SAIL trade ideas

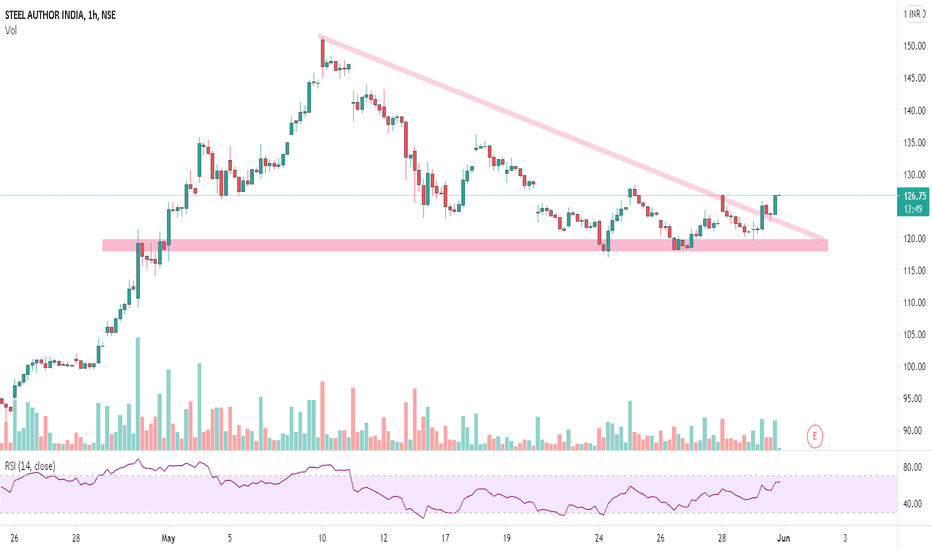

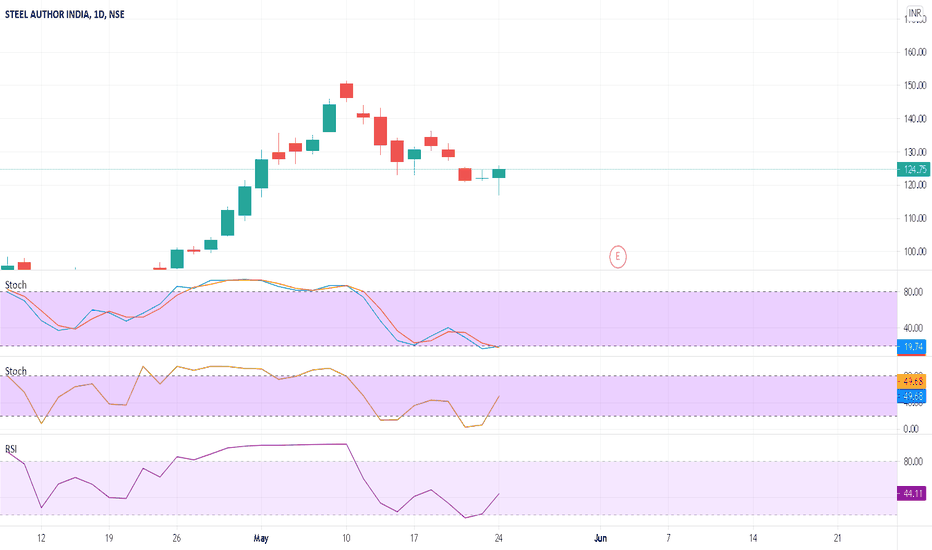

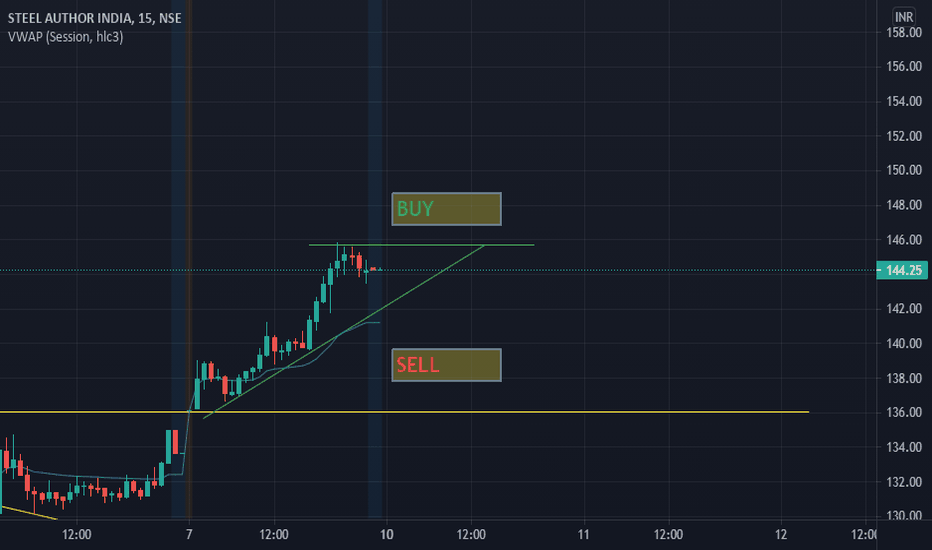

SAIL - STEEL AUTHORITY OF INDIAThe way it has come down from 5% from day high, this one should hold around 119.50 as per the date.

