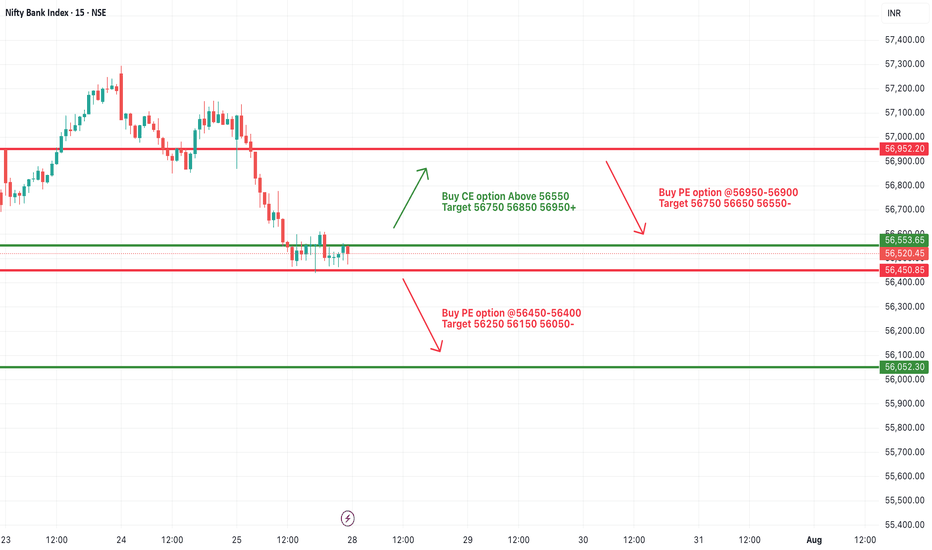

[INTRADAY] #BANKNIFTY PE & CE Levels(28/07/2025)Bank Nifty is expected to open slightly lower and is currently trading near a critical zone of 56,450–56,550, which may act as a key pivot for today's session. This narrow band will decide the next directional move.

If Bank Nifty sustains above 56,550, we can expect an upward move toward 56,750, 56,850, and 56,950+ levels. This zone could act as a breakout trigger for intraday momentum on the upside.

On the downside, if the index slips and trades below 56,450–56,400, it may indicate bearish pressure, with possible downside targets at 56,250, 56,150, and 56,050-.

Alternatively, a rejection near the 56,900–56,950 zone could also act as a reversal point and push the index back down.

For now, wait for a clear breakout or breakdown from the 56,450–56,550 range before taking directional trades.

BANKNIFTY trade ideas

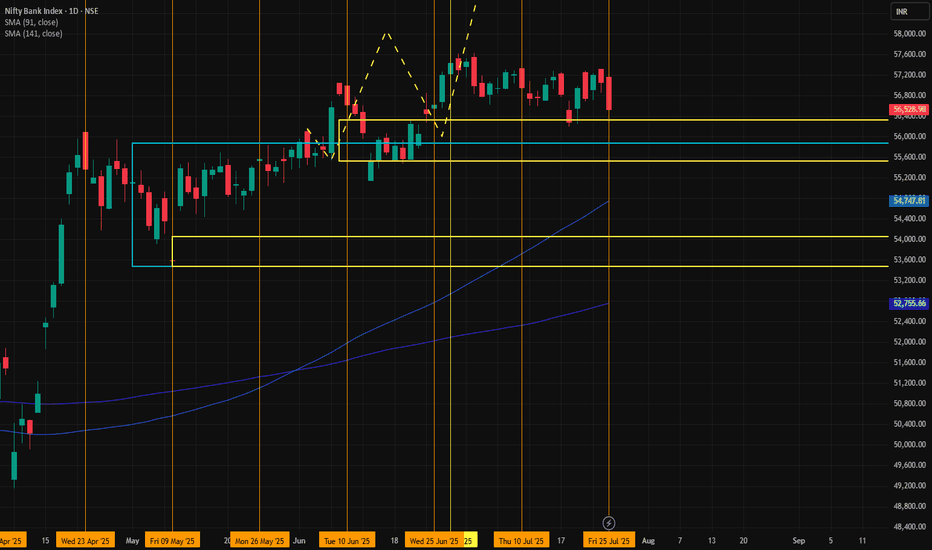

BANK NIFTY📈 Trade Setup Details

🔹 Trade Plan 1 (MTF-Based Entry)

Metric Value

Entry 56,223

Stop Loss 55,475

Risk 748 pts

Target 63,232

Reward 7,009 pts

Risk:Reward 1:9.4

🔸 Comment:

A high RR setup using the Daily DMIP zone. Ideal for trend continuation if price respects 55,780–56,223 range.

🔹 Trade Plan 2 (Deep Pullback Entry - ITF Zone)

Metric Value

Entry 54,054

Stop Loss 53,483

Risk 571 pts

Target 61,819

Reward 7,765 pts

Risk:Reward 1:13.6

🔸 Comment:

An aggressive RR trade if price retraces. Very favorable for swing traders anticipating bounce from deeper ITF demand zone.

🧭 Technical Landmarks

Key Level Value

Last High 55,467

Last Low 47,702

Point Range 7,765

🧠 Strategic Notes

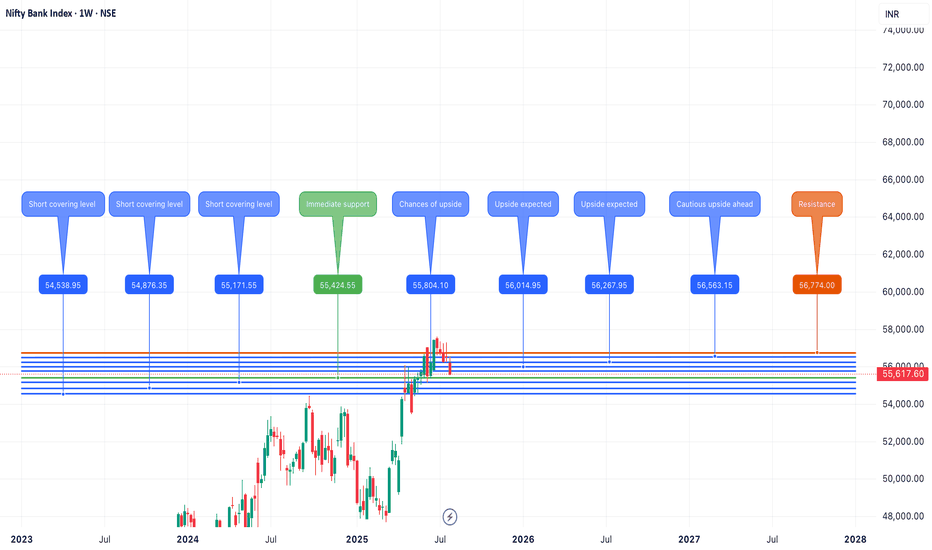

Bias: Strong Bullish.

