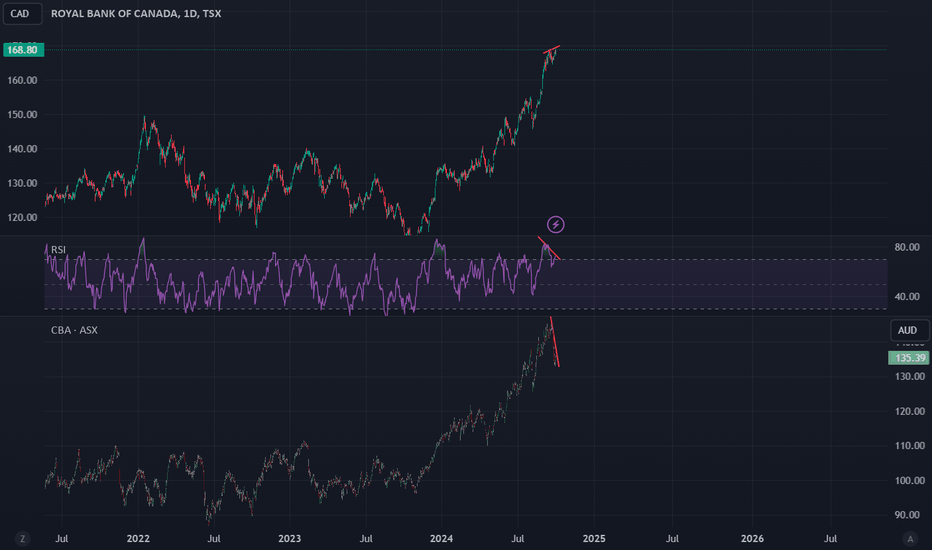

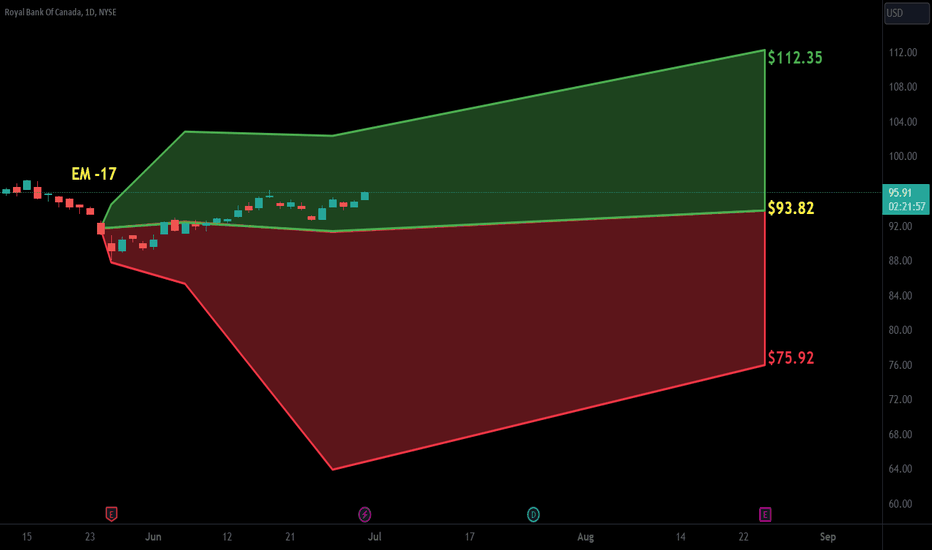

SHORT Royal Bank of Canada at 168.8 due to divergencesHello!

Id like to be short Royal Bank of Canada here at $168.8 as it has divergences vs Commonwealth Bank of Australia (Who are in a very similar position) and on its RSI.

We had a similar instance in 2023, that ignited a 20% decline in Royal Bank of Canadas share price.

Target is an 11% decli

Key facts today

Canaccord Genuity has set a price target of C$194.00 per share for Royal Bank of Canada.

