#Nifty directions and levels for July 30th:Good morning, friends! 🌞

Here are the market directions and levels for July 30th:

There have been no major changes in the global market. The global sentiment remains moderately bullish,

while the local market continues to show a bearish tone.

Today, Gift Nifty indicates a gap-down opening of around 40 points.

What can we expect today?

In the previous session, both Nifty and Bank Nifty took a solid pullback after the gap-down start.

However, neither of them broke the 38% Fibonacci level in the current swing.

So, unless the 38% level is broken, we should continue to approach the market with a bearish view.

At the same time, key parameters have been lagging recently, which has made it difficult for the market to take a clear direction.

My primary expectation is consolidation within the previous day's range.

However, if the market breaks the bottom with a solid structure, then we can expect the correction to continue.

NIFTY trade ideas

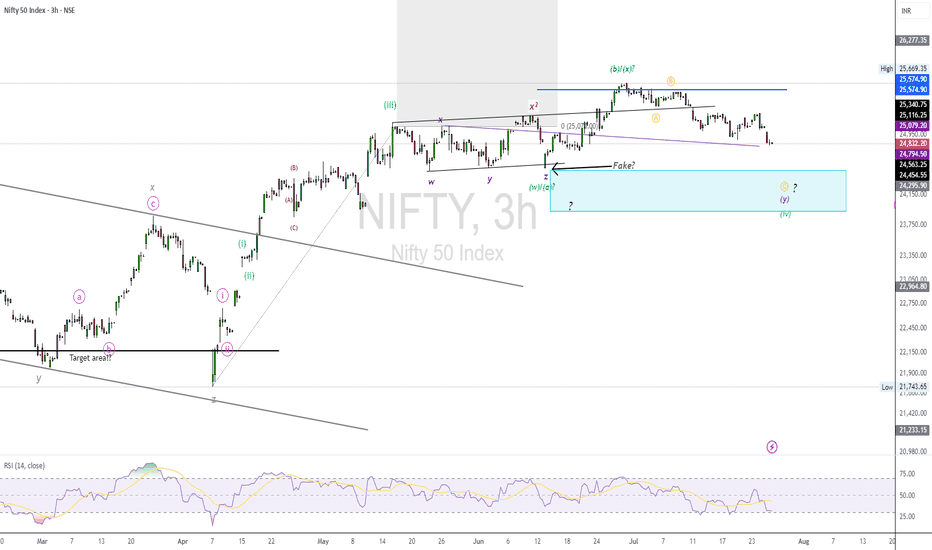

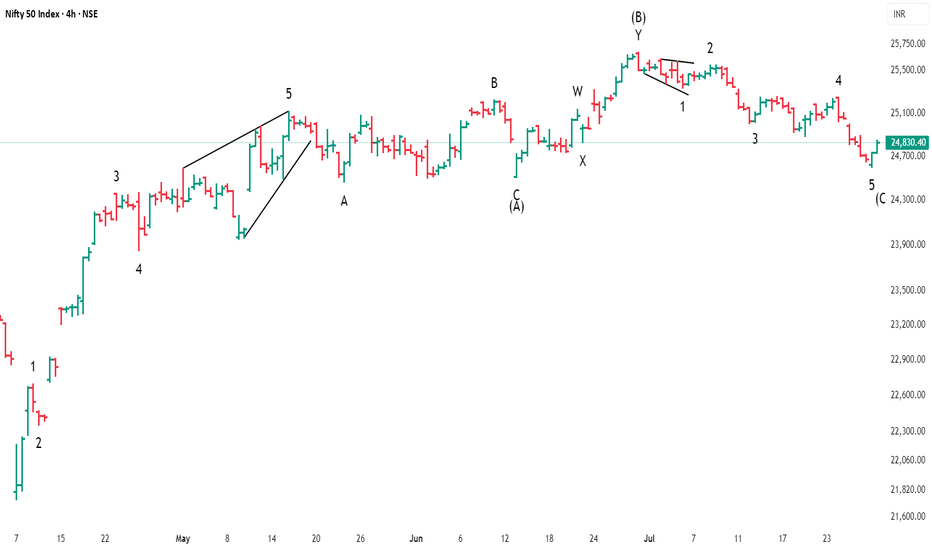

NIFTY50.....Miss a final sell-off!Hello Traders,

the NIFTY50 is moving within a sideways-range. It ranges from a possible wave ((iii)), with a green high @ 25116 and a low of 24508, the end of a wave z (pink) of a wave (w)/(a) of ((iv)) green!

What can we expect for the coming days?

I think, the final low is not in the cards yet! I miss a final "sell-off" that will take N50 down into the range of the rectangle, sky-blue, for the coming days. That means, a possible finale low would be around the 24473 to 23935 points.

If so to come, a break of the 25250 area probably would open the door to 25580 area in the next 2 weeks. If this high were to occur, it would end wave ((iii), in pink, with a wave (iv), pink, to follow. Seasonally, that would fit well into the structure 'til end of September/ mid-October!

Anyway! As can be seen at the 3h chart, there is a divergence at RSI (standard deviation 14). This, more often than not, indicates a change of trend, in this case to the upside! However, the daily RSI has room to decline for the reminder of the week.

So, again. The structure seems to be not done to the downside, and I expect a new low, below the Friday's low, to come.

Have a great week.....

Ruebennase

Please ask or comment as appropriate.

Trade on this analysis at your own risk.

