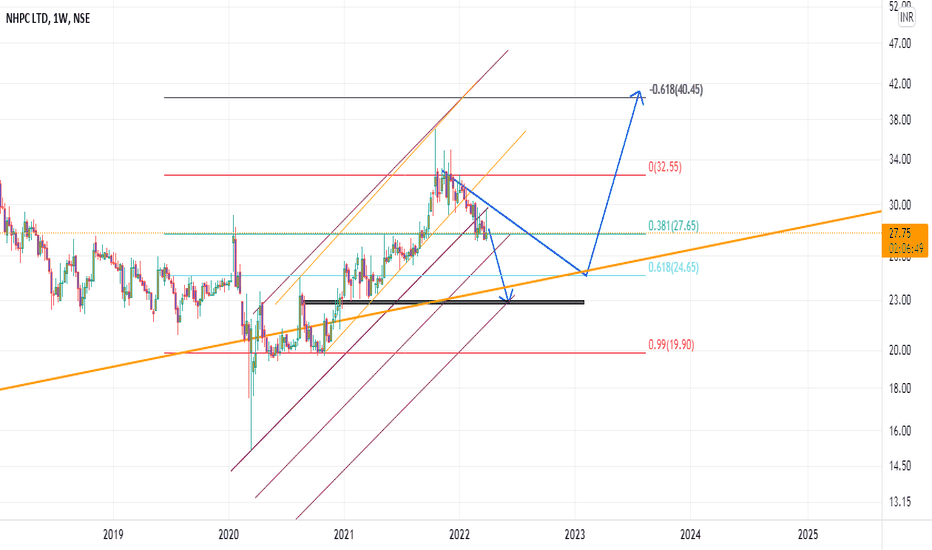

No Dullness Till now.Hello

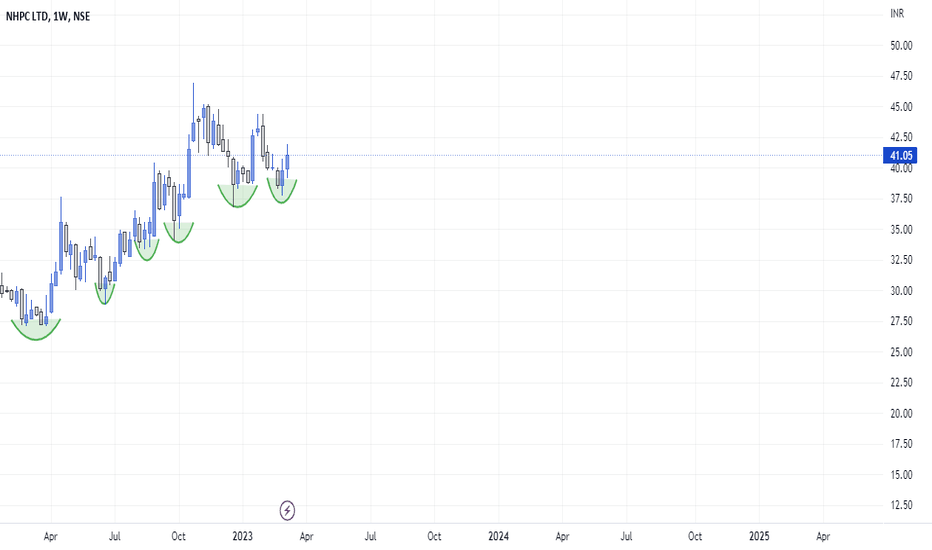

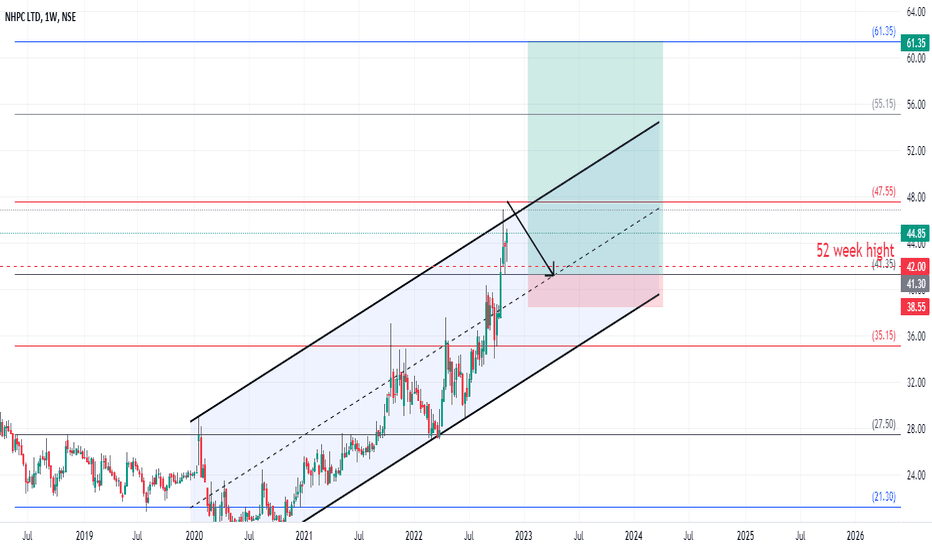

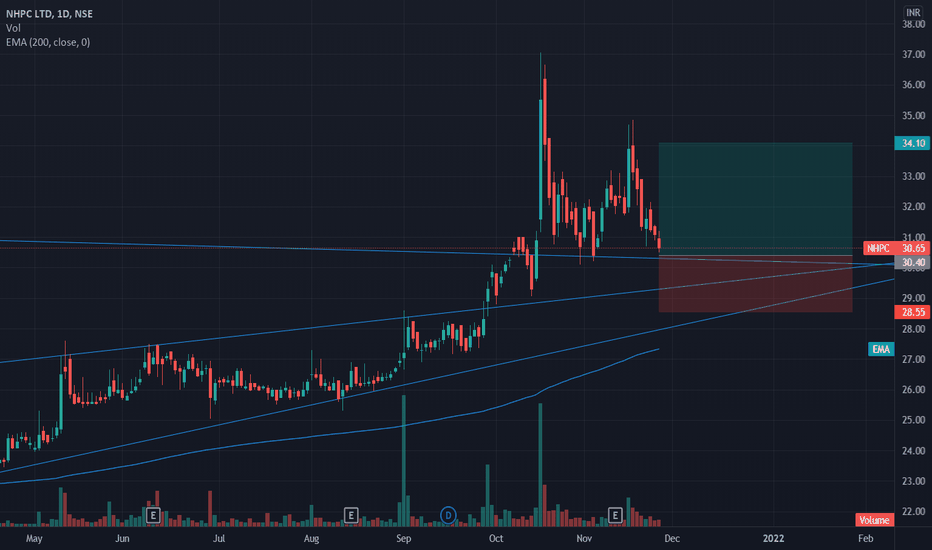

this script is looking in an up Trend as per me I am seeing a lower low and lower high continuously it is holding its lower low since March 2020 a perfect uptrend in this chart until it broke its lower low.

when it is making a low a buy should be punched. very low risk and the reward is great.

Rest you know the best.

Gratify if you appreciate the practice then you can like it, share it and

If you want me to investigate any chart for you then would cherish doing that for you.

Thank you for your time and support.

Stay safe.

