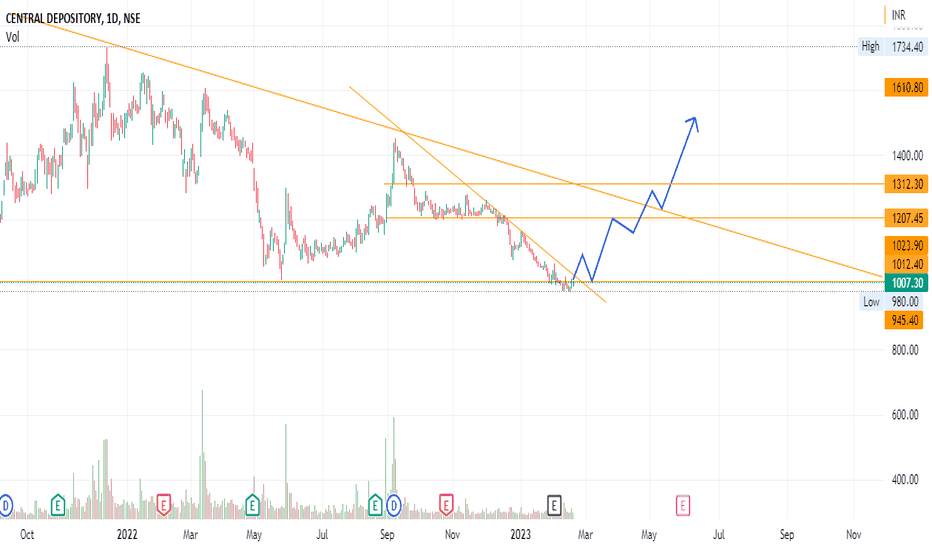

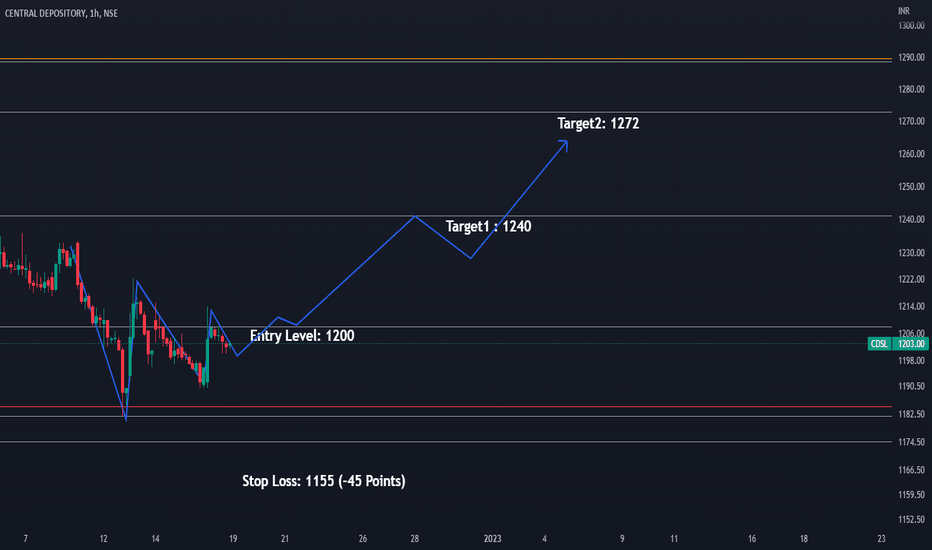

CDSLMake falling wedge chart pattern in 4 hour time fram take break out at resistance level make retest at that that level , take support of 50 EMA that's bullish Sign , MACD also saw fair value so first Target will be 1165.55 and Stop loss will be 993.05

This is for educational purpose not a trading advice so that's my view comment down your view 🤗

