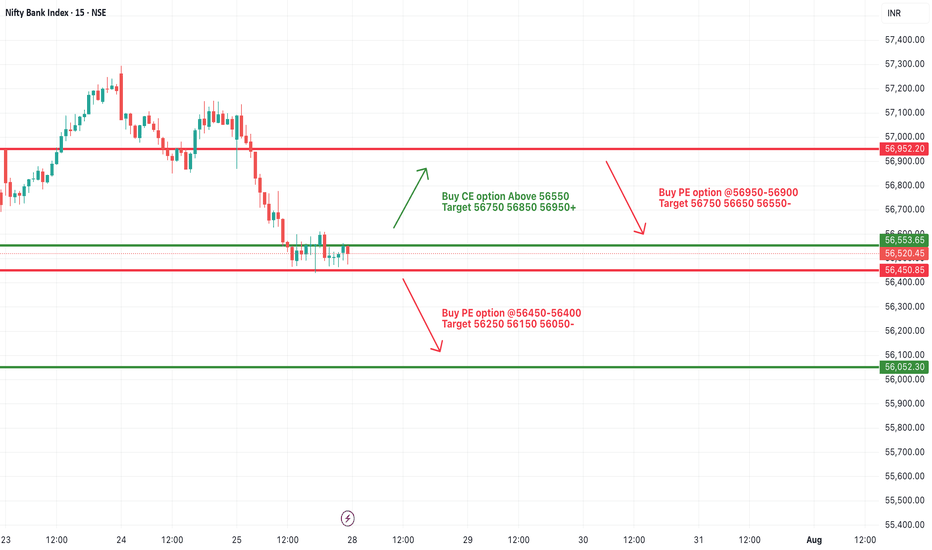

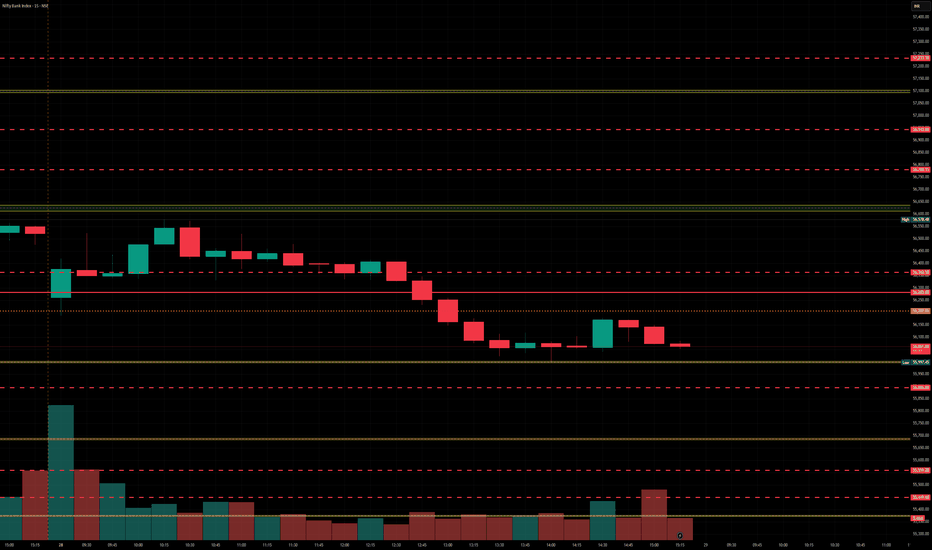

[INTRADAY] #BANKNIFTY PE & CE Levels(28/07/2025)Bank Nifty is expected to open slightly lower and is currently trading near a critical zone of 56,450–56,550, which may act as a key pivot for today's session. This narrow band will decide the next directional move.

If Bank Nifty sustains above 56,550, we can expect an upward move toward 56,750, 56

Related indices

BANK NIFTY📈 Trade Setup Details

🔹 Trade Plan 1 (MTF-Based Entry)

Metric Value

Entry 56,223

Stop Loss 55,475

Risk 748 pts

Target 63,232

Reward 7,009 pts

Risk:Reward 1:9.4

🔸 Comment:

A high RR setup using the Daily DMIP zone. Ideal for trend continuation if price respects 55,780–56,223 range.