On June 25, 2025, Royal Bank of Canada reported transactions involving Direct Line Insurance Group Plc, including purchases, sales, and derivatives, but did not disclose specific details.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

12.59 CAD

16.23 B CAD

133.22 B CAD

1.41 B

About ROYAL BANK OF CANADA

Sector

Industry

CEO

David Ian McKay

Website

Headquarters

Toronto

Founded

1864

FIGI

BBG008838XW1

Royal Bank of Canada engages in the provision of banking and financial services. It operates through the following segments: Personal and Commercial Banking, Wealth Management, Insurance, Capital Markets, and Corporate Support. The Personal and Commercial Banking segment deals with a broad suite of financial products and services in both individual and business clients in Canada, the Caribbean, and the U.S. The Wealth Management segment offers a suite of wealth, investment, trust, banking, credit, and other advice-based solutions. It also offers other wealth management solutions to institutional and individual clients through its distribution channels and third-party distributors. The Insurance segment refers to a suite of advice and solutions for individual and business clients including life, health, wealth, property and casualty, travel, group benefits, annuities, and reinsurance. The Capital Markets segment is involved in the provision of advisory and origination, sales and trading, lending and financing and transaction banking to corporations, institutional clients, asset managers, private equity firms and governments globally. The Corporate Support segment consists of technology and operations services. The company was founded by J. W. Merkell, Edward Kenny, T. C. Kinnear, James B. Duffus, William Cunard, John Tobin, George P. Mitchell and Jeremiah Northup in 1864 and is headquartered in Toronto, Canada.