If not the support rests around 116.50, from where it can head to its journey towards 125, 130.

Before trade do analyze the two levels given and keep small stop loss.

************************************************************************************************************************************************

Hi all,

Its pleasure to have you all here.

I have started putting these charts as a contribution from my side to all people who are new to business, as I had to struggle a lot without any sources at disposal. So please consider this a just small contribution from my side.

Few Honest Disclosures:

1. Any idea shared is my personal view, its not a recommendation, neither any kind of paid propaganda, so please

do your bit of research.

2. Ideas shared does not mean that I trade all or have position in them, this is just a helping hand to all.

3. I expect no comments or like nor any negativity, as I said its just a small helping hand from my side, please plan your risk and trade as per your capacity.

4. To trade in Cash, options or futures is your sole choice and your own risk

5. I am no expert in Tech Indicators, I believe in support resistance and trendline theory, you may use this as a supplement theory for better results.

6. I work for my own living, this is a hobby which I do sincerely to help anyone who might come across my charts.

***********************************************************************************************************************************************

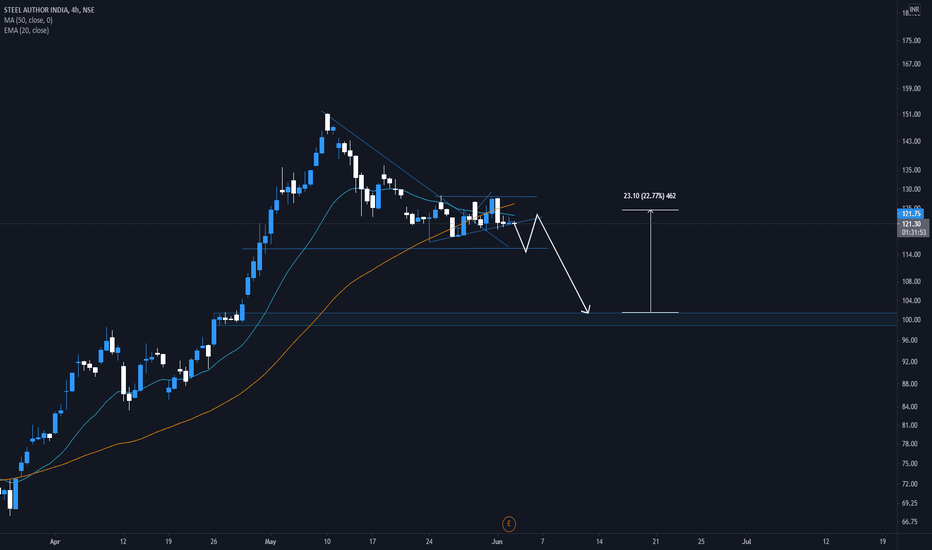

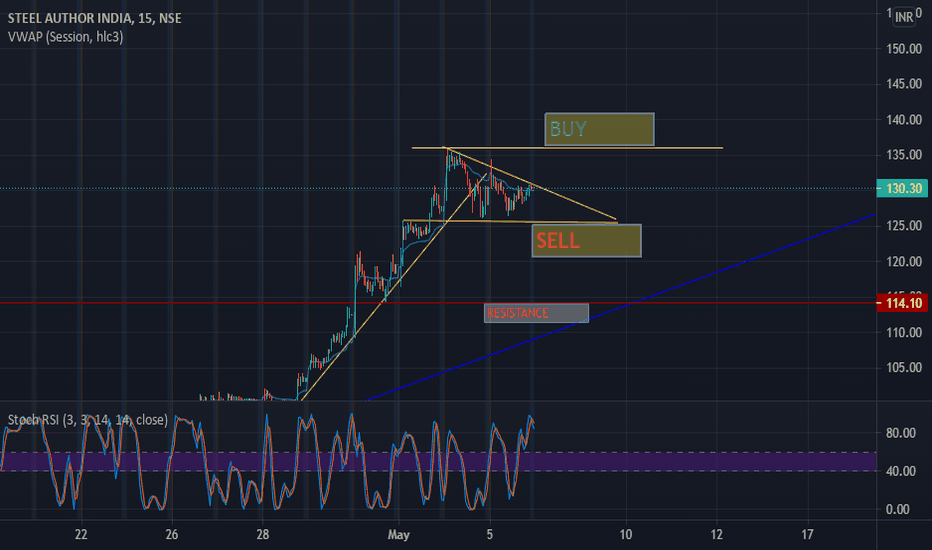

SAIL: Delivery (22.77%) | #NIFTYMETALNSE:SAIL

Overview:

