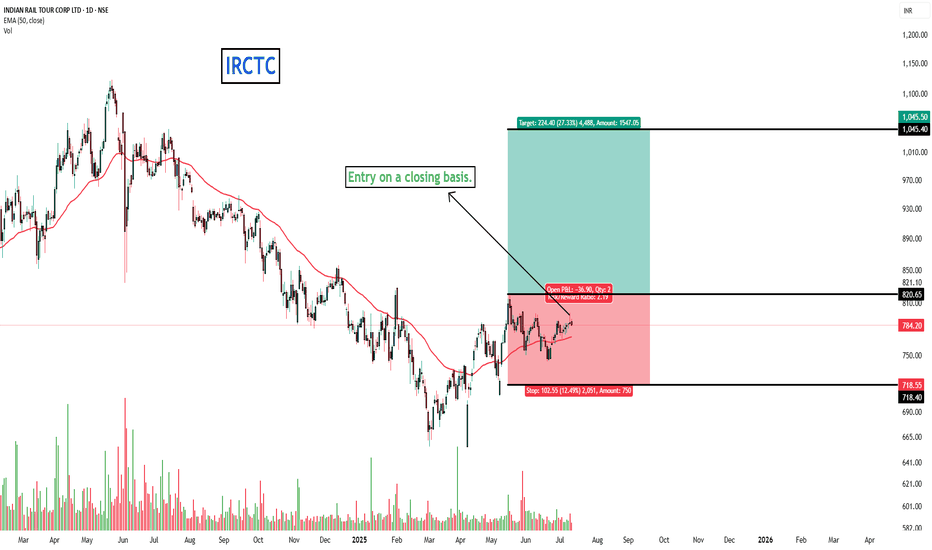

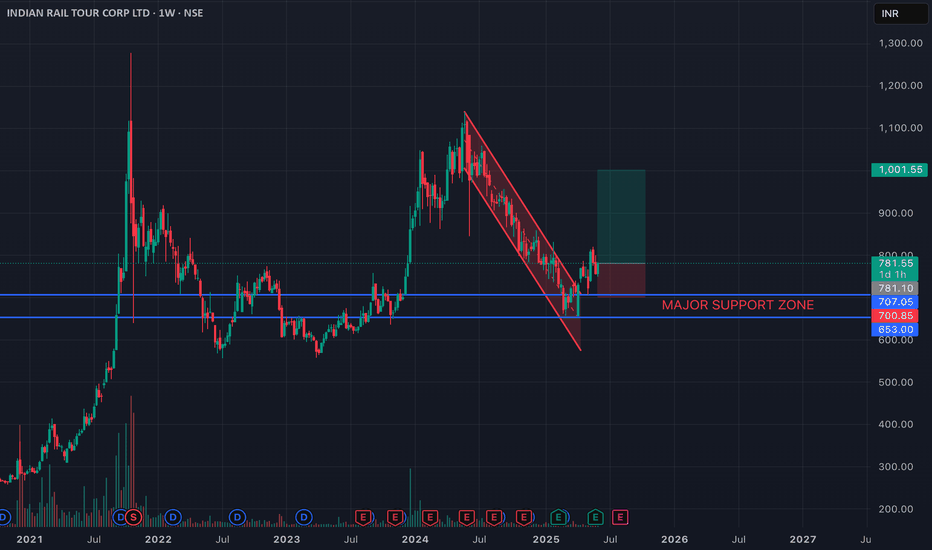

IRCTC - READY TO SWING WITH 1:2 RREverything is pretty much explained in the picture itself.

I am Abhishek Srivastava | SEBI-Certified Research and Equity Derivative Analyst from Delhi with 4+ years of experience.

I focus on simplifying equity markets through technical analysis. On Trading View, I share easy-to-understand insights

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

16.70 INR

13.15 B INR

46.75 B INR

300.83 M

About Indian Railway Catering & Tourism Corp. Ltd.

Sector

Industry

CEO

Sanjay Kumar Jain

Website

Headquarters

New Delhi

Founded

1999

ISIN

INE335Y01020

FIGI

BBG00GM75WS8

Indian Railway Catering & Tourism Corp. Ltd. provides railway related services. It engages in Catering and Hospitality, Internet Ticketing, Travel and Tourism and Rail Neer Plants business. It operates through the following business segments: Catering, Packaged Drinking Water, Internet Ticketing, and Travel and Tourism. The company was founded on September 27, 1999 and is headquartered in New Delhi, India.

