NIFTY trade ideas

Nifty Analysis EOD – June 20, 2025 – Friday🟢 Nifty Analysis EOD – June 20, 2025 – Friday 🔴

🚀 Bull Run Out of the Blue 🚀 – A Masterclass in Price Action

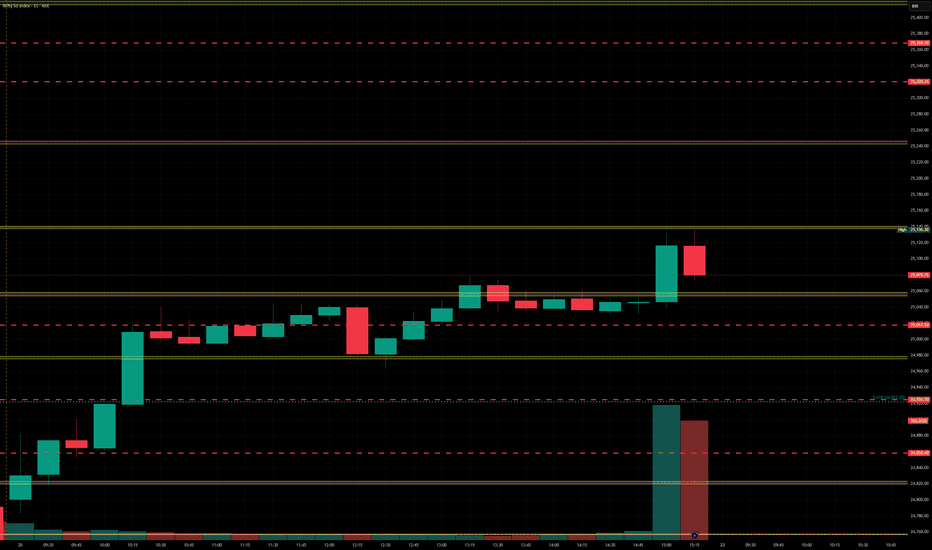

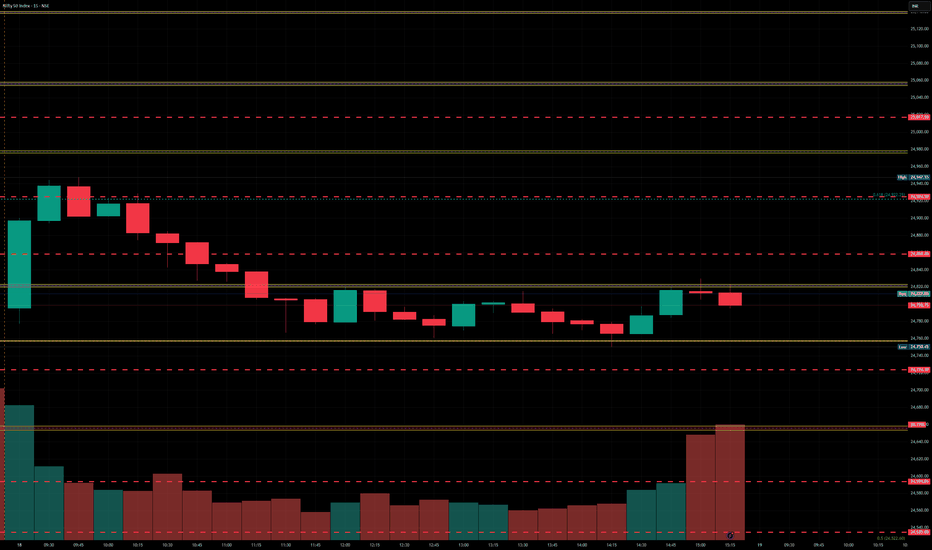

Nifty kicked off the session with a +56-point gap-up — surprising many, especially since Gift Nifty hinted flat to negative and yesterday’s close was weak. The real jolt came when, in the very first minute, price broke above the Previous Day High (PDH) and opened directly above the CPR zone — a rare occurrence when geopolitical tensions are peaking.

As I often say:

📌 “Market rarely follows the obvious. It thrives in the unexpected.”

Today was a textbook example of that.

Luckily, we were prepped. In yesterday’s note, I mentioned the bullish trigger above 24,862 — and right from the open, Nifty respected every level, offering "hope-on" and "hope-off" trades. What seemed like a 25K test turned into a blast to 25,136, with 100 points added in the last 30 minutes, leaving even seasoned traders awestruck.

The intraday close at 25,079.75 and the adjusted close at 25,112.40 — both above the 15th May closing levels — give a bullish vibe heading into the weekend. 🤞

💬 Personal Note:

Today was special — I sat with my elder daughter, helping her understand real-time market behavior. And what a day it was! From trend reversals, cup & handle, head & shoulders, wedges, shallow pullbacks, to aggressive one-way rallies — everything aligned perfectly to make this a live-action lesson in intraday trading.

🕯 5 Min Time Frame Chart with Levels

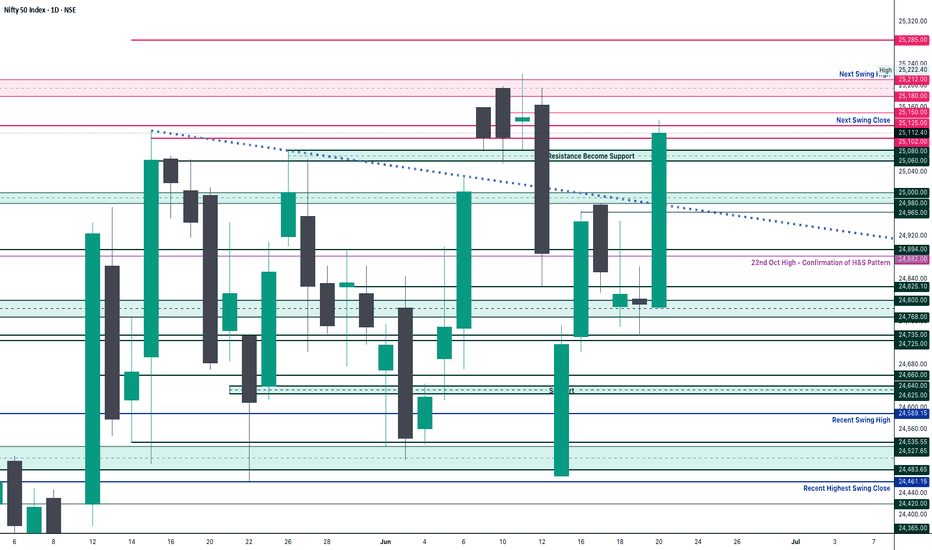

🕯 Daily Time Frame Chart

🕯 Daily Candle Breakdown

Open: 24,787.65

High: 25,136.20

Low: 24,783.65

Close: 25,112.40

Change: +319.15 (+1.29%)

📊 Candle Structure Breakdown

Real Body: 324.75 pts → ✅ Strong Green Candle

Upper Wick: 23.80 pts

Lower Wick: 4.00 pts

🔍 Interpretation

Opened flat and never looked back.

Minimal wicks = clear directional strength.

Buyers in full control from open to close.

