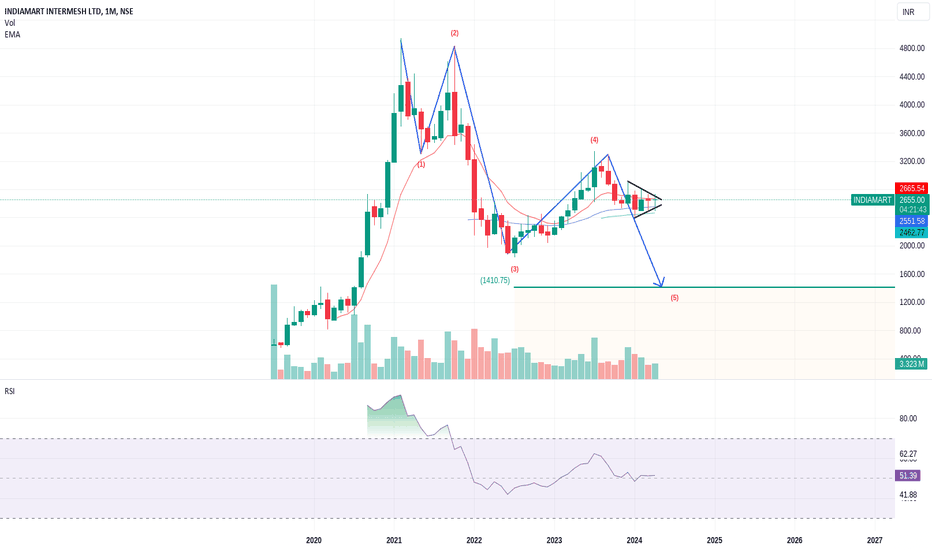

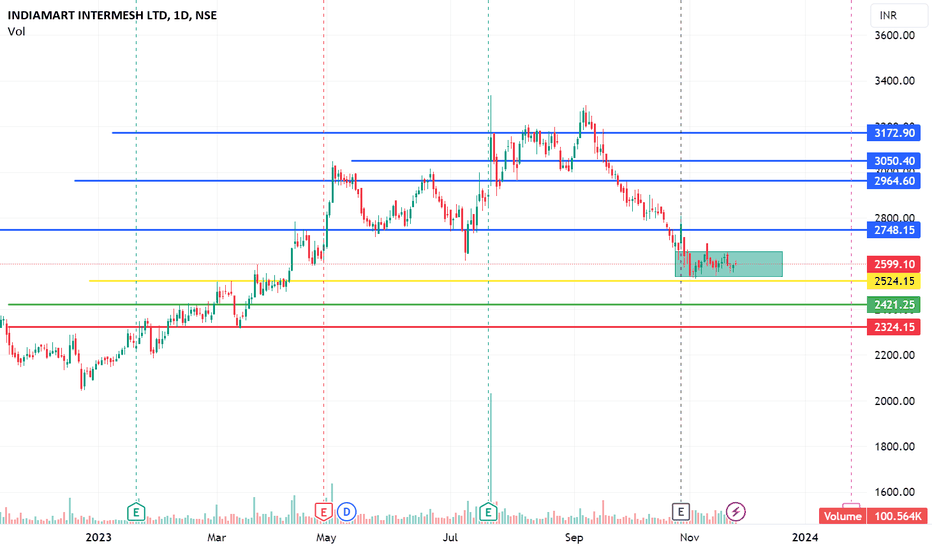

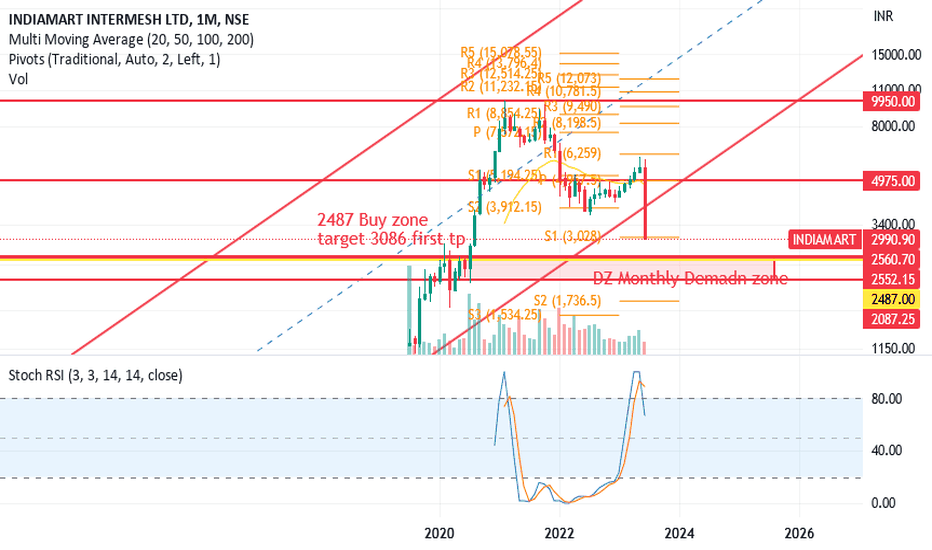

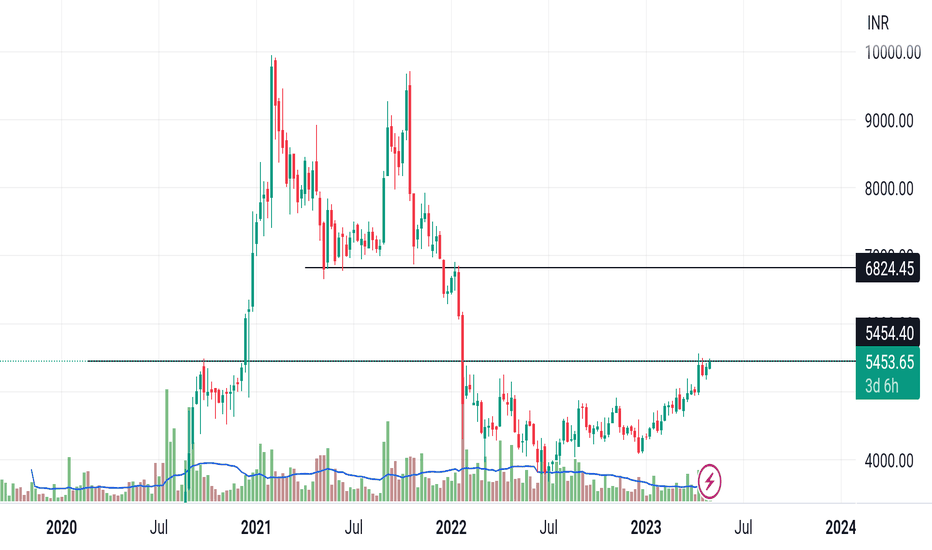

INDIAMART for another 46% DOWN movement Based on the observed four-wave pattern within the monthly timeframe, there's a distinct possibility for a continuation towards a fifth wave, indicated by prevailing market signals. Consequently, a prudent strategy would involve considering short positions subsequent to a breakout in price action. It's advisable to manage such positions by trailing stops in alignment with downward movements, thereby optimizing risk management within the trade.