Related stocks

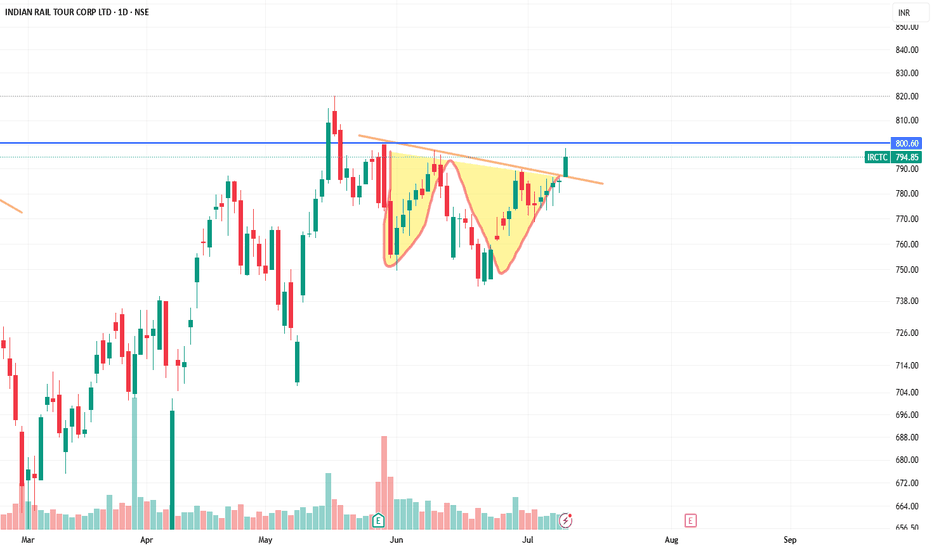

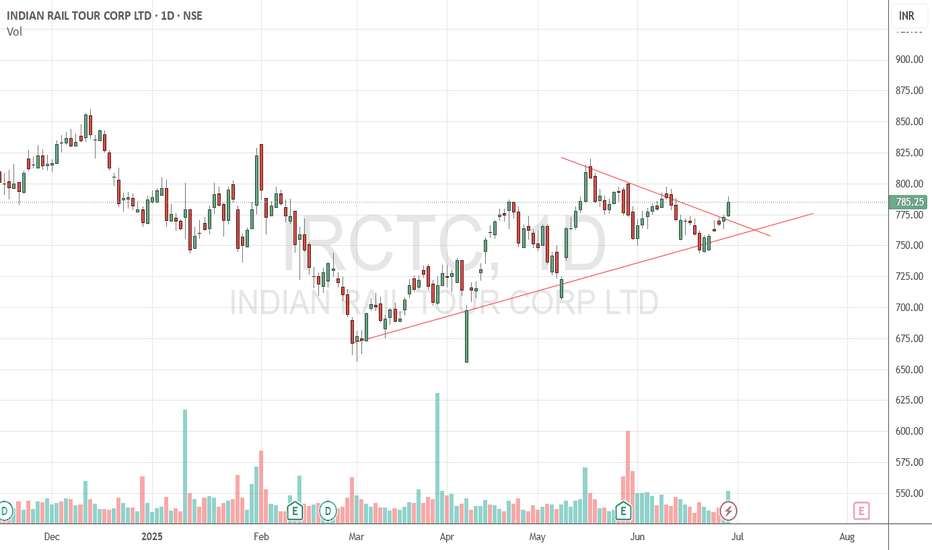

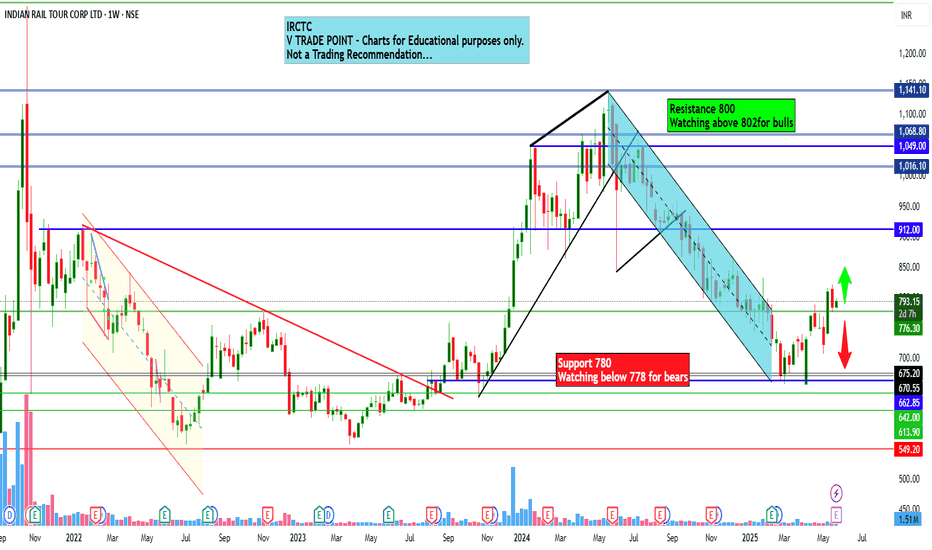

Indian Rail Tour Corp Ltd view for Intraday 28th May #IRCTC Indian Rail Tour Corp Ltd view for Intraday 28th May #IRCTC

Resistance 800 Watching above 802 for upside momentum.