🕯 Candle Type

📈 Bullish Marubozu-like — One of the strongest bullish signals. A powerful sign of trend continuation or breakout momentum.

📌 Key Insight

Today’s candle reinforces bullish strength.

Holding above 25,100 is key going forward.

A move above 25,136 could invite fresh upside targets — possibly 25,180+ and beyond.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 251.32

IB Range: 116.6 → Medium IB

Market Structure: 📈 ImBalanced

Trades Triggered:

🔹 9:41 AM – Long Trade → Target Achieved (Trailing Exit, R:R 1:4.79)

🔹 12:18 PM – Short Contra Trade → Target Achieved (R:R 1:2)

🔹 1:07 PM – Long Trade → Target Achieved (Trailing Exit, R:R 1:2.62)

📌 Support & Resistance Zones

Resistance Levels

25,125 ~ 25,150

25,180 ~ 25,212

25,285

Support Levels

25,080 ~ 25,060

25,000 ~ 24,980

24,965

24,894 ~ 24,882

💭 Final Thoughts

The market surprised today — not just in movement but in clarity.The clean break, follow-through strength, and intraday structure hint at momentum continuation — but weekends can bring surprise news.

📌 Watch 25,100 as line in the sand on Monday.

🧠 “Markets are teachers. Today’s lesson? Expect the unexpected, but prepare like it’s already here.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

