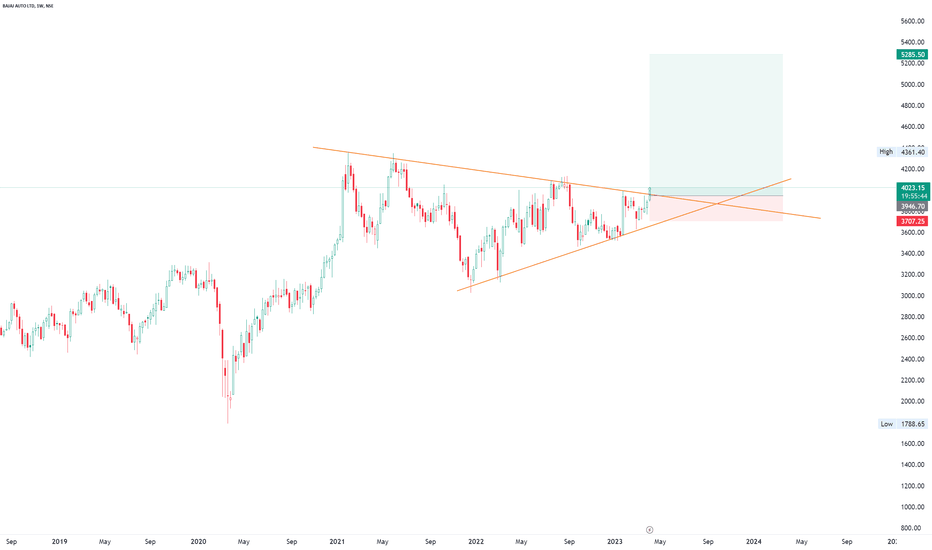

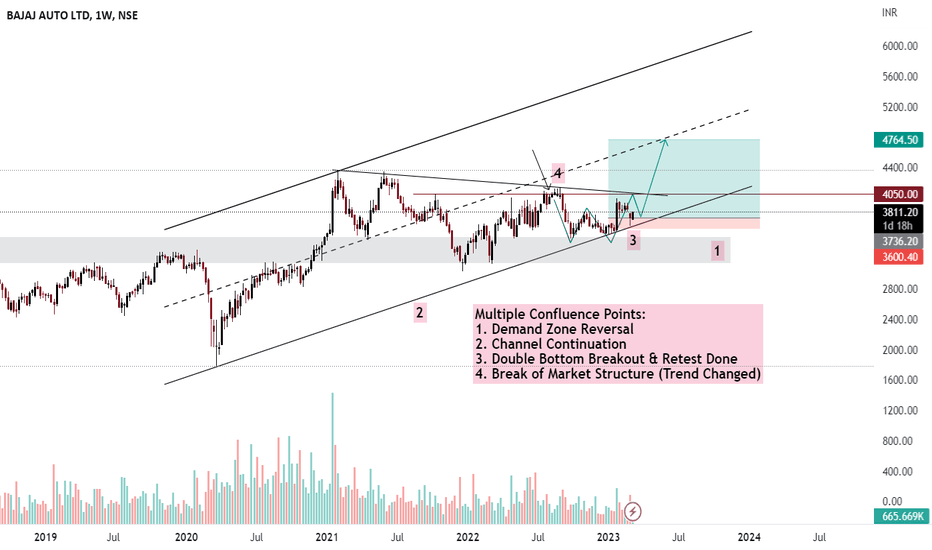

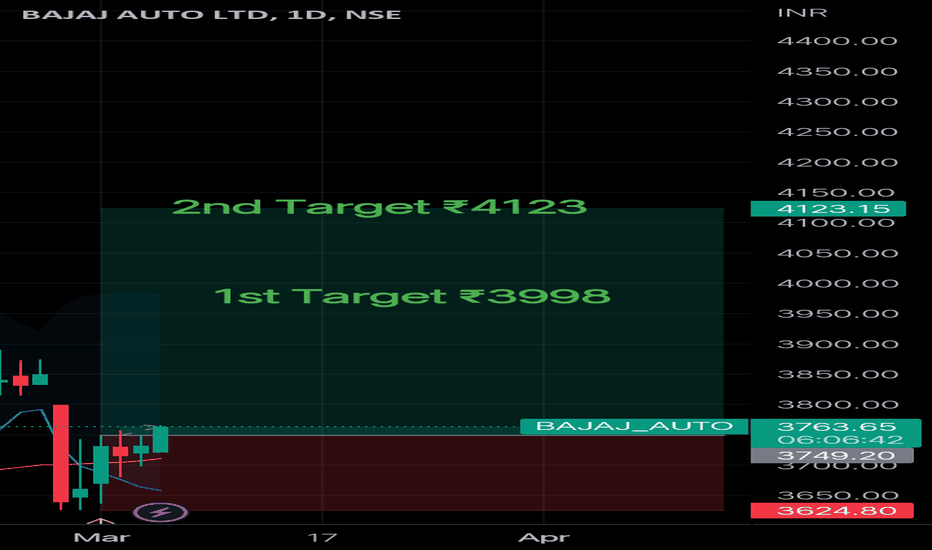

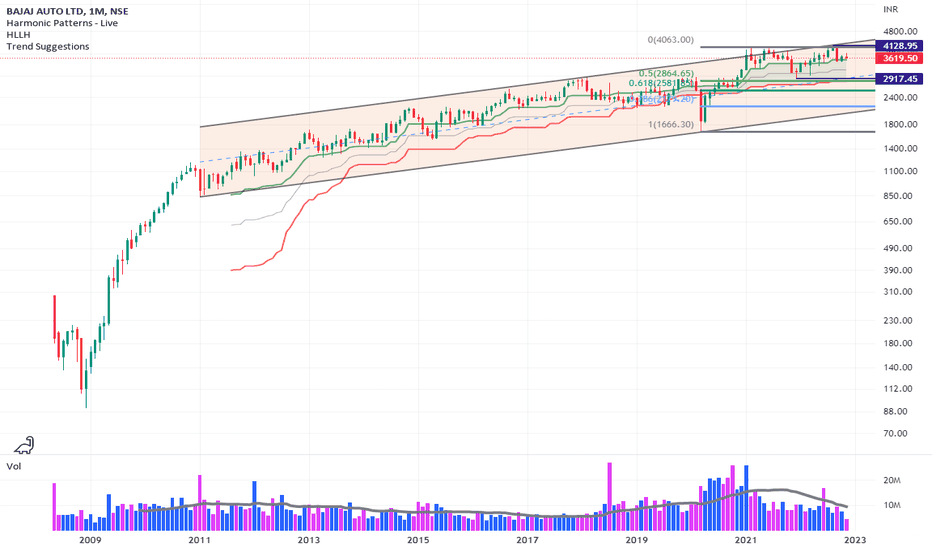

BAJAJAUTONSE:BAJAJ_AUTO

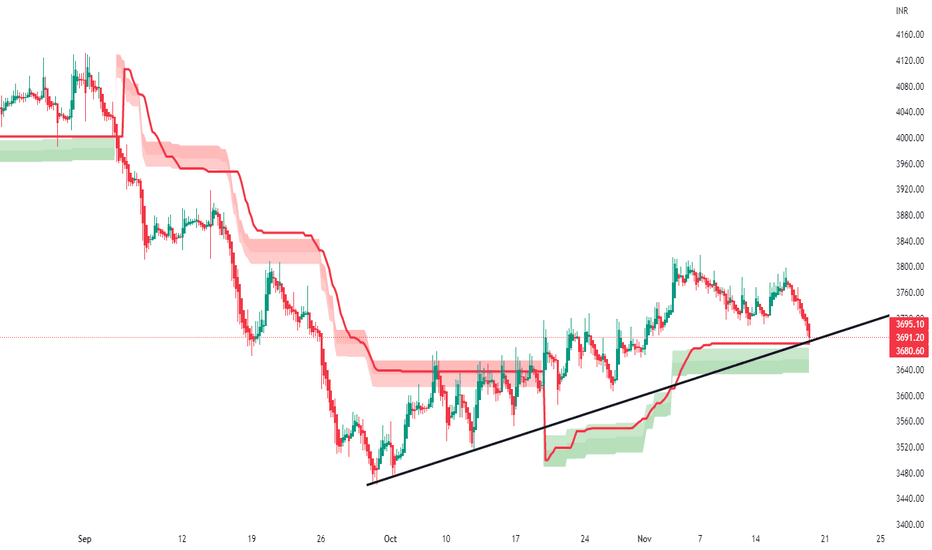

