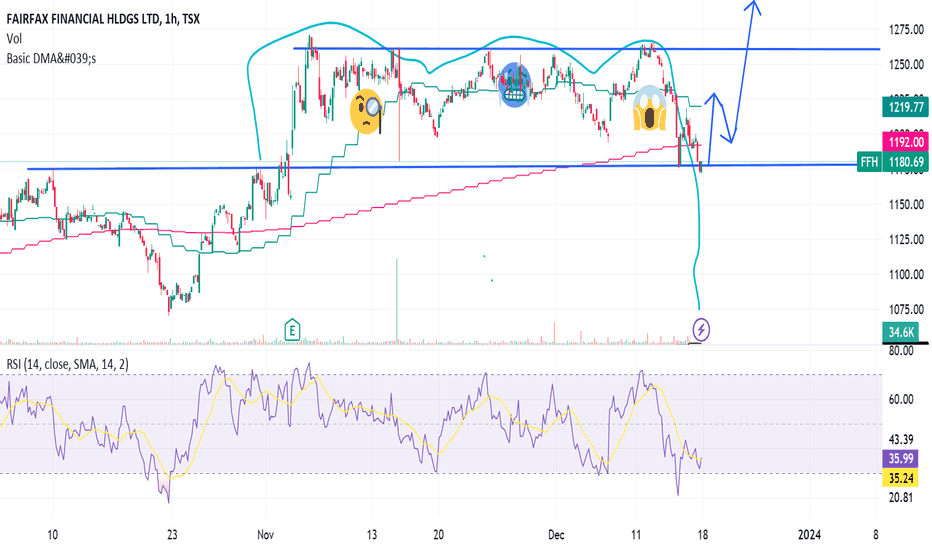

FFH is going to bounce like a basketball! H&S pattern too!It appears as though FFH is showing two alternatives, an H&S breaking down, or, sideways trading in a horizontal channel, with a breakout likely happening early 2024.

A horizontal channel is a neutral chart pattern that marks investor indecision. Buyers and sellers fight, and it is only at the exi

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

291.90 CAD

5.31 B CAD

55.83 B CAD

21.75 M

About FAIRFAX FINANCIAL HLDGS LTD

Sector

Industry

CEO

Vivian Prem Watsa

Website

Headquarters

Toronto

Founded

1951

FIGI

BBG0016VGLN3

Fairfax Financial Holdings Ltd. is a holding company, which engages in the provision of property and casualty insurance, and reinsurance, and investment management. It operates through the following segments: Insurance and Reinsurance, Runoff, and Other. The Insurance and Reinsurance segment comprises of Group Re, Bryte Insurance, Advent, Fairfax Latin America and Fairfax Central; and Eastern Europe, which focuses on third party business and specialty property reinsurance and insurance risks. The Runoff segment includes European Run-off, which includes RiverStone (UK) and Syndicate 3500 at Lloyd's, and U.S. Run-off, which includes TIG Insurance. The Other segment consists of all the non-insurance operations such as Restaurants & Retail, Fairfax India, Thomas Cook India, and Other. The company was founded by Vivian Prem Watsa on March 13, 1951 and is headquartered in Toronto, Canada.

Related stocks

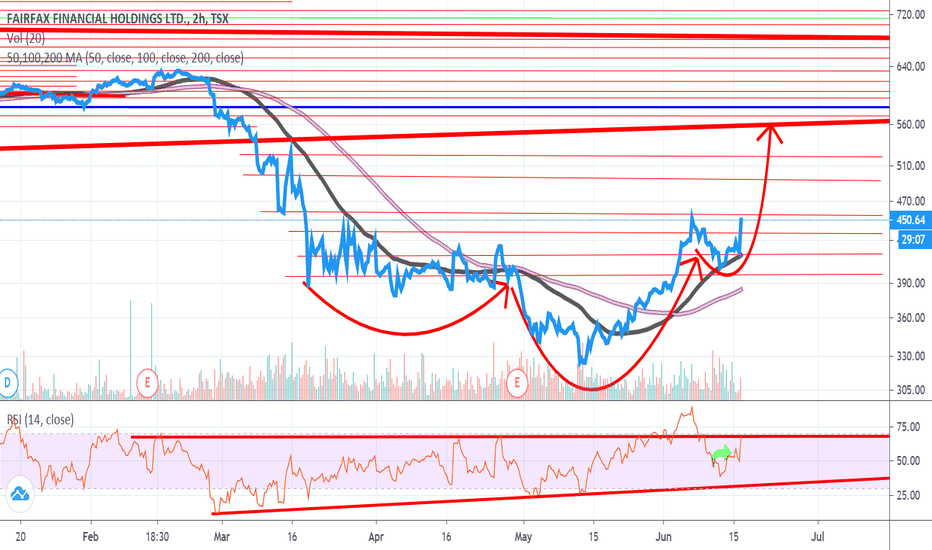

Is FFH breaking out of an Inverted H&S?On the RSI FFH has created a higher high, very bullish.