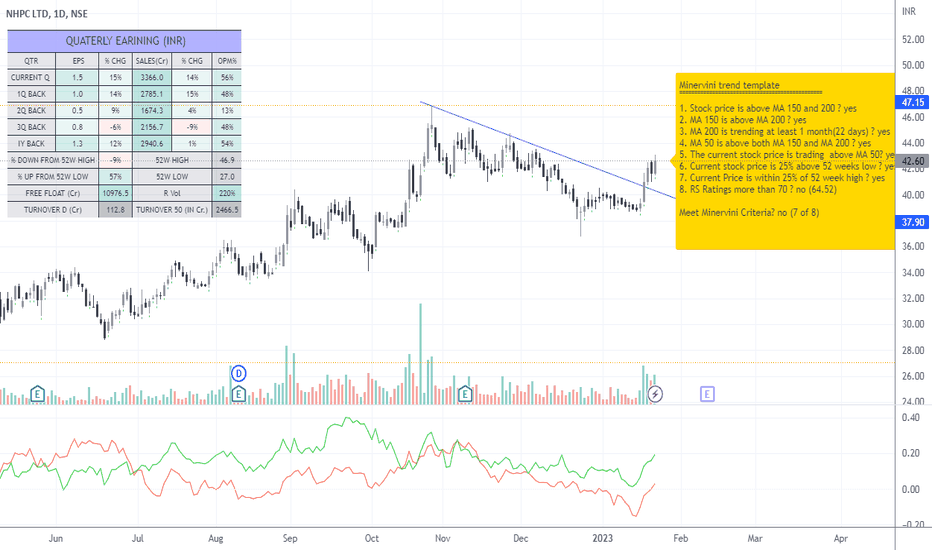

NHPC trade ideas

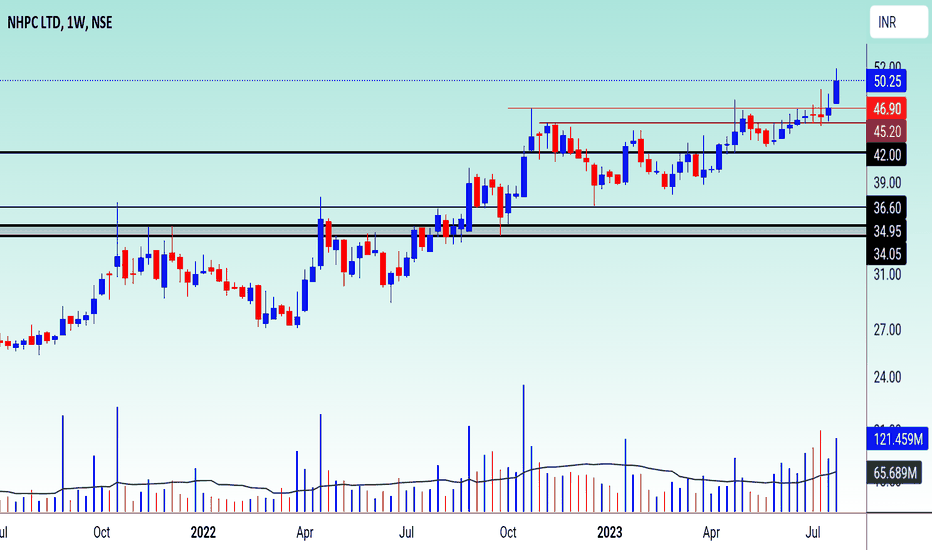

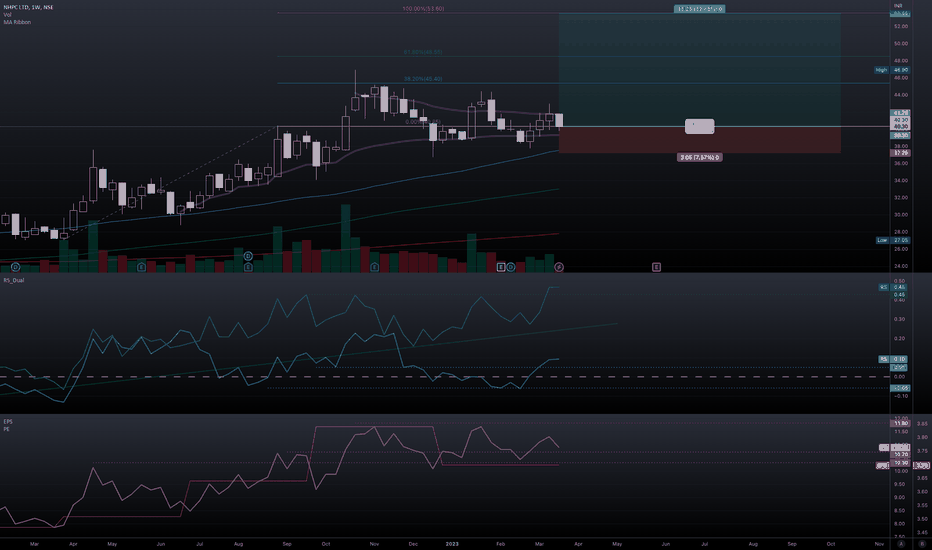

NHPC - Weekly Chart Analysis After breaking out of the rounding base in july-aug 2022 the stock consolidated and form a small base since then. This week it gave a breakout of this base too. Volume support is decent enough. Stock also trading above its key moving averages. Wait for minor confirmations and its good to go.

