HINDZINC trade ideas

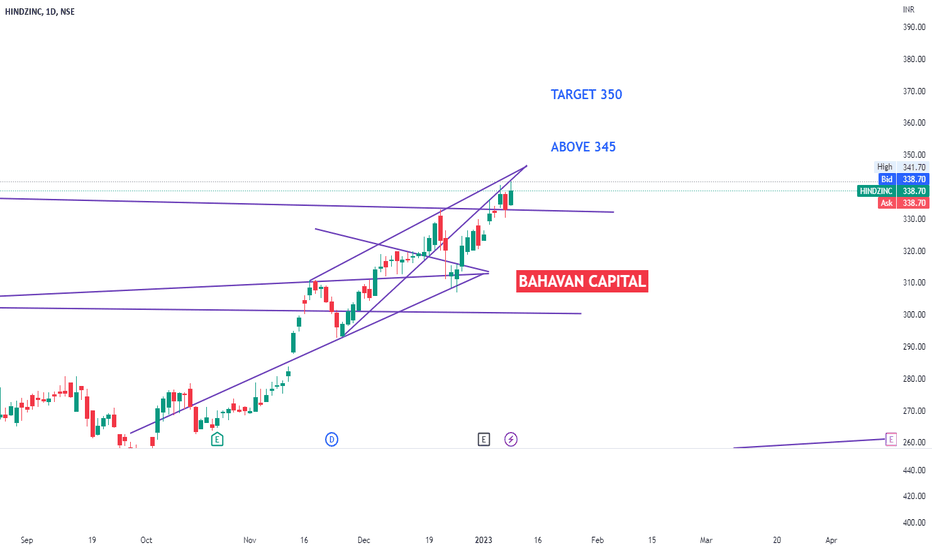

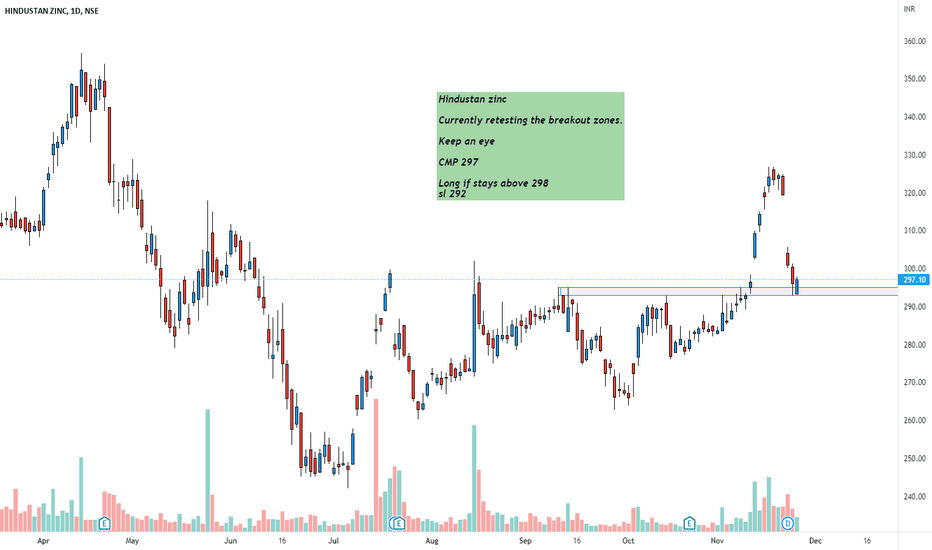

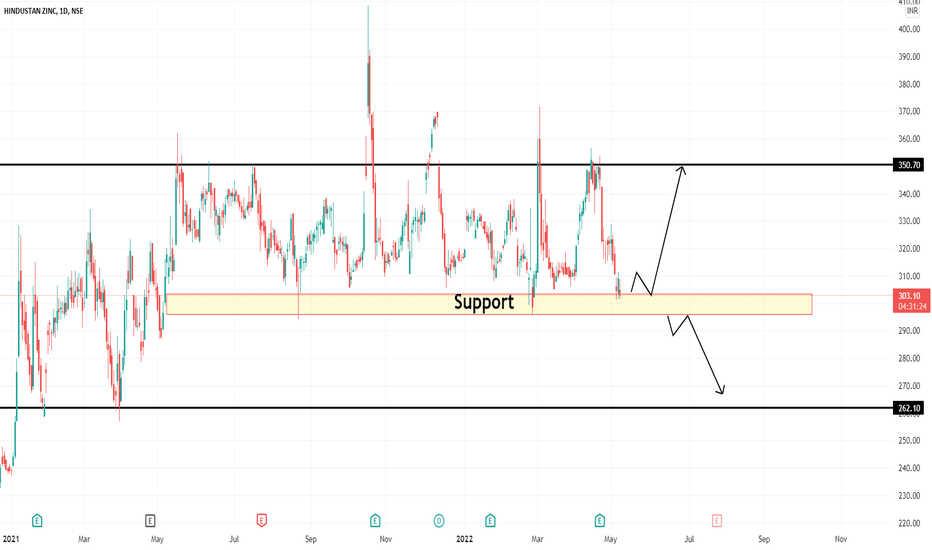

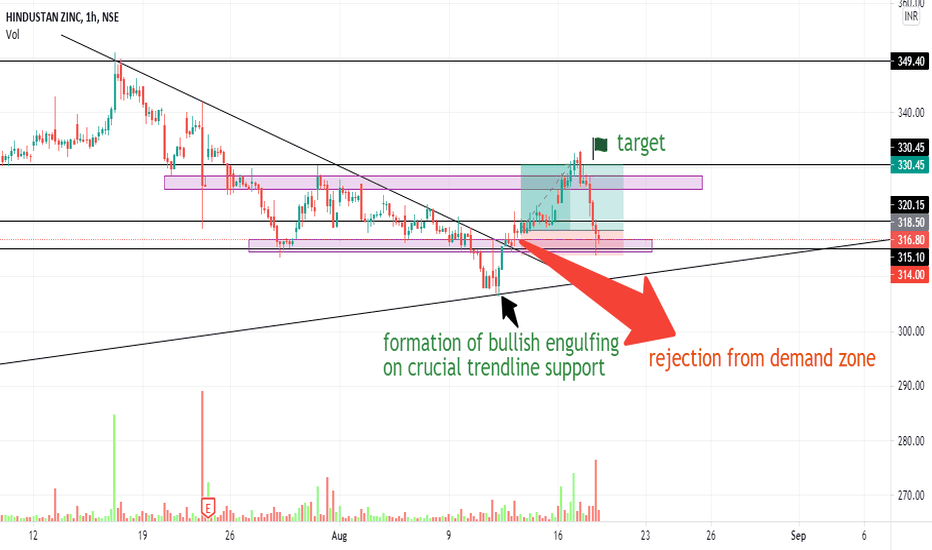

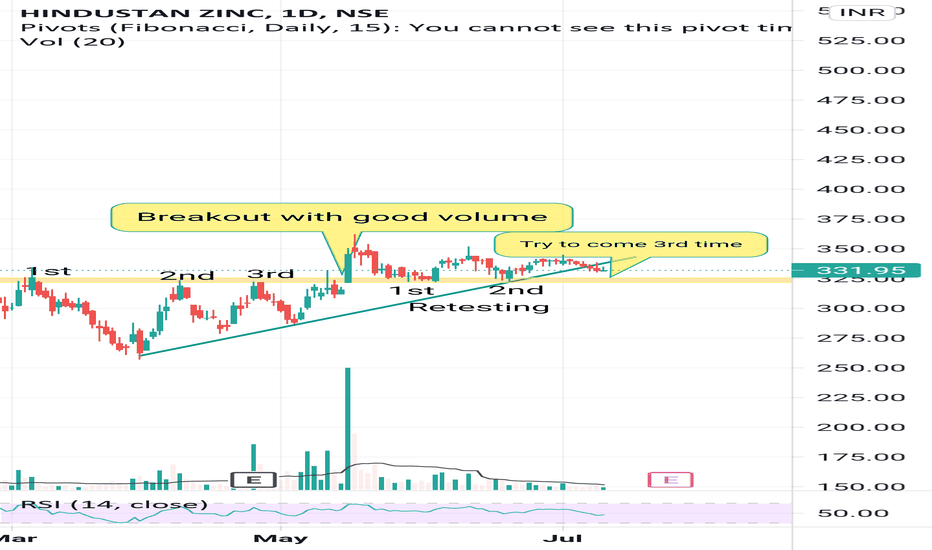

HINDUSTAN ZINC - DAY CHART - 09.01.2023 - BAHAVAN CAPITALHINDUSTAN ZINC as per Day Chart Analysis Stock

ABOVE 345 TARGET 350

Today FII Net selling had come down considerably to 203.13 Cr and DII Net Buying increased to 1723.79 Cr.