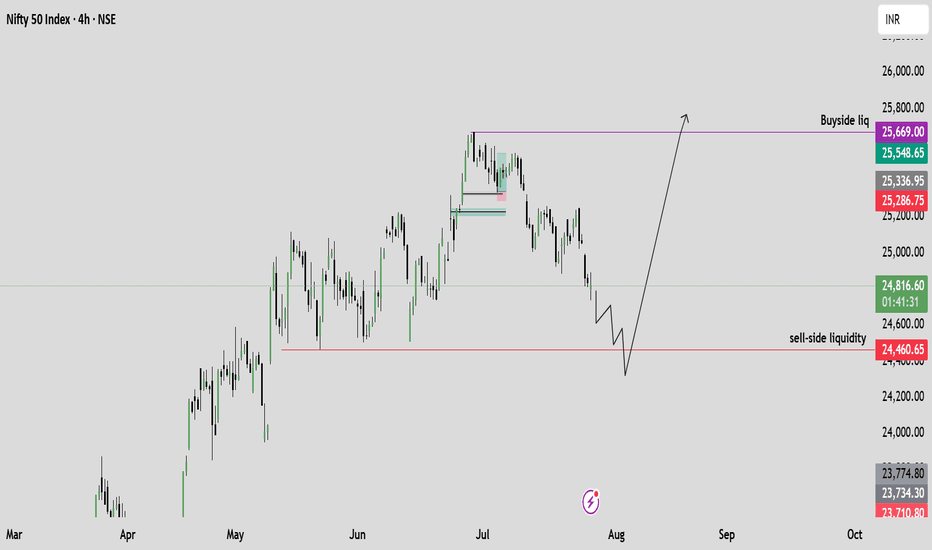

Bearish Outlook on Nifty – Based on Smart Money ConceptI'm seeing a clear downside setup on Nifty, with Smart Money indicating distribution and the market transitioning into a bearish trend.

📉 Target: 25,340

📍 Current Price: 25,474

🔍 Reasoning: Clear signs of institutional distribution and lower highs/lows forming. Smart Money is exiting, suggesting the beginning of a deeper correction.

Will monitor closely for any change in structure, but as of now, bias remains strongly bearish.

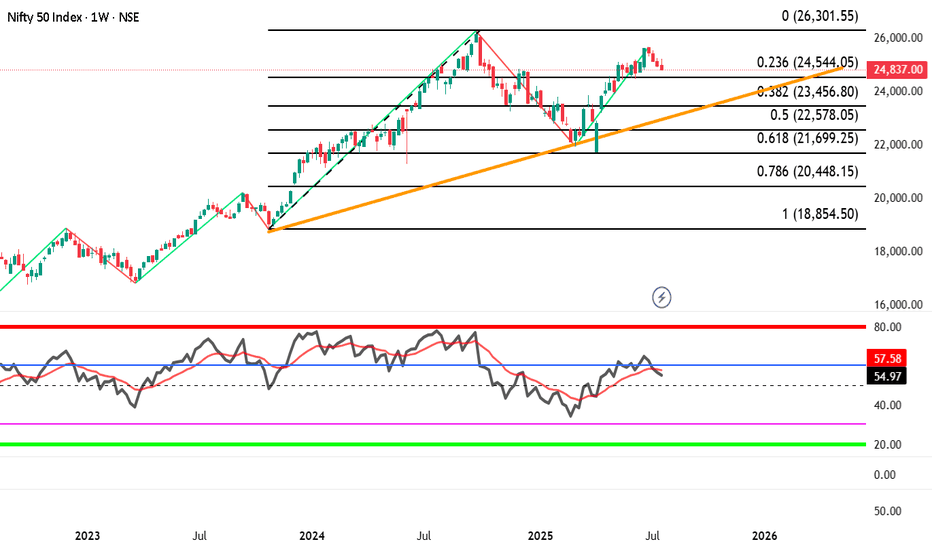

Nifty index showing downtrend with negative divergence BEARISH VIEW Nifty index --showing downtrend with negative divergence , watch out important trendline breakdown and fib. levels on nifty index.

if it happens than there might be BLOOD BATH IN MIDCAP AND SMALL CAP INDEX ALSO

Nifty index may fall big time if breaks 24544 than 23460, 22580, 21700 possible.

lets see

From Demand to Glory: Nifty’s Bullish March to 25,220 Nifty Bullish Outlook

-Current Price: 24,905 (approx)

- Key Demand Zone: 24,620 – 24,660

- Key Supply Zone: 25,200 – 25,240

Technical View

- Strong Demand Bounce: Nifty reversed sharply from the demand zone (24,620–24,660),

indicating strong buying interest.

- Trend Breakout Potential: Price is approaching resistance near 24,920; a breakout could push

towards the supply zone at 25,220 (target).

- Momentum Structure: Higher lows formed after the demand zone test, showing bullish

strength.

News & Data Supporting Bullish Bias

- India’s Q1 GDP Growth: The latest estimates show strong economic growth, supporting equity

market sentiment.

- FIIs Turning Buyers: Foreign Institutional Investors (FIIs) have been net buyers over the past

few sessions, supporting index upside.

- Global Market Tone: US and Asian equities are stable, and crude oil prices are moderating,

supporting risk appetite.

- RBI Policy Outlook: Market expects no immediate rate hikes, keeping liquidity positive for

equities.

Expectation

If Nifty sustains above 24,900, we expect a bullish move towards 25,220 in the short term.

Stop-loss: Below 24,780 (to manage risk).

