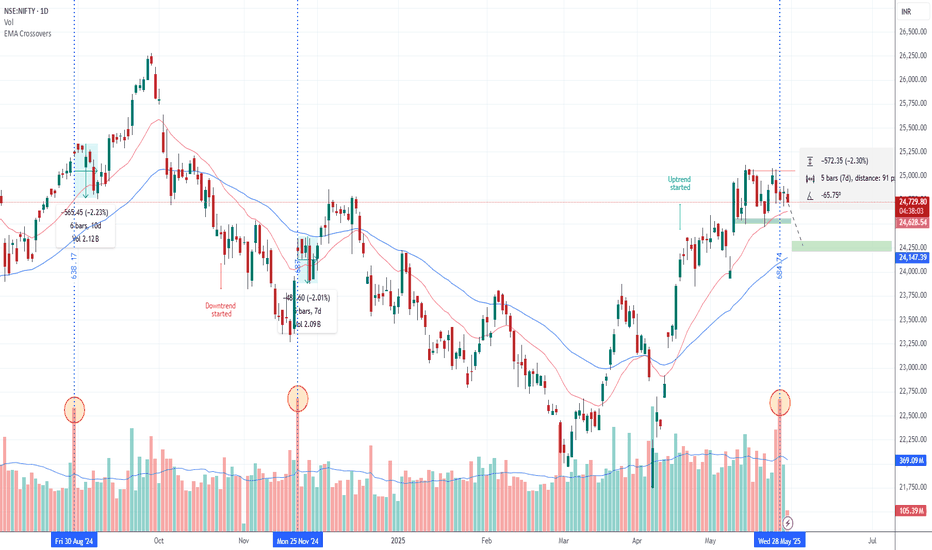

Nifty Might Give around 2 % correction in short TermWhy are we expecting Short Term Correction near 24200-24300 why?

30 August 2024 volume 638.13 million

25 November 2024 volume 687.13 million

28 May 2025 Volume 684.74 million

No.1 In near term past whenever a red or Doji candle forming on daily chart volume traded above 680 million, we had seen around 2 -3 % fall.

No.2 strong 50 EMA support

No.3 Nifty want to fill gap

No.4 Double Top Near 25000 level

This analysis is based on daily Chart, it's just assumption pls trade on your own Risk