Related stocks

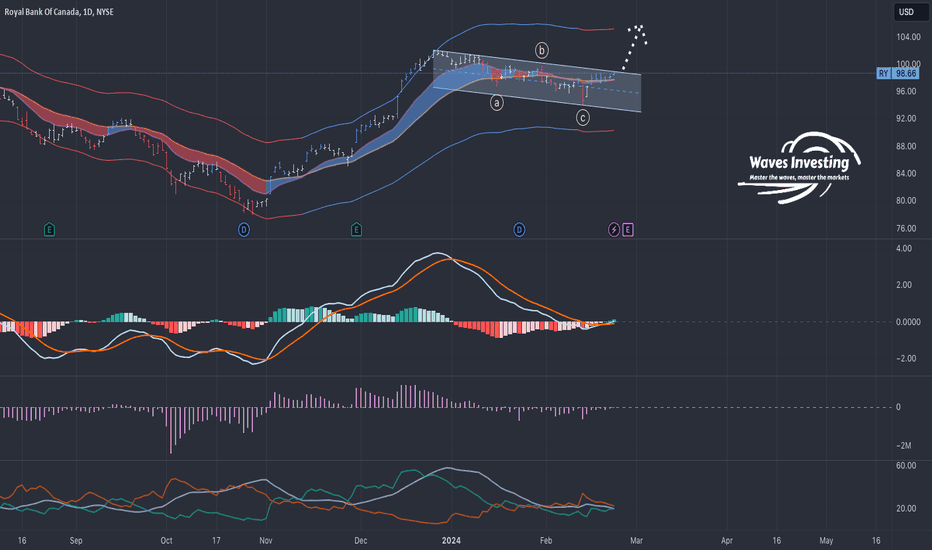

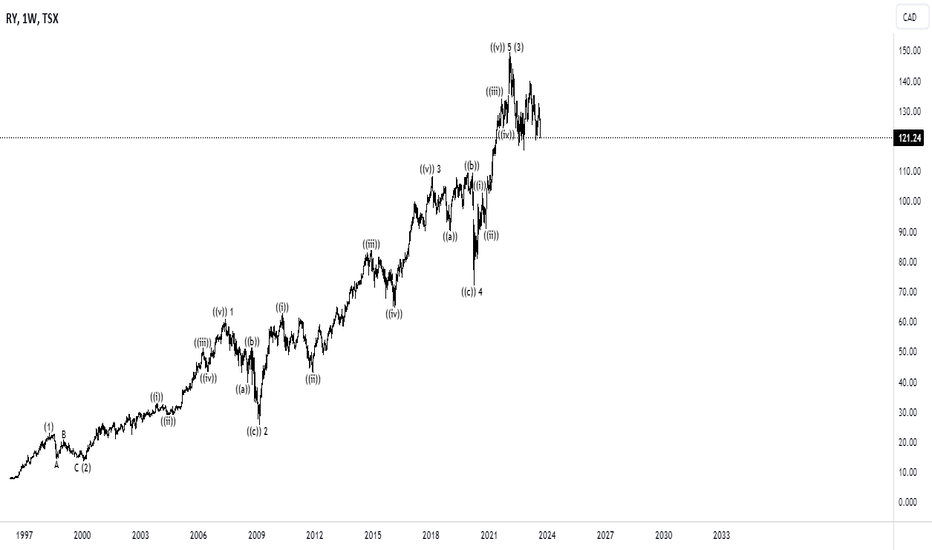

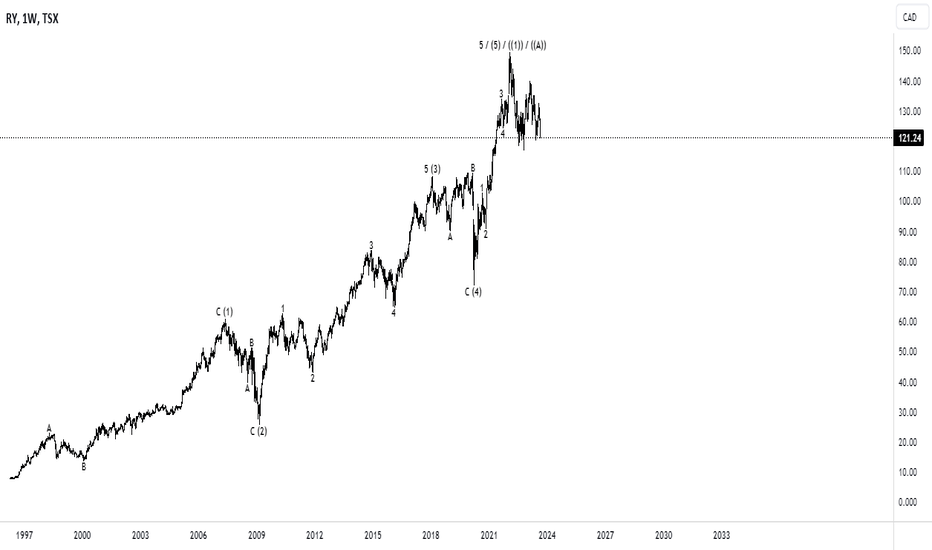

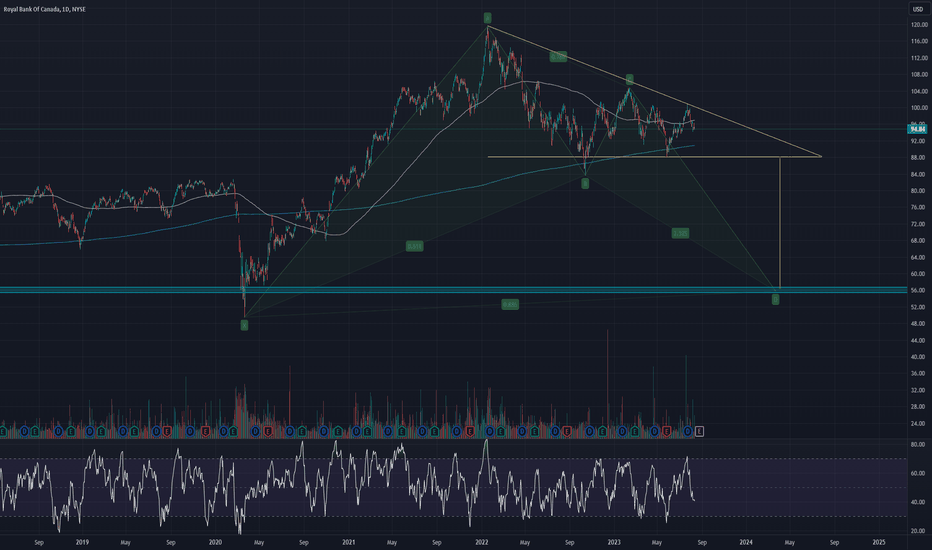

$RY out of correction?A good earning report can pop the price of TSX:RY to the upper channel line.

