Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.61 CAD

596.00 M CAD

12.45 B CAD

296.80 M

About ALTAGAS LTD

Sector

Industry

CEO

Vern D. Yu

Website

Headquarters

Calgary

Founded

1994

FIGI

BBG0014LYJ70

AltaGas Ltd. is a North American energy infrastructure company that connects natural gas liquids (NGLs) and natural gas to domestic and global markets. It operates through the following segments: Utilities, Midstream, and Corporate & Other. The Utilities segment serves its customers through ownership of regulated natural gas distribution utilities and regulated natural gas storage utilities in the United States, delivering clean and affordable natural gas to homes and businesses. The Utilities segment also includes storage facilities and contracts for interstate natural gas transportation and storage services, as well as the affiliated retail energy marketing business. The Midstream segment connects customers and markets from wellhead to tidewater and beyond. The three pillars of the Midstream segment include: global exports, which includes AltaGas' two LPG export terminals; natural gas gathering and extraction; and fractionation and liquids handling. AltaGas' Midstream segment also includes its natural gas and NGL marketing business, domestic logistics, trucking and rail terminals, and liquid storage capability. The Corporate & Other segment consists of AltaGas' corporate activities and a small portfolio of remaining power assets. The company was founded by David Wallace Cornhill on April 1, 1994 and is headquartered in Calgary, Canada.

Related stocks

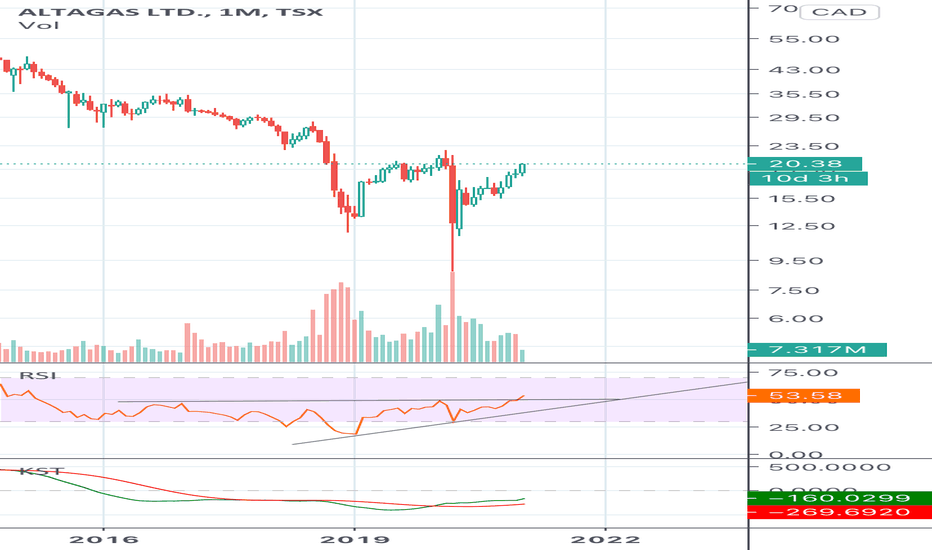

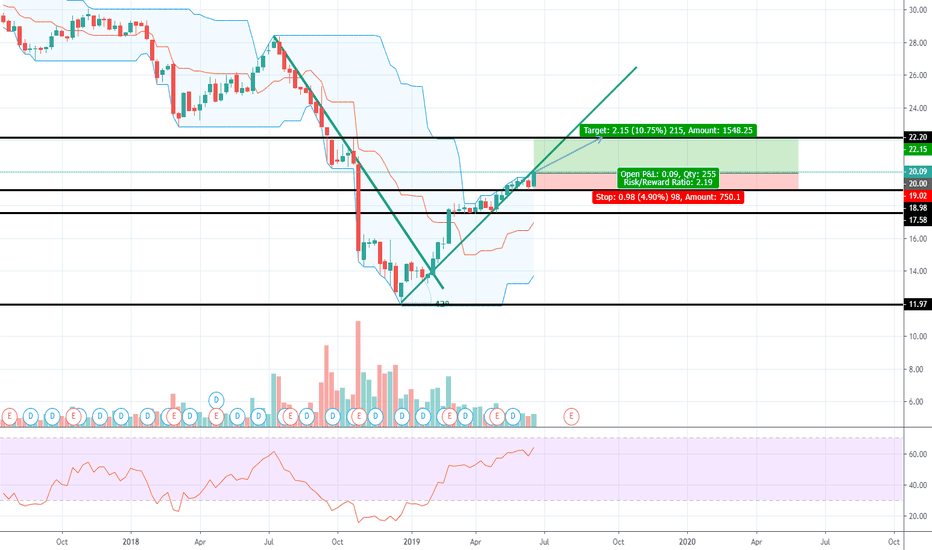

Long Altagas (ALA.TO)Altagas started to rebound after massive dump, on a weekly chart management and the firms restated objectives and debt repayment plans have started to regain investor confidence, as it can be evidenced from the price movement, over the past several weeks. It is clear that down trend is finally over

