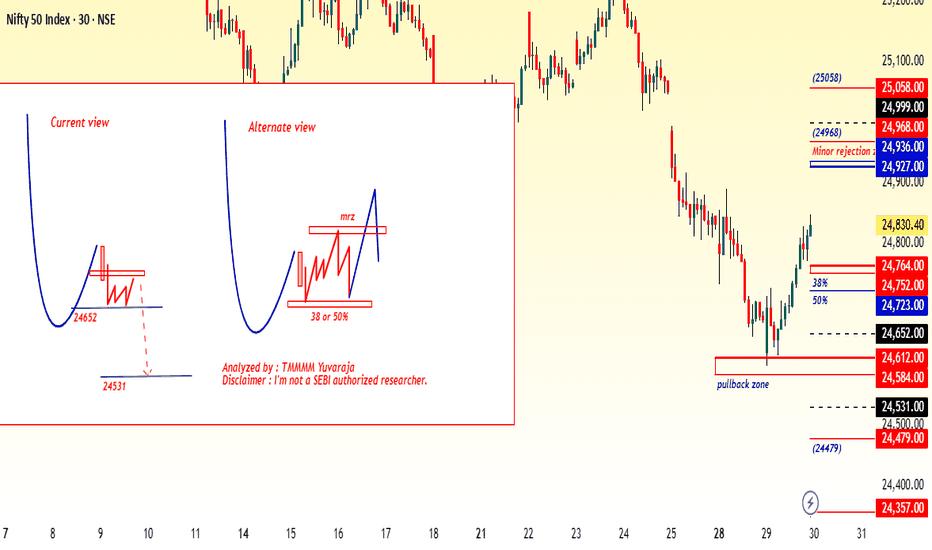

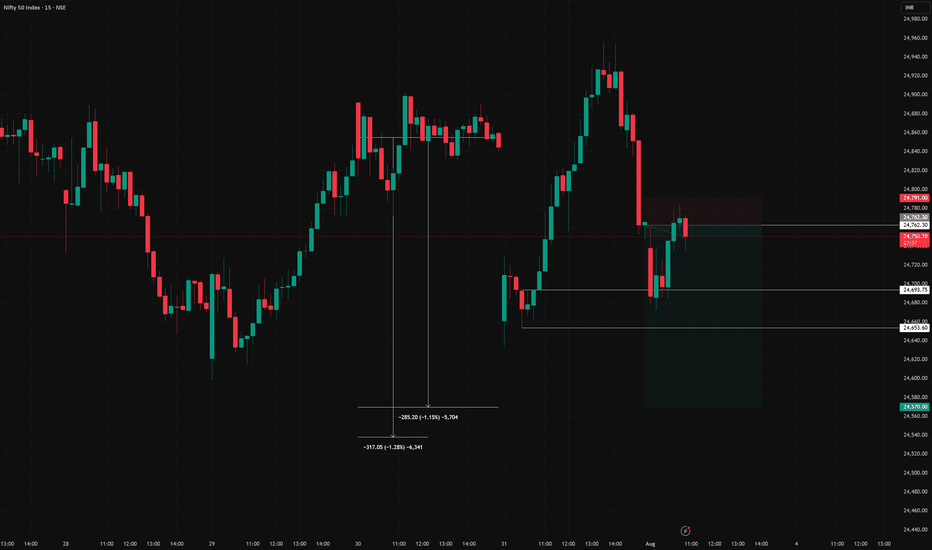

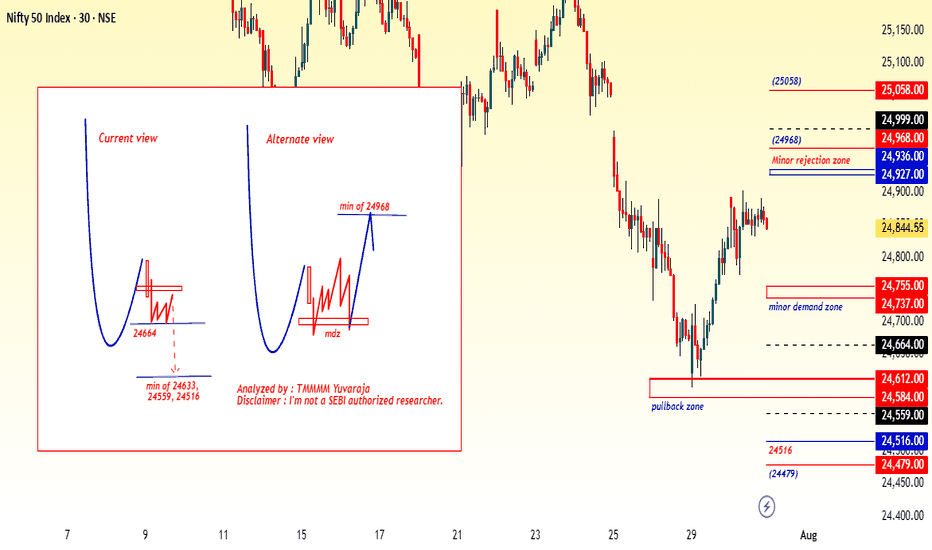

#Nifty directions and levels for July 30th:Good morning, friends! 🌞

Here are the market directions and levels for July 30th:

There have been no major changes in the global market. The global sentiment remains moderately bullish,

while the local market continues to show a bearish tone.

Today, Gift Nifty indicates a gap-down opening of aroun

About Nifty 50 Index

NIFTY 50 is the main index for the National Stock Exchange of India (NSE). It tracks the performance of the top 50 stocks by market capitalization from 13 sectors of the Indian economy. With such a relatively small number of companies within the index it still represents over 60% of the free float market capitalization of the stocks listed on NSE, and serves as a benchmark for fund portfolios and index funds. The list of the NIFTY 50 Index constituents is rescheduled every 6 month.

