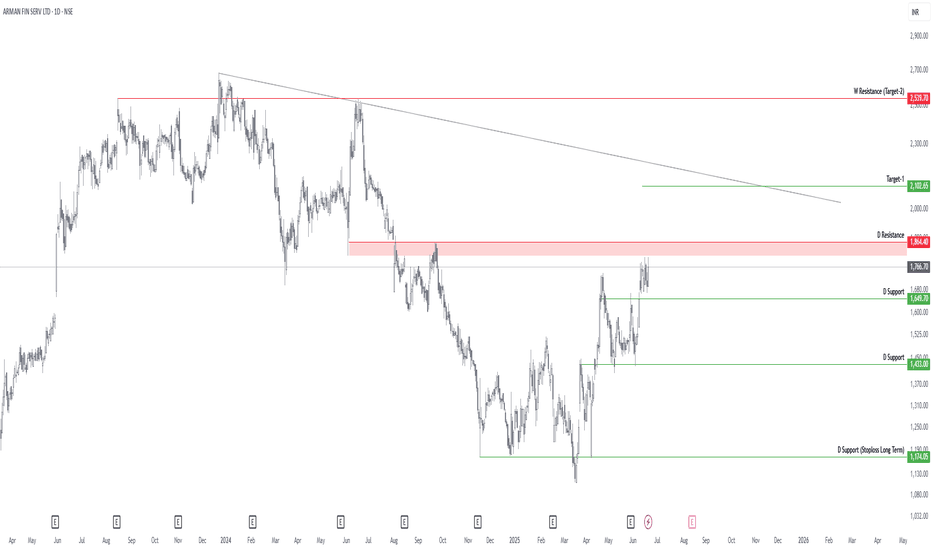

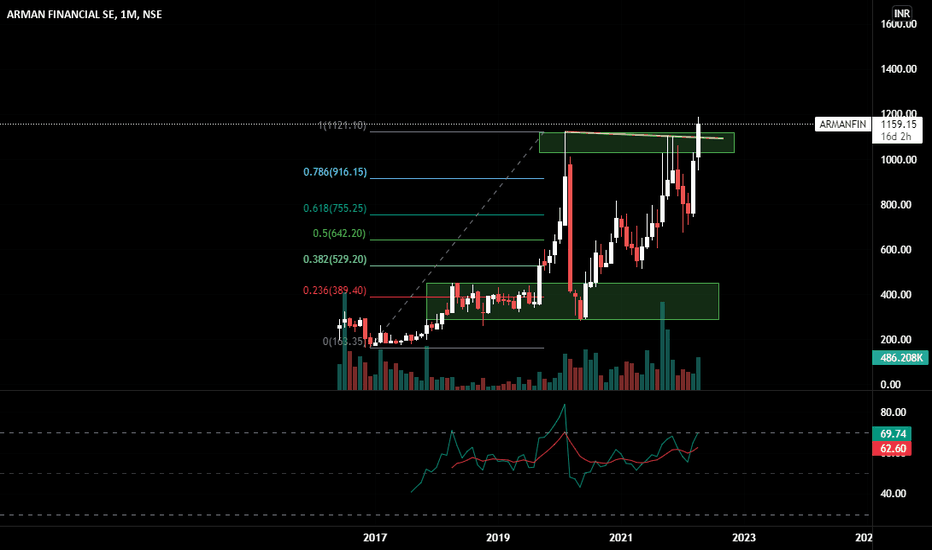

ARMANFIN Long IdeaARMANFIN chart looks strong. It is in uptrend and going towards ATH.

Supports and Targets are given in Chart.

Risk management is Important.

pro's : Repo Rate fallen down. Overall MFI space is better than previous quarters.

Con's : ArmanFinancial has no growth guidnace for FY26. They are in Asset Quality management currently.

