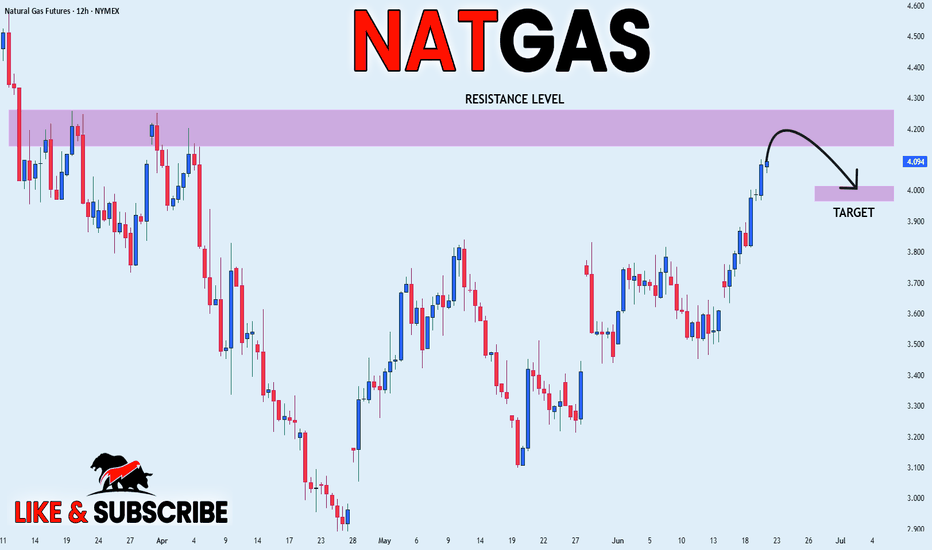

NATGAS STRONG RESISTANCE AHEAD|SHORT|

✅NATGAS has been growing recently

And Gas seems locally overbought

So as the pair is approaching

A horizontal resistance of 4.256$

Price decline is to be expected

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receiv

Related commodities

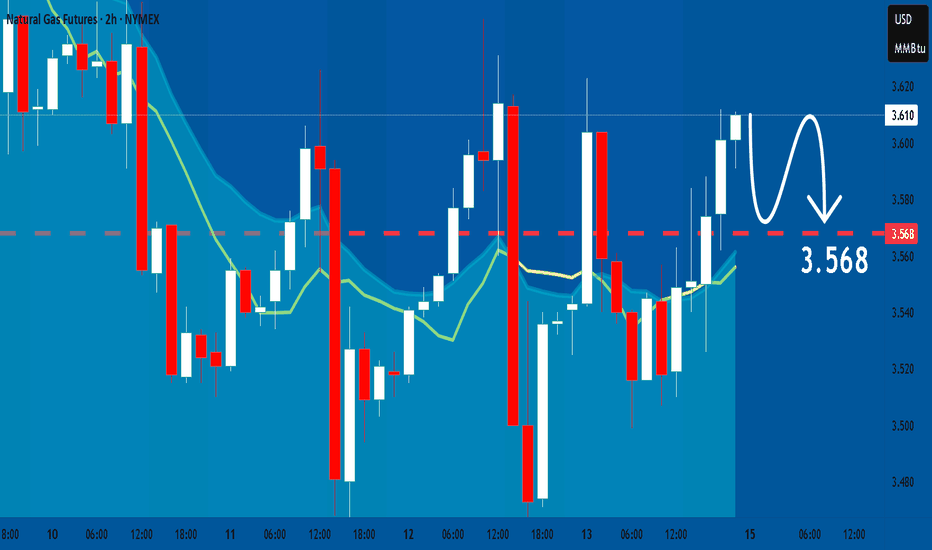

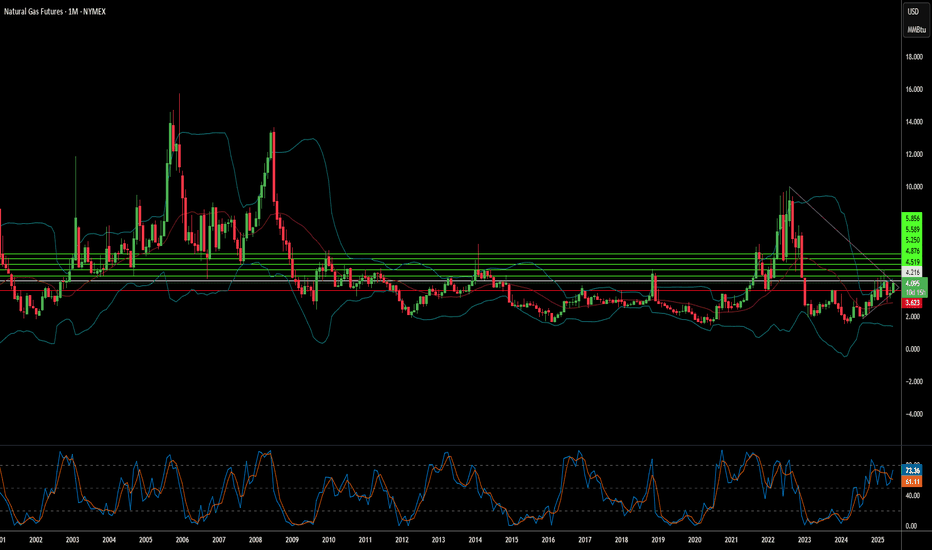

NATGAS: Market of Sellers

Balance of buyers and sellers on the NATGAS pair, that is best felt when all the timeframes are analyzed properly is shifting in favor of the sellers, therefore is it only natural that we go short on the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee fo

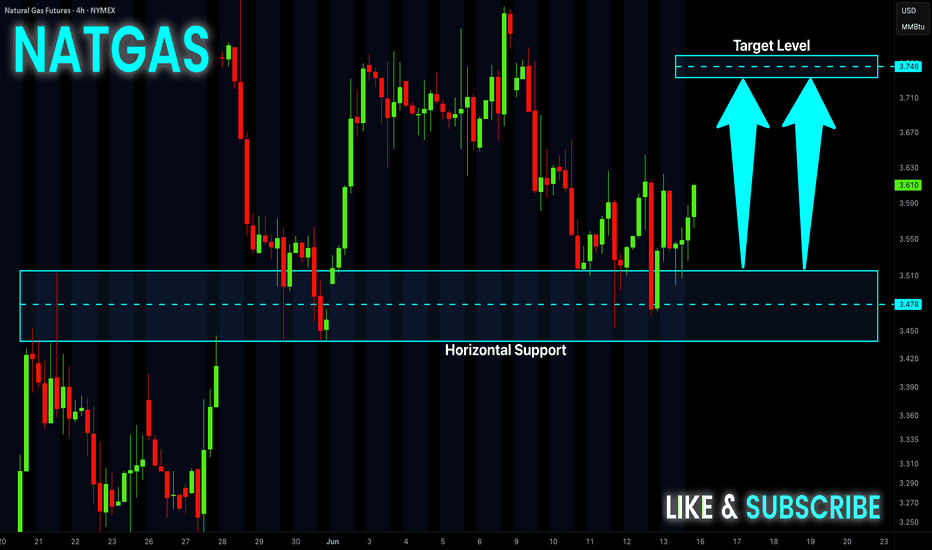

