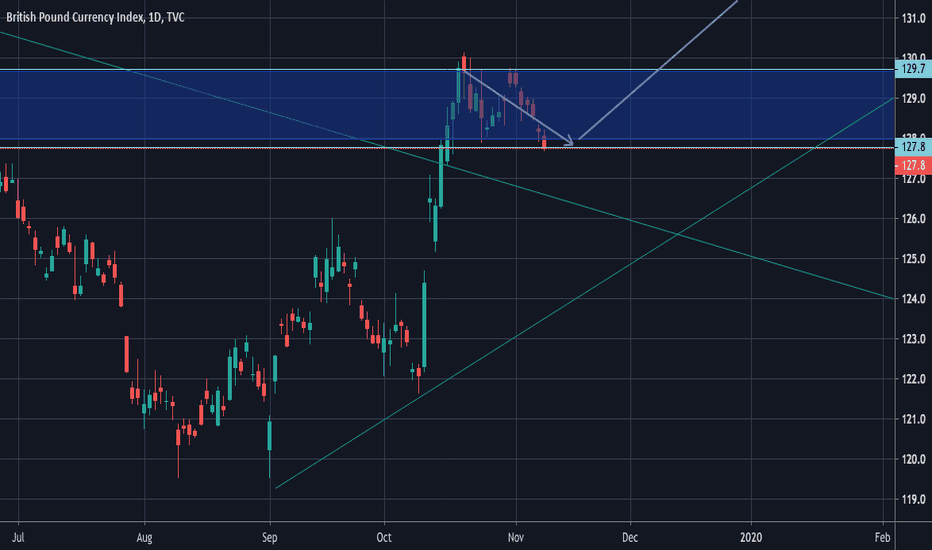

The selling pressure begins to mount below 130, with a move below 128 likely causing a sharp decline as a significant number of stop losses get hit.

Disclosure: long GBPJPY on an unrelated strategy.