Related indices

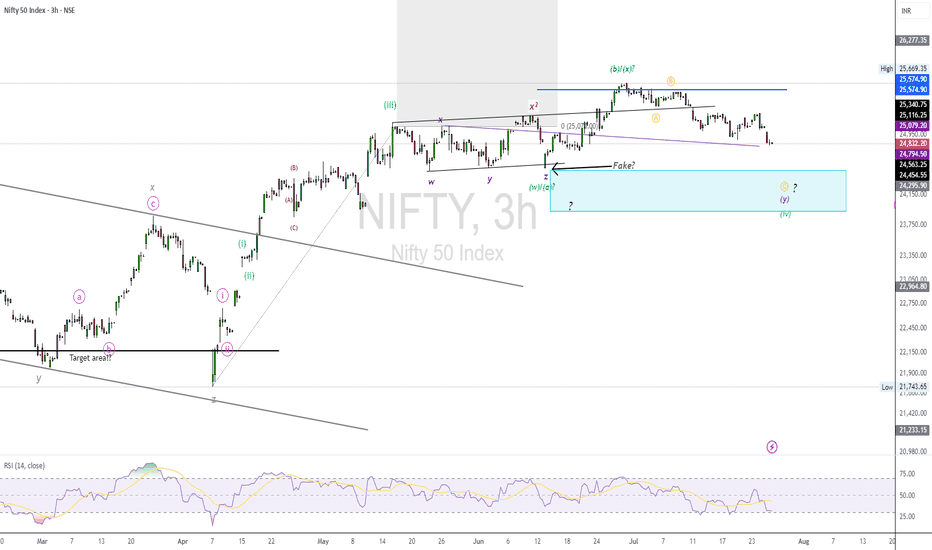

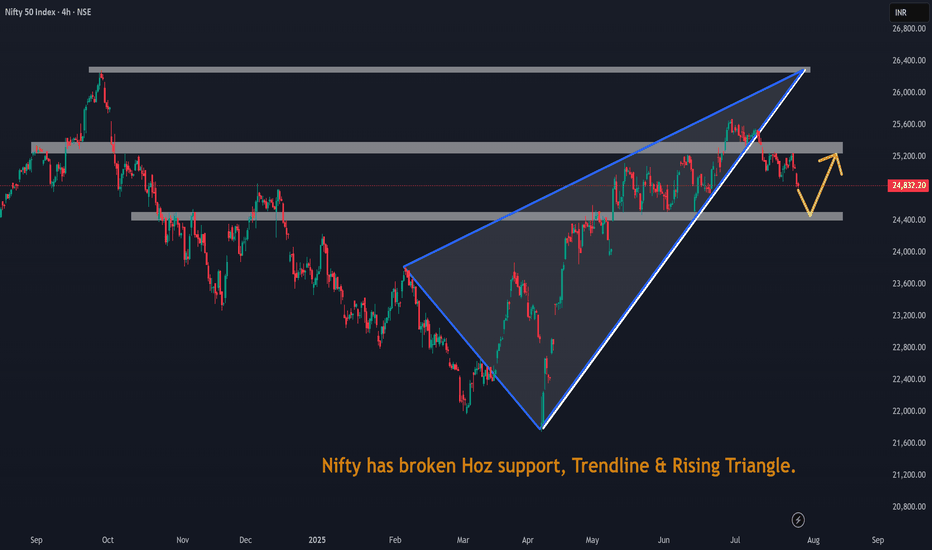

NIFTY50.....Miss a final sell-off!Hello Traders,

the NIFTY50 is moving within a sideways-range. It ranges from a possible wave ((iii)), with a green high @ 25116 and a low of 24508, the end of a wave z (pink) of a wave (w)/(a) of ((iv)) green!

What can we expect for the coming days?

