CDSL trade ideas

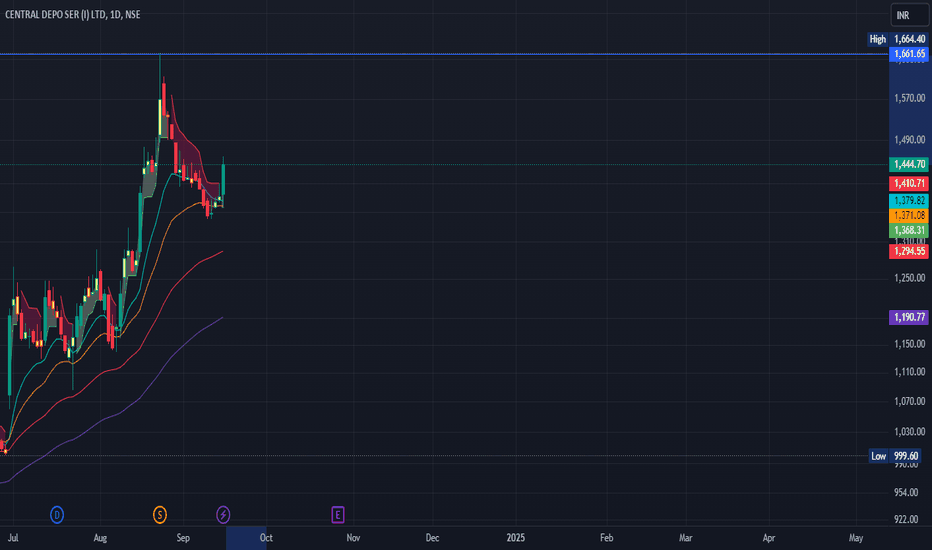

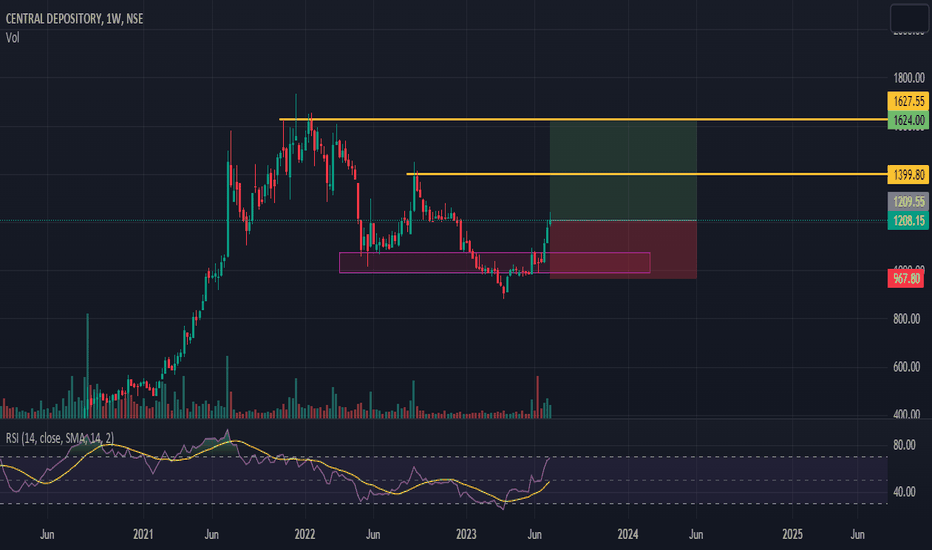

CDSL S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA: If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

RSI: RSI readings greater than the 70 level are overbought territory, and RSI readings lower than the 30 level are considered oversold territory.

Combining RSI with Support and Resistance:

Support Level: This is a price level where a stock tends to find buying interest, preventing it from falling further. If RSI is showing an oversold condition (below 30) and the price is near or at a strong support level, it could be a good buy signal.