Disclaimer: This is just an analysis. It should not be considered as a buy/sell recommendation. If you intend to trade this counter then do your own due diligence and trade at your own risk.

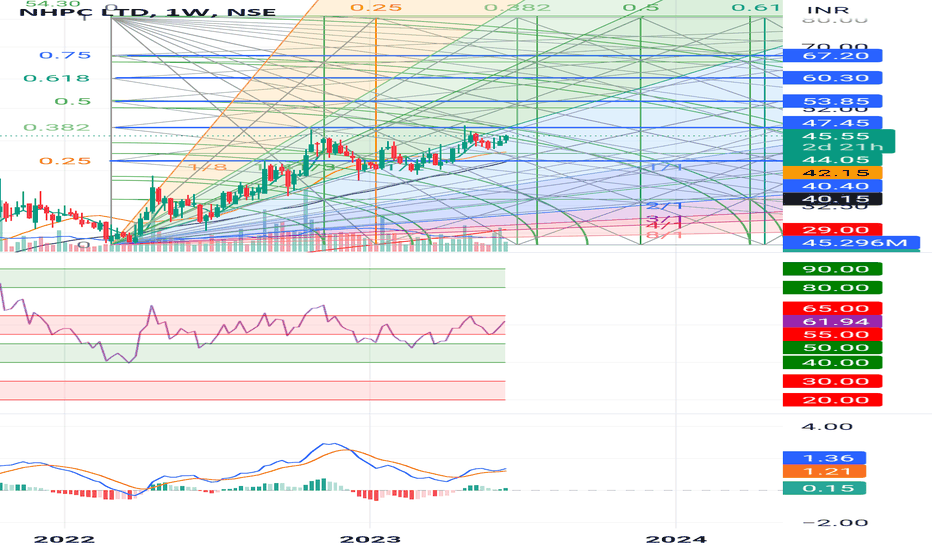

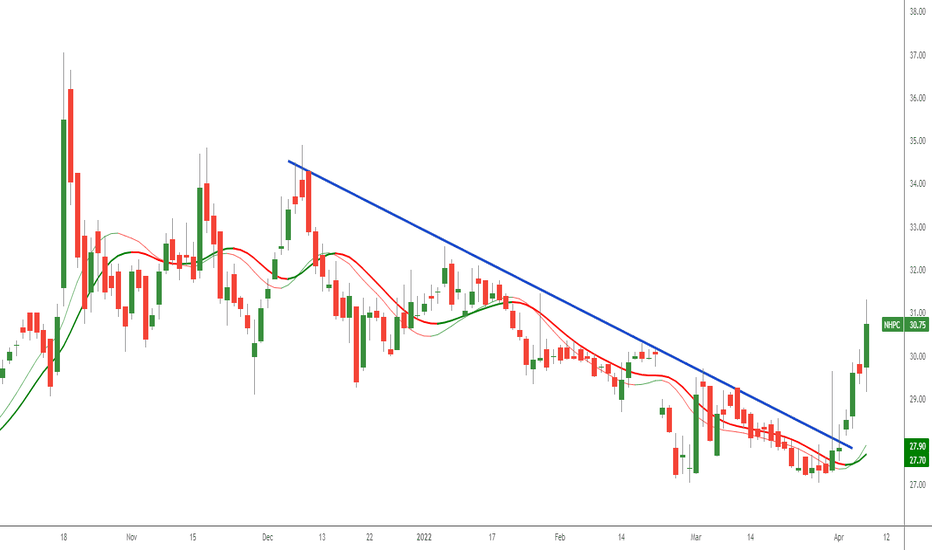

Trendline Breakout

Please look into the chart for a detailed understanding.

