LICI trade ideas

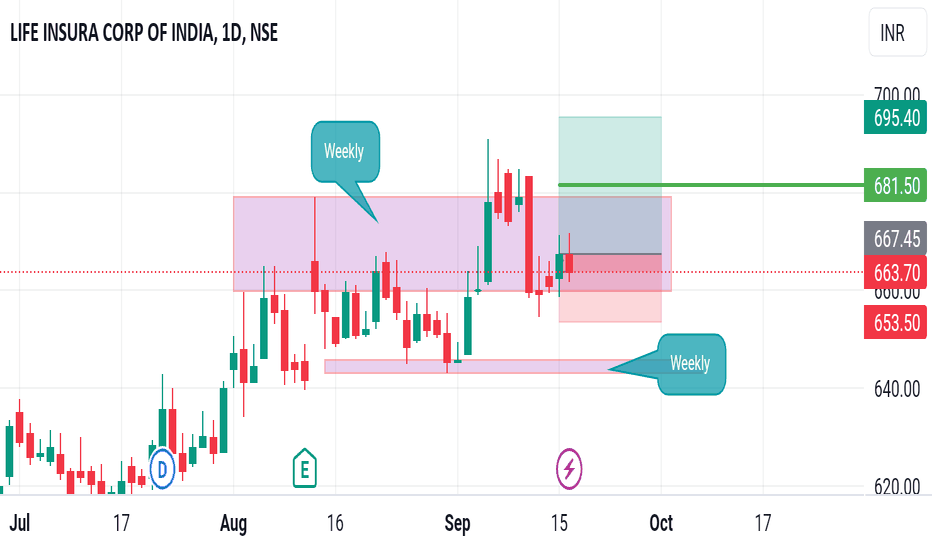

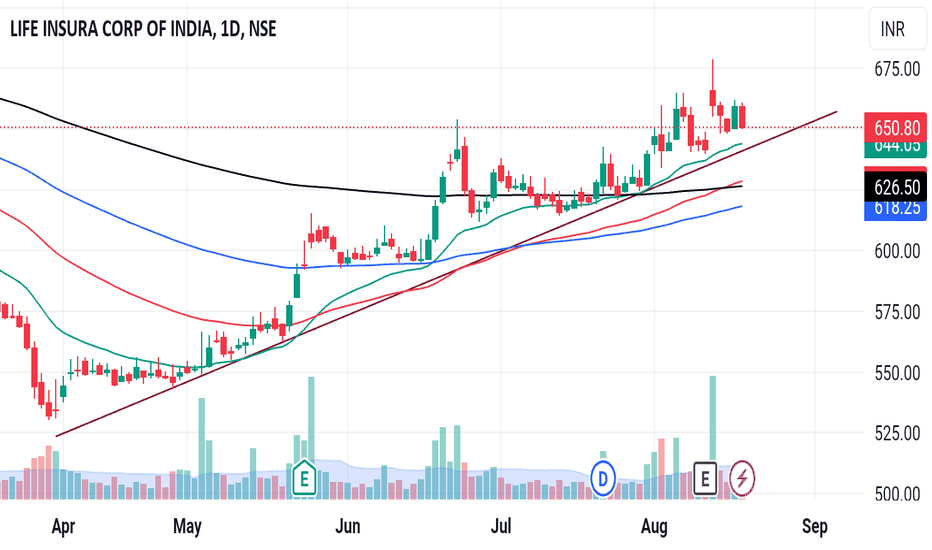

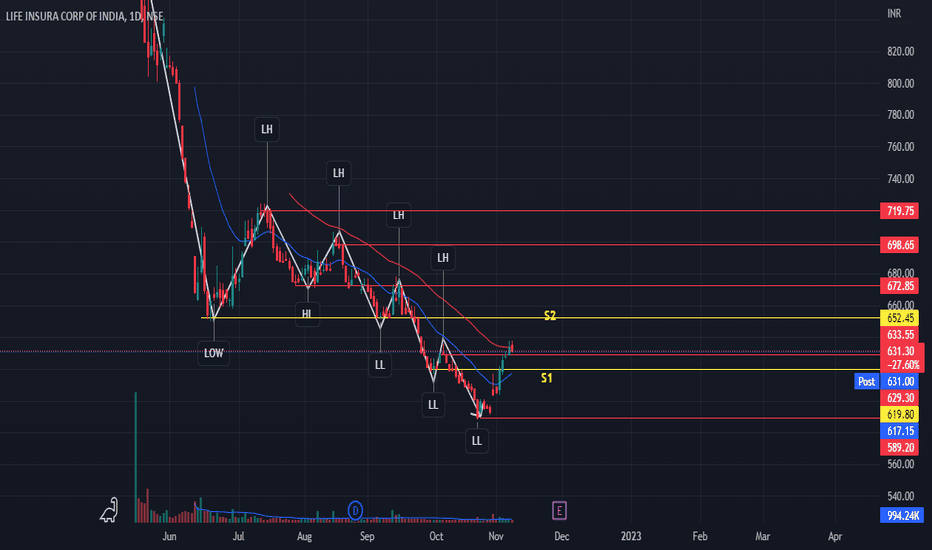

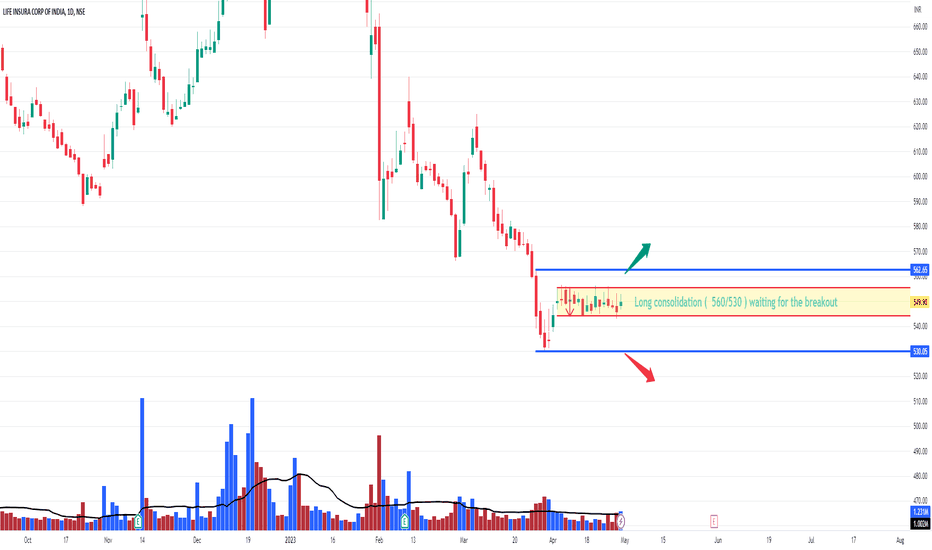

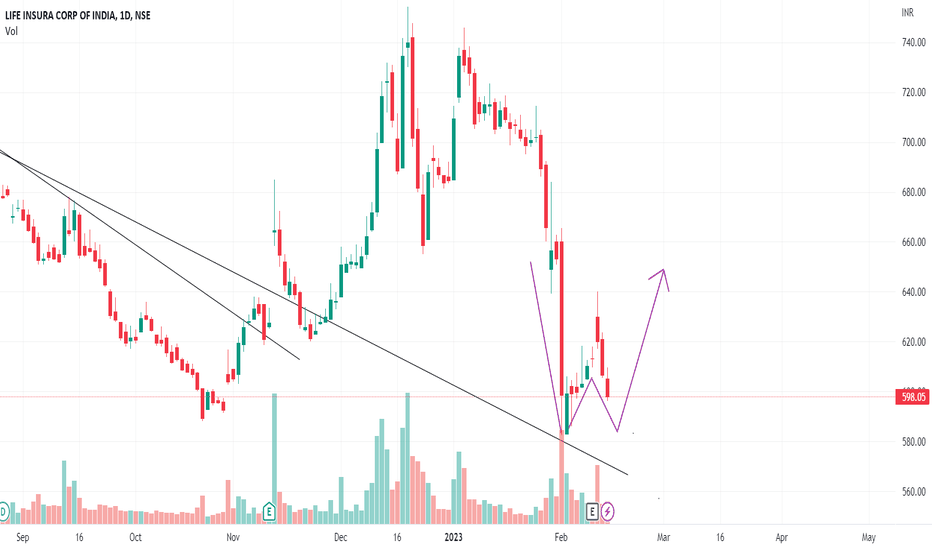

LICIPrice always support trend line means stock in a uptrend zone.

Price above in DEMA also means stock in a uptrend zone.

If the trend line break and make lower high lower low formation it means trend reversal.

20Dema is a dynamic support 644 wait and watch situation as now.

Don't make any entry 🚫

Wait for confirmation.

Macd & Rsi also show little weakness in trend.

Disclaimer:- This is my personal view for education purpose only.

No Buy sell recommendations give by me.