INDIAMART trade ideas

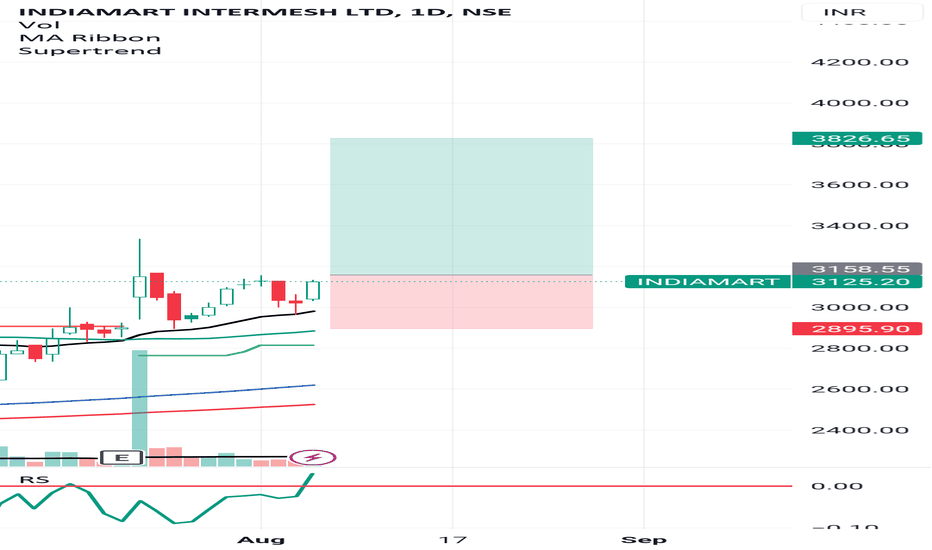

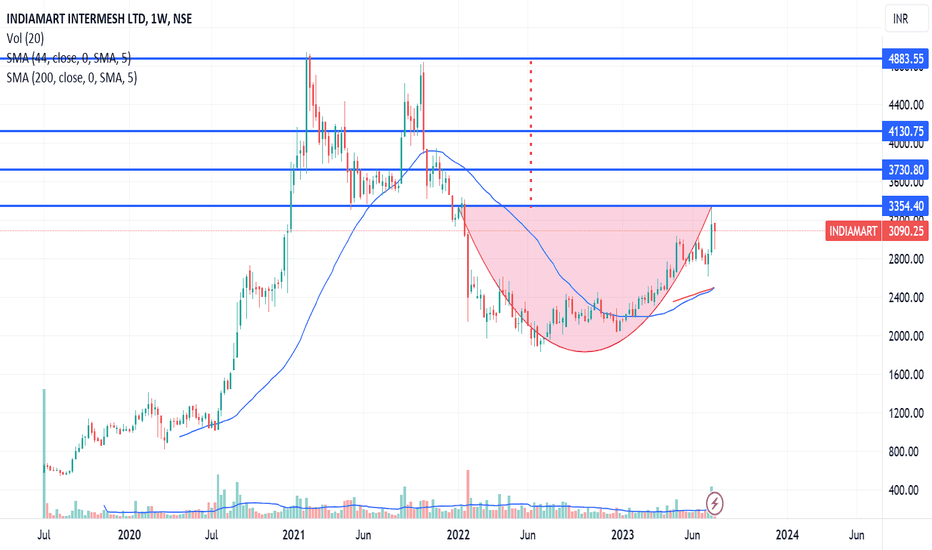

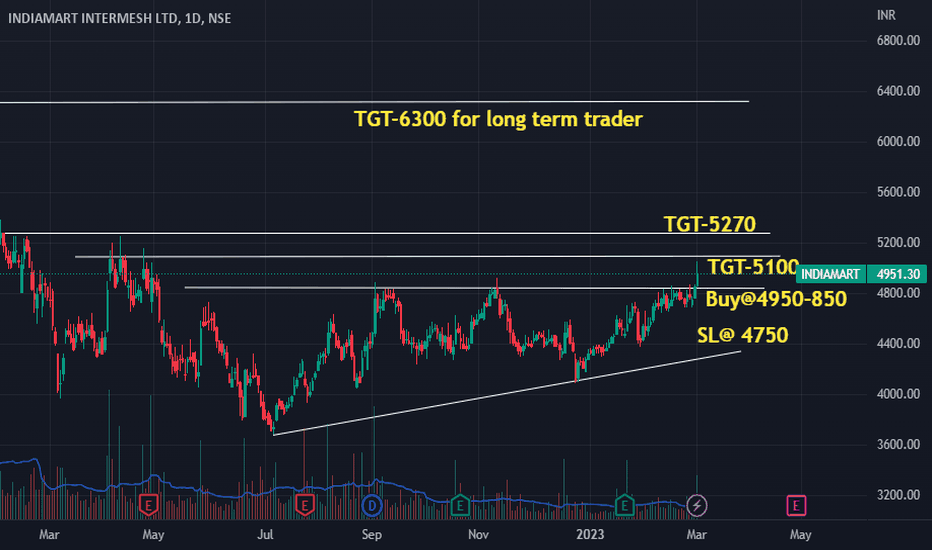

Indiamart After a downmove price structure bullish now.