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

W

SEN3667019

Washington Gas Light Company 5.44% 11-AUG-2025Yield to maturity

10.83%

Maturity date

Aug 11, 2025

W

SEN4882757

Washington Gas Light Company 3.65% 15-SEP-2049Yield to maturity

6.79%

Maturity date

Sep 15, 2049

W

SEN3687386

Washington Gas Light Company 5.211% 03-DEC-2040Yield to maturity

6.73%

Maturity date

Dec 3, 2040

W

SEN4403855

Washington Gas Light Company 3.796% 15-SEP-2046Yield to maturity

6.66%

Maturity date

Sep 15, 2046

W

SEN3667920

Washington Gas Light Company 5.781% 15-MAR-2036Yield to maturity

6.09%

Maturity date

Mar 15, 2036

W

SEN3705537

Washington Gas Light Company 6.81% 13-MAR-2028Yield to maturity

5.41%

Maturity date

Mar 13, 2028

W

SEN3705530

Washington Gas Light Company 6.46% 23-JUL-2027Yield to maturity

5.16%

Maturity date

Jul 23, 2027

W

SEN3705536

Washington Gas Light Company 6.85% 09-MAR-2028Yield to maturity

5.08%

Maturity date

Mar 9, 2028

W

SEN3705518

Washington Gas Light Company 6.63% 23-OCT-2026Yield to maturity

5.05%

Maturity date

Oct 23, 2026

See all ALA.PR.A bonds

Frequently Asked Questions

The current price of ALA.PR.A is 24.73 CAD — it has decreased by −0.64% in the past 24 hours. Watch ALACN V3.38 PERP A stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NEO exchange ALACN V3.38 PERP A stocks are traded under the ticker ALA.PR.A.

ALA.PR.A stock has fallen by −0.48% compared to the previous week, the month change is a 7.99% rise, over the last year ALACN V3.38 PERP A has showed a 27.28% increase.

ALA.PR.A reached its all-time high on Jul 22, 2025 with the price of 24.98 CAD, and its all-time low was 7.69 CAD and was reached on Mar 24, 2020. View more price dynamics on ALA.PR.A chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

ALA.PR.A stock is 0.65% volatile and has beta coefficient of 0.35. Track ALACN V3.38 PERP A stock price on the chart and check out the list of the most volatile stocks — is ALACN V3.38 PERP A there?

Today ALACN V3.38 PERP A has the market capitalization of 12.35 B, it has increased by 2.61% over the last week.

Yes, you can track ALACN V3.38 PERP A financials in yearly and quarterly reports right on TradingView.

ALACN V3.38 PERP A is going to release the next earnings report on Oct 30, 2025. Keep track of upcoming events with our Earnings Calendar.

ALA.PR.A earnings for the last quarter are 0.27 CAD per share, whereas the estimation was 0.23 CAD resulting in a 16.61% surprise. The estimated earnings for the next quarter are 0.05 CAD per share. See more details about ALACN V3.38 PERP A earnings.

ALACN V3.38 PERP A revenue for the last quarter amounts to 2.84 B CAD, despite the estimated figure of 3.00 B CAD. In the next quarter, revenue is expected to reach 2.85 B CAD.

ALA.PR.A net income for the last quarter is 180.00 M CAD, while the quarter before that showed 397.00 M CAD of net income which accounts for −54.66% change. Track more ALACN V3.38 PERP A financial stats to get the full picture.

Yes, ALA.PR.A dividends are paid quarterly. The last dividend per share was 0.19 CAD. As of today, Dividend Yield (TTM)% is 2.97%. Tracking ALACN V3.38 PERP A dividends might help you take more informed decisions.

ALACN V3.38 PERP A dividend yield was 3.55% in 2024, and payout ratio reached 61.11%. The year before the numbers were 4.03% and 49.29% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 5, 2025, the company has 2.72 K employees. See our rating of the largest employees — is ALACN V3.38 PERP A on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ALACN V3.38 PERP A EBITDA is 1.60 B CAD, and current EBITDA margin is 12.11%. See more stats in ALACN V3.38 PERP A financial statements.

Like other stocks, ALA.PR.A shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ALACN V3.38 PERP A stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ALACN V3.38 PERP A technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ALACN V3.38 PERP A stock shows the strong buy signal. See more of ALACN V3.38 PERP A technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.