I think, the final low is not in the cards yet! I

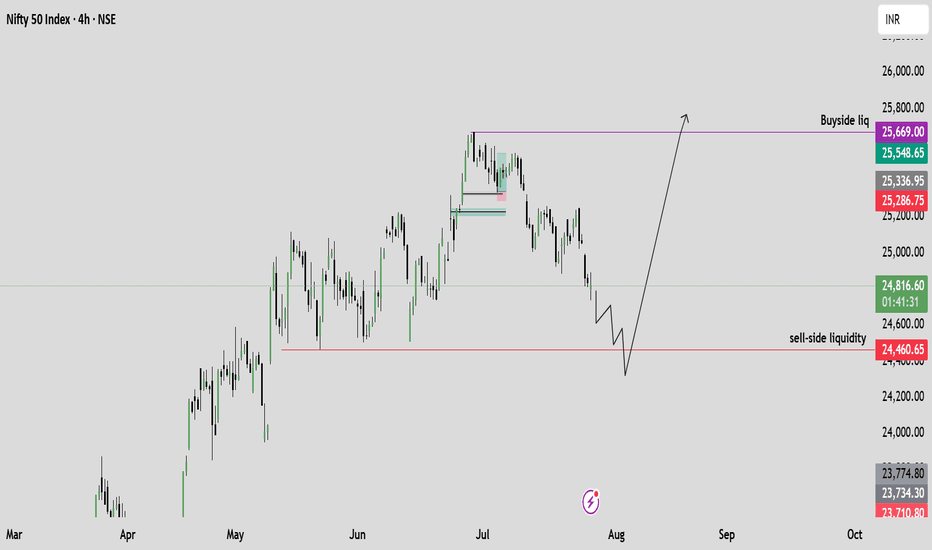

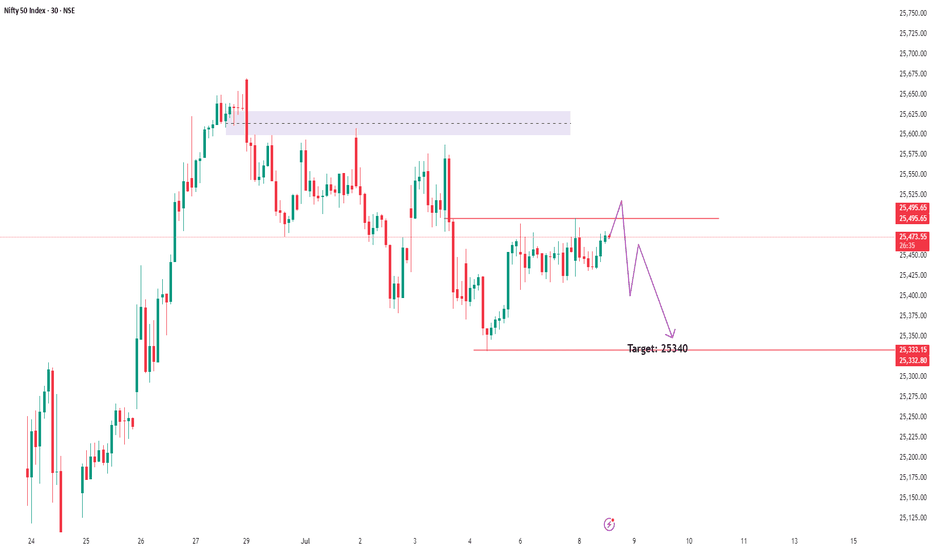

Bearish Outlook on Nifty – Based on Smart Money ConceptI'm seeing a clear downside setup on Nifty, with Smart Money indicating distribution and the market transitioning into a bearish trend.

📉 Target: 25,340

📍 Current Price: 25,474

🔍 Reasoning: Clear signs of institutional distribution and lower highs/lows forming. Smart Money is exiting, suggesting th

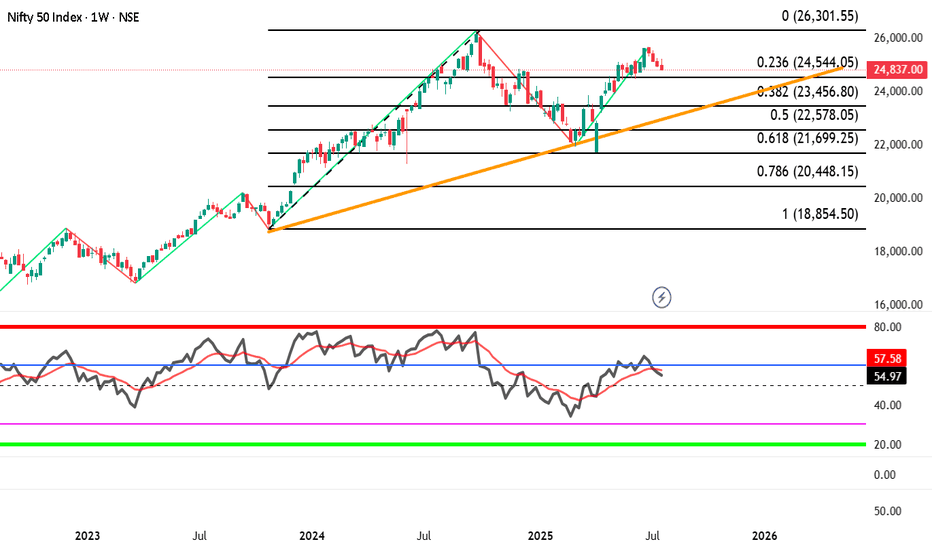

Nifty index showing downtrend with negative divergence BEARISH VIEW Nifty index --showing downtrend with negative divergence , watch out important trendline breakdown and fib. levels on nifty index.