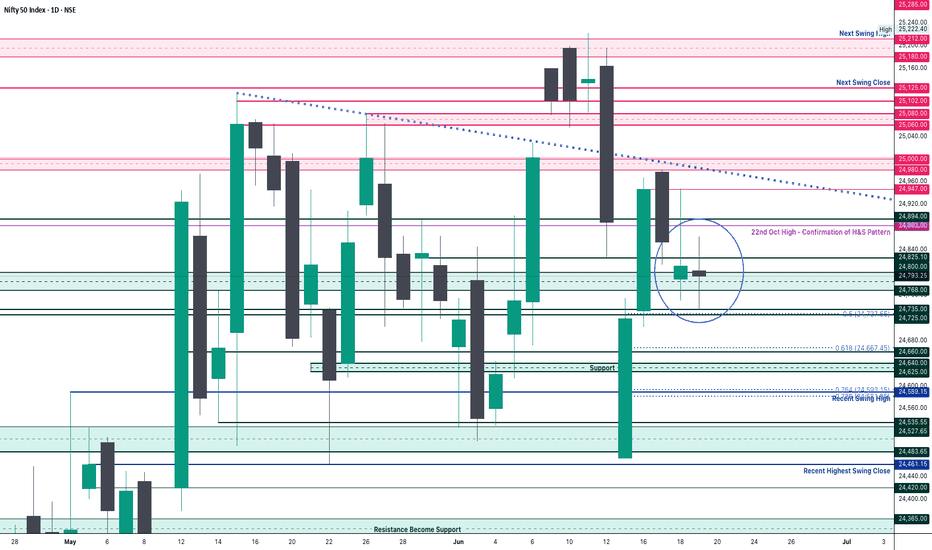

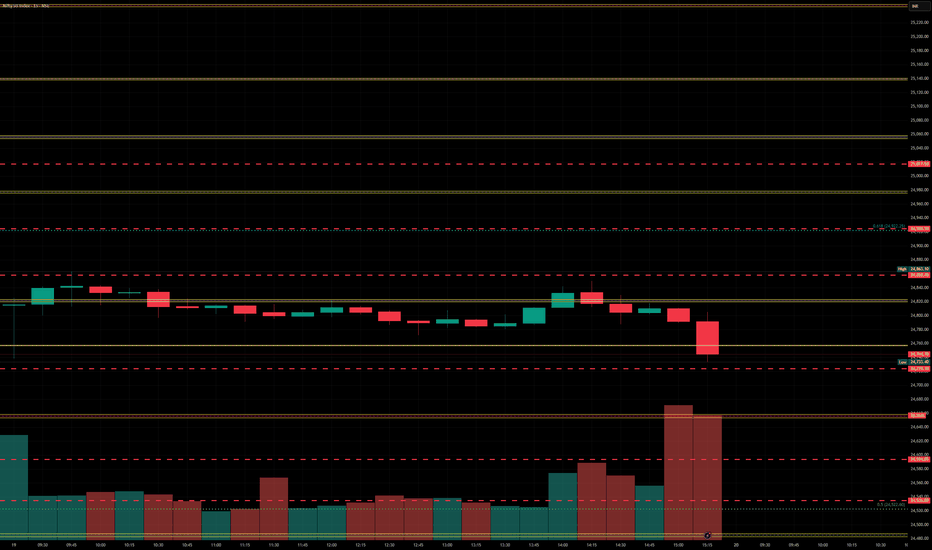

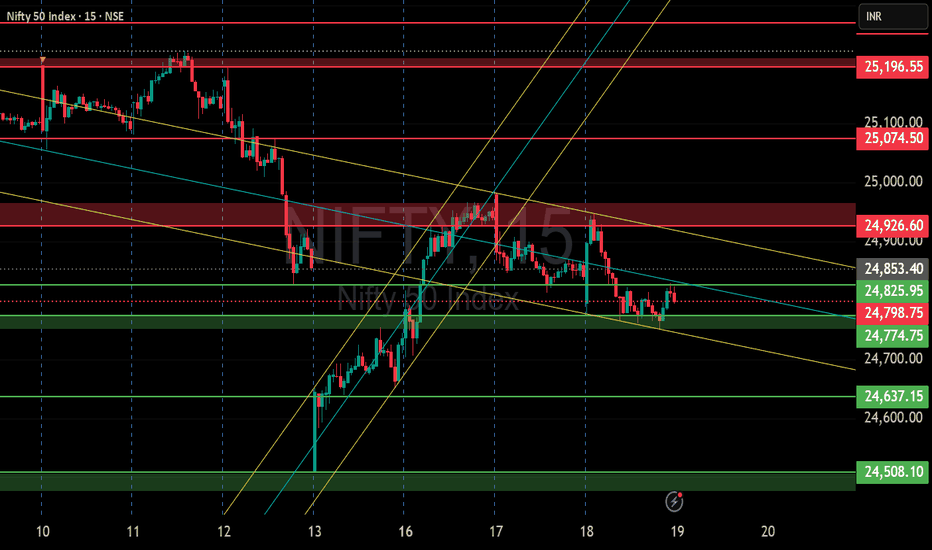

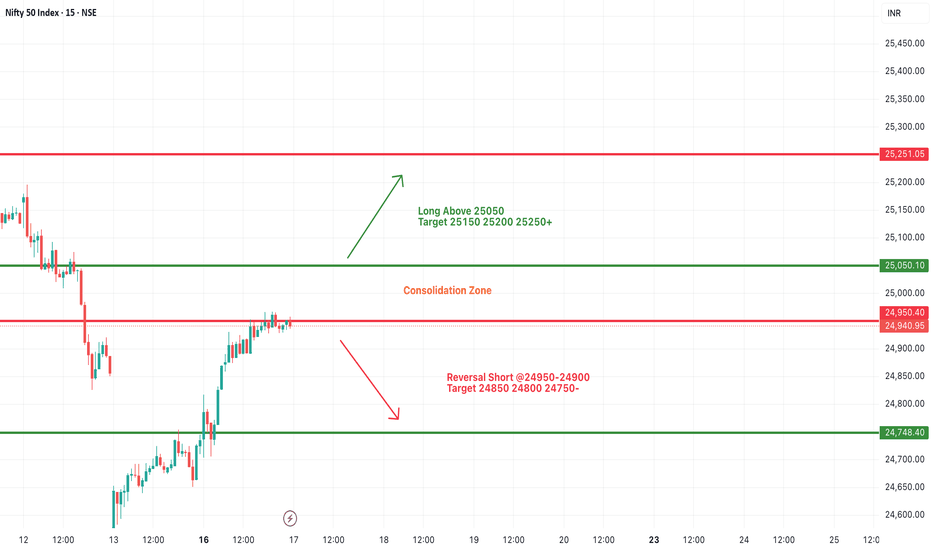

Nifty levels - Jun 23, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

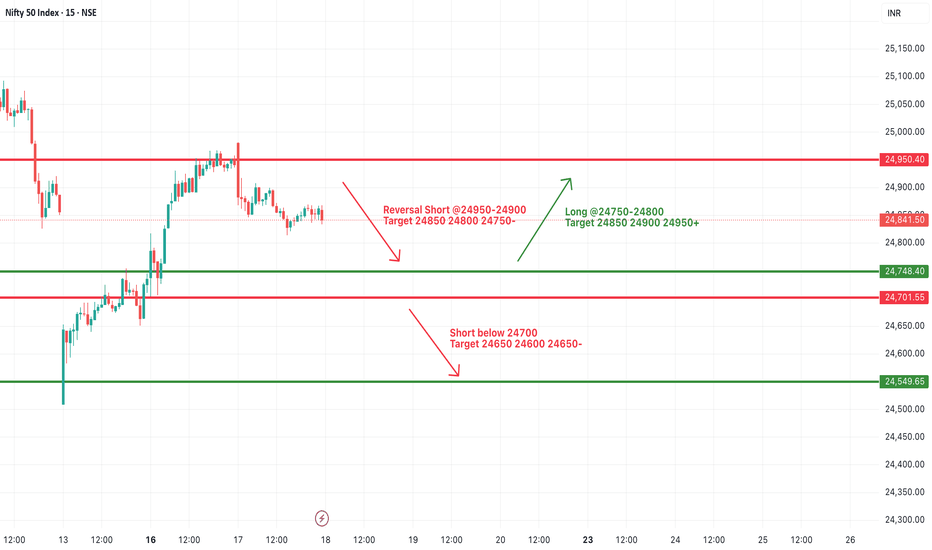

#NIFTY Intraday Support and Resistance Levels - 20/06/2025A flat opening is expected in Nifty today. After the open, all eyes will be on the 24,700 level, which has acted as a key support zone recently.

🔽 If Nifty starts trading below 24,700, downside momentum may pick up, with potential targets at 24,650 → 24,600 → 24,550-. Sustained weakness below 24,700 could attract short positions.

🔼 On the upside, if Nifty reclaims 24,750–24,800 and sustains, a bullish move may trigger toward 24,850 → 24,900 → 24,950+. However, 24,950 remains a strong resistance area from the past sessions.

⚠️ Strategy Note:

Market remains in a range-bound zone; wait for a decisive breakout for positional trades.

Use strict stop-losses and manage risk actively.

Ideal approach: scalp the range with quick profit booking unless a directional move confirms.

Nifty Analysis EOD – June 19, 2025 – Thursday🟢 Nifty Analysis EOD – June 19, 2025 – Thursday 🔴

📉 Bookish Spinning Top Doji – Another Day of Indecision on Expiry

Nifty opened with a mild +16-point gap-up and immediately dipped to test the Previous Day Low (PDL), marking the day low at 24,738.10. A quick reversal took the index 125 points higher, reaching a high of 24,863, only to settle back into theta-eating mode around VWAP.

Just as things looked ready to turn, a 13:50 breakout attempt fizzled as the price faced rejection above the CPR zone, leading to a final dip below the previous low, touching a new intraday low at 24,733.

Though the intraday close was at 24,744.70, the settlement close was 24,793.25 — a 47.65-point difference that’s not trivial, especially on expiry day.

The entire day remained a narrow-range, rollercoaster ride — clearly showing neither bulls nor bears could take charge. The total range was just 130 points, forming a textbook Spinning Top, which reflects market contraction.

📌 Now what?

Keep a close eye on the range:

🟢Bullish Breakout ➤ above 24,862 (CDH)

🔴Bearish Breakdown ➤ below 24,733 (CDL)

The squeeze is on. Expansion is near.

🕯 5 Min Time Frame Chart with Levels

🕯 Daily Time Frame Chart

🕯 Daily Candle Breakdown

Open: 24,803.25

High: 24,863.10

Low: 24,733.40

Close: 24,793.25

Change: −18.80 (−0.08%)

📊 Candle Structure Breakdown

Real Body: 10.00 pts → 🔻 Small Red Candle

Upper Wick: 59.85 pts

Lower Wick: 59.85 pts

🔍 Interpretation

Equal wicks show balanced buying and selling.

Small real body signals strong indecision.

Intraday volatility was neutral despite expiry impact.

🕯 Candle Type

⚖️ Perfect Spinning Top / Doji-like Candle – Indicates market contraction, waiting for directional resolution.

📌 Key Insight

The market continues its tight range-bound structure.

Any breakout beyond 24,865 or breakdown below 24,730 could trigger directional moves.

Till then: “Wait and watch mode.”

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 240.08

IB Range: 125.00 → Medium IB

Market Structure: ⚖️ Balanced

Trades:🚫 No Trade Triggered by System

📌 Support & Resistance Zones

Resistance Levels

24,894 ~ 24,882

24,972 ~ 25,000

25,060 ~ 25,080

25,102 ~ 25,125

Support Levels

24,825 ~ 24,847

24,725 ~ 24,735

24,660

24,590

💭 Final Thoughts

The market is compressing like a coiled spring.Spinning tops near resistance often signal upcoming volatility.Let the breakout come to you — don’t pre-empt, participate.

