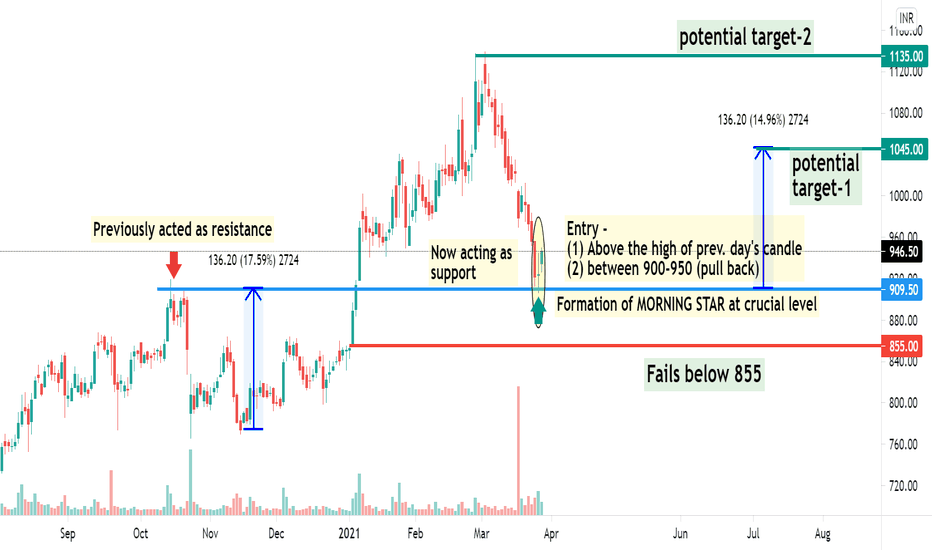

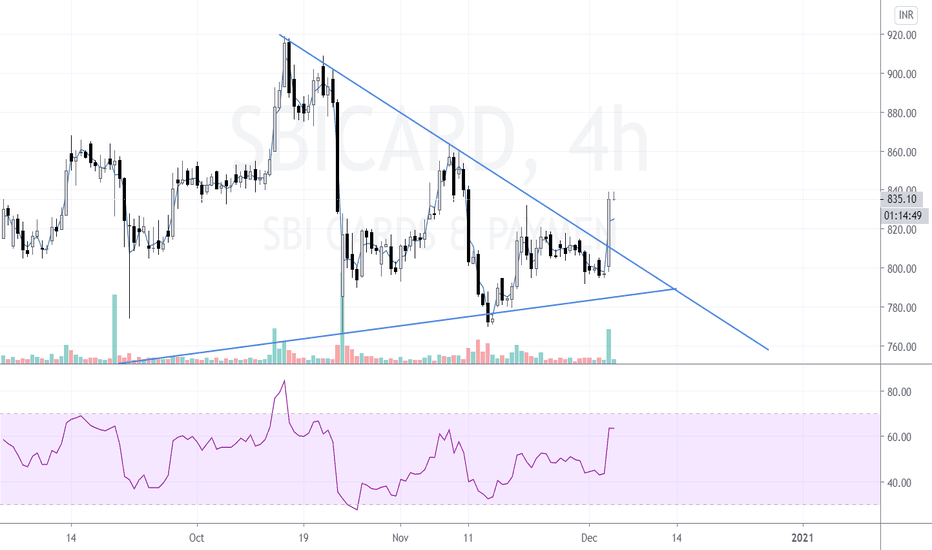

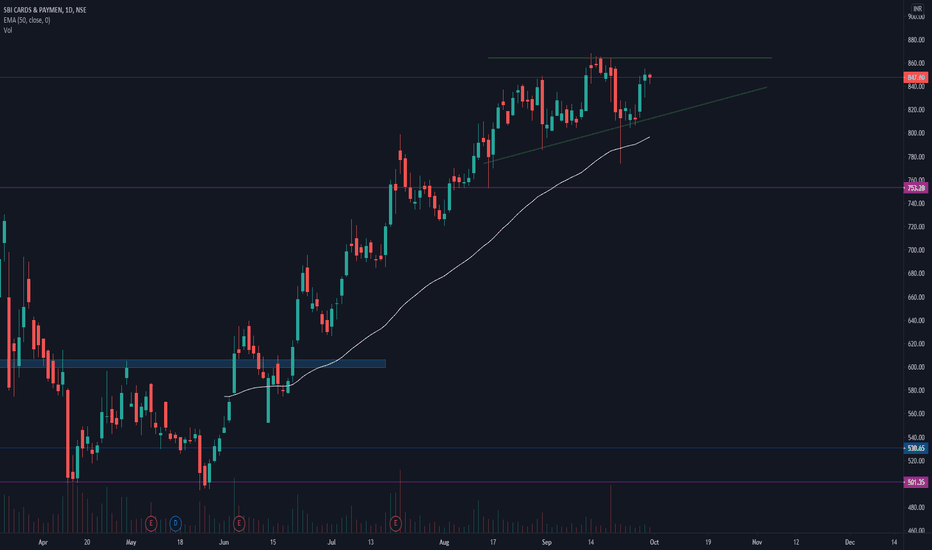

SBICARD - Morning Star at support level - Short Term swingThe above analysis is done purely on basis of Price Action & Chart Patterns.

The analysis is done on daily TF hence price may take few days to few weeks in order to reach the targets

Logic, Entry range, SL are shown in image itself.

The above analysis is purely for educational purpose. Traders must do their own study before entering into any trade. Traders must trade as per their own risk taking capacity and money management.

Feel Free to comment for any query or suggestion regarding this stock or Price Action Analysis.

Checkout my other ideas to understand how one can earn from stock markets with simple trade setups.

