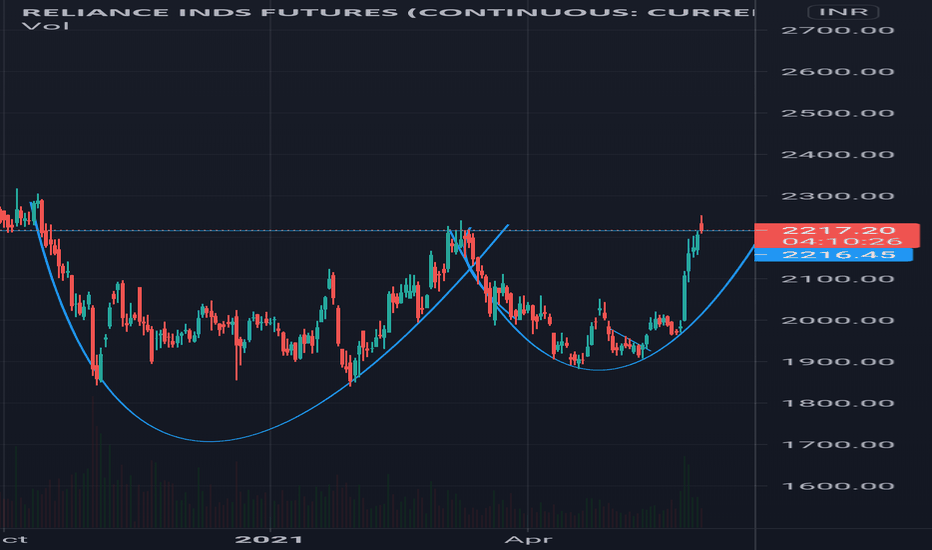

RELIANCE2! trade ideas

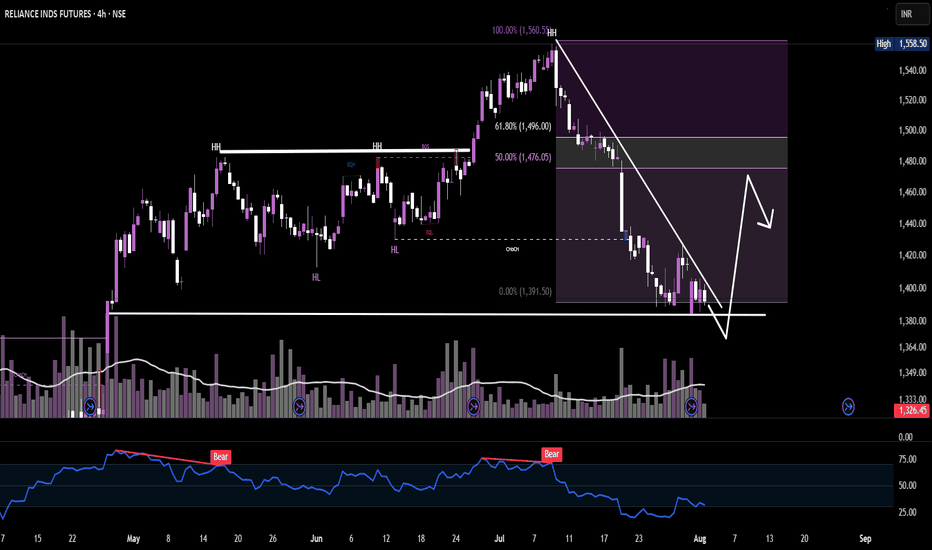

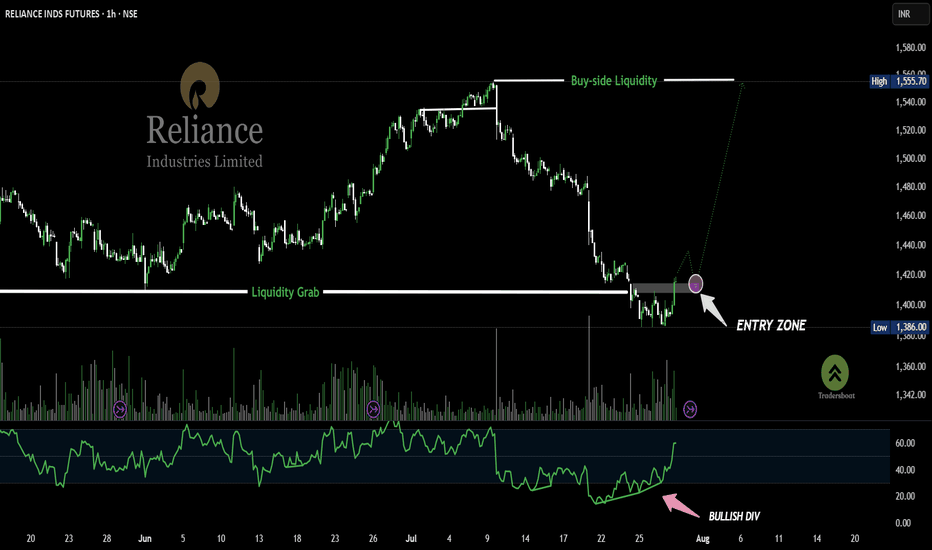

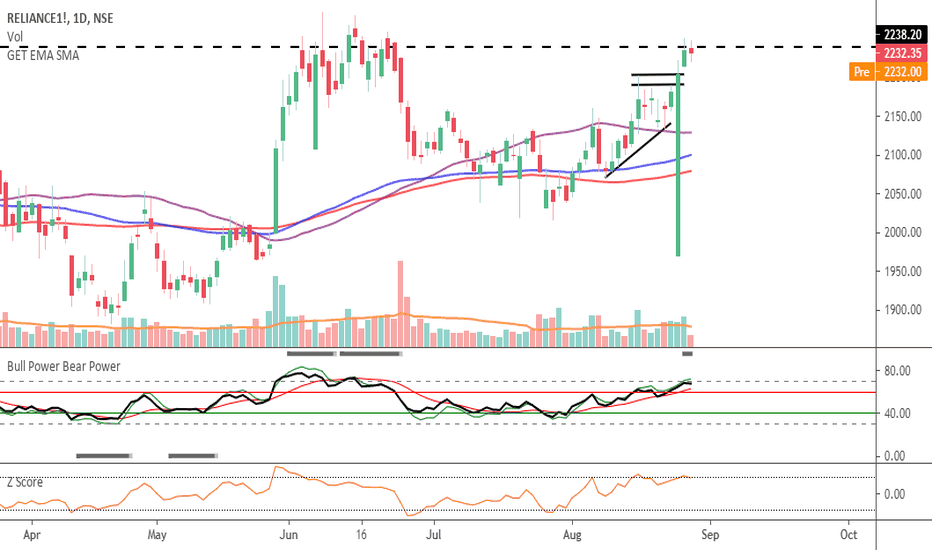

RELIANCE-1H Smart Money Strikes AgainThis 1H chart of RELIANCE INDS FUTURES shows a classic Smart Money Reversal Setup.

Price first executes a sweep of sell-side liquidity (marked "SWEEP") and then confirms strength with a bullish divergence in RSI 📈.

A possible retracement into the demand zone (highlighted pink circle) could offer a high-probability long entry, targeting the previous high (Buy-side Liquidity Zone).