Price above of all moving averages cluster.

Big bull candle on chart & good volume.

RSI indicate Bullish

MACD BULLISH CROSSOVER

Chart setup is favour of long position.

Disclaimer This is my personal view for education purpose only

No Buy sell recommendations.

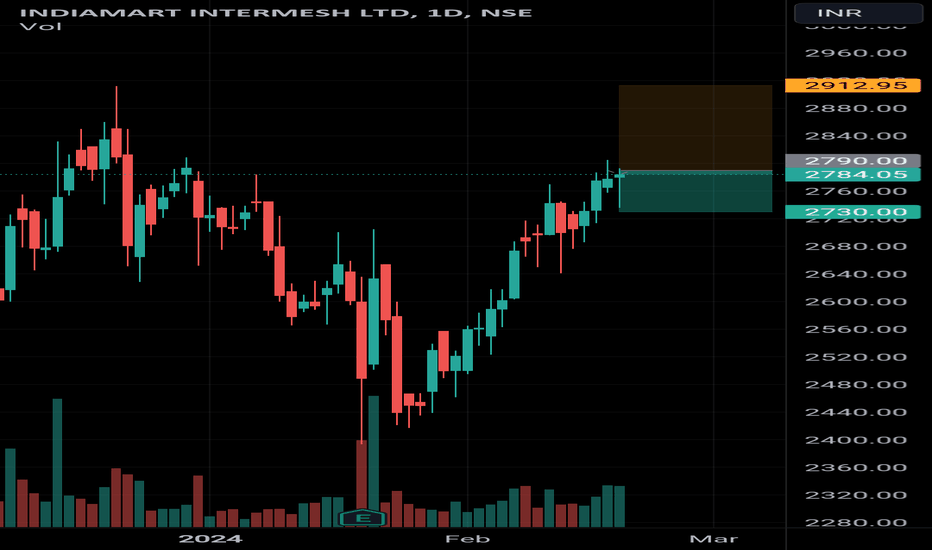

INDIAMART READY FOR A BREAK OUT India mart ready for a break out after long time can give a good positional trade or Swing trade with good targets

ENTRY - 2790

STOPLOSS - 2730

TARGET - 2900, 3000++

Note- if any trade or value that's gone from the marked levels then that's not our trade just let it go or wait for it to come back