🧠 “When the market sleeps in narrow ranges, it dreams of big moves.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

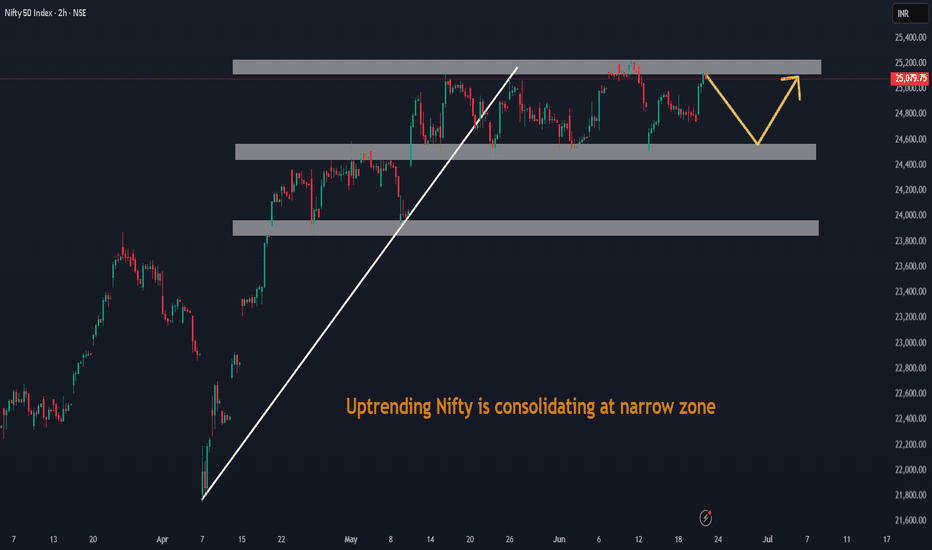

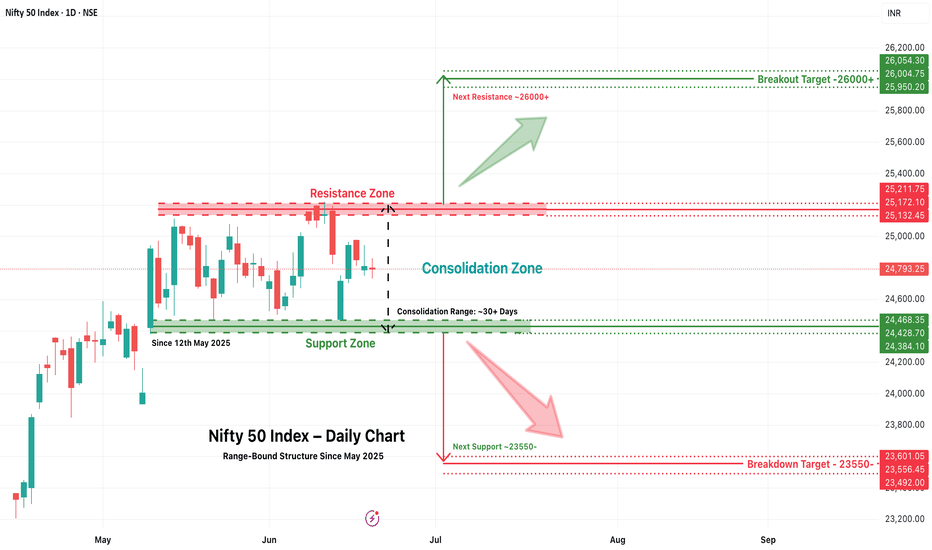

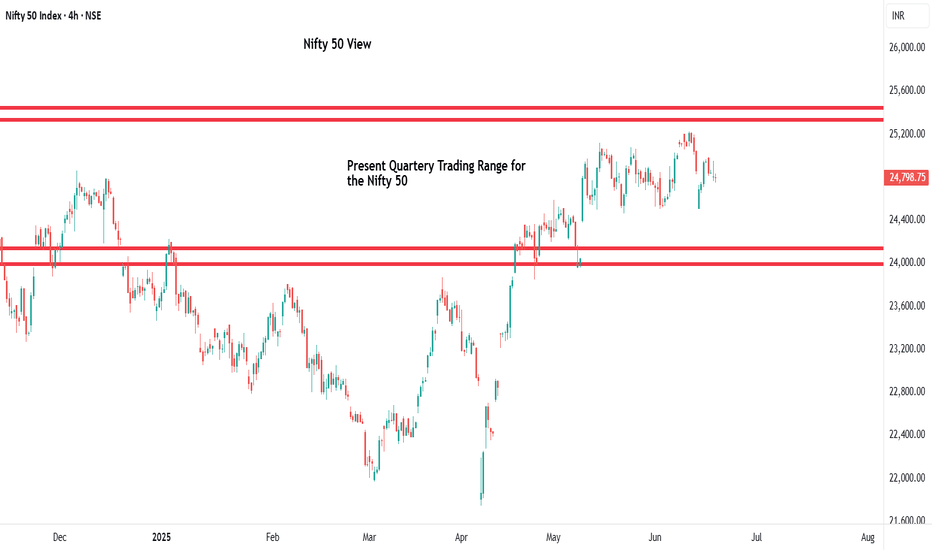

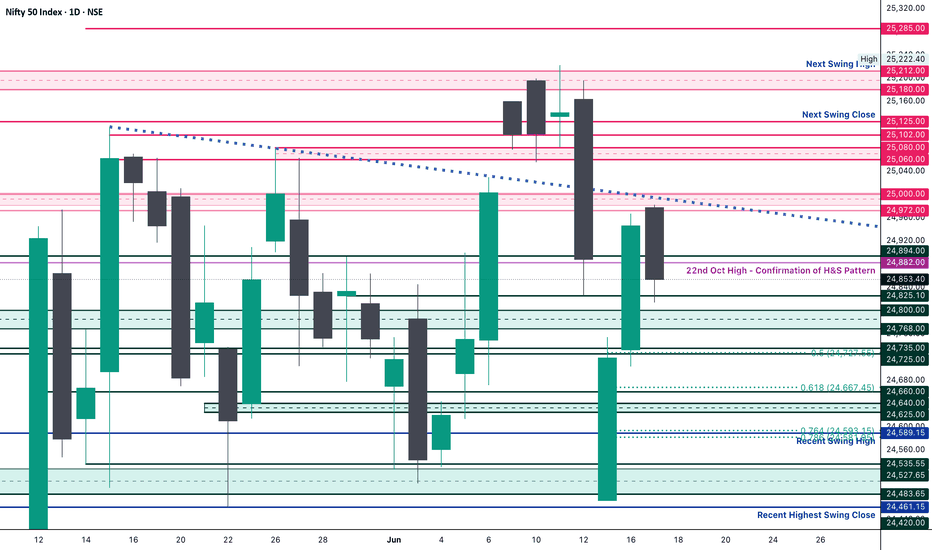

Nifty 50 Trapped in a Tight Range – Breakout or Breakdown Ahead?📍 Market Overview:

For over a month now, the Nifty 50 Index has been moving sideways in a tight consolidation range, frustrating both bulls and bears. Since May 12, 2025, the index has fluctuated between 24,350 on the lower side and 25,250 on the upper side, forming a classic rectangular pattern often associated with accumulation or distribution phases.

This zone is now becoming a crucial battlefield that could define the index’s direction for the coming sessions.

🔲 The Consolidation Zone

Support Zone: 24,350 – 24,450

Resistance Zone: 25,150 – 25,250

Consolidation Duration: ~30+ days

Current Price: 24,793.25

This range has seen multiple rejections at the top and bottom, reflecting indecisiveness in broader market sentiment. Traders are waiting for a trigger — either fundamental or technical — that could push the index out of this range with strength.

📈 Bullish Scenario: Breakout Above 25,350

If Nifty 50 breaks and sustains above 25,350, especially with higher volume and a strong daily close, it could signal a bullish continuation pattern. This scenario would be supported by:

A potential breakout from the rectangle consolidation.