Consider these for short-term & swing trades with 2% profit.

For BTST trades consider booking

target for 1% - 2%

For long-term trades look out for resistance drawn above closing.

Please consider these ideas for educational purpose

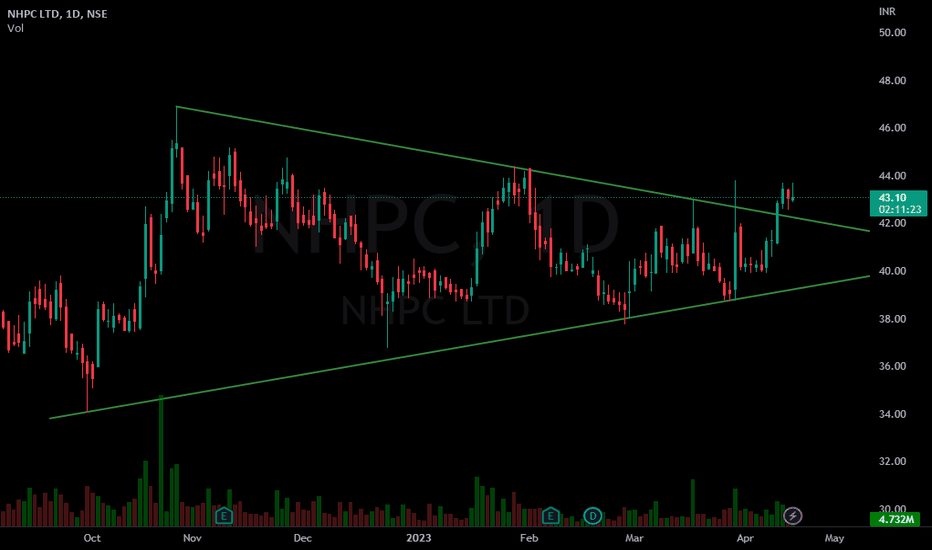

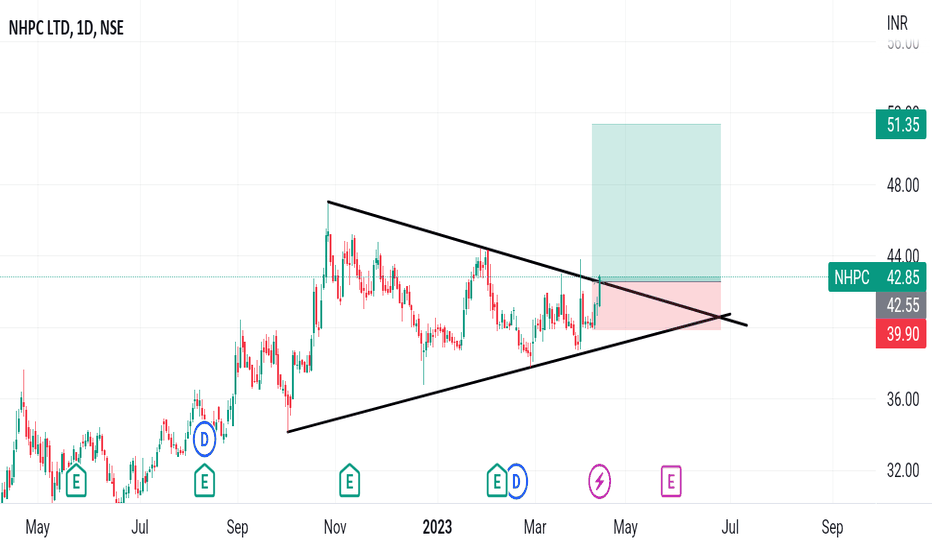

