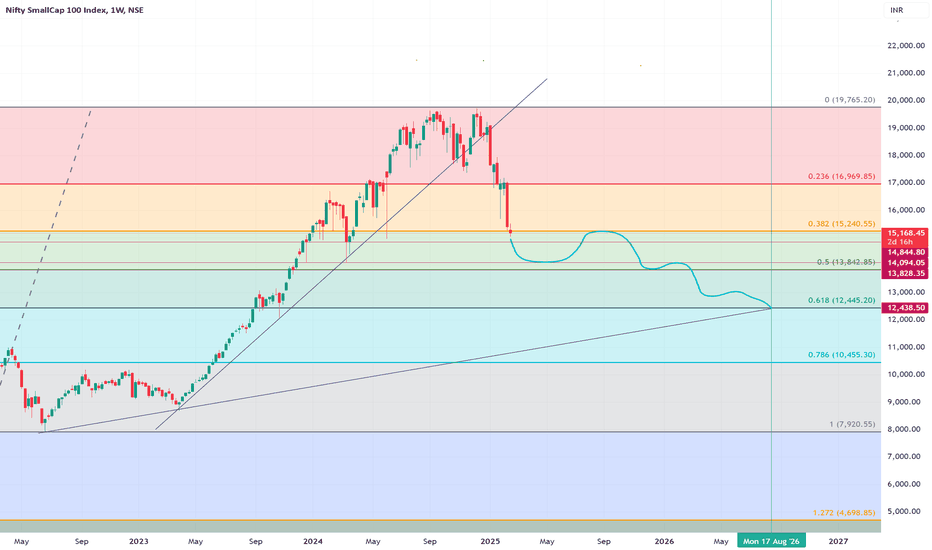

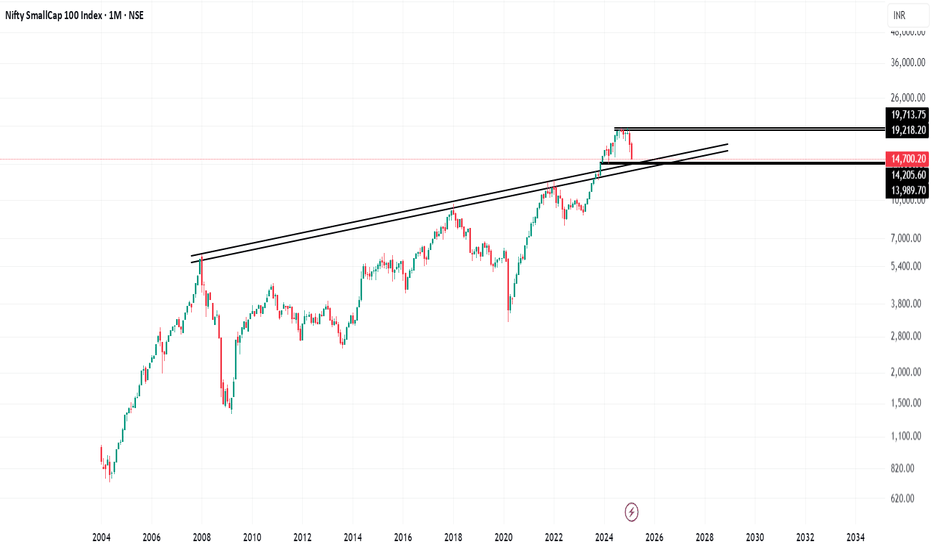

Nifty Smallcap 100 Index Trading plan 📈 Current Market Context

1H Chart:

The index is in a short-term downtrend after a strong rally.

Price is nearing a potential demand zone (previous bullish order block) from late June around 18,500–18,600, a likely mitigation point for re-accumulation.