SBICARD trade ideas

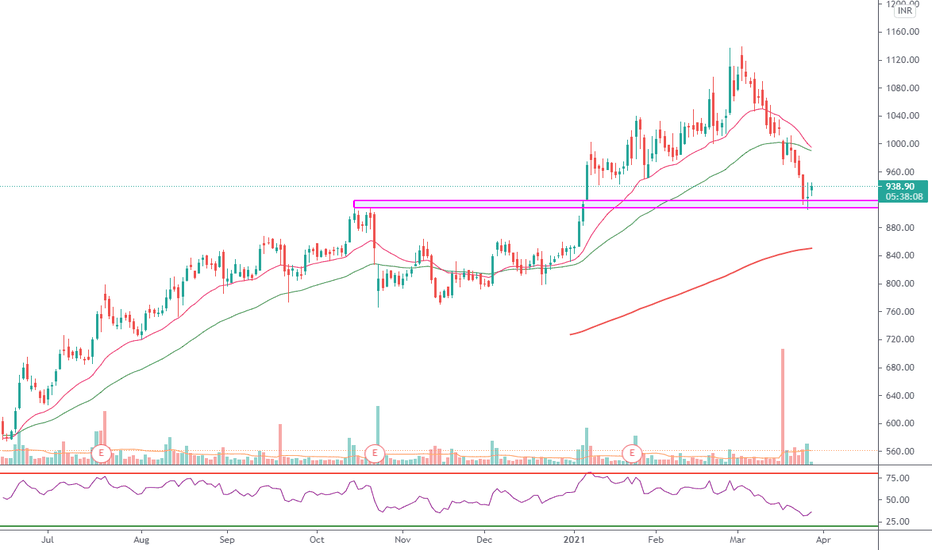

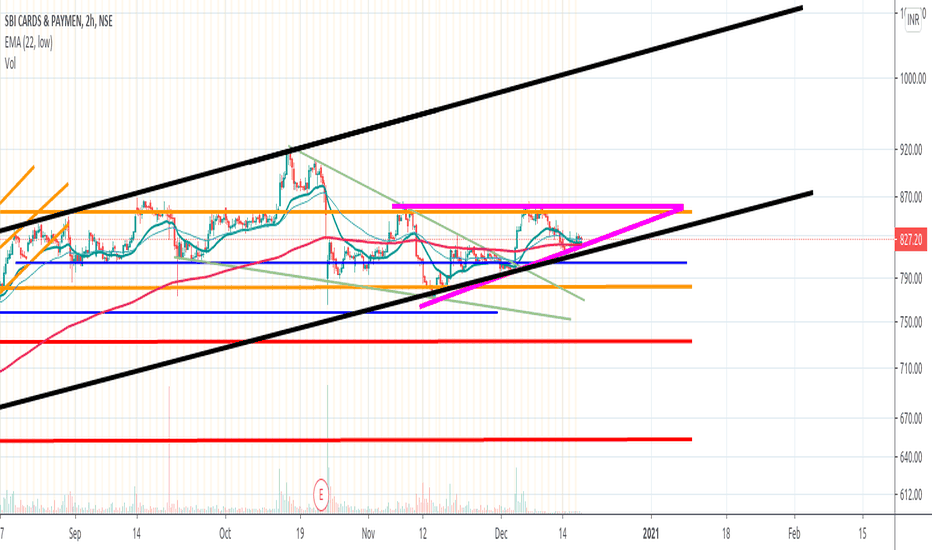

SBICARD IMPORTANT LEVELS FOR BUYINGSBICARD has seen a remarkable rally from 500 levels to 1100 levels in the past 1 year.

Currently, we are seeing some correction in the stock.

The monthly and weekly structure is still positive, though it looks weak on the daily chart and the current price action also indicates that this correction can extend a little more.

Important support that Weekly and daily chart gives around 850 levels.

And the major support levels come around 799 - 670, which you can say lifeline support.

So keep an eye on the stock and grab the opportunity when stock presents it to you.

Trade/Invest at your own risk.

