NIFTYM2025 trade ideas

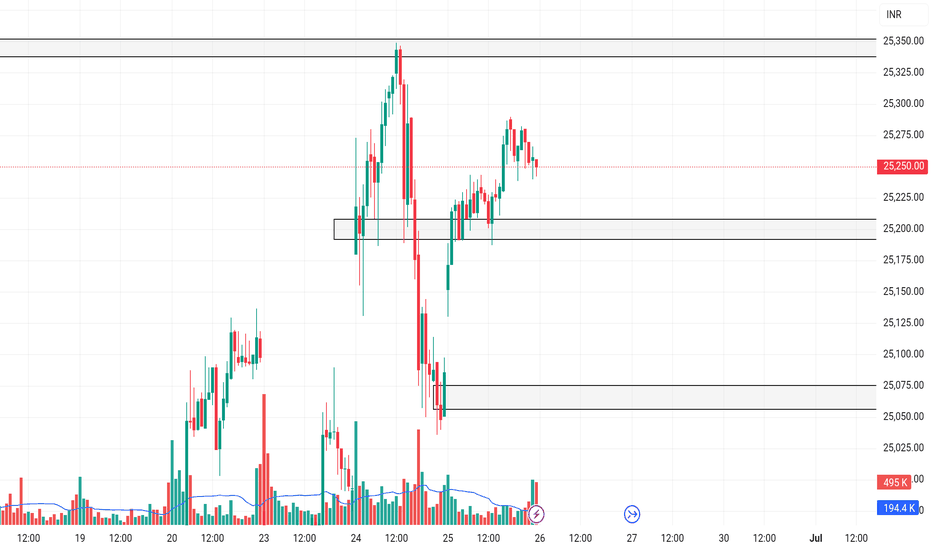

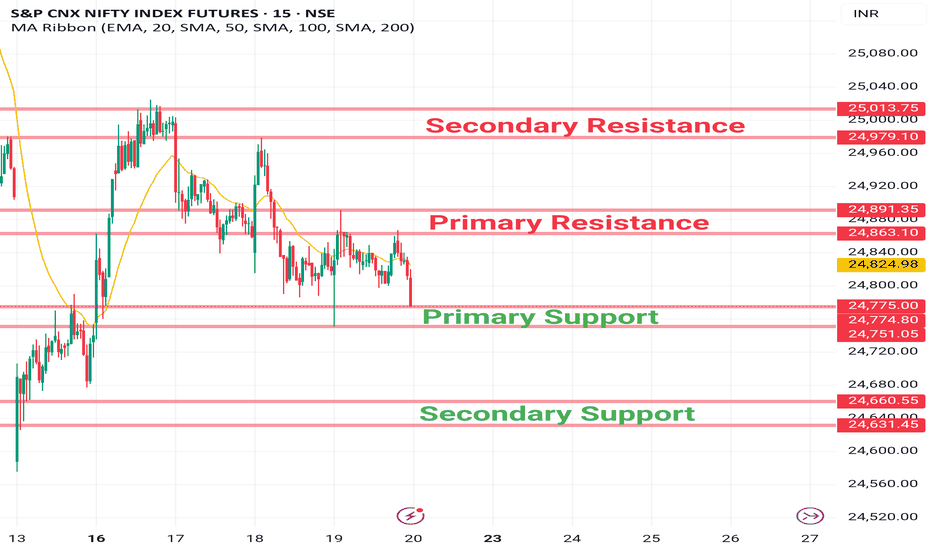

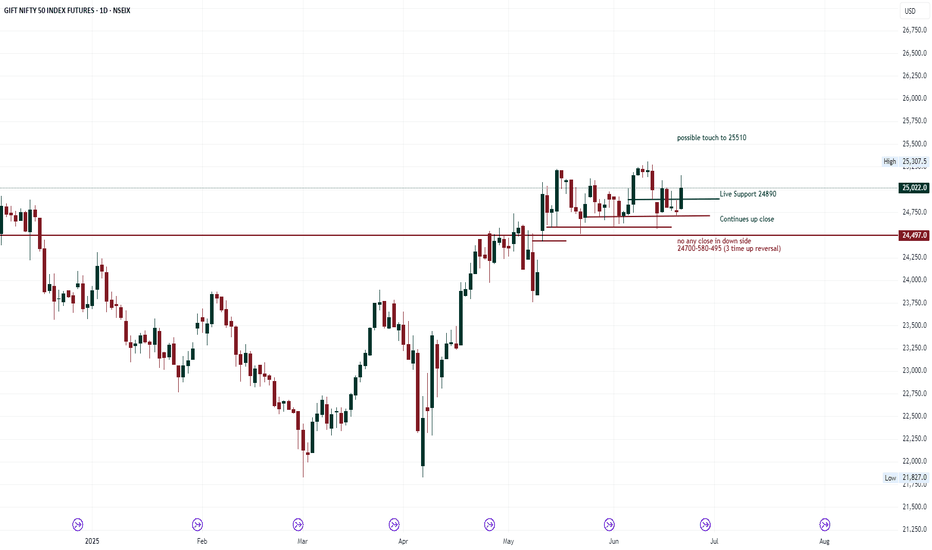

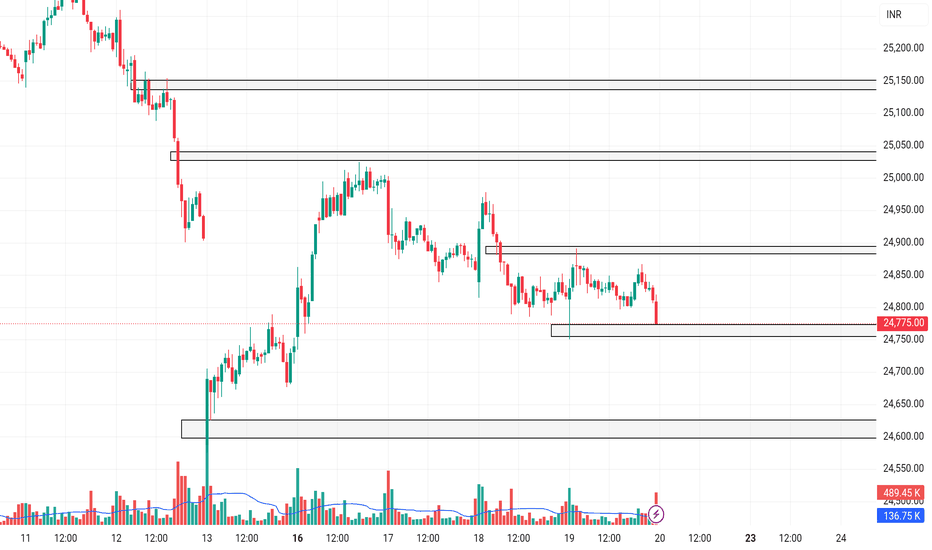

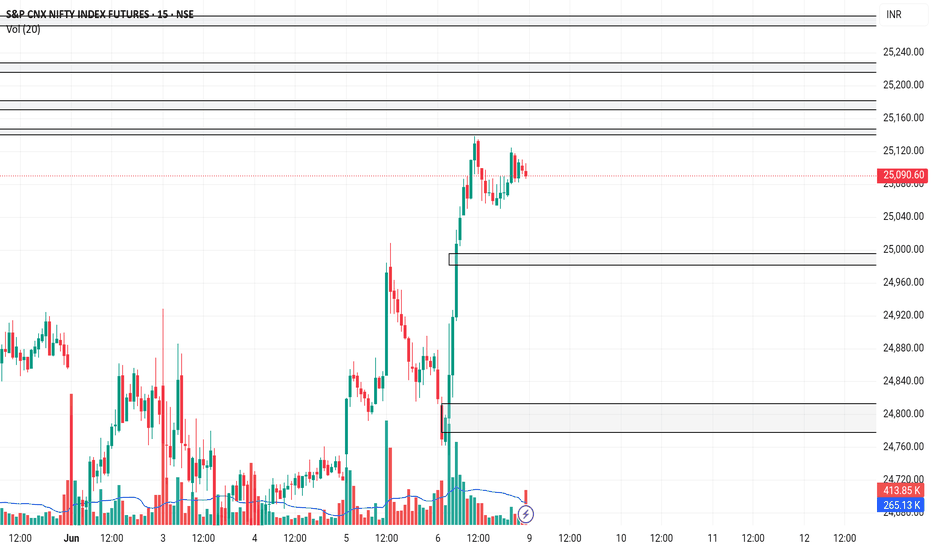

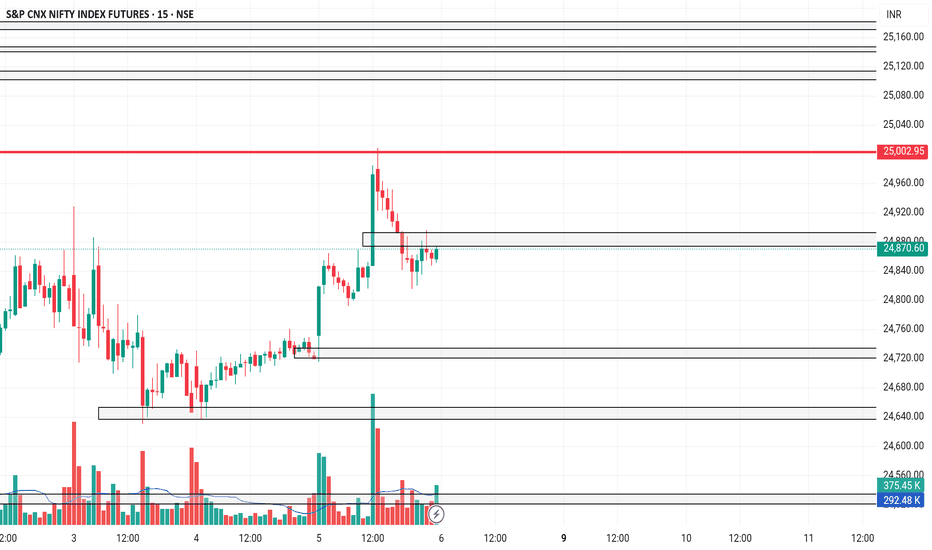

Nifty Important Levels for 20th June 2025Hello fellow traders,

