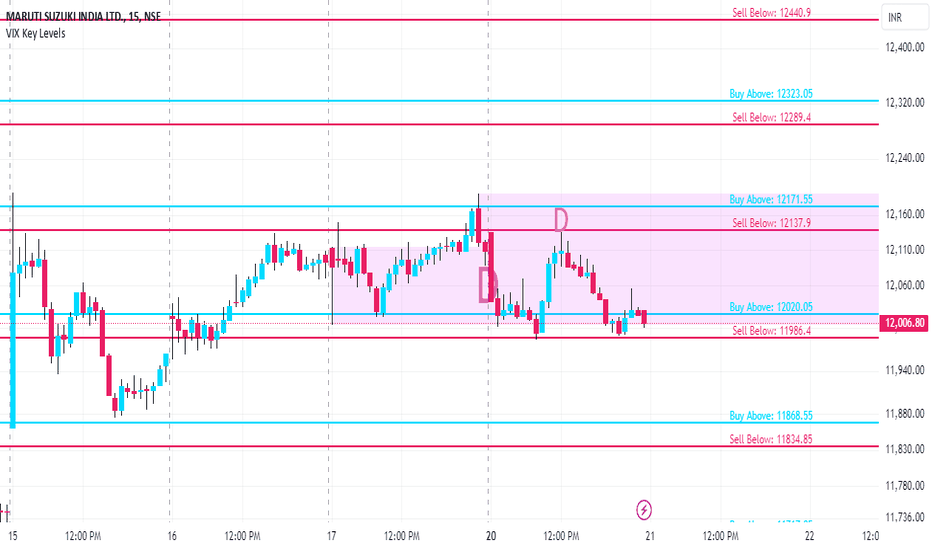

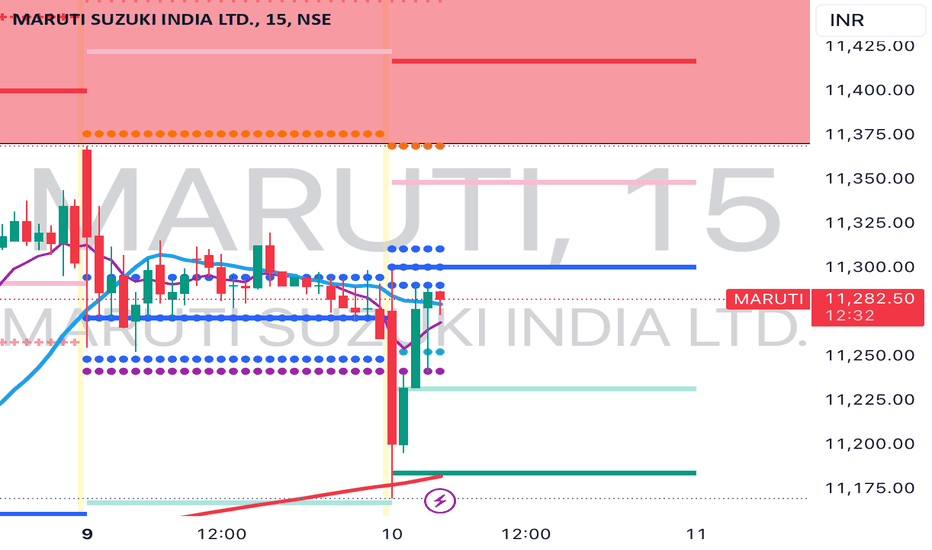

MARUTI Key Levels for 21/01/2025**Explanation:**

This trading system helps you avoid blind trades by providing confirmation for better entries and exits.

**Entry/Exit Points:**

- **Entry/Exit Lines:** Use the BLACK line for long trades and the RED line for short trades, based on confirmation from your trading plan.

- **Stop Loss:** For long trades, set the stop loss at the RED line below. For short trades, set it at the BLACK line above.

- **Take Profit:** For long trades, target the next RED line above. For short trades, target the next BLACK line below.

**Timeframe:**

Use a 5 timeframe for trading.

**Risk Disclaimer:**

This setup is for educational purposes. I'm not responsible for your gains or losses. Check the chart for more details.