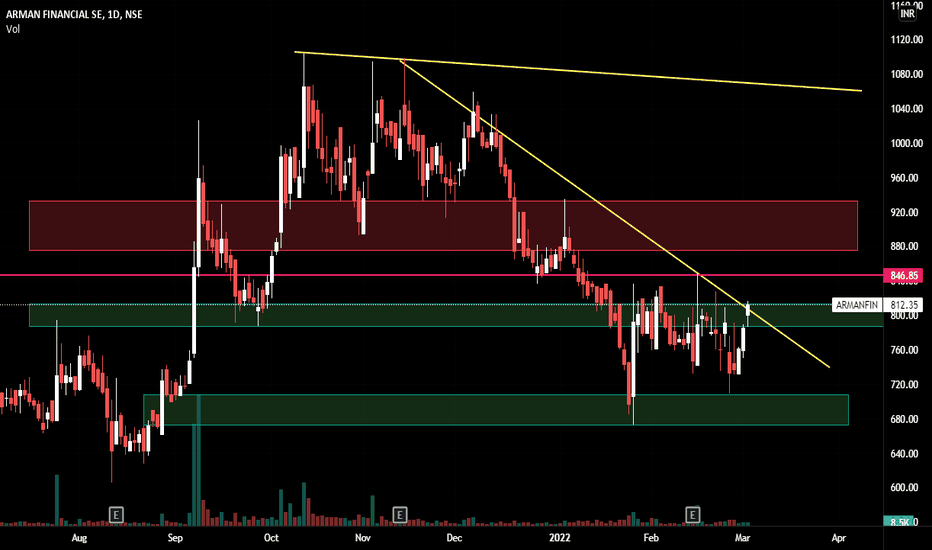

ARMANFIN trade ideas

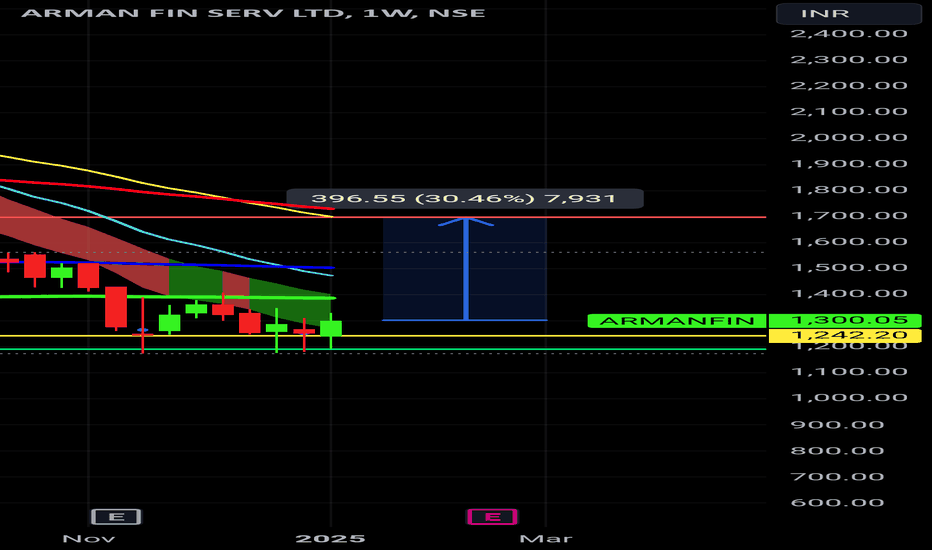

BUY TODAY SELL TOMORROW for 5% DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