Preferred Entry: If price reacts bullishly at 56,223, can trigger first trade. If market dips, watch 54,054 for second trade.

Stop Loss Discipline: Clearly placed with low drawdown.

Trend Confirmation: All HTF zones are bullish, adding confidence to long entries.

🔍 Multi-Timeframe (MTF) Analysis Summary

Timeframe Trend Zone Type Proximal Distal Average

Yearly UP Rally-Base-Rally 54,467 44,429 49,448

Half-Yearly UP BUFL 54,467 49,654 52,061

Quarterly UP Rally-Base-Rally 54,467 49,156 51,812

HTF Avg. UP 54,467 47,746 51,107

| Monthly | UP | Rally-Base-Rally | 55,875 | 53,483 | 54,679 |

| Weekly | UP | Rally-Base-Rally | 56,328 | 55,381 | 55,855 |

| Daily | UP | DMIP (BUFL) | 56,223 | 55,780 | 56,002 |

| MTF Avg. | UP | | 56,142 | 54,881 | 55,512 |

| 240m | UP | DMIP | 55,942 | 55,475 | 55,709 |

| 180m | UP | DMIP | 55,597 | 55,475 | 55,536 |

| 60m | UP | DMIP | 55,597 | 55,475 | 55,536 |

| ITF Avg. | UP | | 55,712 | 55,475 | 55,594 |

✅ Conclusion: All timeframes are bullish, with higher highs and strong demand zones developing across MTF and ITF — indicating a clear uptrend continuation structure.

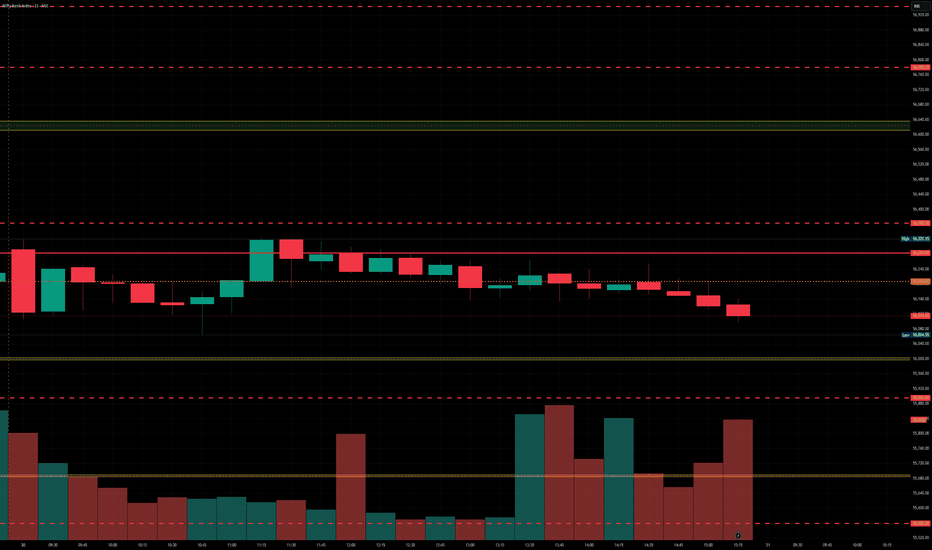

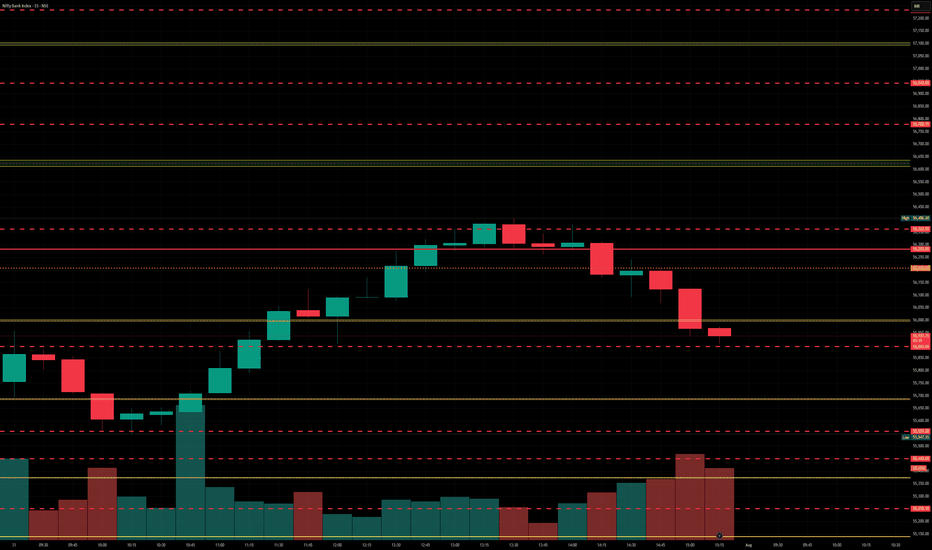

BankNfity levels - Jul 31, 2025Utilizing the support and resistance levels of BankNifty, along with the 5-minute timeframe candlesticks and VWAP, can enhance the precision of trade entries and exits on or near these levels. It is crucial to recognize that these levels are not static, and they undergo alterations as market dynamics evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We trust that this information proves valuable to you.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you successful trading endeavors!

BankNifty levels - Jul 04, 2025Utilizing the support and resistance levels of BankNifty, along with the 5-minute timeframe candlesticks and VWAP, can enhance the precision of trade entries and exits on or near these levels. It is crucial to recognize that these levels are not static, and they undergo alterations as market dynamics evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We trust that this information proves valuable to you.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you successful trading endeavors!

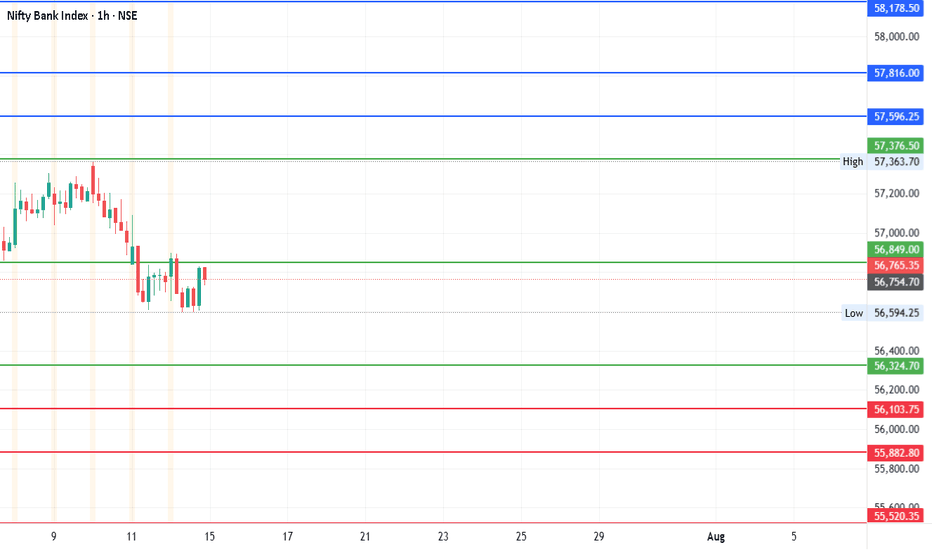

#BankNifty Weekly: Major Levels & Targets You Need to KnowDate: 14-07-2025

#Nifty Bank Technical Levels

Current Price: ₹56,765.35

Pivot Point: ₹56,849.40

Upside Targets (if price moves above Pivot)

