ICRA📌 Trade Setup Summary

Parameter Value

Trade Type Positional BUY

Entry ₹6,570

Stop Loss ₹6,051

Risk ₹519

Target ₹10,455

Reward ₹3,885

Risk:Reward 7.5x

Last High ₹7,735

Last Low ₹5,015

✅ Why This Trade Works

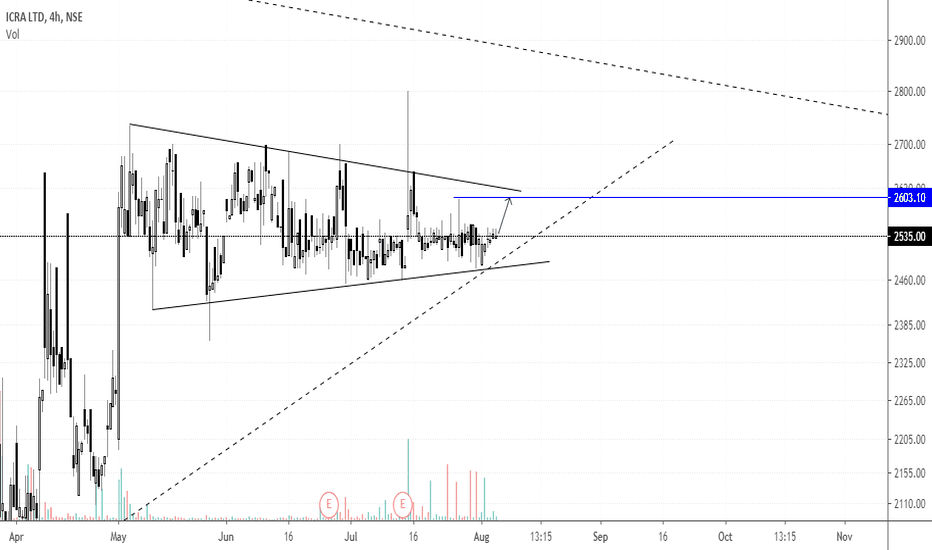

🔹 Strong Multi-Timeframe Confluence: Entry lies in Weekly + Daily demand zone.

🔹 Fresh Institutional Demand at ₹6,051–₹6,570 (aligned across MTF and ITF).

🔹 Quarterly Breakout aligns with prior HTF zone, confirming momentum.

🔹 Aggressive R:R Ratio of 7.5x makes this a high reward trade with limited risk.

🔹 Breakout Retest Structure: Price action suggests demand revisit post breakout – ideal accumulation zone.

⚙️ Execution Plan

Entry Trigger: Between ₹6,520–₹6,570 with volume confirmation.

SL Below: ₹6,050 (just under daily/weekly demand zone).

Initial Target: ₹7,735 (Previous High).

Final Target: ₹10,455 (Extension projection).

SL Trailing: Start trailing post ₹7,400 for capital protection.

🚨 Risk Control & Entry Filter

Avoid entering on a gap-up candle >2%.

Watch for tight consolidation between ₹6,450–₹6,570.

Exit immediately if price breaks and sustains below ₹6,000 on high volume.

🏁 Conclusion

ICRA offers a premium high-conviction long opportunity with trend confirmation across all major timeframes, a low-risk entry near MTF + ITF demand clusters, and a clean 7.5:1 risk-reward setup. Excellent for swing/positional traders eyeing structured, institutional-grade setups.

🔷 ICRA – Multi-Timeframe Demand-Based Trade Plan (Refined)