Positive sentiment from global markets or domestic catalysts (monsoon, earnings, policy announcements, etc.)

A shift in FII or DII buying behavior.

📌 Breakout Target:

👉 26,000 – 26,100 (Based on measured move projection)

📌 Next Resistance Zone:

👉 26,050 – 26,200

In this case, traders may look for long opportunities with trailing stop-losses under the breakout zone.

📉 Bearish Scenario: Breakdown Below 24,350

On the flip side, a decisive breakdown below the 24,350 mark, especially with increased selling pressure and bearish candles, may lead to a quick decline toward the next major support levels.

📌 Breakdown Target:

👉 23,550 – 23,400

📌 Next Support Zone:

👉 23,500 – 23,300

This could trigger panic selling or profit-booking in frontline stocks. Caution is advised in such scenarios, and shorting opportunities may arise for experienced traders.

🧠 Strategic Insights for Traders

Avoid trading within the range: Unless you're scalping, wait for breakout/breakdown.

Watch global cues and FII flows: They often align with large breakouts.

Stick to risk management: Whichever direction the index moves, always set a stop loss.

🚀 Final Thoughts

The market is clearly in a wait-and-watch phase, but such consolidation periods often precede large moves. Nifty’s current structure suggests a breakout or breakdown is imminent — and being positioned correctly can make a big difference in returns.

Stay alert. Don’t predict — prepare.

⚠️ Disclaimer

This article is for educational and informational purposes only and does not constitute financial advice or a recommendation to buy or sell any securities. Trading and investing in the stock market involve risk, including the risk of losing capital. Always conduct your own research or consult with a qualified financial advisor before making any trading decisions. We are not responsible for any losses incurred from decisions based on this analysis.

Nifty levels - Jun 20, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

#NIFTY Intraday Support and Resistance Levels - 19/06/2025Today, a flat opening is expected in Nifty around the 24,800 level. The index continues to trade within a narrow range, indicating market indecision and potential consolidation.

🔼 On the upside, if Nifty sustains above the 24,750–24,800 zone, it may trigger a bullish move toward 24,850 → 24,900 → 24,950+. Sustained strength above 24,950 can further open room for a breakout.

🔽 On the downside, if the index slips below 24,700, a short opportunity may arise toward 24,650 → 24,600 → 24,550-. Breach of 24,550 could lead to deeper correction.

⚠️ Key Notes:

The market is likely to remain range-bound and volatile.

Reversals from resistance and support levels are possible.

Trade with a strict stop loss and manage positions actively.

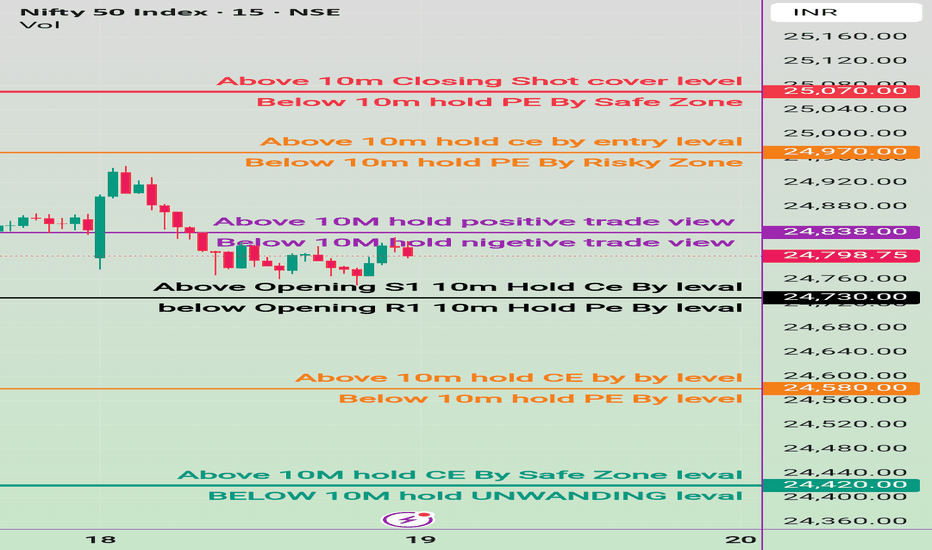

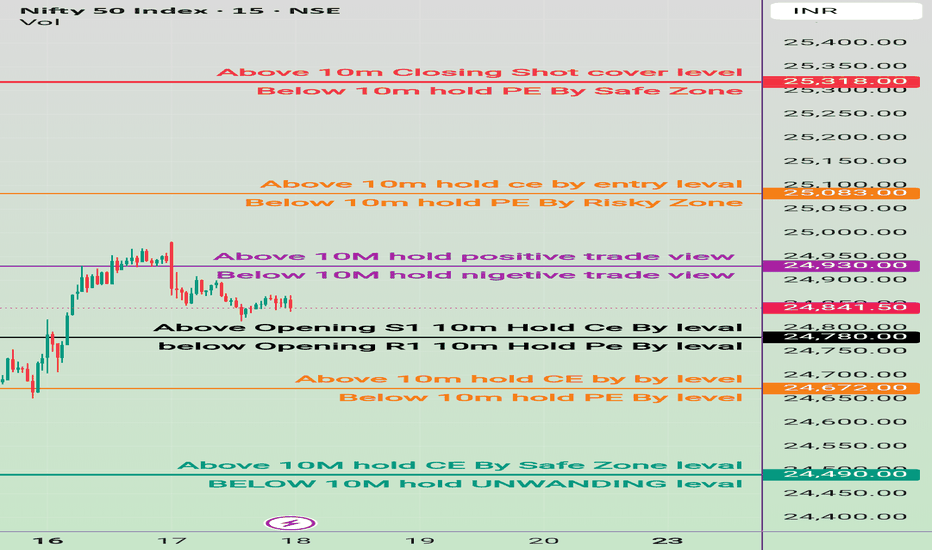

19 june Nifty50 brekout and Breakdown leval

✅ Safe Buy Zone (Support Levels):

24,437.70 → Above 10M: Hold CE by Safe Zone Level

24,420.00 → Below 10M: Hold Unwinding Level

→ Breach below could trigger unwinding / profit booking.

🔴 Resistance & Bearish PE Zones:

25,070.00 – Above 10m closing: Short Cover Level

→ Strong resistance; if crossed and sustained, short covering possible.

24,970.00 – Above 10m: Hold CE by Entry Level

→ Bullish entry confirmation level.

24,838.00 – Above 10M: Hold Positive Trade View

→ Indicates shift to bullish bias if held above.

⚫ Opening Based Levels:

24,730.00

→ Above Opening S1: Hold CE by Level

Below Opening R1 (level not clearly marked with value but appears near 24,730)

→ Hold PE by Level

Nifty Analysis EOD – June 18, 2025 – Wednesday🟢 Nifty Analysis EOD – June 18, 2025 – Wednesday 🔴

⚖️ Dhamakedar Start, But Indecisive Close – Weekly Expiry Caution Ahead

Nifty opened with a 65-point gap-down at 24,788.35, but what followed was a power-packed bullish start — within just 25 minutes, it surged over 150 points, hitting a day high of 24,947.55.