| Target | Price |

| ----------- | ---------- |

| 🎯 Target 1 | ₹57,596.25 |

| 🎯 Target 2 | ₹57,816.00 |

| 🎯 Target 3 | ₹58,178.48 |

| 🎯 Target 4 | ₹58,540.95 |

🔽 Downside Targets (if price drops below Pivot)

| Target | Price |

| ----------- | ---------- |

| 🎯 Target 1 | ₹56,103.76 |

| 🎯 Target 2 | ₹55,882.80 |

| 🎯 Target 3 | ₹55,520.33 |

| 🎯 Target 4 | ₹55,157.85 |

🛑 Support & Resistance Levels

Support: ₹56,324.71

Resistance: ₹57,376.51

Observations:

Since the current price is below the pivot (₹56,849.40), immediate bearish bias could be assumed unless a strong reversal happens.

A break below ₹56,324.71 (Support) could trigger the downside targets.

Conversely, crossing back above the pivot may shift bias to bullish, targeting the resistance and beyond.

#TradingView #Stocks #Equities #StockMarket #Investing #Trading #Nifty

#TechnicalAnalysis #StockCharts #Finance #BankNifty #NiftyBank #WeeklyAnalysis

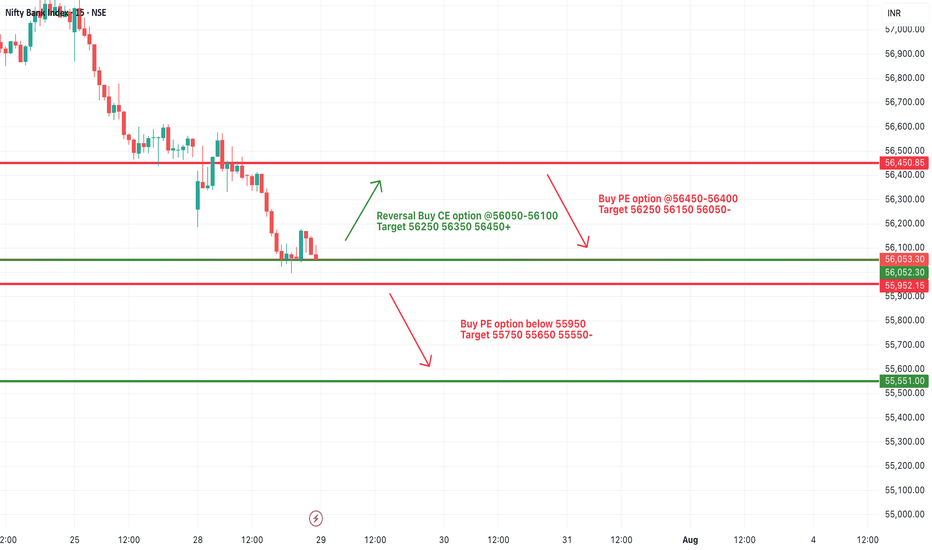

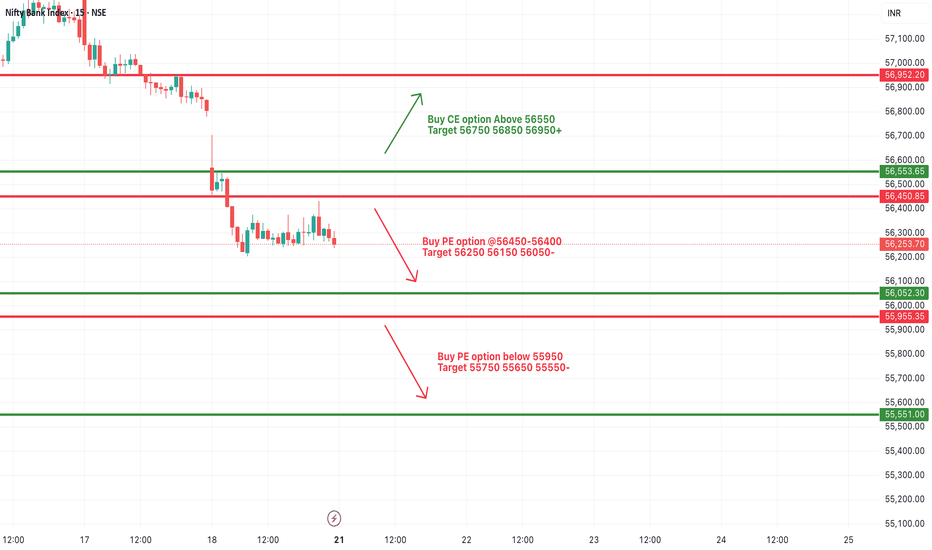

[INTRADAY] #BANKNIFTY PE & CE Levels(29/07/2025)Bank Nifty is expected to open with a gap-down, continuing its downside pressure from the previous sessions. The index is now hovering near an important support zone around 56,050–55,950.

If Bank Nifty sustains above the 56,050–56,100 zone after the gap-down open, a reversal rally can be seen with potential upside targets of 56,250, 56,350, and 56,450+. This zone may offer a low-risk long opportunity, provided price action confirms strength.

However, if Bank Nifty remains below 56,050 and especially breaches 55,950, fresh short positions can be initiated with downside targets of 55,750, 55,650, and 55,550-. A close below this support zone can accelerate the selling momentum further.

The market remains in a bearish tone unless a clear reversal structure forms above 56,050.