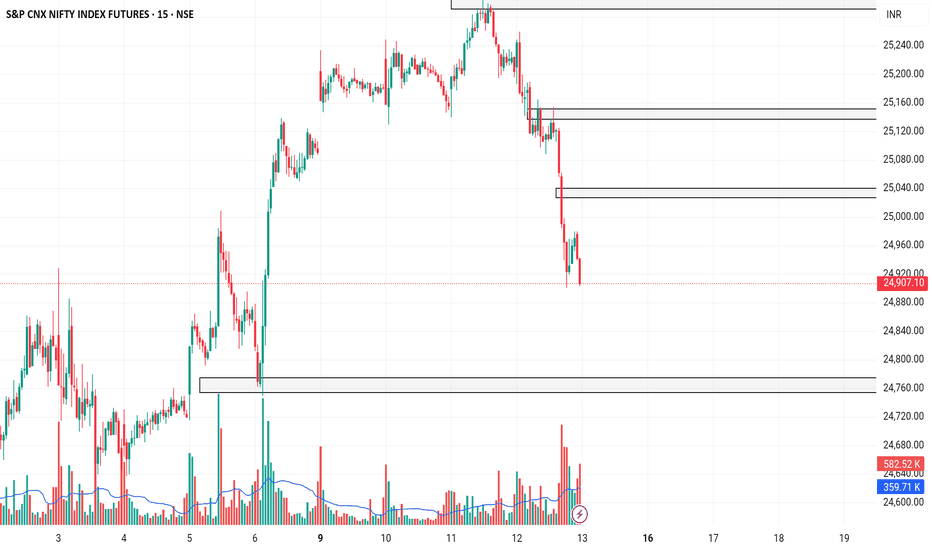

I'd like to share my analysis of the Nifty charts for educational purposes. Based on the chart, here's my understanding:

- If the price reaches primary support, it may bounce back to primary resistance, and vice versa.

- If the price breaks above primary resistance and retests it, it could target secondary resistance. A pullback from secondary resistance might lead it back to primary resistance.

- Conversely, if the price breaches primary support, it may head towards secondary support and potentially rebound back to primary support.

Remember to always use stop-loss and consider EMA 20 for identifying potential price retracements.

Wishing you a successful trading session tomorrow!