NIFTY trade ideas

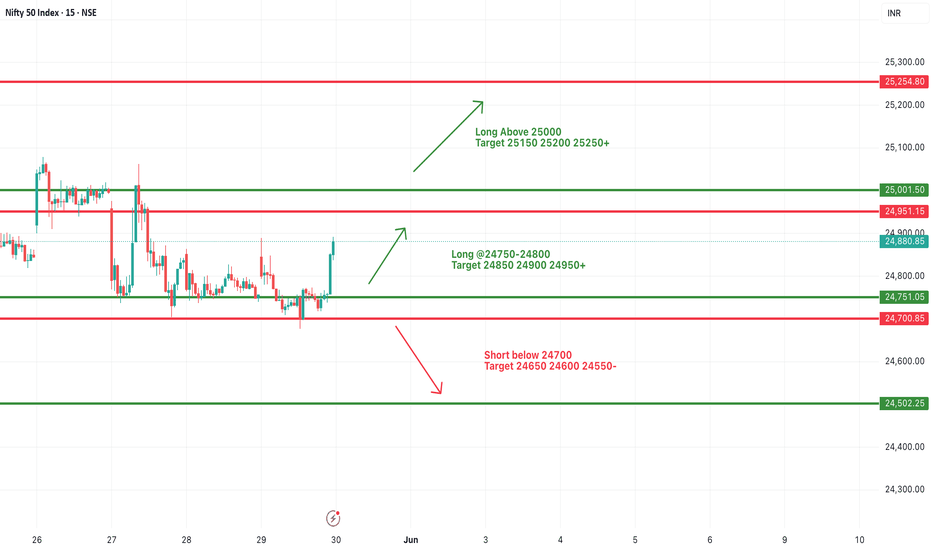

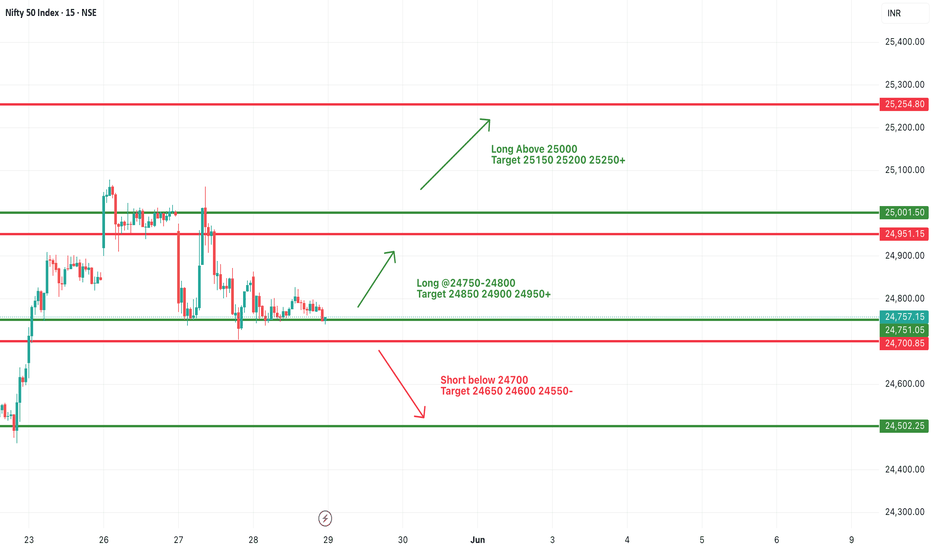

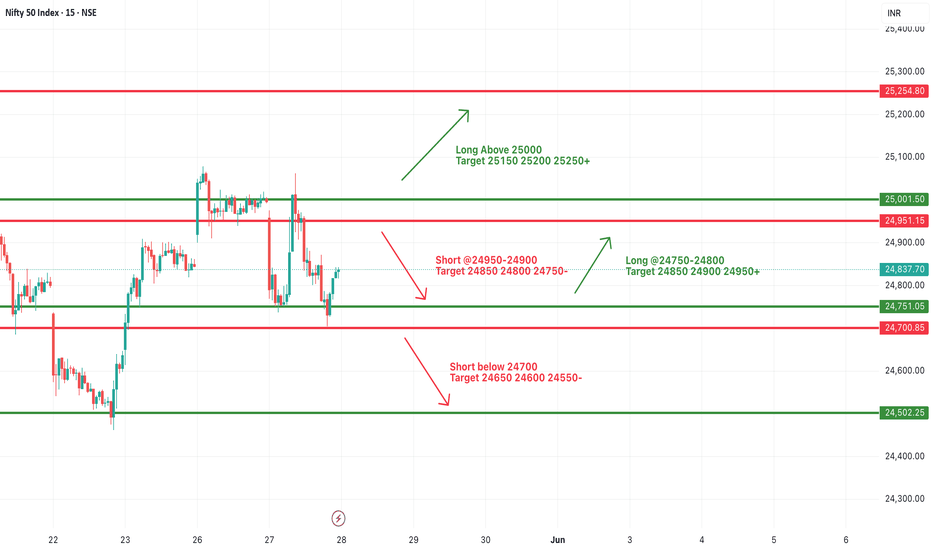

#NIFTY Intraday Support and Resistance Levels - 30/05/2025Nifty is expected to open flat around the 24800–24850 range. The market has shown signs of recovery from lower levels, and if it manages to hold above the 24800–24850 support zone, we can expect a continuation of upward momentum. In that case, possible intraday upside targets are 24900, 24950, and a breakout beyond 25000 could extend the rally toward 25150, 25200, and 25250+ levels.

However, if Nifty fails to sustain above 24800 and faces resistance near 24900–24950, a pullback may occur. A confirmed breakdown below 24700 would signal weakness and could trigger a fresh round of selling. In such a scenario, downside targets would be 24650, 24600, and possibly 24550.

Today’s session may start off sideways with consolidation between key levels. Wait for clear confirmation above 24850 for longs or below 24700 for shorts. Keep trailing your stop-loss and book partial profits near every target zone.