CDSL trade ideas

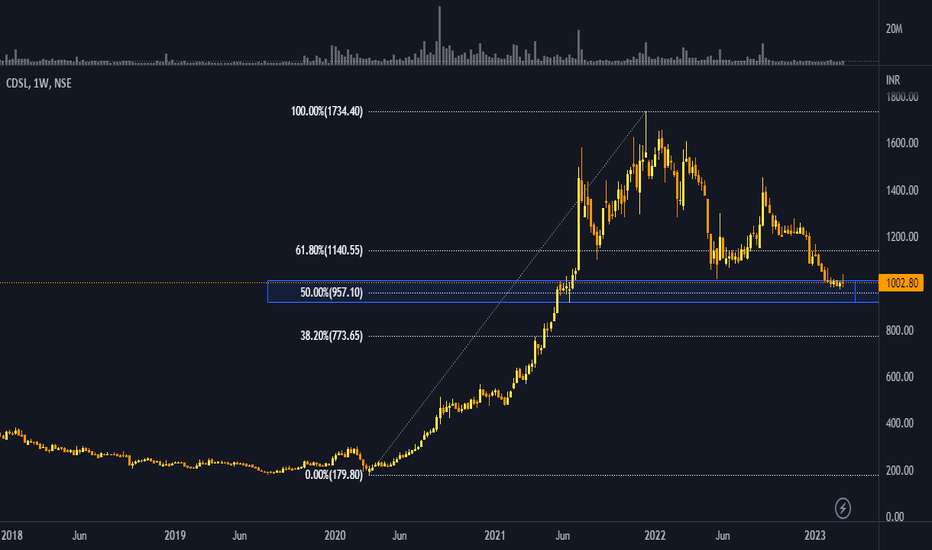

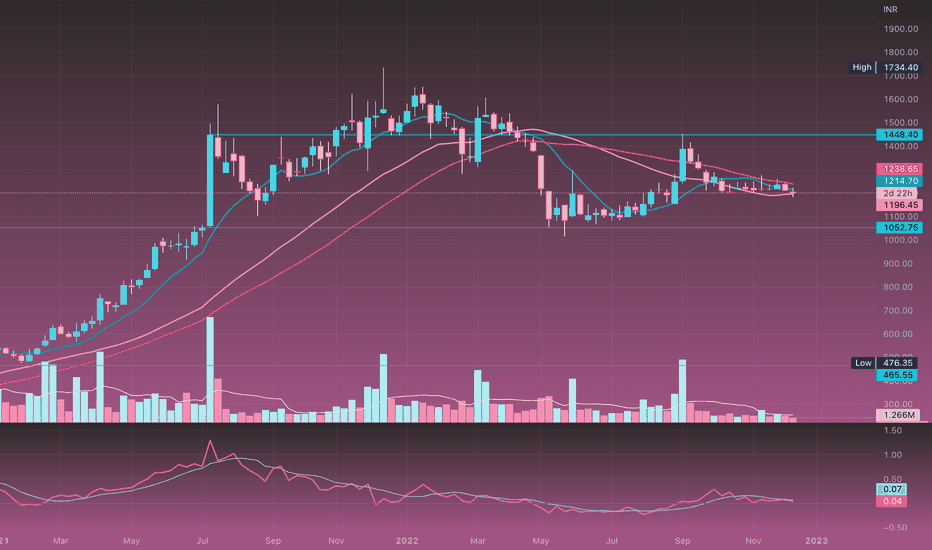

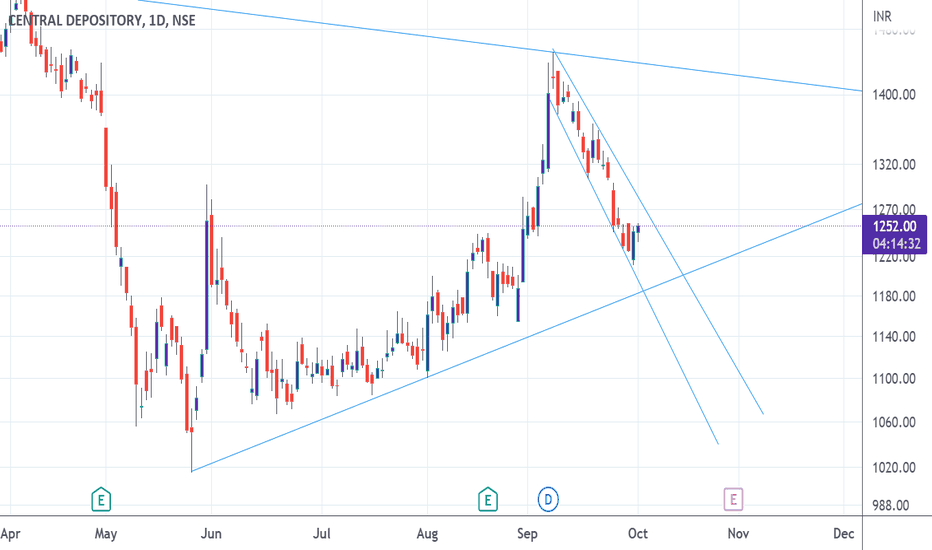

predictive analysis in wcbNSE:CDSL presently trading around 50% retracement zone of drawn fibonacci retracement levels. may take reversal from hereon after spending sometime here at this zone. is it time for accumulation or wait n watch??? comment your opinion below.

Disclaimer - This chart analysis is only for educational study purpose. Do