Volume spike + RSI trend breakout = institutional accumulation signs.

RELIANCE Futures - Strong Breakout | Sector Aligned |Here is the full structured checklist review for RELIANCE Futures (Lot Size = 500)

using AI.

RELIANCE Futures - Strong Breakout | Sector Aligned | Dip Opportunity 1440-1460

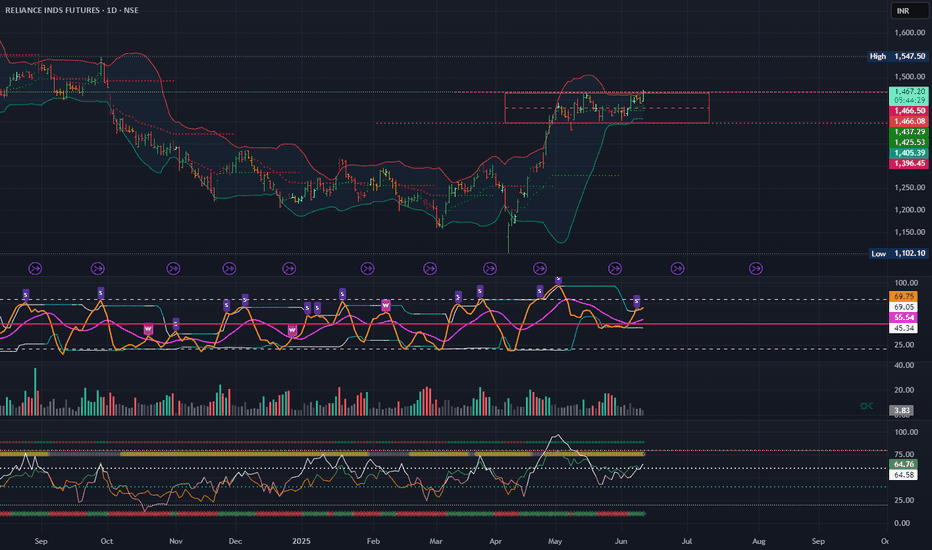

🗓️ 1️⃣ Week & Month Check

Weekly Chart:

✅ Positive momentum → clear rising structure

✅ No falling MA → 20 EMA starting to rise again, 10 EMA supportive

✅ RSI Weekly ~69 → strong → near breakout zone

✅ Volume → moderate, no exhaustion

Monthly Chart:

✅ Overall trend supportive, no falling MA

⚠️ Monthly RSI ~59 → mid-range → room to expand

✅ Price holding above key MAs → bullish base building

✅ Week & Month → Strong base breakout potential

✅ 2️⃣ Daily TF

Squeeze breakout → ✅ YES → clean consolidation breakout visible

Change in polarity → partial → may test 1450-1460 again

RSI 60 cross → ✅ YES

Wedge break → ✅ → small wedge resolved

Relative volume → ✅ huge spike on breakout day → strong confirmation

✅ Daily → Strong breakout action

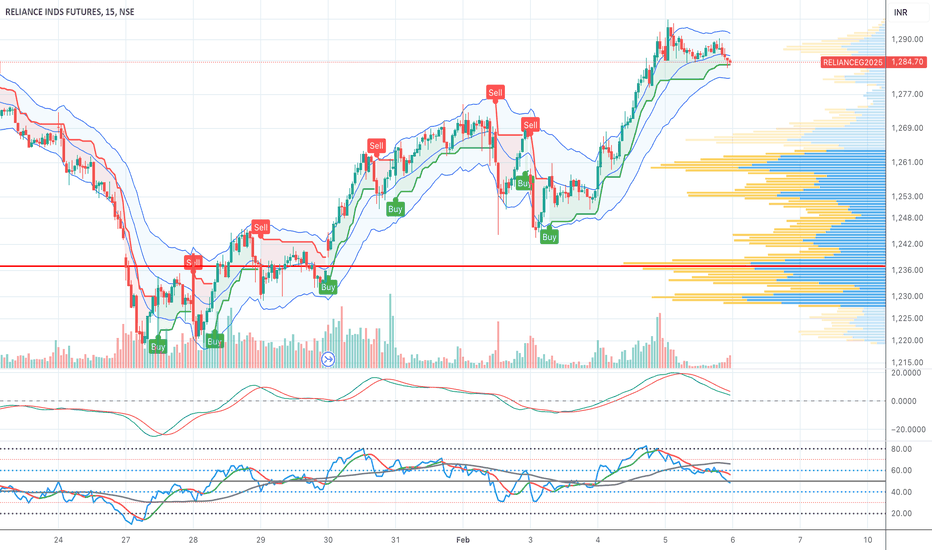

⏱️ 3️⃣ 125min TF

RSI not above 80 → ⚠️ Borderline → ~80.5 → caution

Price structure → ✅ Breakout validated → sustained above 1463

125min Verdict: ⚠️ Slight caution → RSI extended → not ideal for fresh full size entry → look for dip

⏱️ 4️⃣ 75min TF

RSI healthy → ⚠️ ~74 → slightly extended → similar caution

Price structure → ✅ Higher highs / higher lows

8–21 EMA aligned → ✅ YES

75min Verdict: ⚠️ Slight caution → better to enter on dip

⏰ 5️⃣ 20min TF

RSI not above 80 → ✅ ~67

Price above 1st 20min high → ✅ yes

CVD positive & rising → ✅ clear CVD strength

Breakout volume supportive → ✅ excellent volume

Sector aligned → ✅ Nifty Oil & Gas RSI > 67 and rising → sector supporting move

✅ 20min → Entry acceptable but caution as higher TFs extended

📊 6️⃣ TPO Profile (30min)

POC shifting higher → ✅ clearly seen

Untested area below → ✅ ~1420-1440 strong support → LVN present

✅ TPO → Very supportive

Final Checklist Summary:

Component Status

Week & Month ✅ Strong

Daily TF ✅ Strong

125min TF ⚠️ Slight caution, RSI high

75min TF ⚠️ Slight caution, RSI high

20min TF ✅ Strong

TPO Profile ✅ Strong

Sector ✅ Supportive (Nifty Oil & Gas strong)

🎯 Actionable Trade Plan - RELIANCE Futures

Parameter Value

Entry Zone 1440–1460 (ideal dip zone → near TPO LVN + polarity retest)

Aggressive Entry Current zone 1467 → reduced size only if intraday strong

Stop Below 1420

Target 1 1500

Target 2 1550

Lot Size 500

🔔 Execution Guidance:

→ Do NOT chase highs full size → RSI high on higher TFs

→ Best to enter on dip 1440-1460 zone → matches TPO + polarity zone → ideal R/R

→ If entering now (~1467+), use small size + tight trailing

Tactical Insights:

✅ Best R zone: ₹1440 → gives strong 3R to T1 and 5.5R to T2

✅ Acceptable: ₹1460 okay if sector continues strong

⚠️ Chase level: ₹1467 → reduced size → high TF RSI elevated

Summary Action:

→ Wait for dip to 1440–1460 zone → ideal R/R

→ If entering now (~1467), partial size + tight trailing mandatory

Conclusion:

RELIANCE Futures offers a high probability dip-buy opportunity with strong sector tailwind. Patience for entry near 1440-1460 will offer best risk/reward. Sector and CVD both confirm trend strength.