🔹 Trade Plan 2 (

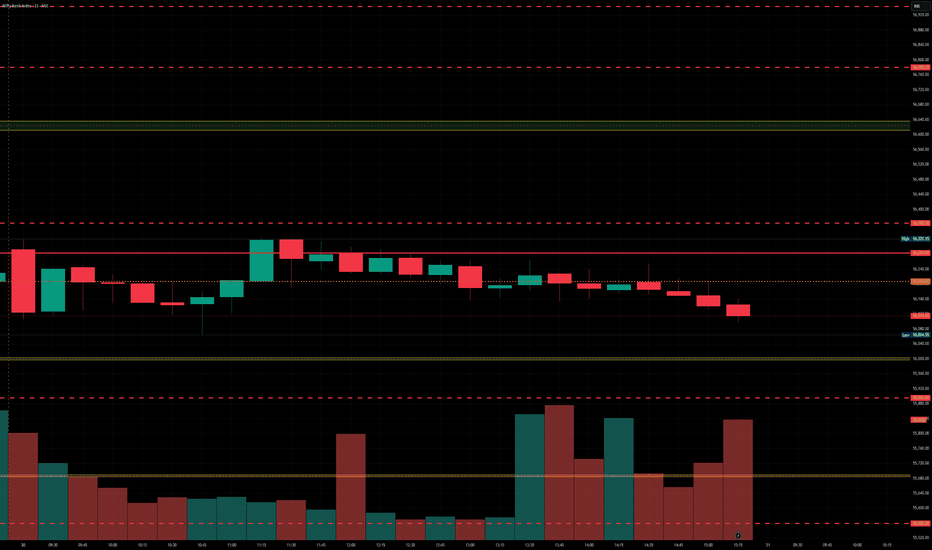

BankNfity levels - Jul 31, 2025Utilizing the support and resistance levels of BankNifty, along with the 5-minute timeframe candlesticks and VWAP, can enhance the precision of trade entries and exits on or near these levels. It is crucial to recognize that these levels are not static, and they undergo alterations as market dynamic

BankNifty levels - Jul 04, 2025Utilizing the support and resistance levels of BankNifty, along with the 5-minute timeframe candlesticks and VWAP, can enhance the precision of trade entries and exits on or near these levels. It is crucial to recognize that these levels are not static, and they undergo alterations as market dynamic