proper research before trade/investment or consult with your financial advisor. This opinion isn't a trade/investment recommendation. SEBI unregistered.

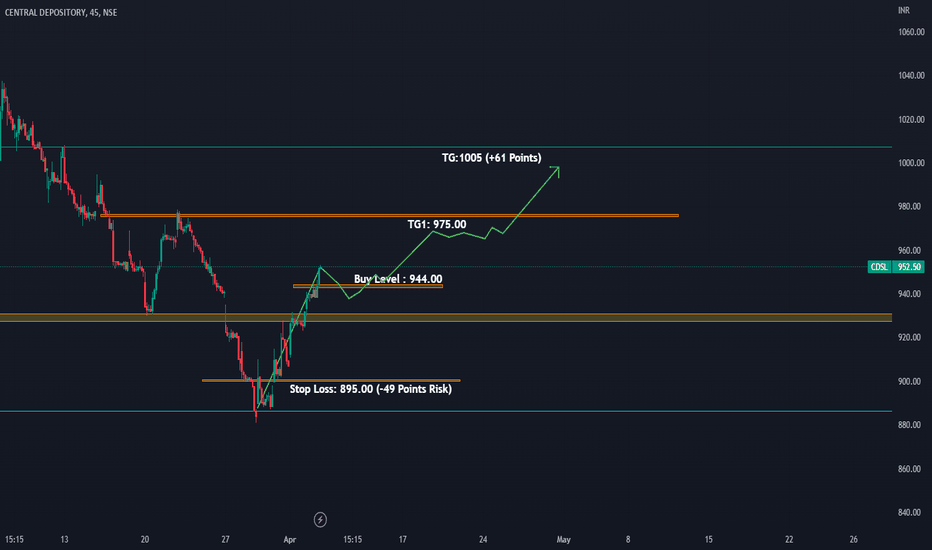

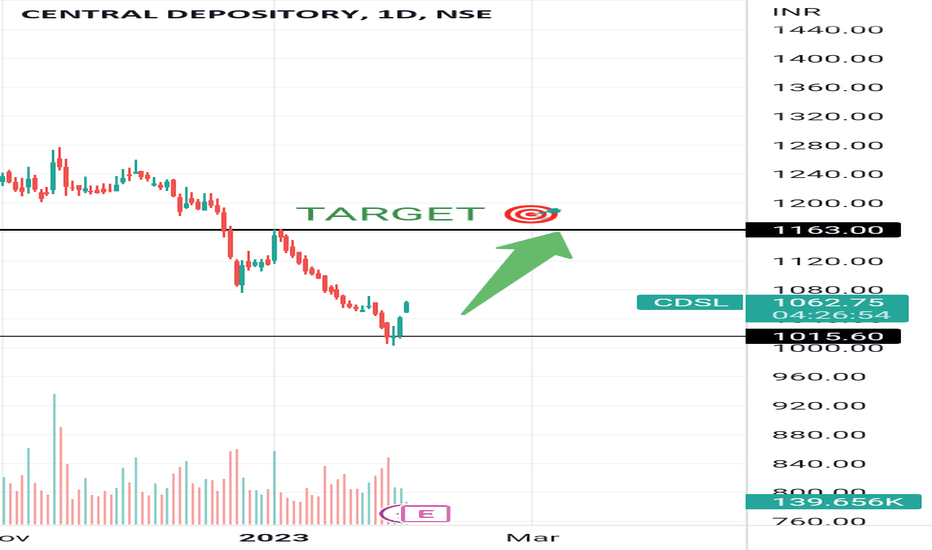

CDSL Positional Buy ideaNSE:CDSL has break major resistance of 935, my idea is to take entry when price come at 944. Stop loss will be 895 (-49 Points Risk). My expected upside target would be 975 and 1005. It may take 5-6 days to get the targets.