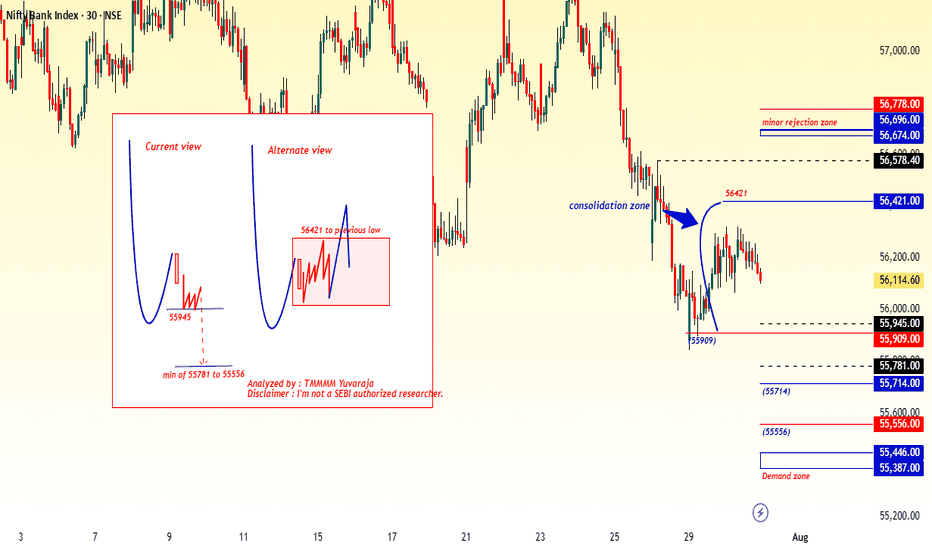

#Banknifty directions and levels for July 31st:

What can we expect today?

In the previous session, both Nifty and Bank Nifty went through consolidation.

Structurally, we are still in a bearish tone, and with Gift Nifty indicating a gap-down start,

if the market breaks the immediate support levels with a solid candle, we can expect further correction.

On the other hand, if it finds support there, then the range-bound movement is likely to continue.

Which means, if the initial market takes a pullback, we can expect consolidation within the previous day’s range.

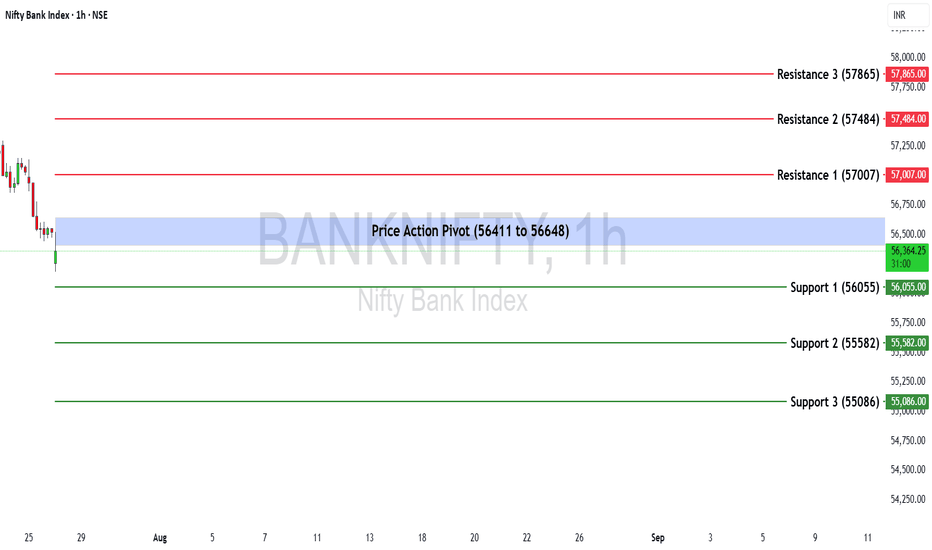

Bank Nifty Weekly Insights: Key Levels & TrendsBank Nifty ended the week at 56,528.90, registering a marginal gain of +0.44%.

🔹 Key Levels for the Upcoming Week

📌 Price Action Pivot Zone:

The critical zone to monitor for potential trend reversals or continuation lies between 56,411 and 56,648.

🔻 Support Levels:

Support 1 (S1): 56,055

Support 2 (S2): 55,582

Support 3 (S3): 55,086

🔺 Resistance Levels:

Resistance 1 (R1): 57,007

Resistance 2 (R2): 57,484

Resistance 3 (R3): 57,865

📈 Market Outlook

✅ Bullish Scenario:

If Bank Nifty sustains above the pivot zone (56,648), it may trigger renewed buying interest, potentially pushing the index toward R1 (57,007) and higher levels like R2 (57,484) and R3 (57,865).

❌ Bearish Scenario:

A breakdown below the lower end of the pivot zone at 56,411 may attract selling pressure, dragging the index towards S1 (56,055) and possibly lower levels like S2 (55,582) and S3 (55,086).

Disclaimer: lnkd.in

BankNifty levels - Aug 01, 2025Utilizing the support and resistance levels of BankNifty, along with the 5-minute timeframe candlesticks and VWAP, can enhance the precision of trade entries and exits on or near these levels. It is crucial to recognize that these levels are not static, and they undergo alterations as market dynamics evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We trust that this information proves valuable to you.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you successful trading endeavors!

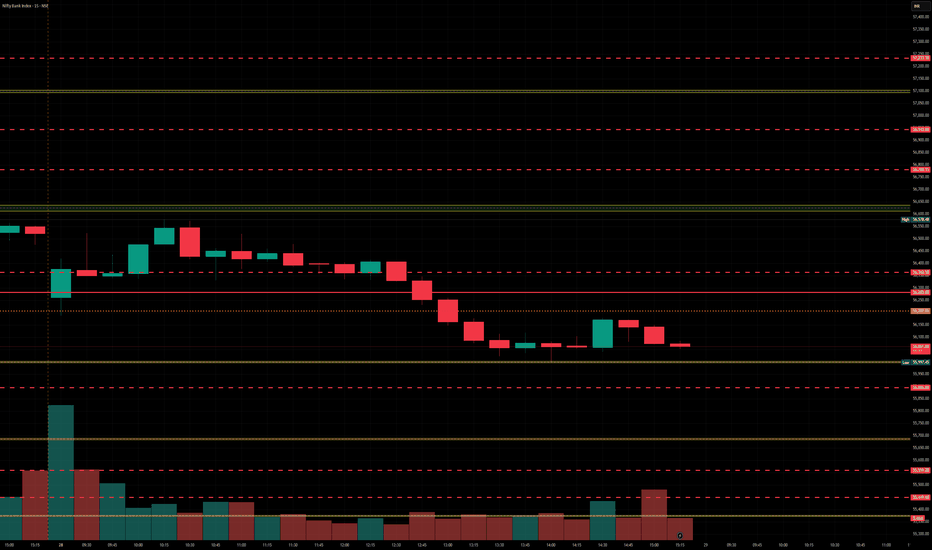

BankNifty levels - Jul 29, 2025Utilizing the support and resistance levels of BankNifty, along with the 5-minute timeframe candlesticks and VWAP, can enhance the precision of trade entries and exits on or near these levels. It is crucial to recognize that these levels are not static, and they undergo alterations as market dynamics evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We trust that this information proves valuable to you.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you successful trading endeavors!