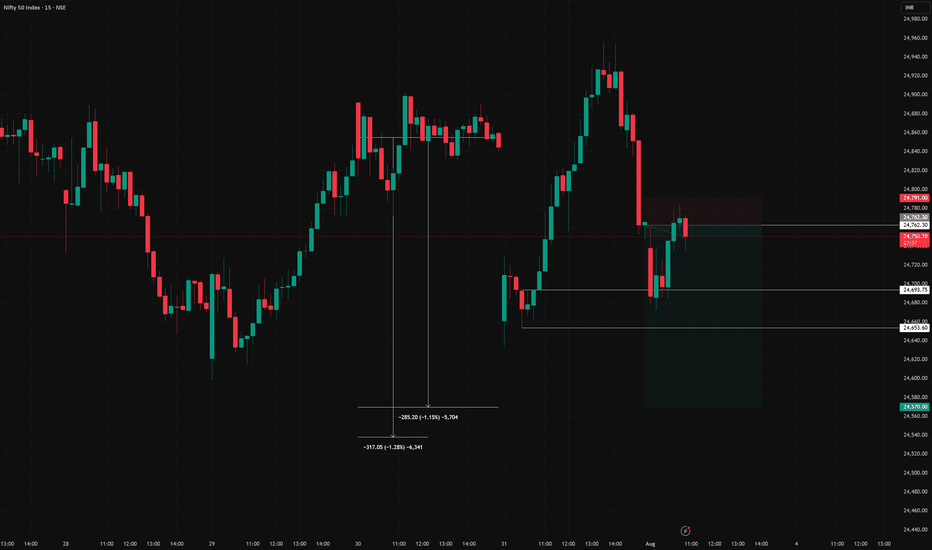

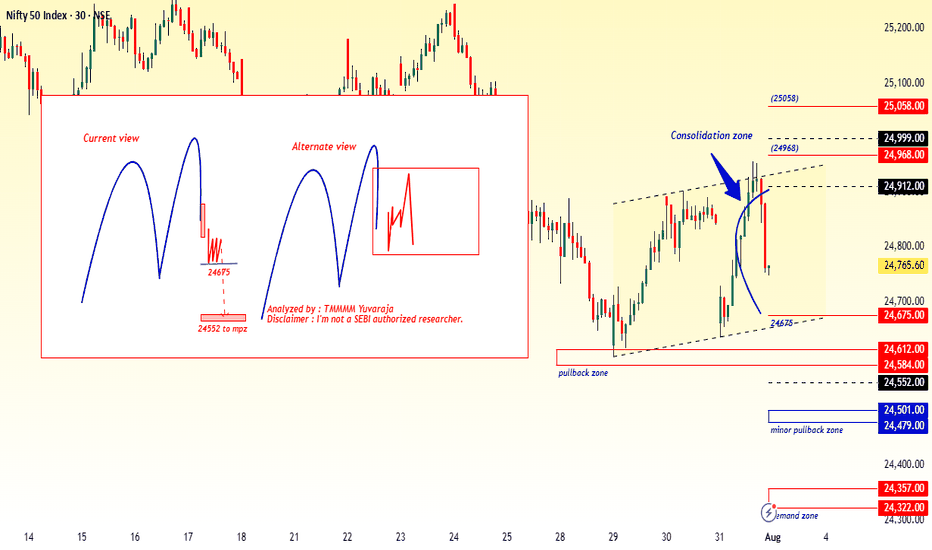

#Nifty directions and levels for July 31st:Good morning, friends! 🌞

Here are the market directions and levels for July 31st:

In the past two sessions, the global market (based on Dow Jones) has shown a moderately bearish sentiment,

while the local market continues to reflect a bearish tone.

Today, Gift Nifty indicates a gap-down opening of around 160 points (as per the chart).

What can we expect today?

In the previous session, both Nifty and Bank Nifty went through consolidation.

Structurally, we are still in a bearish tone, and with Gift Nifty indicating a gap-down start,

if the market breaks the immediate support levels with a solid candle, we can expect further correction.

On the other hand, if it finds support there, then the range-bound movement is likely to continue.

Which means, if the initial market takes a pullback, we can expect consolidation within the previous day’s range.

#Nifty directions and levels for August 1st:Good morning, friends! 🌞

Here are the market directions and levels for August 1st:

The global market (based on the Dow Jones) has shown a moderately bearish sentiment,

while the local market continues to display a bearish tone.

Today, Gift Nifty indicates a neutral opening.

What can we expect today?

In the previous session, both Nifty and Bank Nifty experienced high volatility.

However, the closing happened around the middle of the current swing, indicating a possible range-bound market. Until this range is broken, we cannot expect a strong directional move.

If the range breaks, we can follow the breakout direction.

In my side, the structures of Nifty and Bank Nifty appear slightly different. Nifty continues to show bearish sentiment, whereas Bank Nifty is showing signs of a mild bounce back. So, they may counterbalance each other, and if that happens, we may see a neutral closing by the end of the day.

On the other hand, if the market breaks immediate support or resistance with a solid candle or after consolidation, we can expect a directional move in that breakout direction.

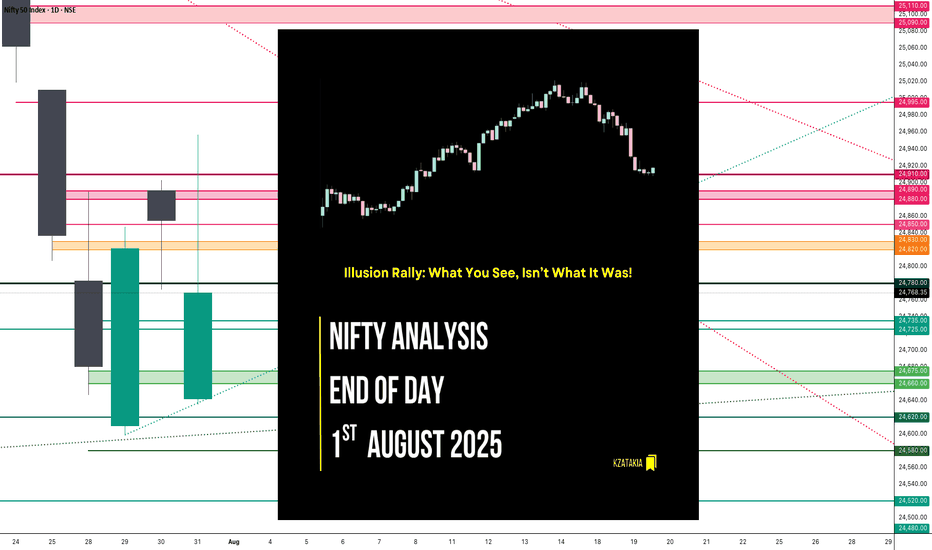

Nifty Analysis EOD – August 1, 2025 – Thursday🟢 Nifty Analysis EOD – August 1, 2025 – Thursday 🔴

🎢 Illusion Rally: What You See, Isn’t What It Was!

🧾 Nifty Summary

As we all expected, a negative gap-down opening occurred due to external news. Nifty opened 183 points lower, tested the 24,660–24,675 support zone, then rebounded sharply after a symmetrical triangle + VWAP breakout. The rally pierced through all key levels like a hot knife through butter, topping at 24,950, only to reverse with equal intensity. Closed at 24,765.

📌 Despite the technical structure, today’s move had no clear technical reasoning — more likely triggered by a mix of tariff news, confidence in Modi, weekly + monthly expiry, and manipulation.

📌 in spite of a bullish candle, strong upper rejection from 24,950 hints weakness. Candle appears bullish on colour, but bears dominated intraday close — forming a bearish Moboroshi Candle (illusion of strength).

