Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.10 USD

3.78 B USD

37.24 B USD

2.18 B

About ENBRIDGE INC

Sector

Industry

CEO

Gregory Lorne Ebel

Website

Headquarters

Calgary

Founded

1949

FIGI

BBG004BJ03M6

Enbridge, Inc. engages in the provision of gas and oil. It operates through the following segments: Liquid Pipelines, Gas Distribution and Storage, Gas Transmission and Midstream, Renewable Power Generation, and Energy Services. The Liquids Pipelines segment consists of common carrier and contract crude oil, natural gas liquids and refined products pipelines and terminals in Canada and the U.S., including Canadian Mainline, Regional Oil Sands System, Southern Lights Pipeline, Spearhead Pipeline, Seaway Crude Pipeline interest, and other feeder pipelines. The Gas Distribution & Storage segment consists of natural gas utility operations, the core of which is Enbridge gas, which serves residential, commercial and industrial customers. It also includes natural gas distribution activities in Quebec and an investment in Noverco, which holds a majority interest in a subsidiary entity engaged in distribution and energy transportation primarily in Quebec. The Gas Transmission & Midstream segment consists of investments in natural gas pipelines, processing and green energy projects, the company's commodity marketing businesses, and international activities. The Renewable Power Generation segment consists primarily of investments in wind and solar power generating assets, as well as geothermal, waste heat recovery, and transmission assets. The Energy Services segment consists of businesses in Canada and the United States including logistical services, refinery supply services and the firm's volume commitments on various pipeline systems. The company was founded on April 30, 1949 and is headquartered in Calgary, Canada.