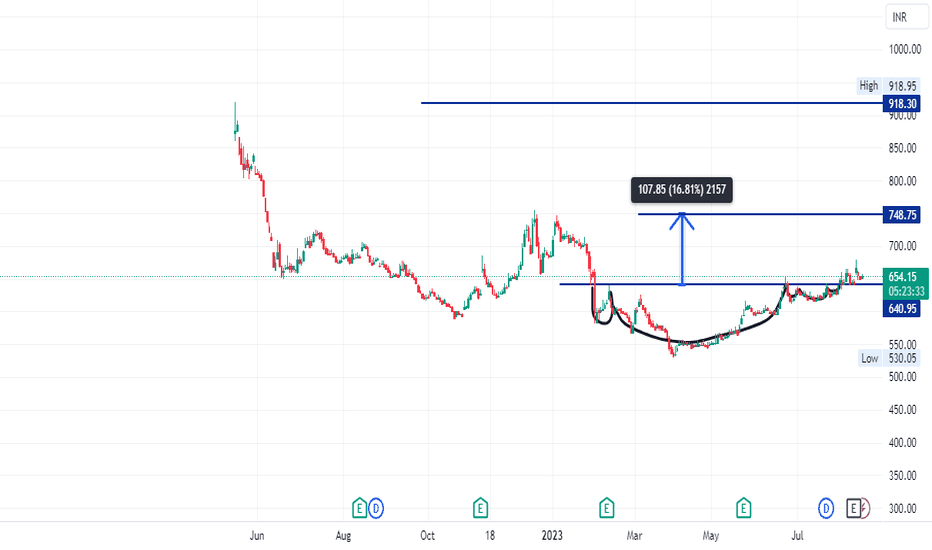

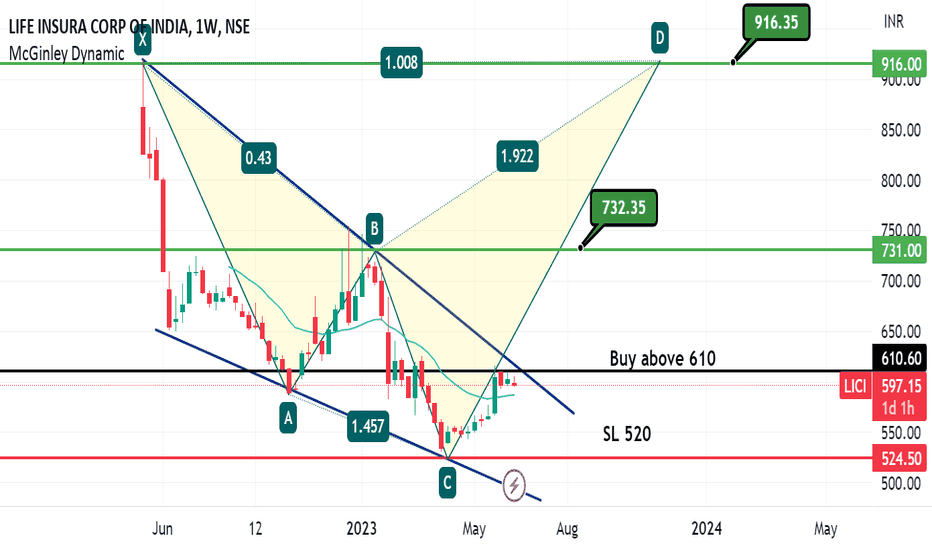

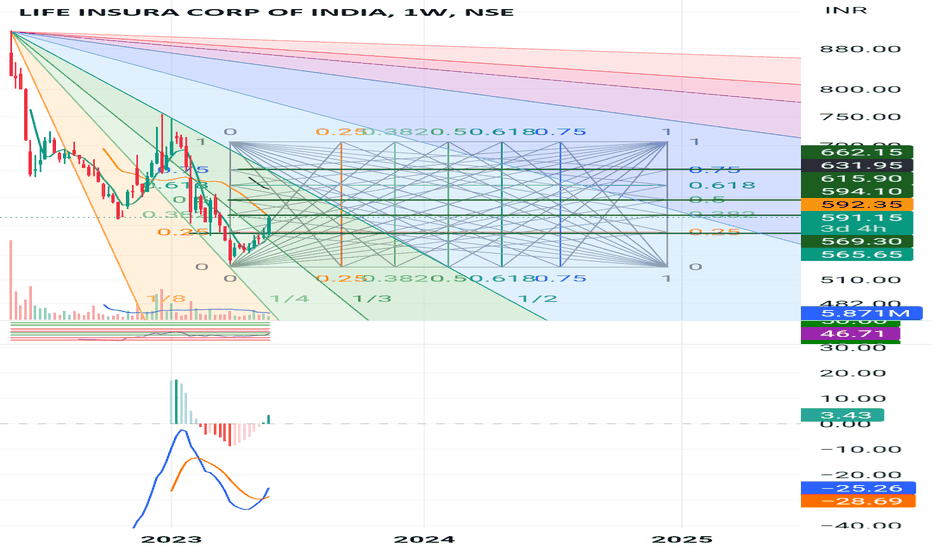

LICCompany is almost debt free.