📌 Bearish Moboroshi Candle Structure : close > open and close < Previous Close

🔍 Intraday Walk

📉 Gap down of 183 pts

🟢 Support held at 24,660–24,675

🔺 Symmetrical triangle + VWAP breakout

🚀 Sharp upmove to 24,950 zone

🔁 Reversal with same intensity

📉 Closed at 24,765 — below prior close

🖼 5 Min Time Frame Chart with Intraday Levels

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 24,642.25

High: 24,956.50

Low: 24,635.00

Close: 24,768.35

Change: −86.70 (−0.35%)

Candle Structure:

✅ Green Candle (Close > Open) → +126.10 pts real body

⬆️ Upper Wick → 188.15 pts (Very Long)

⬇️ Lower Wick → 7.25 pts (Tiny)

Interpretation:

Opened near yesterday's low

Intraday sharp rally towards 24,950+

Faced strong selling at highs

Closed above open, but way below high — signals clear rejection

Candle Type:

📌 Bearish Moboroshi Candle — Appears bullish but hides weakness

🧠 Buyers strong initially, but sellers took control at the top

Key Insight:

Bulls need decisive close above 24,880–24,910

Else, expect drift back toward 24,660–24,675

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 208.29

IB Range: 93.95 → Medium

Market Structure: Unbalanced

Trades Triggered:

✅ 10:40 AM – Long Entry → Trailing Target Hit (R:R – 1:6.25)

📌 Trade Summary: Big R:R win today on breakout with trailing logic execution!

🧱 Support & Resistance Levels

🔺 Resistance Zones:

24,820 ~ 24,830

24,850

24,880 ~ 24,890

24,910

🔻 Support Zones:

24,780

24,725 ~ 24,715

24,660 ~ 24,650

24,620 ~ 24,600

💭 Final Thoughts

"When the move can’t be explained, the best position is caution."

Today's market behavior reinforces the idea that not all moves are technical. Keep your tools sharp, but don’t ignore contextual chaos.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