Resistance Level: This is a price level where a stock tends to find selling interest, preventing it from rising further. If RSI is showing an overbought condition (above 70) and the price is near or at a strong resistance level, it could be a signal to sell or short the asset.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

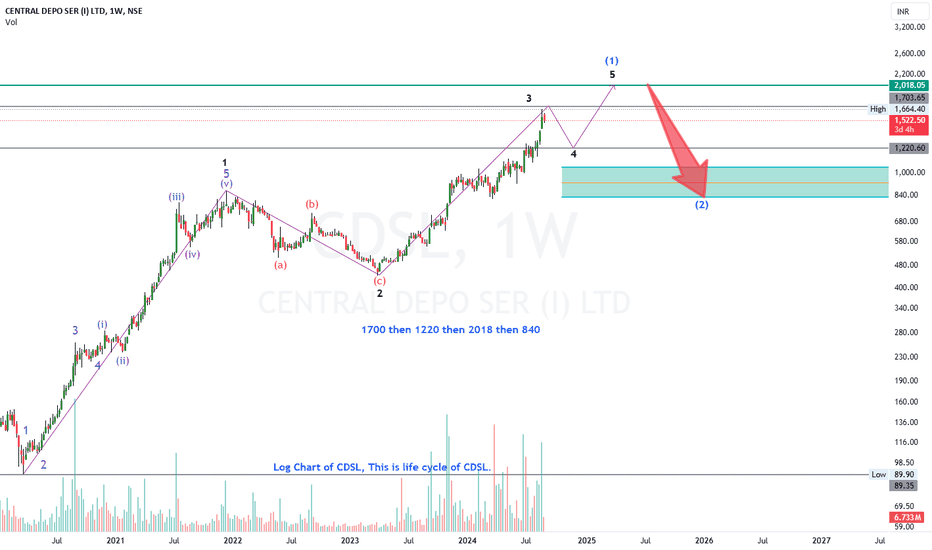

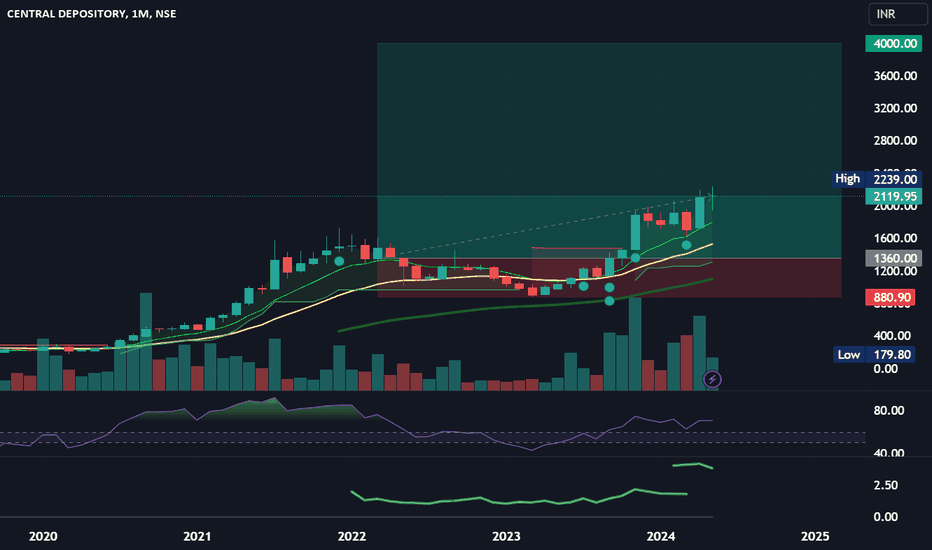

The life cycle analysis of CDSLI have depicted the intermediate degree chart of the CDSL , however, we do not have much data on the scrip but if we count we are in 3rd wave of the miner degree and uppar levels for 3rd are marked with lines (gray).

Again not a buy sell Reco. only an educational material.