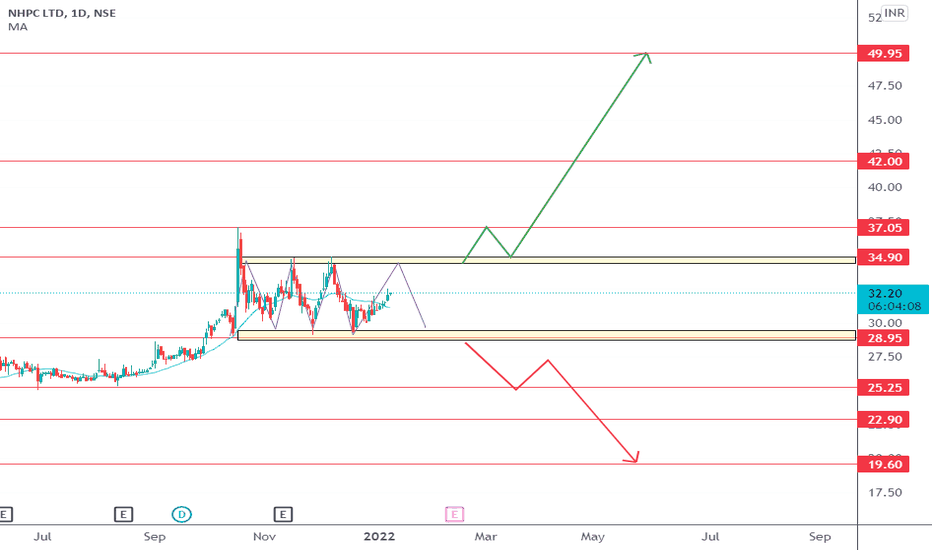

Triangle pattern BreakoutPlease look into the chart for a detailed understanding.

Consider these for short-term & swing trades with 2% profit.

For BTST trades consider booking

target for 1% - 2%

For long-term trades look out for resistance drawn above closing.