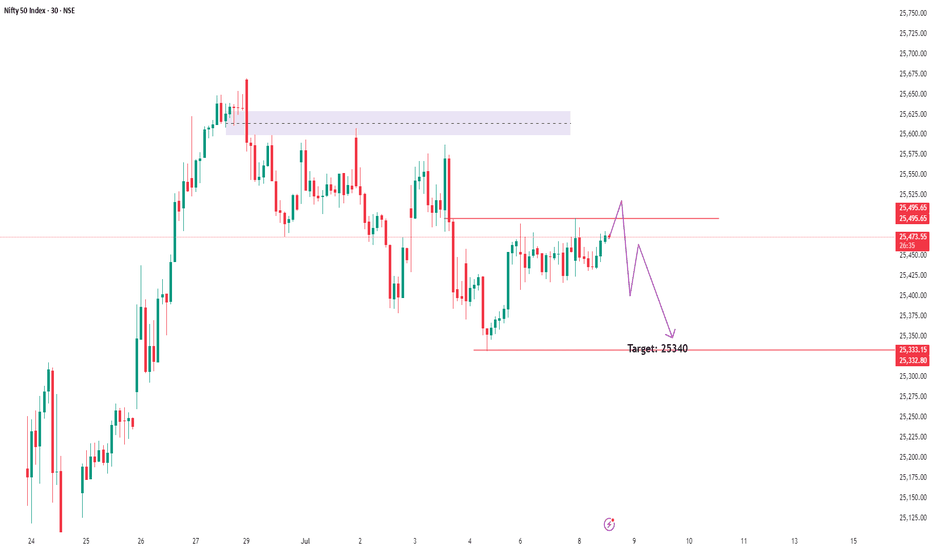

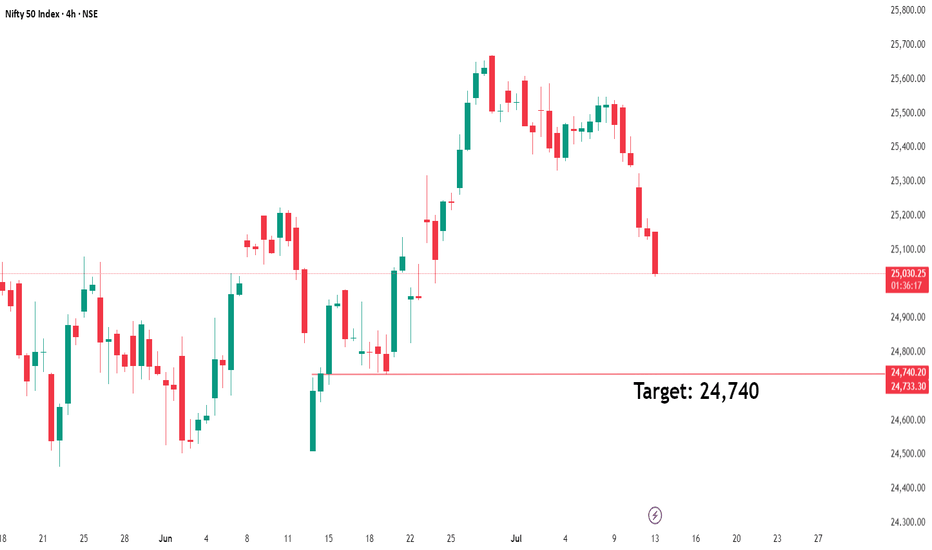

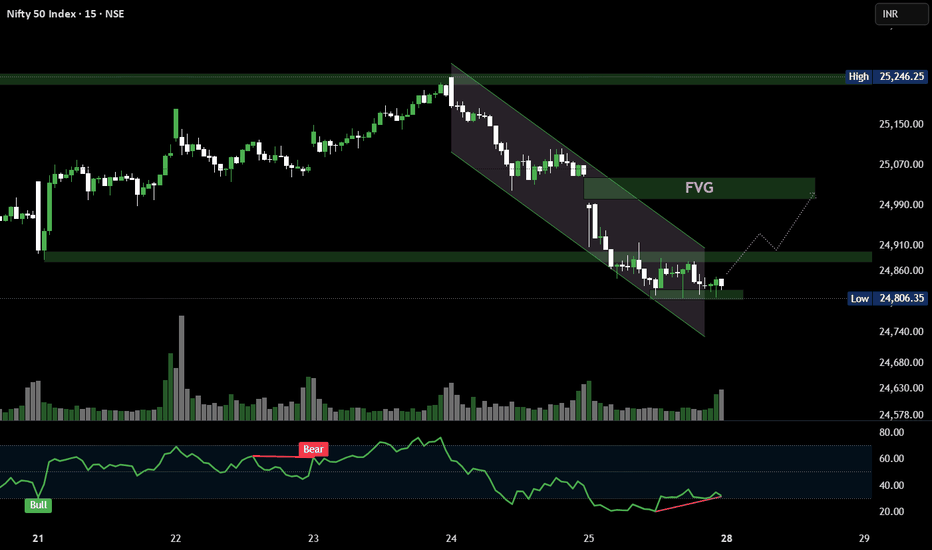

NIFTY 24740: Smart Money Signals Bearish Move IncomingThe directional bias is clear – bearish – and I'm currently waiting for a precise setup to present itself. Based on the Smart Money Concept, we could be looking at a potential short opportunity around the 24740 zone.

📍 Once the setup is confirmed, I’ll be sharing the exact entry and stop-loss levels with you.

Stay tuned – patience here is key. Let the market come to us.

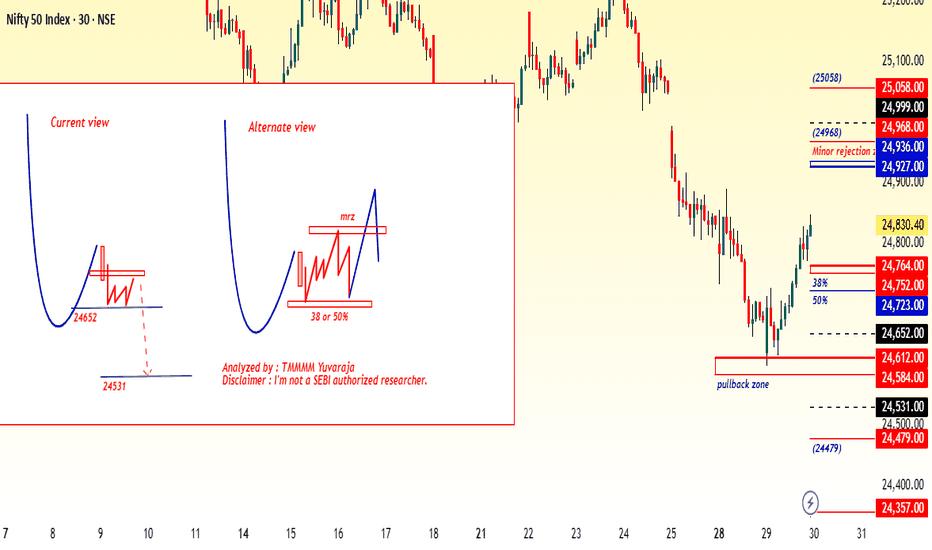

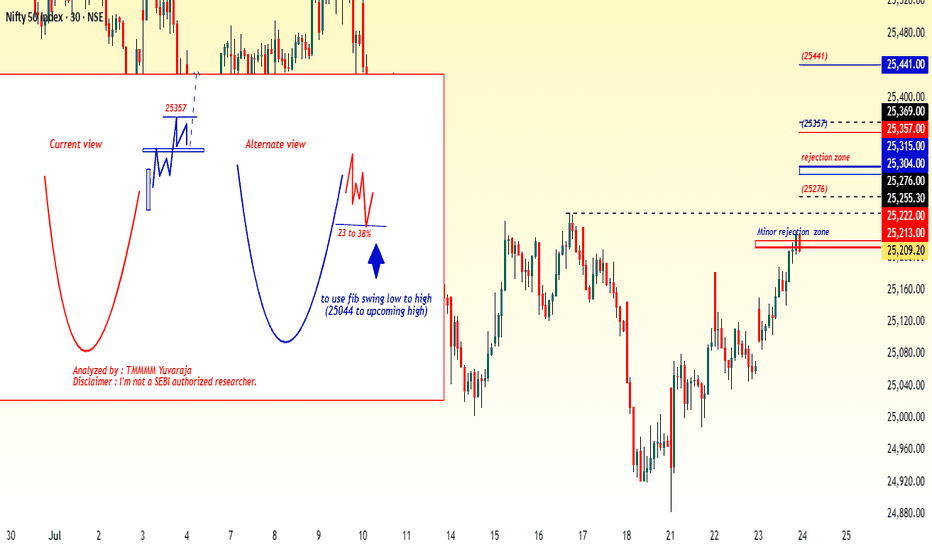

#nifty directions and levels for July 24Good morning, friends! 🌞

Here are the market directions and levels for July 24th:

The global market is showing a moderately bullish sentiment.

Meanwhile, the local market is also exhibiting a moderately bullish tone.

Today, Gift Nifty indicates a gap-up opening of around 60 points.

What can we expect today?

In the previous session, both Nifty and Bank Nifty took a solid pullback.

At the same time, the open interest also shifted to the bullish side.

So, if the gap-up sustains, we can expect the pullback continuation.

Also, as it’s a new moon day(for south), some volatility can be expected.

Let’s look at the charts:

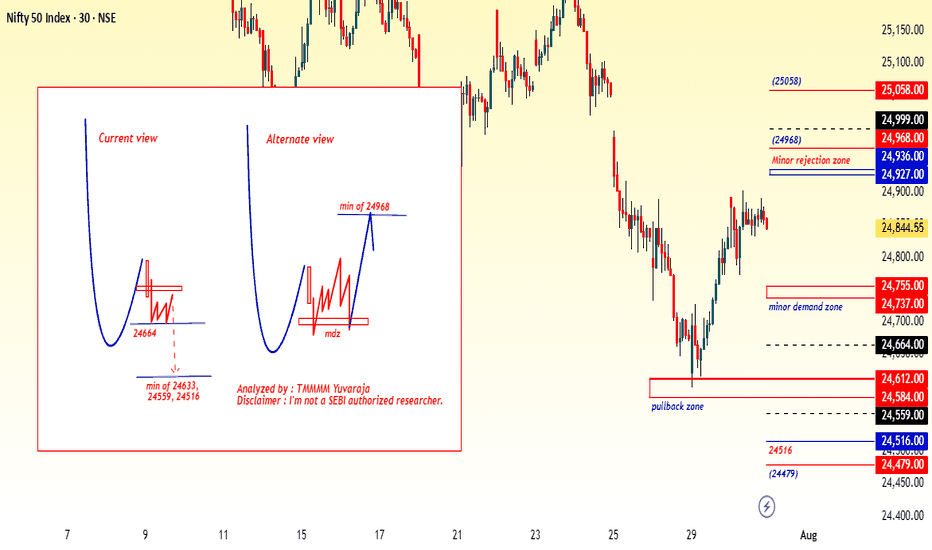

Current View:

The current view suggests that, as mentioned above,

if the gap-up sustains, we can expect a rally continuation with some consolidation.