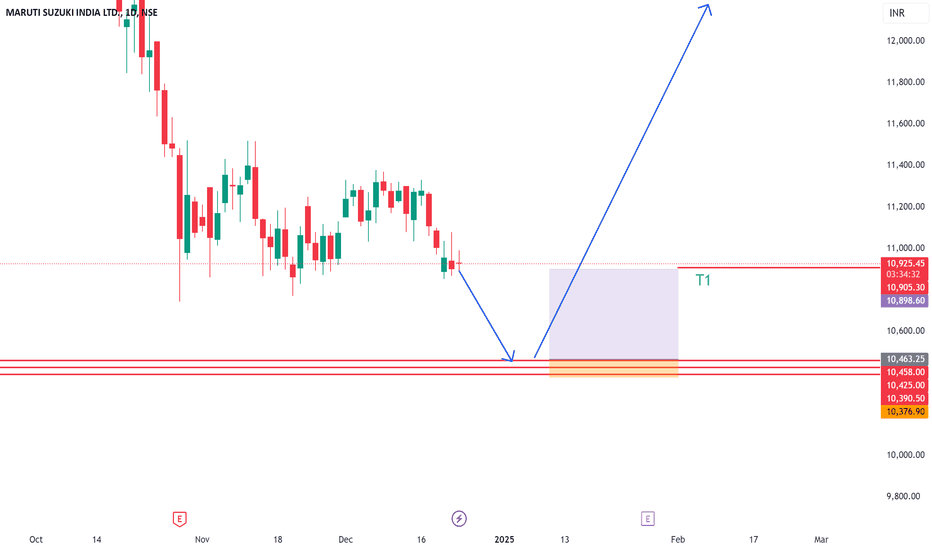

MARUTI trade ideas

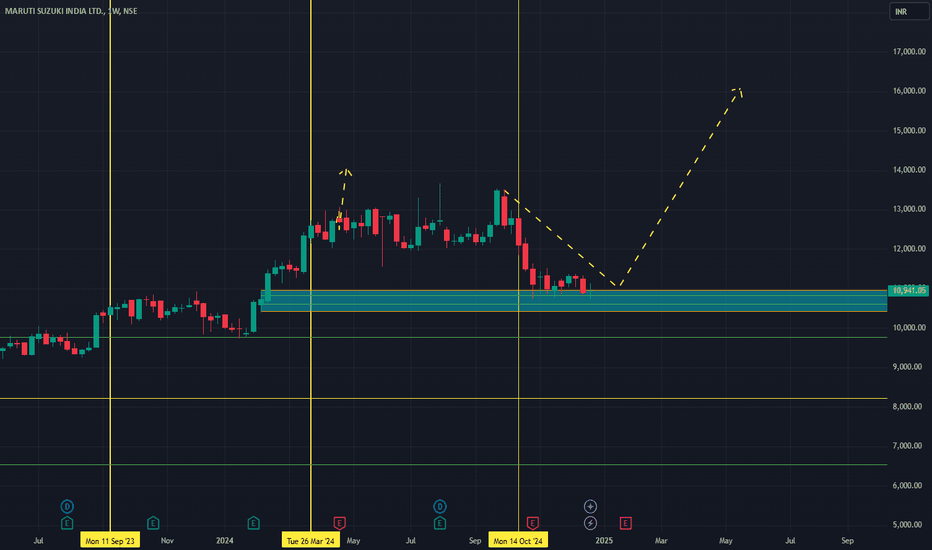

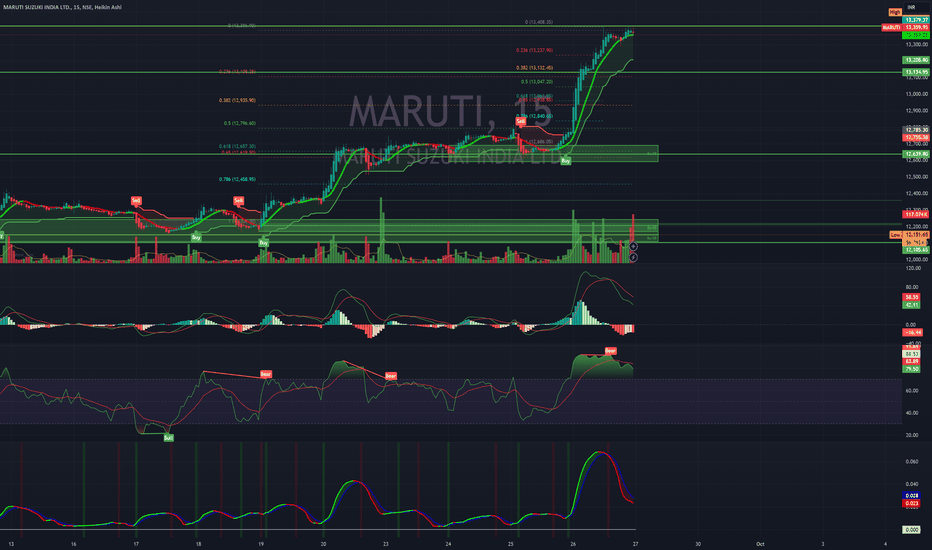

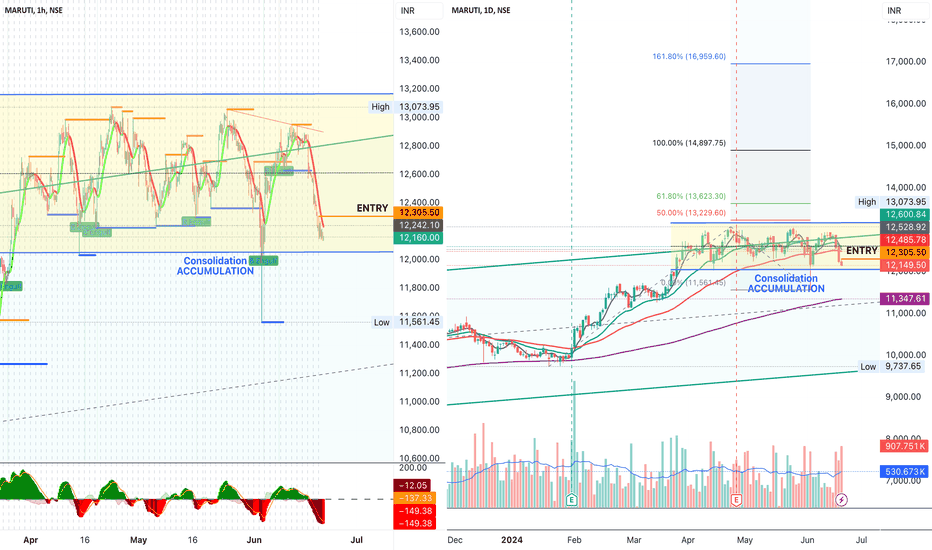

Maruti LongMaruti

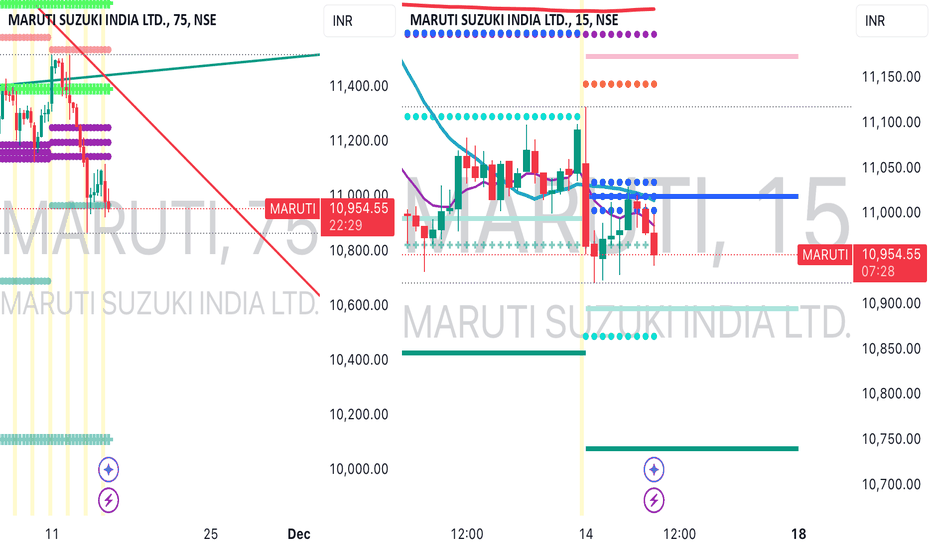

MTF Analysis

MarutiYearly Demand 9769

Maruti 6 Month Demand 10932

MarutiQtrly Demand BUFL 10932

MarutiMonthly Demand 10345

MarutiWeekly Demand 10973

MarutiWeekly Supply 1088

MarutiDaily Demand DMIP 10830

