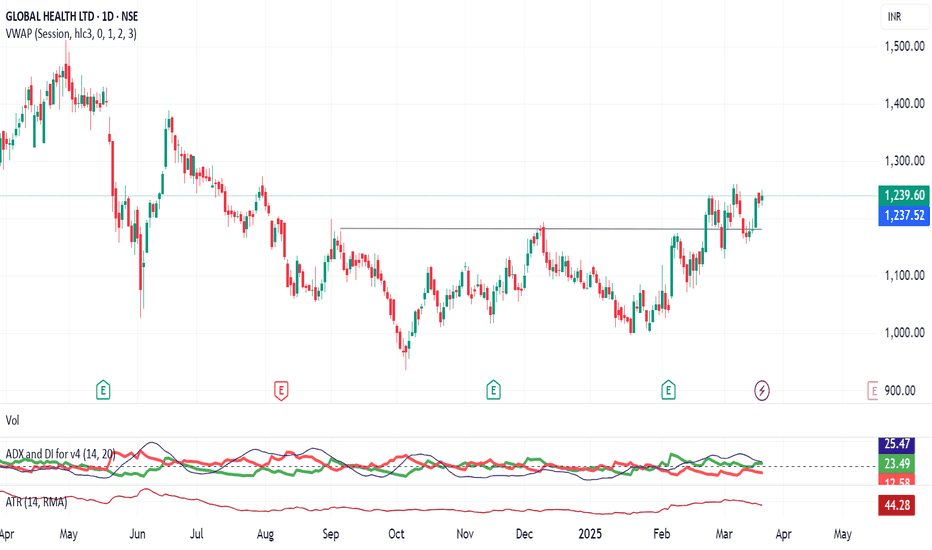

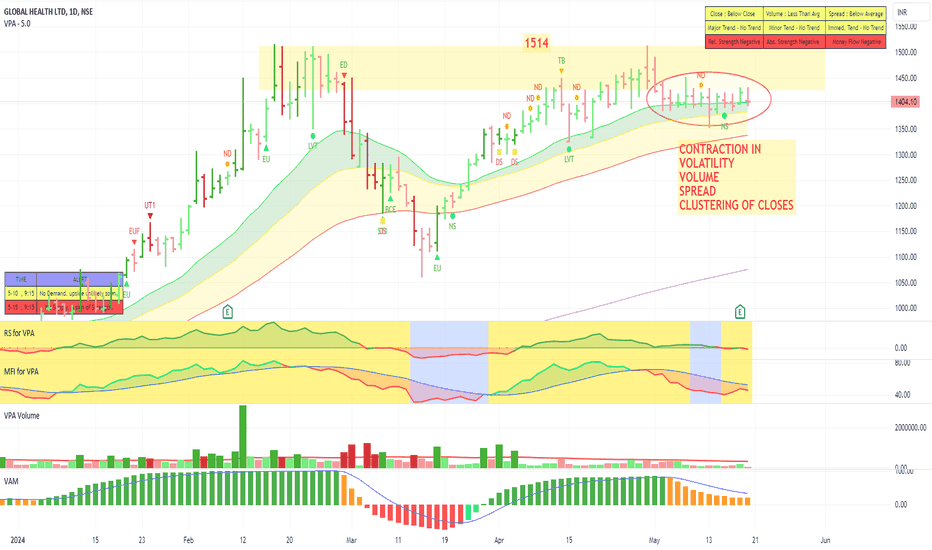

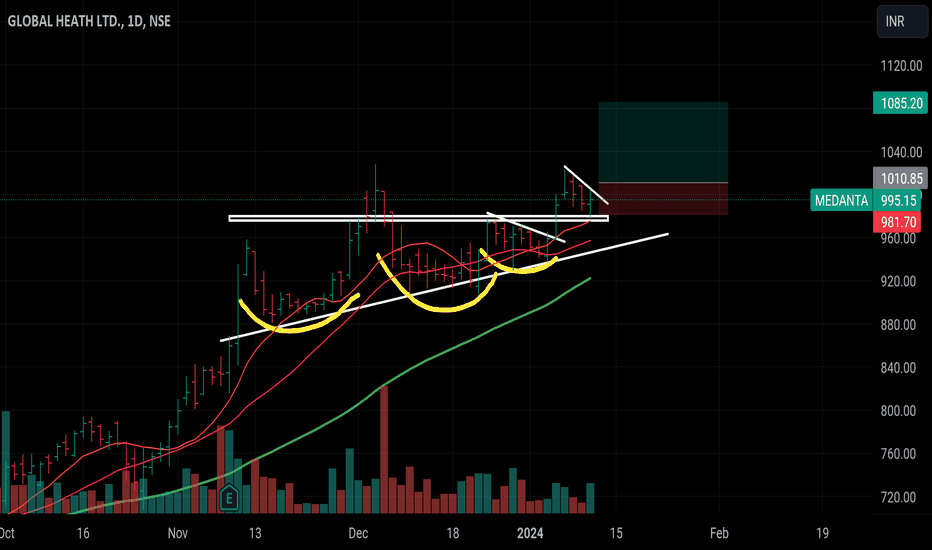

nice breakout in medanta :)Nice breakout on Medanta — that old resistance level basically curled into a cute little rounded bottom ⭕

🔴 Red flag alert:

It didn’t even flinch at that resistance — just blasted through like it owed it money (rude --)

Could be a sign of trouble, but hey, setup’s clean enough for me to trade it (ง •̀•́)ง