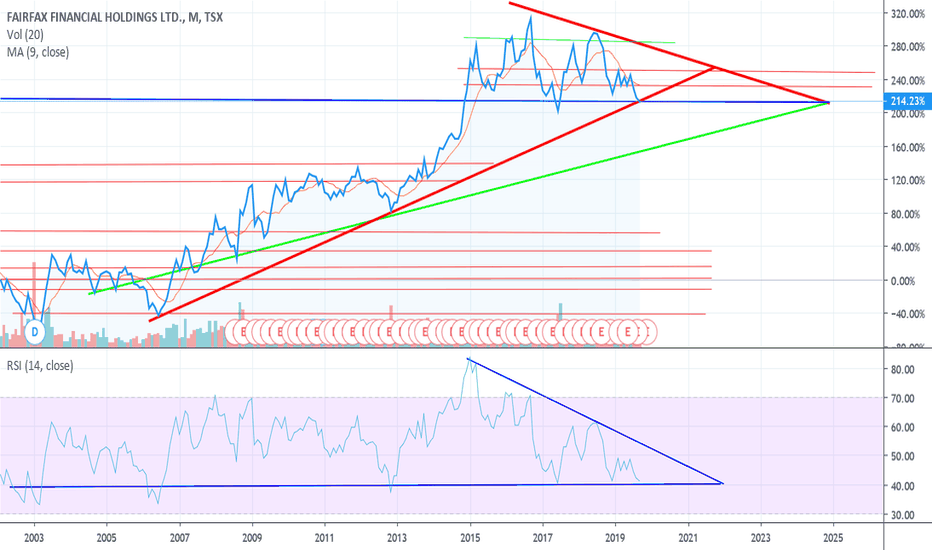

Prem Watsa bought nearly Half a Million shares of FFH, I wonder if the Blackberry rumors are true?

An inverse head and shoulders is similar to the standard head and shoulders pattern, but inverted: with the head and shoulders top used to pre

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

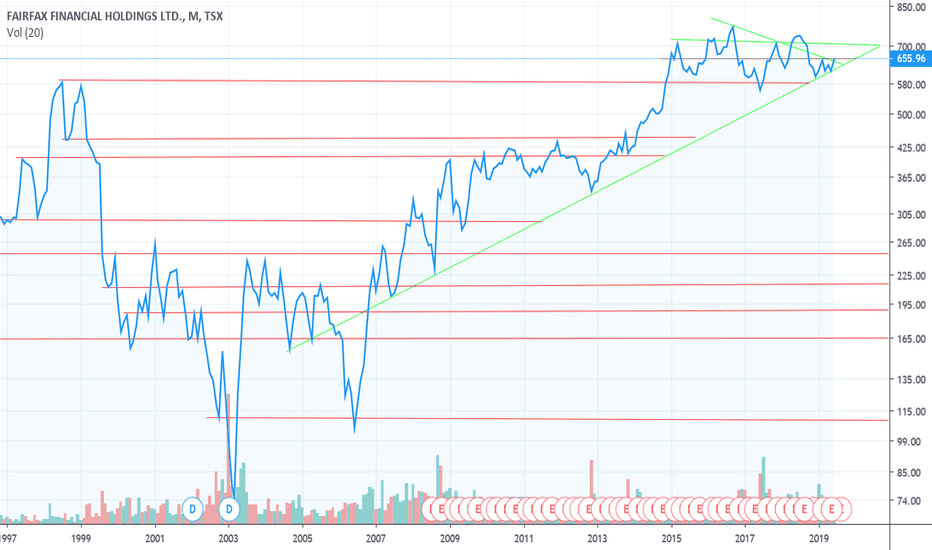

Displays a symbol's price movements over previous years to identify recurring trends.