5M Chart:

There’s a liquidity sweep and pote

Related indices

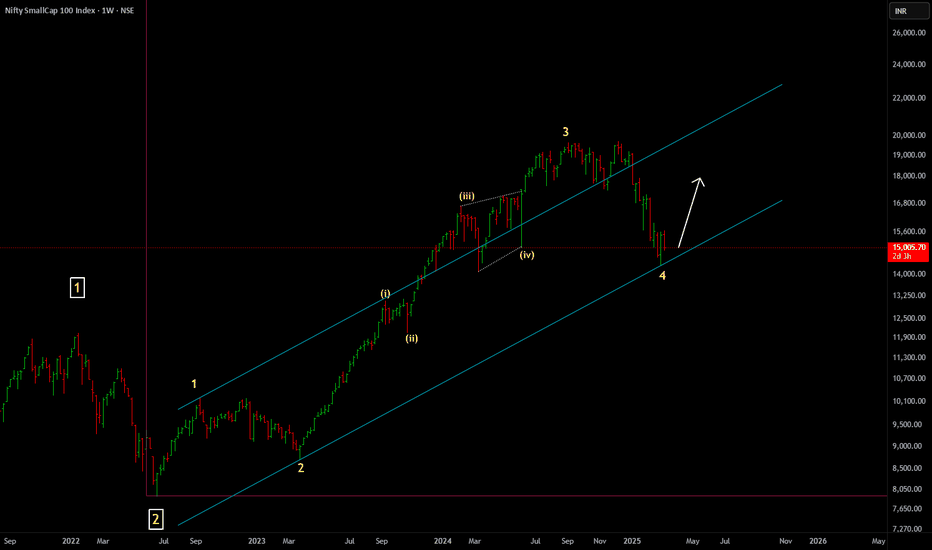

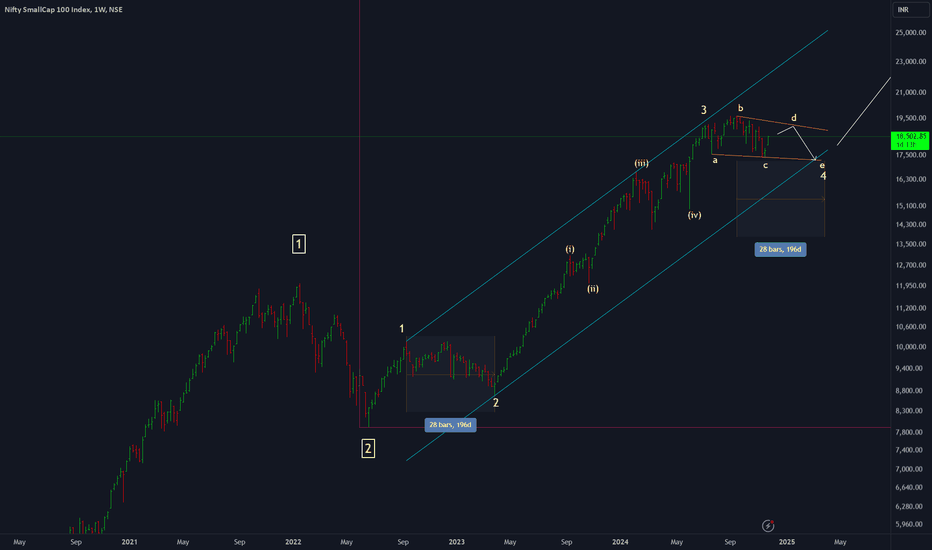

Nifty SmallCap 100 Elliot Wave ViewWave 2 of 3: This corrective wave occurred between September 2022 and March 2023, lasting approximately 28 weeks, as highlighted in the chart.

Wave 4's Progression: The recent peak in September suggests symmetry in the cycle, mirroring Wave 2's timeline. If Wave 4 matches Wave 2 in duration (aroun