Regards

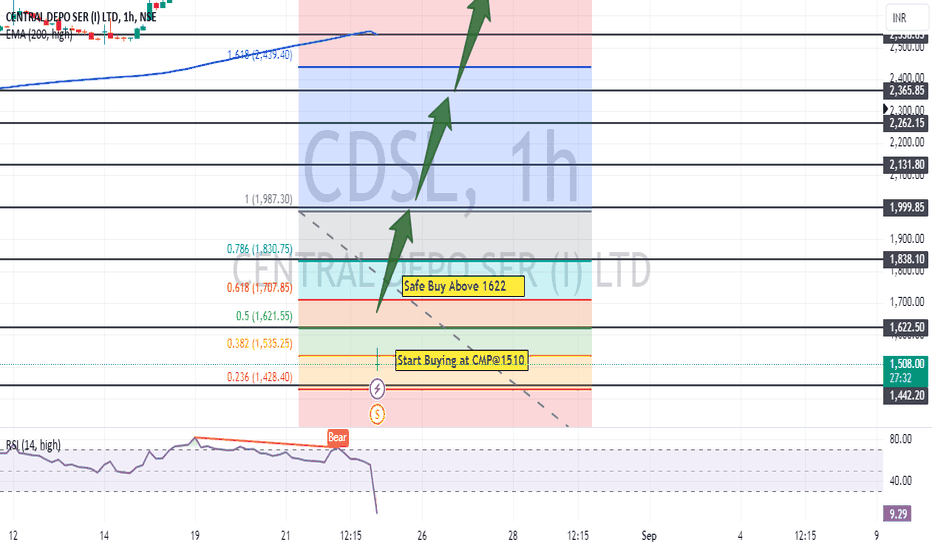

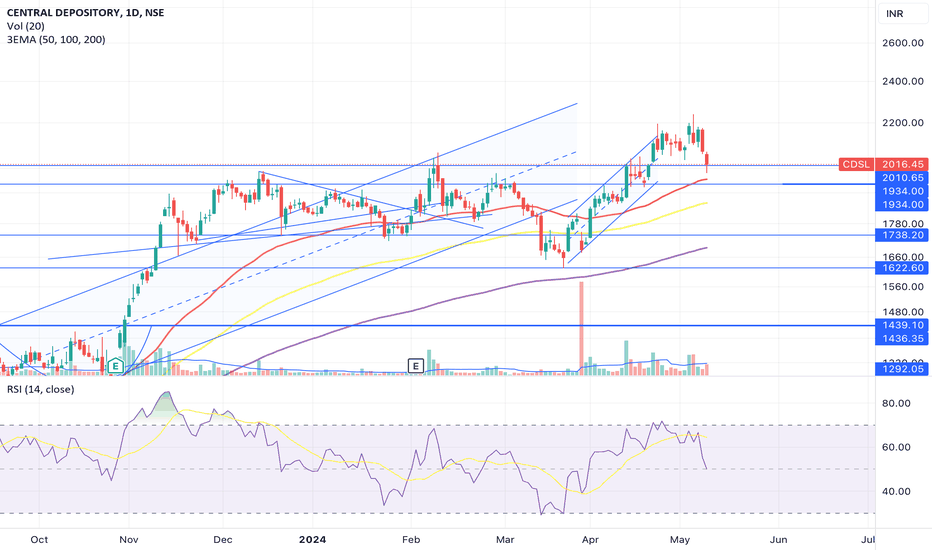

Technical Analysis of CDSL Ltd (Buy & Hold)Technical Analysis of CDSL Ltd (Central Depository Services India Ltd)

Key Indicators and Observations

Timeframe: - This technical Analysis is on the 1-hour timeframe.

Price Action: The price is currently trading above the 200-period Exponential Moving Average (EMA), which is generally considered a bullish signal.

Support and Resistance:

The 0.618 Fibonacci retracement level (around 1,707.85) is acting as a significant support level.

The 0.5 Fibonacci retracement level (around 1,621.55) is also a potential support level.

A "Safe Buy" zone is indicated above the 0.618 level, suggesting that buying opportunities may arise in that area.

Relative Strength Index (RSI): The RSI is currently below the 50 level, indicating a bearish trend. However, it's not significantly oversold, suggesting that there might be some buying interest at lower prices.

Bearish Engulfing Pattern: A bearish engulfing pattern is visible on the chart, which could be a bearish signal. However, the significance of this pattern depends on other factors, such as volume and price action.

Potential Outlook

Based on the technical analysis, here are some potential scenarios:

Bullish Scenario: - If the price can break above the bearish engulfing pattern and maintain support at the 0.618 Fibonacci level, it could signal a bullish reversal. A move above the recent highs is also possible.

