Henry Hub Natural Gas Futures forum

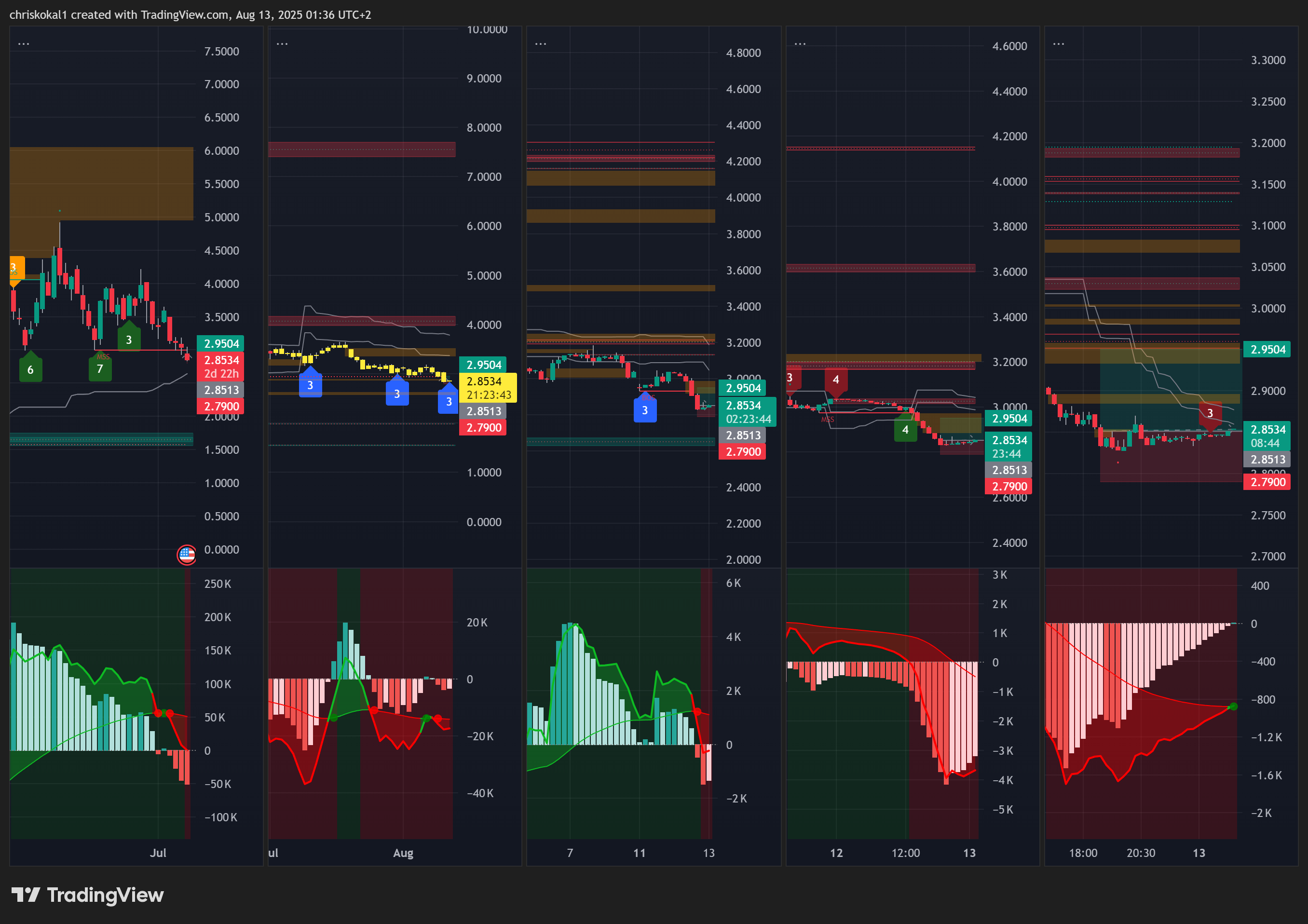

Watch when the 200MA crosses through the 800/750ema..

200MA has crossed 800/750 on the daily and weekly...

Its good on the smaller timeframes too... try it

👉till next week 22/08/25 only analysis let see market plan

can test 3.234 to 3.333 or not ?

Good luck everyone!