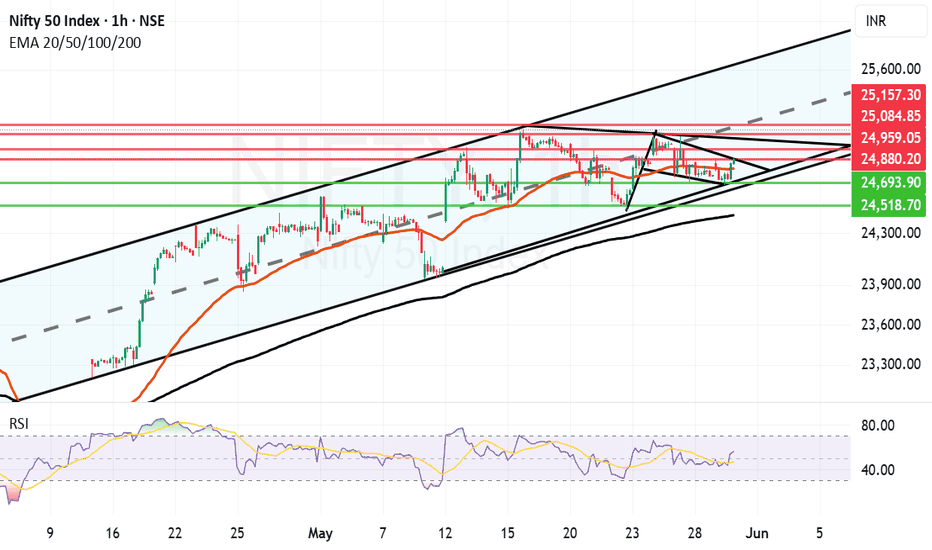

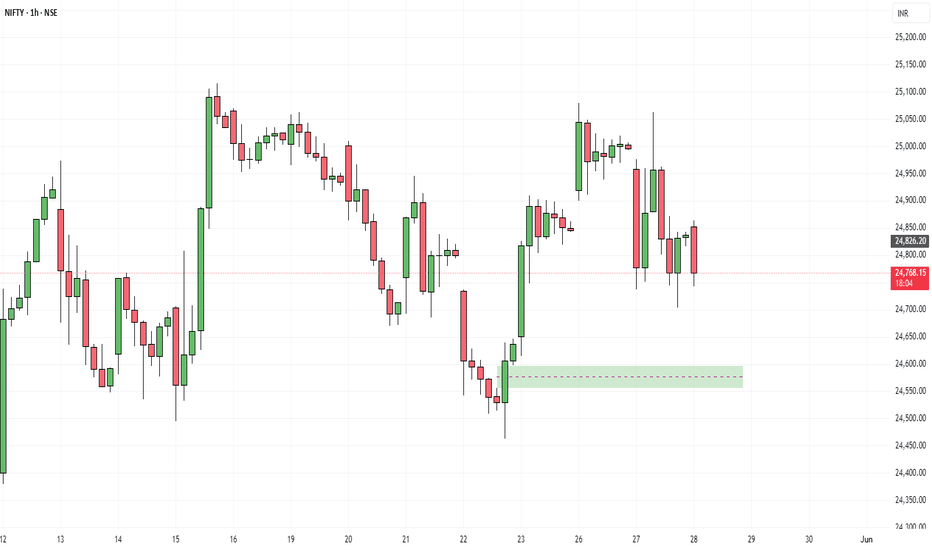

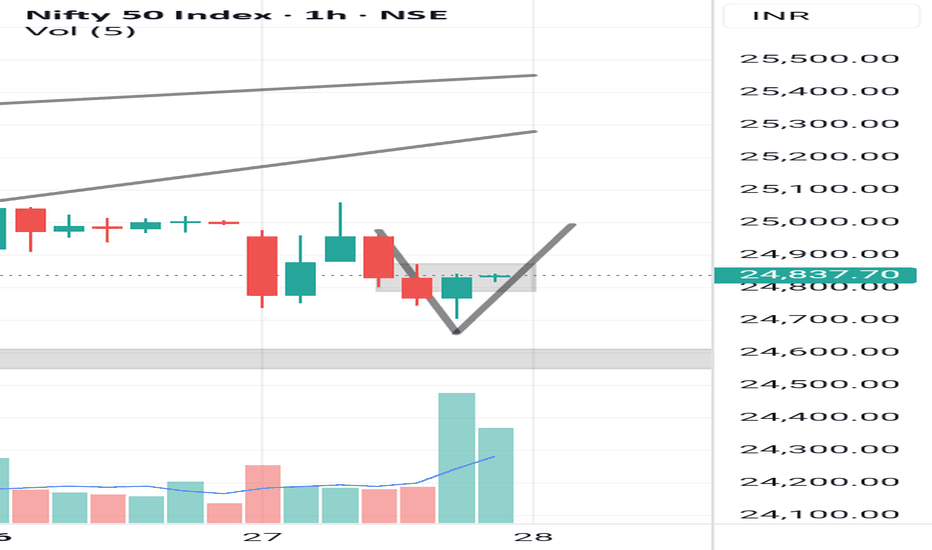

Flag and Pole kind of structure forming in Nifty. There is a very positive looking flag and pole kind of structure forming in Nifty hourly chart. This is within a parallel channel which Nifty has been following since April 15th 2025. This Flag and Pole breakout will come into effect if and only if we get a closing above 24880.

In case of flag and pole breakout happening the future resistances will be near 24959, 25084 and 25157. 25157 again will be a major resistance as it will be the mid of the channel.

The supports for Nifty in case the flag and pole breakout does not take effect are at 24804 (Mother line of hourly chart) 24693, 24518 and finally 24439.

Below 24439 bears can take over the market. Above 25157 Bulls can take over the market. Shadow of the candle is effectively neutral to positive.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

Nifty Analysis EOD – May 29, 2025 – Thursday🟢 Nifty Analysis EOD – May 29, 2025 – Thursday 🔴

Tricky Expiry Day Rollout… Catch or Caught?

🗞 Nifty Summary:

Nifty opened with a gap-up of 88 points at 24,846, making a quick move to 24,889.70—but the bulls couldn’t hold for long. By 10:30, the key support zone at 24,800–24,768 was breached, dragging the index to an intraday low of 24,677.30.

Just when things seemed to be settling into a narrow expiry-day range, a sharp 65-point spike in 3 minutes surprised both sides—creating a mean-reversion V-shape move right back to VWAP and BC levels.

The real twist? A sudden domino-effect breakout at 15:00, marking a fresh high of 24,892.60 and closing at 24,880.85, nearly at the day’s peak.

⏪ Yesterday’s Note Recap:

"Most probable scenario: range-bound day between 24,660 and 24,882... Tricky expiry day."✔️ Spot on. Nifty respected the projected boundaries almost precisely.

🛡 5 Min Chart with Patterns and Levels

📈 Intraday Walk:

09:15 – Gap-up start, optimism in the air.

10:25 – Support at 24,800–24,768 tested and breached.

10:29 – IB Low Break and Day’s low at 24,677.30, bears step in.

12:38 – Surprise spike of 65 points in 3 min

Midday – Consolidation around VWAP and BC levels.

15:00 – Final push leads to breakout above day high → 24,892.60.

Close – Ends at 24,880.85, just below the day high.

🔍 Chart Observations:

✅ Inverse Head & Shoulders pattern formed around 24,768 on the 5-min chart—target achieved.

📦 Box Consolidation Zone repeated from yesterday and respected.

⚠️ Volatility spikes despite being an expiry day—tricky traps for both sides.

🛡 5 Min Chart with Patterns

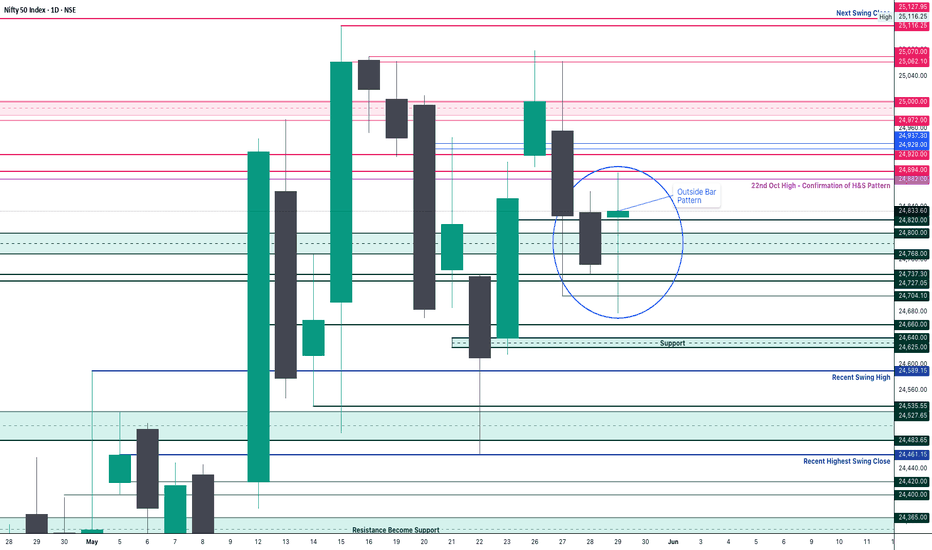

🕯 Daily Time Frame Chart

🕯 Daily Candle Breakdown:

Open: 24,825.10

High: 24,892.60

Low: 24,677.30

Close: 24,833.60

Change: +81.15 (+0.33%)

Candle Structure:

Real Body: +8.50 pts → Tiny green body

Upper Wick: 59.00 pts

Lower Wick: 147.80 pts

Interpretation:A classic Hammer-like candle, showing strong intraday buying from lower zones. Although bulls couldn’t extend gains, they clearly defended 24,700 levels well.