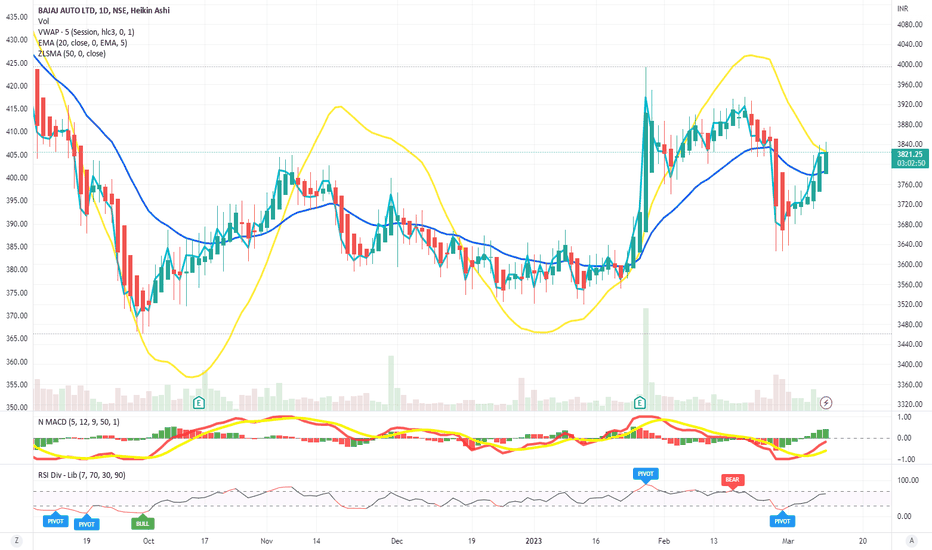

One Can Enter Now ! Or Wait for Retest of the Trendline (BO) Or wait For better R:R ratio

Note :

1.One Can Go long with a Strict SL below the Trendline or Swing Low of Daily Candle.

2. Close, should be good and Clean.

3. R:R ratio should be 1 :2 minimum

4. Plan as per your RISK appetite

Disclaimer : You are responsible for your Profits and loss, Shared for Educational purpose