if it happens than there might be BLOOD BATH IN MIDCAP AND SMALL CAP INDEX ALSO

Nifty index may fall big time if breaks 24544 than 23460, 22580, 21

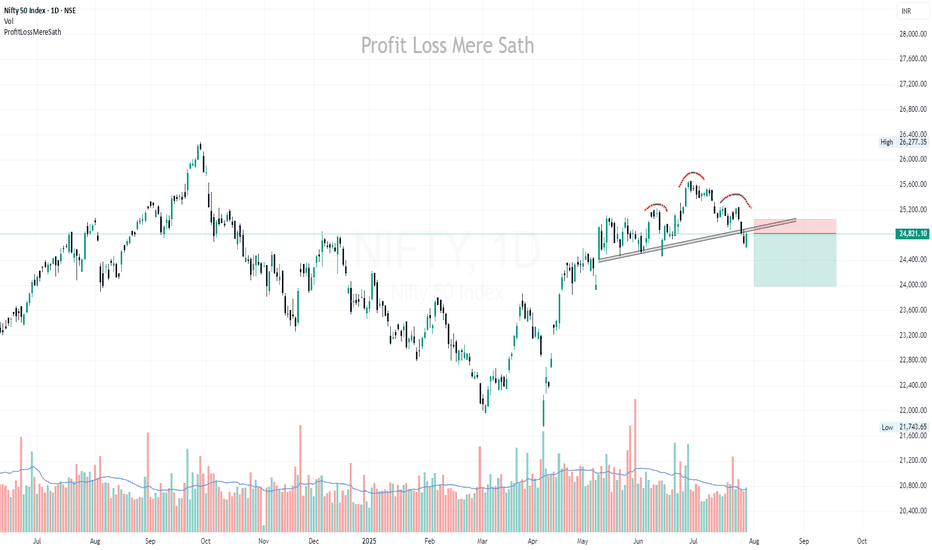

From Demand to Glory: Nifty’s Bullish March to 25,220 Nifty Bullish Outlook

-Current Price: 24,905 (approx)

- Key Demand Zone: 24,620 – 24,660

- Key Supply Zone: 25,200 – 25,240

Technical View

- Strong Demand Bounce: Nifty reversed sharply from the demand zone (24,620–24,660),

indicating strong buying interest.

- Trend Breakout Potential: Pric

#Nifty directions and levels for July 31st:Good morning, friends! 🌞

Here are the market directions and levels for July 31st:

In the past two sessions, the global market (based on Dow Jones) has shown a moderately bearish sentiment,

while the local market continues to reflect a bearish tone.

Today, Gift Nifty indicates a gap-down opening of

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current value of Nifty 50 Index is 24,565.35 INR — it has fallen by −0.82% in the past 24 hours. Track the index more closely on the Nifty 50 Index chart.

Nifty 50 Index reached its highest quote on Sep 27, 2024 — 26,277.35 INR. See more data on the Nifty 50 Index chart.

The lowest ever quote of Nifty 50 Index is 279.00 INR. It was reached on Jul 3, 1990. See more data on the Nifty 50 Index chart.

Nifty 50 Index value has decreased by −1.78% in the past week, since last month it has shown a −4.00% decrease, and over the year it's decreased by −1.86%. Keep track of all changes on the Nifty 50 Index chart.

The top companies of Nifty 50 Index are NSE:RELIANCE, NSE:HDFCBANK, and NSE:TCS — they can boast market cap of 214.97 B INR, 176.99 B INR, and 125.56 B INR accordingly.

The highest-priced instruments on Nifty 50 Index are NSE:MARUTI, NSE:ULTRACEMCO, and NSE:BAJAJ_AUTO — they'll cost you 12,302.00 INR, 12,113.00 INR, and 8,044.50 INR accordingly.

The champion of Nifty 50 Index is NSE:ETERNAL — it's gained 31.93% over the year.

The weakest component of Nifty 50 Index is NSE:INDUSINDBK — it's lost −45.27% over the year.

Nifty 50 Index is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy Nifty 50 Index futures or funds or invest in its components.

The Nifty 50 Index is comprised of 50 instruments including NSE:RELIANCE, NSE:HDFCBANK, NSE:TCS and others. See the full list of Nifty 50 Index components to find more opportunities.