ENTRY -1 Long 10830

SL 10392

RISK 438

Target as per Entry 12800

RR 4

Positional Target 16462

Target Points 1,970

Recent High 13,541

Recent Low 10,725

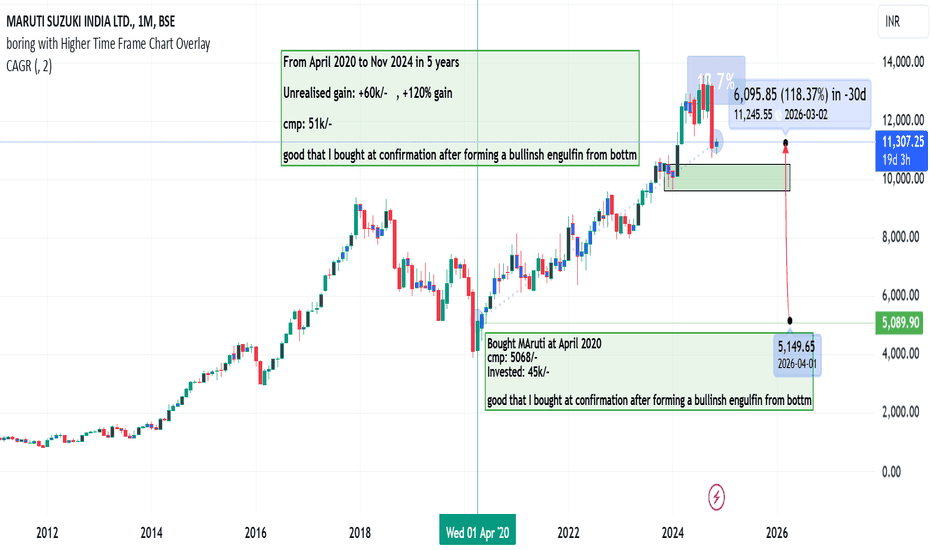

Maruti Suzuki India Ltd: Super Trade Alert!🚗💥 This Trade Blow Your Mind 💥🚗

This setup is looking explosive—get ready for a mind-blowing move! 🚀 Maruti Suzuki is poised for a stellar run, and this could be your ticket to ride the wave.