Note: This is my personal analysis, only to learn stock market behavior. Thanks.

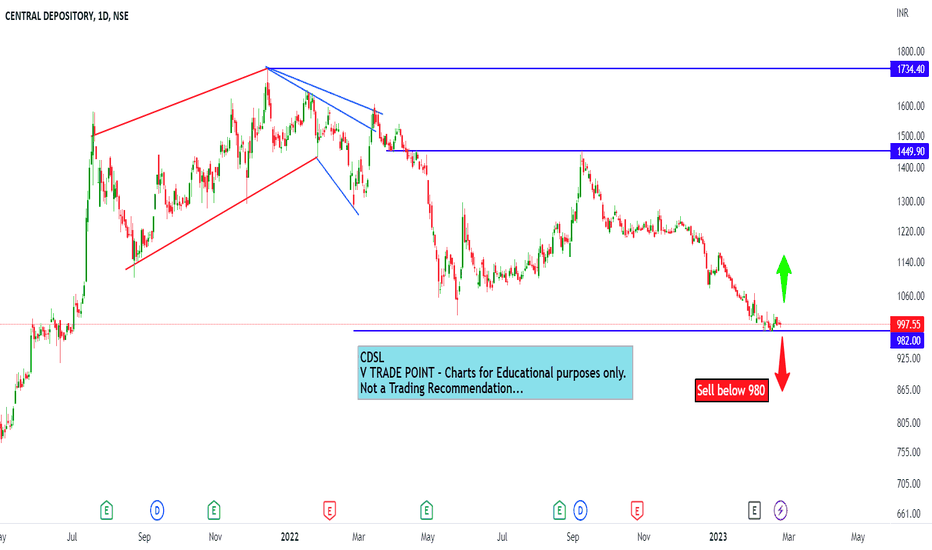

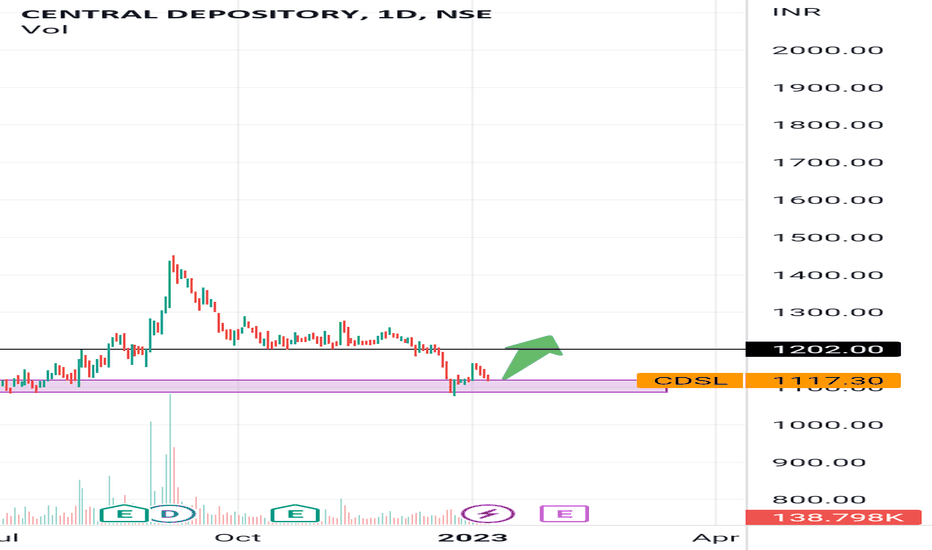

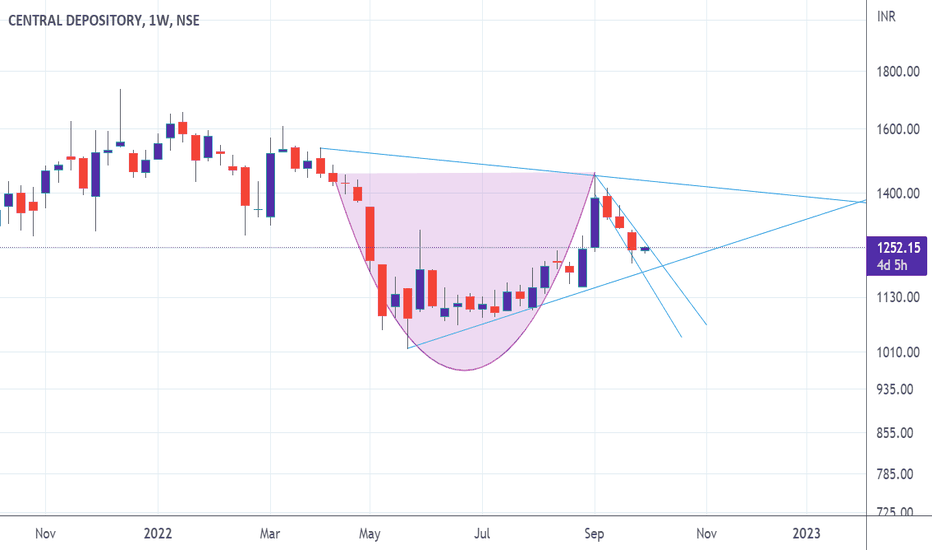

make or break time for cdsl NSE:CDSL

it is now trading in such a narrow range for some time i think a breakout on either side ie 1150 on the downside and 1250 on the up side will make it clear where the stock is going no need to be a long term investor go with trend only. there is nothing so special about this company that it cannot trade on lower price to earning valuation. if there is no significant increase in net profit in next quater and the stock starts to trade below 1150 ,1160 i do not think one should hold on to this stock for some fantasy long term story i will be buyer only if it trades above 1250/1260 for 1/2weeks or more