I'm not sebi registered this is my personal view

Please like or boost my idea of you like it or traded it.. thankyou

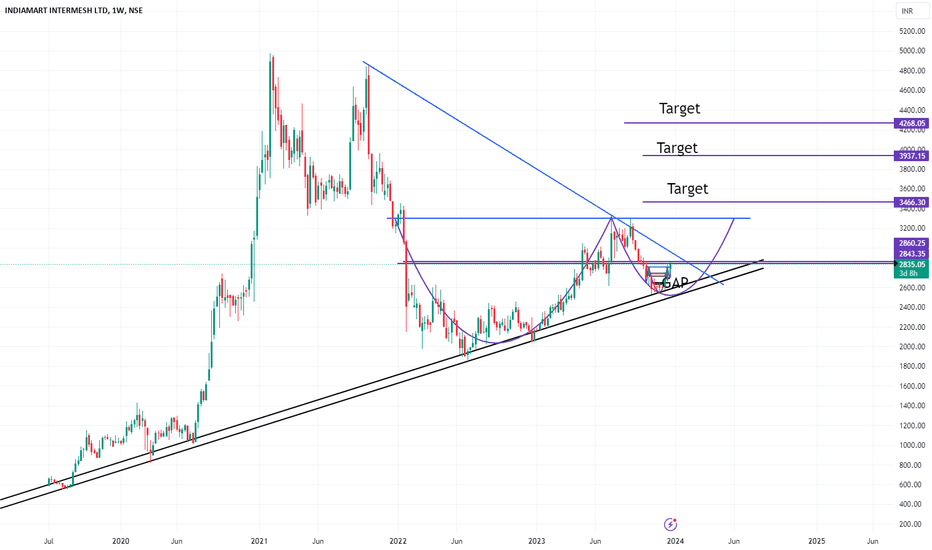

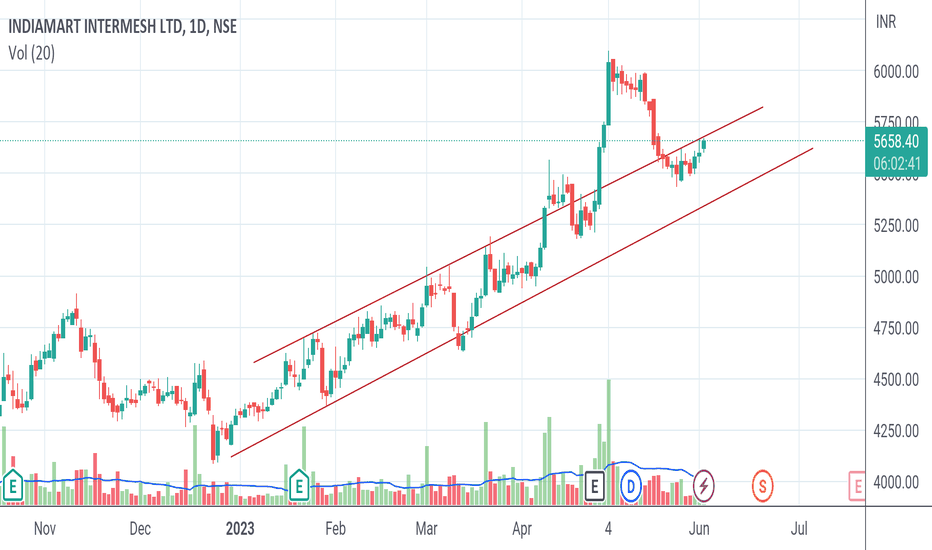

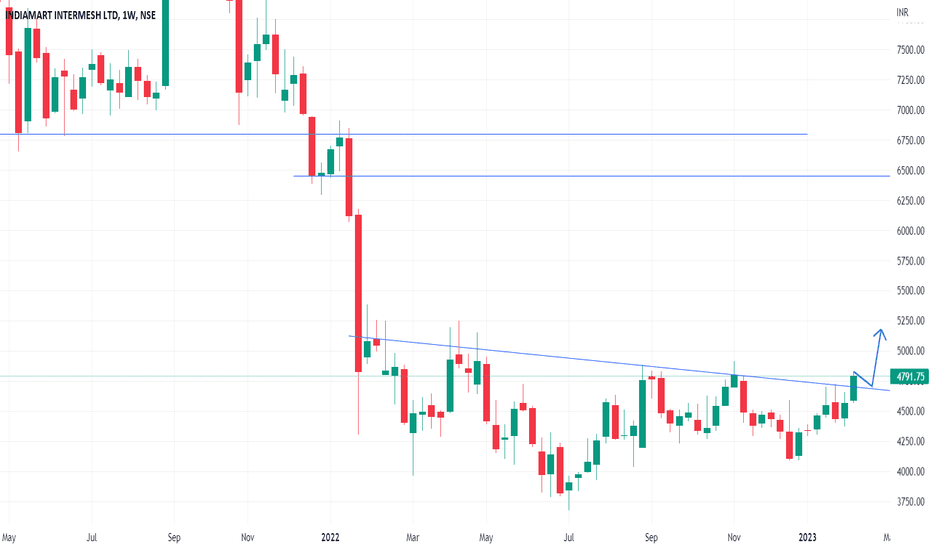

India Mart Bottom BuyHello All,

I am glad you have liked my post and I am sure everyone who have traded on these post would have made profits.