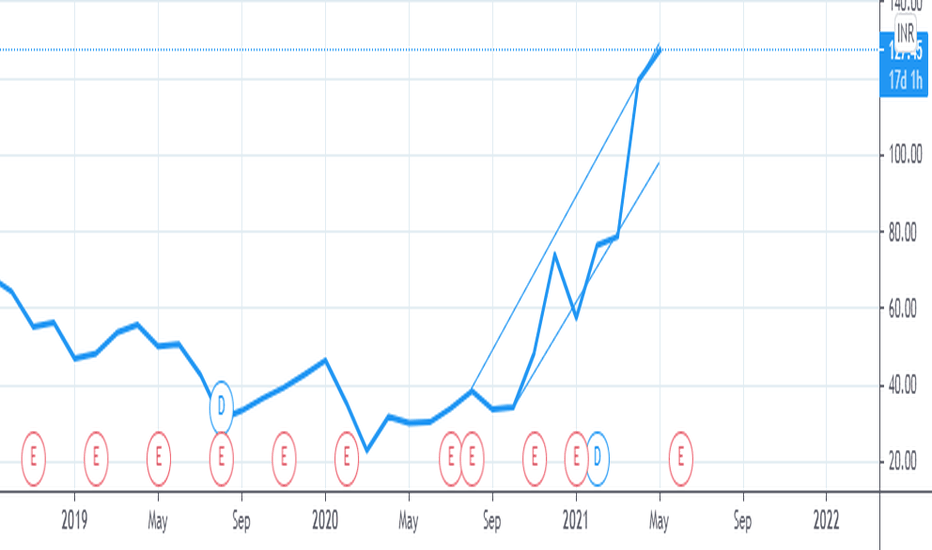

Sail delivery trade- BUY(102) | Sell(122)

Fundamental:

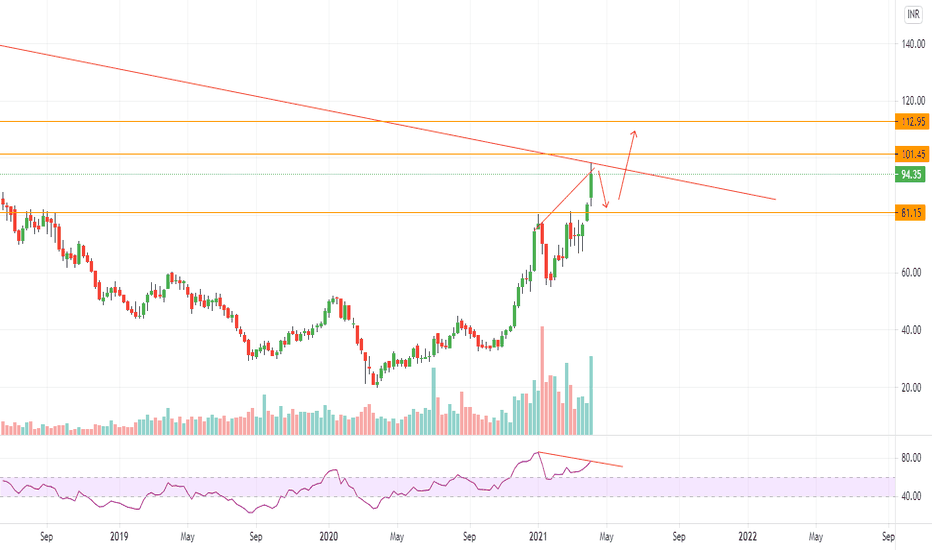

NiftyMetal has already been declined by 8.5% which result into bearish momentum.

Now it has been anticipated the metal stocks are going further down due to contraction in Tangshan steel production which effect the Metal industry and likely construction prices are hiked and stay in pressure in the whole month JUNE,2021

However Manufacturing PMI of may,2021 has been declined by (9%) and the upcoming service PMI that will be announced on this Thursday will come out with poor numbers as Unemployment rate has been double from April Fiscal year (2020).