Nifty Once Breaks the resistance at 18169 then the target is 18240 level.

Bank Nifty Once Breaks the resistance at 42716 then the target is 42932 level

Tomorrow Market trend to be on the positive side..

Happy Profitable Trading to all...

Hind zinc Company has reduced debt.

Company is almost debt free.

Stock is providing a good dividend yield of 11.3%.

Company is expected to give good quarter

Company has been maintaining a healthy dividend payout of 98.1%

negative :

The company has delivered a poor sales growth of 11.2% over past five years.

Promoters have pledged 86.0% of their holding

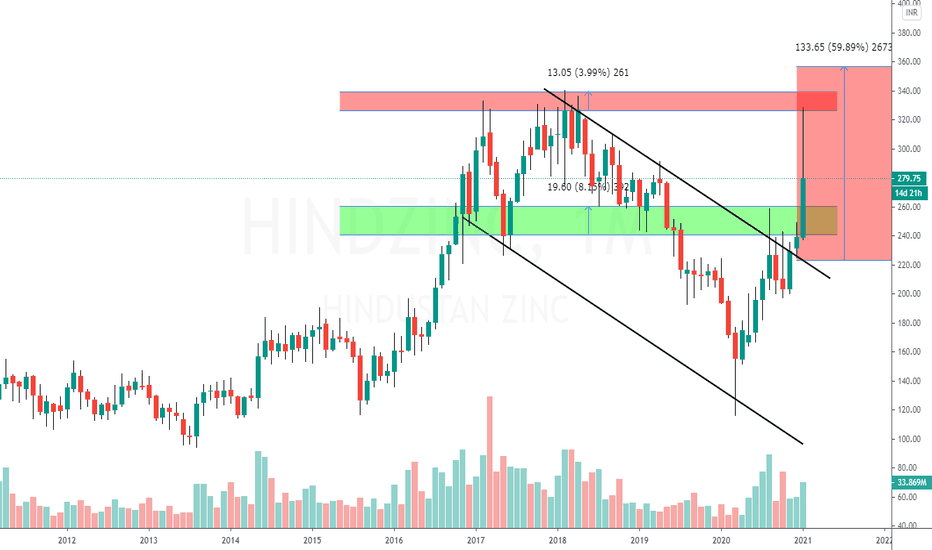

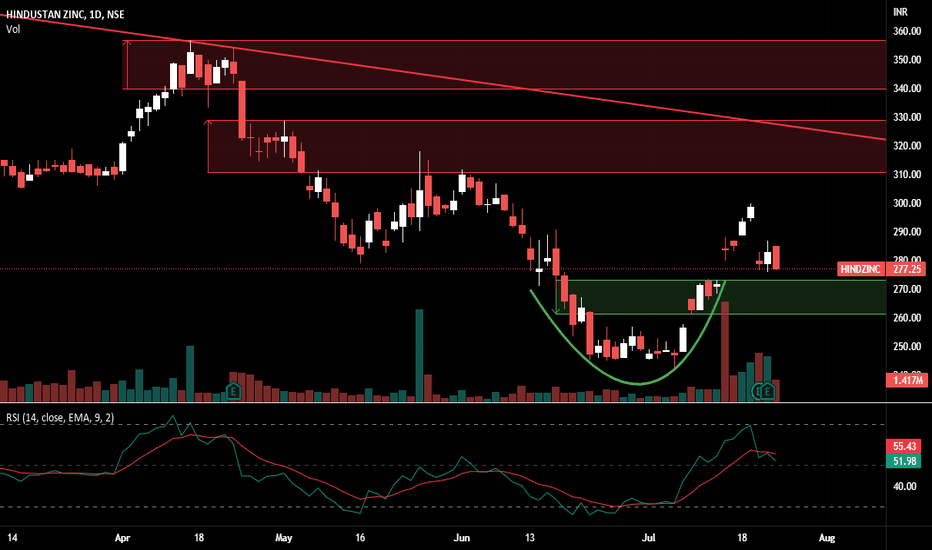

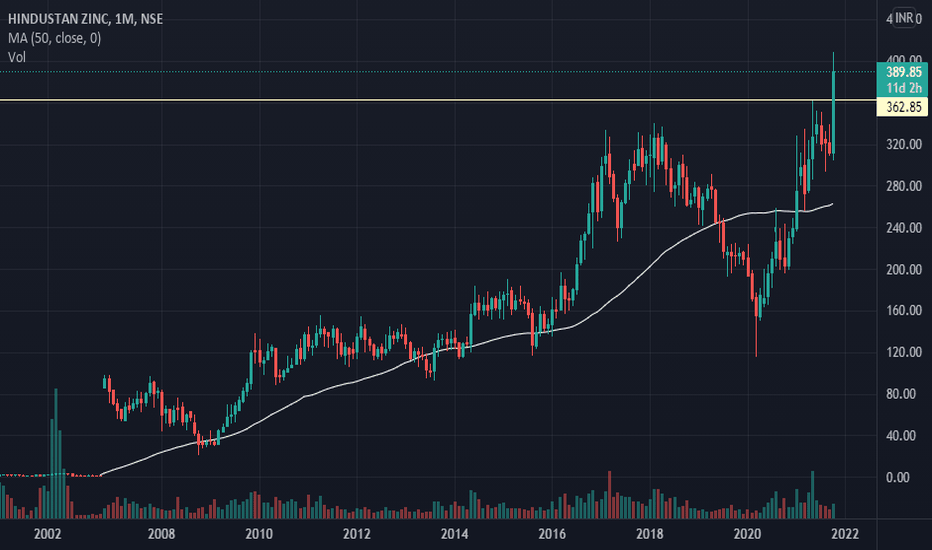

Rounding Bottom pattern activatedHindzinc daily chart is being seen as rounding bottom pattern with volumes activities and

It is also fundamentally attractive valuation available with strong balance sheet. Quarterly results were also very strong posted by company.

Stop Loss : 255

Target : 307, 325, 385

Time Frame : 1 year

Investment as per your risk profile..

Risk is yours and Reward is too yours totally.

