ZEEL trade ideas

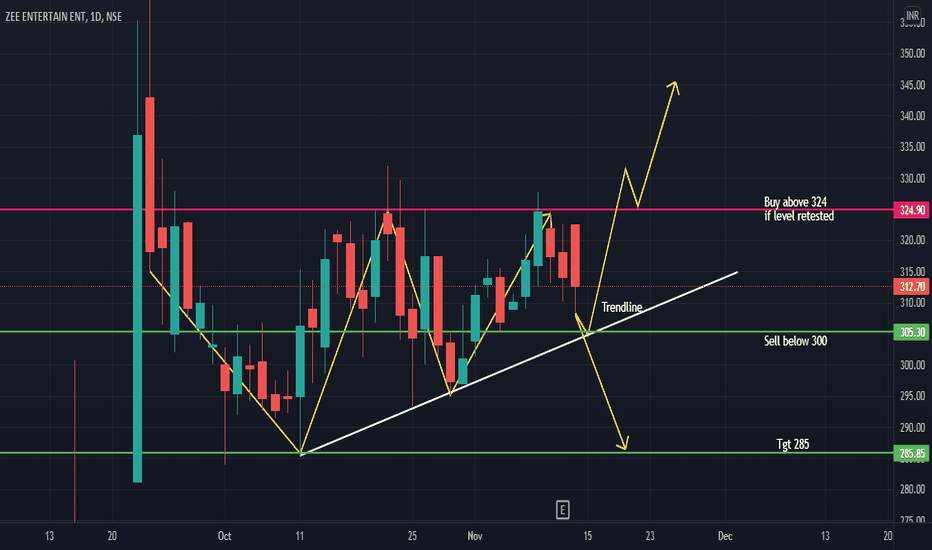

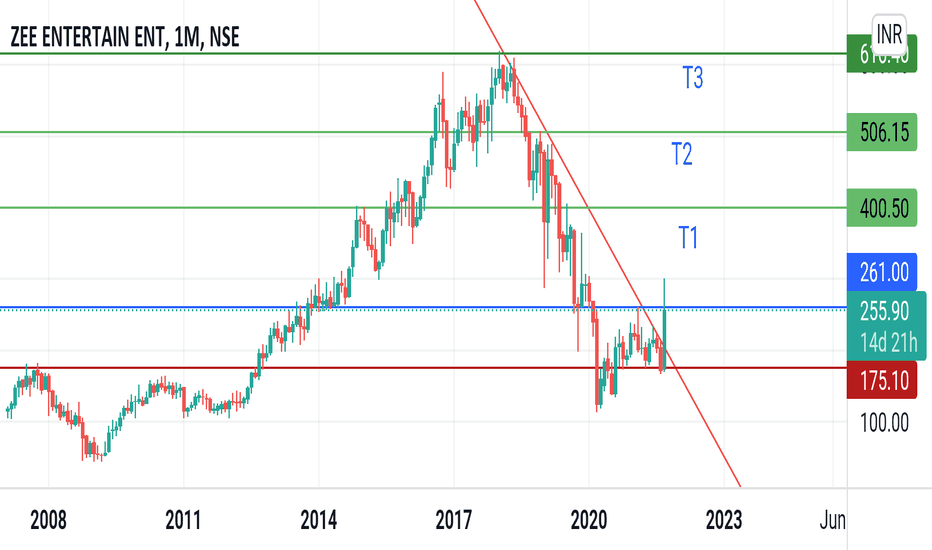

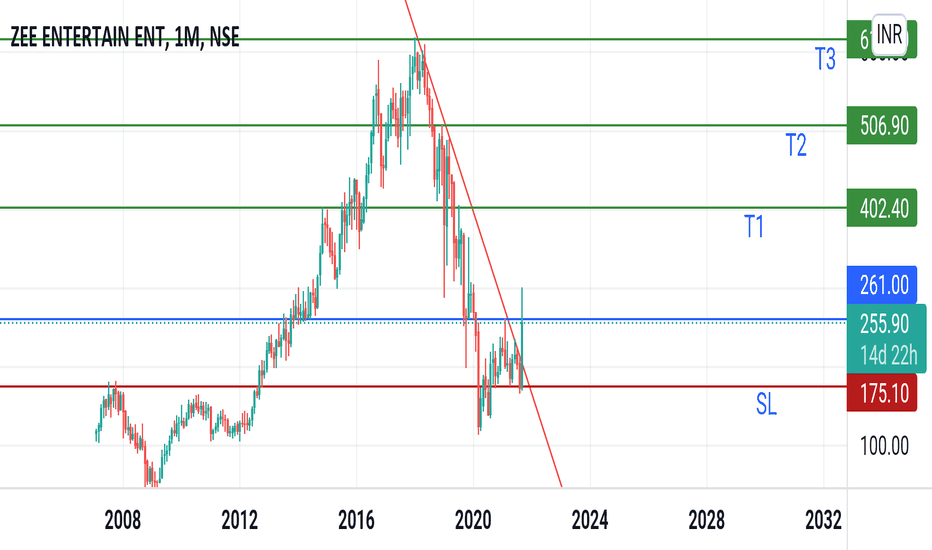