However, the euphoria didn’t last.

As the session progressed, the index gradually gave up all its gains, slipped below the previous day’s low, and finally found support at 24,750, a critical level. By the end of the day, Nifty settled around the opening zone at 24,812.05, just +23 points above open, while net change remained −41.35 points from the previous close.

The day showcased both strength and weakness — a typical "everyone-expected-fall-but-it-didn't-fall-enough" kind of day. The long upper wick reflects failed attempts by bulls, while the lack of breakdown keeps the bears in check.

Tomorrow is weekly expiry — caution is advised.

🕯 5 Min Time Frame Chart with Levels

🕯 Daily Time Frame Chart

🕯 Daily Candle Breakdown

Open: 24,788.35

High: 24,947.55

Low: 24,750.45

Close: 24,812.05

Change: −41.35 (−0.17%)

📊 Candle Structure Breakdown

Real Body: 23.70 pts → ✅ Green Candle (tiny body)

Upper Wick: 135.50 pts

Lower Wick: 37.90 pts

🔍 Interpretation

Strong bullish momentum early on, but buyers failed to hold above 24,900.

Long upper wick signals supply or profit-booking at higher levels.

Price closed near open despite wide range → indecision between bulls and bears.

🕯 Candle Type

🟨 Spinning Top – A textbook indecisive candle, often seen at turning points or during pauses in trend.

📌 Key Insight

Buyers couldn’t reclaim or close above 24,950 — resistance strengthened.

Support held at 24,750 — but barely.

Watch 24,950 on upside and 24,750 on downside — a breakout from either may decide expiry-day trend.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 252.34

IB Range: 170.65 → Medium IB

Market Structure: ⚖️ Balanced

Trades:🚫 Short Trigger at 12:45 : Trapped - SL Hit

📌 Support & Resistance Zones

Resistance Levels

24,894 ~ 24,882

24,972 ~ 25,000

25,060 ~ 25,080

25,102 ~ 25,125

Support Levels

24,825 ~ 24,847

24,725 ~ 24,735

24,660

24,590

💭 Final Thoughts

When price travels 200 points but closes flat, it tells you something: Smart money is waiting.Weekly expiry ahead could bring unexpected moves.✅ Stay nimble. Stay alert.

🧠 “When in doubt, let the market shout — not whisper. Listen for the breakout.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty 50 view Considering that, we have had already been in quarterly, and at the fag end of new Fiscal Year QTR which is Apr to Jun 25.

If you could observe present quarter has entered the domain July to Sep 24 domain, and it was challenging the previous data points. While it was doing so, it appears to be experiencing fatigue before challenging the highest zonal resitance of all time high.

For the time being index is weak on shorter time frames, but longer time frames are solid as of now.

The best biased opnion will be to buy on deeps

NIFTY S/R for 19/5/25Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

Nifty levels - Jun 19, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

#NIFTY Intraday Support and Resistance Levels - 18/06/2025Today, Nifty is expected to open with a slight gap down near the 24,850 zone, indicating caution among participants at higher levels.

🔼 If Nifty sustains above the 24,750–24,800 zone, a positive move may unfold with upside targets at 24,850 → 24,900 → 24,950+. Sustained strength above 24,950 could lead to a further rally.

🔁 On the other hand, if Nifty approaches the 24,950–24,900 zone and shows signs of rejection, it could lead to a reversal. In that case, the downside targets may be 24,850 → 24,800 → 24,750-.

🔽 A decisive move below the 24,700 level would indicate bearish control, opening further downside towards 24,650 → 24,600 → 24,550-.

18 june Nifty50 brekout and Breakdown leval

CALL (CE) – Bullish triggers

↑ 24,437 – 24,547 : Safe‑zone long entry

↑ 24,672: Hold CE while above this mark

↑ 24,780 : Opening‑S1 breakout, keep holding CE

↑ 24,930.00 : Turns bias positive; fresh CE can be added

↑ 25,083.00 : Entry level for aggressive longs

↑ 25,318.00 : Short‑cover zone; strong upside momentum possible

PUT (PE) – Bearish triggers

↓ 25,318.00 : If price closes back under, shift to PE (safe)

↓ 25,083 : PE in the “risky” reversal zone

↓ 24,930 : Bias flips negative; keep/add PE

↓ 24,780 : Opening‑R1 break; hold PE

↓ 24,672 : Continue PE below this level

↓ 24,535 : Unwinding zone – watch for fast drops

↓ 24,437 : Final downside support; trail PEs here

Nifty Analysis EOD – June 17, 2025 – Tuesday🟢 Nifty Analysis EOD – June 17, 2025 – Tuesday 🔴

⚠️ Resistance Rejection at 25K – Pause or Warning Sign?

Yesterday’s note rightly anticipated today’s challenge near 25K — and that’s exactly how the session unfolded.

Nifty opened at 24,977.85, right inside the critical resistance zone of 24,972–25,000, and formed a near O=H (Open = High) structure. The index quickly lost ground, dropping 135 points within the first hour to mark a day low of 24,813.70, forming a medium-sized Initial Balance (IB) within a wide CPR — conditions known for range-bound or tricky days.

Throughout the session, Nifty hovered largely inside the CPR and IB, with a false breakdown attempt around 12:50 PM. Such setups (wide CPR + higher value + medium IB) often result in false moves or low-conviction sessions, and today was no exception.

By day’s end, Nifty closed at 24,853.40, logging a modest −93.10 point dip, forming what can be termed as a healthy pullback — but the real test remains.

If bulls want to take charge again, they must breach and close above 25,025. On the flip side, if 24,800–24,820 gives way, it could trigger a slide toward 24,725 and 24,660 in the coming sessions.

🕯 Daily Time Frame Chart

🕯 Daily Candle Breakdown

Open: 24,977.85

High: 24,982.05

Low: 24,813.70

Close: 24,853.40

Change: −93.10 (−0.37%)

📊 Candle Structure Breakdown

Real Body: 124.45 pts → 🔻 Red Candle

Upper Wick: 4.20 pts

Lower Wick: 39.70 pts

🔍 Interpretation

Opened near the day’s high but selling dominated soon after.

Small upper wick shows minimal buyer strength; recovery attempts were mild.

Lower wick indicates some support emerged at day’s low, but overall tone remained bearish.

🕯 Candle Type

🟥 Bearish Candle – strong real body, minor lower wick — reflects steady intraday selling, though not overly aggressive.

📌 Key Insight

Nifty has now rejected the 25K zone two days in a row, turning it into short-term resistance.

If 24,800 breaks, expect pressure to mount — next watch: 24,725 → 24,660.

Bulls need a close above 25,025 to regain command.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 258.48

IB Range: 131.60 → Medium IB

Market Structure: ⚖️ Balanced

Trades:🚫 No Trade Triggered by System

📌 Support & Resistance Zones

Resistance Levels

24,894 ~ 24,882

24,972 ~ 25,000

25,060 ~ 25,080

25,102 ~ 25,125

Support Levels

24,825 ~ 24,847

24,725 ~ 24,735

24,660

24,590

💭 Final Thoughts

Today’s session didn’t break anything major — but it also didn’t conquer anything new.Stuck between major support and resistance, the index is coiling for a move. Bulls have the burden of proof now.