Company has delivered good profit growth of 71.6% CAGR over last 5 years

Company has a good return on equity (ROE) track record: 3 Years ROE 108%

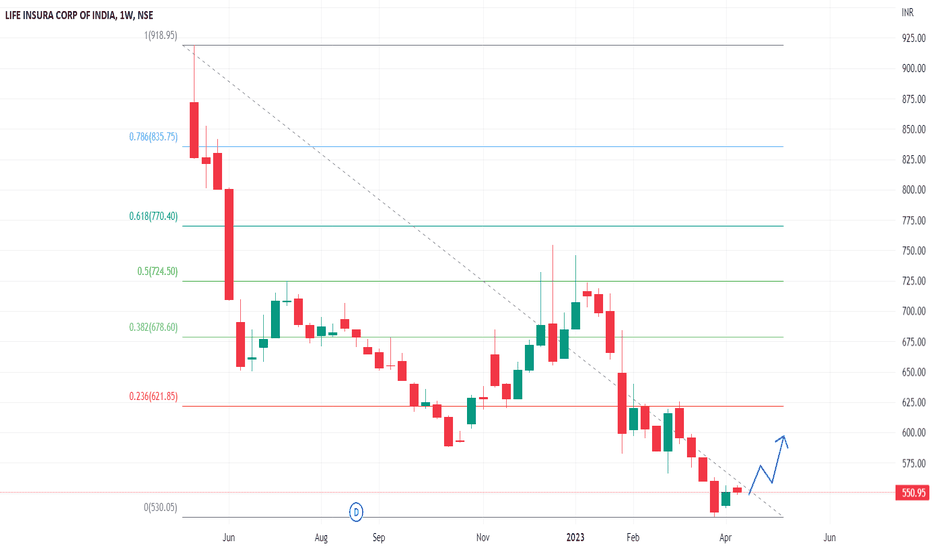

it is far below ipo listing price

recently company has shown good revenue generation with good profit margins

IT HAS FORMED COMPLEX HEAD AND SHOULDER PATTERN

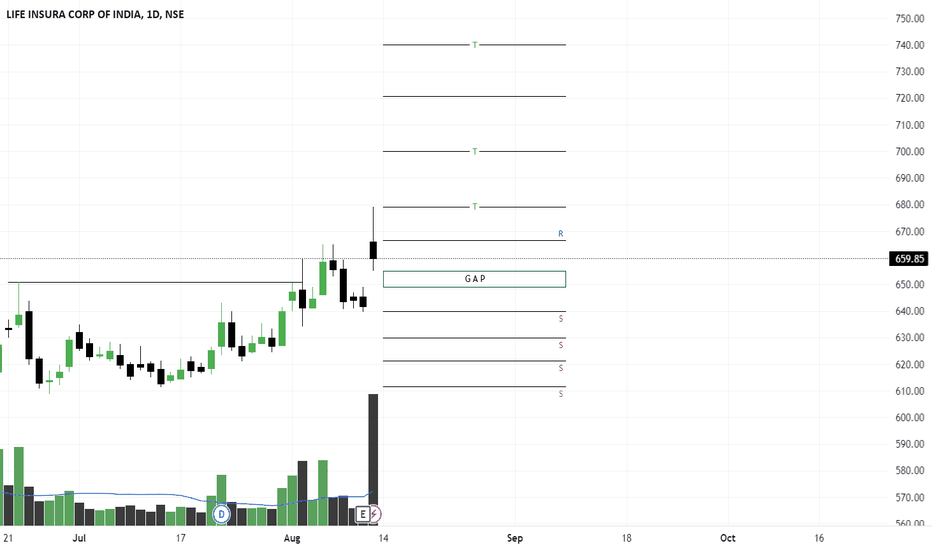

FIRST TARGET WILL BE AROUND T1-750 which is recent high

SECOND TARGET WILL BE NEAR IPO PRICE T2-910

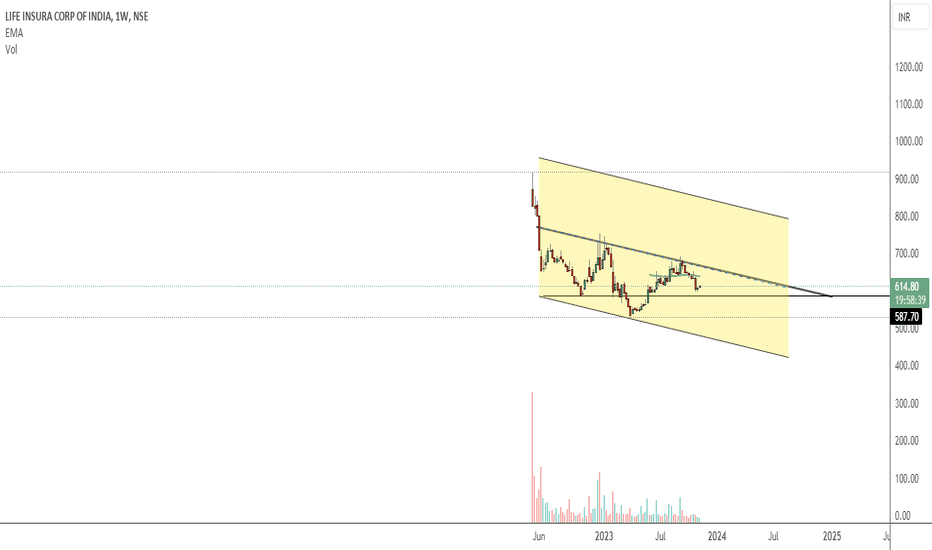