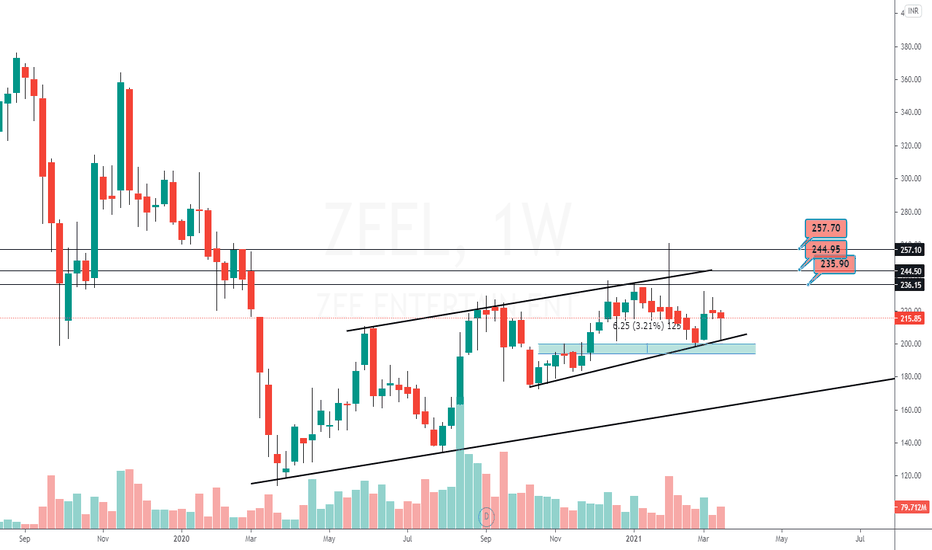

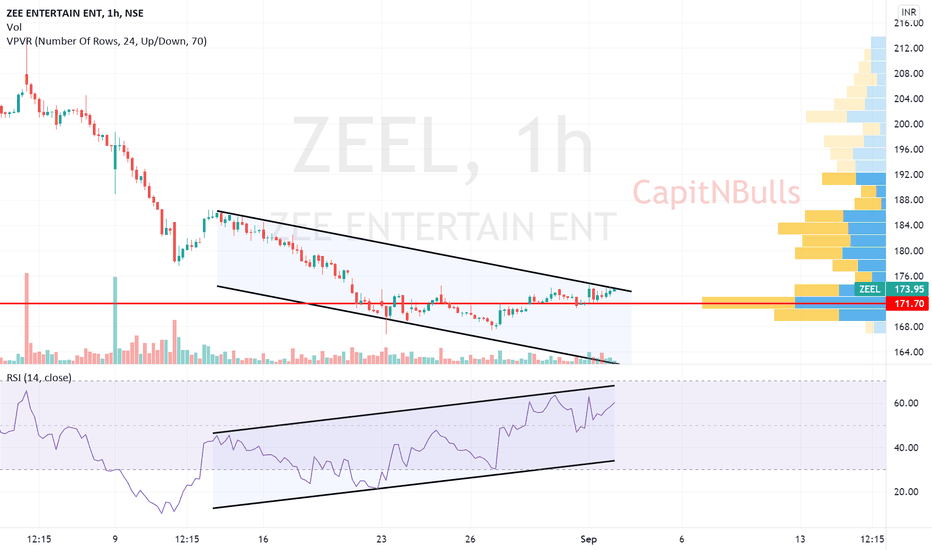

ZEEL LevelsStock is has made W pattern.