Hashtags:

#RelianceFutures #NiftyOilGas #BreakoutTrading #MultiTimeFrameAnalysis #FuturesTrading #PriceAction #TPOProfile #RelativeVolume #TradingSetup #LearningPurpose #ResearchOnly

Disclosure:

This idea is shared purely for learning and research purposes. It is not trading advice and I am not a SEBI registered analyst. Please do your own research and consult with a qualified advisor before taking any trades based on this post.

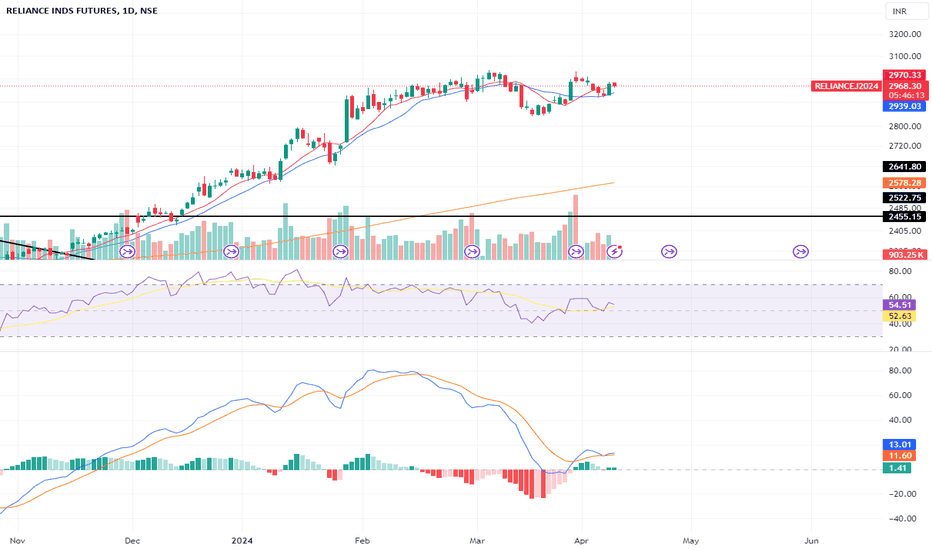

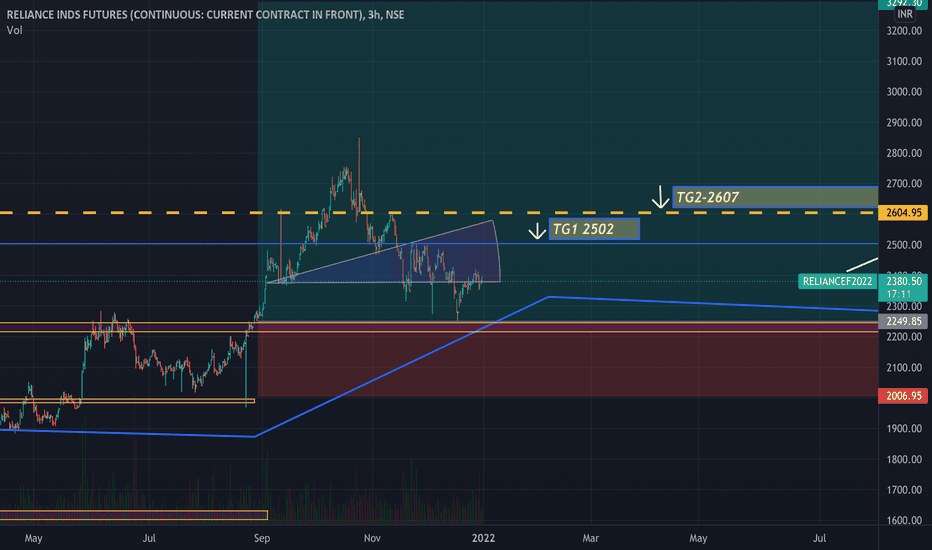

Positional Buy Reliance Fut near 2966 tgt 3080 Stop loss 2940Indicators of the stock are suggesting a good momentum ahead as it has given internal positive crossover. Also Its has been taking strong support at short term moving averages which can act as stop loss. Stock could touch new life high in coming months.