Please consider these ideas for educational purpose

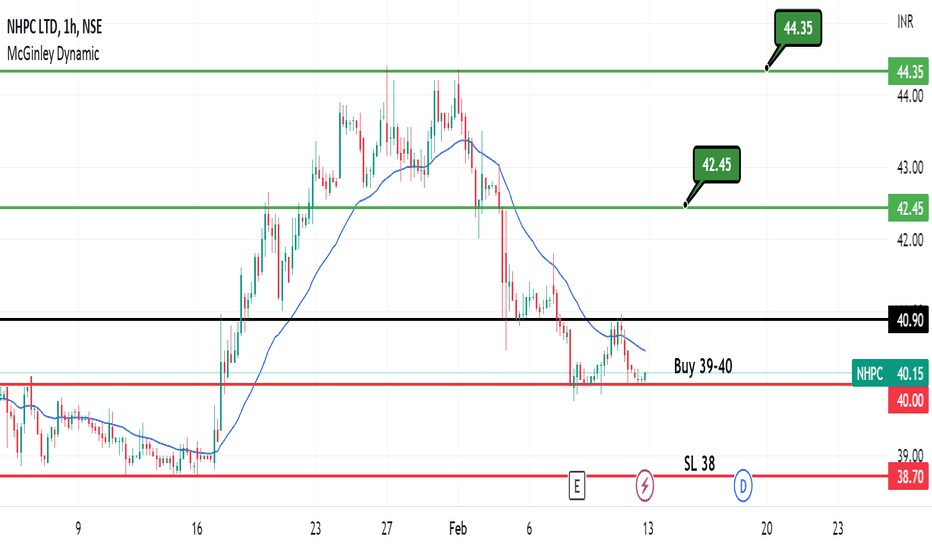

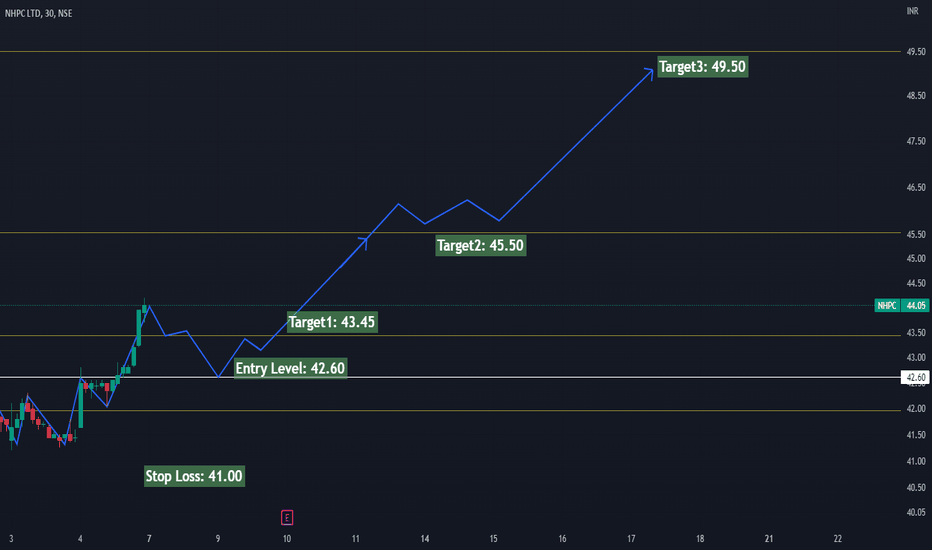

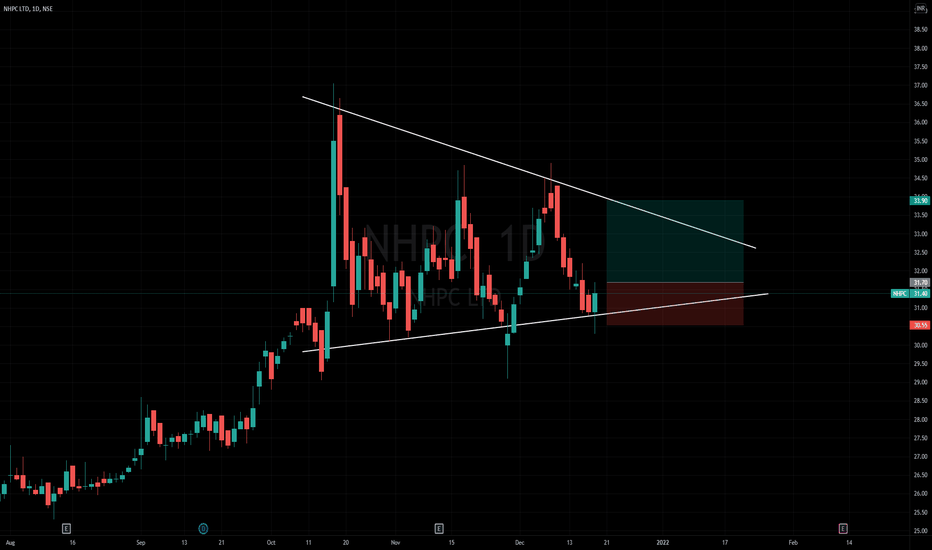

NHPC | Swing Long | R/R = 4.3> This is the only PSE stock which appeared to be having the best R/R

> Will consider to be strong if it sustains above A-VWAP: 41.75

> Volatility contraction happening - we might need to wait more time before eventual breakout in any direction.

> Need patience in this market

Note: InvestIn10 would ride this till Momentum exists. The Target & SL are for Swing Investors only.