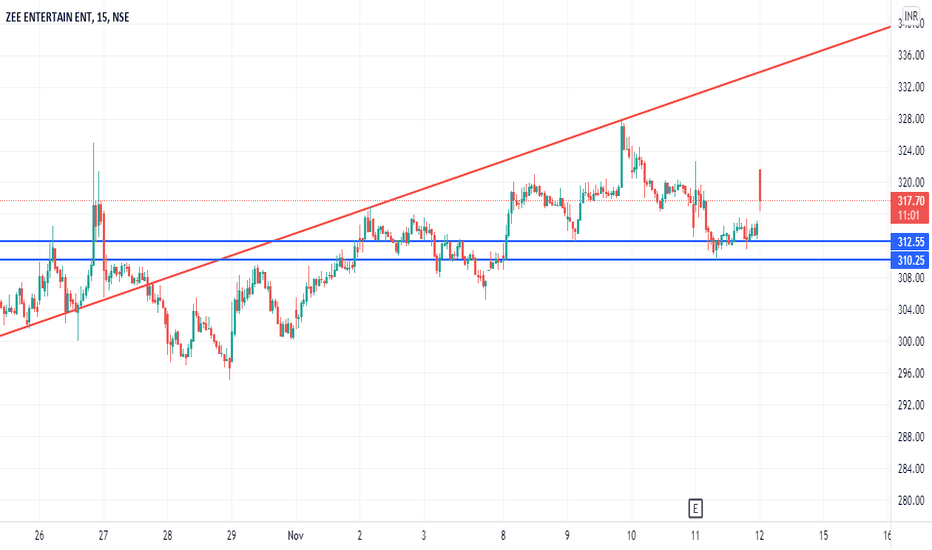

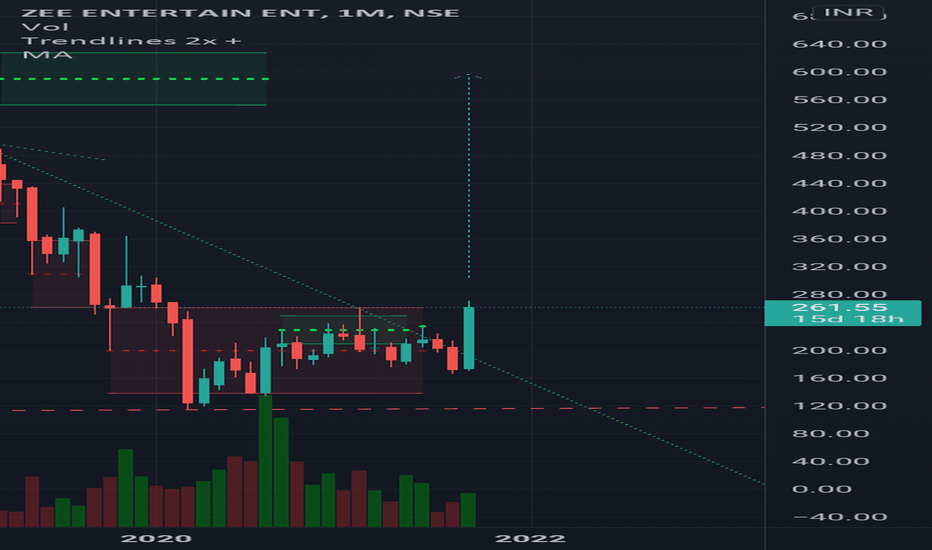

Moving Sideways

volume reducing

rest all level as shown on charts

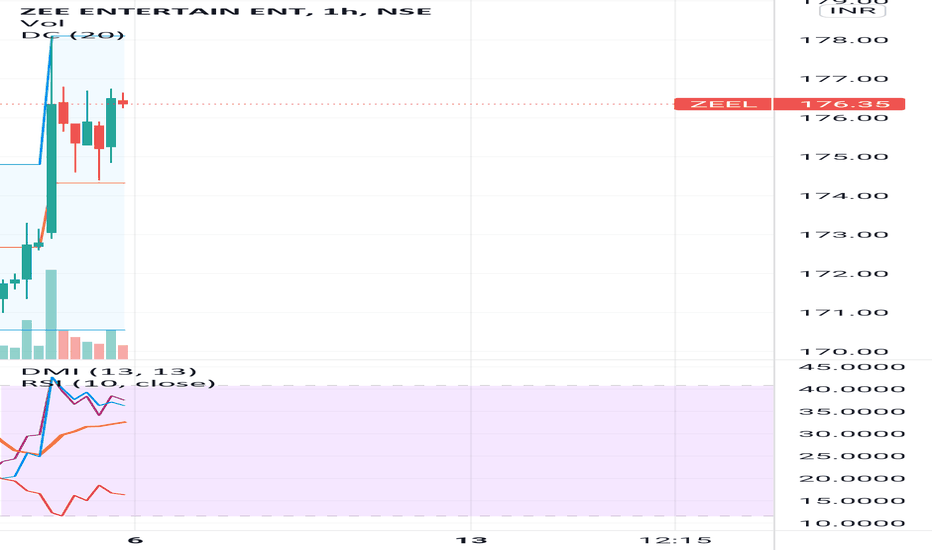

requested by many so uploading Zeel chart

Must Correlate yourself also on charts before taking an entry. This is for Educational purposes only. Please consult your Financial advisor before investing.

