AARTIDRUGS trade ideas

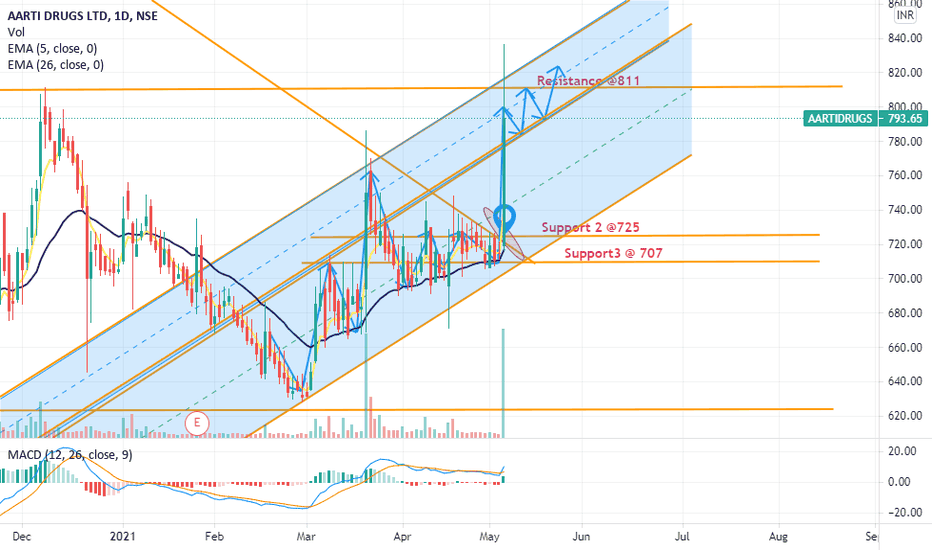

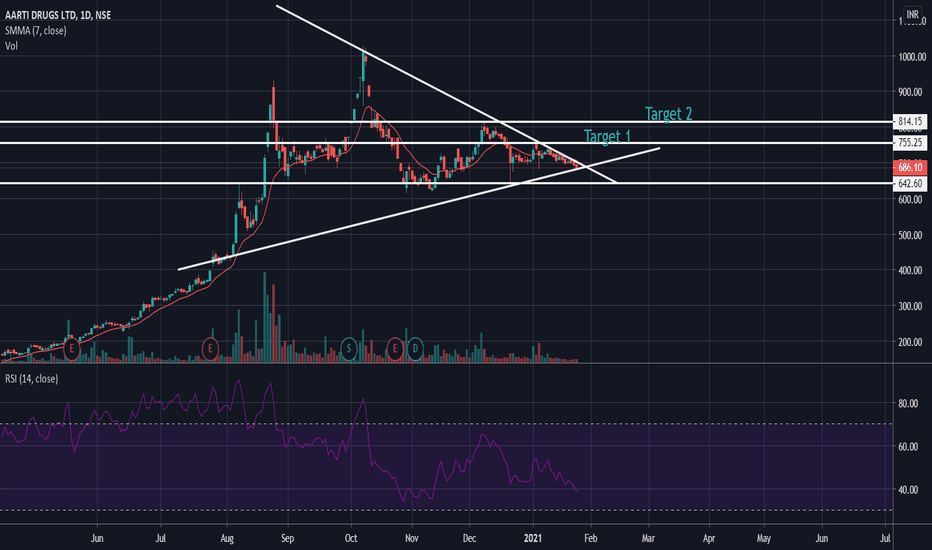

Aarti Drug time

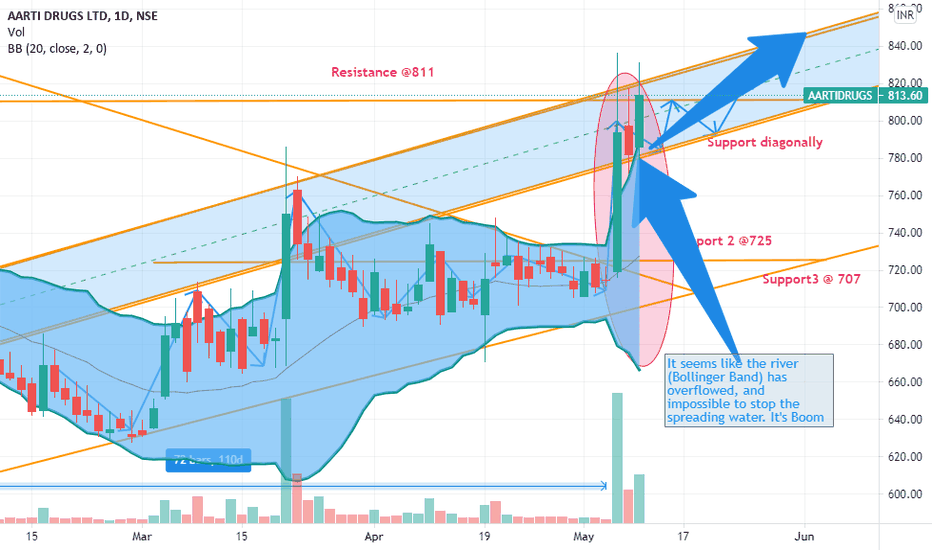

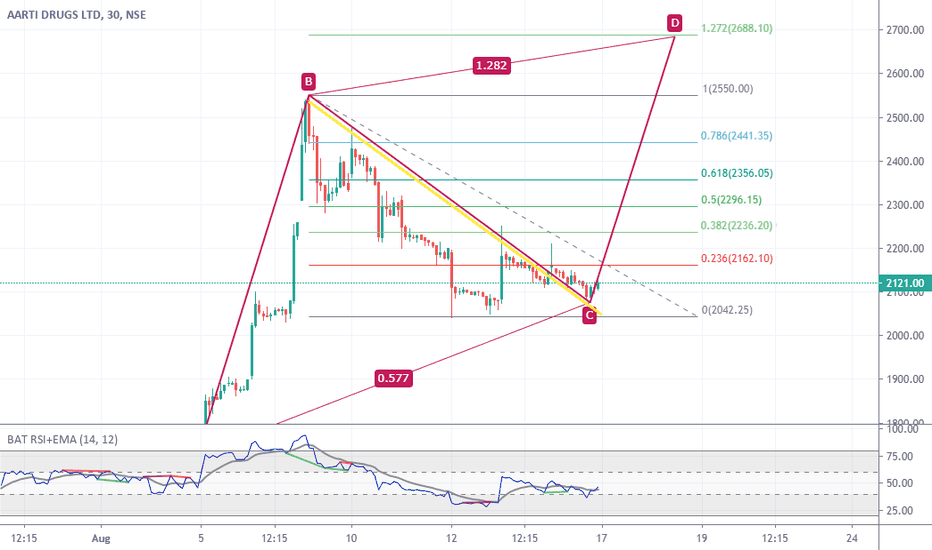

If we look at this chart, it tries to break the Bollinger band two times within 110 days; even we look at the past, it was unable to break. But now you can see the last three days it closes almost above the upper resistance of BB, i.e. (mean + 2* Standard Deviation). Bollinger Band, In mathematics, we called it Gaussian or normal distribution or bell curve.

If we notice the MACD is positive, and Histogram shows its strength is continuously increasing.

RSI is also above 60, and today's it 71.15, and the interesting fact is it tries to reverse but again ready to go up.

If we notice today's close price (813.6), it also breaks the resistance that was 811pts and might be a support for this month.

All those four signs indicate that the rally has begun for aarti drug.

In Fluid Mechanics, we called when the flow tries to contract (Squeezing the BB from last 4 to 5 months), the pipe will burst, and due to sudden expansion and that flow will be uncontrolled flow.

Disclaimer,

This analysis only for study purposes.

Do your own study before any call.

I'm not a Sebi register.

All trading strategies are used at your own risk.