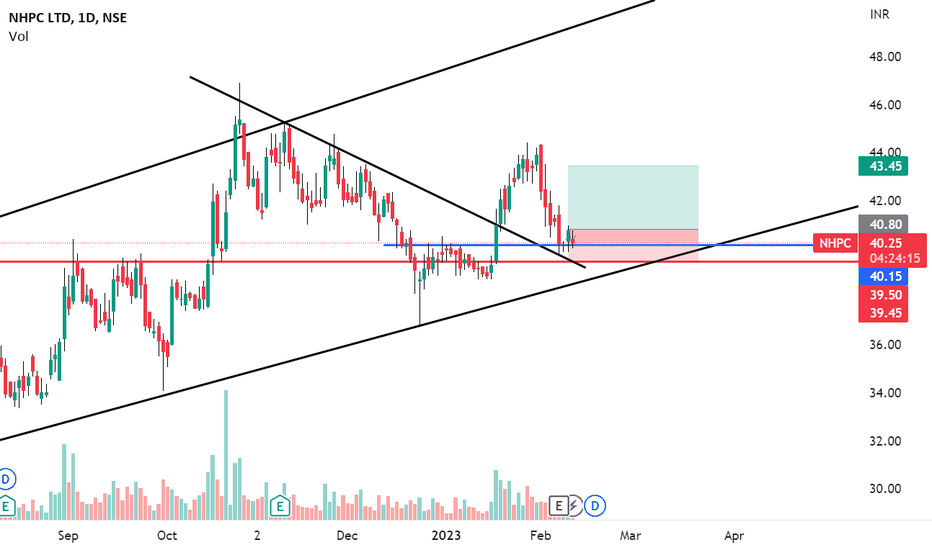

NHPC up side view.It will be best for me to take entry on NSE:NHPC once price retest level of 42.60.

Then hold the same positionally till three targets 43.45, 45.50 & 49.50

Will exit if price trade below level of 41 (only 1.60 point risk)

Note: This is my personal analysis, only for learning.

Thanks.

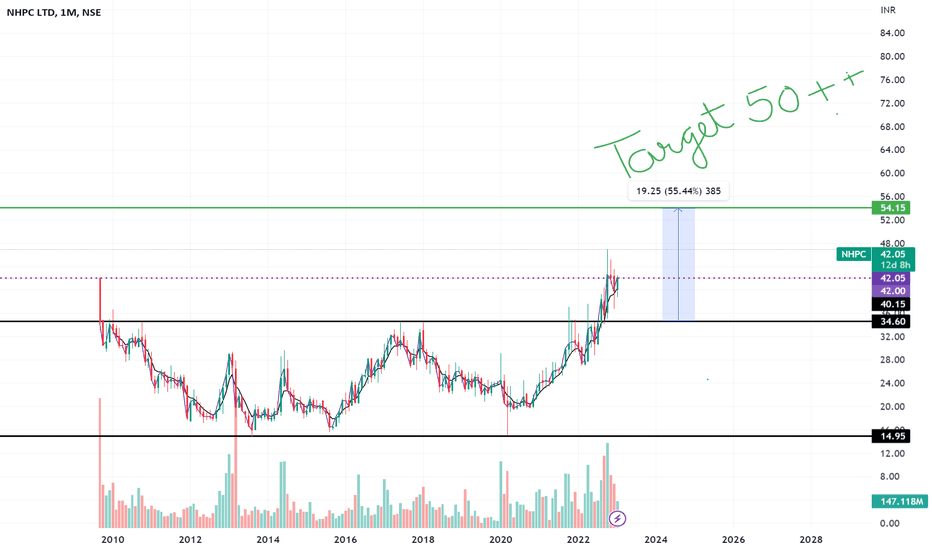

NHPC ROUNDING BOTTOM & MULTIYEAR # NHPC

Chart Time Frame: #MONTHLY

On All Time Frame (D/W/M) the Stock is about to give a Good Breakout of #ROUNDING BOTTOM Pattern & #MULTIYEAR after a long period of #10 years and it is also sustaining above the #Supply Zone from last 3 months which shows that any fall towards 35 will be a great opportunity to add the stock and fundamentals of the stock is also good and a good dividend paying Co.

So as per the Chart Stock looks Good for Long Position for Medium to Long Term as per the Levels given below:

CMP - 40.65 or BoD 35

Target 1 - 52

Target 2 - 62

Target 3 - 72 +

SL - 33.30

Holding Time Frame - Medium to Long Term

All charts posted here are only for EDUCATIONAL PURPOSE

NHPC - Bullish tradeMedium term trade -

Stock is giving a multi year decade long breakout

on big charts.

Stock is about to give a close above 34.50 on

monthly chart since 2010.

Stock is holding strong in this turbulent market.

To me, this is a meaningful breakout and as per

my experience, NHPC has potential to give 20-25%

gain in 6-9 months.

I am a buyer in this stock at CMP, and will add

more units as and when a dip comes around

31-32 levels. Trend is intact unless a closing

below 27 comes on weekly basis.