Related stocks

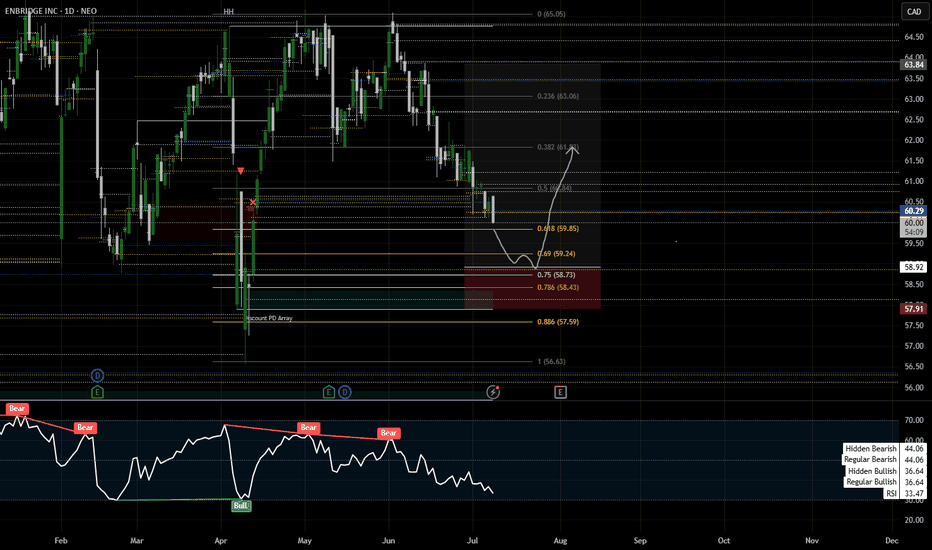

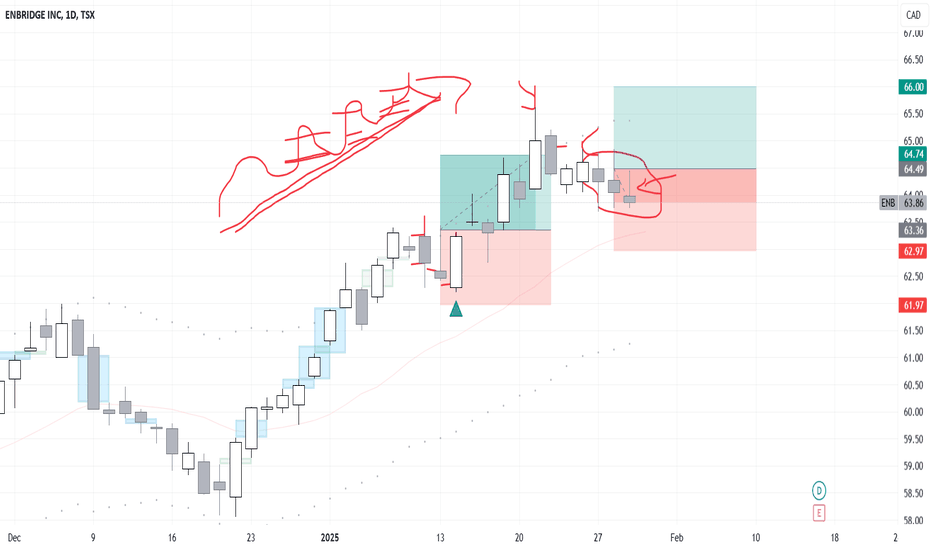

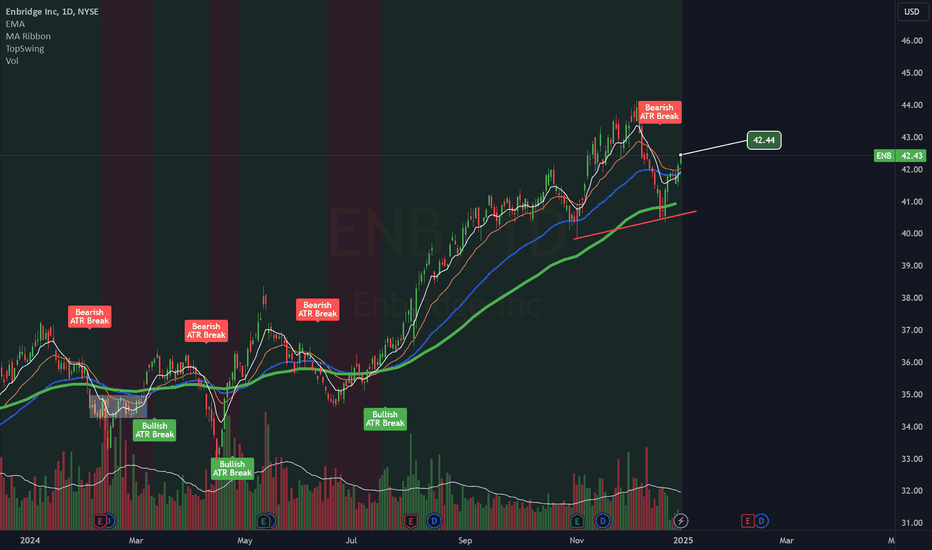

Enbridge Setting Up For An Inside Bar Entry On A PullbackWe are going back to well after previously recommending TSX:ENB in one of my other one good trade videos. In this video, I cover the concept of swing trading pullbacks. I got into depth of the price action on the pullback and I explain where I would put my stop and take profit.