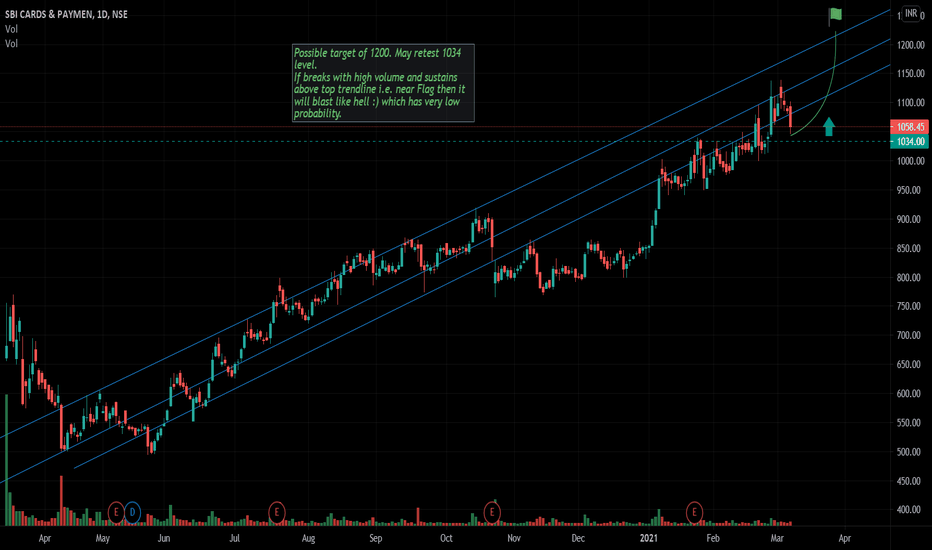

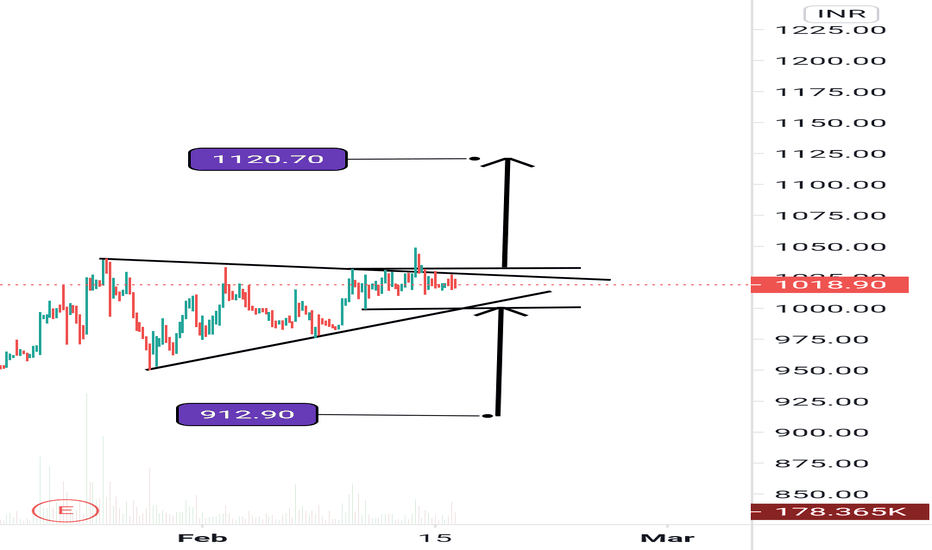

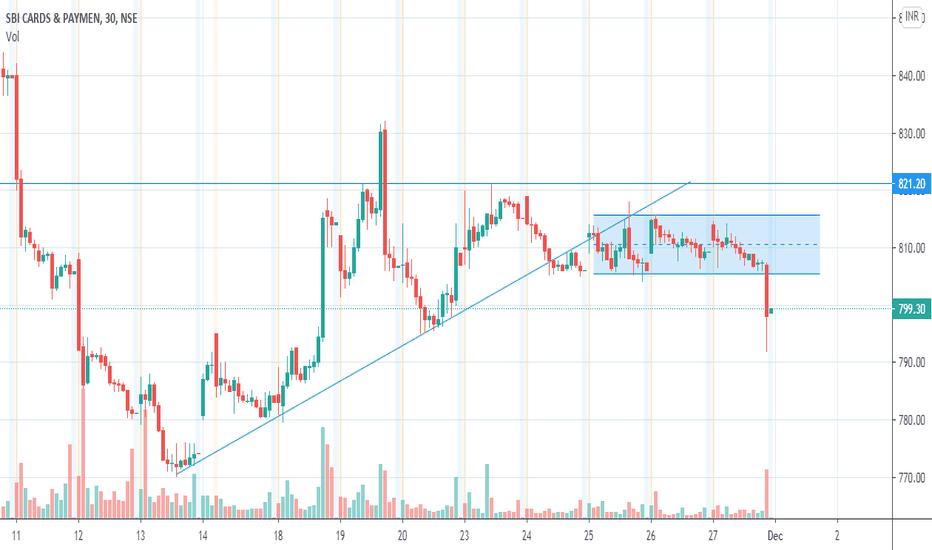

SBICARD - Ascending Triangle pattern - Short term swing tradeThis analysis is purely based on price action and Chart Patterns.

The analysis is on 30min TF hence target can be achieved in intraday trade or in couple of days.

Trade logic with SL and Target is explained in image itself.

Don't chase the price. Always plan your trade & trade your plan

Keep trailing SL accordingly once entered into the trade.

This analysis is purely for education purpose. Kindly do your own study before entering into any trade .

Also check out my other ideas to understand how price action works and how it can be used to make regular profits without any complex strategies.

Feel Free to comment for any queries regarding the above stock or price action analysis in general.