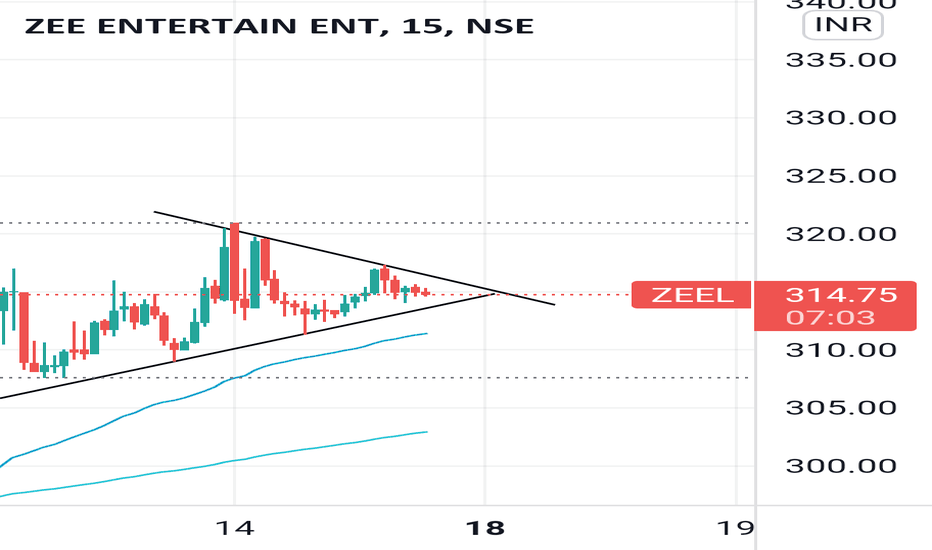

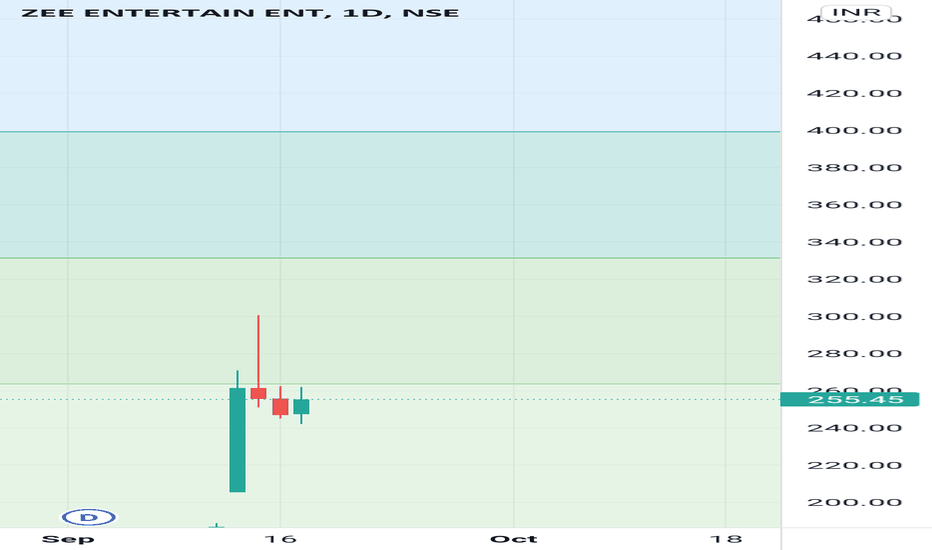

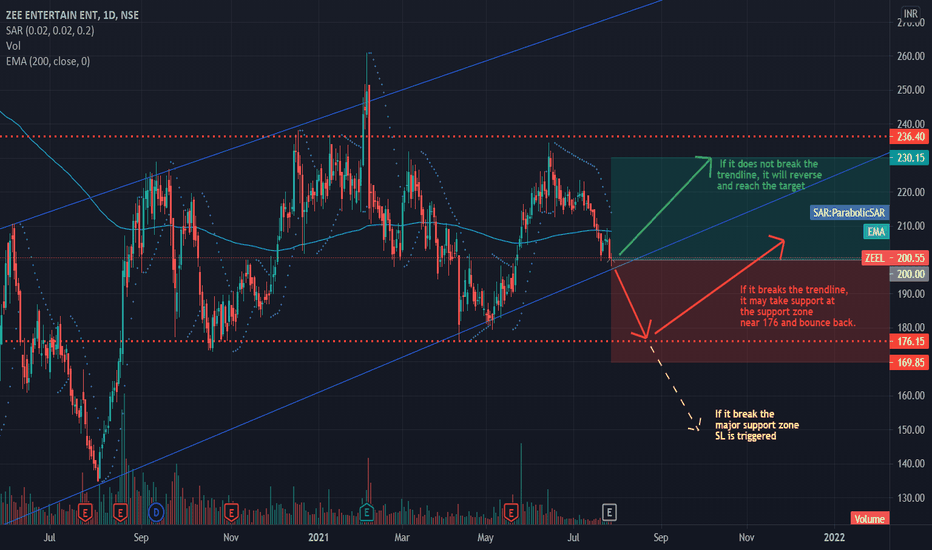

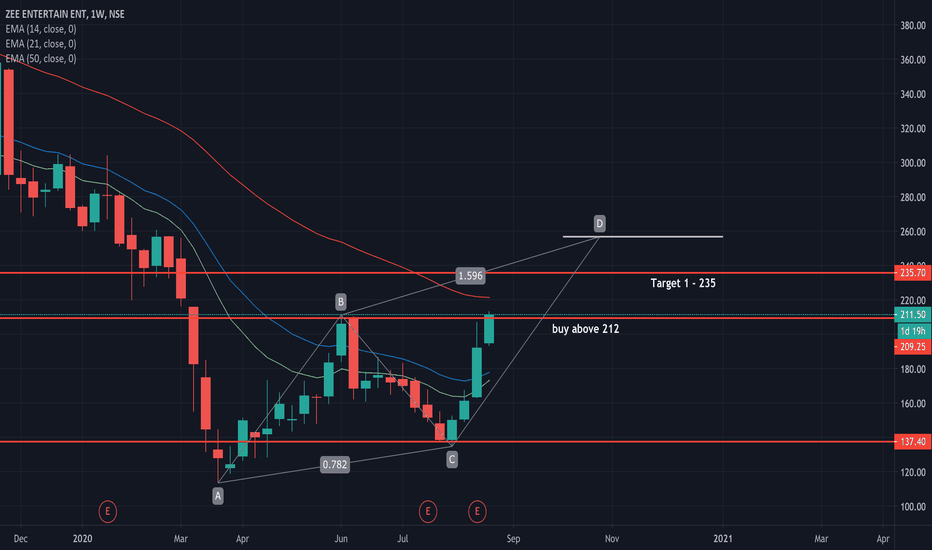

ZEE Breakout and Medium Term InvestmentThe stock has broken out and retested, so it may undergo a rally. Trade is supported by brokerage calls and Supports Nearby.

Risk Reward Ratio - 3:1

SL is placed below support zone & the previously upper trendline. The target is placed based on fundamentals and near swing high.