In this case, the parameters are showing slight strength,

so the rejection zone may act just around the minor resistance.

Alternate View:

The alternate view suggests that

if the gap-up does not sustain or if the market rejects near immediate resistance with a solid reversal,

then we can expect a minor correction of around 23% to 38%.

However, unless the market breaks below the 38% level,

we cannot confirm a reversal into a bearish trend.

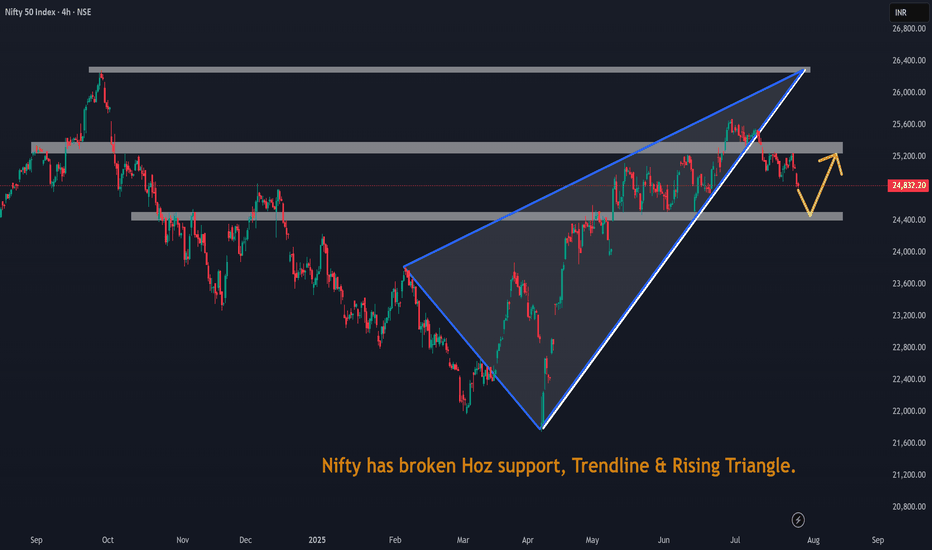

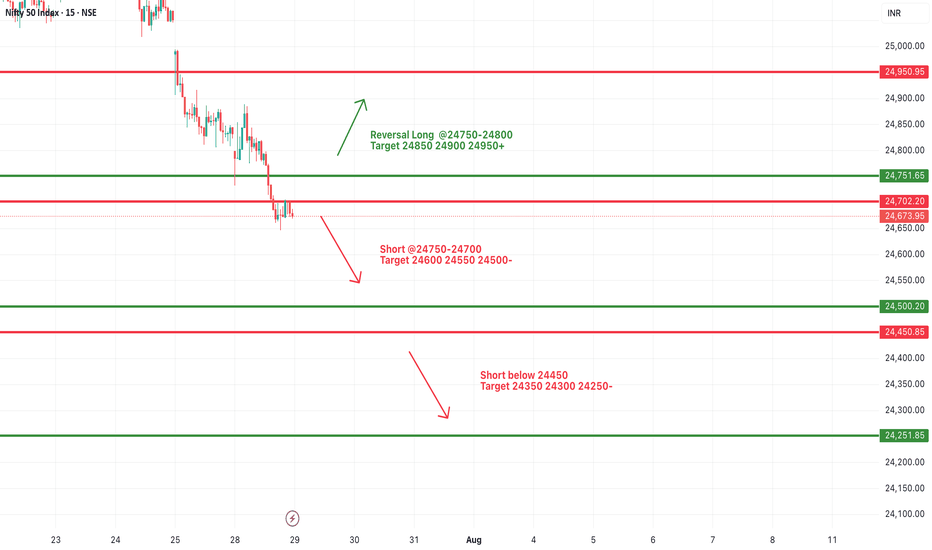

#NIFTY Intraday Support and Resistance Levels - 29/07/2025Nifty is expected to open with a gap-down today, continuing its bearish momentum seen in recent sessions. The index is now trading well below the key resistance zone of 24,750–24,800, with a visible weakness on the chart.

A short opportunity may arise if Nifty stays below the 24,750–24,700 zone. Any pullback toward this level may face selling pressure, and fresh shorts can be considered with downside targets of 24,600, 24,550, and 24,500-.

If the index breaks below the 24,450 level, the selling momentum may intensify, targeting 24,350, 24,300, and 24,250- levels intraday. This level marks a critical support, and traders should closely monitor price action here.

On the other hand, a reversal can only be expected if Nifty reclaims the 24,750–24,800 zone with strength. In that case, a bounce toward 24,850, 24,900, and 24,950+ is possible, but the reversal is only valid if strong bullish price action sustains above 24,800.