If you like my Idea, Don't forget to Boost and comment on my Analysis.. The recommendations are purely for educational purpose only, consult you financial advisor before trading.

Gautam Khanna

Technical Analyst by Passion :-)

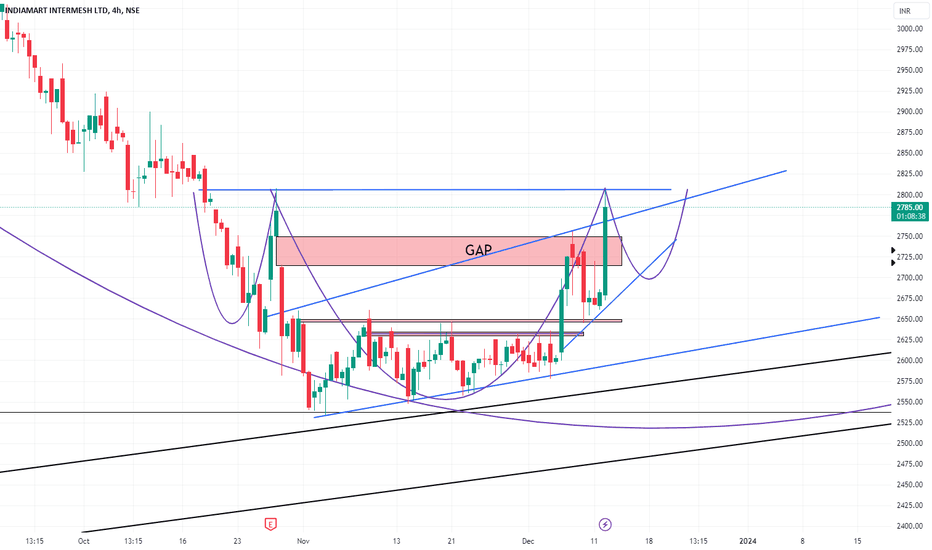

India Mart - what a trade it was todayHello All, I traded in India mart today and made good profit ..

Now waiting to enter it again.

Hello All,

I am glad you have liked my post and I am sure everyone who have traded on these post would have made profits.

If you like my Idea, Don't forget to Boost and comment on my Analysis.. The recommendations are purely for educational purpose only, consult you financial advisor before trading.

Gautam Khanna

Technical Analyst by Passion :-)

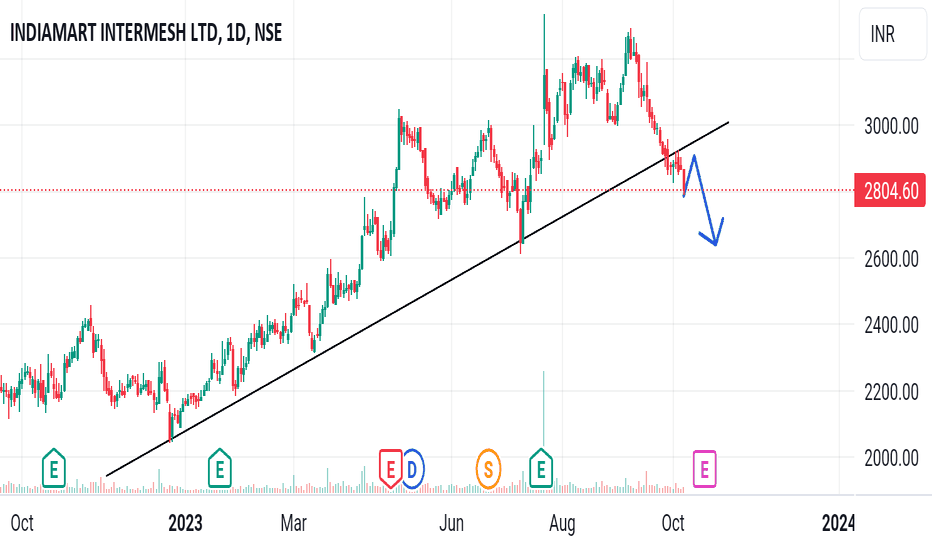

IndiamartCMP: 2804.60

1. Trendline breakout and retest

2. Big bar candle

If stock price trendline candle day closing And retest than see bearish movement !