🔔 Pattern Insight:

Outside Bar pattern on Daily → Often a bullish reversal sign

Bullish confirmation comes above 24,890+

Breakdown below 24,677 would invalidate the bullish signal

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update:

ATR: 291.38

IB Range: 110 → Medium

Market Structure: Balanced

Total Trades: 1

🕐 10:25 AM – 1st trade triggered→ Trailing SL hit at 1:3 risk-reward

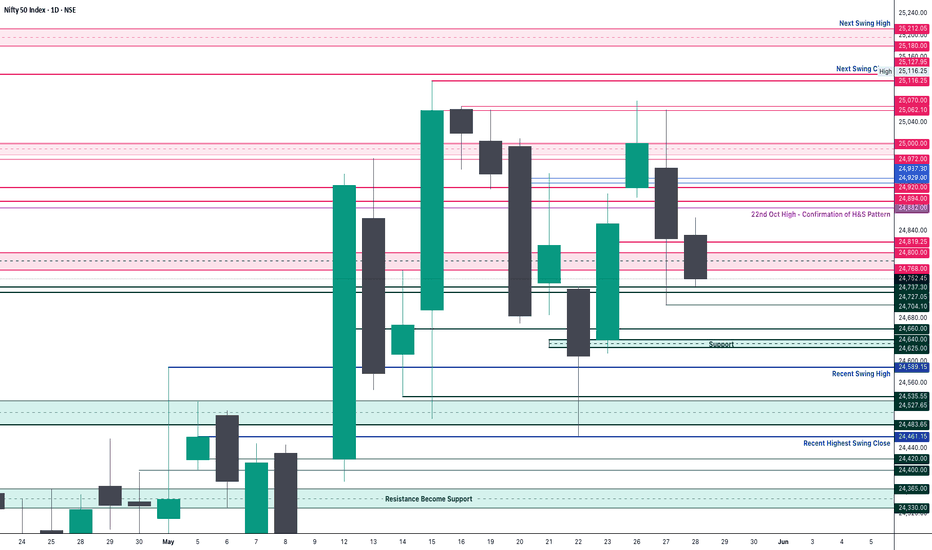

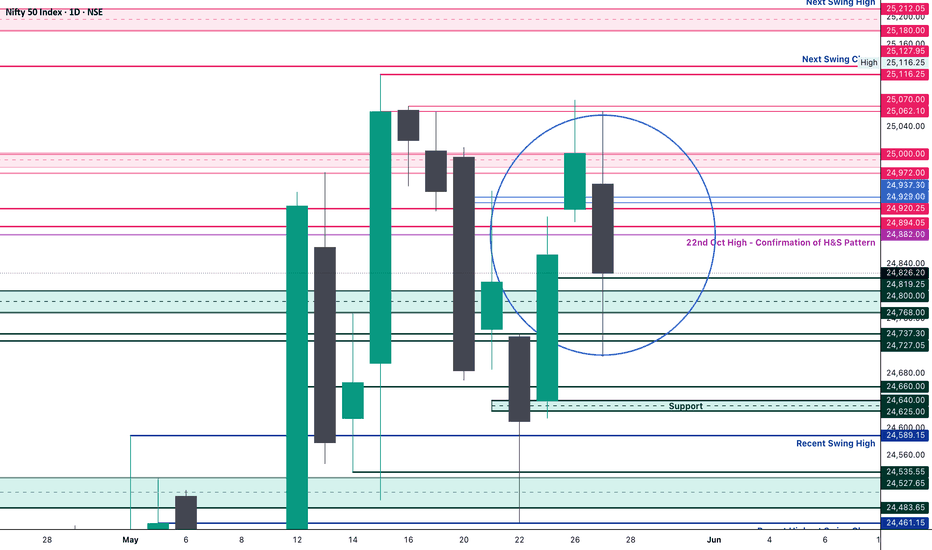

🧱 Support & Resistance Levels:

Resistance Zones:

24,882

24,894

24,920

24,972 ~ 25,000

25,062 ~ 25,070 (5th rejection!)

25,116 ~ 25,128

25,180 ~ 25,212

25,285 ~ 25,399

Support Zones:

24,820

24,768 ~ 24,800

24,737 ~ 24,727

24,700

24,660

24,640 ~ 24,625

24,590

24,530 ~ 24,480

24,460

🧭 What’s Next?

Above 24,890 → May trigger short-covering rally toward 25,000, 25,065, and 25,116 levels.

Below 24,677 → Expect downside toward 24,625, 24,590, and possibly 24,530.

With expiry behind, volatility may remain elevated tomorrow as new series begins.

📌 Bias: Mild bullish, but needs confirmation above 24,890.

🧠 Final Thoughts:

“Markets don’t trap you; your bias does.”Stay sharp. Today was a day full of whipsaws—but also full of lessons.

✏️ Disclaimer:This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty levels - May 30, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

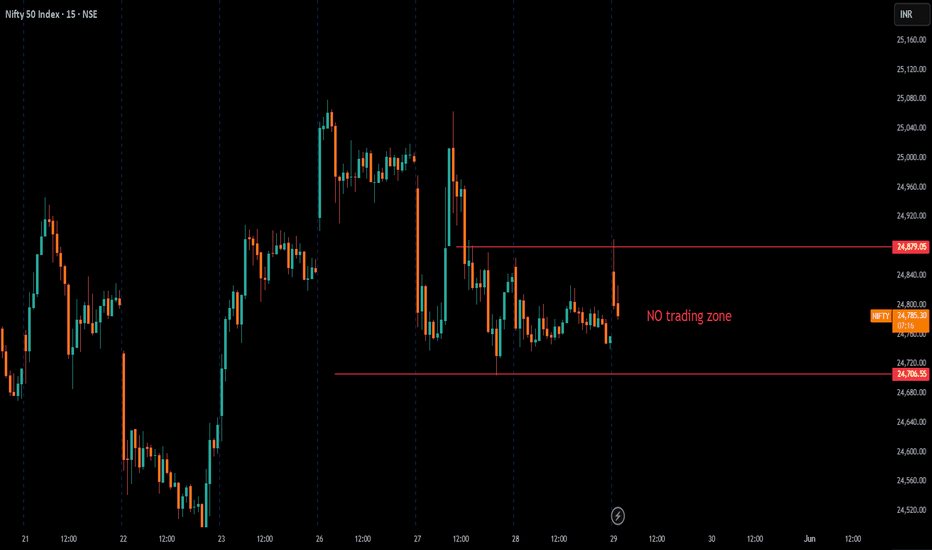

#NIFTY Intraday Support and Resistance Levels - 29/05/2025Today, Nifty is expected to open flat near the 24750 level. If it sustains above the 24750–24800 zone, a bullish move is possible with upside targets at 24850, 24900, and 24950+.