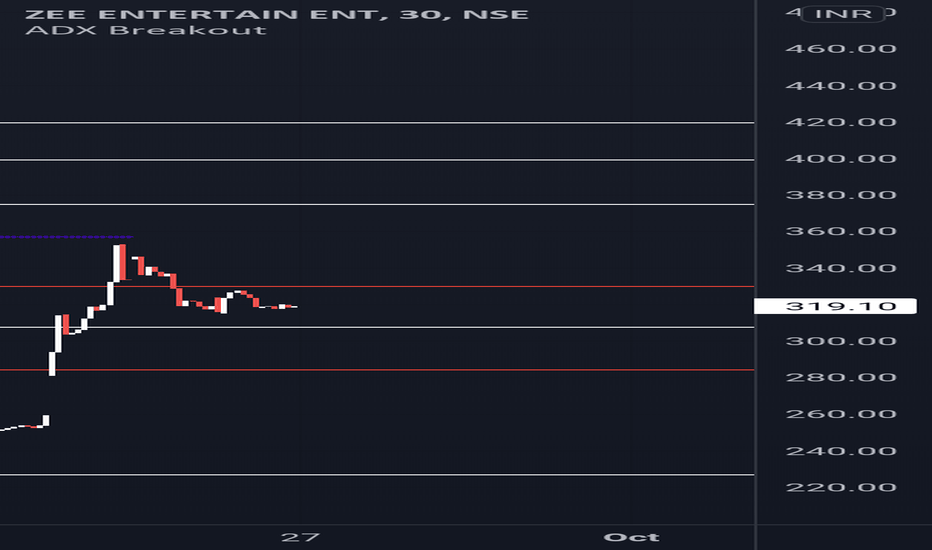

ZEELOpen 322.00

Previous Close 318.20

UC Limit 350.00

LC Limit 286.40

Volume 73,023,126

VWAP 320.65

Mkt Cap (Rs. Cr.) 30,630

20D Avg Volume 51,281,140

20D Avg Delivery 10,477,078

Beta 1.07

Face Value 1

TTM EPS 10.24

TTM PE 31.14

Sector PE 28.04

Book Value Per Share 105.23

P/B 3.04

Dividend Yield 0.78

P/C 24.53