🧠 “Markets don’t pause forever — compression leads to expansion. Be ready when it chooses its direction.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

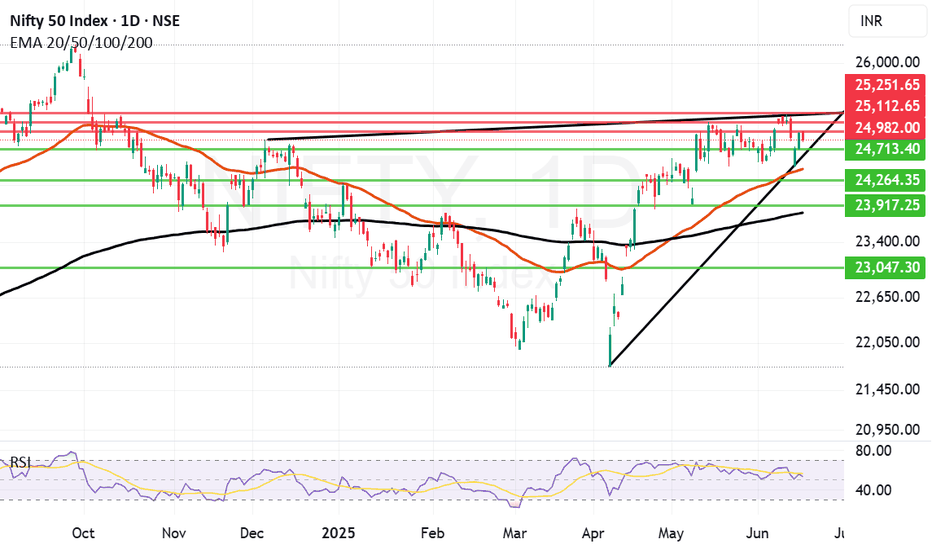

Resistance zones and Geo-political instability acting up.Geo-Political instability and resistance zone are acting up together to stop Nifty and not allowing it to close above 25K. As the world is looking at developments in Iran Vs Israel conflict with beated heart market today gave up some gains from yesterday. The only index looking strong is IT index right now. Avoid taking very long positions unless you are very sure of the company. Yesterday also Nifty failed to close above 25K opened briefly near 25K today and then moved downwards. Lot will be decided in the short term by the developments that happen tonight. Important G7 meet and US Federal reserve Rate Cut meet is also to happen later in the week. These 2 global factors will decide fate of the market in the short term. Local factors are all in line and nothing to worry for Indian markets on that front.

The supports for Nifty remain at: 24713 (Trend line support), 24425 (Mother line support of Daily chart), next support is near 23917, 23806 (Father line support of daily chart is in place). Closing below 23906 can lead to further down side and in such a scenario Nifty can fall further towards 23500 or 23047 levels. If we get a closing below that we will give updates regarding the same.

Resistances for Nifty remain at: 24982 (Today's high), 25112 and trend line resistance of 25251. When we get a closing above 25251 we will update you regarding the further upward resistnace levels.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

Nifty levels - Jun 18, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

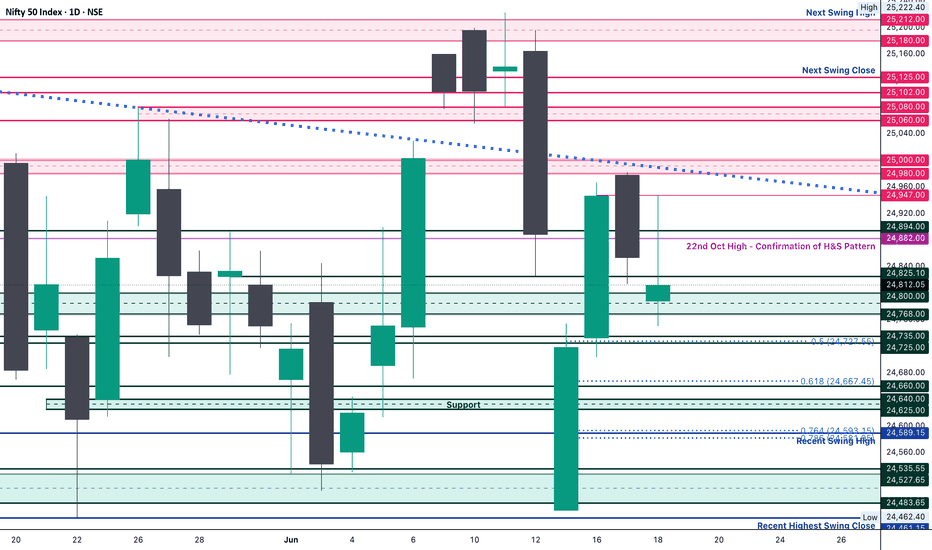

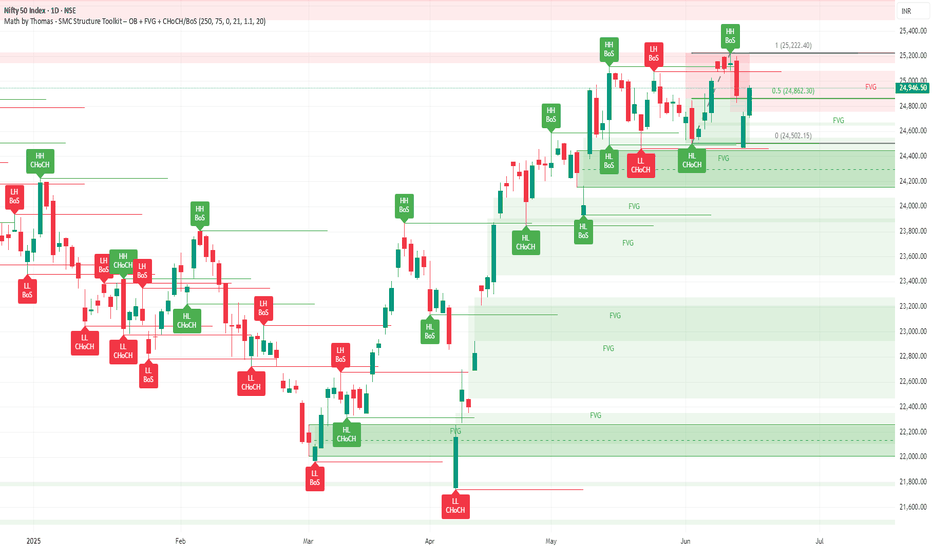

Daily SMC Post-Market Analysis – Nifty 50 | 16 June 2025🔍 Daily Chart – Smart Money Concepts (SMC) Analysis

Instrument: Nifty 50 Spot Index

Date Analyzed: 16 June 2025 (Monday)

Timeframe: 1D (Daily) – Higher Timeframe Structure

📈 Daily Price Summary

🟢 Open: 24,732

🔼 High: 24,967

🔽 Low: 24,703

🔴 Close: 24,946

Price closed strongly near the high of the day, pushing deeper into the Bearish FVG1 zone, indicating potential premium exhaustion in HTF.