These are swing idea's which you can add your watchlist and analysis for yourself.

Keep on radar.

This content for only education purpose!

I am not SEBI Register.

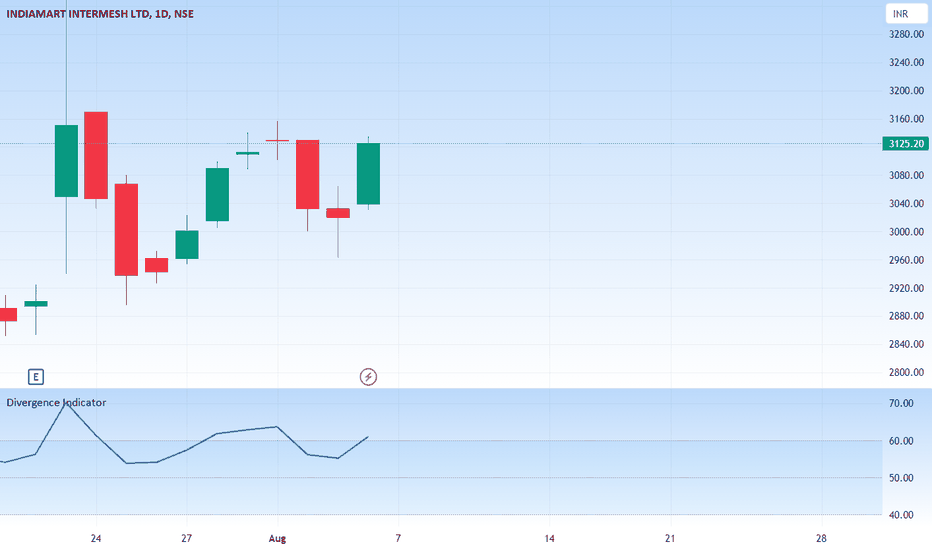

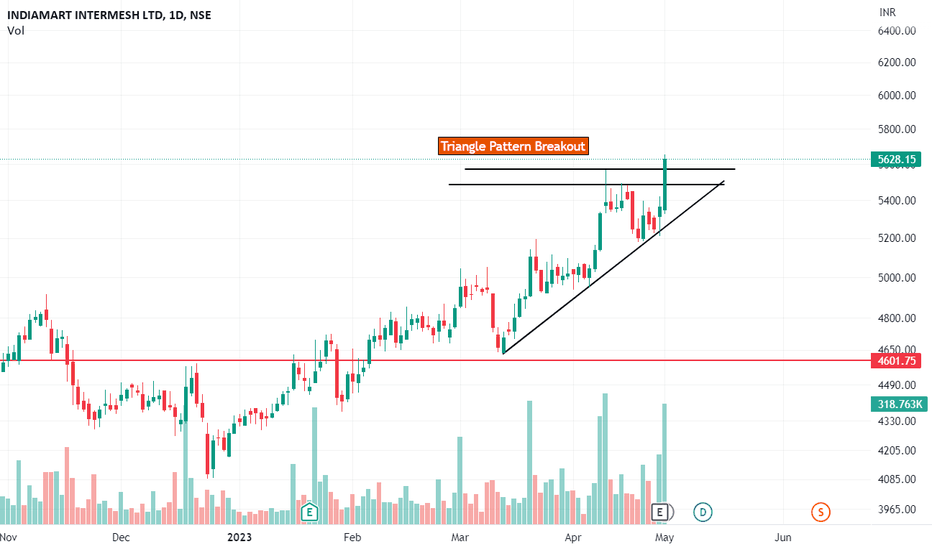

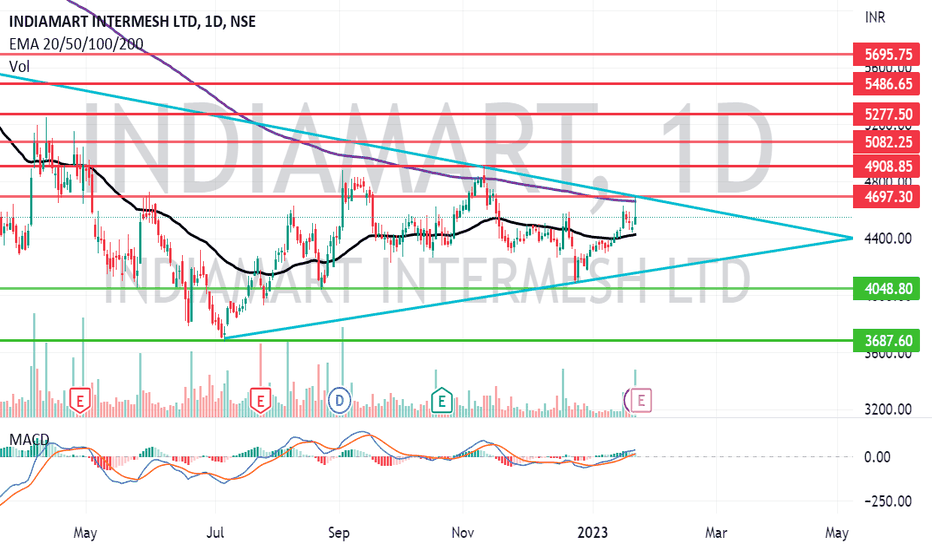

Triangle pattern BreakoutPlease look into the chart for a detailed understanding.

Consider these for short-term & swing trades with 2% profit.

For BTST trades consider booking

target for 1% - 2%

For long-term trades look out for resistance drawn above closing.

Please consider these ideas for educational purpose

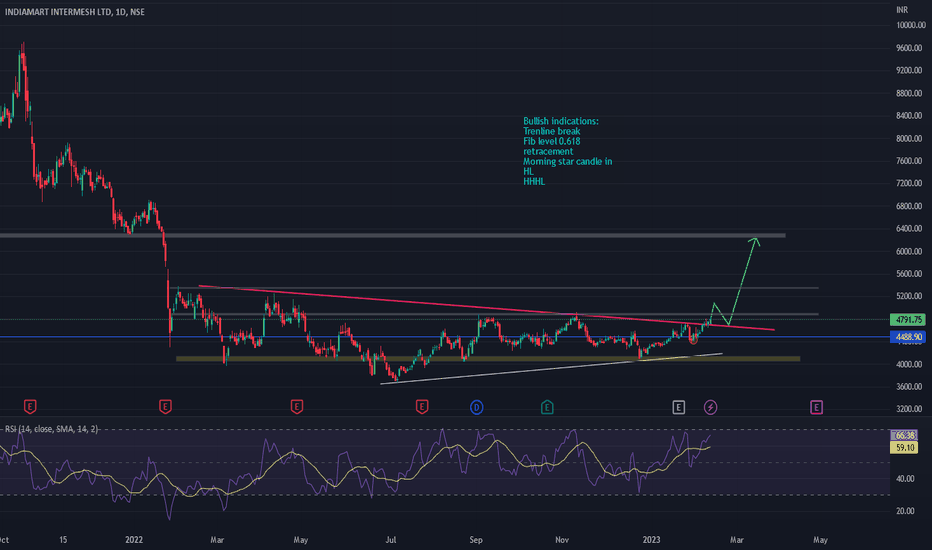

Indiamart may get a start soon...IndiaMart Intermesh is an India e-commerce company that provides B2B and customer to customer sales service via its web portal. IndiaMart intermesh is an India’s largest online B2B market place, connecting buyers with supplies. CMP – 4549.60. Negatives of the company are high valuation (P.E. = 48.8) and declining annual net profit. Positive of the company are MFs and FIIs are increasing stake. No debt, zero promoter pledge, improving cash from operating activity annual and improving book value per share. Entry in the stock can be taken after closing above 4698. The Long Term Target in the stock will be 4908 and 5082. In a very long run the stock can reach 5277 and 5400+. Stop Loss should be maintained at a closing below 4400. For Paper Trading.