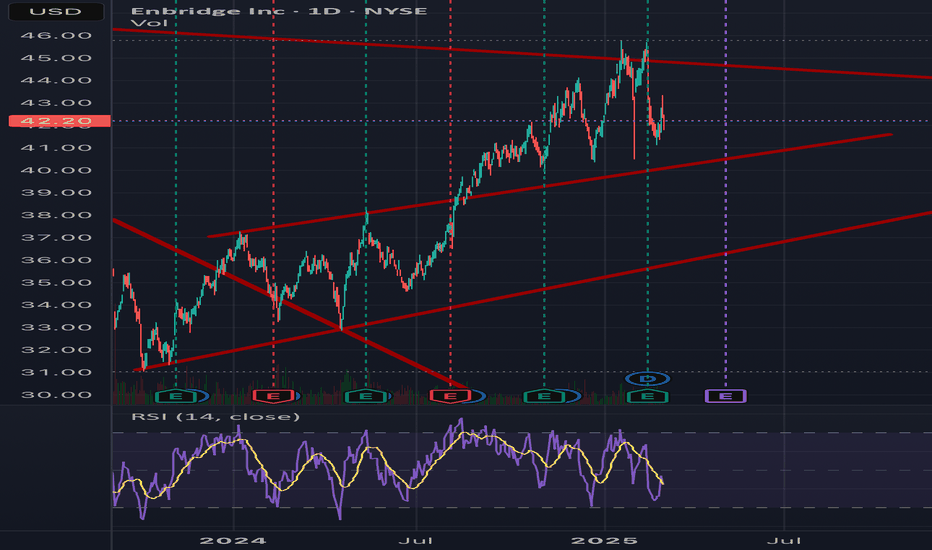

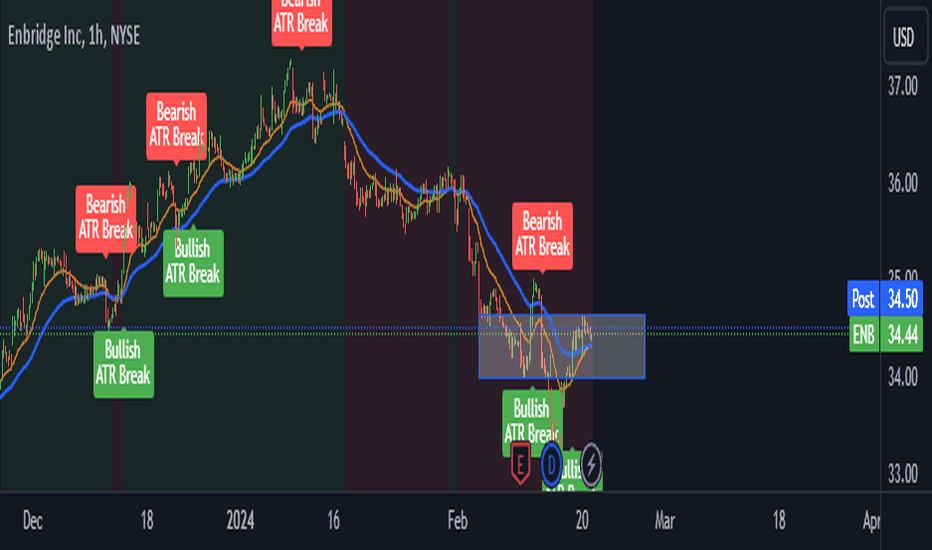

Buy ENB - 5th wave pivot identifiedPrice reversal and pivot from the end of wave 4. Buying with 1% allocation. Open @ 34 34 TP @ 37.25 (+8.5%)

Strategy:

Based on Elliot wave theory, pivot points and classic chart patterns.The 5th wave pivot strategy identifies the last impulse of the elliot wave sequence. The 5th wave can be equal

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where ENB.PR.V is featured.

Midstream oil: The middlemen of the energy sector

35 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of ENB.PR.V is 24.50 USD — it has increased by 0.12% in the past 24 hours. Watch ENBCN V5.9491 PERP 1 stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NEO exchange ENBCN V5.9491 PERP 1 stocks are traded under the ticker ENB.PR.V.

ENB.PR.V stock has risen by 0.91% compared to the previous week, the month change is a 2.52% rise, over the last year ENBCN V5.9491 PERP 1 has showed a 10.31% increase.

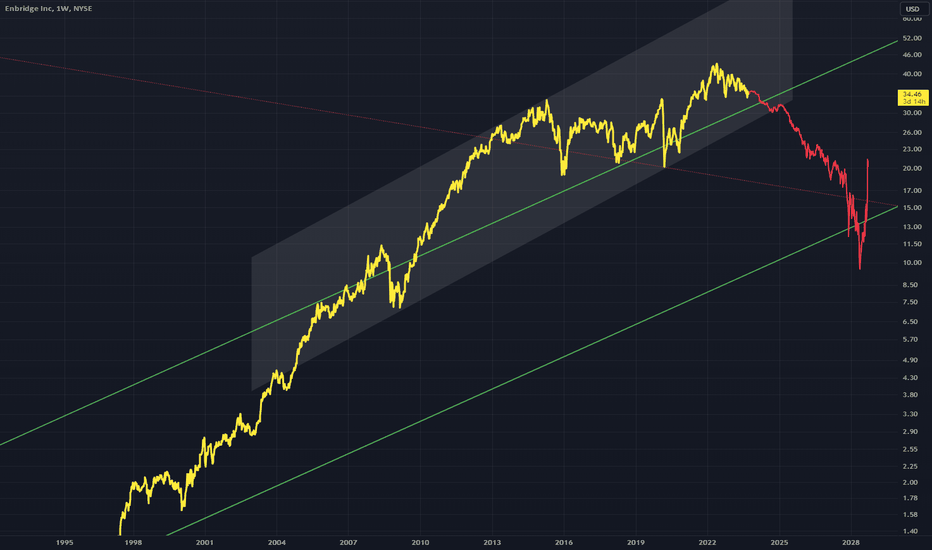

ENB.PR.V reached its all-time high on Feb 2, 2018 with the price of 24.63 USD, and its all-time low was 11.43 USD and was reached on Mar 23, 2020. View more price dynamics on ENB.PR.V chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

ENB.PR.V stock is 0.41% volatile and has beta coefficient of −0.38. Track ENBCN V5.9491 PERP 1 stock price on the chart and check out the list of the most volatile stocks — is ENBCN V5.9491 PERP 1 there?