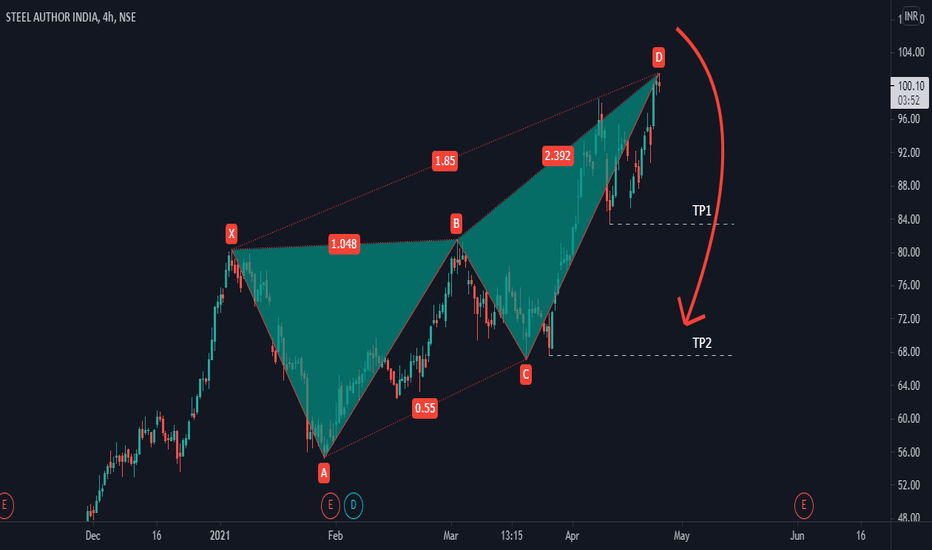

Technical:

Rising wedge from bearish 4H trend is come out with low volume which is against the harmonics of Rising wedge.

Sail is high BETA stock with 1.20B as compare to Index NIFTYMETAL...

Structure-

(Short) Short the market is unethical from the perspective of a Investor

Breakout: @116.17

Retest: @116.17-@119

Entry: @115

Exit: @101.25 (minimum) @95 (maximum)

(Long)

Breakout: @100 from @95 pullback

Entry: @102

Exit: @122.60 (minimum) @143 (maximum: Long term only)

Recently SAIL have received a order for constructing the advance Railway tracks that should be more balanced than china high-speed bullet tracks...Closure of agreement of net-settlement amount has not been confirmed yet.

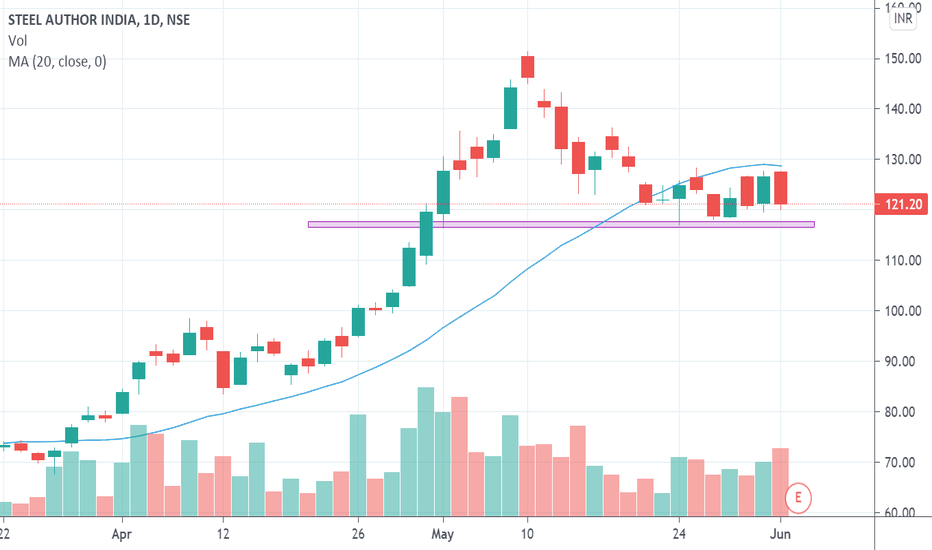

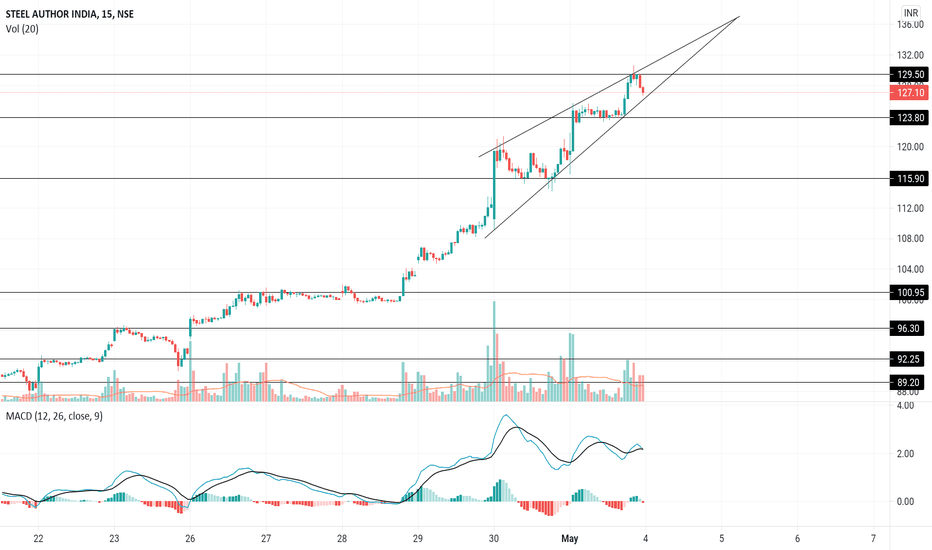

SAIL LONGENTRY ABOVE-125.8

Sl - 117

DISCLAIMER:These recommendations and reports are based on the theory of technical analysis and personal observations and are for educational purpose. This does not claim for profit. We are not responsible for any losses made by traders. It is only the outlook of the market with reference to its previous performance. You are advised to take your position with your sense and judgment.