3 reasons why?

1. A decisive move about the parallel channels line will signal the end of the correction marked by me on the chart as the abc correction.

2. But if the report is negative or more precisely the market vi

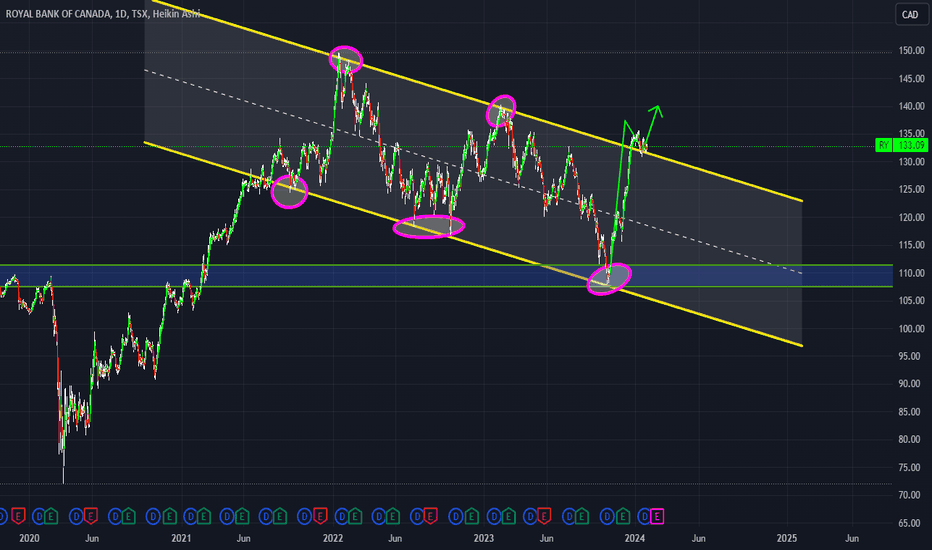

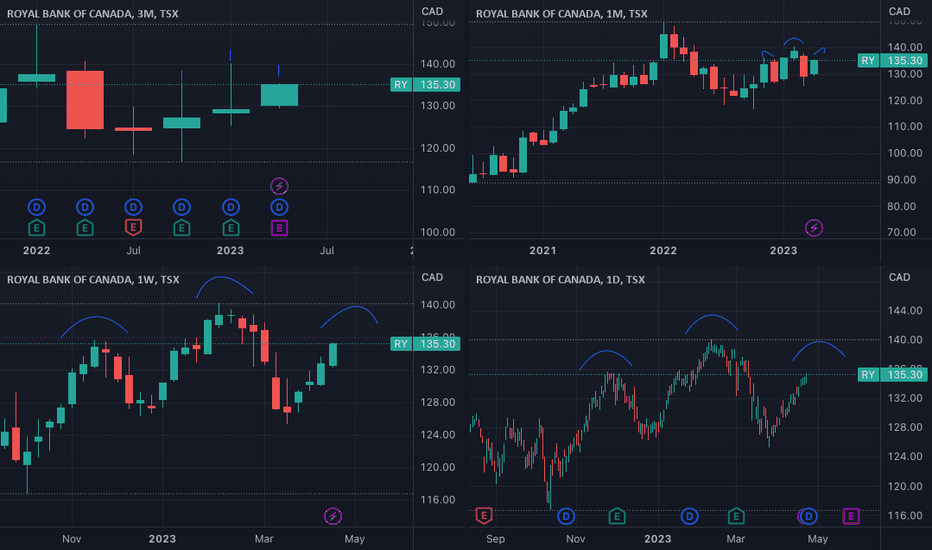

Is RY forming a head-and-shoulders?* Big support between 125-127

* now reaching previous resistance (135) from November 2022

* It broke through this before (February 2023) but retreated back to support.