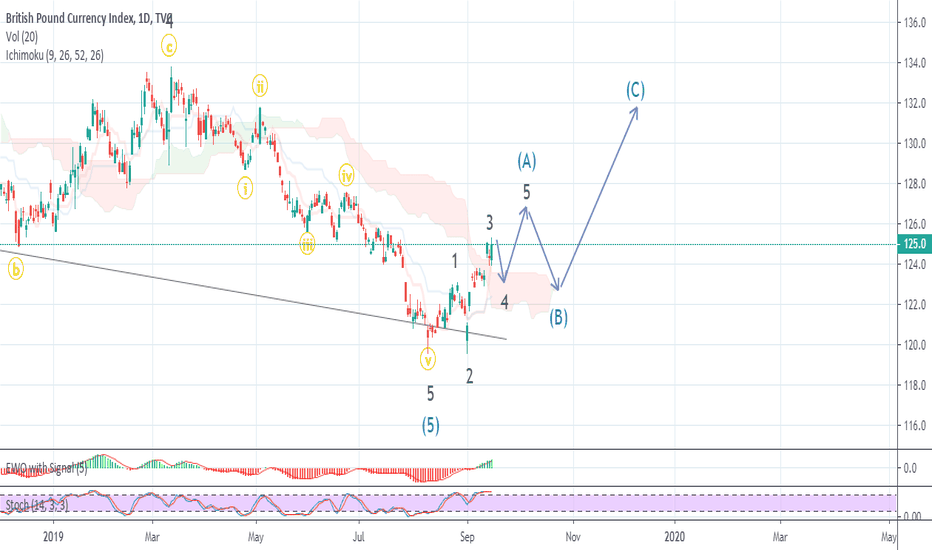

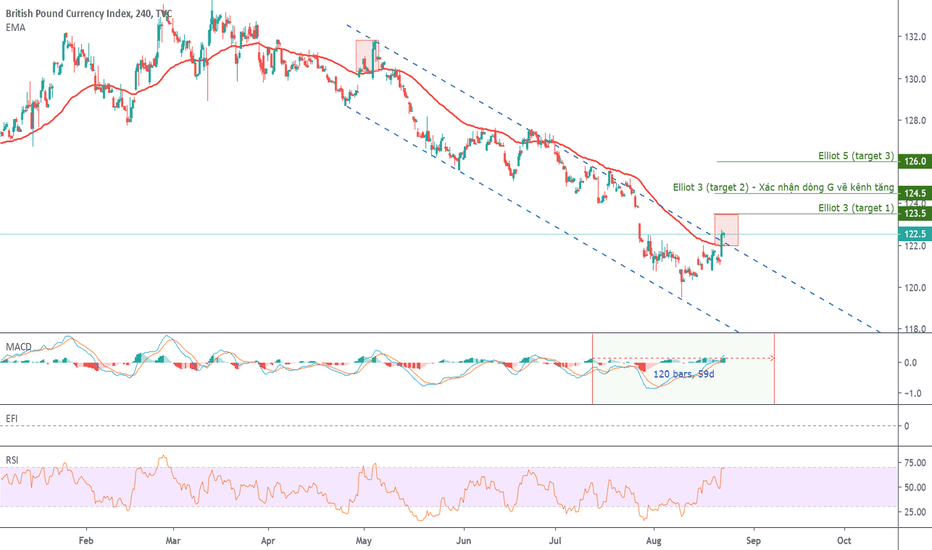

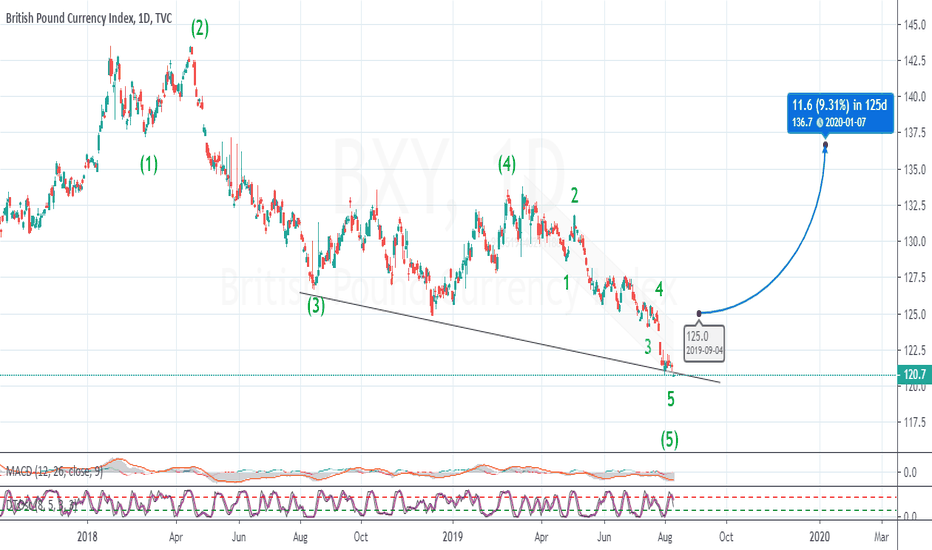

XDB trade ideas

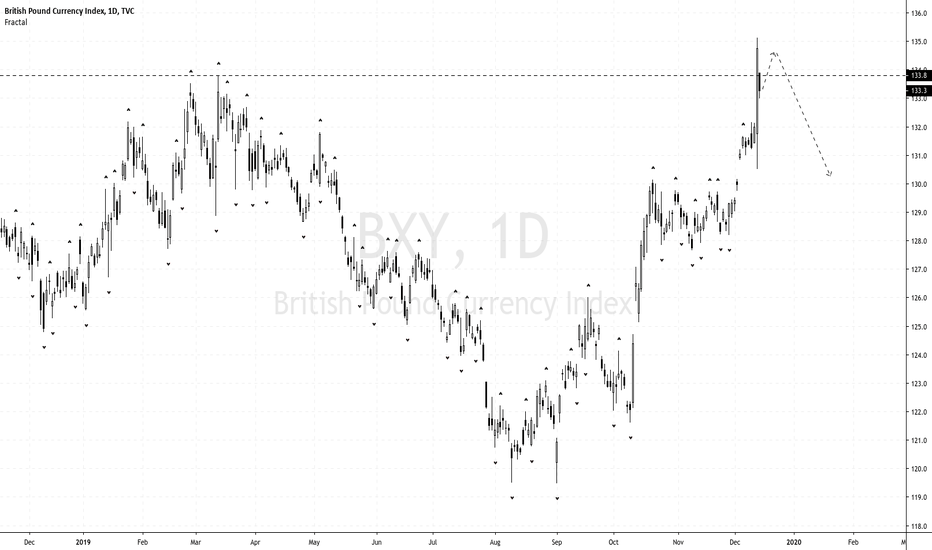

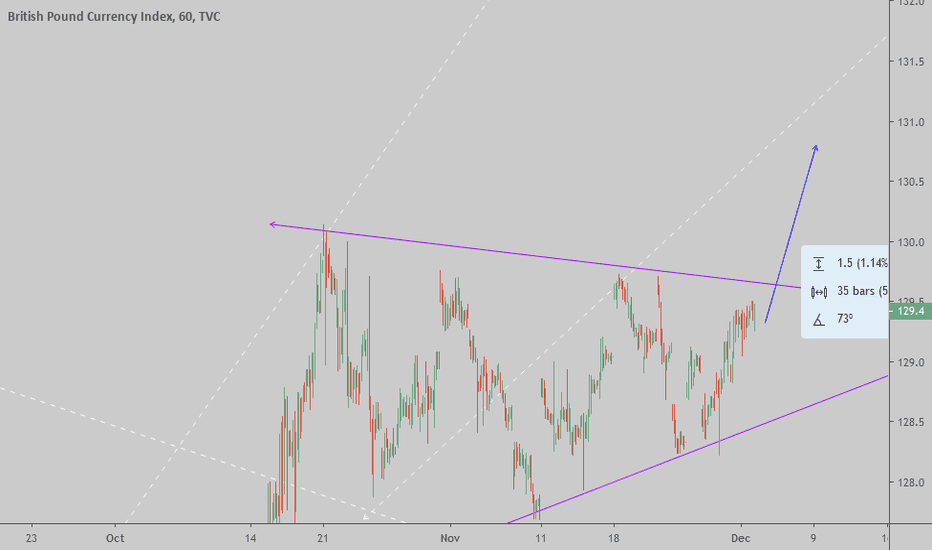

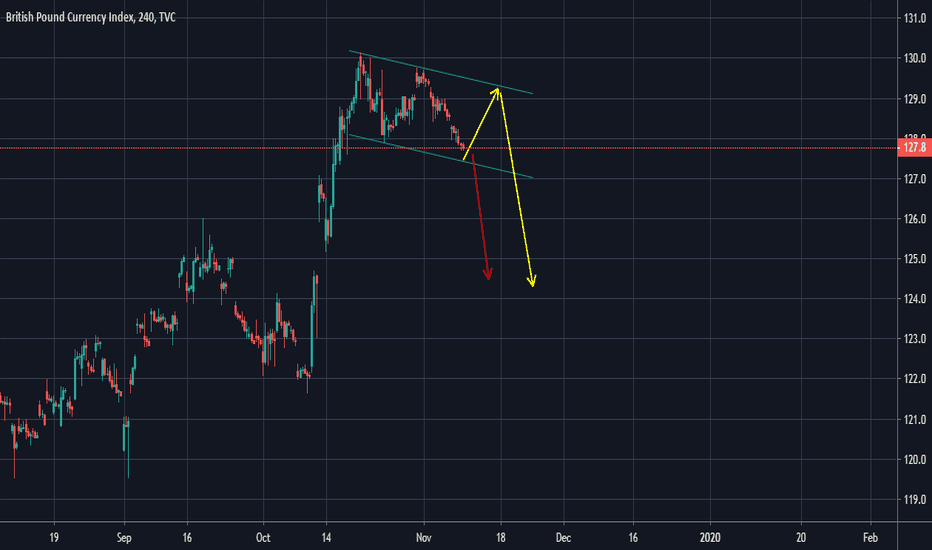

BXY- British Pound Technical Analysis for WC 28-10-2019The British Pound had a similar trend as the Euro Index in last week's session but with a drop of -1.54% at the end of the trading week. The Index will be looking for support around 128.0 at the beginning of next week opening trades. The long term outlook is still bullish; however, it will need to remain above 128.0 to continue to the upside. The Index could continue down to around 126.9 if it fails at 128.0.