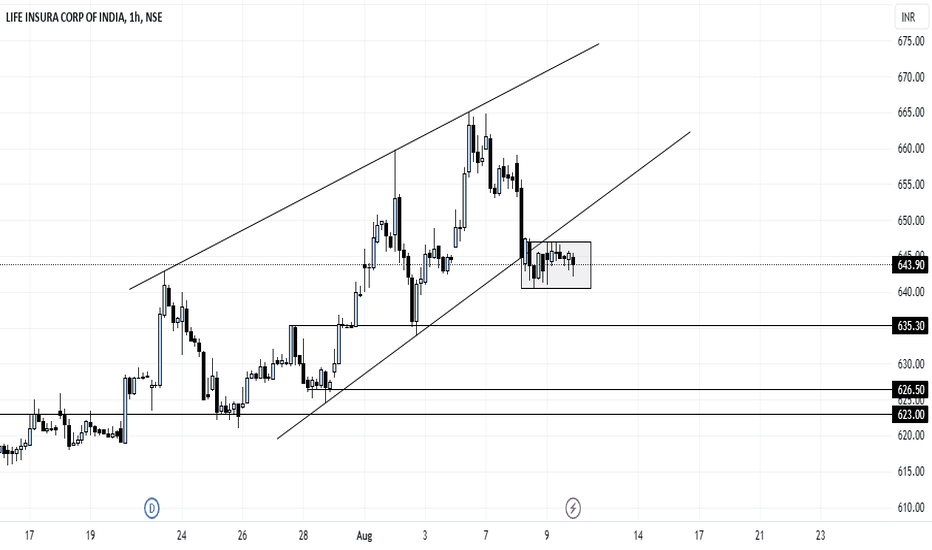

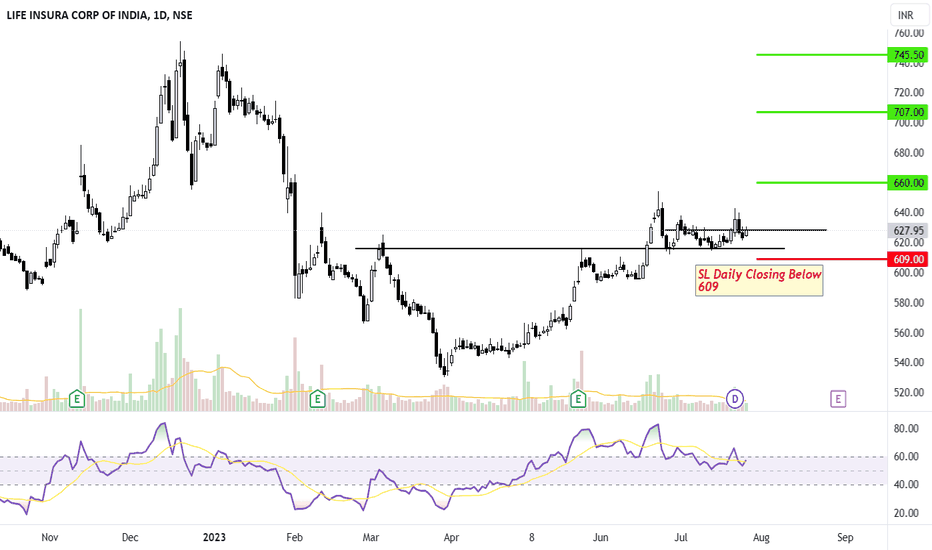

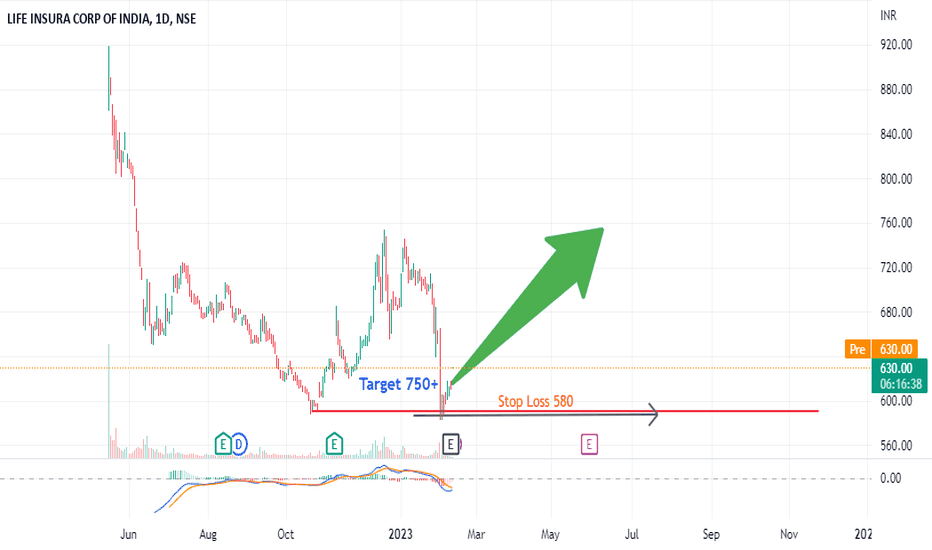

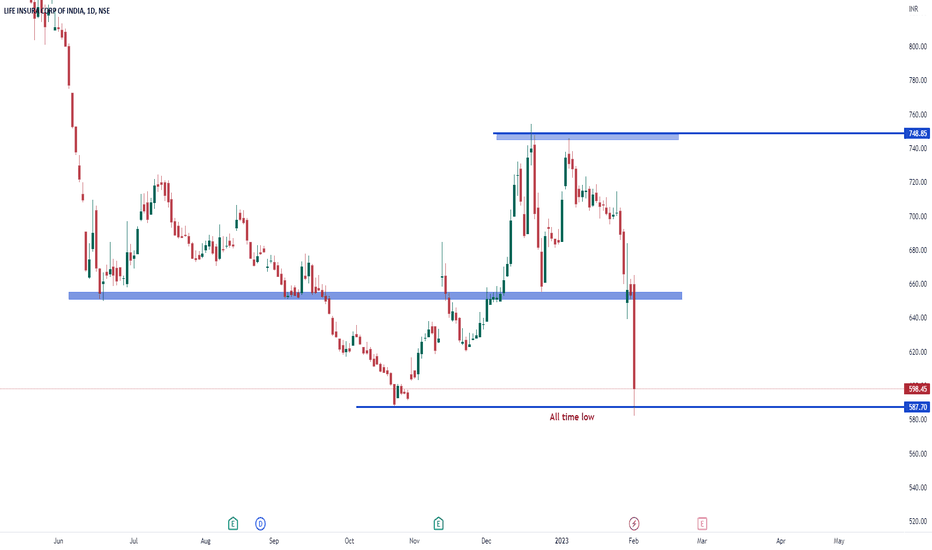

LONG in LICI with a small SL for Big Targets.After making a cup n handle formation LICI is holding up near 50EMA and above 200EMA since last 25 trading sessions, this 615-635 level is also a retesting zone of support area after a Breakout of Cup n Handle formation. Thus we may consider this phase as cool-off period prior to a fresh Breakout. Levels are mentioned on Chart itself.