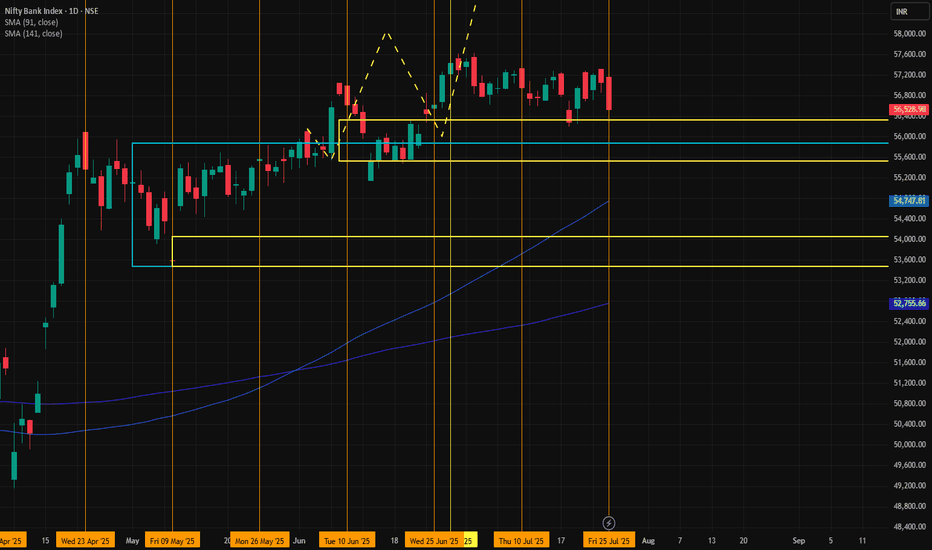

#BankNifty Weekly: Major Levels & Targets You Need to KnowDate: 14-07-2025

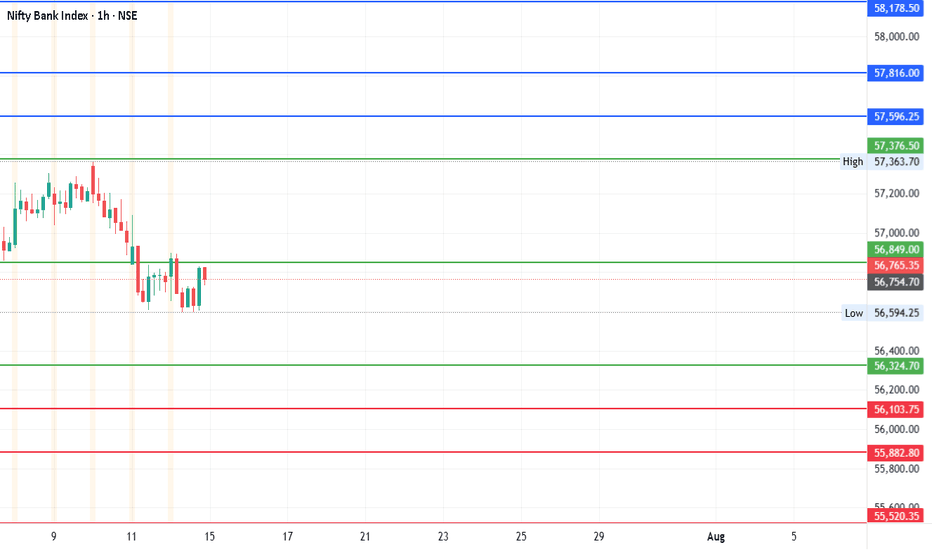

#Nifty Bank Technical Levels

Current Price: ₹56,765.35

Pivot Point: ₹56,849.40

Upside Targets (if price moves above Pivot)

| Target | Price |

| ----------- | ---------- |

| 🎯 Target 1 | ₹57,596.25 |

| 🎯 Target 2 | ₹57,816.00 |

| 🎯 Target 3 | ₹58,178.48 |

| 🎯 Target 4

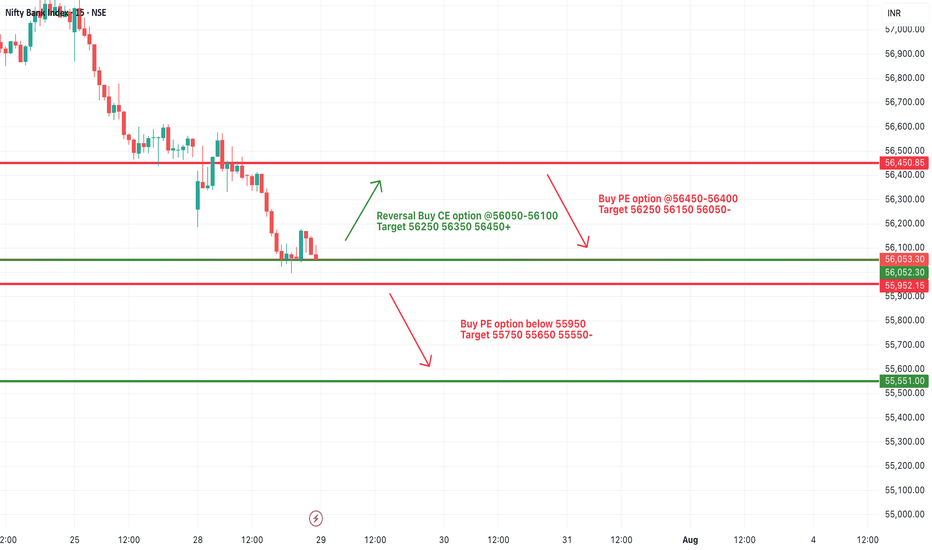

[INTRADAY] #BANKNIFTY PE & CE Levels(29/07/2025)Bank Nifty is expected to open with a gap-down, continuing its downside pressure from the previous sessions. The index is now hovering near an important support zone around 56,050–55,950.

If Bank Nifty sustains above the 56,050–56,100 zone after the gap-down open, a reversal rally can be seen with

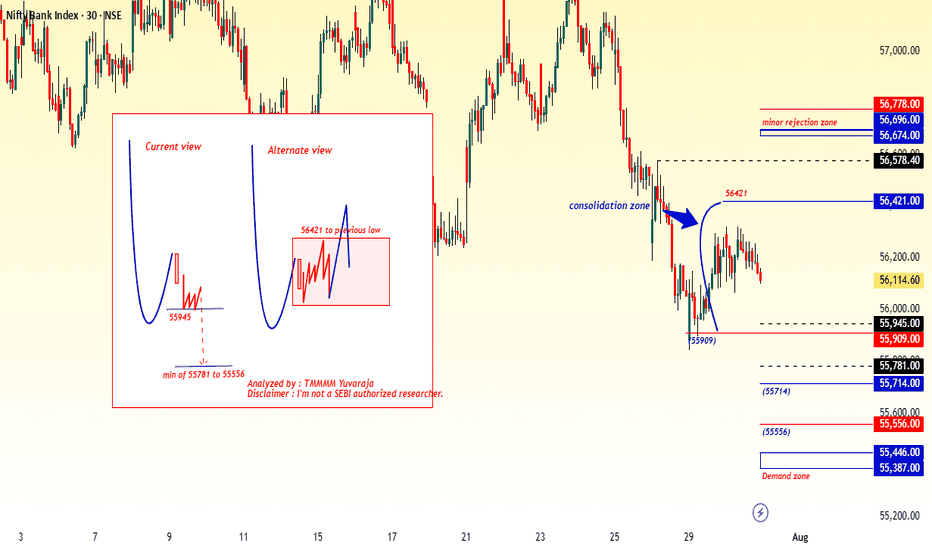

#Banknifty directions and levels for July 31st:

What can we expect today?