Support area 780 Below 790 ignoring upside momentum for intraday

Watching below 778 for downside movement...

Above 790 ignoring downside move for intraday

Charts for Educational pur

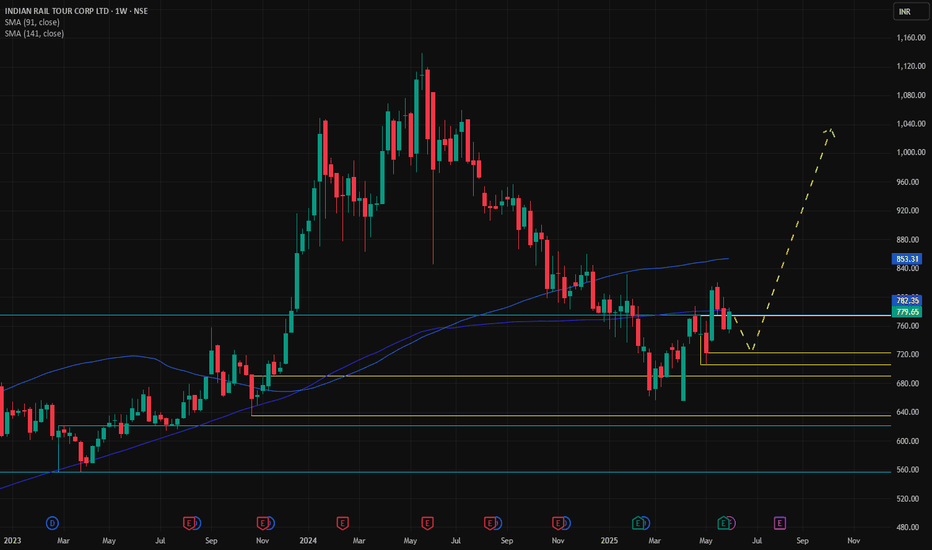

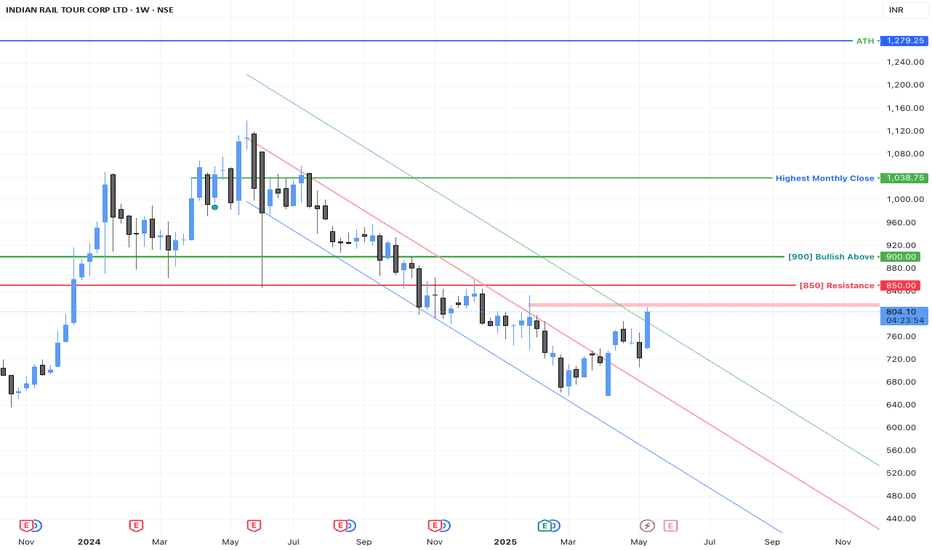

IRCTC Weekly ChartIRCTC weekly chart confirmed a breakout from the channel it was trading for the last one year.

Short term resistance around 815.

Look for signs of reversal near 850.