#hindzinc #vedl #hindcopper #coalindia #xauusd #xagusd #steel #HINDZINC

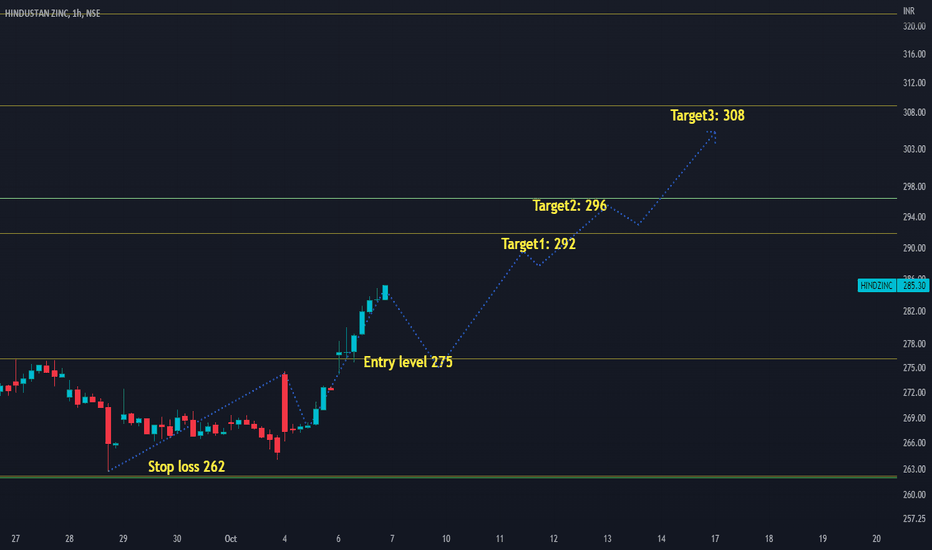

NSE:HINDZINC

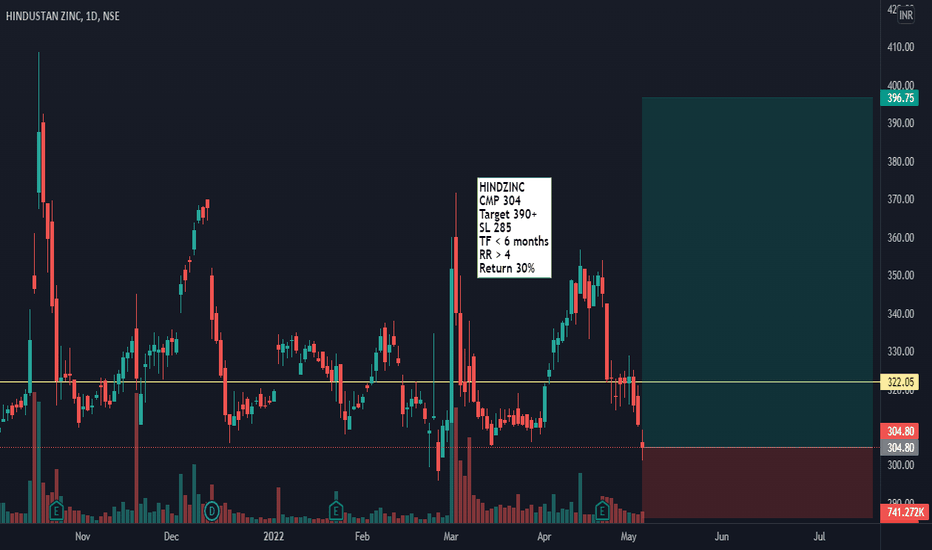

NSE:HINDZINC

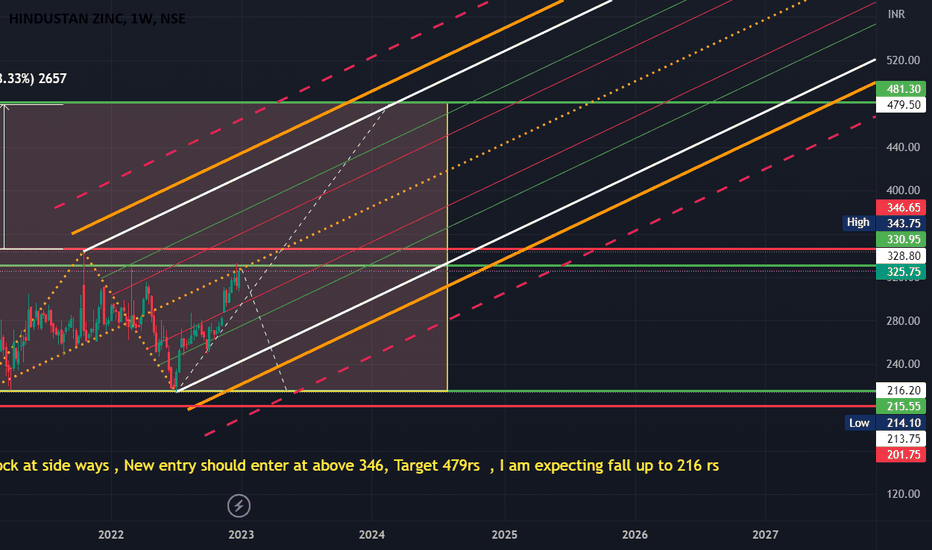

HINDZINC

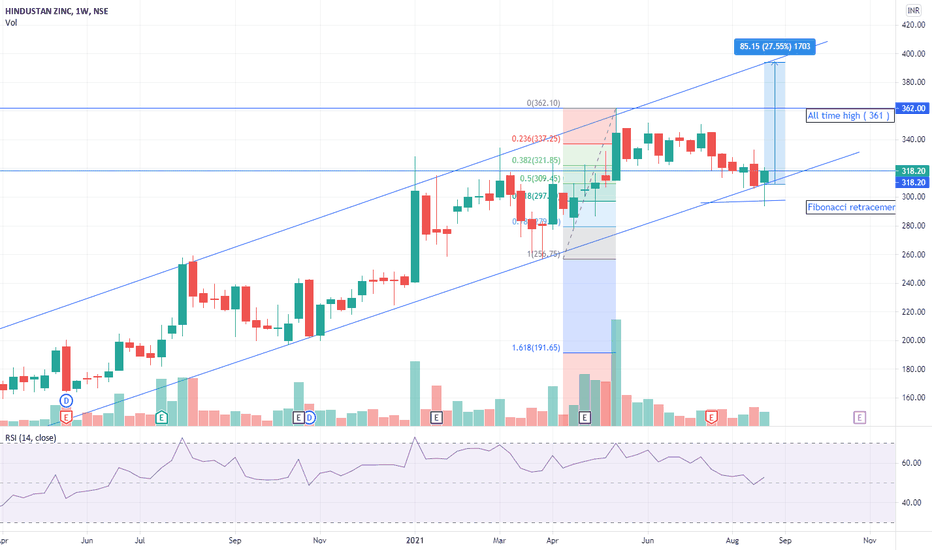

CMP 304

Target 390+

SL 285

TF < 6 months

RR > 4

Return 30%

Factors:

BULLISH WEDGE BREAKOUT

Trend Following

Rising Volume with rising Prices.

Flag pattern breakout.

Pennant Pattern Breakout with Bullish Candle.

Retest Successful.

Higher Highs & Higher Lows.

Broken above RESISTANCE levels

Trading at SUPPORT levels

Earnings are strong.

Bullish Wedge Breakout

Risk Return Ratio is healthy.

And

Rising from Double Bottom Pattern to Flag Pattern forming.

If you like my work KINDLY LIKE SHARE & FOLLOW this page for free Stock Recommendations.