* Will it rally to a new high or stall out?

Honestly I don't know. Would love to hear your comments.

NYSE:RY TSX:RY

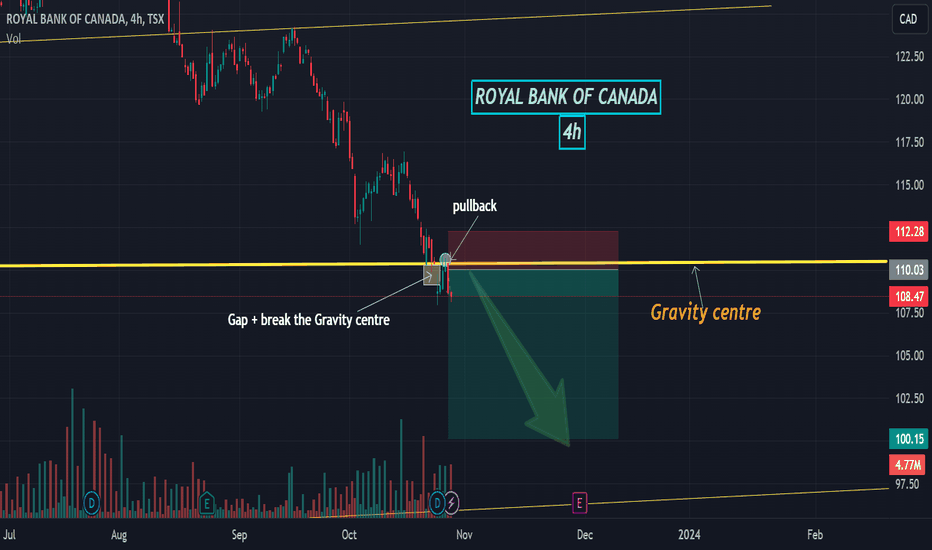

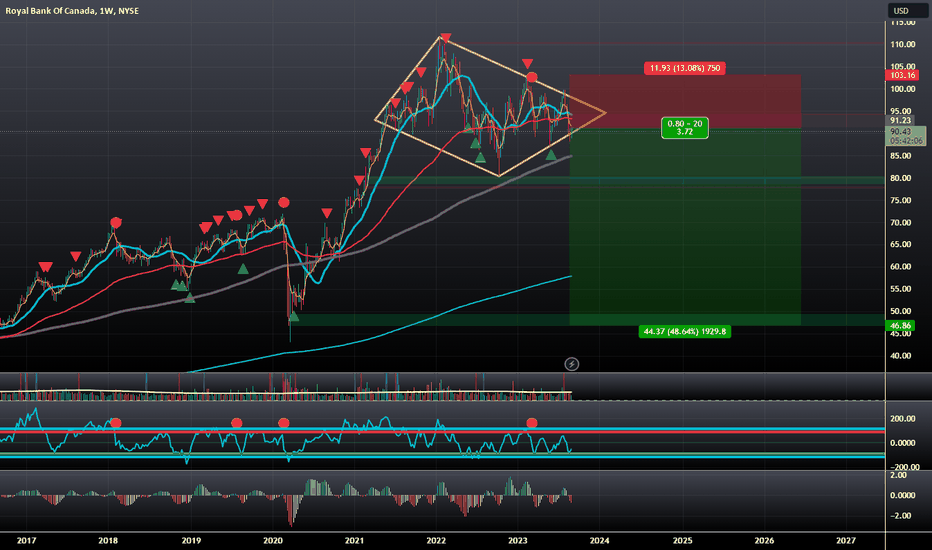

Royal Bank of Canada: Bearish Diamond AnticipationRoyal Bank of Canada has confirmed a Diamond Top pattern on the weekly, along with a breaking of the Moving Average. Upon breaking down, I think it will start a move down all the way to the 88.6% Retrace, likely near $46. Since the Diamond is a Neutral pattern and we have not gotten an official brea