🔑 What’s the buzz?

Strong technical setup forming, indicating a potential breakout.

Key levels identified—entry from my mark for maximum impact.

Momentum is building, and this one looks ready to shift gears toward new highs.

Long from my mark, and hold tight—this one’s a rocket! 🚀

MARUTI KEY LEVELS FOR 16/12/2024**Explanation:**

This trading system helps you avoid blind trades by providing confirmation for better entries and exits. It considers volume, past prices, price range and indiavix.

**Entry/Exit Points:**

- **Entry/Exit Lines:** Use the BLACK line for long trades and the RED line for short trades, based on confirmation from your trading plan.

- **Stop Loss:** For long trades, set the stop loss at the RED line below. For short trades, set it at the BLACK line above.

- **Take Profit:** For long trades, target the next RED line above. For short trades, target the next BLACK line below.

**Timeframe:**

Use a 5 timeframe for trading.

**Risk Disclaimer:**

This setup is for educational purposes. I'm not responsible for your gains or losses. Check the chart for more details.

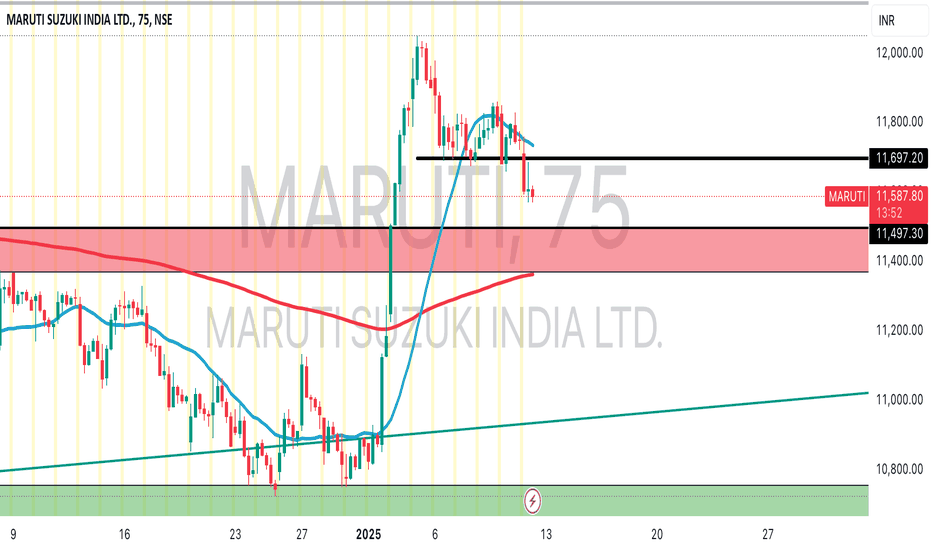

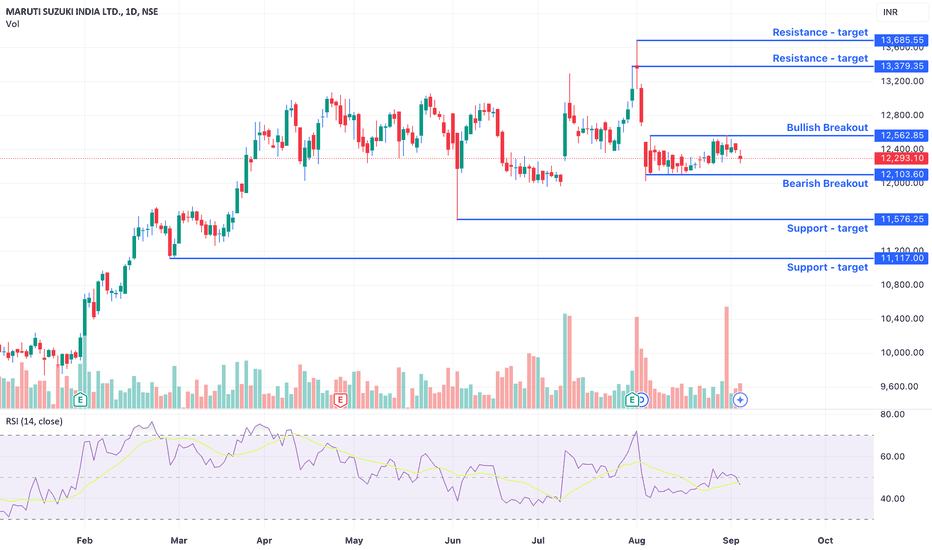

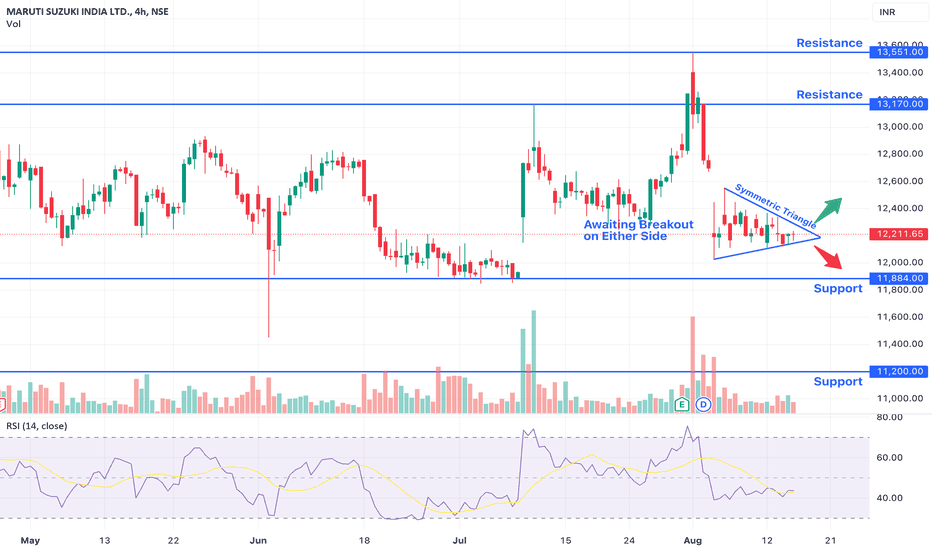

Maruti | Long | Swing / BTSTMaruti is showing a good bullish momentum.

Price is trading above the Monthly Pivot and has now closed above the Weekly Pivot as well.

Good buying coming in from the lows.

A long option trade can be initiated till 11,500 level maximum which also coincides with 50 DEMA resistance.

SL will be the present days' low.

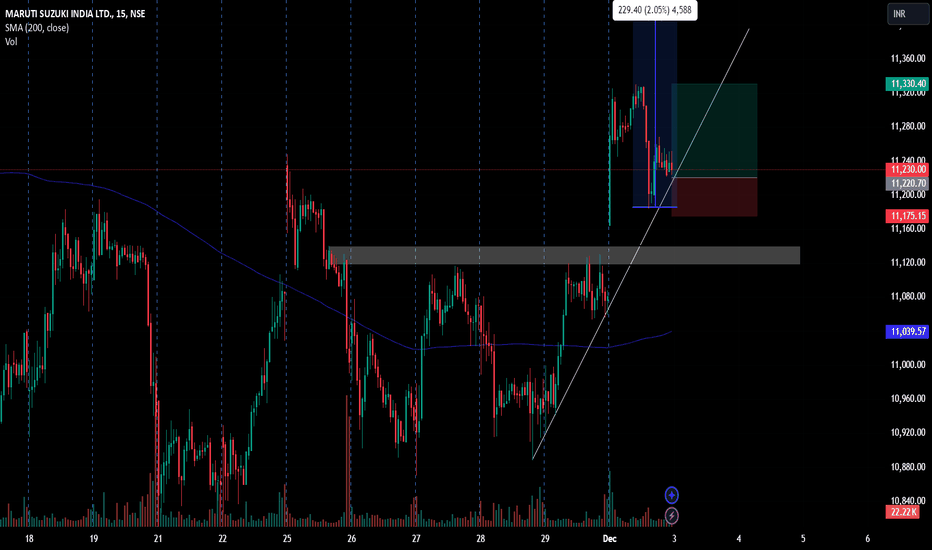

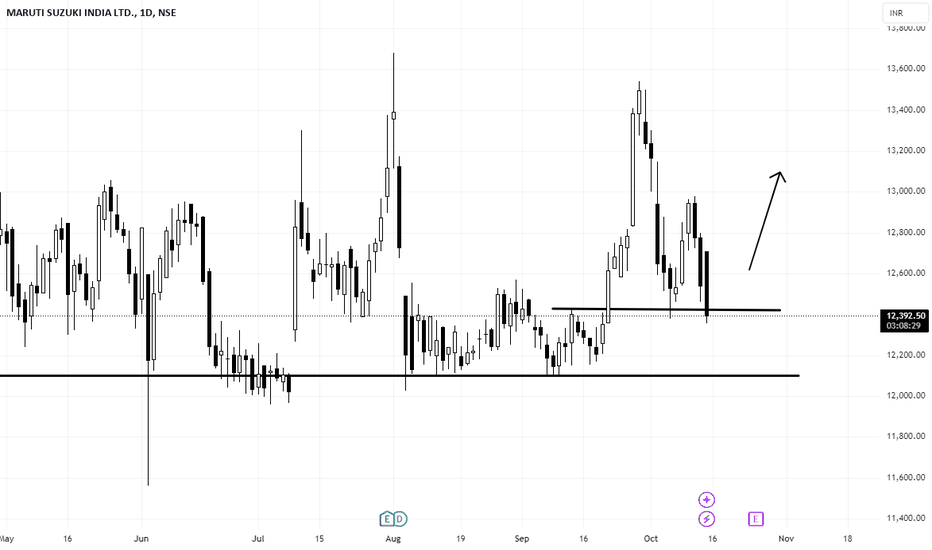

MARUTI--Demand & Supply??This stock recently broken the demand zone consolidating.

if this demand acts as supply zone price fall continues downwards up to the previous resistance turns as support levels.

we have to look for buyside when price comes back to the support levels.