🔹 Market Structure & Technical Alignment

Timeframe Trend Zone Type Demand Zone (₹) Avg Price

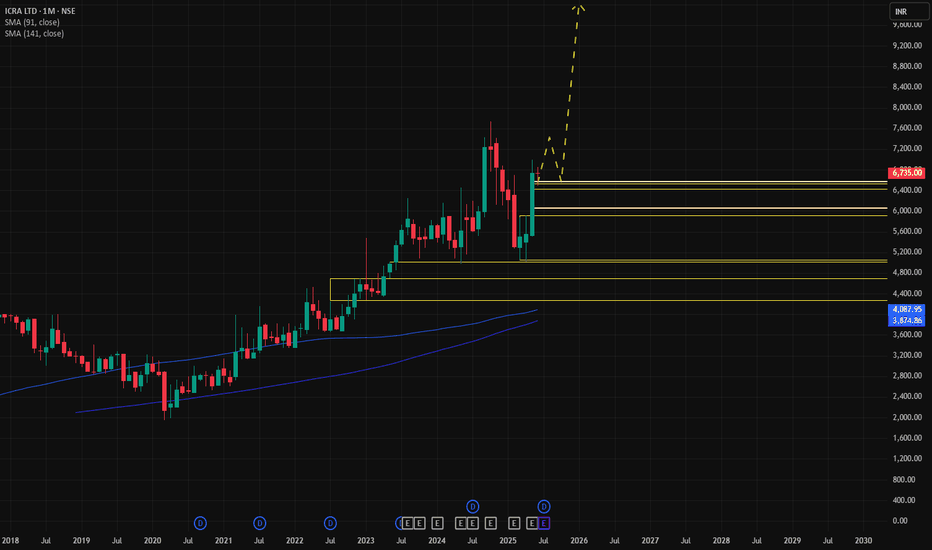

Yearly UP BUFL + Breakout 4699 – 4275 4487

Half-Yearly UP BUFL + Breakout 4699 – 4275 4487

Quarterly UP BUFL + Breakout 6450 – 4983 5717

HTF Avg UP — 5283 – 4511 4897

| Monthly | UP | BUFL | 5909 – 5015 | 5462 |

| Weekly | UP | BUFL & Swap | 6570 – 6051 | 6311 |

| Daily | UP | BUFL / DMIP | 6570 – 6051 | 6311 |

| MTF Avg | UP | — | 6350 – 5706 | 6028 |

| 60M/180M/240M | UP | DMIP | 6570 – 6426 | 6498 |

ICRA trade ideas

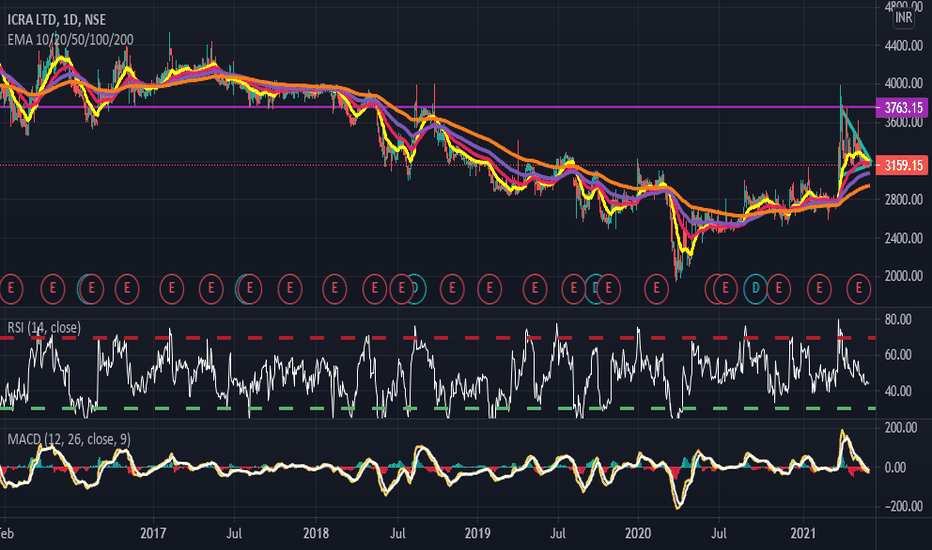

Positional Trade Strategy for ICRA Ltd:

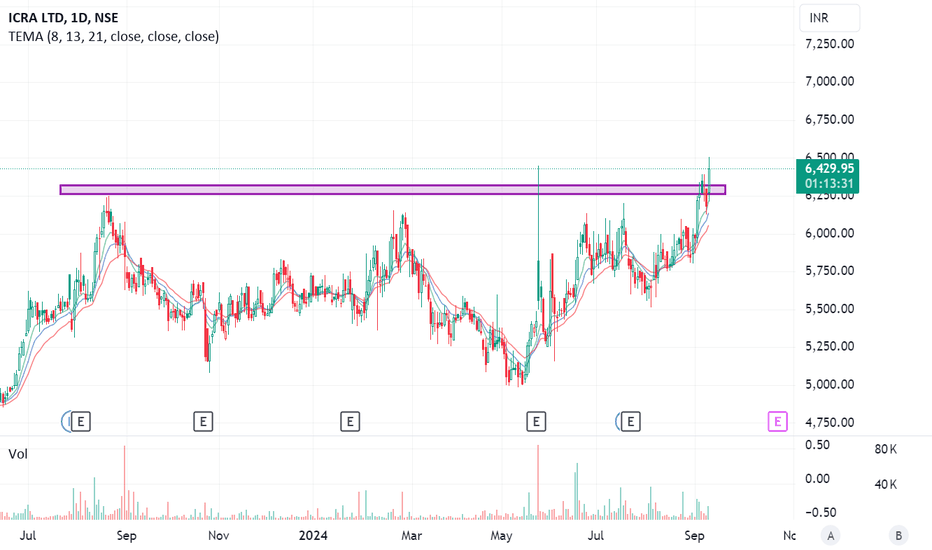

Entry Point: Enter the trade around the current price level of 6,446 INR or on a slight pullback towards the breakout level near 6,400 INR.

Stop Loss: Set a stop loss below the breakout zone to manage risk in case of a false breakout. A suitable stop loss could be around 6,200 INR, considering the previous support level just below the breakout point.

Target Price:

First Target: 6,800 INR - This is a conservative target based on the breakout strength and the stock's previous price action.

Second Target: 7,000 INR - A more aggressive target, taking into account the stock's potential to continue the uptrend with momentum from the breakout.

Time Horizon: Since this is a positional trade, the holding period could range from a few weeks to a couple of months, depending on how the price action develops.

Volume Confirmation: The breakout has occurred with decent volume, which is a positive sign. Continue to monitor volume levels; rising volumes on upward moves would confirm the breakout strength.

Risk Management: Use an appropriate position size based on your risk tolerance, considering the defined stop loss level.

Additional Considerations:

Keep an eye on broader market conditions and any specific news related to ICRA Ltd, as these can impact the stock's performance.

Watch for any retests of the breakout level, which can offer additional entry points if the breakout holds.

This strategy is based on the technical analysis of the breakout pattern shown in the chart. Adjustments should be made according to your risk management and investment objectives.