Best regards

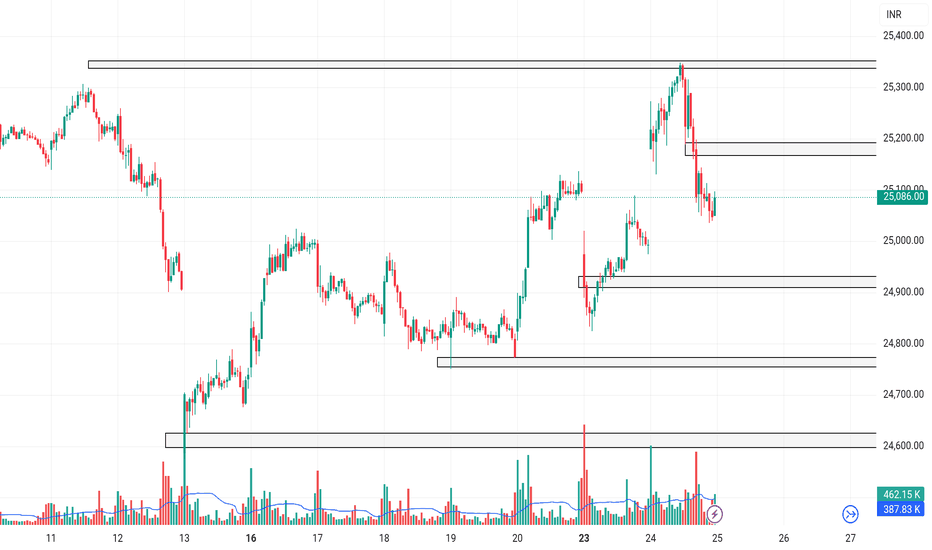

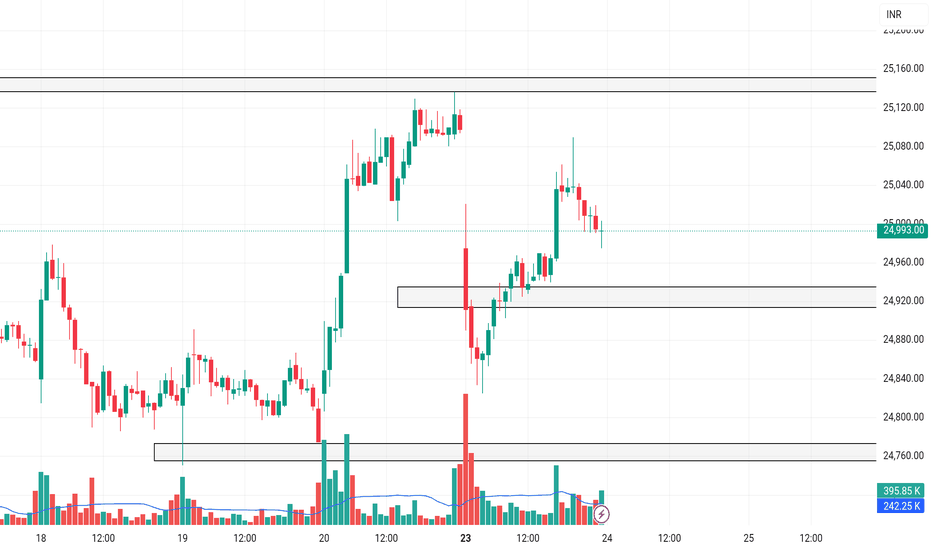

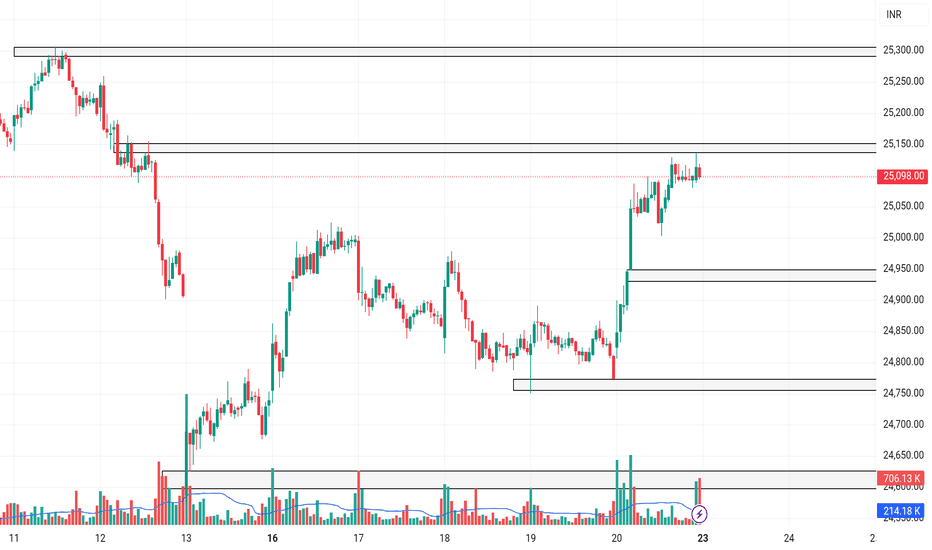

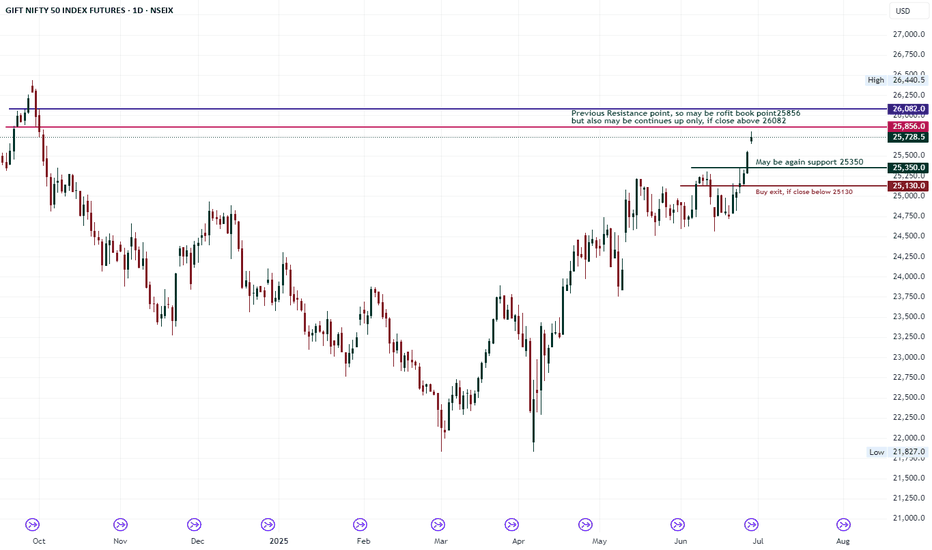

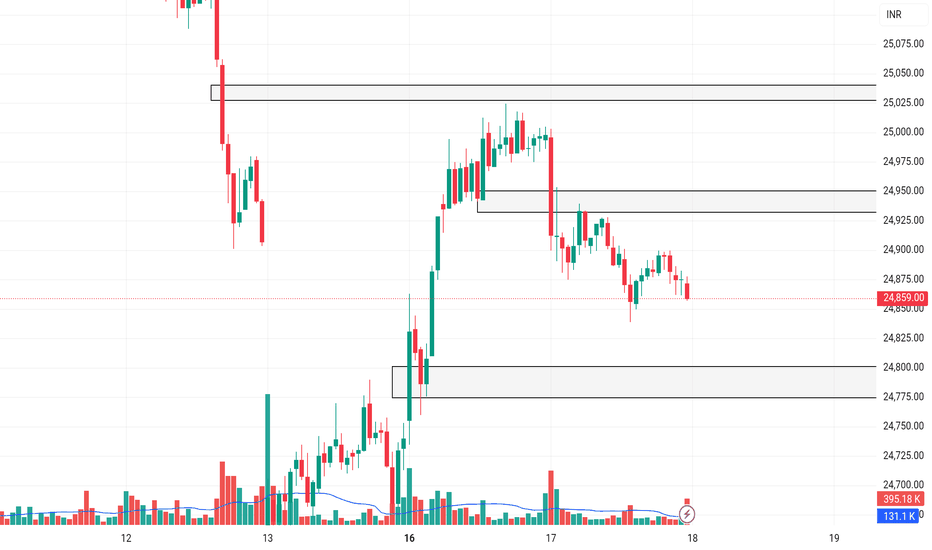

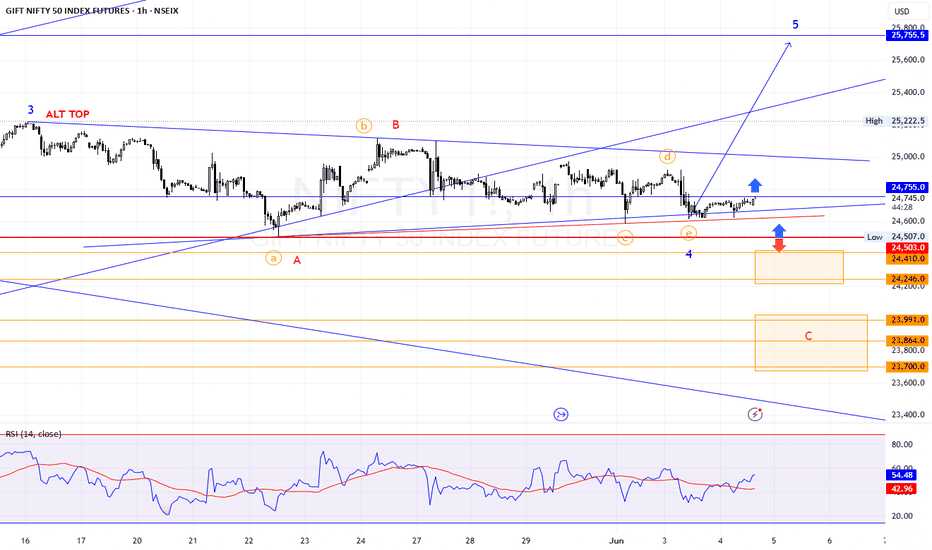

Gift Nifty bullishNSEIX:NIFTY1!

We are already bullish in Gift Nifty, in the analysis of which it was bought from 24930. Now the current market price of 25728 is near the previous resistance point 25856, which can become a profit book point, but the close of 26082 again gives bullishness to the market,

Otherwise, according to the report, buy support is again seen at 25350, which can be traded with a close stoploss of 25130.