MEDANTA trade ideas

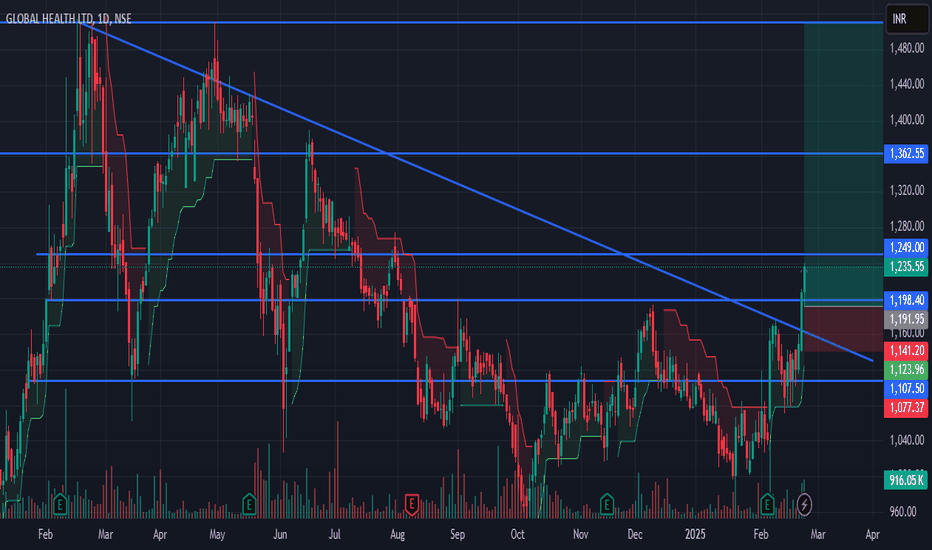

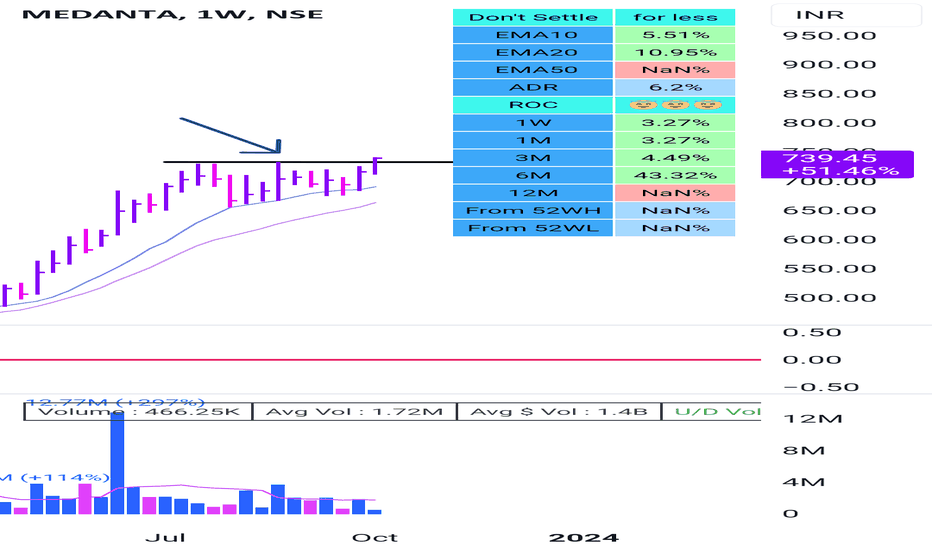

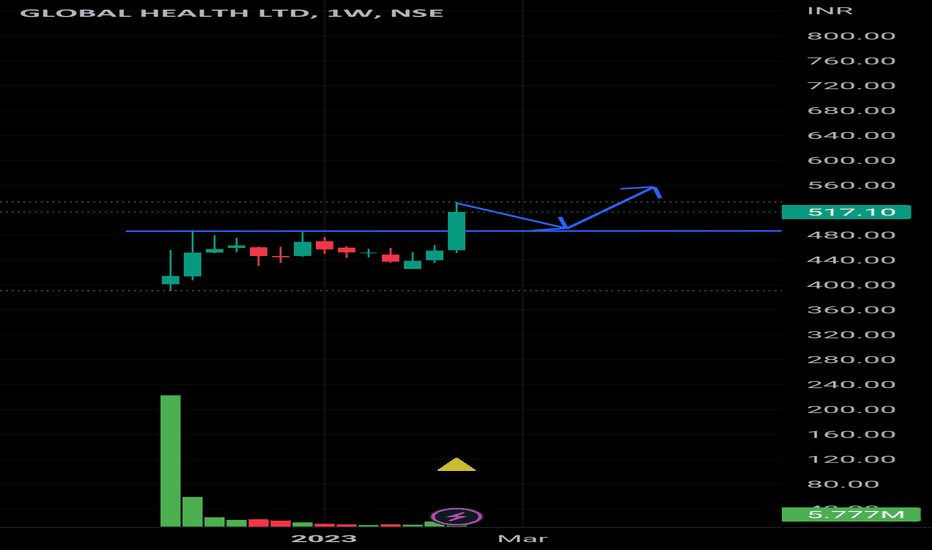

GLOBAL HEALTH LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

Review and plan for 21st March 2025 Nifty future and banknifty future analysis and intraday plan.