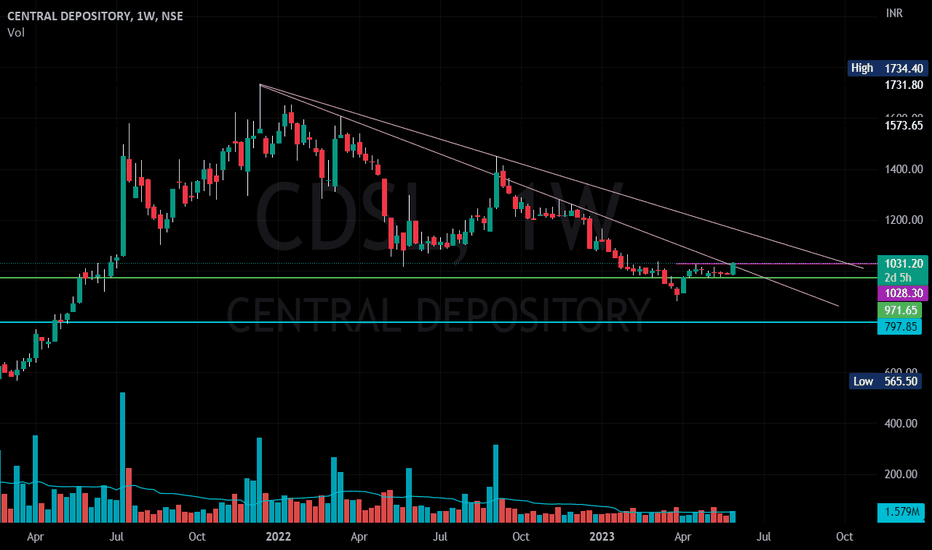

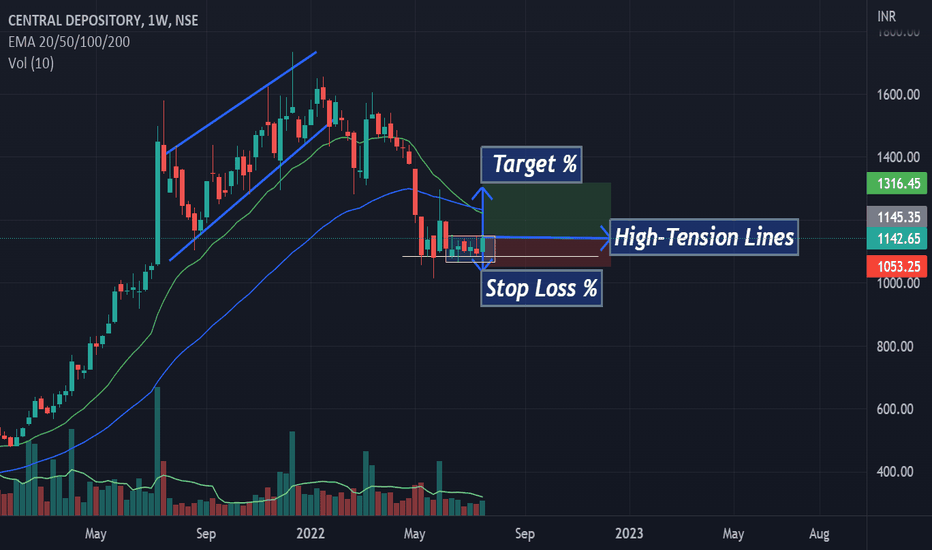

High Tension Lines In 1 WTF//CDSL*Let it cross the 50 EMA with confident volumes in 1 DTF!

*The trend may go Up-Wards or Down-Wards, because of that we are supposed to follow strict SL.

*There is lot of bearish candles before in the trend, but I see something is changing in the trend!

LET'S WATCH!!!

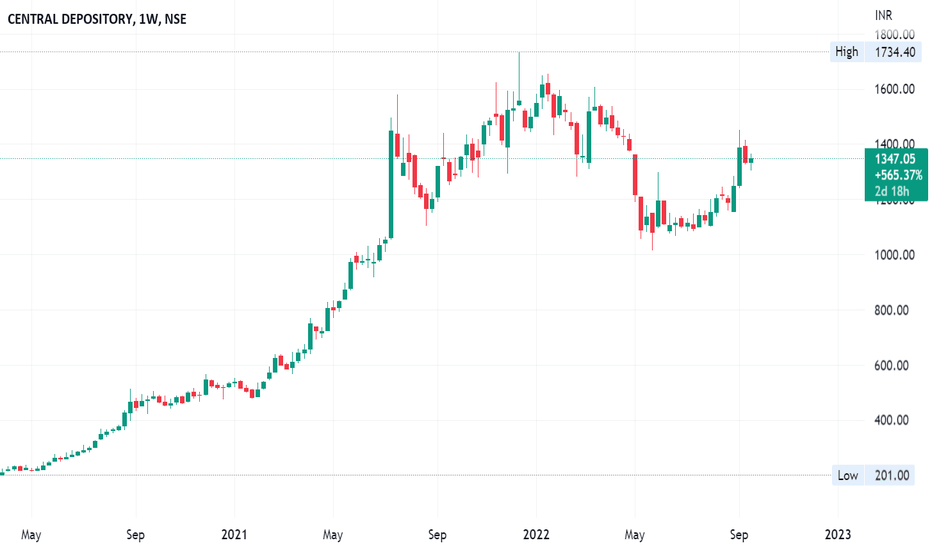

CDSL Trend AnalysisPrice has formed a Head & Shoulder Pattern with declining volume suggesting price is heading towards the technical target of H & S pattern which is around 650 level.

Fundamentally sound but CMP is more than 10 times its book value, better to buy when PE will be around 20-25 levels

Key support level and golden FIB zone will add more confluence to 650 odd levels.

Better to accumulate around 600-650 levels for the following targets:

Short term swing target @ 970 (51.5% ROI with 3.67 R:R)

Medium term swing target @ 1240 (93.75 ROI with 6.75 R:R)

Long term positional target @ 1555 (143% ROI with 10.17 R:R)

Stop loss around 550.

Do your own due diligence before taking any action.

Peace!!