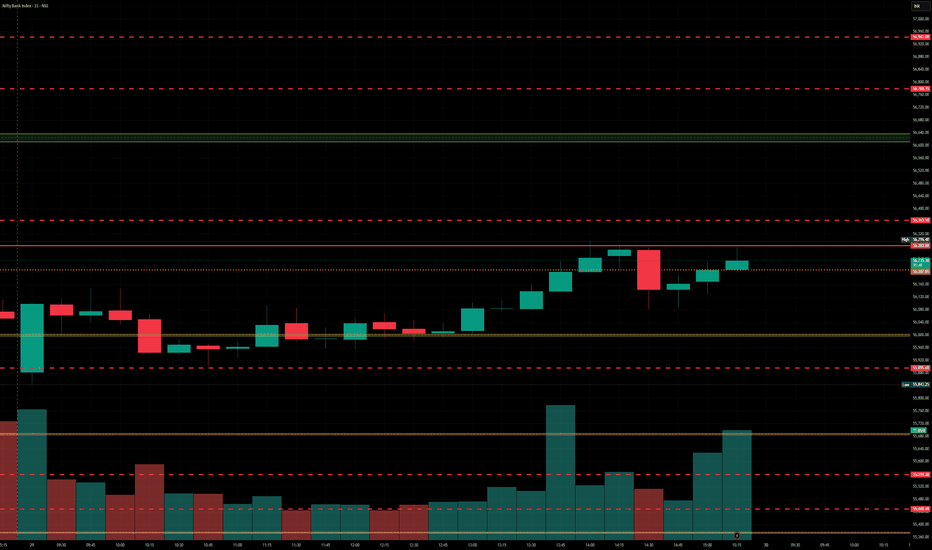

BankNifty levels - Jul 30, 2025Utilizing the support and resistance levels of BankNifty, along with the 5-minute timeframe candlesticks and VWAP, can enhance the precision of trade entries and exits on or near these levels. It is crucial to recognize that these levels are not static, and they undergo alterations as market dynamics evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We trust that this information proves valuable to you.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you successful trading endeavors!

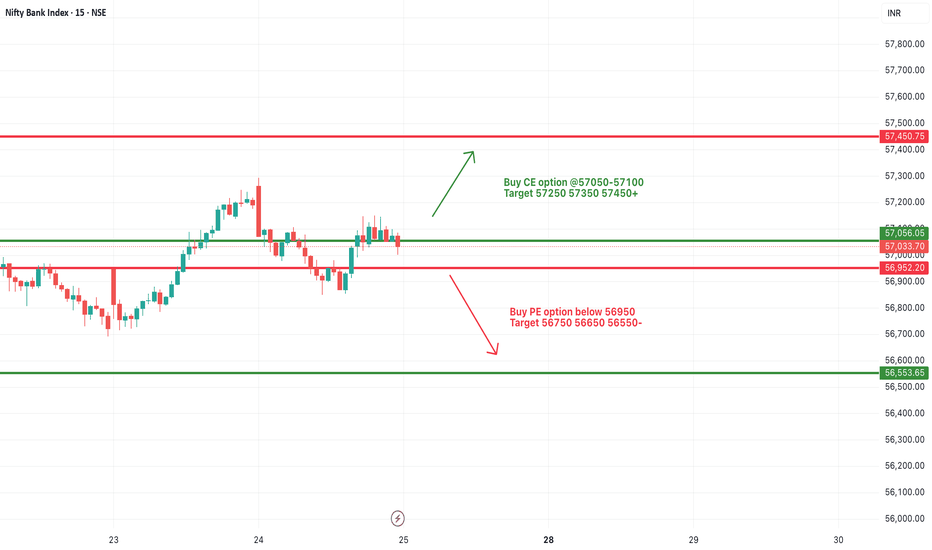

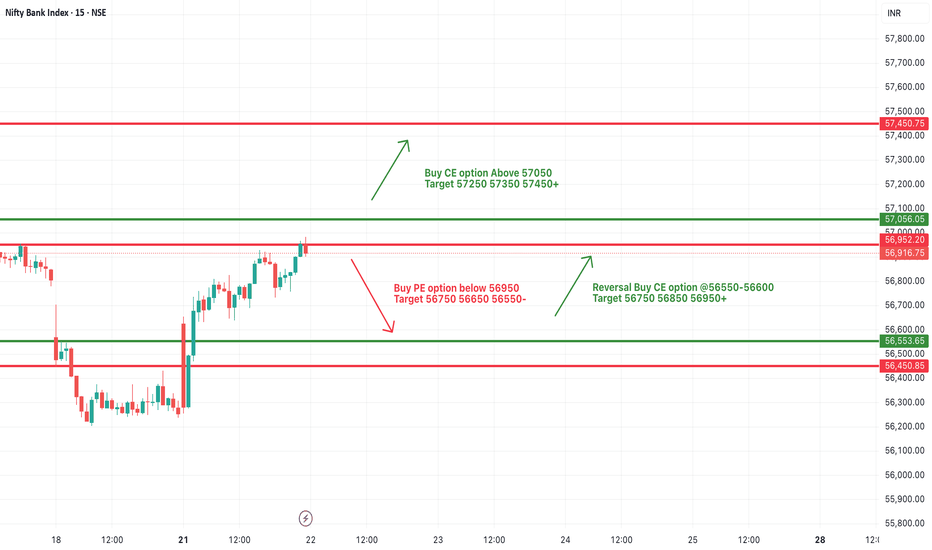

[INTRADAY] #BANKNIFTY PE & CE Levels(25/07/2025)Bank Nifty is likely to start the session with a slight gap-down, hovering just below the 57,050–57,100 resistance zone. This zone has been acting as a critical barrier over the past sessions, and until it's breached, upside momentum may remain capped.

A strong bullish move can be anticipated above 57,050, where call option buying is favored. If Bank Nifty sustains this breakout, we can expect a continuation rally toward 57,250, 57,350, and 57,450+ levels. This would mark a short-term trend reversal and signal fresh bullish interest.

On the downside, weakness may resume if the index breaks below the 56,950 mark. A sustained move below this could trigger a quick correction targeting 56,750, 56,650, and 56,550- levels, offering good opportunities for put option buyers.