Price is consolidation now, if price manipulates to upside we will go for short and if price manipulates to downside will go for buying.

Its now in manipulation area, keep observing and enter when price tests this support areas.

MARUTINSE:MARUTI

One Can Enter Now !

Or Wait for Retest of the Trendline (BO) !

Or wait For better R:R ratio !

Note :

1.One Can Go long with a Strict SL below the Trendline or Swing Low.

2. R:R ratio should be 1 :2 minimum

3. Plan as per your RISK appetite and Money Management.

Disclaimer : You are responsible for your Profits and loss, Shared for Educational purpose

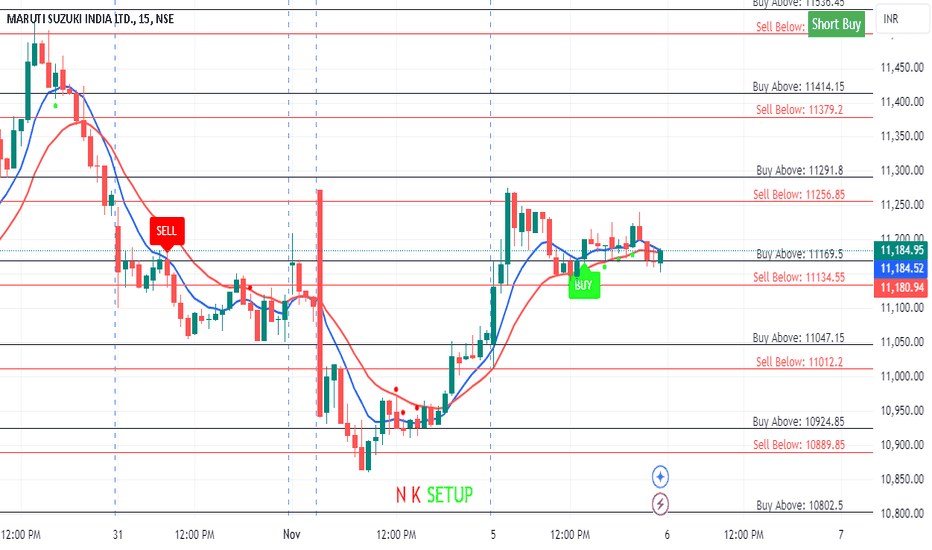

MARUTI KEY LEVELS FOR 06/11/2024**Explanation:**

This trading system helps you avoid blind trades by providing confirmation for better entries and exits. It considers volume, past prices, price range and indiavix.

**Entry/Exit Points:**

- **Entry/Exit Lines:** Use the BLACK line for long trades and the RED line for short trades, based on confirmation from your trading plan.

- **Stop Loss:** For long trades, set the stop loss at the RED line below. For short trades, set it at the BLACK line above.

- **Take Profit:** For long trades, target the next RED line above. For short trades, target the next BLACK line below.

**Timeframe:**

Use a 5 timeframe for trading.

**Risk Disclaimer:**

This setup is for educational purposes. I'm not responsible for your gains or losses. Check the chart for more details.

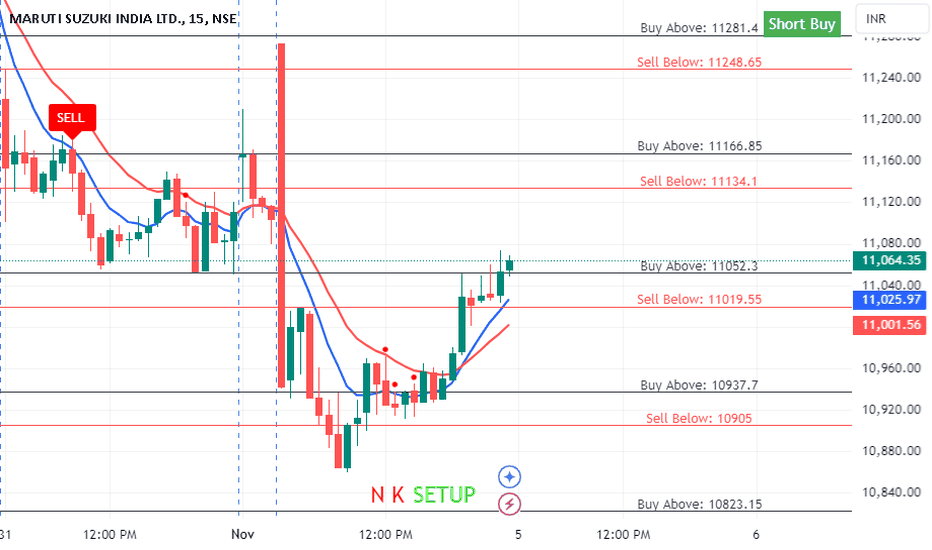

MARUTI KEY LEVELS FOR 05/11/2024//@description

// All credit goes to Tony for the concept of this indicator. His Trading View link: tradingview.sweetlogin.com

// Note: The calculation method in this indicator differs from Tony's, but the concept is derived from his work.