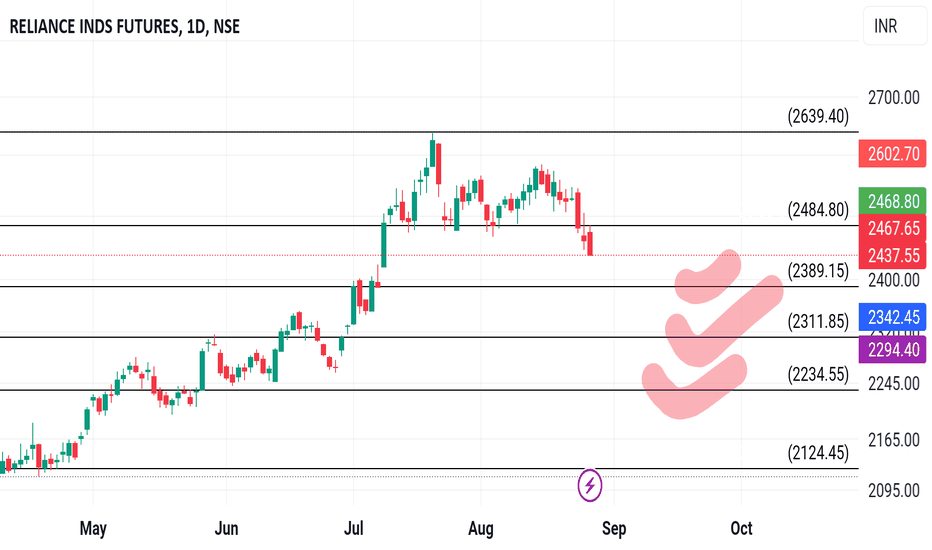

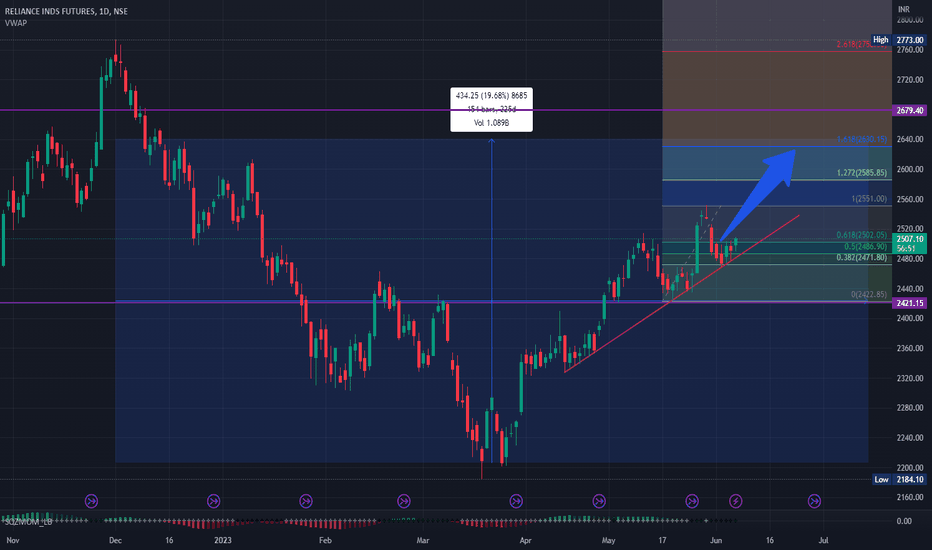

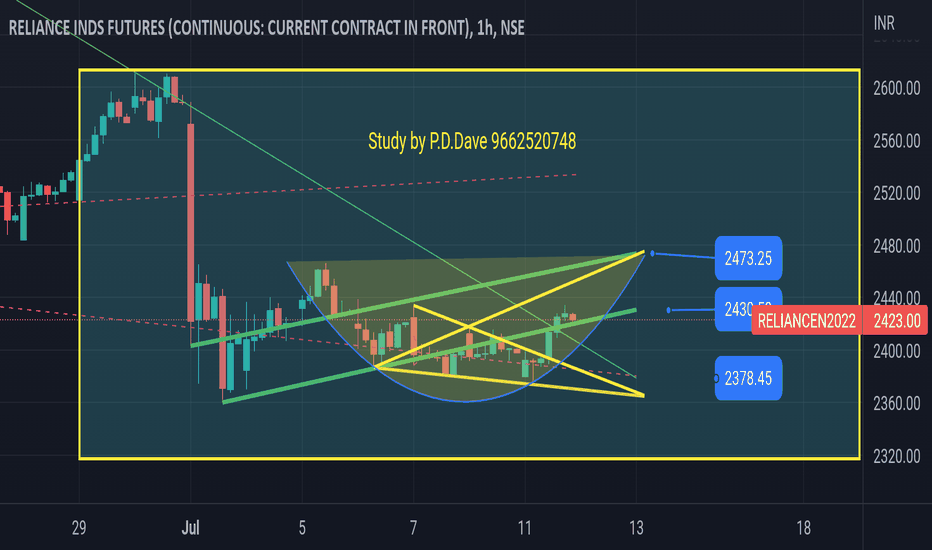

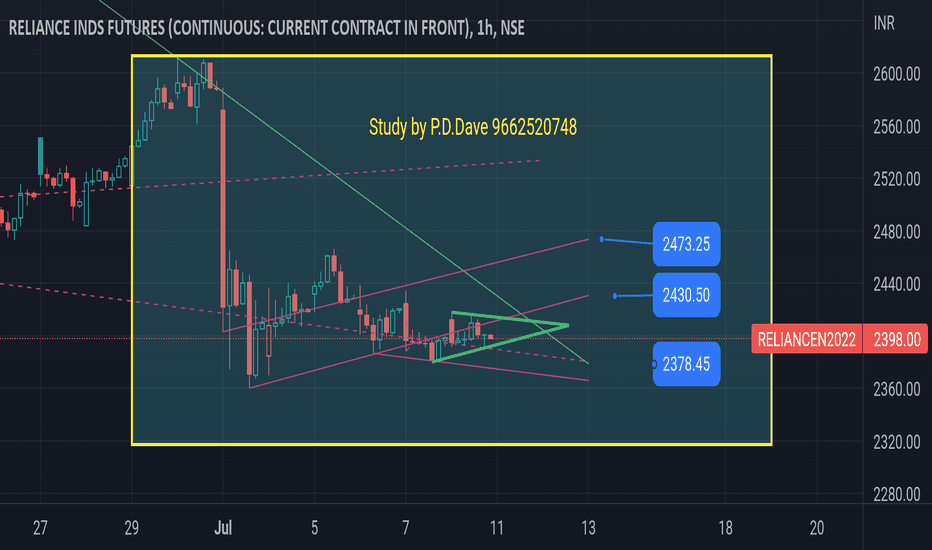

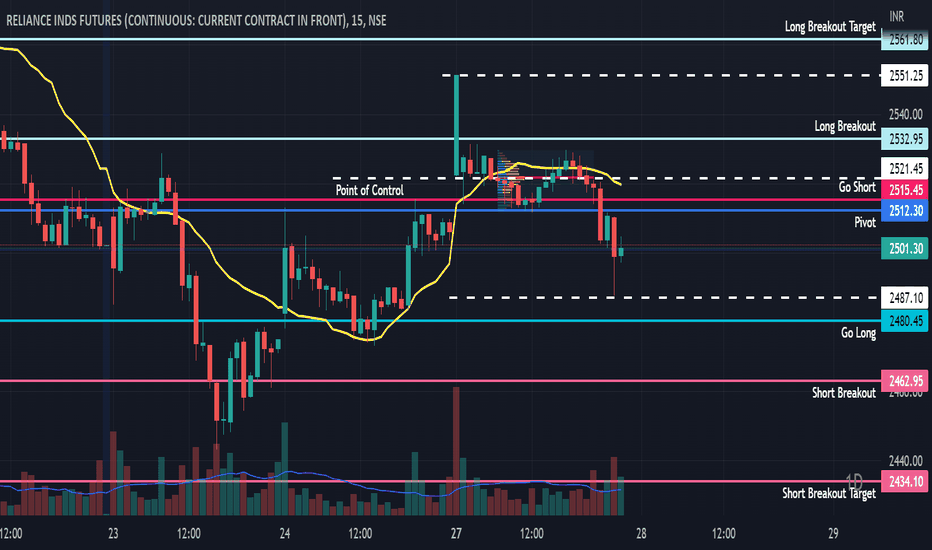

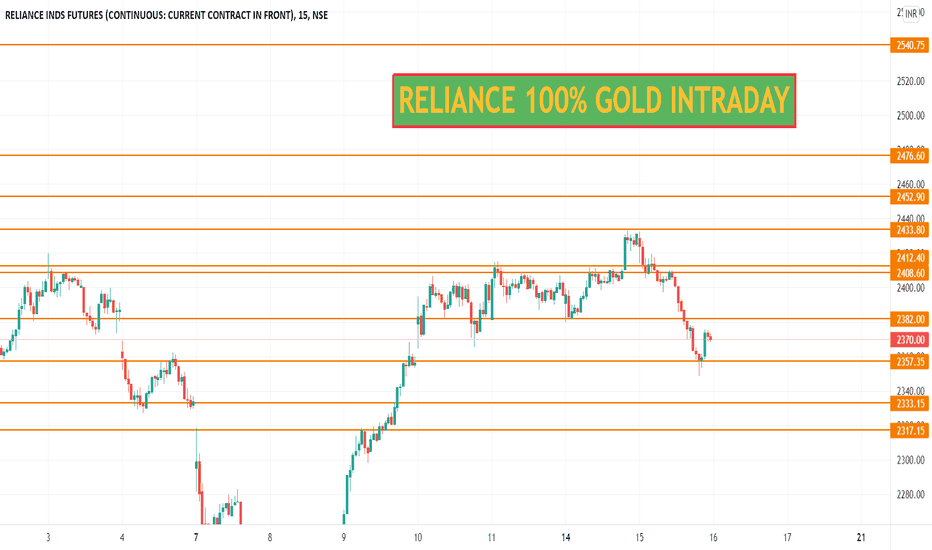

Reliance Futures Key trading level 28th June 2022Reliance Futures Key trading level 28th June 2022

Disclaimer: These levels are purely based on Price action/demand and supply zones & and consumed only for educational purpose & should not be taken as buy/sell recommendation. I will not be responsible for any loss/profit incurred if anyone takes trades based on my views.