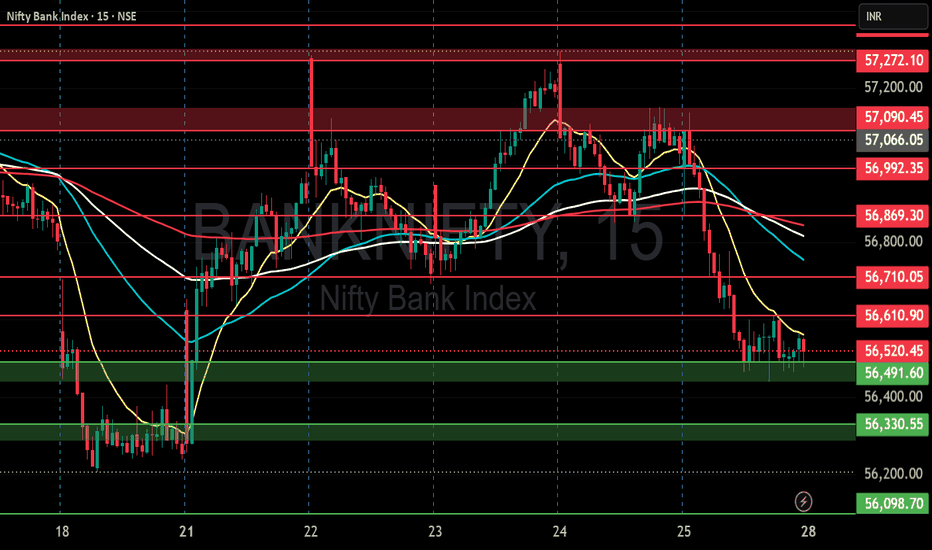

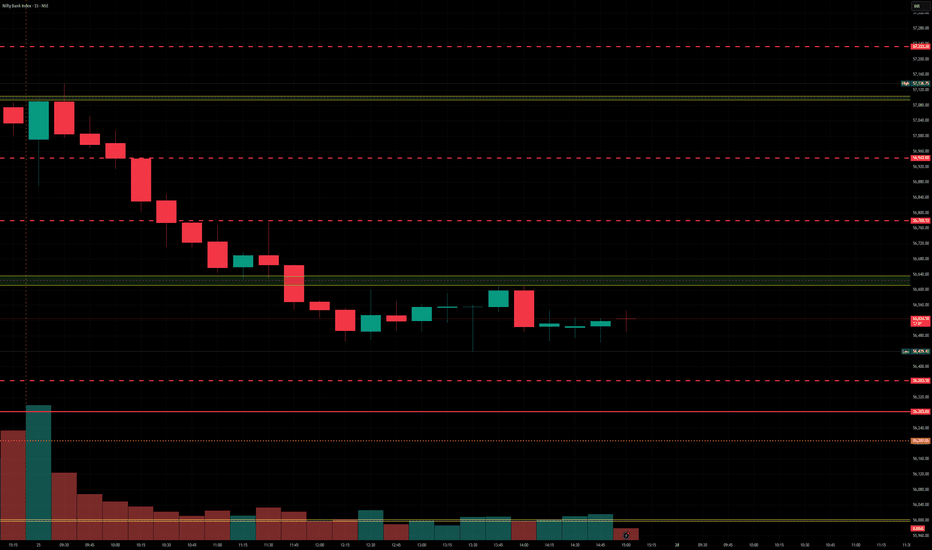

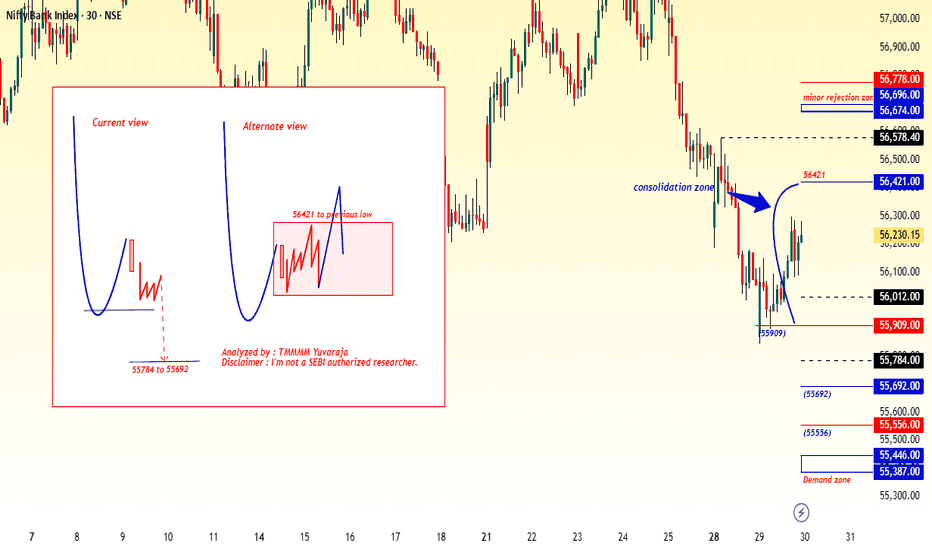

BANK NIFTY S/R for 28/7/25Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

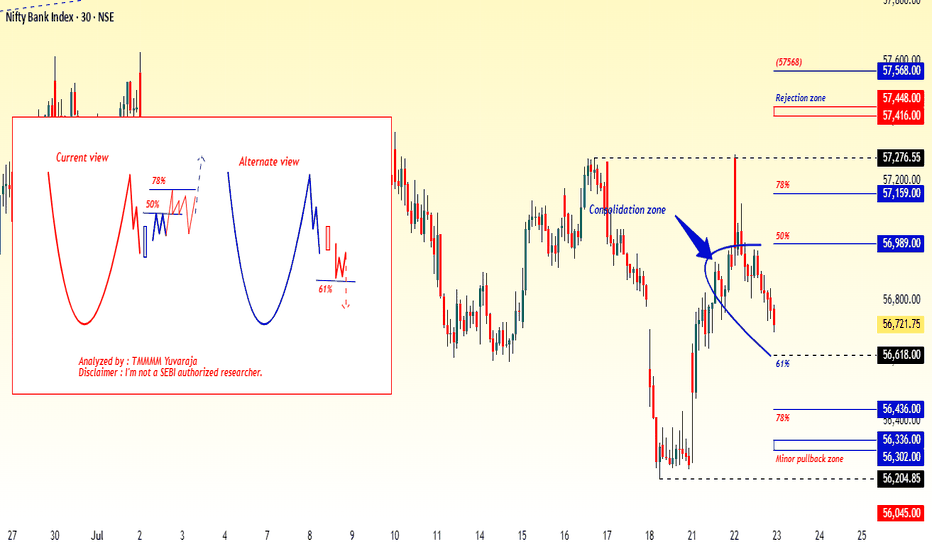

#BankNifty directions and levels for July 23rd:Looking at the chart, the current view suggests:

* If the market sustains the gap-up and breaks the immediate resistance, we can expect the pullback to continue with a moderately bullish tone.

Alternate view:

* If the gap-up doesn’t sustain and the market declines initially, it may reach the immediate support level.