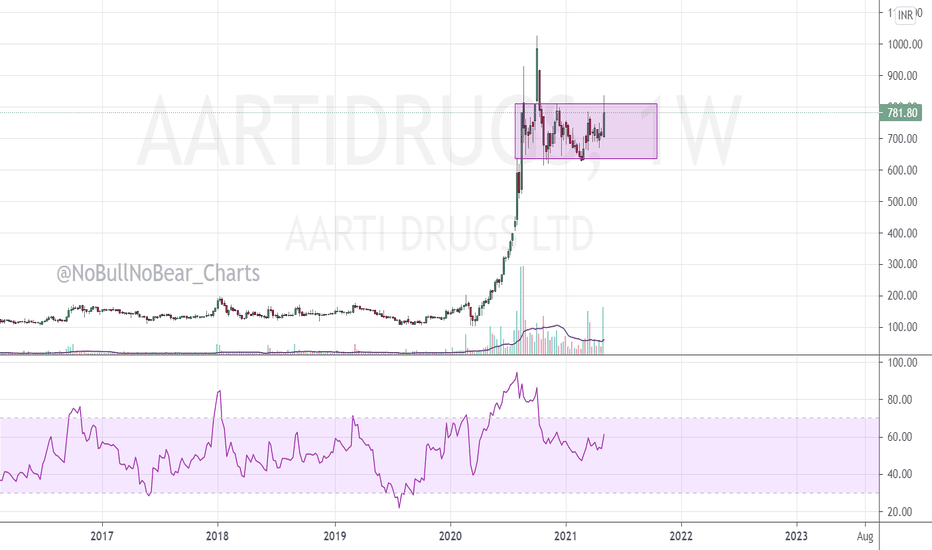

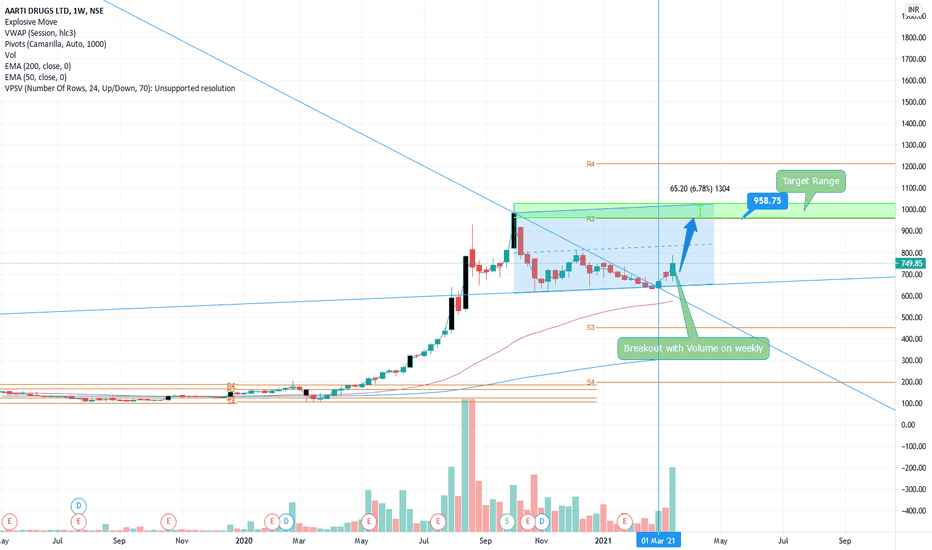

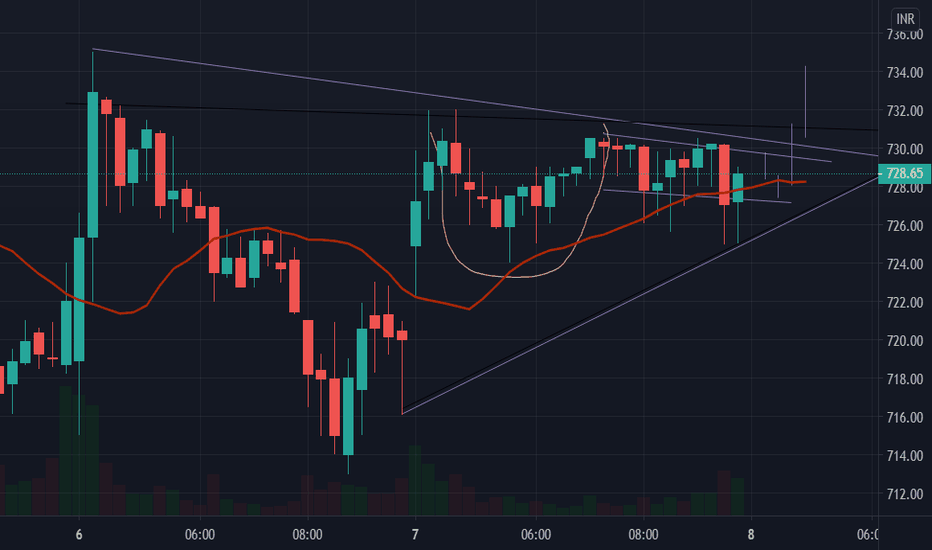

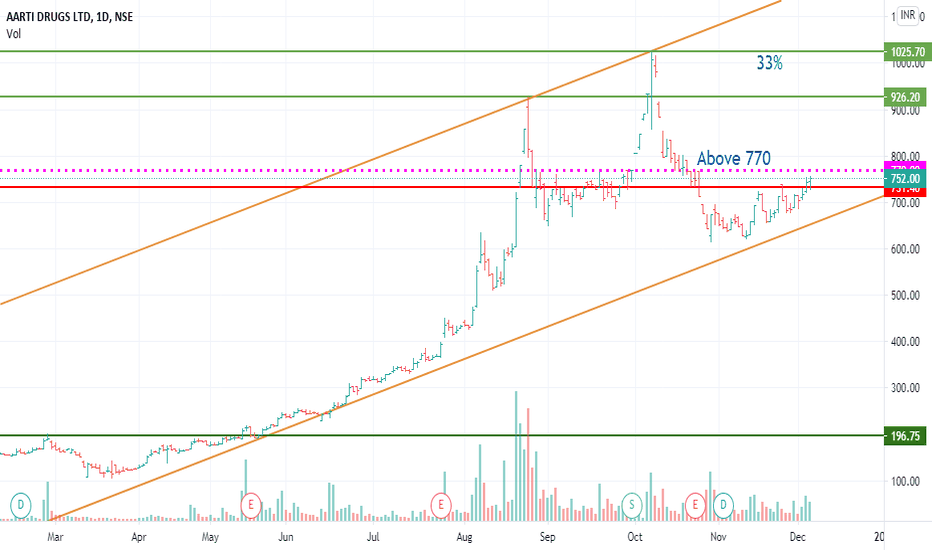

AartiDrugsTimeFrame - Weekly

AartiDrugs is trading in a range for the past few weeks, closing above range can give fresh BO.

Weekly RSI has just crossed 60 - Showing strength

Once Breakout happens, once can go along with SL 700 weekly closing basis.