🔹 HTF Market Structure (Daily Chart)

🔼 Last HH / Break of Structure (BoS): 25,222

🔽 Last HL / Change of Character (CHoCH): 24,502

🔁 Previous LH (BoS): 25,079

🔁 Previous HH (BoS): 25,116

📌 Trend Bias: Still Bullish, as long as price holds above the Higher Low (24,502)

📍 Caution: Price is inside bearish premium zones and reacting to internal resistance

💰 Premium / Discount Zoning (Swing-Based)

🟢 Swing Low: 24,502

⚖️ Swing Mid: 24,862

🔺 Swing High: 25,222

📍 Current Close (24,946) = In Premium Zone → Watch for liquidity sweep or reversal setups.

🟩 Bullish Order Block (HTF)

Zone: 24,150 – 24,447

Volume Multiplier: 1.1

🔍 This OB sits in deep discount, and marked with institutional interest. If price returns here, it could offer high-probability long setups.

🔻 Bearish Fair Value Gaps (FVG)

24,754 – 25,081 ✅ Currently active

25,143 – 25,230 🔺 Awaiting reaction

25,485 – 25,739 🔺 Future resistance zone

🟢 Bullish Fair Value Gaps (FVG)

24,644 – 24,971 ✅ Price traded inside this today

24,164 – 24,547 ✅ Deep support zone aligning with OB

📌 Summary Outlook:

HTF (Daily) remains bullish but price has entered premium and bearish FVGs, approaching resistance.

Price must break and close above 25,222 to confirm a fresh bullish leg.

A breakdown below 24,502 (HL) would be the first sign of structure shift, invalidating the bullish setup.

Key levels for reaction:

Upside Breakout Zone: 25,230+

Downside Watch Zone: 24,447–24,150 (Bullish OB with volume)

#NIFTY Intraday Support and Resistance Levels - 17/06/2025Today, a flat opening is expected in Nifty near the 24,950 level. The index has been moving in a narrow consolidation zone and currently trades just below an important resistance. If Nifty manages to sustain above the 25,050–25,100 zone after the opening, we may witness bullish momentum building up. This could lead to an upward move toward 25,150, 25,200, and possibly 25,250+ levels during the day.

However, if Nifty fails to hold above the 24,950 mark and slips into weakness, it may invite intraday profit booking. A drop below the 24,900–24,950 level could open the downside toward 24,850, 24,800, and 24,750 levels. This zone has previously acted as a support range, and any break here could intensify selling pressure.

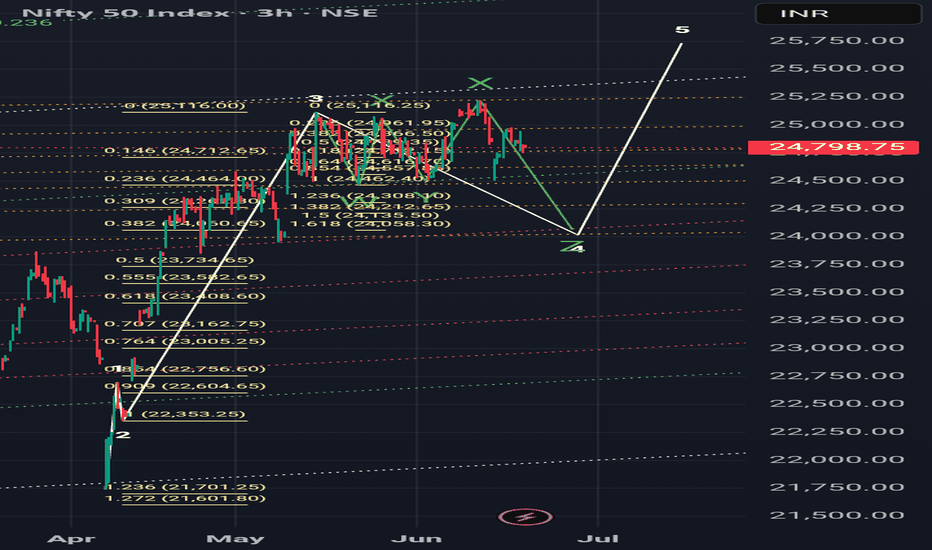

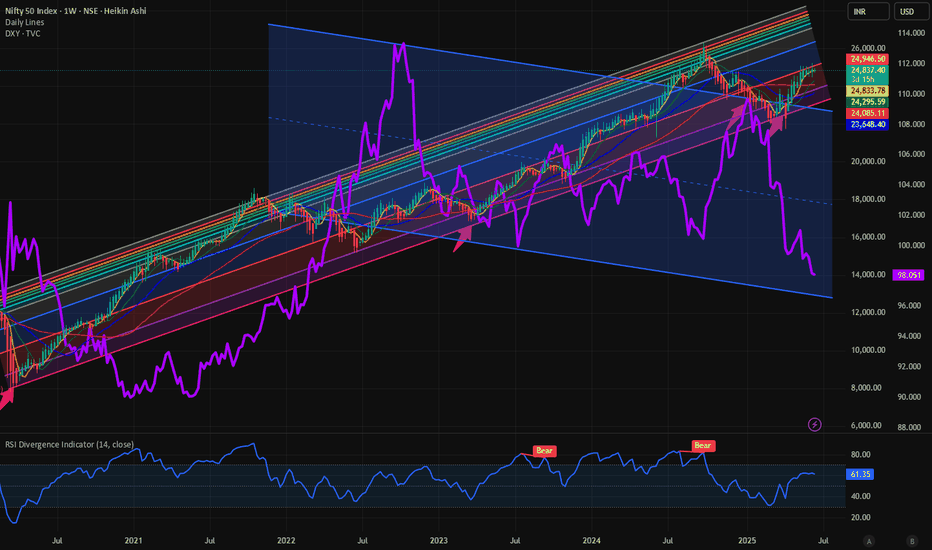

$DXY weakness and EM markets: $NIFTY more upside? The recent weakness in TVC:DXY is well documented. We have analyzed it here in detail in our blogs. This weakness is giving wings to all kinds of risk assets including Ems. One of our favorite EM in this space has been India and NSE:NIFTY index for quiet some time. It is the only EM which is close to beating S&P 500 over the last 5-year period. We have been recently bullish at NSE:NIFTY and published new targets on June 6. Please check the post in the link here.

NSE:NIFTY : New highs incoming; 27500 can be cycle highs for NSE:NIFTY by RabishankarBiswal — TradingView

The road to the medium-term target of 27500 on NSE:NIFTY has to do with the weakness of $DXY. As we see, lower lows and lower highs in the Dollar index TVC:DXY provides the required boost to risky assets like Stocks, Crypto and EMs. Even if we have some recent choppiness in the market the upward momentum will continue. By the end of July, we might see TVC:DXY at 96 up 2.5% and NSE:NIFTY @ 26000 up 5%.

Verdict : Pair Trade : Short TVC:DXY to 96 and Long NSE:NIFTY to 26000.