Further rally may be seen if Nifty breaks above the 25000 level, aiming for extended targets of 25150, 25200, and 25250+.

On the downside, if Nifty slips below 24700, a bearish trend may unfold with downside targets at 24650, 24600, and 24550.

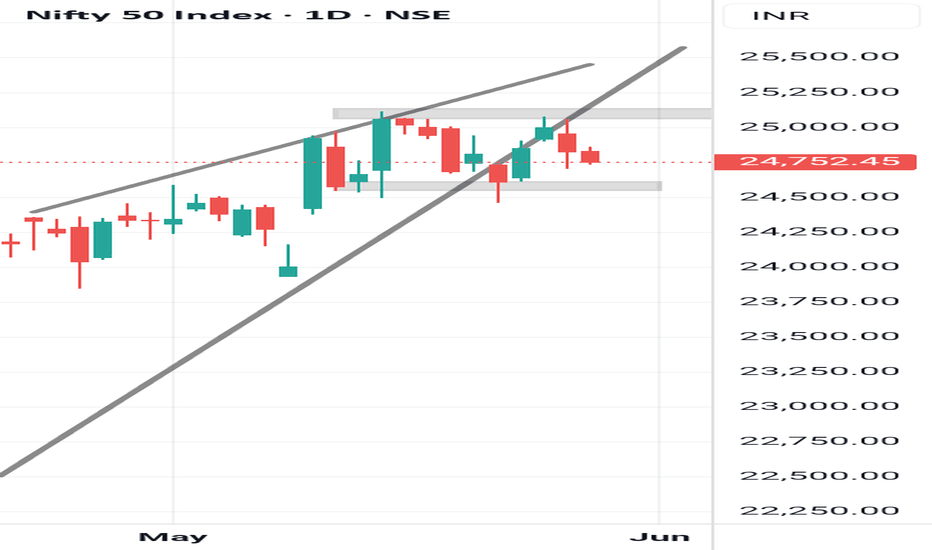

NIFTY 50

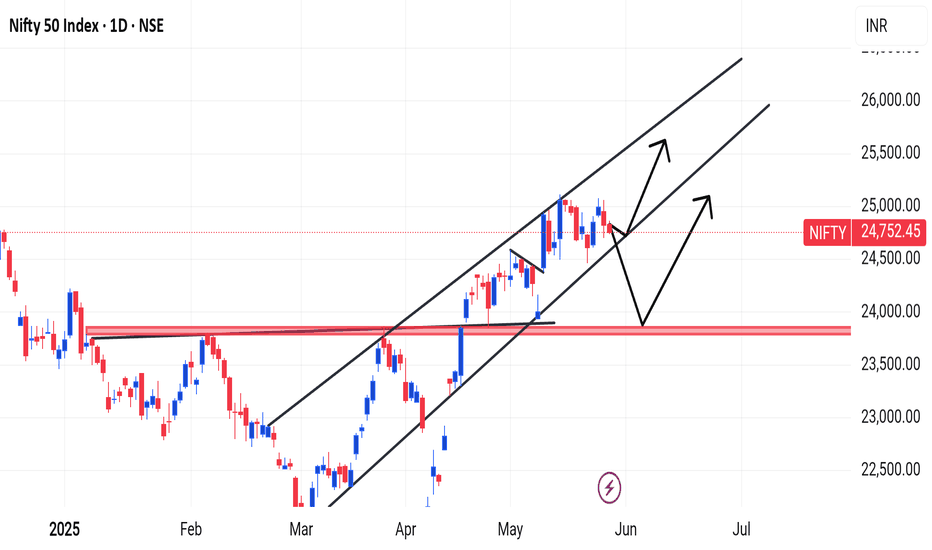

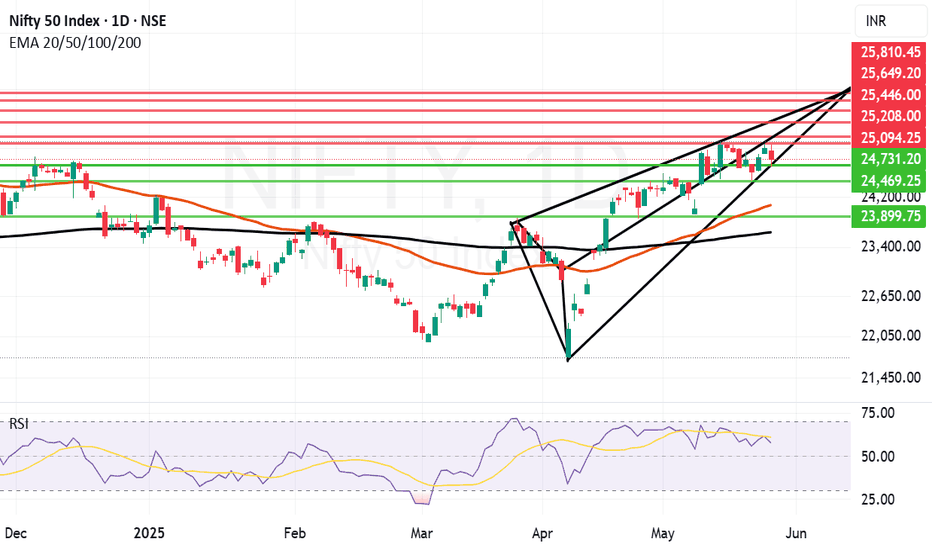

1. Ascending Channel:

Nifty is trending within a clear upward (ascending) channel, indicating a bullish trend as long as the price stays within this channel.

2. Support & Resistance:

There is a strong support zone in the range of 24,000–24,200, highlighted by a red-shaded area on the chart.

The current level (24,752.45) is near the middle of the channel and showing signs of minor correction.

3. Two Possible Scenarios (Arrows):

Scenario 1: From the current level, the market could move towards the upper boundary of the channel (around 25,500–26,000).

Scenario 2: There could be a short-term correction (downward movement) first, followed by a bounce from the support zone and then an upward move.

If you find this helpful and want more FREE forecasts in TradingView, Hit the 'BOOST' button

Drop some feedback in the comments below! (e.g., What did you find most useful?

How can we improve?)

Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week

DISCLAIMER: I am NOT a SEBI registered advisor or a financial adviser. All the views are for educational purpose only

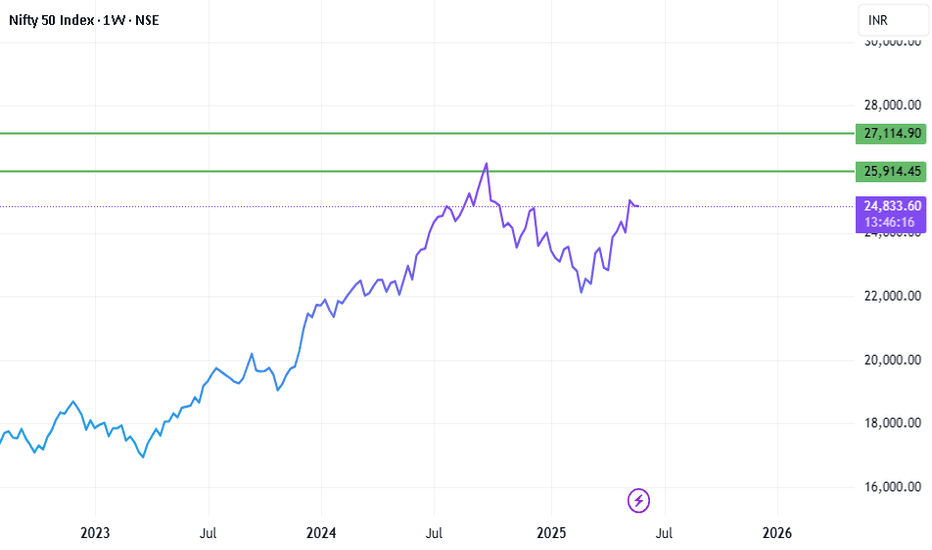

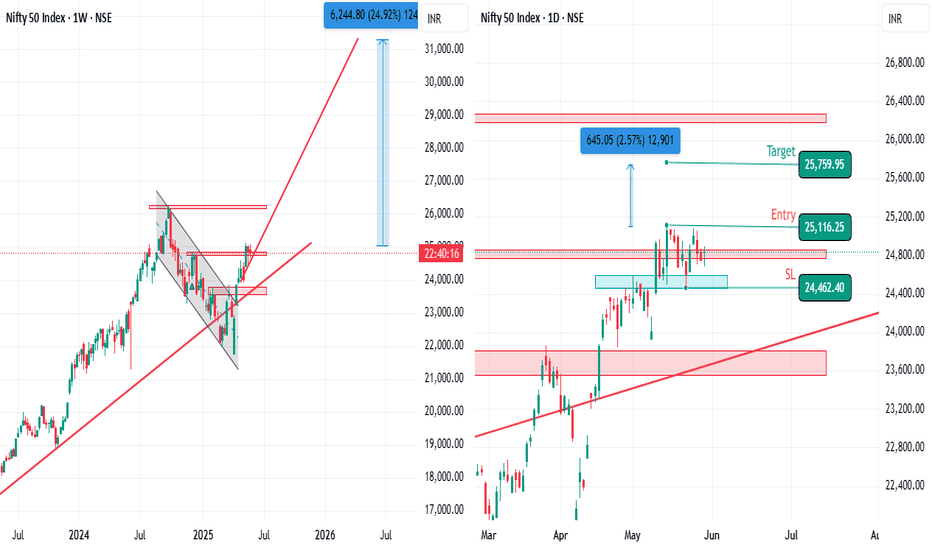

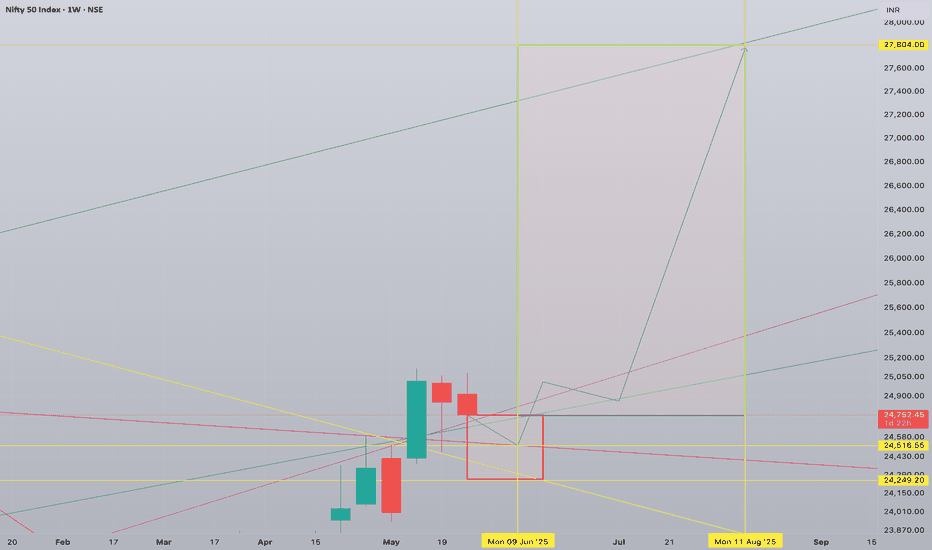

NIFTY 1W forecast until August 2025India's stock market is correcting now. The correction will be short and not deep - just a normal retest of 24,500 but should not make a weekly close below 24,250 during the first half of June 2025.

A major bullrun will start in the middle of June 2025. Slowly at first, but explosive during summer.

It will find its top in August 2025 at the level of 27,800

Here I publish 1W charts, for weekly 1D charts check my profile for more ways to keep in touch

Nifty Analysis EOD – May 28, 2025 – Wednesday🟢 Nifty Analysis EOD – May 28, 2025 – Wednesday 🔴

Consolidation at the bottom—ready to blast? Or more of the same tomorrow?

📊 Nifty Summary:

Nifty opened mildly higher at 24,832.50, only to spend the entire session grinding within a narrow 127-point range. Most of the action stayed trapped in a 60-point box, giving day traders a frustratingly sideways experience. Attempts to break the range failed, and the index closed at the day's lower edge, continuing the consolidation near key support zones.

🔍 Intraday Walk:

Nifty opened with a small positive bias but failed to find follow-through.