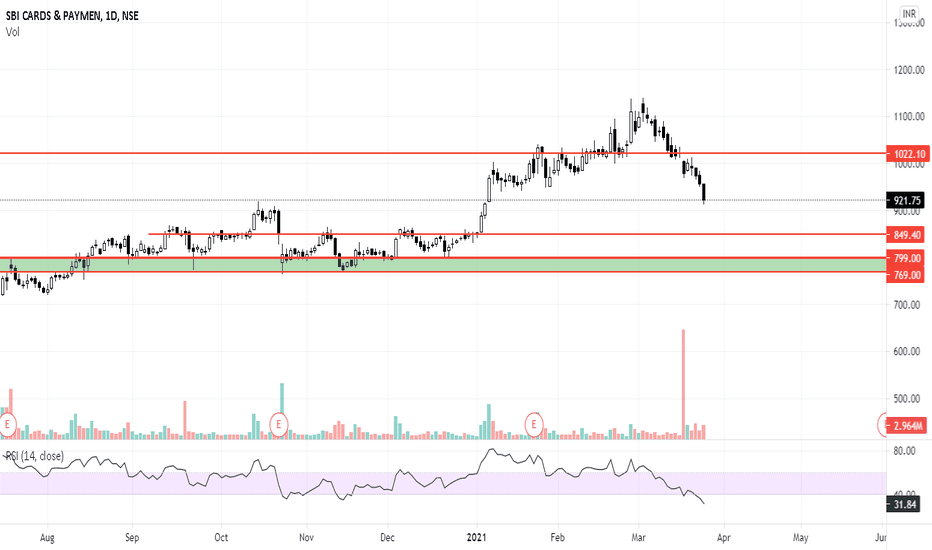

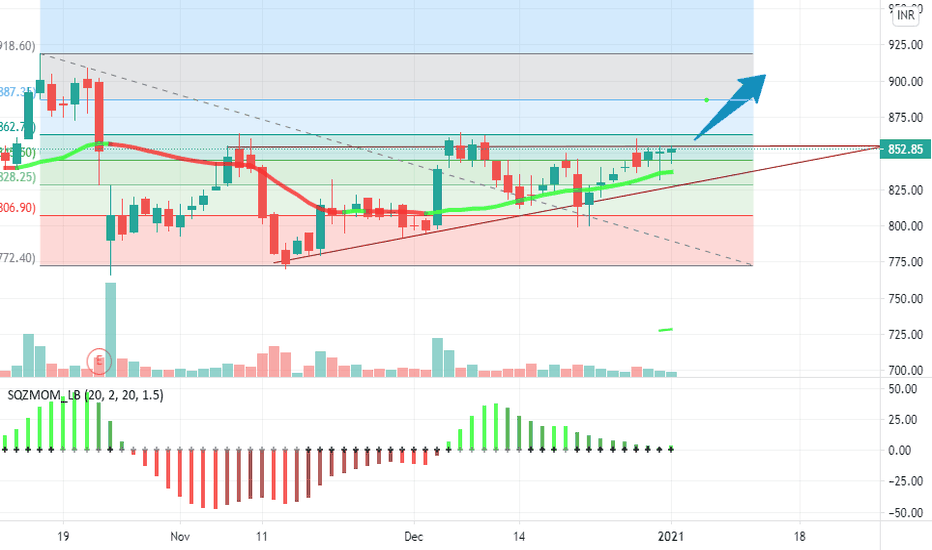

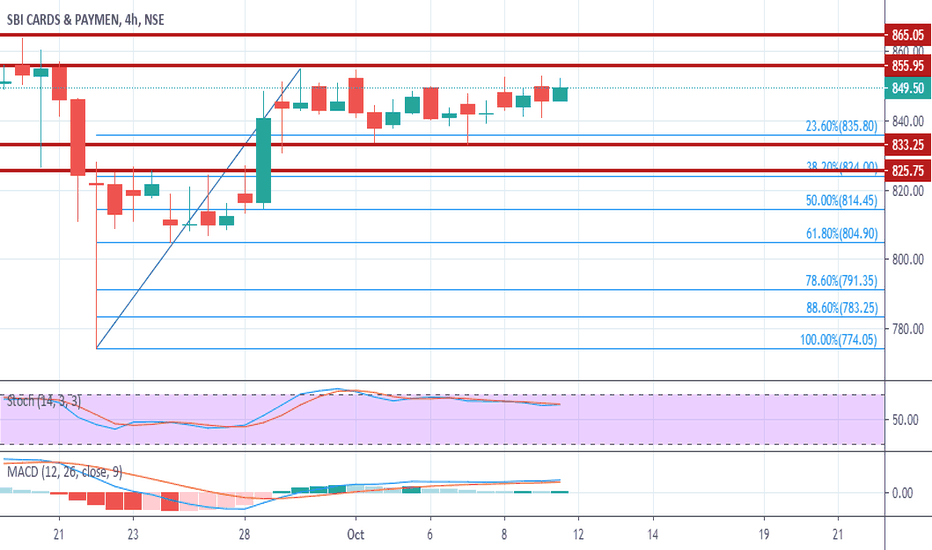

SBICARD_educational viewIf SBICARD consistently maintains 855 level (within 1-2% error band), then breakout possible before 05/01/2021 and shall achieve midterm target of 1050 (on or before 15/01/2021)

Immediate Support at 805

Strong Support at 782

For this period, 16-12-2020 to 05-01-2021, 820-856 would acts as support line.