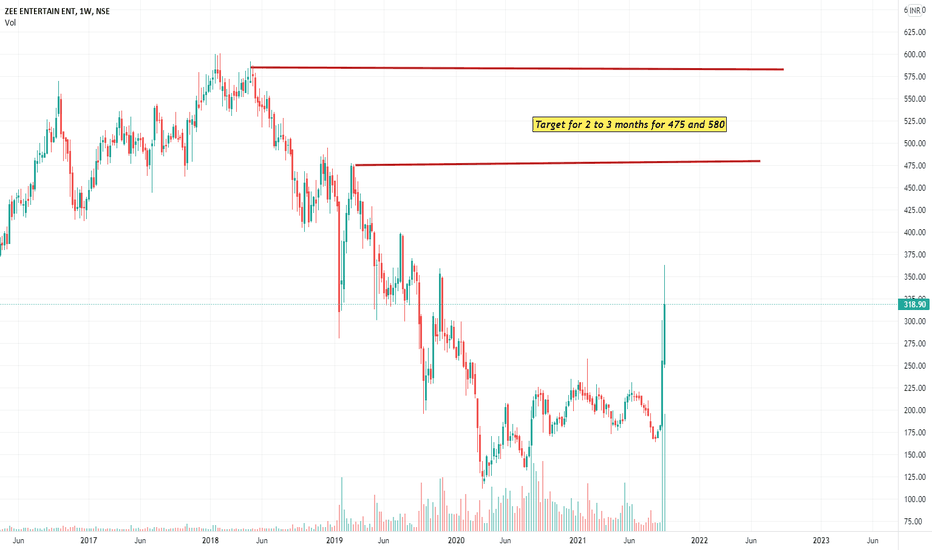

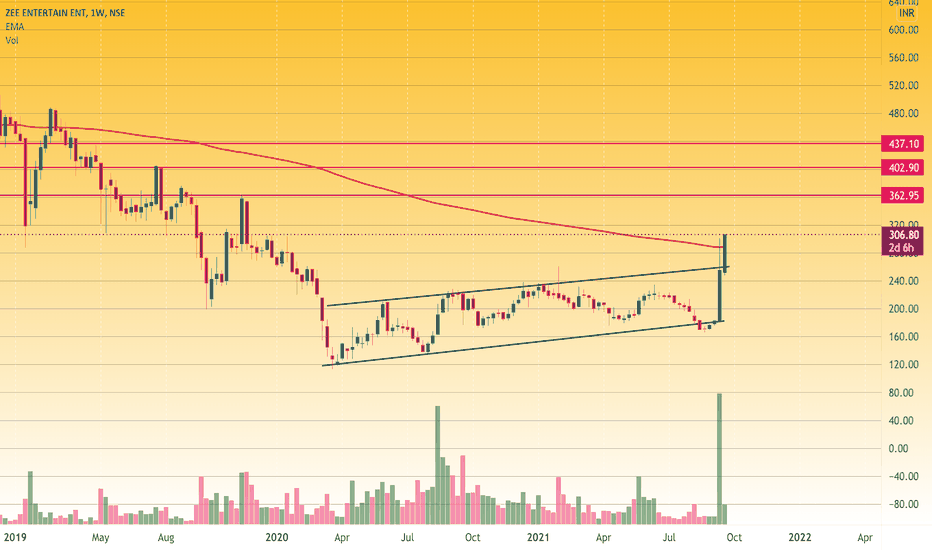

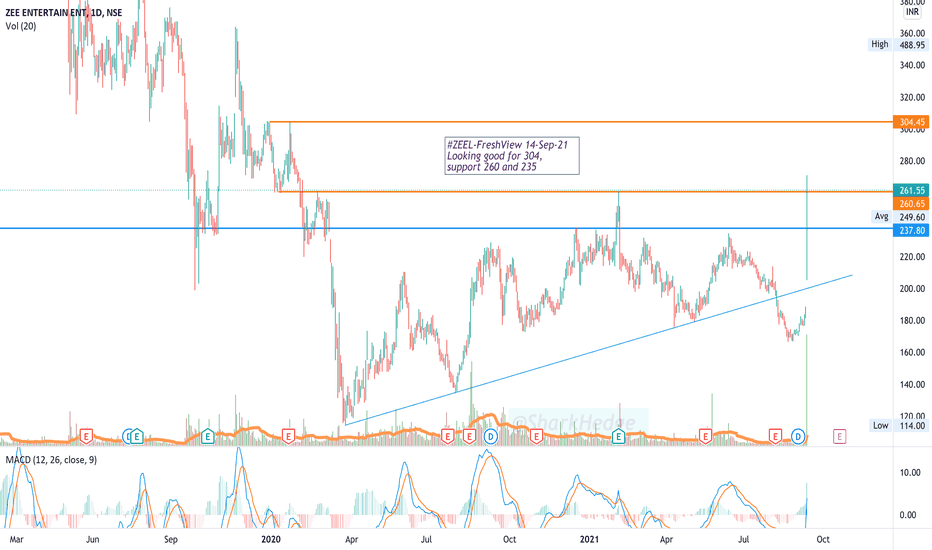

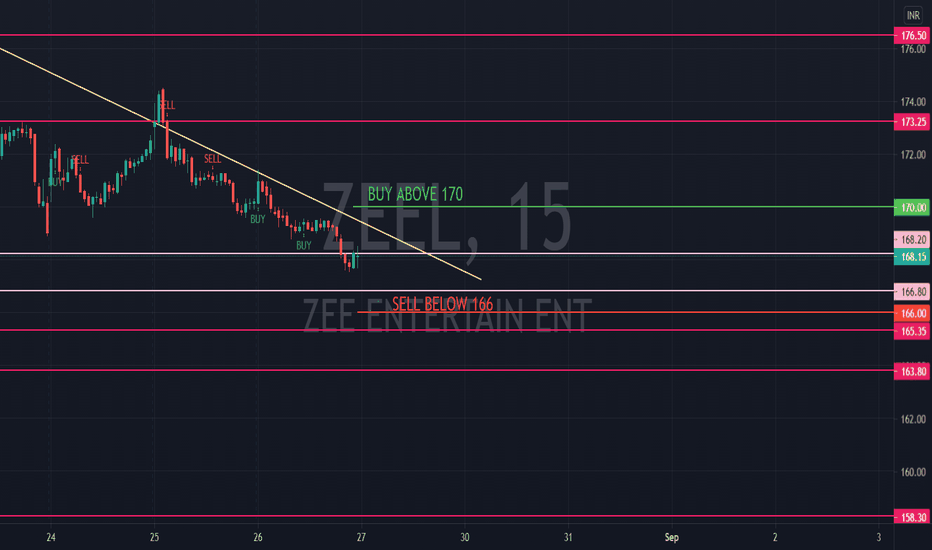

Big Volume breakoutZee has been trading with good volumes since some sessions...BO from channel and most importantly trading ABOVE 200 EMA ( wavy RED line). Anyone following me knows how important 200 EMA is. Targets marked.