For the major part of the day, price action remained boxed in a tight range—ideal only for scalpers and option writers.

An attempted breakout was seen, but the index quickly fell back into the consolidation zone.

Triangle breakout on 5-min chart came late (3:00 PM), with no time for validation.

Closed near day’s low at 24,752.45, just above crucial support.

🛡 5 Min Chart with Patterns

🛡 5 Min Chart with Patterns and Levels

🔎 Chart Observations:

🔸 Mini M-Pattern formed twice on 5-min chart at key level—adds to bearish caution.

🔸 Box consolidation zone repeated from yesterday’s range.

🔸 Symmetrical Triangle seen on 5-min chart broke on the downside at 15:00—too late to act but worth noting.

🔸 Yesterday’s low stayed protected, though price closed weak.

🔸 Volatility dried up ahead of monthly expiry—expect positioning tomorrow.

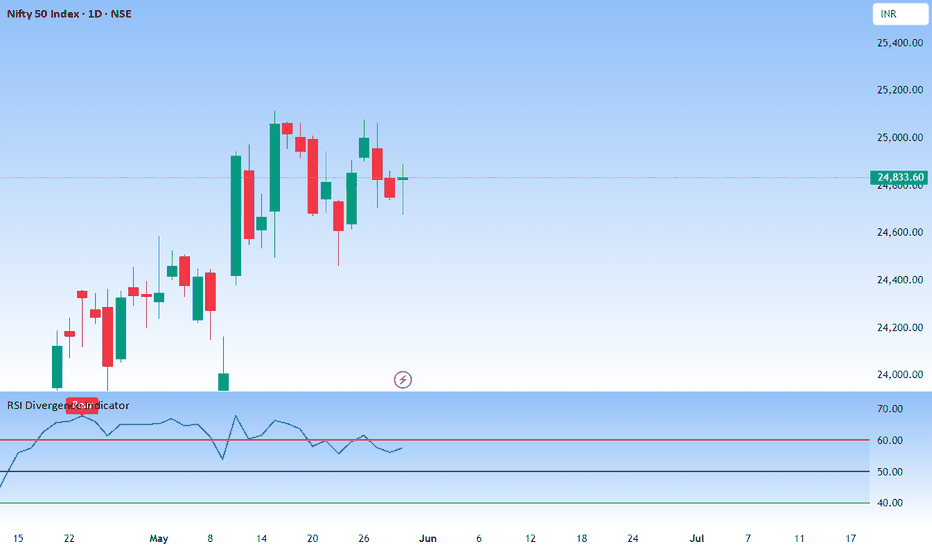

🕯 Daily Time Frame Chart

📉 Daily Candle Breakdown:

Open: 24,832.50

High: 24,864.25

Low: 24,737.05

Close: 24,752.45

Change: −73.75 (−0.30%)

Candle Structure:

Real Body: 80.05 pts (Red candle)

Upper Wick: 31.75 pts

Lower Wick: 15.40 pts

Interpretation:

Small-bodied candle with short wicks on both ends—a Bearish Spinning Top, hinting at indecision but with a slight bearish bias.

Inside Bar formation – breakout watch on either side.

🧠 Key Insight:

The market is digesting the recent downside with sideways consolidation. If bulls fail to protect 24,700, deeper cuts could follow. On the flip side, a break above 24,882 could trigger short-covering ahead of expiry.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update:

ATR: 299.84

IB Range: 121.2 → Medium

Market Structure: Balanced

Total Trades: 0

❌ No valid triggers today – system stayed out due to tight range and lack of momentum.

📌 Support & Resistance Levels:

🔺 Resistance Zones:

24,768 ~ 24,820

24,882

24,894

24,920

24,972 ~ 25,000

25,062 ~ 25,070 (Rejected for 5th time!)

25,116 ~ 25,128

25,180 ~ 25,212

25,285 ~ 25,399

🔻 Support Zones:

24,737 ~ 24,727

24,700

24,660

24,640 ~ 24,625

24,590

24,530 ~ 24,480

24,460

🔮 What’s Next?

Scenario 1 – Breakdown:If 24,700 breaks and sustains, Nifty may head towards 24,589 → 24,500 → 24,461.

Scenario 2 – Breakout:If 24,882 breaks and sustains, Nifty can test 24,920 → 24,972 → 25,000 → 25,065 → 25,116 → 25,180.

📍 Most probable scenario:Expecting a range-bound day between 24,660 and 24,882, typical of Monthly expiry sessions. However, if short covering triggers, the day could flip into a trend day.

⛔ Caution: Tomorrow is a tricky expiry day—stay nimble, follow strategy, and respect levels!

🧘 Final Thoughts:

"The calm before the storm often wears the mask of boredom. When the market sleeps, prepare for the wake-up call."

✏️ Disclaimer:This is just my personal viewpoint. Always consult your financial advisor before taking any action.

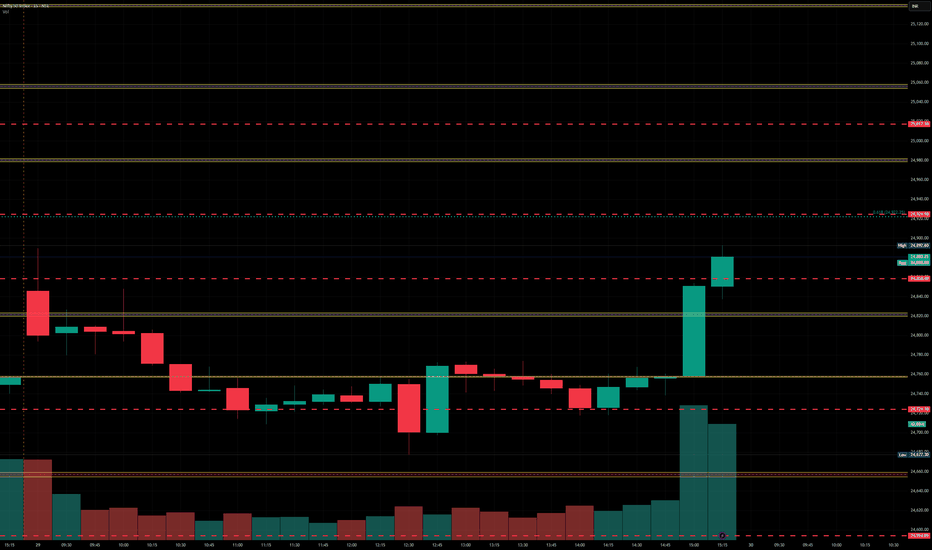

Nifty levels - May 29, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

#NIFTY Intraday Support and Resistance Levels - 28/05/2025Today, Nifty is expected to open flat near the 24800–24850 zone. If it sustains above 24800–24750, a bullish move is possible toward 24850, 24900, and 24950+.