In the previous session, both Nifty and Bank Nifty went through consolidation.

Structurally, we are still in a bearish tone, and with Gift Nifty indicating a gap-down start,

if the market breaks the immediate support levels with a solid candle, we can expect further corre

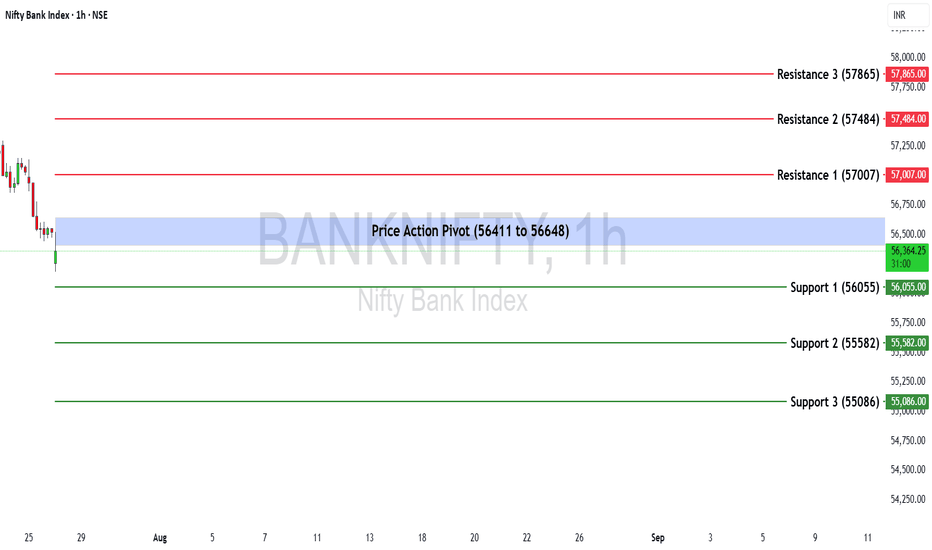

Bank Nifty Weekly Insights: Key Levels & TrendsBank Nifty ended the week at 56,528.90, registering a marginal gain of +0.44%.

🔹 Key Levels for the Upcoming Week

📌 Price Action Pivot Zone:

The critical zone to monitor for potential trend reversals or continuation lies between 56,411 and 56,648.

🔻 Support Levels:

Support 1 (S1): 56,055

Suppo

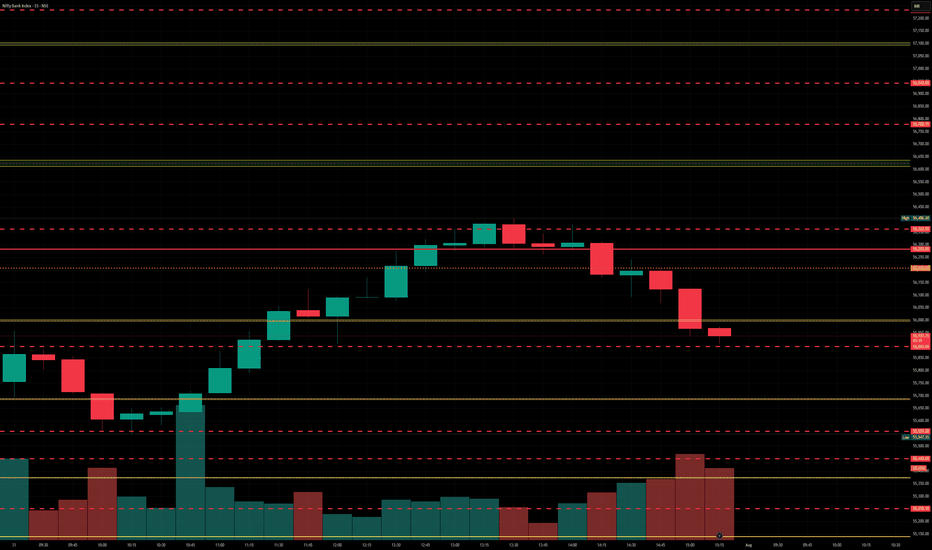

BankNifty levels - Aug 01, 2025Utilizing the support and resistance levels of BankNifty, along with the 5-minute timeframe candlesticks and VWAP, can enhance the precision of trade entries and exits on or near these levels. It is crucial to recognize that these levels are not static, and they undergo alterations as market dynamic

BankNifty levels - Jul 29, 2025Utilizing the support and resistance levels of BankNifty, along with the 5-minute timeframe candlesticks and VWAP, can enhance the precision of trade entries and exits on or near these levels. It is crucial to recognize that these levels are not static, and they undergo alterations as market dynamic

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.