BAJAJ_AUTO trade ideas

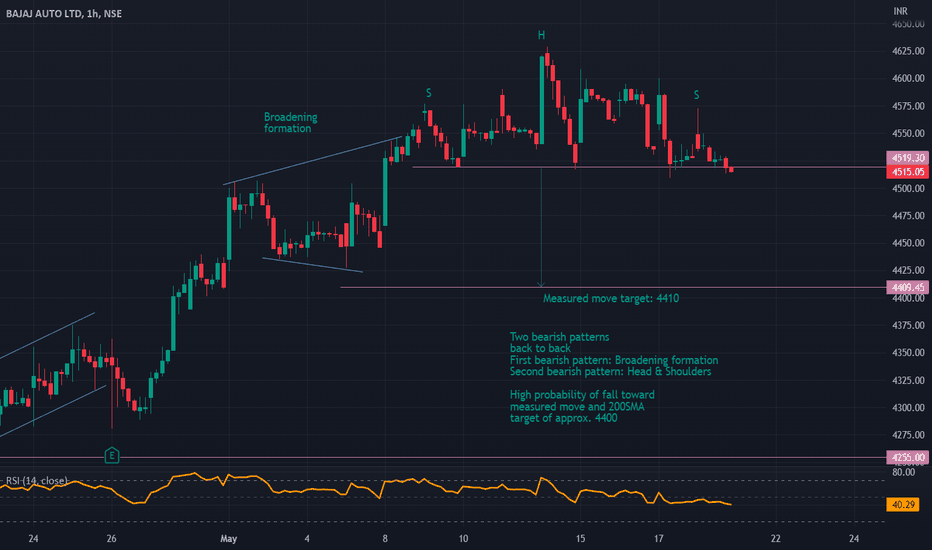

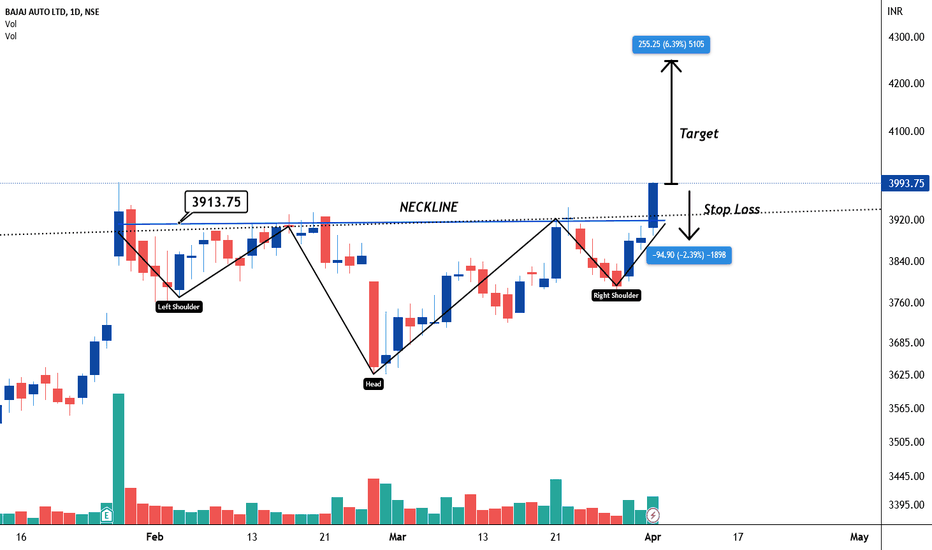

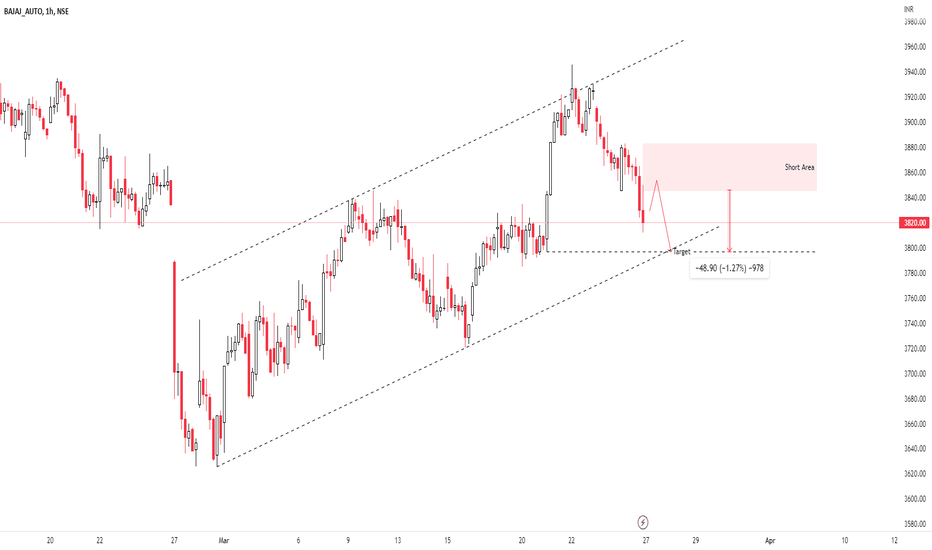

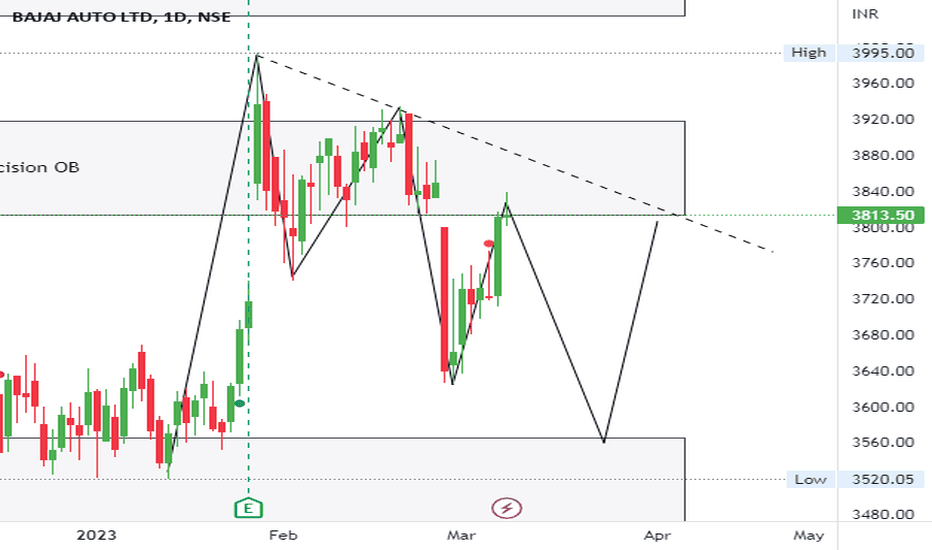

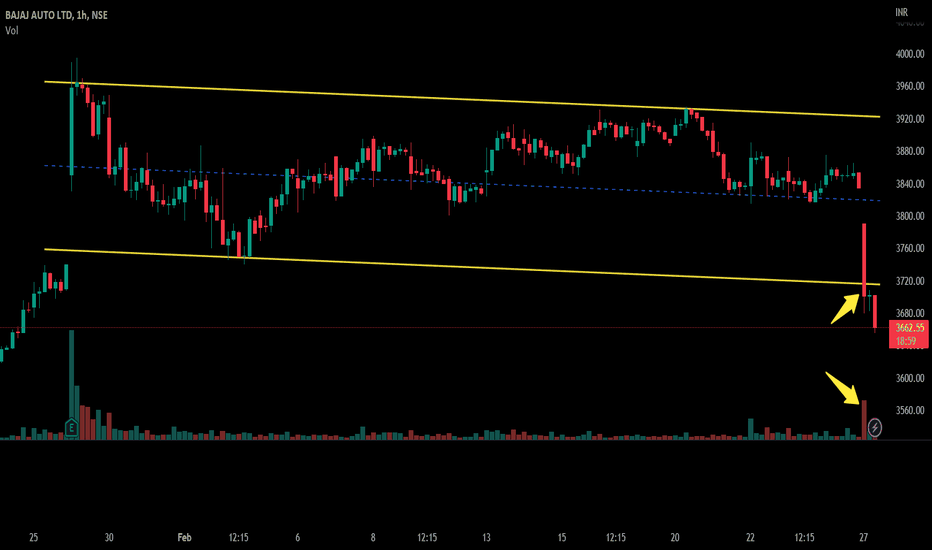

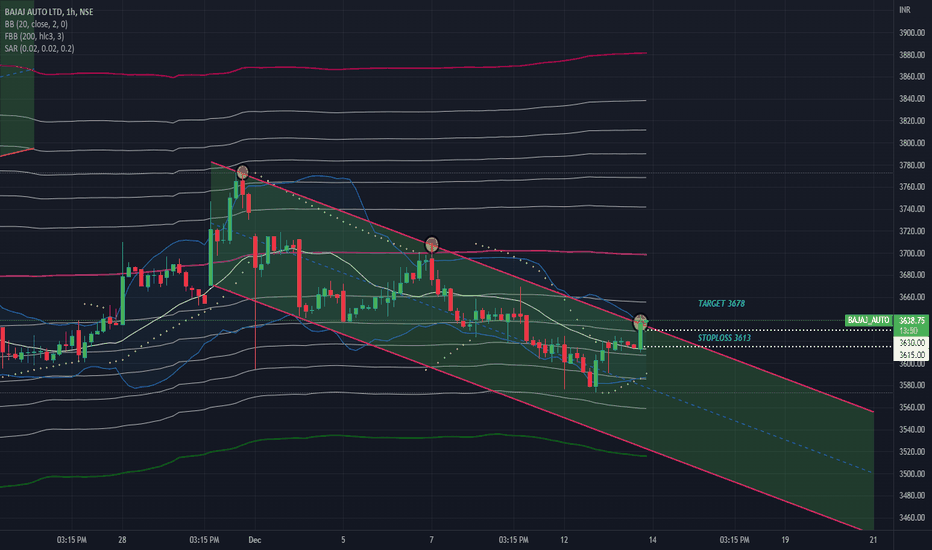

Bearish on Bajaj AutoBajaj Auto (NSE Ticker: BAJAJ_AUTO) is forming two back to back bearish patterns on the hourly chart.

First bearish pattern: Broadening formation

Second bearish pattern: Head & Shoulders

We see high probability of fall in price in the coming days toward measured move and 200SMA target of 4410.