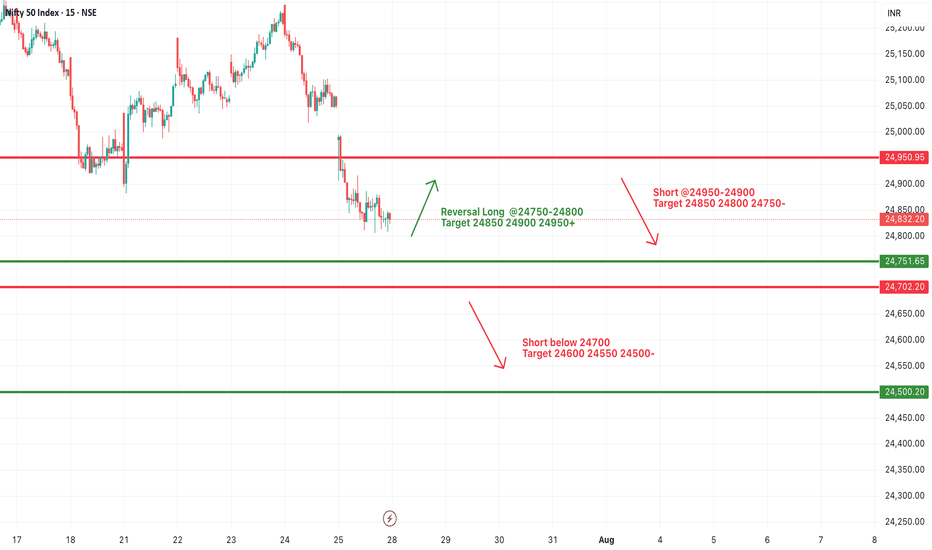

#NIFTY Intraday Support and Resistance Levels - 28/07/2025Nifty is expected to open slightly lower and remains under selling pressure from higher levels. The key intraday zone to watch is 24,750–24,900, which may act as a trigger range for today's direction.

If Nifty sustains above the 24,750–24,800 zone, a short-covering rally may push the index toward 24,850, 24,900, and 24,950+. This zone may offer a reversal opportunity if supported by strong price action.

On the downside, if the index fails to hold above 24,900–24,950, further weakness may be seen below 24,700, opening downside targets at 24,600, 24,550, and 24,500-.

The broader price action suggests a narrow consolidation between 24,700–24,900, with either side breakout likely to lead to intraday momentum. Maintain strict risk management and avoid aggressive trades within this zone.

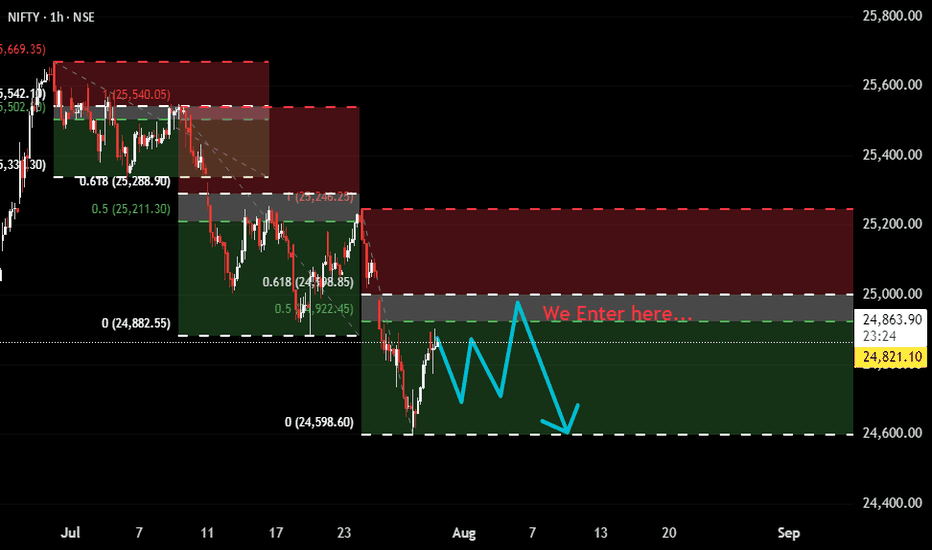

Nifty Bearish Setup: Watching 50–61.8% Fib Zone for Short EntryThis is more of an observation-based post rather than a trade setup.

It appears that Nifty, in its current bearish trend, is consistently respecting the 50–61.8% Fibonacci retracement zone before continuing downward. We’ve seen multiple pullbacks stall and reverse from this zone — making it a key area to watch.

🔸 If you're looking to short, avoid entering too early.

🔸 Let price pull back into the 50–61.8% zone, wait for structure or weakness to develop (e.g., reversal candles, BOS on lower timeframe), and then consider action.

🔸 Trying to catch tops or jumping in too soon can lead to poor entries and stop hunts.

This zone seems to be where sellers are stepping in with conviction.

Staying patient and respecting the structure can offer better entries and risk management.

⚠️ Disclaimer:

This is for educational and observational purposes only. I am not SEBI registered. Always do your own analysis before taking any trades.