**Explanation:**

This trading system helps you avoid blind trades by providing confirmation for better entries and exits. It considers volume, past prices, price range and indiavix.

**Entry/Exit Points:**

- **Entry/Exit Lines:** Use the BLACK line for long trades and the RED line for short trades, based on confirmation from your trading plan.

- **Stop Loss:** For long trades, set the stop loss at the RED line below. For short trades, set it at the BLACK line above.

- **Take Profit:** For long trades, target the next RED line above. For short trades, target the next BLACK line below.

**Timeframe:**

Use a 5 timeframe for trading.

**Risk Disclaimer:**

This setup is for educational purposes. I'm not responsible for your gains or losses. Check the chart for more details.

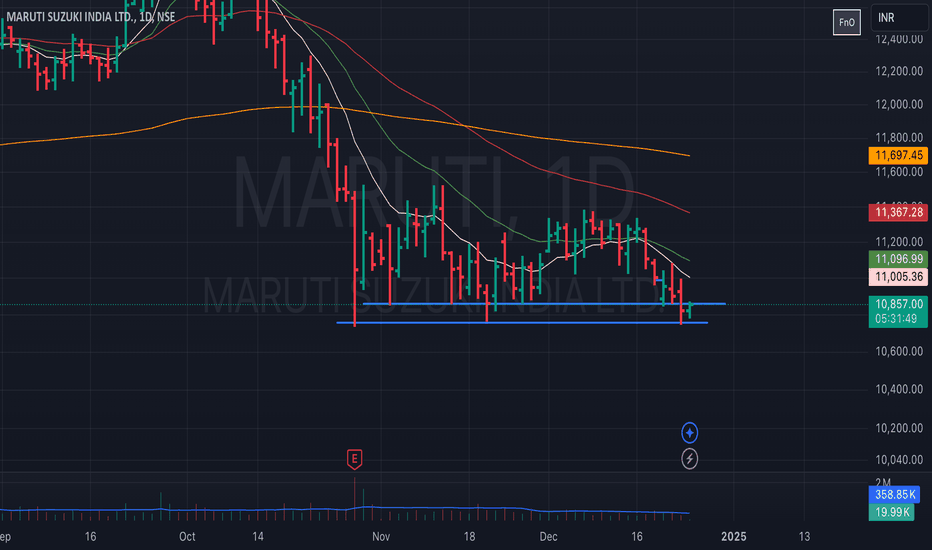

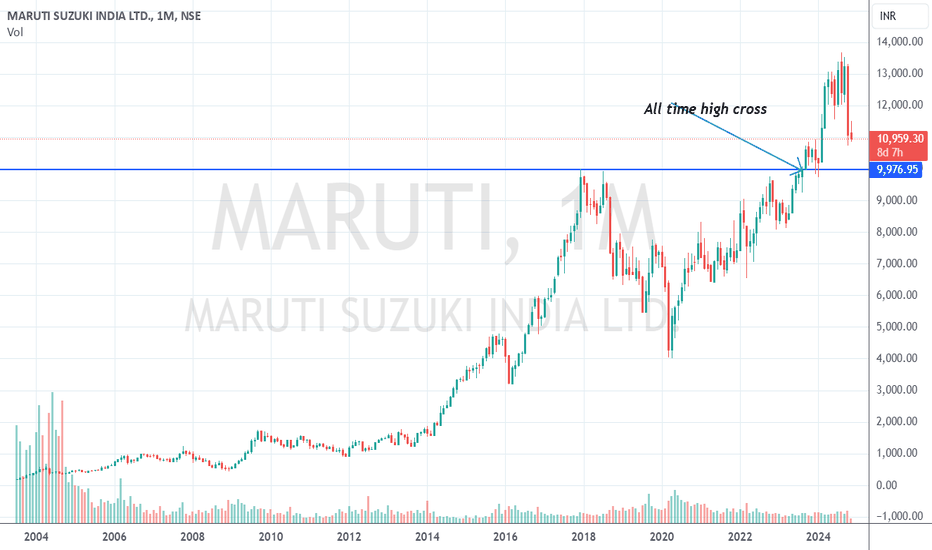

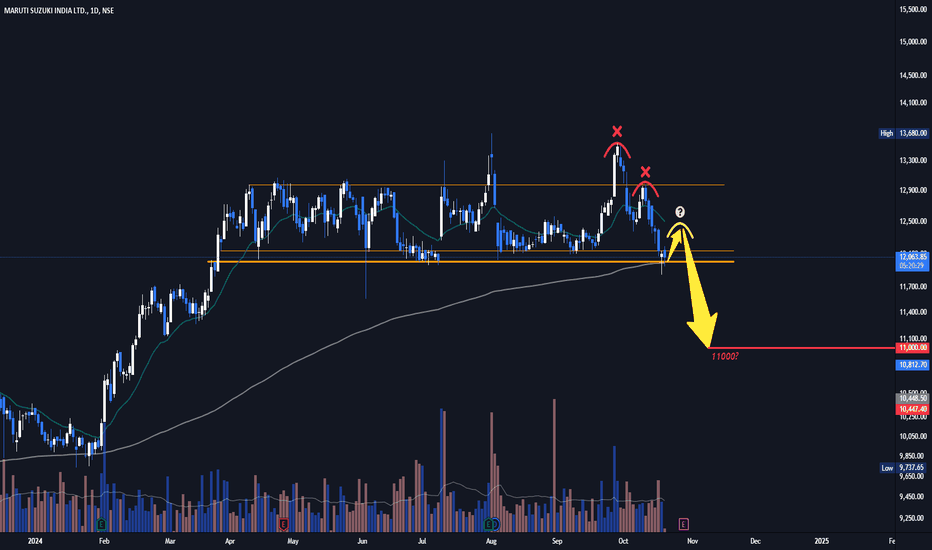

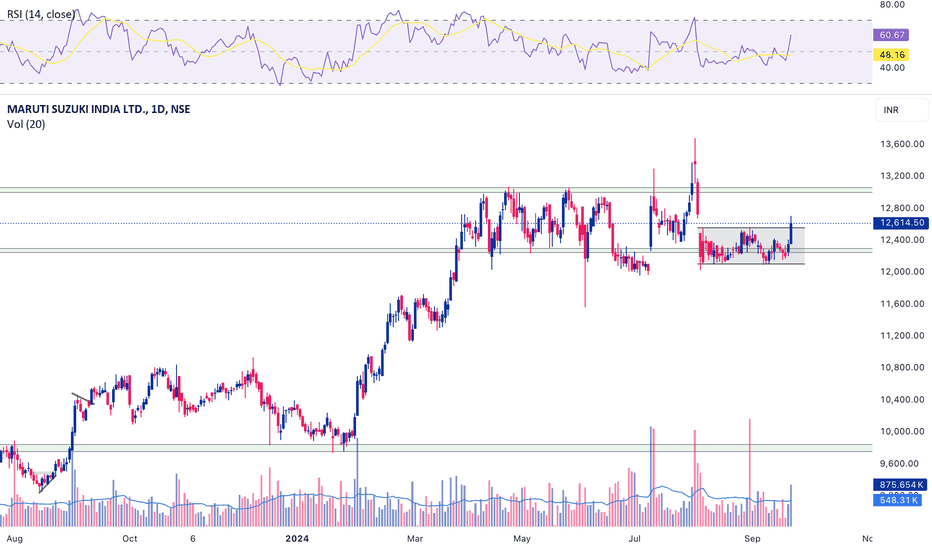

Alert:Maruti on Edge as Lower Highs Signal Looming Support breakWhen a stock 📉 consistently makes lower highs, it signals a weakening trend, with sellers taking control. Maruti is at major support suggests a critical level where the stock might break down further, potentially accelerating the decline 🚨. Investors watch these levels closely for exit signals, as breaking support can lead to sharp price drops 📉, driven by increased selling pressure and waning confidence in the stock's prospects. However, it may also bounce bank to make another lower low, continuing the bearish trend.