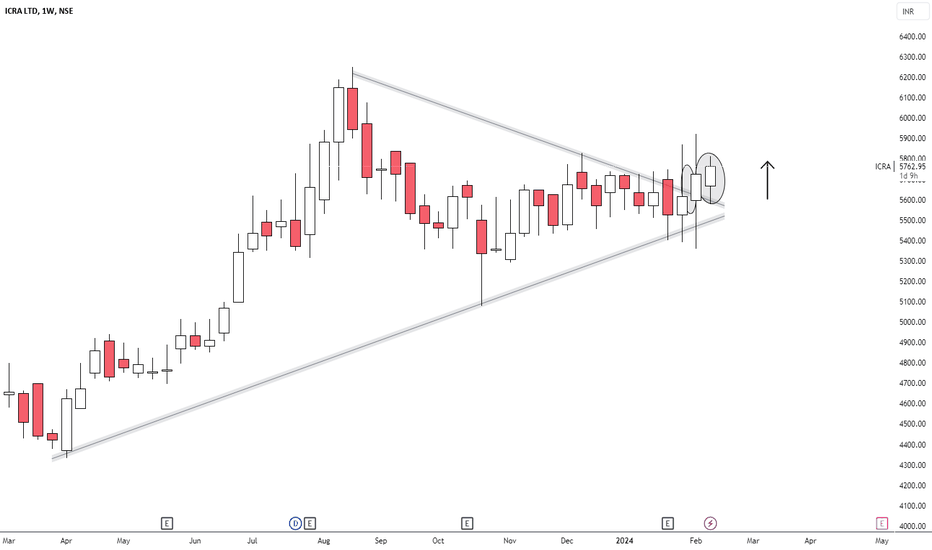

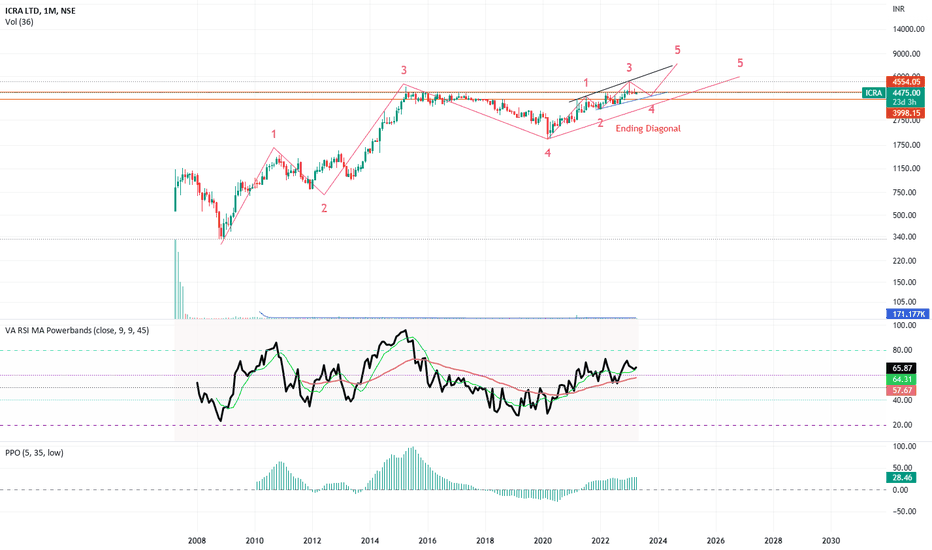

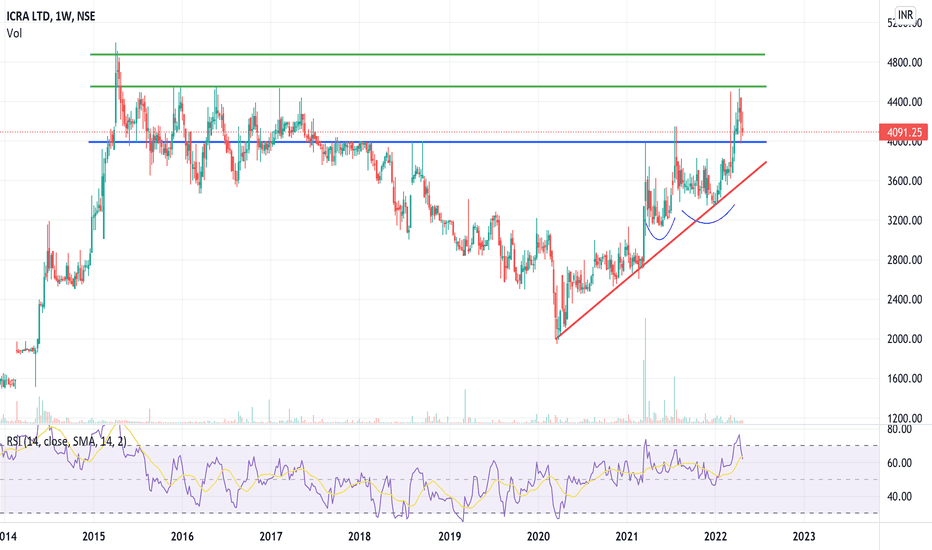

ICRA - bullish tradeStock is in uptrend, making higher highs and higher lows continuously.

Stock is making series of rounding bottom patterns and trading in an upward trend line.

Stock tried to crack its 2018 highs and retraced with market correction. Now stock is available at attractive buying price.

One can go long at CMP and accumulate on dips. Stock’s current technical patterns have potential to show targets of 4500, 4800+ and eventually make a new life time high.

A weekly closing below upward trend line can be used as a stop loss.