Few stocks analysed.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

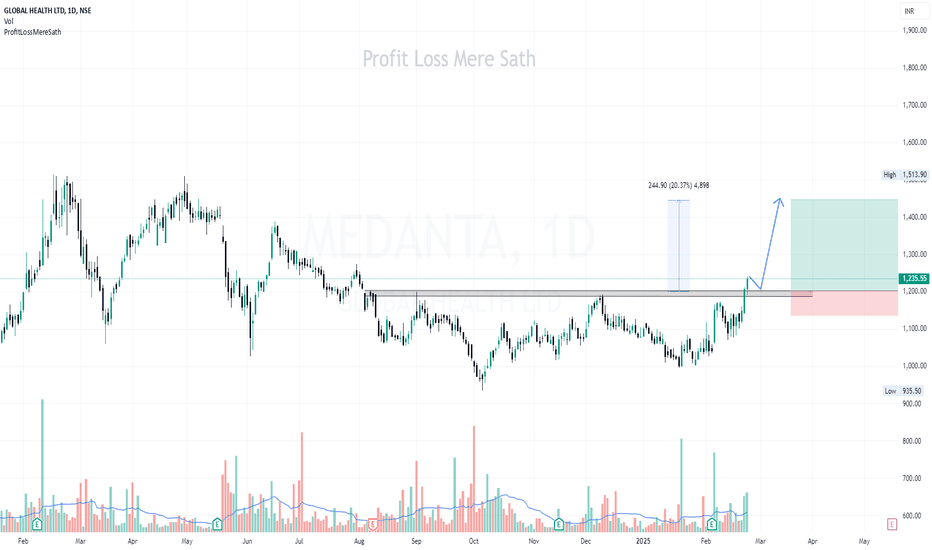

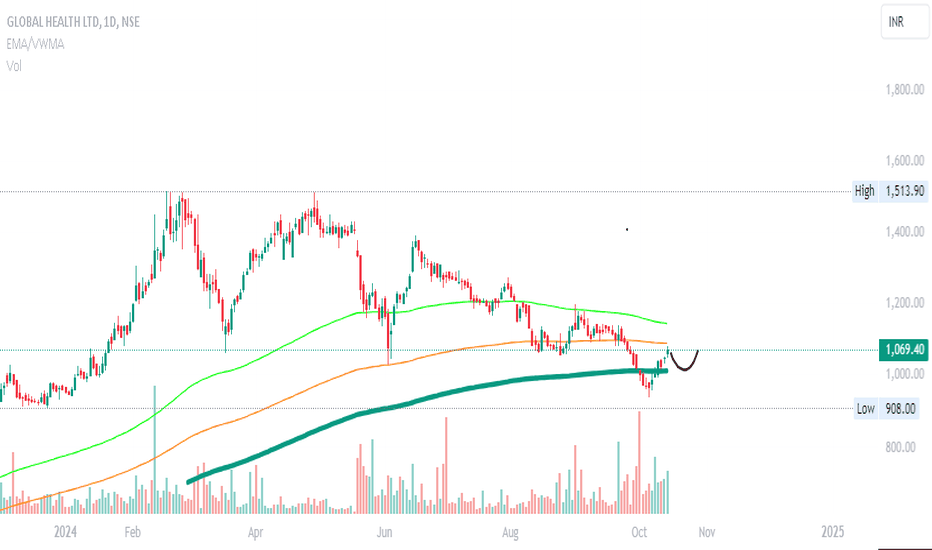

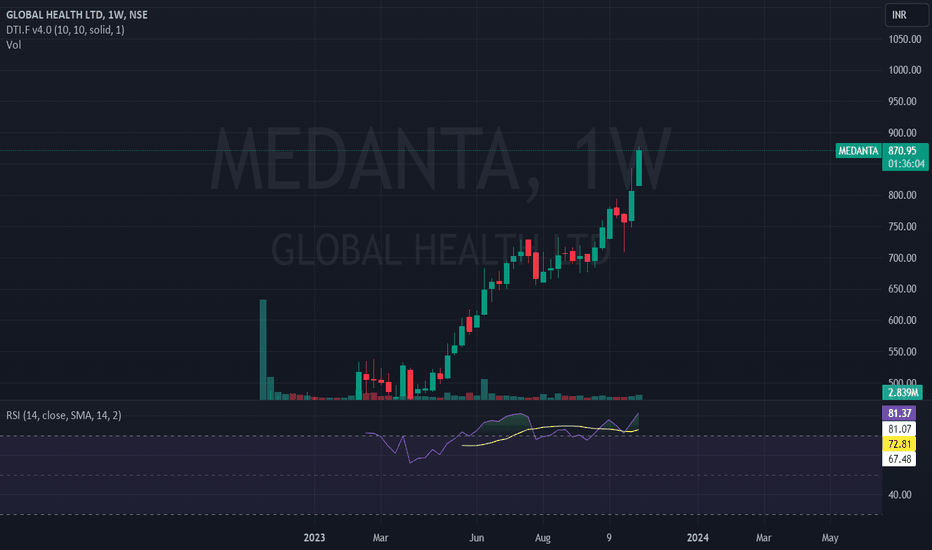

MEDANTA CMP 1235.Medanta is a QoQ and YoY Sales and Profit grower.YoO net profits are increasing consistently.On weekly time frame it bounce from a very important level.Chart show strength in this stock . Daily RSI shows a overbought zone . If sustain above levels we can see a strong rally for targets-1300........1350........1400.Add to your wishlist and how it perform in coming days.(Not a Buy Sell ) Only for study porpose.