Daily close above 12500 is the key level to watch as it will tell us where the stock is headed.

Disclaimer: All ideas are my personal views and not financial advise. I do not have any Telegram channel nor do I sell any courses.

[Positional] Maruti SnR IdeaIf it hits stoploss, I will not close the trade but will deploy sphinx method.

Note -

One of the best forms of Price Action is to not try to predict at all. Instead of that, ACT on the price. So, this chart tells at "where" to act in "what direction. Unless it triggers, like, let's say the candle doesn't break the level which says "Buy if it breaks", You should not buy at all.

=======

I use shorthands for my trades.

"Positional" - means You can carry these positions and I do not see sharp volatility ahead. (I tally upcoming events and many small kinds of stuff to my own tiny capacity.)

"Intraday" -means You must close this position at any cost by the end of the day.

"Theta" , "Bounce" , "3BB" or "Entropy" - My own systems.

=======

I won't personally follow any rules. If I "think" (It is never gut feel. It is always some reason.) the trade is wrong, I may take reverse trade. I may carry forward an intraday position. What is meant here - You shouldn't follow me because I may miss updating. You should follow the system I share.

=======

Like -

Always follow a stop loss.

In the case of Intraday trades, it is mostly the "Day's High".

In the case of Positional trades, it is mostly the previous swings.

I do not use Stop Loss most of the time. But I manage my risk with options as I do most of the trades using derivatives