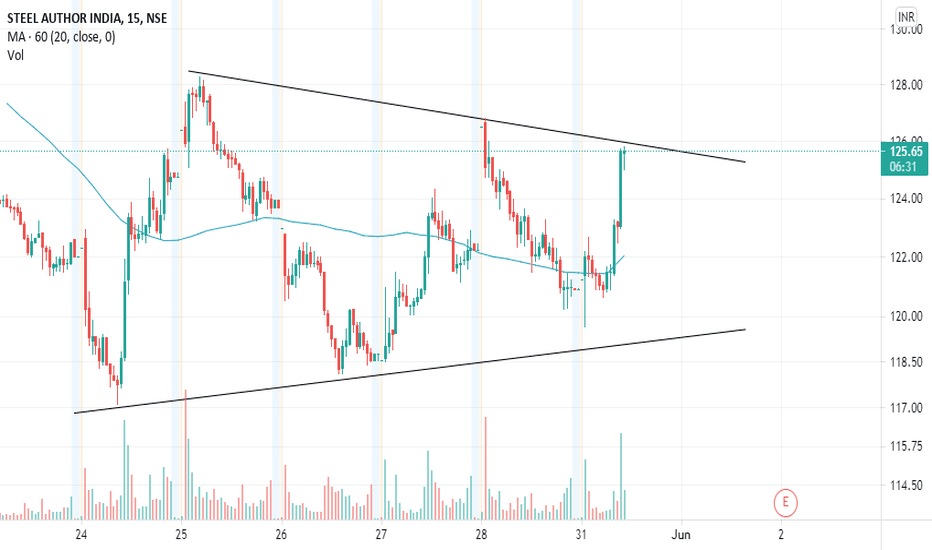

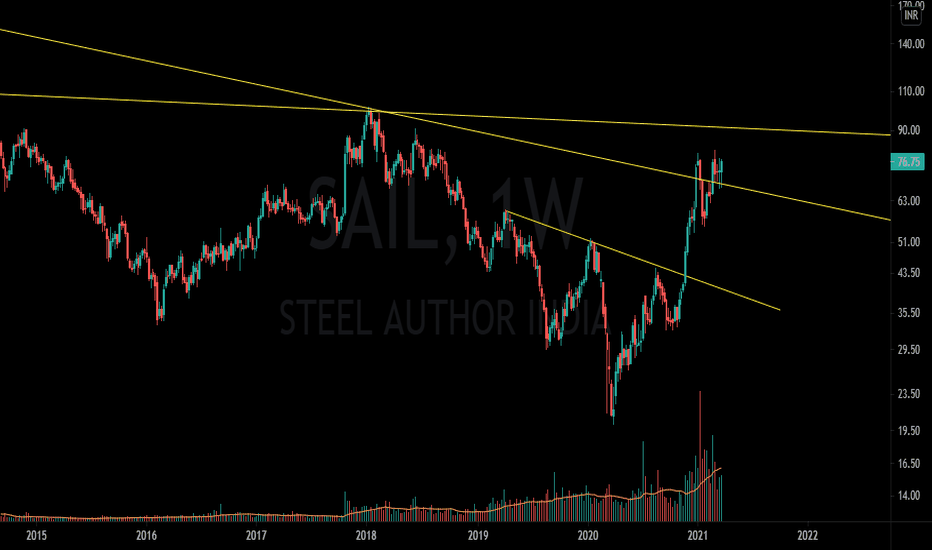

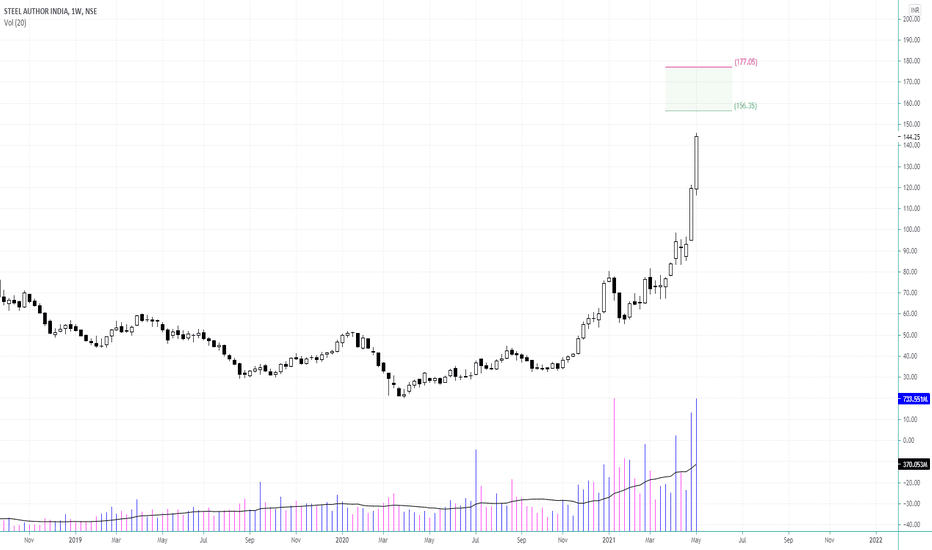

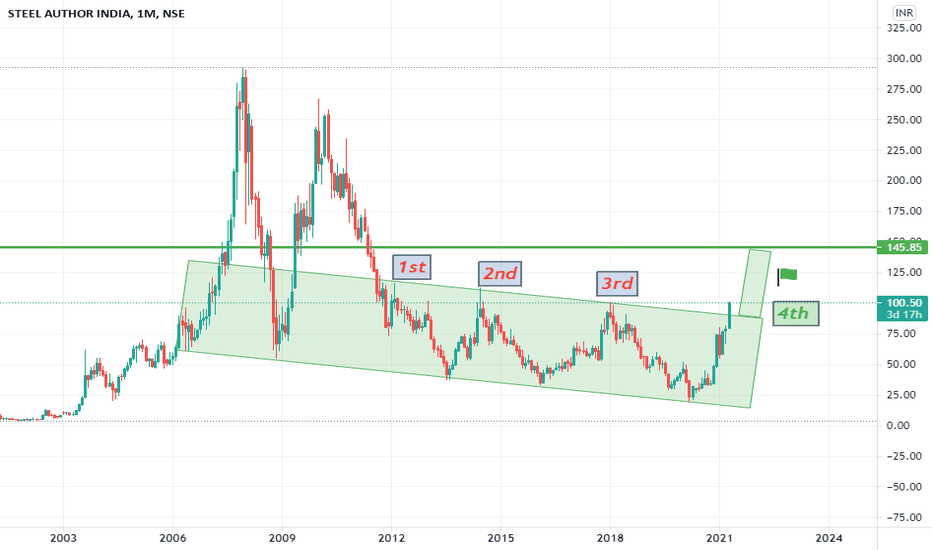

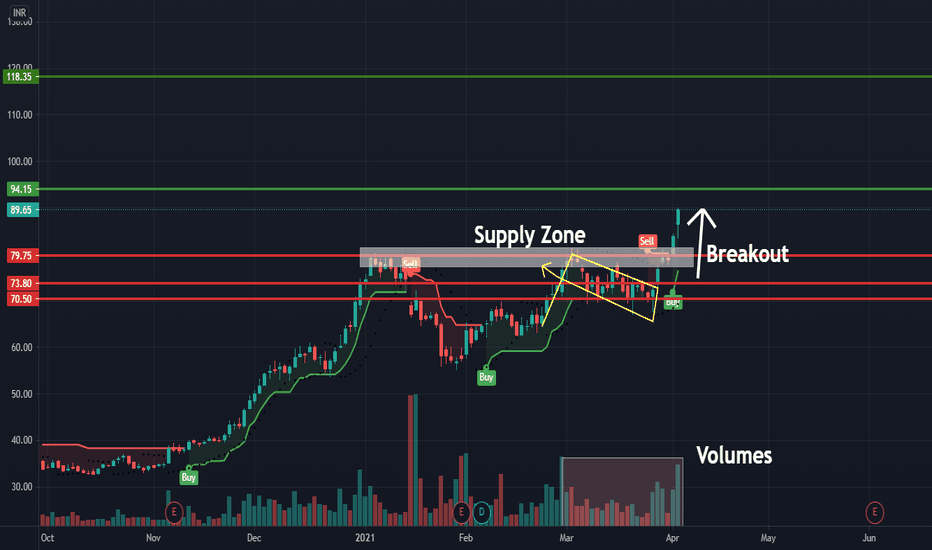

SAIL: Accumulate for Mid-Long term CMP 76.75 TGT 90,100,115+Another chart for study the price action;

SAIL: Accumulate for Mid-Long term CMP 76.75

TGT 1 = 90,

TGT 2 = 100,

TGT 3 = 115+

ROI 1 = 17%

ROI 2 = 30%

ROI 3 = 49%

Hold with Patience for Greater Reward, To Manage risk - Consult your Financial advisor