Neutral Scenario: The price could remain range-bound between the 0.618 and 0.5 Fibonacci levels, indicating indecision.

Bearish Scenario: If the price breaks below the 0.5 Fibonacci level and the RSI moves further into oversold territory, it could signal a bearish trend.

Recommendations -

Wait for Confirmation: Given the bearish engulfing pattern and the RSI's position, it might be prudent to wait for a clearer confirmation of a bullish reversal before entering a long position.

Risk Management: If you decide to enter a trade, it's essential to implement proper risk management strategies, such as setting stop-loss orders.

Fundamental Analysis: While technical analysis provides valuable insights, it's also important to consider fundamental factors such as the company's financial health, industry trends, and overall market conditions.

Remember: This analysis is based on the limited information provided in the chart. For a more comprehensive understanding, consider factors like volume, news, and economic .

Disclaimer: - This analysis is based on the provided chart and is for informational purposes only. It does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

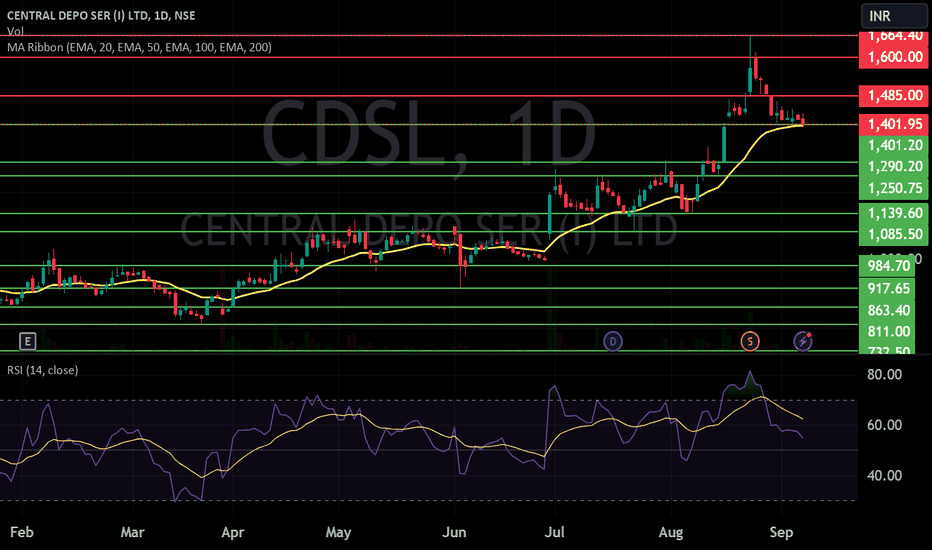

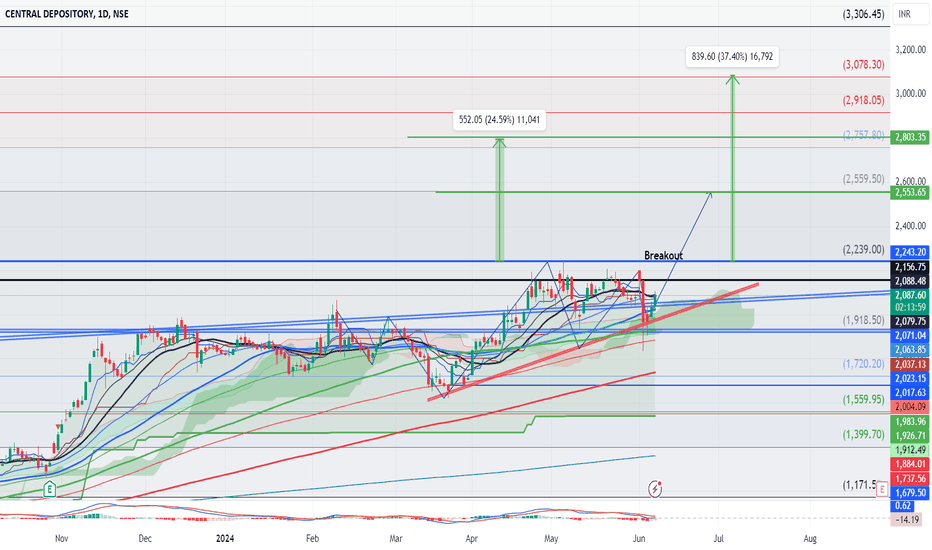

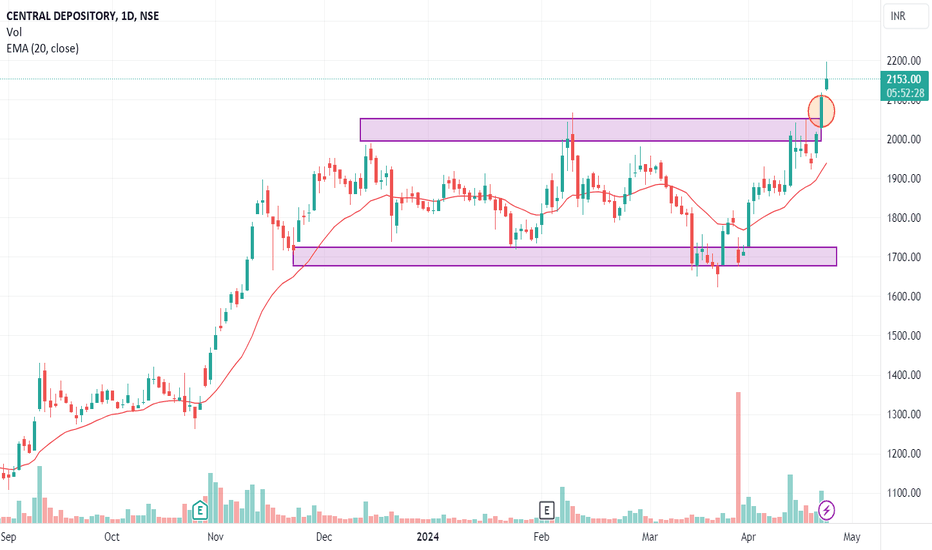

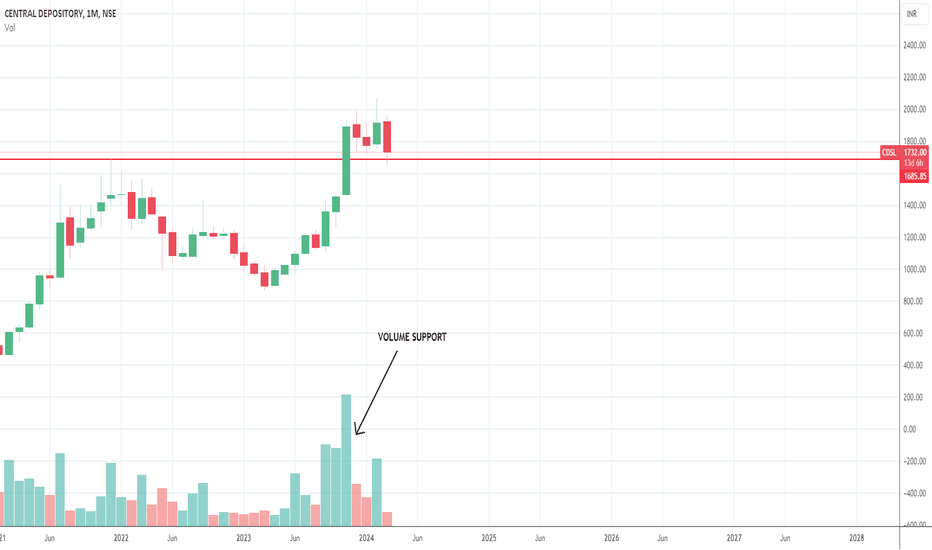

SWING IDEA - CDSLConsider a promising swing trade opportunity in Central Depository Services Limited (CDSL) , a leading securities depository in India, facilitating the holding and transfer of securities in electronic form.

Reasons are listed below :

Breakout from Strong Resistance at 2000 : CDSL has successfully broken above a significant resistance zone at 2000, with a strong close, indicating potential bullish momentum.

Bullish Marubozu Candle on Daily Timeframe : The presence of a bullish Marubozu candlestick pattern on the daily timeframe suggests strong buying momentum and potential upward movement.