With 💚 from Rachit Sethia

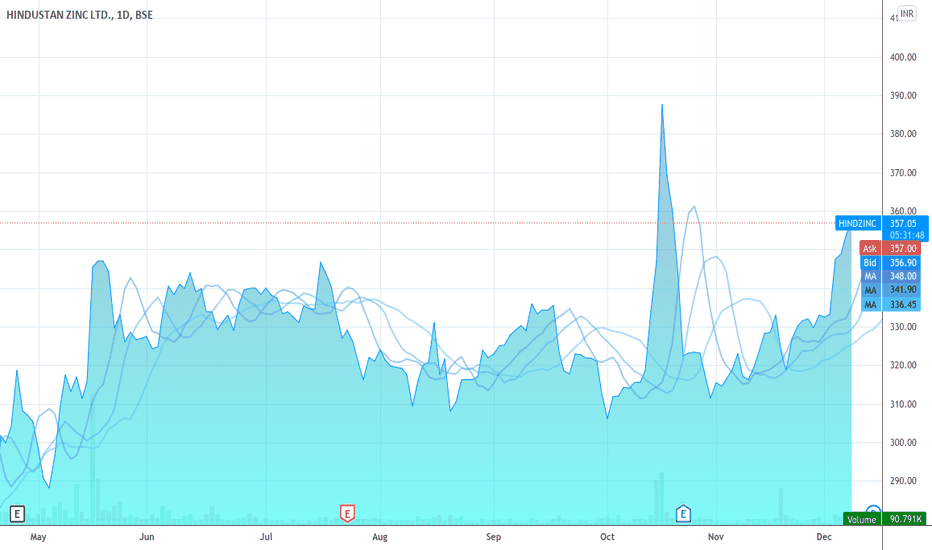

Hindustan ZincSun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

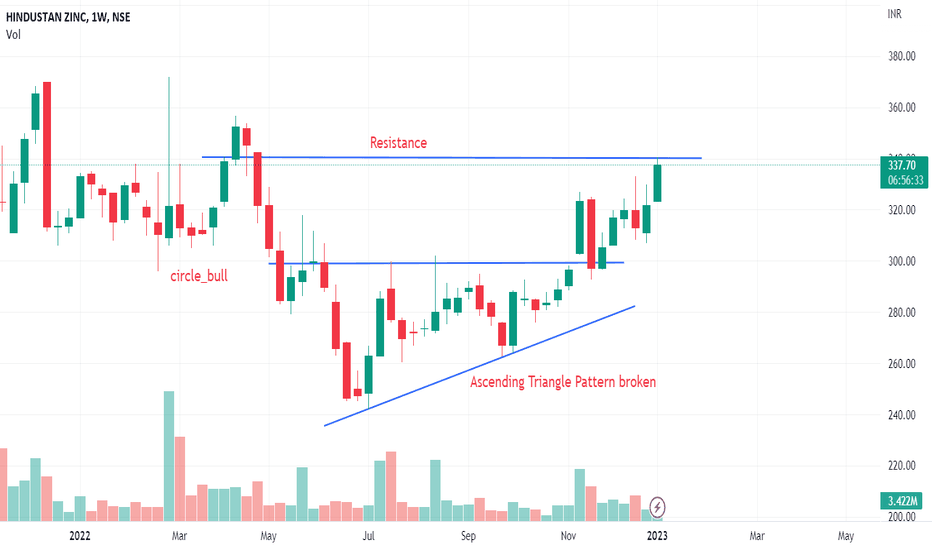

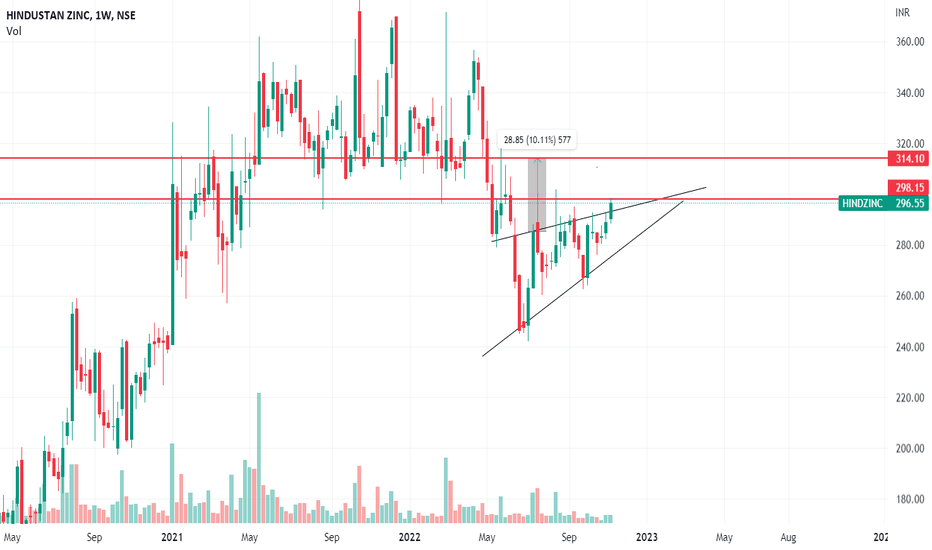