* If a pullback happens from there, we can expect a range-bound market.

* Conversely, if the support breaks, the correction is likely to continue.

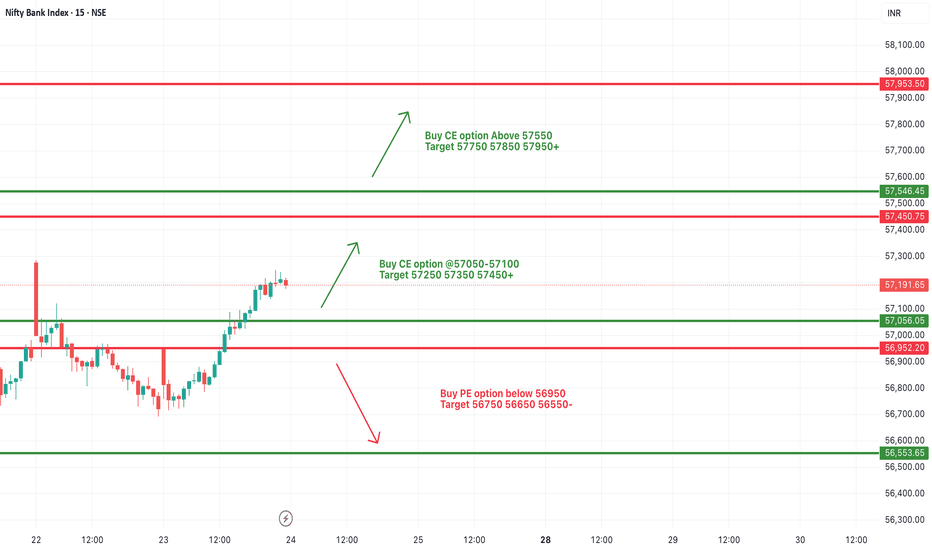

[INTRADAY] #BANKNIFTY PE & CE Levels(24/07/2025)Bank Nifty is likely to open with a slight gap-up, continuing its recent upward trajectory. The index has shown strength by reclaiming key resistance zones and now trades above 57,100, indicating bullish sentiment in the market. Today’s price action will be crucial near immediate supply and resistance zones.

On the upside, if Bank Nifty sustains above 57,050–57,100, a continuation move may unfold toward 57,250, 57,350, and 57,450+ levels. A decisive breakout above 57,550 will open up further upside possibilities with targets near 57,750, 57,850, and 57,950+, where the next key resistance lies.

On the downside, weakness will only emerge if the index breaks below 56,950, which could trigger a sell-off with downside targets of 56,750, 56,650, and 56,550-. This zone also marks the base of the recent rally, and breaching it could suggest exhaustion of momentum.

Overall, the trend remains positive with momentum favoring the bulls as long as the index remains above 57,000. Traders are advised to wait for confirmation near the mentioned levels before initiating trades and maintain strict risk management with trailing stop-losses.

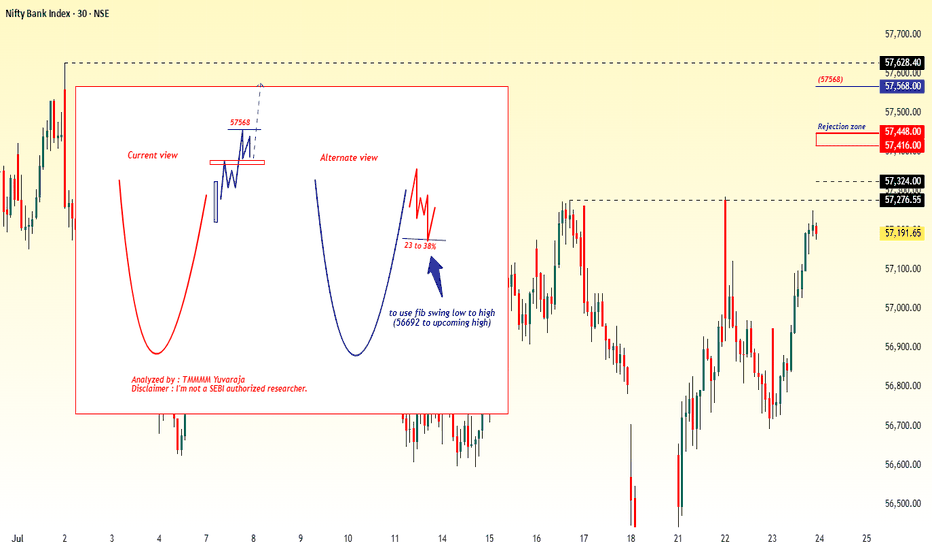

#Banknifty directions and levels for July 24Current View:

The current view suggests that, as mentioned above,

if the gap-up sustains, we can expect a rally continuation with some consolidation.

In this case, the parameters are showing slight strength,

so the rejection zone may act just around the minor resistance.

Alternate View:

The alternate view suggests that

if the gap-up does not sustain or if the market rejects near immediate resistance with a solid reversal,

then we can expect a minor correction of around 23% to 38%.

However, unless the market breaks below the 38% level,

we cannot confirm a reversal into a bearish trend.

BankNifty levels - Jul 28, 2025Utilizing the support and resistance levels of BankNifty, along with the 5-minute timeframe candlesticks and VWAP, can enhance the precision of trade entries and exits on or near these levels. It is crucial to recognize that these levels are not static, and they undergo alterations as market dynamics evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We trust that this information proves valuable to you.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you successful trading endeavors!

BankNifty levels - Jul 22, 2025Utilizing the support and resistance levels of BankNifty, along with the 5-minute timeframe candlesticks and VWAP, can enhance the precision of trade entries and exits on or near these levels. It is crucial to recognize that these levels are not static, and they undergo alterations as market dynamics evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We trust that this information proves valuable to you.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you successful trading endeavors!

[INTRADAY] #BANKNIFTY PE & CE Levels(22/07/2025)Bank Nifty is expected to open gap-up today, continuing the momentum seen in yesterday’s session. The index has successfully crossed above the short-term resistance zone near 56,900, showing bullish strength. The next key breakout level is at 57,050, and once crossed decisively, we may see a sharp upward rally.

Traders can look to Buy CE option above 57,050, targeting 57,250, 57,350, and 57,450+. The structure indicates that momentum buyers may take over above this zone, with the potential for strong upside if Bank Nifty sustains above the breakout level.

On the downside, if the index slips back and breaks 56,950 decisively, then Buy PE option below 56,950 can be considered, with potential downside targets of 56,750, 56,650, and 56,550-. This zone will act as an immediate intraday support and any fall below it can lead to quick profit-booking.

Additionally, if Bank Nifty finds support near the 56,550–56,600 zone again, traders may also consider reversal CE buying with upside targets of 56,750, 56,850, and 56,950+.