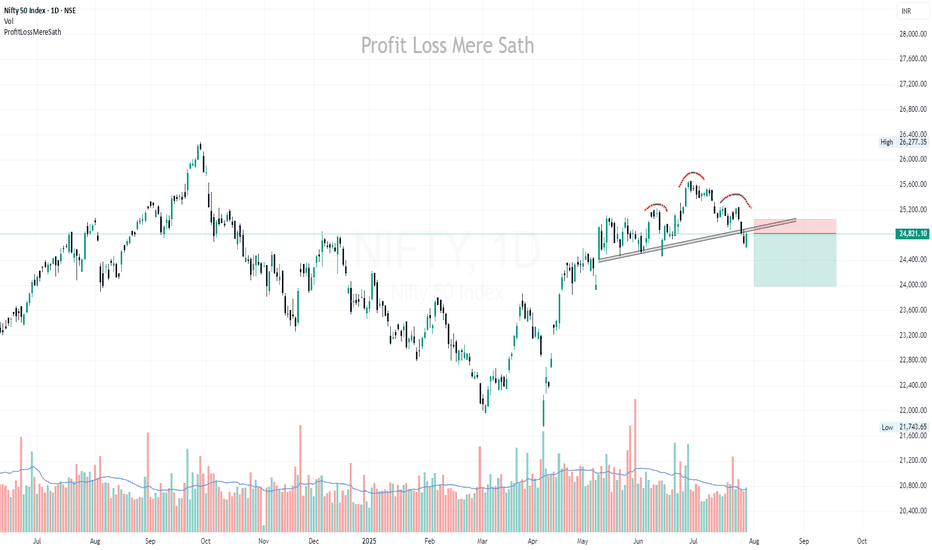

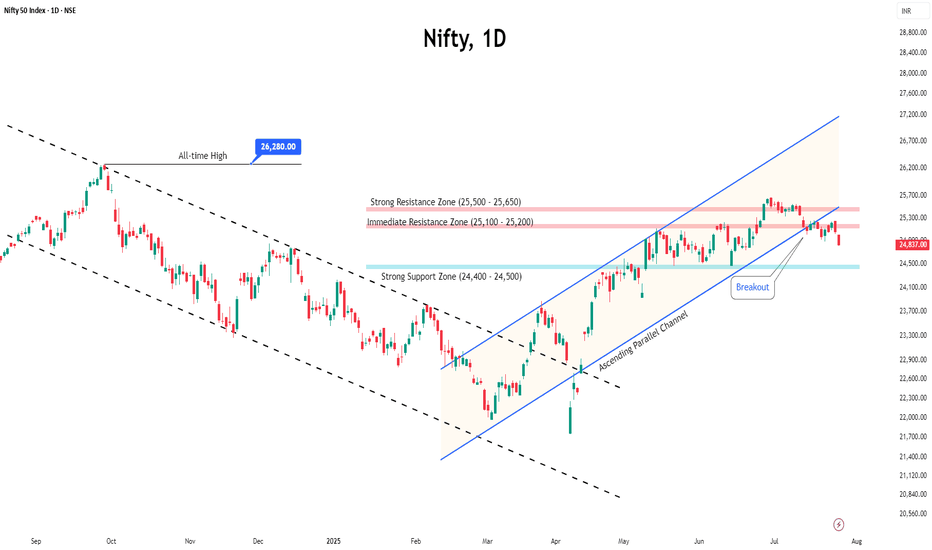

Pressure Builds on Nifty Before ExpiryThe Nifty traded in a tight range for most of the week but eventually slipped below the 25,000 mark, ending on a weak note.

With the monthly expiry approaching, the index is likely to remain under pressure, and volatility may pick up in the coming sessions.

Key resistance levels are seen at 25,200 and 25,500. A decisive move above 25,500 could trigger an upside breakout. On the downside, support is expected around 24,500 and 24,400.

Given the current structure, traders are advised to stay cautious, focus on selective opportunities, and avoid aggressive positions until a clearer trend emerges.

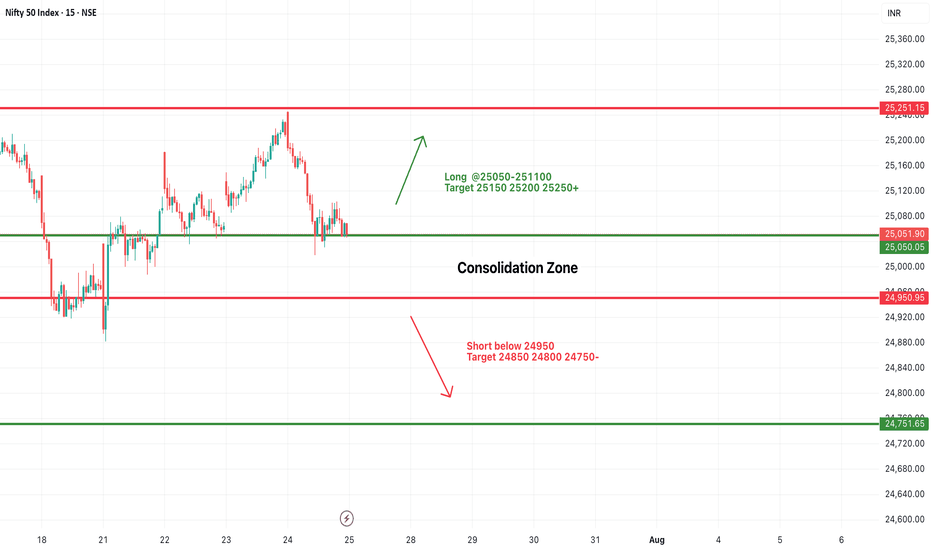

#NIFTY Intraday Support and Resistance Levels - 25/07/2025Nifty is expected to open with a slight gap-down and is currently trading within a tight consolidation zone between 24,950 and 25,050. This narrow 100-point range has acted as a critical zone over the past sessions, indicating indecision and low conviction among traders.

A sustained move above 25,050–25,100 may provide a long opportunity with potential upside targets of 25,150, 25,200, and 25,250+. Strong bullish momentum will only be confirmed if Nifty manages to close above 25,250, which may push the index further toward 25,350–25,400 in the coming days.

On the other hand, a breakdown below 24,950 will shift the bias toward bearishness. A short setup could then target 24,850, 24,800, and 24,750- levels.

Until then, expect sideways price action between 24,950 and 25,050. Traders should wait for a breakout or breakdown before entering fresh trades. Avoid aggressive entries inside this tight band.

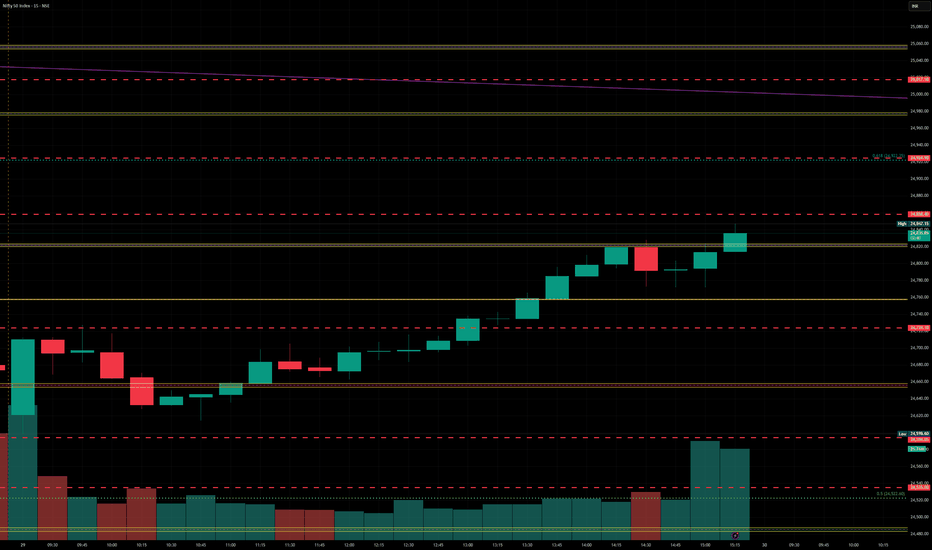

Nifty levels - Jul 30, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!