As Stop Loss is very small here, this trade suits me.

Do comment below if you have any opinion.

Happy Investing :)

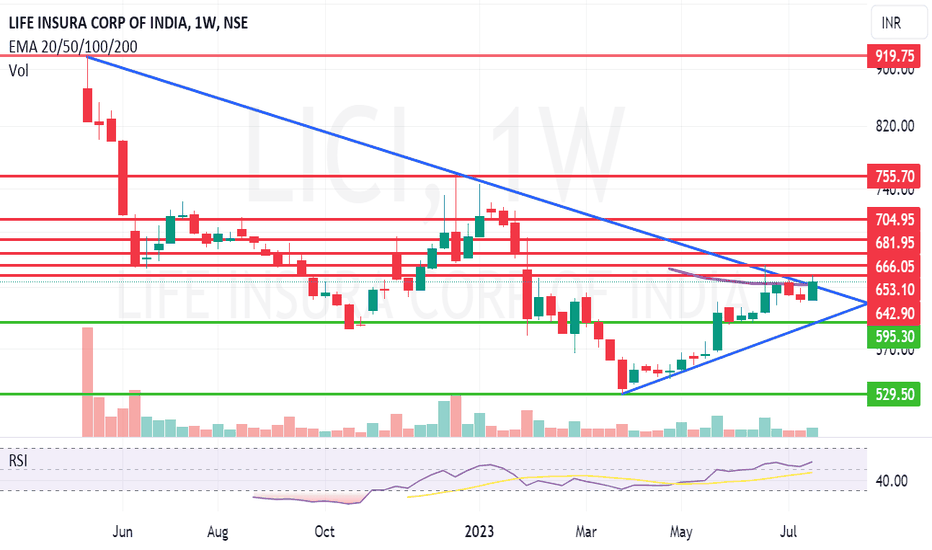

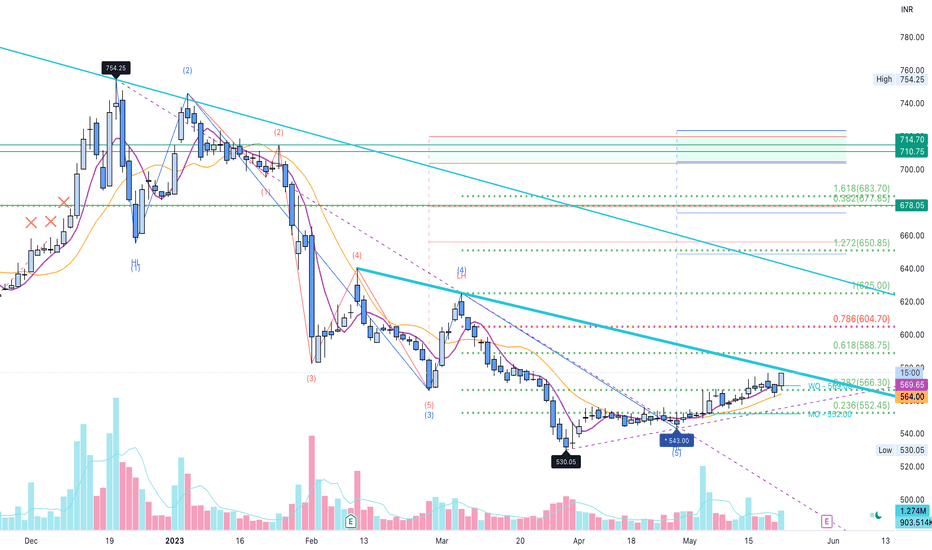

LIC of India trying to make a comeback after consolidation.Life Insurance Corporation of India is the largest multinational insurance corporation and an institutional investor with an asset under management of more than 45 trillion INR. The company offers insurance plans, pension plans, unit linked plans, withdrawn plans and health plans with many other group schemes.