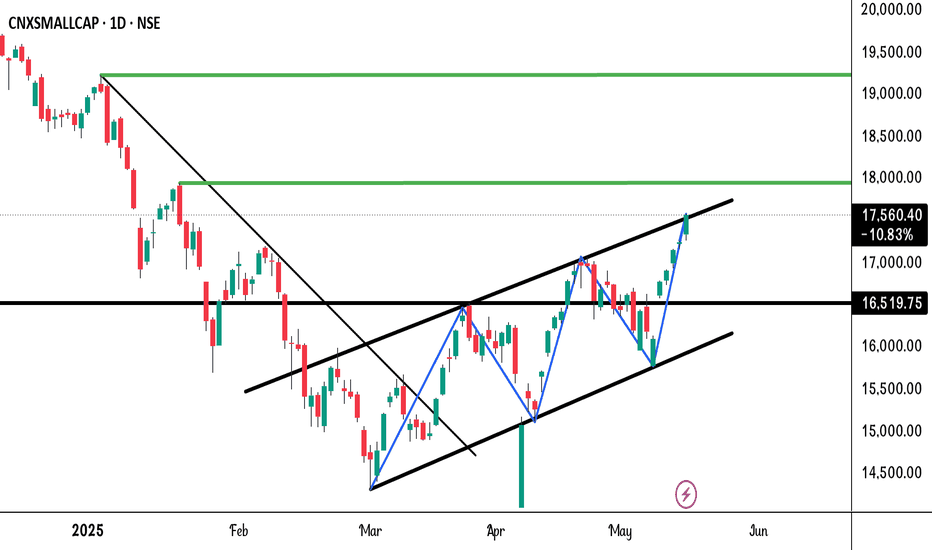

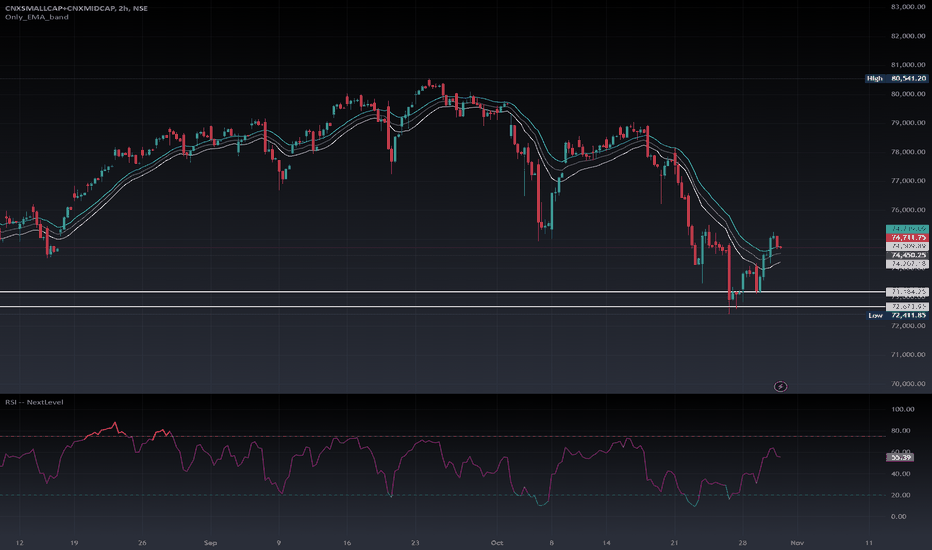

Mid/Smallcap || Recovery As Expected, What now? The Midcap and Small Cap Index have shown signs of recovery as anticipated in my previous analysis. The index is now trading above the 20 EMA Band in the 2-hour timeframe (TF). However, several key conditions must still be met before we can confirm a sustained bull run:

1. 2-hour RSI should cross a

See all ideas

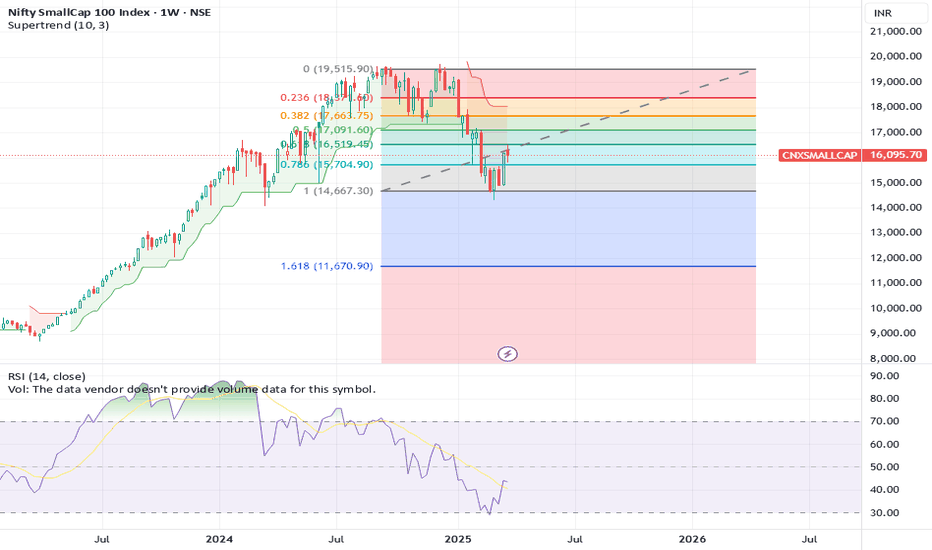

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.