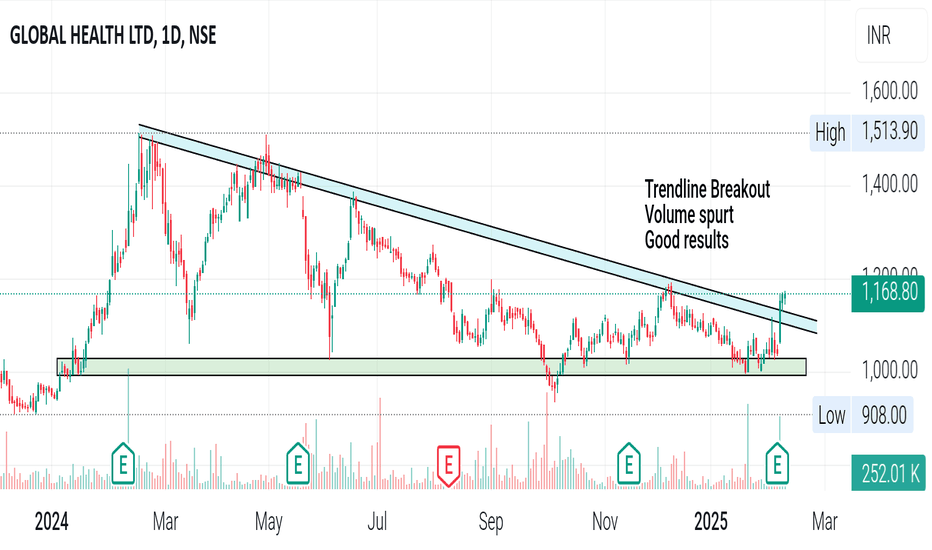

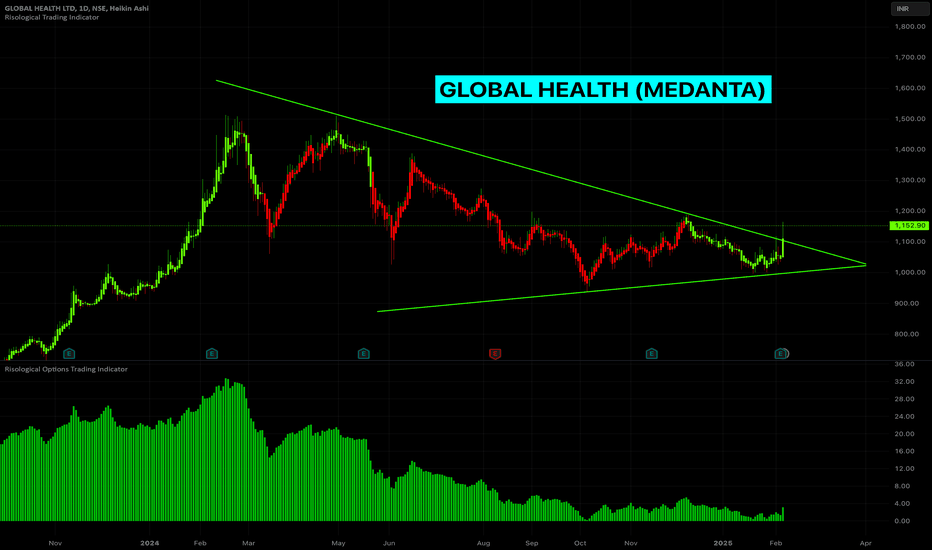

GLOBAL HEALTH LTD - Symmetrical Triangle BreakoutThis is still an open candle and need to wait till this candle closes in GREEN on Friday end of the day. If the candle is green and is clearly breaking out from the triangle on Friday, it is a Bullish sign.

On the daily time frame, the daily candle has closed in GREEN, which is a good sign.

The Risological indicators confirm the bullish movement as seen below.

ENTRY:

The stock can be purchased on the daily time frame as the Risological indicators gave the confirmation

EXIT:

Hold the BUY position till the Risological indicator gives a reversal

Exit on first RED candle close on the daily time frame.