Breakout from 5+ Months of Consolidation : The stock has broken out from a consolidation phase lasting over 5 months, indicating a significant shift in market sentiment and potential for sustained upward movement.

Spike in Volumes : A notable spike in trading volumes reflects growing market interest and potential accumulation by investors, adding confirmation to the bullish thesis for CDSL.

Trading Above 50 and 200 EMA : CDSL is trading above both the 50 and 200 Exponential Moving Averages (EMA), confirming bullish bias and indicating potential for trend continuation.

Higher Highs : The stock consistently forms higher highs, reflecting increasing bullish momentum and reinforcing the potential for further gains.

Target - 2200 // 2400

StopLoss - Daily close below 1820

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

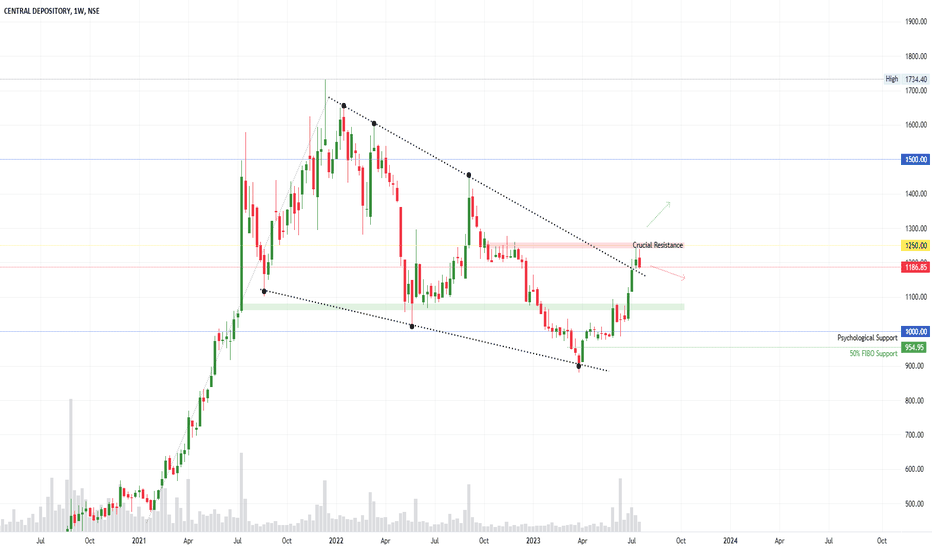

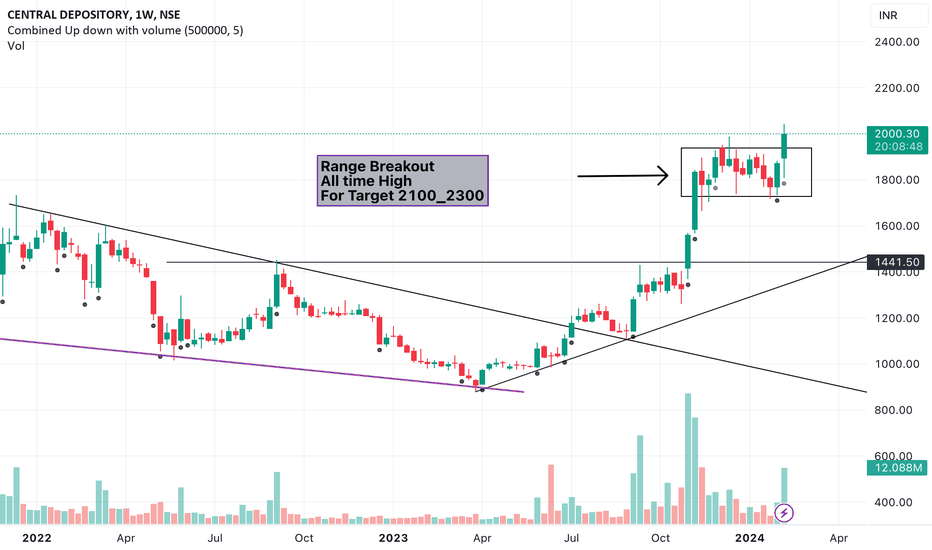

CDSL | Flagpole | NSDL Files for IPO

• NSDL has filed its DHRP, leading to market concerns that investors might shift their funds to NSDL, potentially affecting CDSL.