Only an educational view

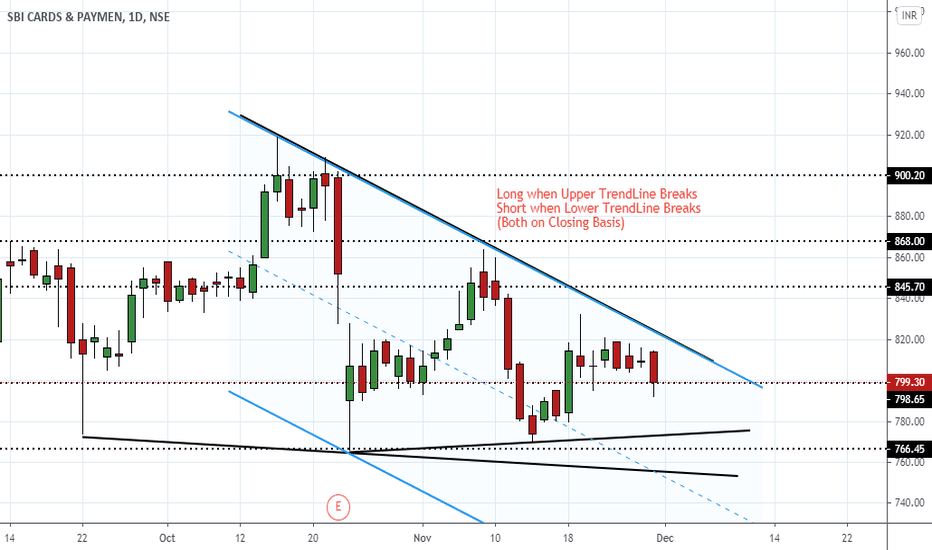

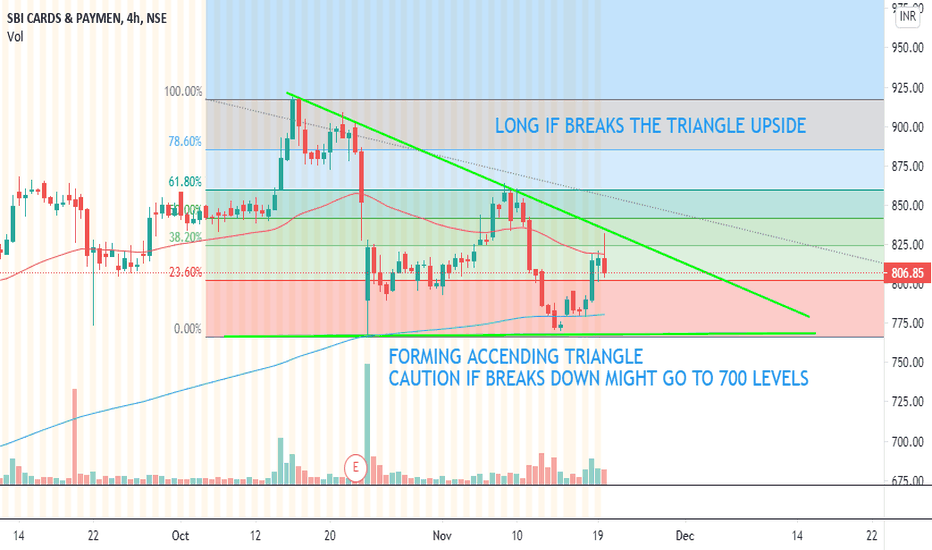

SBICARD TUG OF WARSBICARD is on tug of war between Bulls and Bear. It is forming Triangle Pattern therefore if it breaks upper trend line one can go for Long, however, if it is being controlled by bear they can shed it upto lower trendline. If it comes in control of bears they can further shed it to 760-755 where it can consolidate further for fresh upside. As of now no steam is being shown by it hence we are looking for price to kiss lower trendline.

SBI Card - Intraday / Swing Trade SetupSBI Card CMP - 807.25

Looking bullish in weekly time frame. One can go for Intraday / Swing trade setup with the following entry, exit & targets

Sell at or below - 805 - 803 / Stop Loss 820

Target 1 - 800

Target 2 - 795

Target 3 – 790 / 785

Note: This is my view and for educational purpose only.