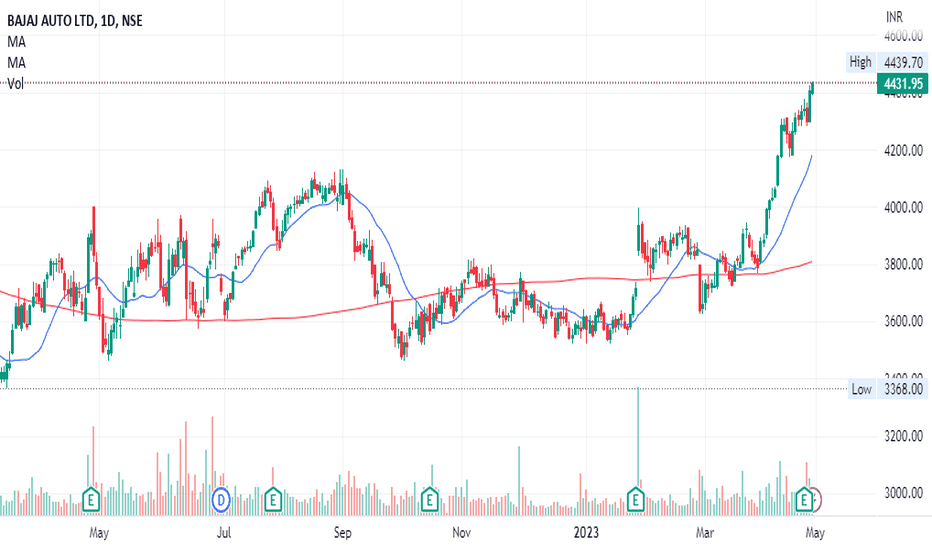

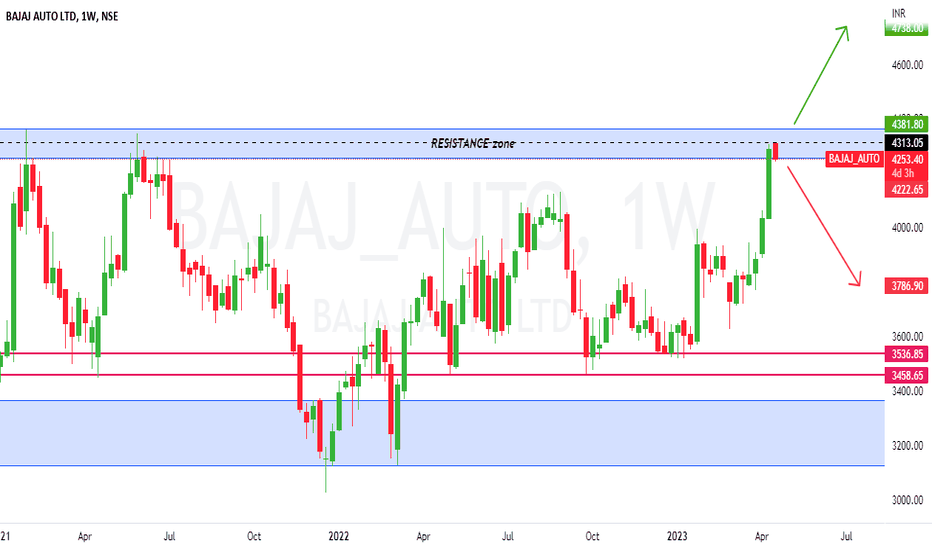

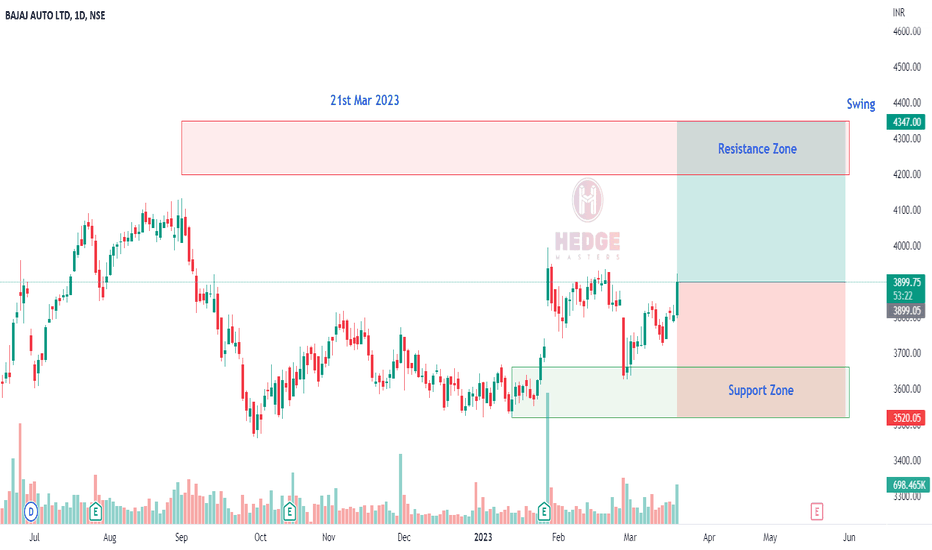

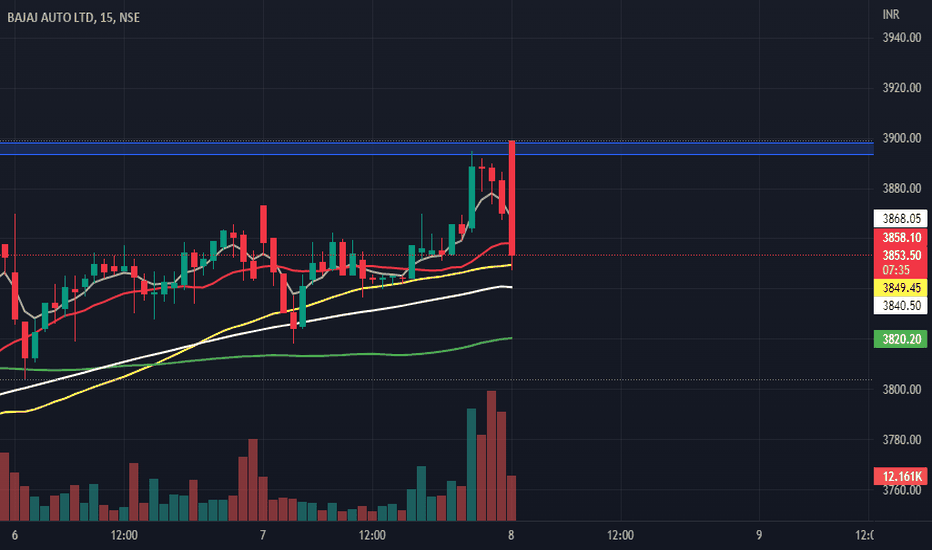

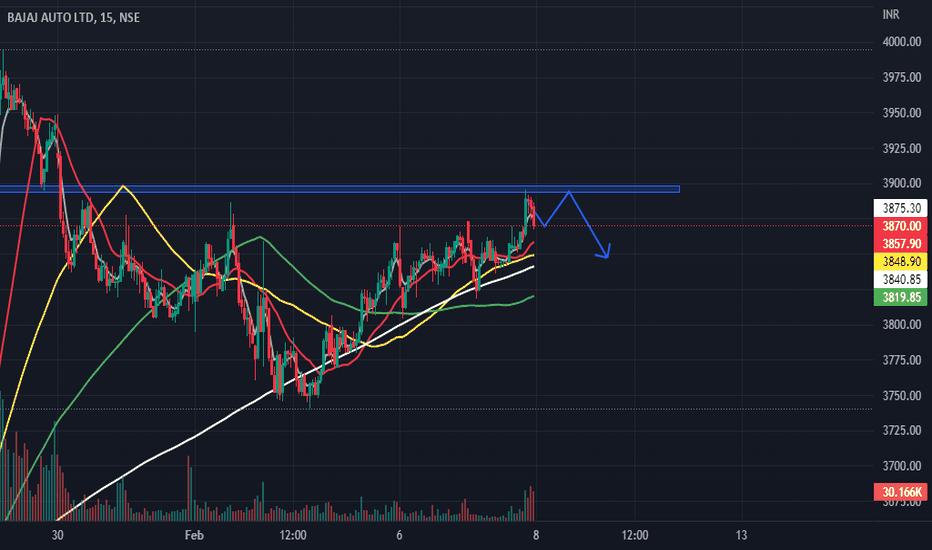

BAJAJ AUTO - Bullish Consolidation Breakout with VolumesNSE: BAJAJ AUTO is closing with a bullish consolidation breakout candle supported with volumes.

Today's volumes and candlestick formation indicates strong demand and stock should move to previous swing highs in the coming days.

The stock has been moving along the trendline support for the past few days which is indicating demand.

One can look for a 8% to 11% gain on deployed capital in this swing trade.

The view is to be discarded in the event of the stock breaking previous swing low.

#NSEindia #Trading #StockMarketindia #Tradingview #SwingTrade

Disclaimer:

This is for educational purposes only.