Please consult your Financial Advisor before making any trading decision.

Leave a comment that is helpful or encouraging. Let's master the markets together.

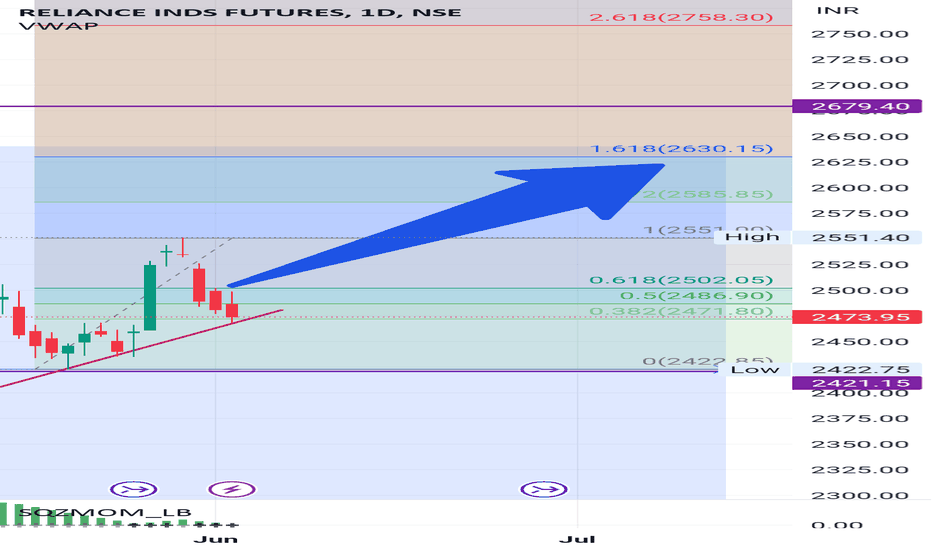

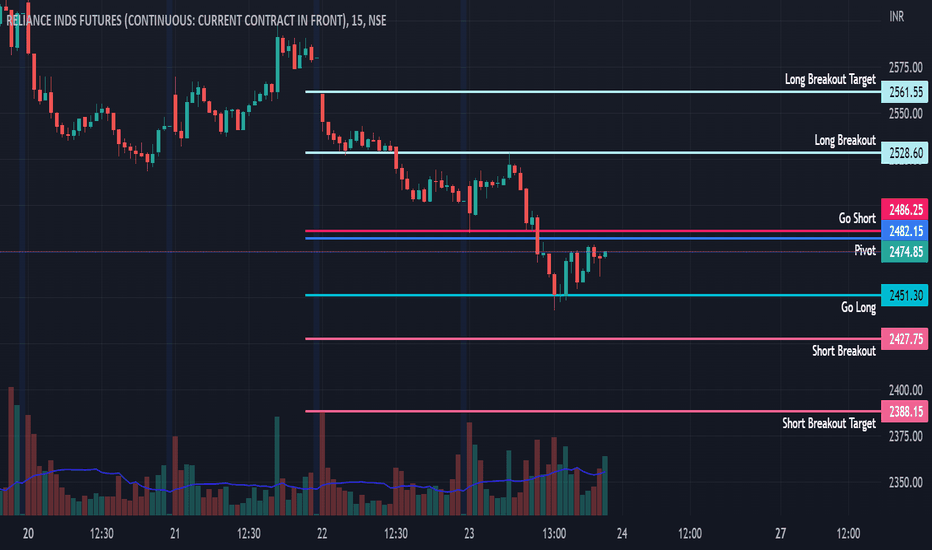

Reliance Futures Key trading level 24th June 2022Reliance Futures Key trading level 24th June 2022

Disclaimer: These levels are purely based on Price action/demand and supply zones & and consumed only for educational purpose & should not be taken as buy/sell recommendation. I will not be responsible for any loss/profit incurred if anyone takes trades based on my views.

Please consult your Financial Advisor before making any trading decision.

Leave a comment that is helpful or encouraging. Let's master the markets together.