(We'll be sharing a detailed comparison for NSDL and CDSL in the comments section below. Feel free to follow us for the updates.)

Now CDSL:

• In the last 13 months, it's formed a beautiful Flag Pole pattern. The breakout of which is already done.

• The 1000 level + 50% Fibo level provided support during its momentum.

• Volumes increased during the rally, which is a positive sign.

• It faces a crucial resistance zone the break and sustenance of which will be necessary.

• Now if you are worried about the funds flowing to NSDL, Remember what happened to BSE when NSE announced its IPO – it literally doubled in value. NSDL's valuation will play a crucial role in boosting CDSL's momentum.

• Duopolies, like Ola and Uber, Airtel and Jio, Swiggy and Zomato, Amazon and Flipkart, tend to fare well. CDSL and NSDL too can coexist.

• Do you know who else can and must Coexist? YOU and WE! Follow us for such interesting Case studies.

Have Insights or Questions? Let us know in the comments below.👇

While you do that, how about a boost for some motivation 🚀

⚠️Disclaimer: We are not registered advisors. The views expressed here are merely personal opinions. Irrespective of the language used, Nothing mentioned here should be considered as advice or recommendation. Please consult with your financial advisors before making any investment decisions. Like everybody else, we too can be wrong at times ✌🏻

“Decade-Long Investment in CDSL: A Pathway to Multibagger ReturnCentral Depository Services Limited (CDSL), one of India’s leading securities depositories, presents a compelling investment opportunity for long-term investors. Holding CDSL shares for a decade could potentially yield multibagger returns, given the company’s robust financial performance and the growth trajectory of the Indian stock market.

Financially, CDSL has demonstrated consistent growth in its revenue and profitability over the years. Its strong business model, coupled with a wide moat in the depository services sector, provides a solid foundation for future growth.

Moreover, the growth story of the Indian stock market adds another layer of optimism. With increasing financial literacy and the rise of digital trading platforms, more Indians are participating in the stock market than ever before. This trend is likely to continue, driving higher volumes of dematerialized securities - the core business of CDSL.

Disclaimer: However, like any investment, it’s important to conduct thorough research and consider various factors such as the company’s financial health, industry trends, and market conditions. Investing in CDSL, or any stock for that matter, should align with your financial goals, risk tolerance, and investment horizon."

"Above are my personal view and I am not SEBI registered"

CDSL C&H PatternVolume Growth

Trend line support

Central Depository Services Limited is a Market Infrastructure Institution (MII), part of the capital market structure, providing services to all market participants - exchanges, clearing corporations, depository participants (DPs), issuers and investors. It is a facilitator for holding of securities in the dematerialised form and an enabler for securities transactions

Weekly and monthly breakeout stock or soon to be break outCDSL stock trading on NSE might going to have break out as on monthly and on weekly time frame it is showing that another 300 to 400 rs move can come . once its going to close on 2070 with volume . RSI is value is high but once value in RSI increase further move can be expected