Further momentum may be seen if Nifty breaks and holds above 25000, targeting 25150, 25200, and 25250+.

On the downside, if Nifty fails to hold above 24950–24900 and starts slipping below this zone, short trades can be considered with targets of 24850, 24800, and 24750.

A breakdown below 24700 may accelerate selling pressure, leading to extended downside targets of 24650, 24600, and 24550.

Expect choppy moves near key levels — trade with a defined stop loss and lock in profits at each stage.

NiftyNifty CMP 24826

if market holds todays low , than this fork would do its wonder

and we may go up to touch the upper end of this fork...

if todays low is broken, than the area which I marked would act as support...

if that is also broken, I would reconsider my approach...

but have a strong feeling that todays low would hold and any dip would be buying opportunity for upside ...

Just a View!!

Vedang ! :)

Chart is for study purpose only!!!

Nifty Analysis EOD – May 27, 2025 – Tuesday🟢 Nifty Analysis EOD – May 27, 2025 – Tuesday 🔴

Another day, another 25K fight. Bulls tried hard, but bears had the final say — what about tomorrow?

📊 Nifty Summary:

The market opened with a slight gap-down of 38 points at 24,958. Within just 10 minutes, Nifty slid 207 points below the previous day’s low, diving into the 24,768–24,800 zone. It briefly halted around 24,737 — marking the first low of the day — and then suddenly reversed sentiment with a rapid 295-point rally within 45 minutes, breaking CPR, PDH, and even touching the previous week’s high. However, this strength didn’t last long. Gradually, Nifty fell back toward VWAP, broke below the current day low, and formed a new low at 24,704. It eventually closed at 24,826 — above the 24,768–24,800 support zone but below the PDL.

The rally between 24,768 and 25,062 was surprising in both speed and size. It didn't feel like short-covering or fresh buying, but it certainly caught many traders off-guard and likely led to position adjustments.

🛡 5 Min Chart with levels

📉 Intraday Walk:

🔻 Sharp fall within first 10 mins: 24,958 → 24,737

🔼 Sudden spike: 24,737 → 25,062 (rally of 295 points in 45 mins)

🔻 Gradual drop back to VWAP and beyond

🧭 Final dip: new low of 24,704 before recovery

✅ Closed at 24,826 — still above a key support zone

🧠 Key Observations:

Today's low (24,704) aligns near the 0.618 Fibonacci retracement from swing low to PDH — suggesting a potential end to the 3-day retracement phase if it holds.

Fair Value Gap (FVG) from May 22–26 is now filled, suggesting fresh buying interest may re-emerge.

But... closing below PDL (24,900) is a concern and hints at continued pressure.

It’s the fifth day of rejection from the 25,062–25,070 supply zone — a major wall to breach.

🕯 Daily Time Frame Chart

📉 Daily Candle Breakdown:

Open: 24,956.65

High: 25,062.90

Low: 24,704.10

Close: 24,826.20

Change: −174.95 (−0.70%)

🔍 Candle Structure

Real Body: Red (130.45 points) — signifies selling pressure

Upper Wick: 106.25 points — resistance near high

Lower Wick: 122.10 points — buyers tried to fight back➡️ Resembles an Inverted High-Wave Candle: signals indecision with bearish bias

Price volatility was intense. Bulls showed strength mid-day, but bears had better endurance. This candle may lead to further weakness unless buyers reclaim 25,063 quickly.

🛡 5 Min Intraday Chart

🥷 Gladiator Strategy Update

ATR: 314.6

IB Range: 178.7 (Medium)

Market Structure: Imbalanced

🎯 Trade Highlights:

🟥 9:20 Short Trigger → No trade (unfavourable R:R, System not Allow)

🟩 11:30 Long Trigger → SL Hit

🟥 14:20 Short Trigger → SL Hit

📉 Total Trades: 2 (Both hit SL)

Tough day for the system — range extremes and sudden reversals ruled the game.

📌 Support & Resistance Levels

📈 Resistance Zones:

• 24,882 ~ 24,895

• 24,920

• 24,980 ~ 25,000

• 25,062 ~ 25,070 (5th rejection!)

• 25,116 ~ 25,128

• 25,180 ~ 25,212

• 25,285 ~ 25,399

📉 Support Zones:

• 24,768 ~ 24,820

• 24,660

• 24,640 ~ 24,625

• 24,590

• 24,530 ~ 24,480

• 24,460

📌 What’s Next?

If 24,704 holds, bulls may attempt a bounce again.

A close above 25,063 would restore bullish sentiment.

But if 24,700 breaks, we may see deeper correction into lower support zones.

💬 Final Thoughts:

"Market will teach you humility every time you think you've figured it out."Today’s sudden rally followed by a deeper fall reminds us how quickly sentiment can shift. Trade with levels, respect zones, and keep adapting — that’s the only constant.

✏️ Disclaimer:

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty feeling pressure, unable to sustain above 25K levels.Nifty not able to sustain levels above 25K is not a good news. Nifty has to sustain above 25094 level on daily and 25208 on weekly closing for further upward move. Market is not showing confidence due to daily tariff related news coming for global Power house US. So Volatility will remain for a while till everything falls in place.

Right now Nifty is resting near trend line support levels of 24731. If 24731 is broken Bears can drag Nifty towards 24469, 24067 (Mother line Support), 23899 or even 23637 (Father line support). If Nifty can sustain above 25094 then there is a possibility for up move towards 25208 or even 25446 levels. Things are delicately poised right now and proper Bear Vs Bull Tussle is going on.

Shadow of the candle is neutral to negative but any positive news on global front can change the tide in favour of Bulls.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.