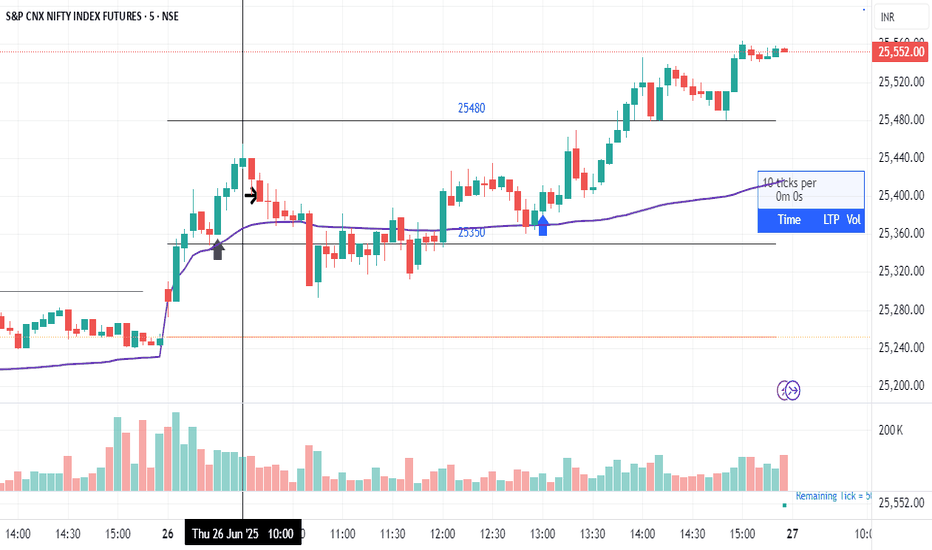

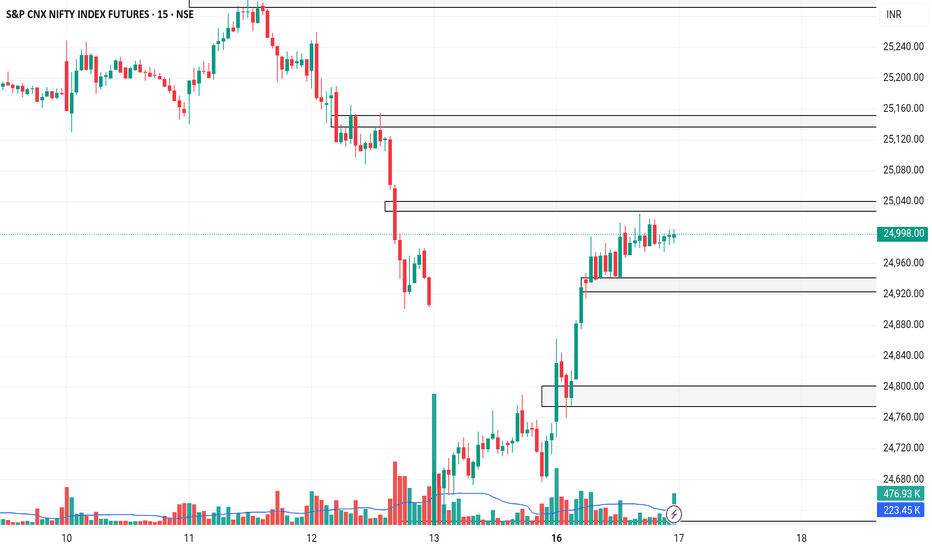

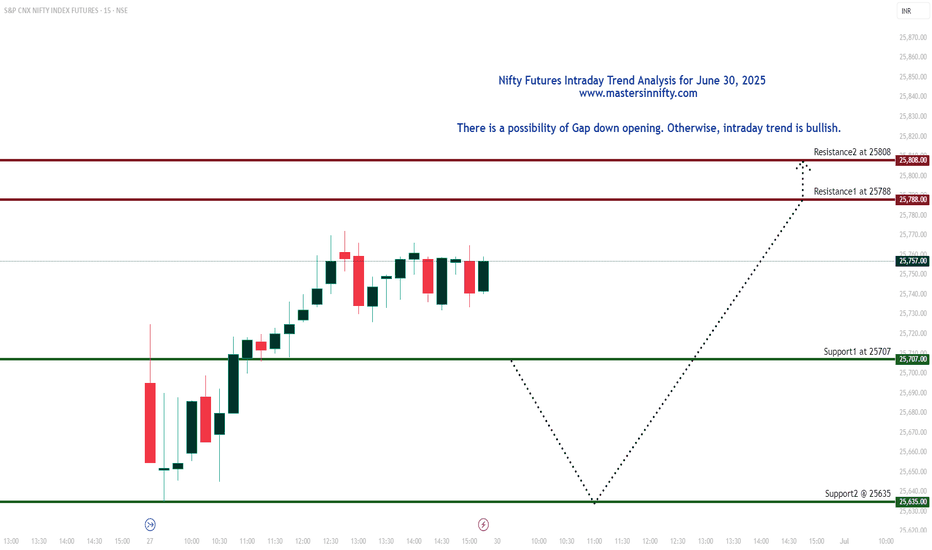

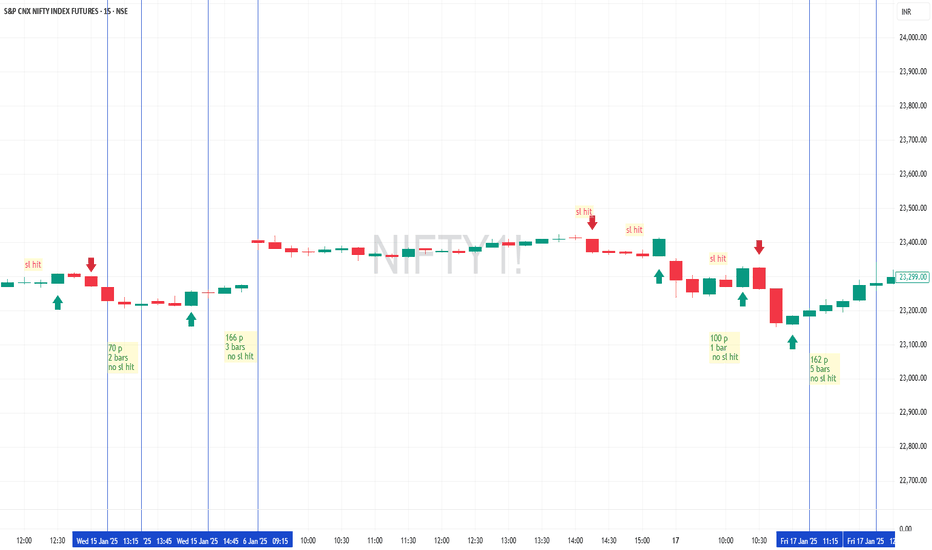

The Nifty Futures Intraday Trend analysis on June 30, 2025According to my analysis and time cycle study, a Gap Down opening is likely on Monday, June 30, 2025. However, the intraday trend appears bullish. Key support levels are at 25,707 and 25,635, while resistance is seen at 25,788 and 25,808. I consider 25,808 to be a strong resistance level—if breached, it may trigger further bullish momentum.

The magnitude of the gap remains uncertain. These levels reflect my personal analysis and are not guaranteed.

Trading in Futures and Options involves significant risk. Traders are strongly advised to conduct their own technical analysis before making trading decisions.