Today ENBCN V5.9491 PERP 1 has the market capitalization of 102.49 B, it has increased by 1.58% over the last week.

Yes, you can track ENBCN V5.9491 PERP 1 financials in yearly and quarterly reports right on TradingView.

ENBCN V5.9491 PERP 1 is going to release the next earnings report on Oct 31, 2025. Keep track of upcoming events with our Earnings Calendar.

ENB.PR.V earnings for the last quarter are 0.48 USD per share, whereas the estimation was 0.42 USD resulting in a 12.63% surprise. The estimated earnings for the next quarter are 0.40 USD per share. See more details about ENBCN V5.9491 PERP 1 earnings.

ENBCN V5.9491 PERP 1 revenue for the last quarter amounts to 10.93 B USD, despite the estimated figure of 7.05 B USD. In the next quarter, revenue is expected to reach 7.60 B USD.

ENB.PR.V net income for the last quarter is 1.67 B USD, while the quarter before that showed 1.64 B USD of net income which accounts for 1.91% change. Track more ENBCN V5.9491 PERP 1 financial stats to get the full picture.

Yes, ENB.PR.V dividends are paid quarterly. The last dividend per share was 0.42 USD. As of today, Dividend Yield (TTM)% is 5.75%. Tracking ENBCN V5.9491 PERP 1 dividends might help you take more informed decisions.

ENBCN V5.9491 PERP 1 dividend yield was 6.00% in 2024, and payout ratio reached 156.31%. The year before the numbers were 7.44% and 125.12% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 7, 2025, the company has 14.5 K employees. See our rating of the largest employees — is ENBCN V5.9491 PERP 1 on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ENBCN V5.9491 PERP 1 EBITDA is 12.32 B USD, and current EBITDA margin is 28.31%. See more stats in ENBCN V5.9491 PERP 1 financial statements.

Like other stocks, ENB.PR.V shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ENBCN V5.9491 PERP 1 stock right from TradingView charts — choose your broker and connect to your account.

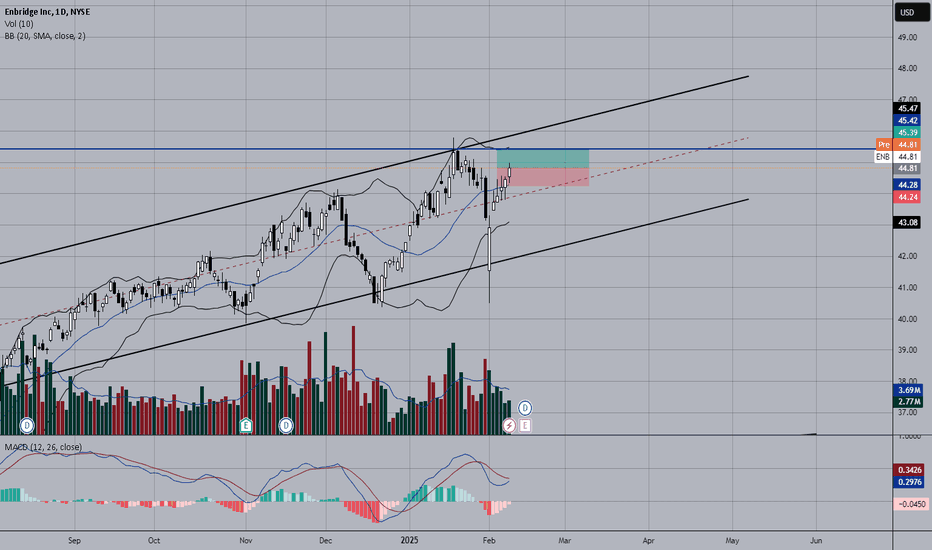

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ENBCN V5.9491 PERP 1 technincal analysis shows the strong buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ENBCN V5.9491 PERP 1 stock shows the buy signal. See more of ENBCN V5.9491 PERP 1 technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.