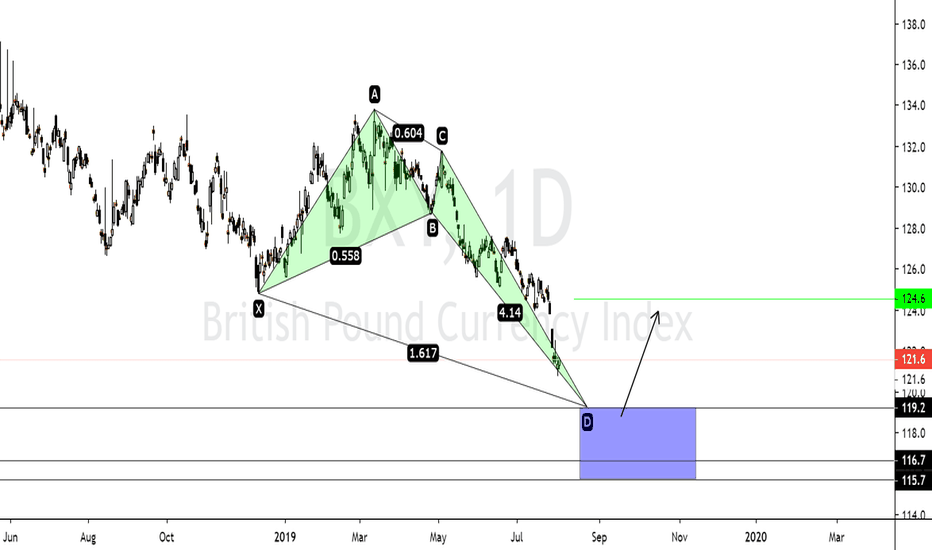

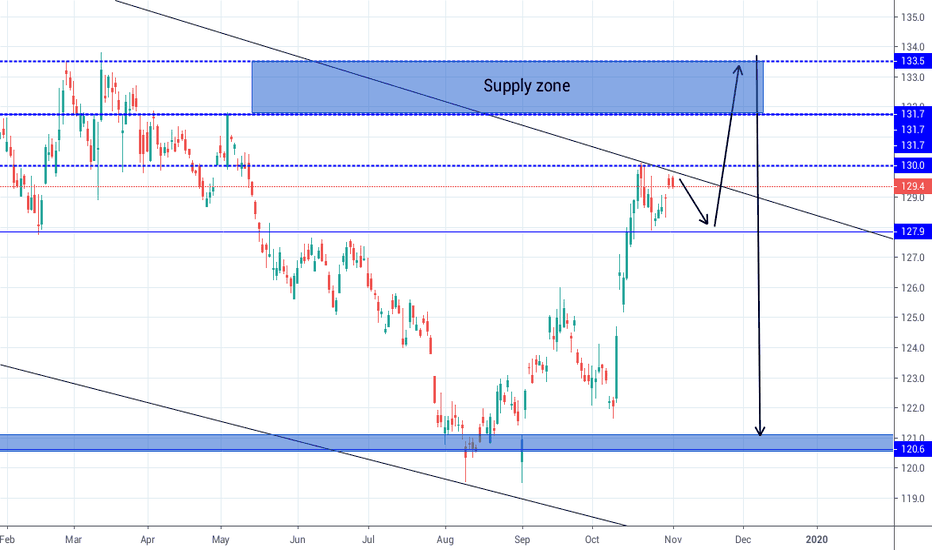

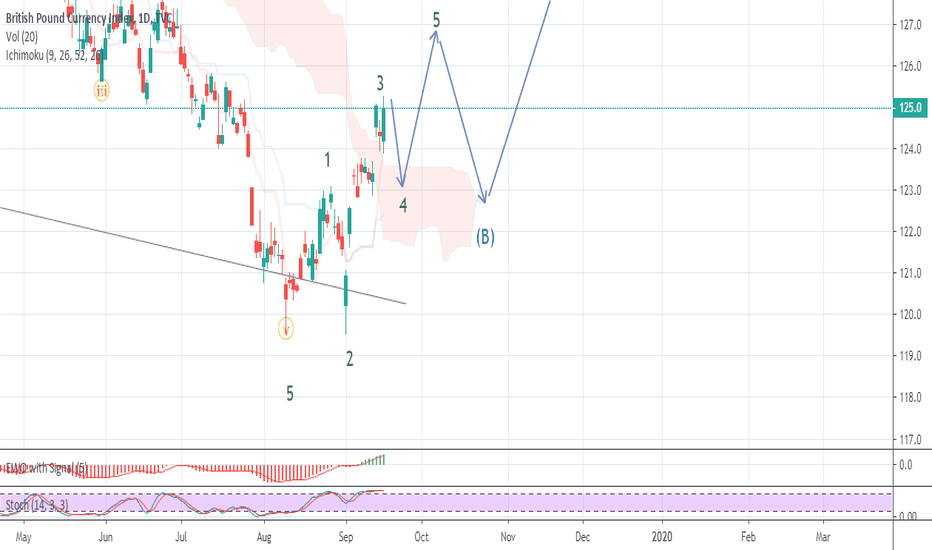

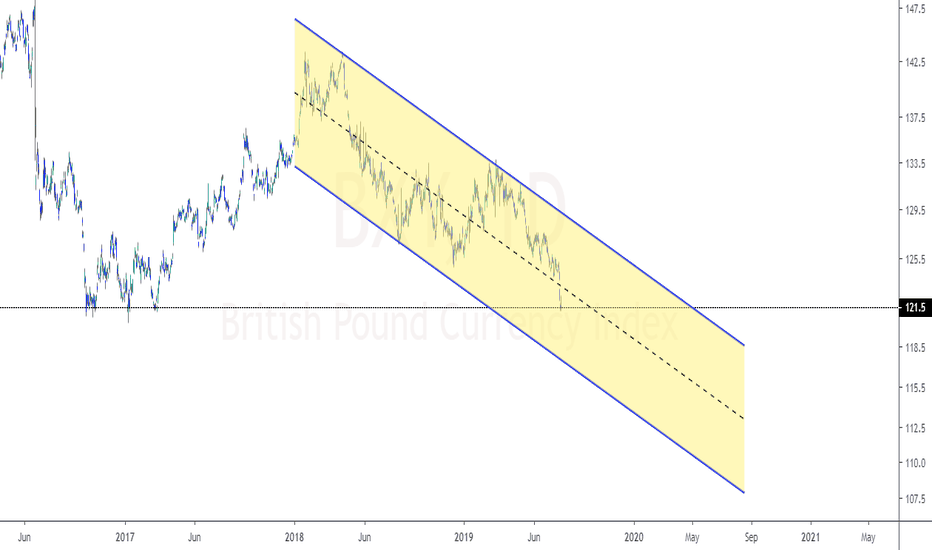

BXY (among others) be scared... Cliff fall is entirely possible.MANY of the major currencies are close to breaking their floors.

They have no real support after this collapse...

This makes the USD incredibly stong (NOT a good thing)

Only do to the fact that it is the global reserve and every other currency is in free fall...

BE CAREFULL, BE PROFITABLE!