FFXDF5139662

Fairfax India Holdings Corporation 5.0% 26-FEB-2028Yield to maturity

7.68%

Maturity date

Feb 26, 2028

FRFHF6066836

Fairfax Financial Holdings Limited 6.1% 15-MAR-2055Yield to maturity

6.27%

Maturity date

Mar 15, 2055

FRFHF5776131

Fairfax Financial Holdings Limited 6.35% 22-MAR-2054Yield to maturity

6.26%

Maturity date

Mar 22, 2054

FRFHF5903675

Fairfax Financial Holdings Limited 6.35% 22-MAR-2054Yield to maturity

6.20%

Maturity date

Mar 22, 2054

FRFHF5834895

Fairfax Financial Holdings Limited 6.1% 15-MAR-2055Yield to maturity

5.80%

Maturity date

Mar 15, 2055

FRFHF5713309

Fairfax Financial Holdings Limited 6.0% 07-DEC-2033Yield to maturity

5.74%

Maturity date

Dec 7, 2033

FRFHF5892012

Fairfax Financial Holdings Limited 6.0% 07-DEC-2033Yield to maturity

5.11%

Maturity date

Dec 7, 2033

FRFHF3675883

Fairfax Financial Holdings Limited 7.75% 15-JUL-2037Yield to maturity

5.07%

Maturity date

Jul 15, 2037

FRFHF5593125

Fairfax Financial Holdings Limited 5.625% 16-AUG-2032Yield to maturity

5.03%

Maturity date

Aug 16, 2032

FRFHF5280985

Fairfax Financial Holdings Limited 3.375% 03-MAR-2031Yield to maturity

4.82%

Maturity date

Mar 3, 2031

See all FFH.PR.I bonds

Curated watchlists where FFH.PR.I is featured.

Frequently Asked Questions

The current price of FFH.PR.I is 24.71 CAD — it has decreased by −0.12% in the past 24 hours. Watch FFHCN V3.327 PERP I stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NEO exchange FFHCN V3.327 PERP I stocks are traded under the ticker FFH.PR.I.

FFH.PR.I stock hasn't changed in a week, the month change is a 1.69% rise, over the last year FFHCN V3.327 PERP I has showed a 30.43% increase.

FFH.PR.I reached its all-time high on Jul 22, 2025 with the price of 24.75 CAD, and its all-time low was 8.09 CAD and was reached on Mar 23, 2020. View more price dynamics on FFH.PR.I chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

FFH.PR.I stock is 0.12% volatile and has beta coefficient of 0.68. Track FFHCN V3.327 PERP I stock price on the chart and check out the list of the most volatile stocks — is FFHCN V3.327 PERP I there?

Today FFHCN V3.327 PERP I has the market capitalization of 58.07 B, it has decreased by −0.94% over the last week.

Yes, you can track FFHCN V3.327 PERP I financials in yearly and quarterly reports right on TradingView.

FFHCN V3.327 PERP I is going to release the next earnings report on Oct 30, 2025. Keep track of upcoming events with our Earnings Calendar.

FFH.PR.I earnings for the last quarter are 83.88 CAD per share, whereas the estimation was 74.61 CAD resulting in a 12.43% surprise. The estimated earnings for the next quarter are 54.50 CAD per share. See more details about FFHCN V3.327 PERP I earnings.

FFHCN V3.327 PERP I revenue for the last quarter amounts to 12.49 B CAD, despite the estimated figure of 12.66 B CAD. In the next quarter, revenue is expected to reach 11.83 B CAD.

FFH.PR.I net income for the last quarter is 1.99 B CAD, while the quarter before that showed 1.36 B CAD of net income which accounts for 46.53% change. Track more FFHCN V3.327 PERP I financial stats to get the full picture.

Yes, FFH.PR.I dividends are paid quarterly. The last dividend per share was 0.21 CAD. As of today, Dividend Yield (TTM)% is 0.90%. Tracking FFHCN V3.327 PERP I dividends might help you take more informed decisions.

FFHCN V3.327 PERP I dividend yield was 1.08% in 2024, and payout ratio reached 9.09%. The year before the numbers were 1.66% and 8.04% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 5, 2025, the company has 57 K employees. See our rating of the largest employees — is FFHCN V3.327 PERP I on this list?

Like other stocks, FFH.PR.I shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade FFHCN V3.327 PERP I stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So FFHCN V3.327 PERP I technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating FFHCN V3.327 PERP I stock shows the strong buy signal. See more of FFHCN V3.327 PERP I technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.