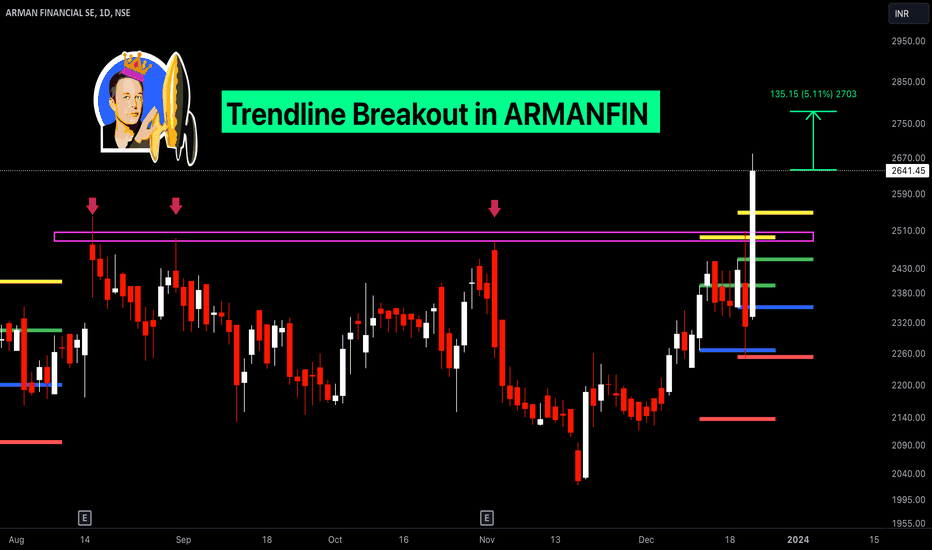

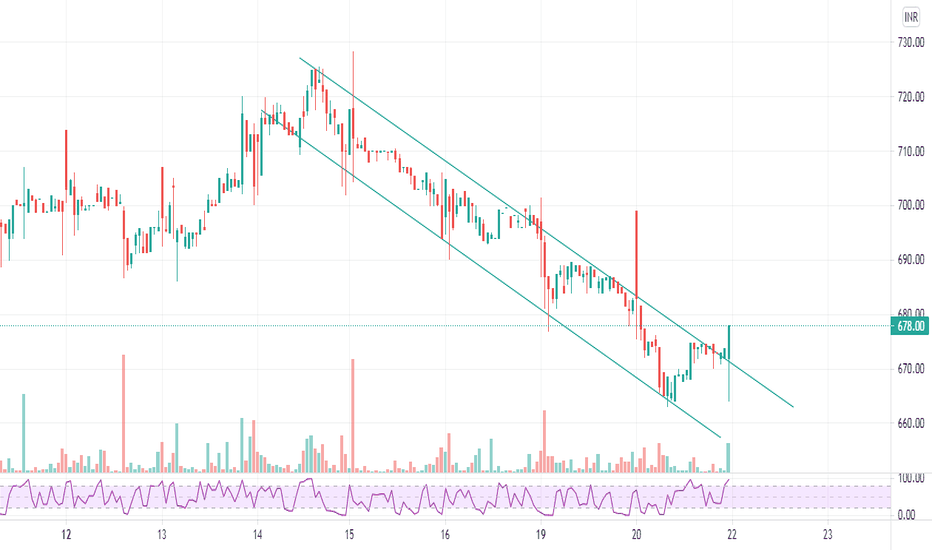

Trendline Breakout in ARMANFIN

BUY TODAY SELL TOMORROW for 5%

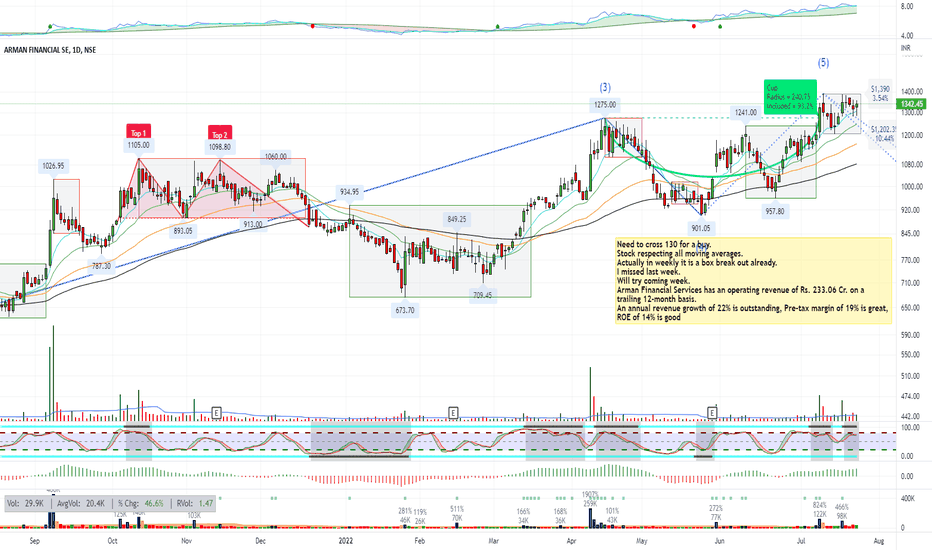

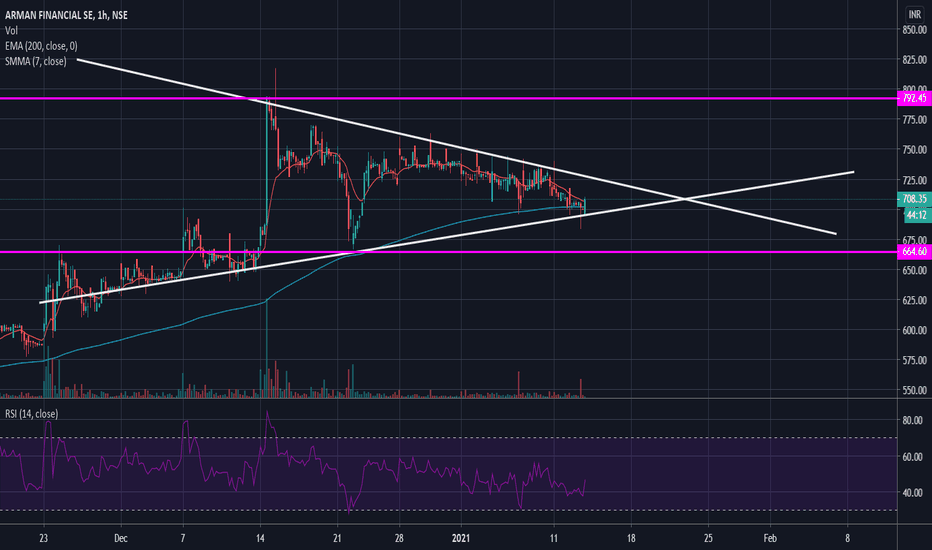

#ArmanFinancialArman Financial Services

Need to cross 130 for a buy.

Stock respecting all moving averages.

Actually in weekly it is a box break out already.

I missed last week.

Will try coming week.

Arman Financial Services has an operating revenue of Rs. 233.06 Cr. on a trailing 12-month basis.

An annual revenue growth of 22% is outstanding, Pre-tax margin of 19% is great, ROE of 14% is good