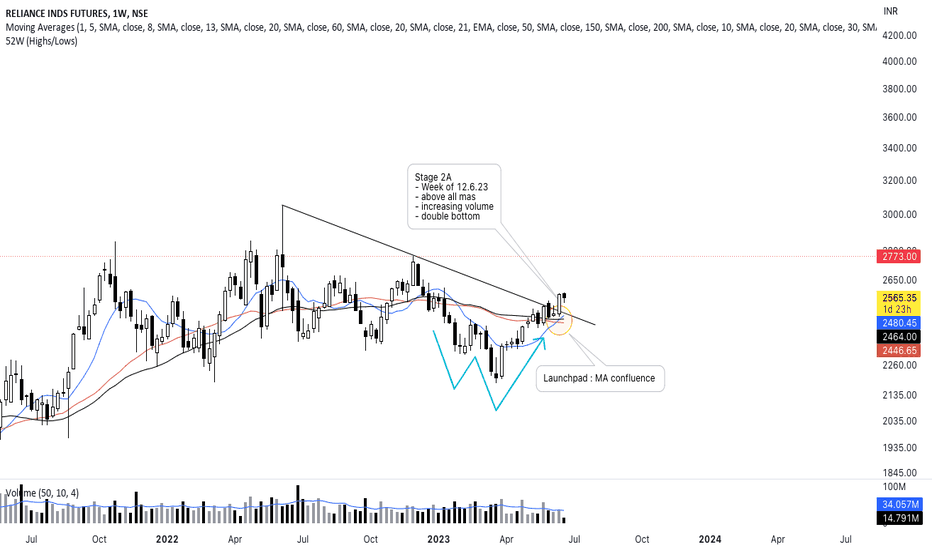

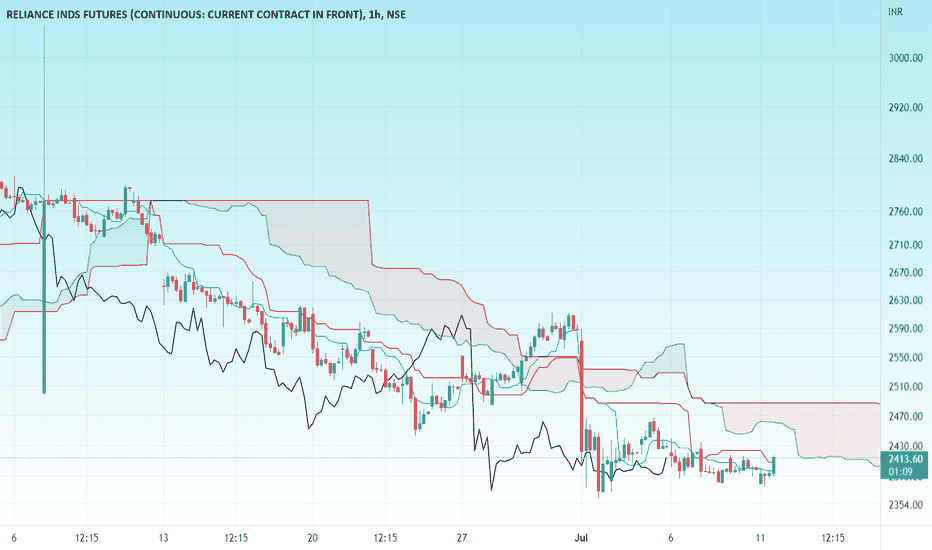

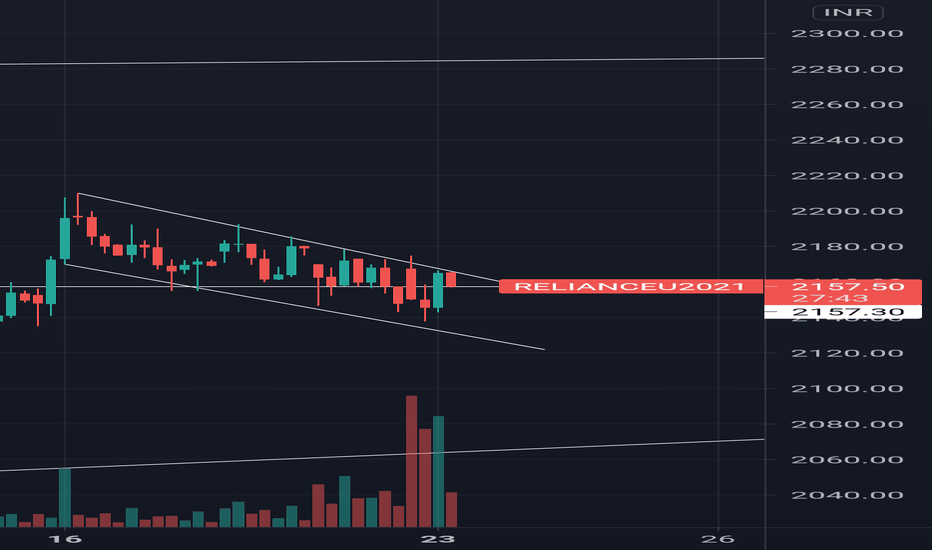

OptionsTrade for RelianceBuy Reliance 2160CE@90-100 and for hedging sell 2 Lots of 2260CE@45-55. Margin will be required to short 2 lots of options.

Buy 1Lot of Reliance Future strictly above 2240.

Disclaimer :

Trading is never ever recommended as it is injurious to mankind. This is purely my study based on technical charts and for educational purpose only. Please do your analysis before taking any trades given by me. I MUST not be held responsible for any profit or loss out of any trades you take on our advice. All Disclaimers Apply.