OR, Exit if the Risological options trading indicator turns into RED.

Hope this helps!

Cheers!

__All info = educational only__

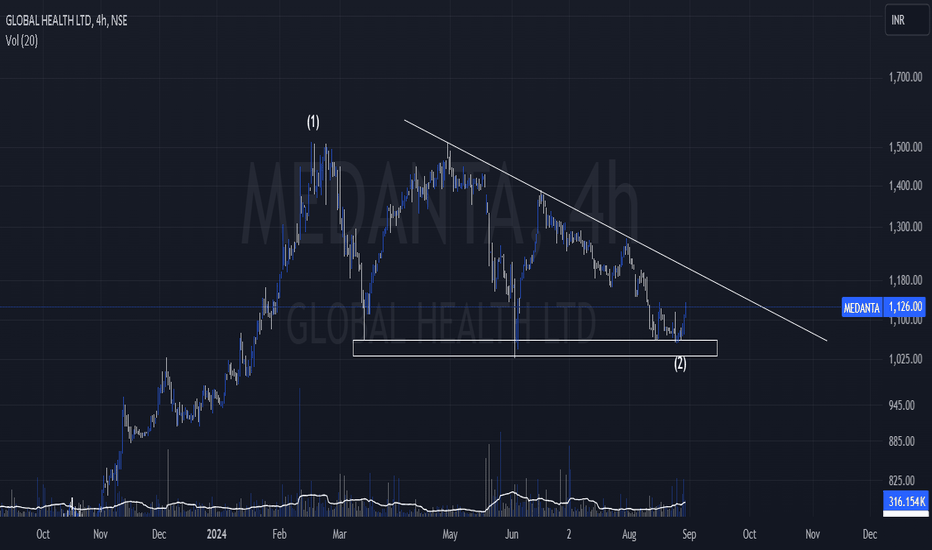

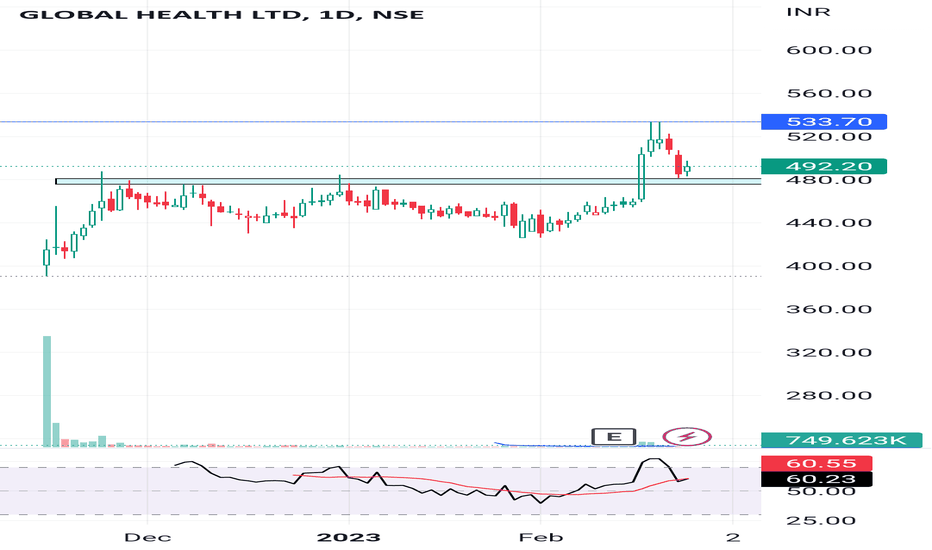

Pullback Trade in Global Health Ltd (MEDANTA)Stock Analysis

Global Health Ltd (MEDANTA) is forming a double bottom pattern.

This setup offers a very favorable risk to reward ratio.

Trading Strategy

Entry Point: Look for a breakout above the 1500 level.

Target and Stop Loss: Levels are plotted on the chart for guidance.

Stop Loss: Set your stop loss as indicated on the chart.

Target: Follow the target level for potential gains.

This pullback trade setup looks promising. Monitor the breakout and trade accordingly!