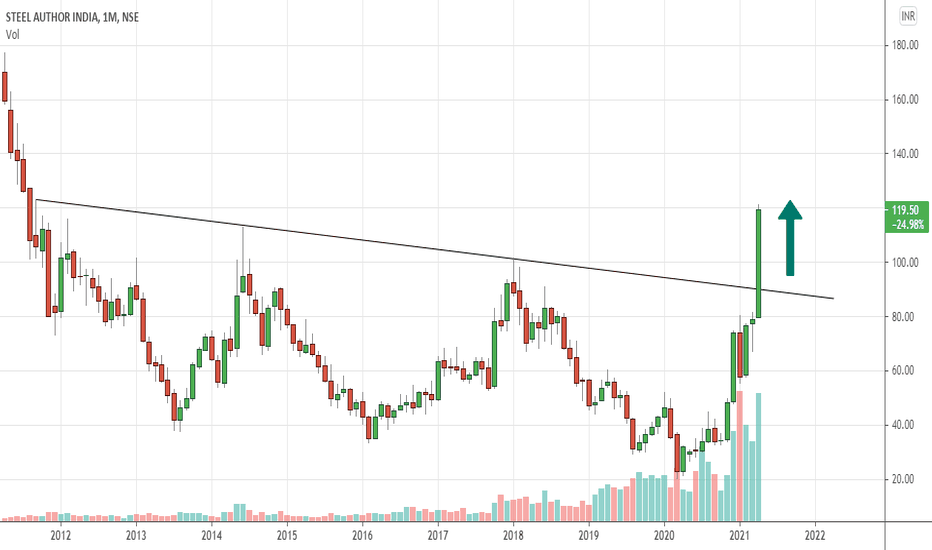

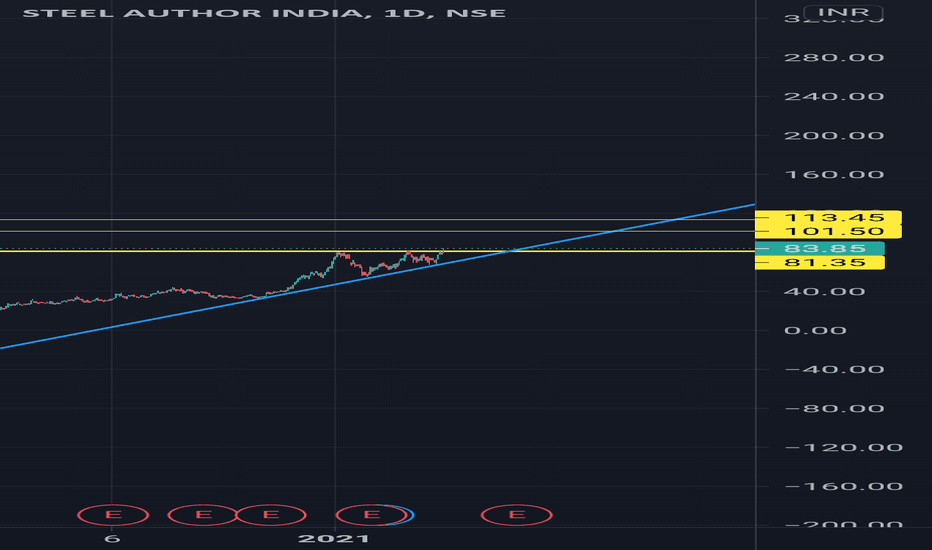

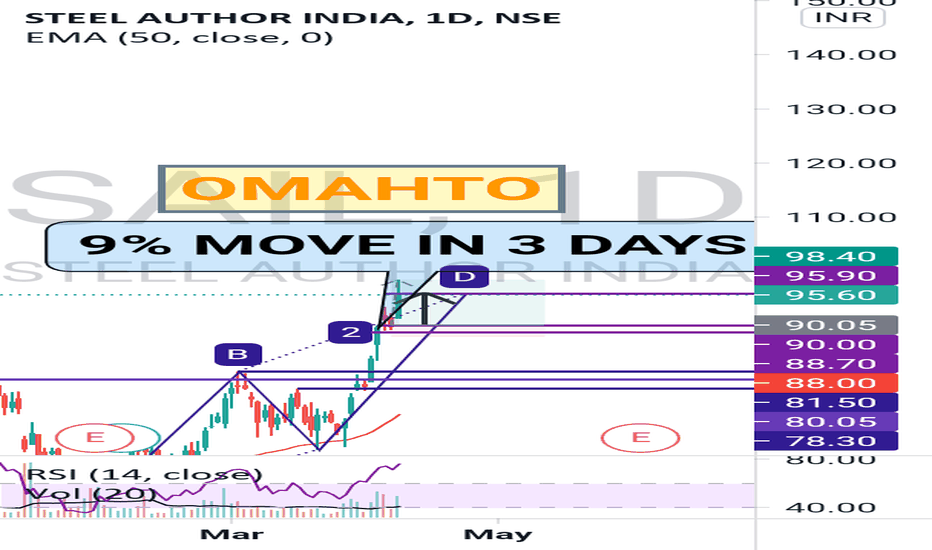

My View on " Sail " For upcomming days Since 2010, on the monthly chart, the stock has tested a level of 100 three times. Now the stock is testing level 100 again today. If stock sustains this level, we can see the upcoming levels up to 120 and above in a couple of months.