[INTRADAY] #BANKNIFTY PE & CE Levels(21/07/2025)Bank Nifty is expected to open with a gap-up, indicating early bullish sentiment. However, price action near the 56,450–56,500 zone will be crucial in deciding the day’s direction. If Bank Nifty manages to sustain above the 56,650 level after opening, it may invite fresh momentum on the upside. A move above this zone can be seen as a strength confirmation, potentially pushing the index toward targets of 56,750, 56,850, and even 56,950+ levels.

On the other hand, if the index faces resistance and shows rejection from the 56,450–56,400 supply zone, weakness can creep in. This could trigger a corrective move toward the lower levels of 56,250, 56,150, and 56,050-, making it a favorable short trade setup for the day if confirmed by price action.

Additionally, a breakdown below the 55,950 support level can lead to strong bearish pressure. If this level is breached and sustained, the index may fall sharply toward the support zones of 55,750, 55,650, and 55,550-, indicating bearish continuation.

Banknifty August 1st week analysisBanknifty is looking uncertain and we can expect high volatility in banknifty in the upcoming week.If banknifty breaches 55400 on the downside then an important level to watch on downside would be 54876. On the upside if banknifty crosses and sustains above 55800-56014 then we can expect upside upto 55560-56700.

All levels are marked in the chart posted.

Smart Liquidity in TradingIntroduction: What Is Smart Liquidity in Trading?

Liquidity is the backbone of financial markets—it refers to how easily assets can be bought or sold without causing drastic price changes. But as markets have evolved with the rise of algorithmic trading, decentralized finance (DeFi), and AI, a more sophisticated concept has emerged: Smart Liquidity.

Smart Liquidity isn’t just about having buyers and sellers in a market. It’s about efficient, dynamic, and intelligent liquidity—where technology, data, and algorithms converge to improve how trades are executed, how markets function, and how risks are managed. Whether in traditional stock markets, forex, or blockchain-based platforms, smart liquidity is now central to modern trading strategies.

Chapter 1: Understanding Traditional Liquidity

Before diving into smart liquidity, let's revisit the basics of traditional liquidity:

Bid-Ask Spread: A narrow spread indicates high liquidity; a wide one shows low liquidity.

Market Depth: The volume of orders at different price levels.

Turnover Volume: How frequently assets are traded.

Price Impact: How much a large order moves the price.

In traditional finance, liquidity providers (LPs) include:

Market makers

Banks and financial institutions

High-frequency trading firms

Exchanges

Liquidity ensures:

Stable pricing

Smooth trade execution

Lower transaction costs

Chapter 2: The Evolution Toward Smart Liquidity

What Changed?

Algorithmic Trading: Algorithms can detect, provide, or withdraw liquidity in milliseconds.

Decentralized Finance (DeFi): Smart contracts offer on-chain liquidity pools without intermediaries.

AI & Machine Learning: Predictive models can identify where liquidity is needed or likely to shift.

Smart Order Routing (SOR): Optimizes trade execution by splitting orders across multiple venues.

These technologies gave rise to “smart liquidity,” where liquidity is not static but adaptive, context-aware, and real-time optimized.

Chapter 3: Components of Smart Liquidity

1. Liquidity Intelligence

Advanced analytics track:

Market depth across exchanges

Order flow trends

Latency and slippage statistics

Arbitrage opportunities

This helps institutions dynamically manage their liquidity strategies.

2. Smart Order Routing (SOR)

SOR systems:

Automatically split large orders across venues

Route based on fees, liquidity, latency, and execution quality

Reduce market impact and slippage

SOR is key in both equity and crypto markets.

3. Algorithmic Liquidity Providers

Market-making bots adjust quotes in real-time based on:

Volatility

News sentiment

Volume spikes

Risk exposure

They enhance liquidity without manual intervention.

4. Automated Market Makers (AMMs)

Used in DeFi:

No traditional order book

Prices determined algorithmically via a liquidity pool

Traders interact with pools, not people

Popular AMMs: Uniswap, Curve, Balancer.

Chapter 4: Use Cases of Smart Liquidity

1. HFT Firms and Institutions

Use predictive liquidity models

Deploy SOR to reduce costs and slippage

Balance exposure across markets

2. Retail Traders

Benefit from tighter spreads and faster execution

Use platforms with AI-driven order matching

3. Decentralized Finance (DeFi)

Anyone can provide liquidity and earn fees

Smart liquidity enables 24/7 trading with no intermediaries

New protocols optimize capital allocation via auto-rebalancing

4. Stablecoin & Forex Markets

Smart liquidity ensures 1:1 peg stability

Algorithms prevent arbitrage imbalances

Chapter 5: Key Metrics to Measure Smart Liquidity

Metric Description

Slippage Difference between expected and actual execution price

Spread Efficiency How close bid-ask spreads are to theoretical minimum

Fill Rate How much of an order is filled without delay or rerouting

Market Impact Price movement caused by a trade

Liquidity Utilization How efficiently capital is allocated across pairs/assets

Latency Time taken from order input to execution

These metrics help evaluate the quality of liquidity provided.

Chapter 6: Risks and Challenges of Smart Liquidity

Despite its benefits, smart liquidity isn’t perfect.

1. Flash Crashes

Caused by sudden withdrawal of liquidity bots

Example: 2010 Flash Crash in U.S. equities

2. Manipulation Risks

Predatory algorithms can spoof or bait other traders

"Liquidity mirages" trick algorithms

3. Smart Contract Failures (DeFi)

Vulnerabilities in AMMs can drain entire liquidity pools

Hacks like those on Curve and Poly Network show smart liquidity can be fragile

4. Impermanent Loss (DeFi)

LPs may lose value if asset prices diverge significantly

Complex math and simulations needed to manage it

5. Regulatory Uncertainty

Especially in crypto, regulators still debating on decentralized liquidity protocols

Conclusion

Smart liquidity represents the next evolution of market infrastructure. It's not just about having capital in the market—it's about how that capital moves, adapts, and executes.

From hedge funds deploying intelligent routing systems to DeFi users earning yields through AMMs, smart liquidity touches every corner of modern finance. As technology continues to mature, expect liquidity to become even more predictive, responsive, and intelligent—unlocking a new level of speed, precision, and access for traders around the world.

#Banknifty directions and levels for July 30th:

What can we expect today?

In the previous session, both Nifty and Bank Nifty took a solid pullback after the gap-down start.

However, neither of them broke the 38% Fibonacci level in the current swing.

So, unless the 38% level is broken, we should continue to approach the market with a bearish view.

At the same time, key parameters have been lagging recently, which has made it difficult for the market to take a clear direction.

My primary expectation is consolidation within the previous day's range.

However, if the market breaks the bottom with a solid structure, then we can expect the correction to continue.