Life Insurance Corporation CMP is 635.75. Negative aspects of the company are declining cash from operations and MFs are decreasing stake. Positive aspects of the company are improving annual net profits, no debt and zero promoter pledge.

Entry after closing above 643. Target of the call will be 653 and 666. Long term targets in the stock will be 681 and 704. Stop loss in the stock should be maintained at closing below 595.

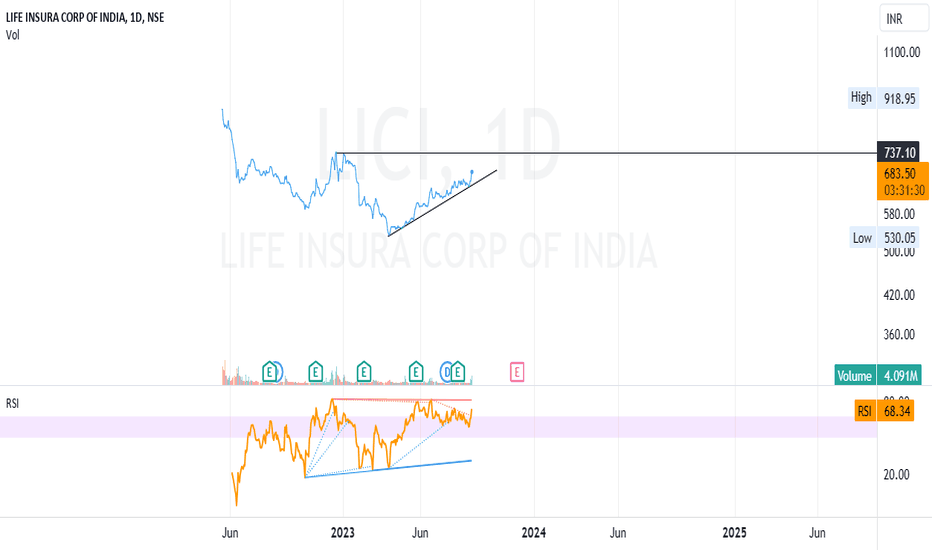

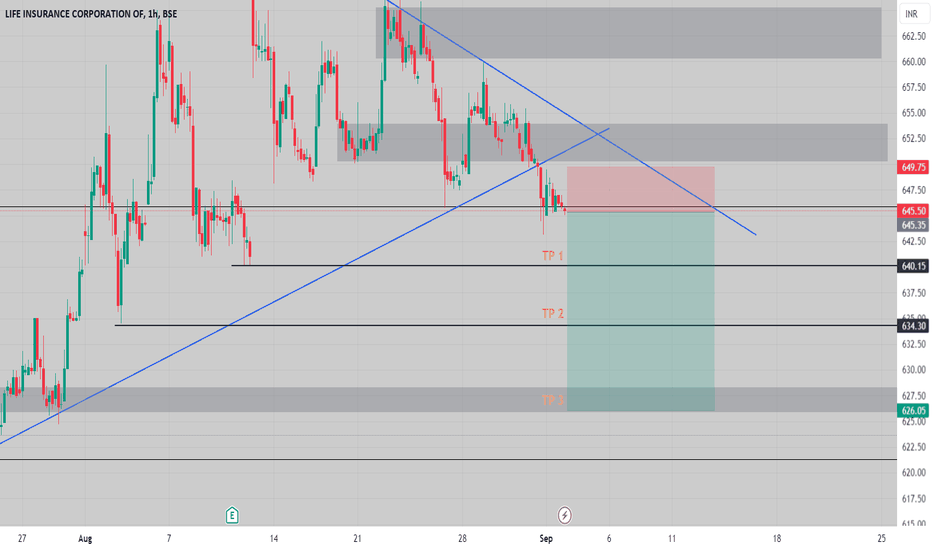

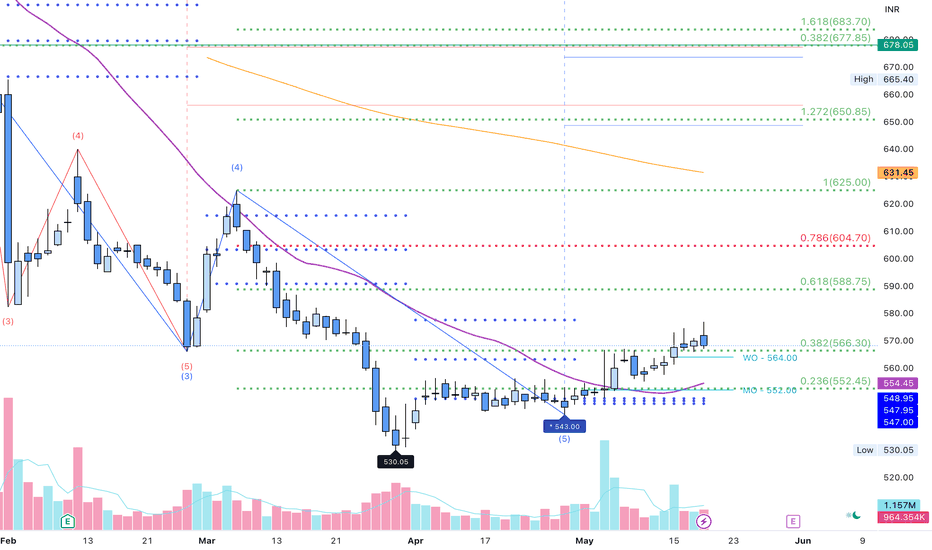

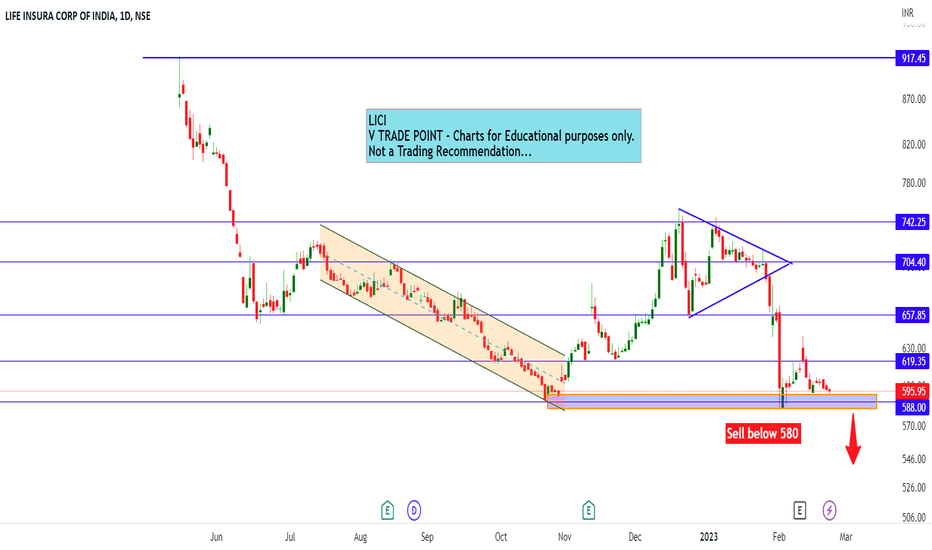

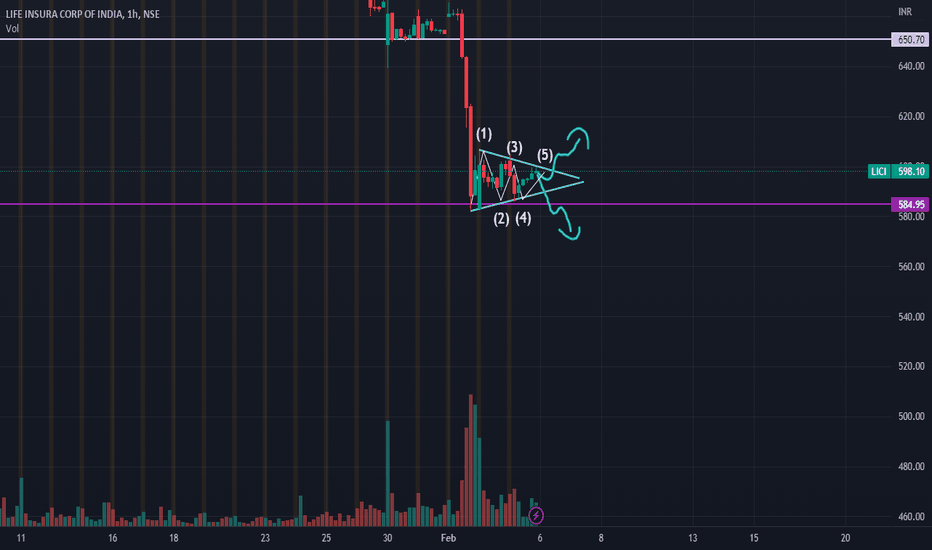

LICI view for ATL need to break for more fallLICI view for today 23rd Feb Thursday

583.15 ALL TIME LOW...

Below 580 sustain then more fall chance in short time frame

If touch 583 then it will be tripple bottom....

Charts for Educational purposes only.

Please do follow strict stop loss and risk reward if you follow my level

Thanks,

V Trade Point

Buy LIC from this level Result fabulous aye hainLIC has posted awesome result,,,and now its trading in lower range,,this has fallen due to ADANI GROUP but this is best time to enter for short term as well as long term,,level i have already put on chart..Trade accordingly but really this is best level, you might won't get these level again.

Please guy's like and follow me for future updates.

Thankyou:))