The stock is also strong fundamentally.

1st target 110

2nd Target 120

Sl 96.50

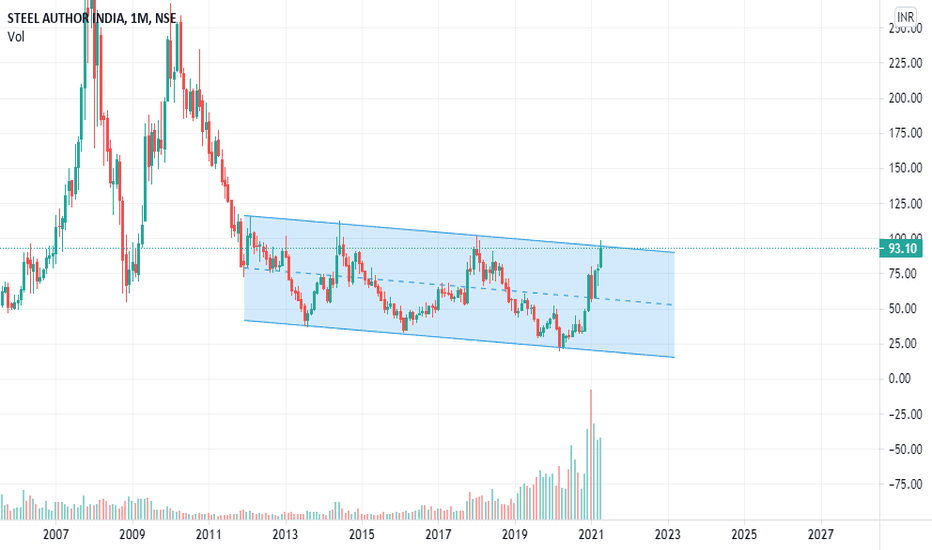

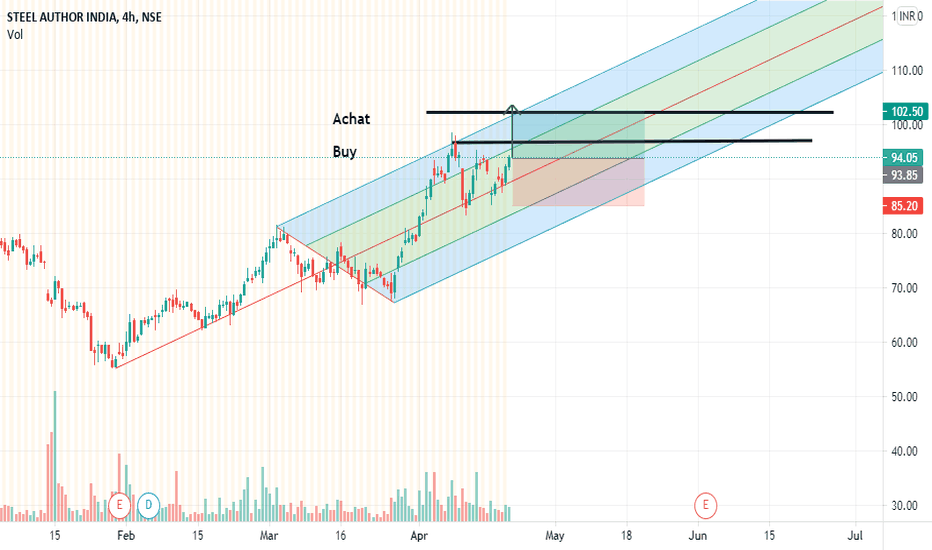

Analyse SAILWe will buy this market at the open as it is heading towards the 102.00 level if it manages to break the 96.85 level. We can double our position with a 95% probability if it breaks the 96.85 level forcefully and has green volume.

Nous achèterons ce marché à l'ouverture car il se dirige vers le niveau 102,00 s'il parvient à casser le niveau 96,85. Nous pouvons doubler notre position avec une probabilité de 95% si elle brise le niveau 96,85 avec force et a un volume vert.

SAIL - Steel Authority of India Limited

Levels -

Buy - Any dip below the CMP

T1 - 94+

T2 - 115+

Stoploss - 83.55 (Low of April 5, 2021)

The stock doesn't belong where it is being traded. It has rallied close to 10% in 2 trading sessions although the Indian Market ended in the red on April 05, 2021. With metals in focus and recent numbers released by SAIL in concern with significant debt reduction and increase in production by 6% indicates a strong move ahead in the stock. Accumulation of SAIL at every dip is what the strategy should be here.

There are several other reasons which strengthen the assumption of stock giving good return in near future. Comment if those reasons are required here.

NOTE: These findings and levels are purely based upon the knowledge and understanding of the post publisher. The idea here is to predict the future price movements hence, please do not consider this as stock advice or recommendation.