Caution - Zee has slid from its highs of 600 Rs to half that value..business is not too good ( compared with say Sun TV)....but one can never know why the market does what it does...right now Zee has got a green signal from market.

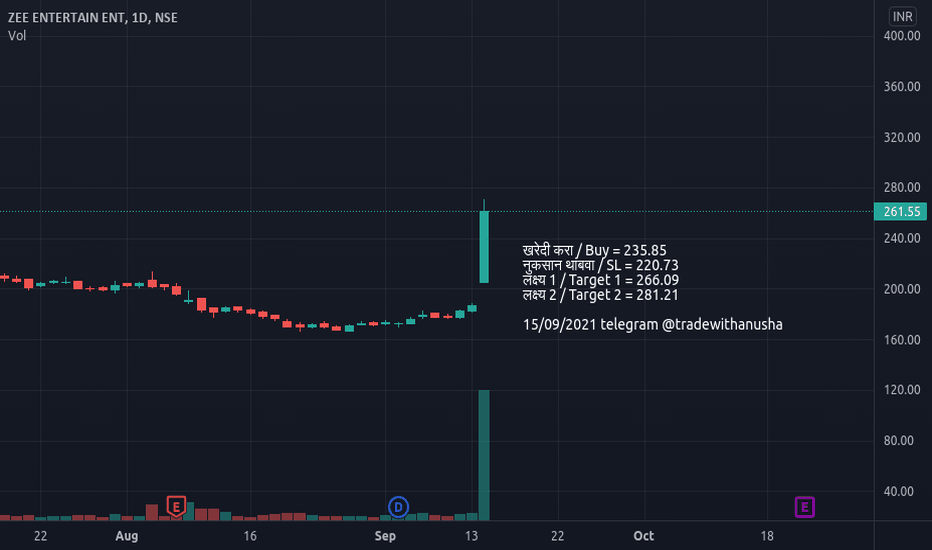

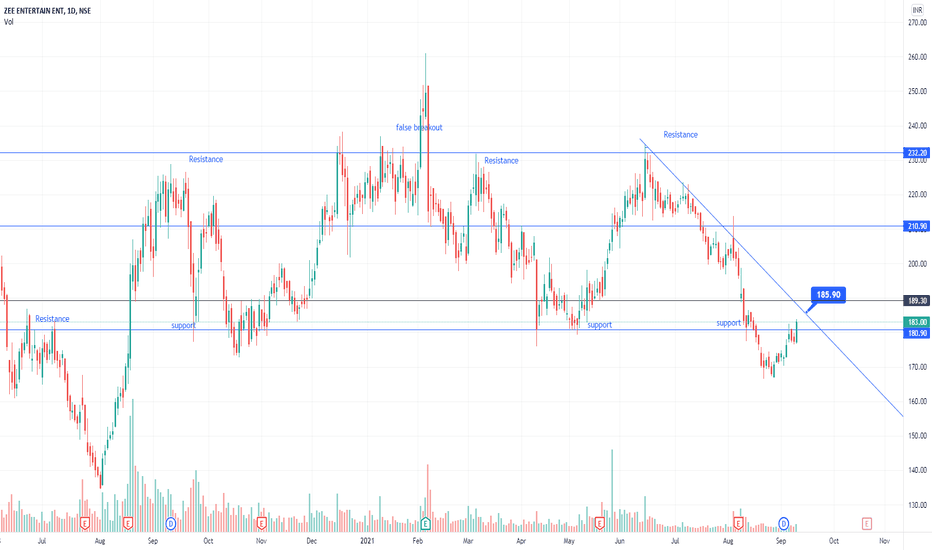

ZEE Entertainment Ltd Short Term ReversalThe stock has reached lower trend line and looks to take support and may undergo a reversal rally. Trade is supported by brokerage calls and Supports Nearby.

SL is placed below major support zone and target is place near swing and channel high.

Note: As the market is under selling pressure, enter only after confirming a reversal