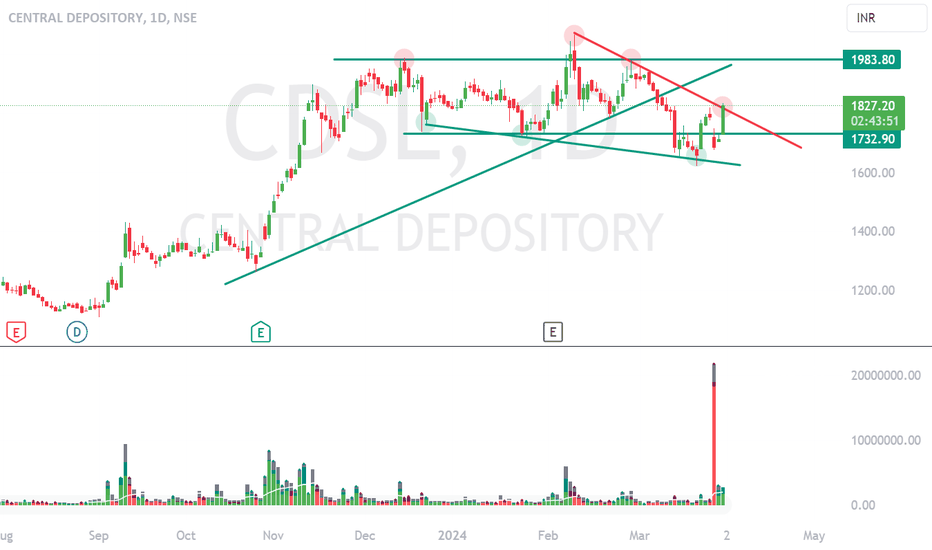

CDSL Long Target 1980CDSL Long Target 1980

After the block deal is completed, CDSL is moving up firmly and decisively.

A break above the red sloping TL will lead to a target of 1980 as there is a 3 drive (3 green dots highlighted in the chart) and a break above inner TL (red sloping TL) will lead to a target in 2 months timeframe

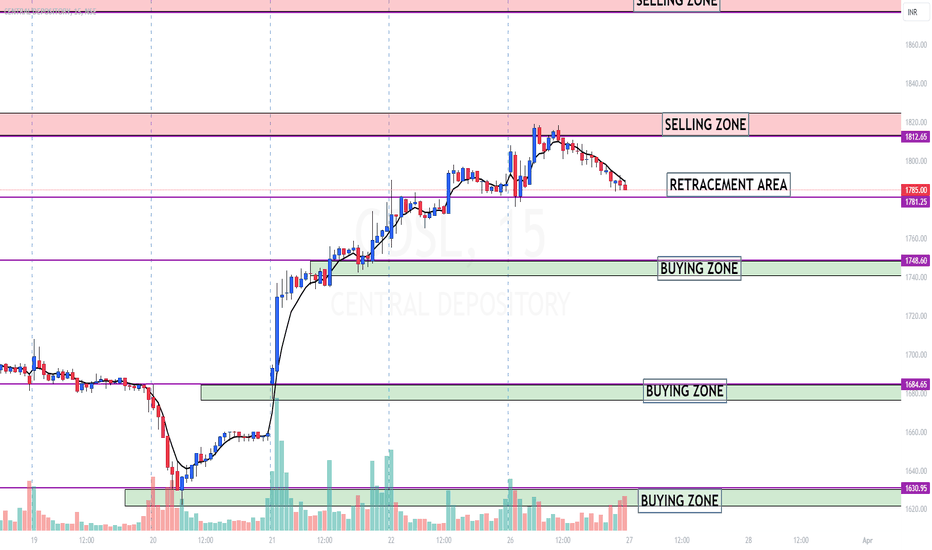

CDSL UPDATED LEVELSAttention dear Traders!

Before you dive into the exhilarating world of trading, where fortunes are made and lost faster than you can say 'bull and bear', remember this: I am not your financial guru, wizard, or psychic hotline. My advice should be taken with a grain (or shaker) of salt, as I'm not a licensed financial advisor

Trading is like riding a rollercoaster blindfolded. It's thrilling, but you never know when you'll hit a loop-the-loop. The stock market is as predictable as a cat on catnip, and past performance is about as reliable as a weather forecast in the Bermuda Triangle. So, don your financial life jacket, do your own homework, and maybe even chat with a real human financial advisor.

Remember,Trading with your money is serious business, but it's okay to chuckle as you read this.

CDSL IMPORTANT LEVELSAttention dear Traders!

Before you dive into the exhilarating world of trading, where fortunes are made and lost faster than you can say 'bull and bear', remember this: I am not your financial guru, wizard, or psychic hotline. My advice should be taken with a grain (or shaker) of salt, as I'm not a licensed financial advisor

Trading is like riding a rollercoaster blindfolded. It's thrilling, but you never know when you'll hit a loop-the-loop. The stock market is as predictable as a cat on catnip, and past performance is about as reliable as a weather forecast in the Bermuda Triangle. So, don your financial life jacket, do your own homework, and maybe even chat with a real human financial advisor.

Remember,Trading with your money is serious business, but it's okay to chuckle as you read this.