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

XS2993415343

RoyBkCan 37Yield to maturity

76.24%

Maturity date

Apr 7, 2037

RY5761680

Royal Bank of Canada 8.5% 28-FEB-2039Yield to maturity

9.92%

Maturity date

Feb 28, 2039

RY5556227

Royal Bank of Canada 8.0% 17-MAR-2033Yield to maturity

9.76%

Maturity date

Mar 17, 2033

RY5792070

Royal Bank of Canada 8.5% 15-APR-2039Yield to maturity

9.46%

Maturity date

Apr 15, 2039

RY5148306

Royal Bank of Canada 2.165071% 15-MAR-2041Yield to maturity

9.11%

Maturity date

Mar 15, 2041

RY5321145

Royal Bank of Canada 0.0% 28-DEC-2026Yield to maturity

8.82%

Maturity date

Dec 28, 2026

RY5754702

Royal Bank of Canada 8.5% 16-FEB-2039Yield to maturity

8.50%

Maturity date

Feb 16, 2039

RBC5752868

Royal Bank of Canada 0.0% 03-MAR-2027Yield to maturity

8.49%

Maturity date

Mar 3, 2027

RY5546083

Royal Bank of Canada 8.25% 24-FEB-2033Yield to maturity

8.25%

Maturity date

Feb 24, 2033

RY5611014

Royal Bank of Canada 8.0% 29-JUN-2033Yield to maturity

8.00%

Maturity date

Jun 29, 2033

RY5795522

Royal Bank of Canada 7.5% 02-MAY-2084Yield to maturity

7.18%

Maturity date

May 2, 2084

See all RY.PR.M bonds

Curated watchlists where RY.PR.M is featured.

Diversity stocks: Most diverse & inclusive employers

19 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of RY.PR.M is 24.70 CAD — it has decreased by −0.20% in the past 24 hours. Watch RY V3 PERP BF stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NEO exchange RY V3 PERP BF stocks are traded under the ticker RY.PR.M.

RY.PR.M reached its all-time high on Sep 10, 2021 with the price of 24.99 CAD, and its all-time low was 11.98 CAD and was reached on Mar 18, 2020. View more price dynamics on RY.PR.M chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

RY.PR.M stock is 0.20% volatile and has beta coefficient of 0.02. Track RY V3 PERP BF stock price on the chart and check out the list of the most volatile stocks — is RY V3 PERP BF there?

Today RY V3 PERP BF has the market capitalization of 246.33 B, it has increased by 2.01% over the last week.

Yes, you can track RY V3 PERP BF financials in yearly and quarterly reports right on TradingView.

RY V3 PERP BF is going to release the next earnings report on Aug 27, 2025. Keep track of upcoming events with our Earnings Calendar.

RY.PR.M earnings for the last quarter are 3.12 CAD per share, whereas the estimation was 3.18 CAD resulting in a −1.90% surprise. The estimated earnings for the next quarter are 3.29 CAD per share. See more details about RY V3 PERP BF earnings.

RY V3 PERP BF revenue for the last quarter amounts to 15.67 B CAD, despite the estimated figure of 15.82 B CAD. In the next quarter, revenue is expected to reach 15.97 B CAD.

RY.PR.M net income for the last quarter is 4.39 B CAD, while the quarter before that showed 5.13 B CAD of net income which accounts for −14.49% change. Track more RY V3 PERP BF financial stats to get the full picture.

Yes, RY.PR.M dividends are paid quarterly. The last dividend per share was 0.19 CAD. As of today, Dividend Yield (TTM)% is 3.32%. Tracking RY V3 PERP BF dividends might help you take more informed decisions.

RY V3 PERP BF dividend yield was 3.33% in 2024, and payout ratio reached 49.70%. The year before the numbers were 4.82% and 51.70% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jun 25, 2025, the company has 94.84 K employees. See our rating of the largest employees — is RY V3 PERP BF on this list?

Like other stocks, RY.PR.M shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade RY V3 PERP BF stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So RY V3 PERP BF technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating RY V3 PERP BF stock shows the buy signal. See more of RY V3 PERP BF technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.