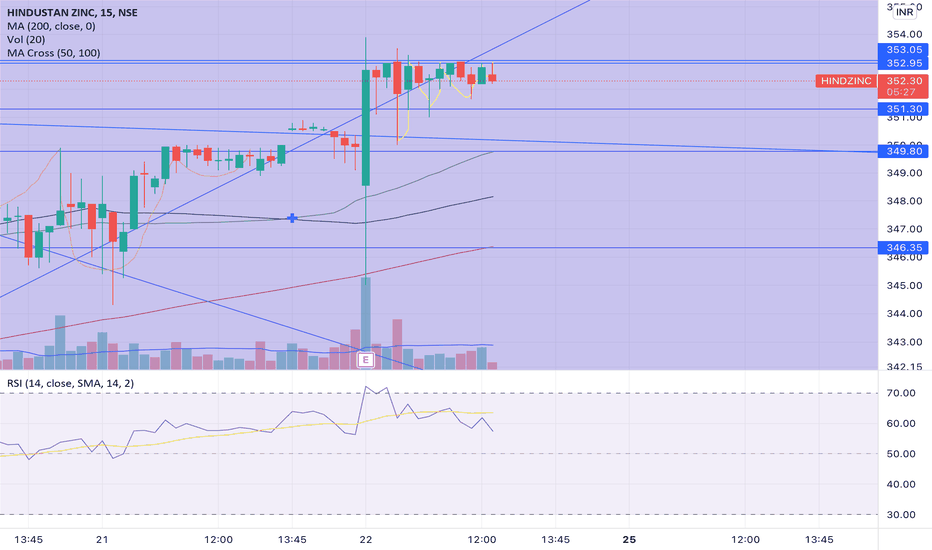

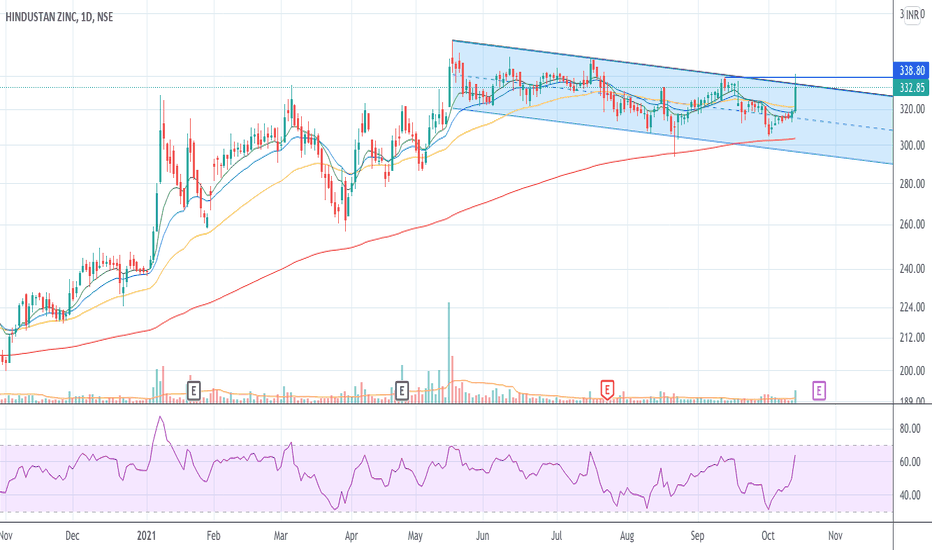

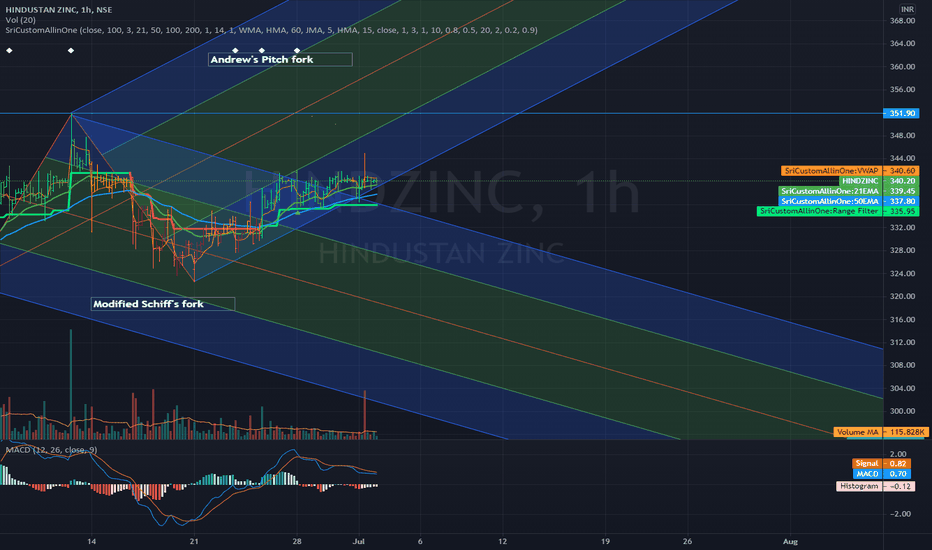

Hindustan Zinc - Channel BreakoutSharp move in Zinc futures..The price of the stock is quite coorelated to the Metal.

Expect the stock to most likely to follow thru tomorrow. If it does it breaks a downward channel the stock has been in.

Long above 339 with a tight SL of 330.

First target 351 followed by 363.