The stock will turn bullish only after a strong close above 900 (will small investors get a chance here?). After 900, target is on

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of IRCTC is 703.95 INR — it has increased by 1.18% in the past 24 hours. Watch Indian Railway Catering & Tourism Corp. Ltd. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange Indian Railway Catering & Tourism Corp. Ltd. stocks are traded under the ticker IRCTC.

IRCTC stock has fallen by −3.67% compared to the previous week, the month change is a −3.43% fall, over the last year Indian Railway Catering & Tourism Corp. Ltd. has showed a −23.90% decrease.

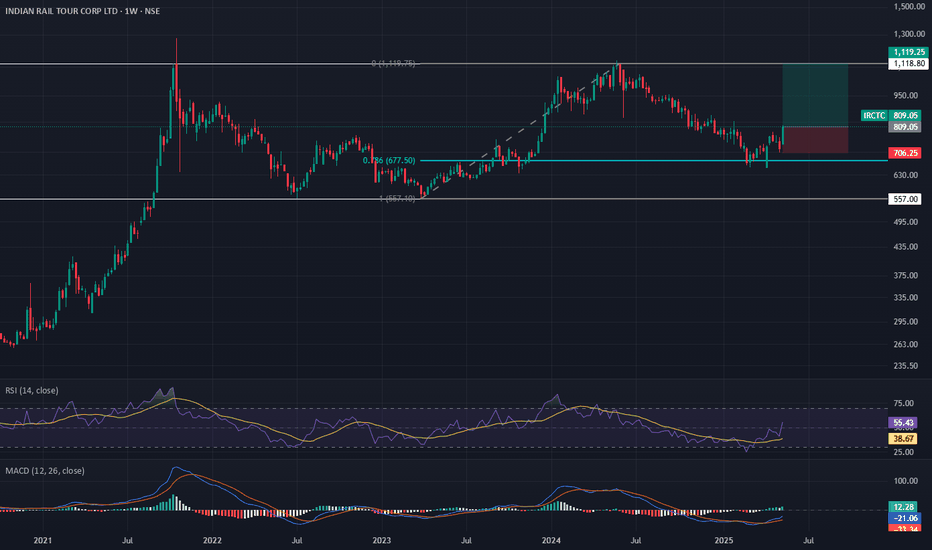

We've gathered analysts' opinions on Indian Railway Catering & Tourism Corp. Ltd. future price: according to them, IRCTC price has a max estimate of 1,200.00 INR and a min estimate of 560.00 INR. Watch IRCTC chart and read a more detailed Indian Railway Catering & Tourism Corp. Ltd. stock forecast: see what analysts think of Indian Railway Catering & Tourism Corp. Ltd. and suggest that you do with its stocks.

IRCTC reached its all-time high on Oct 19, 2021 with the price of 1,279.25 INR, and its all-time low was 125.00 INR and was reached on Oct 14, 2019. View more price dynamics on IRCTC chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

IRCTC stock is 2.10% volatile and has beta coefficient of 1.36. Track Indian Railway Catering & Tourism Corp. Ltd. stock price on the chart and check out the list of the most volatile stocks — is Indian Railway Catering & Tourism Corp. Ltd. there?

Today Indian Railway Catering & Tourism Corp. Ltd. has the market capitalization of 553.36 B, it has decreased by −4.18% over the last week.

Yes, you can track Indian Railway Catering & Tourism Corp. Ltd. financials in yearly and quarterly reports right on TradingView.

Indian Railway Catering & Tourism Corp. Ltd. is going to release the next earnings report on Nov 12, 2025. Keep track of upcoming events with our Earnings Calendar.

IRCTC net income for the last quarter is 3.31 B INR, while the quarter before that showed 3.58 B INR of net income which accounts for −7.68% change. Track more Indian Railway Catering & Tourism Corp. Ltd. financial stats to get the full picture.

Indian Railway Catering & Tourism Corp. Ltd. dividend yield was 1.10% in 2024, and payout ratio reached 48.67%. The year before the numbers were 0.70% and 46.80% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Sep 2, 2025, the company has 2.79 K employees. See our rating of the largest employees — is Indian Railway Catering & Tourism Corp. Ltd. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Indian Railway Catering & Tourism Corp. Ltd. EBITDA is 15.72 B INR, and current EBITDA margin is 33.83%. See more stats in Indian Railway Catering & Tourism Corp. Ltd. financial statements.

Like other stocks, IRCTC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Indian Railway Catering & Tourism Corp. Ltd. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Indian Railway Catering & Tourism Corp. Ltd. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Indian Railway Catering & Tourism Corp. Ltd. stock shows the sell signal. See more of Indian Railway Catering & Tourism Corp. Ltd. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.