Disclaimer

I am not SEBI registered analyst

My studies are Educational purpose only

Please consult with your financial advisor before trading or investing

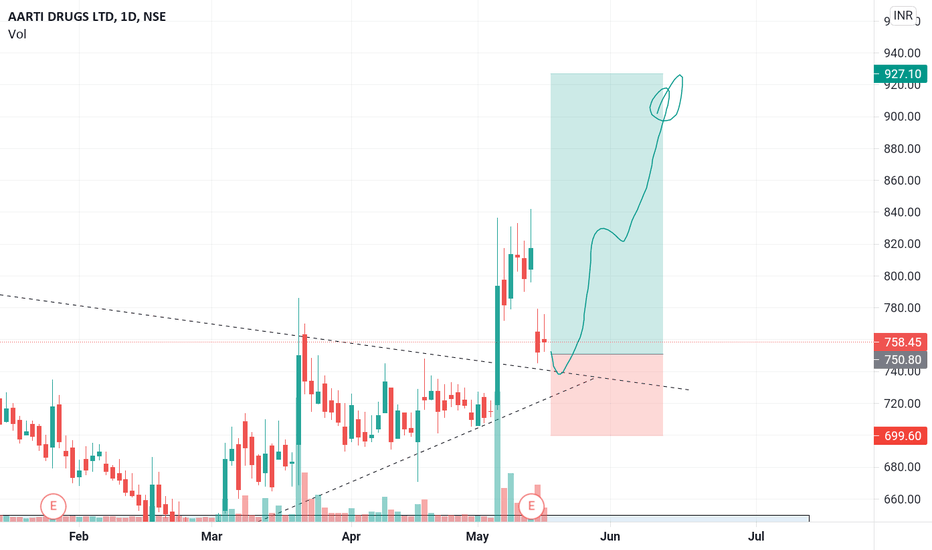

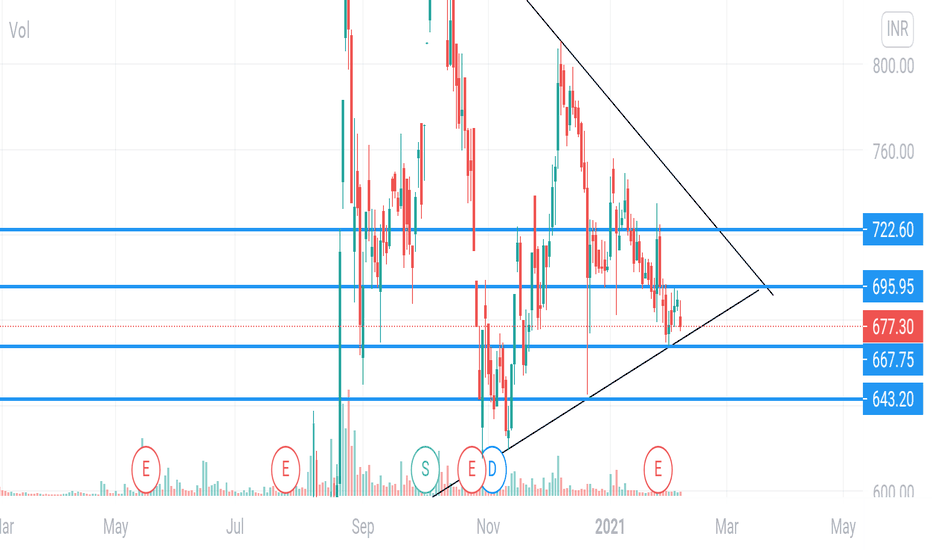

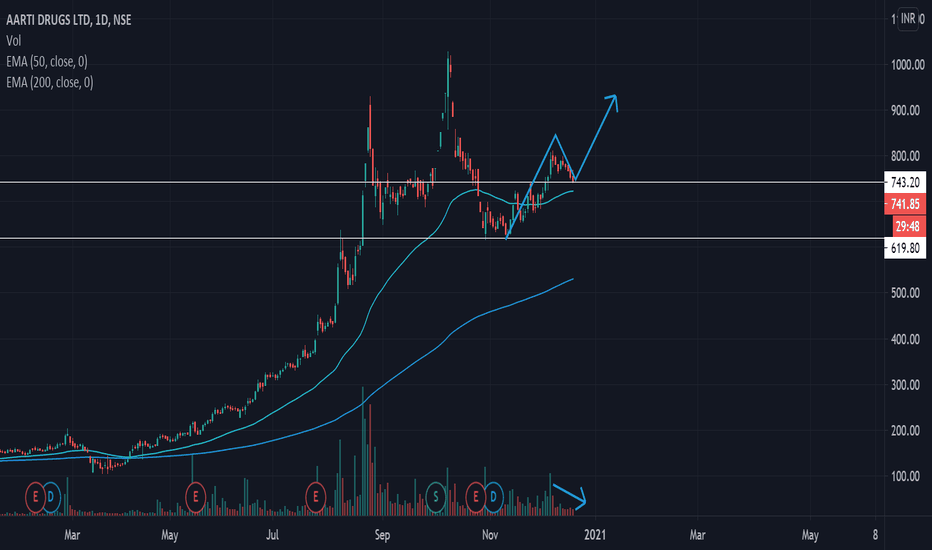

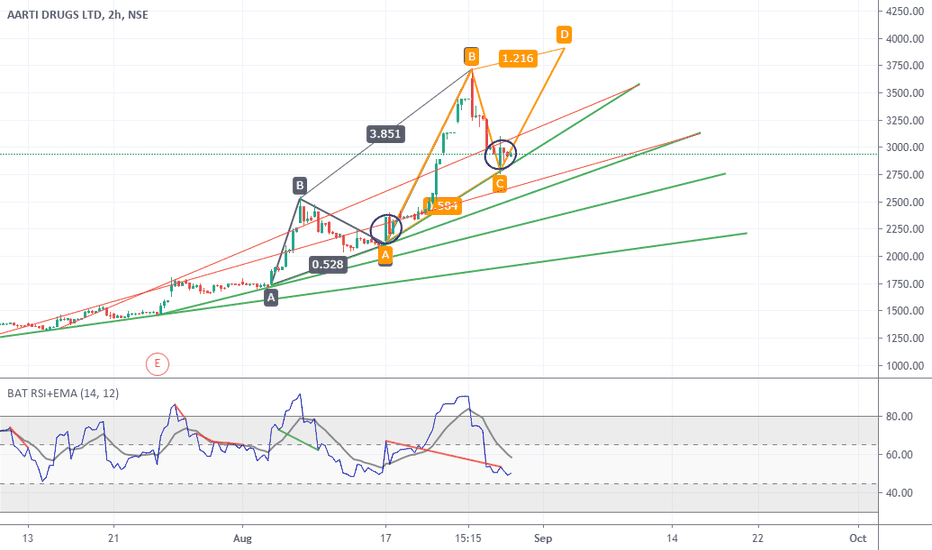

Aarti Drugs - Ready for Take Off ?Higher Highs and Higher Lows.

Green volume candles longer than red candles.

Fasten your seat belts and enjoy the ride.

*****

Help Me to Help Us.

Always keep a stop loss to rescue you out of troubles.

I believe in keeping the chart simple with minimal drawings & easy to interpret.

So kindly express any disagreement & improvements so that we learn & earn together.

Please support the effort and appreciate it with a Like if you felt it deserves it and Following me would only add on to the motivation.

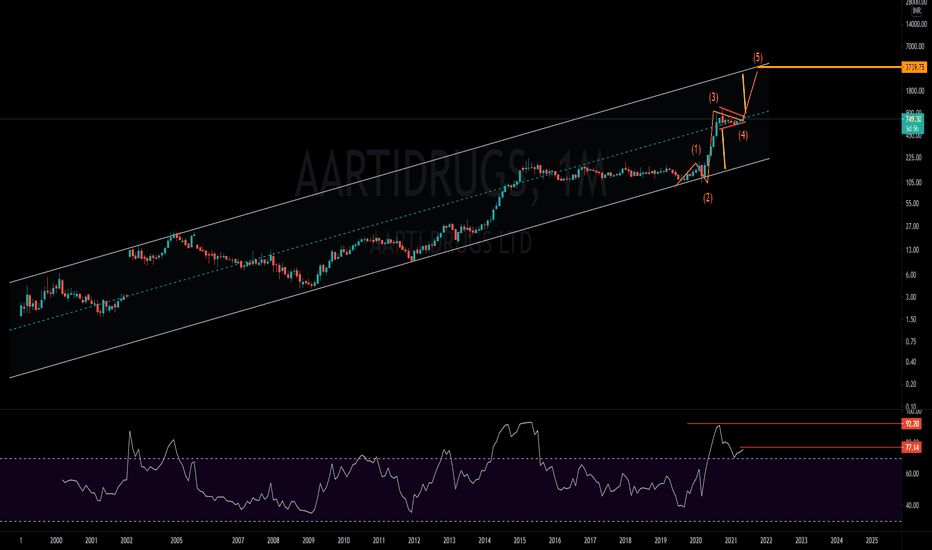

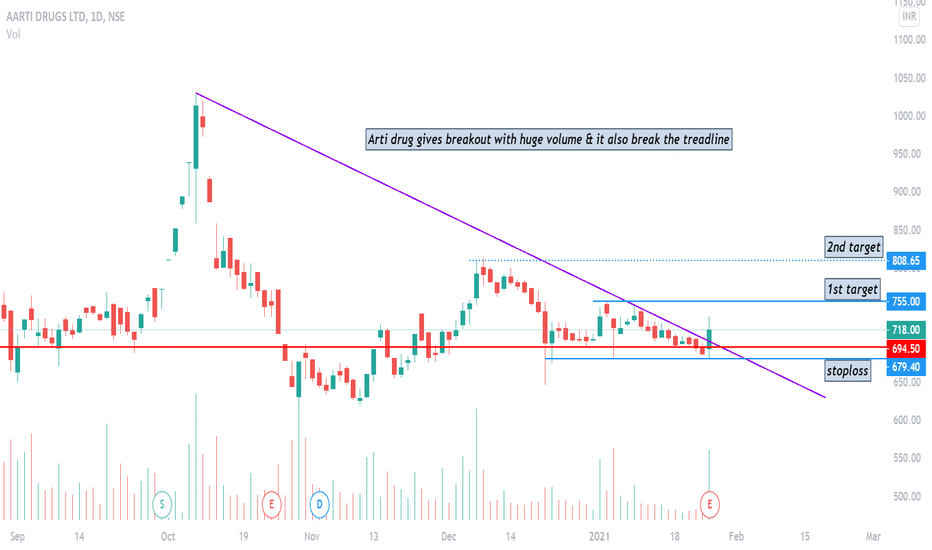

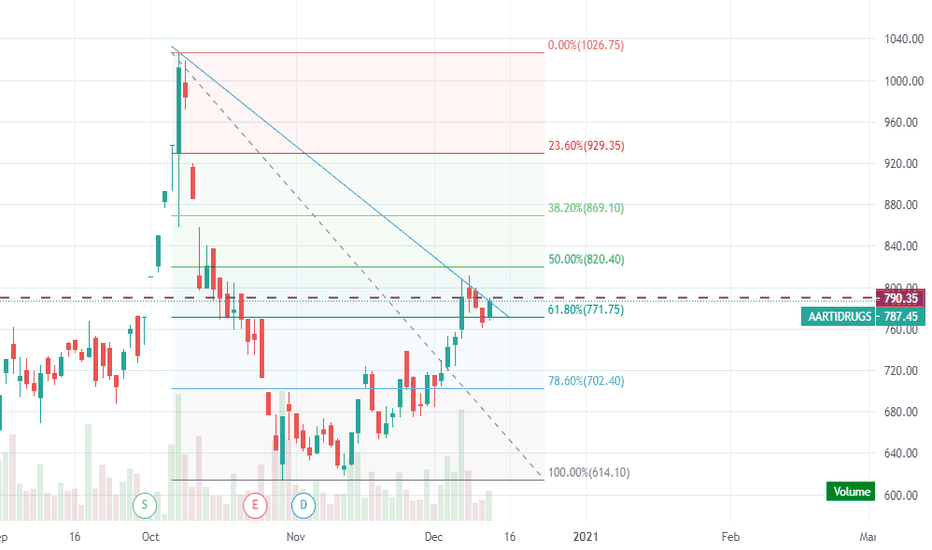

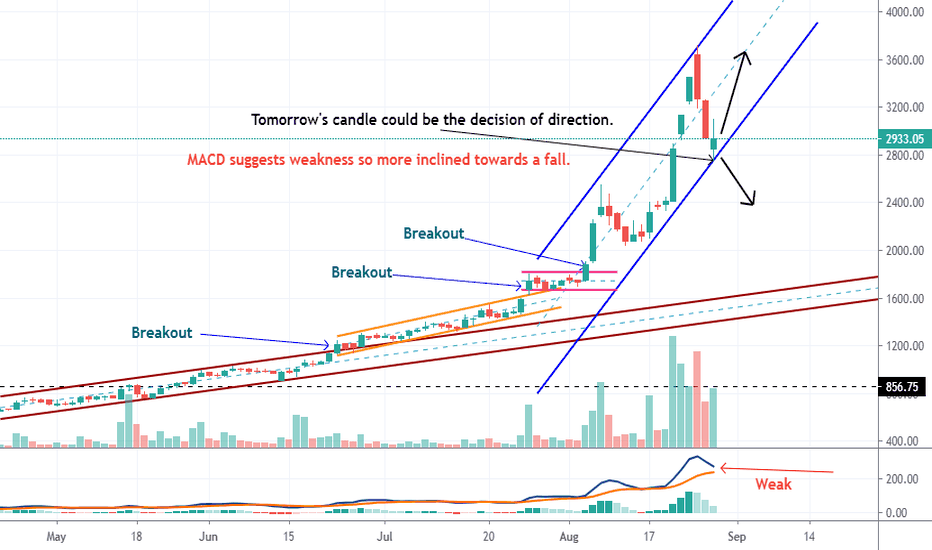

AARTI DRUGS - Buy or Sell ?This chart is made on the request of my follower @Himanshu93.

CMP 2933

Aarti Drugs has had an amazing run since 890 levels breaking out Parallel Channels thrice and returning 300%+ returns in just a few months. The 4th ride is still within the channel but most likely it would break the channel on the lower side tomorrow purely on the basis of MACD indication.

However, since the stock is of great quality, producing human steroids, we cannot ignore the fact that the stock can continue in its journey. So tomorrow's candle will more or less clear the air in deciding the next move.

I had earlier made a chart with my learning of Parabolic Curve. Well, I may have missed the precision but if that was more or less correct then , it further gives us a reason to sell.

*****

Help Me to Help Us.

I believe in keeping the chart simple with minimal drawings & easy to interpret.

So kindly express any disagreement & improvements so that we learn & earn together.

Please support the effort and appreciate it with a Like if you felt it deserves it and Following me would only add on to the motivation.