NATGAS Growth Ahead! Buy!

Hello,Traders!

NATGAS made a retest of

The horizontal support level

Of 3.450$ then established

A double bottom pattern

And a we are already

Seeing some rebound so

We are locally bullish biased

And we will be expecting a

Further bullish move up

On Monday

Buy!

Comment and subscribe to help us grow

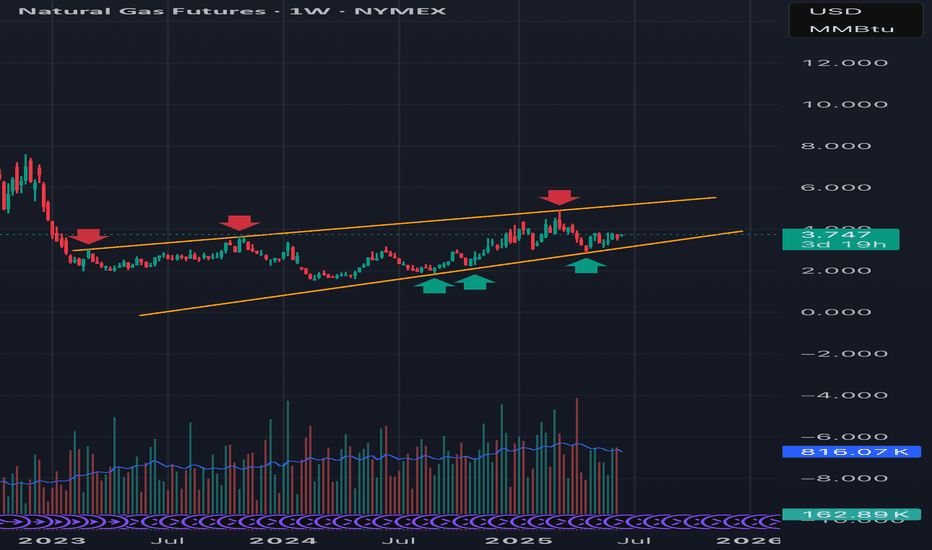

Bullish Trend Remains IntactNatural Gas has been trading inside this rising channel for just over 2 years now. Tested the bottom of this channel for most of this year, now it’s looking to go back up to the top of the channel once again. I would stay long until it hits the top of the channel, unless it closes above the top of t

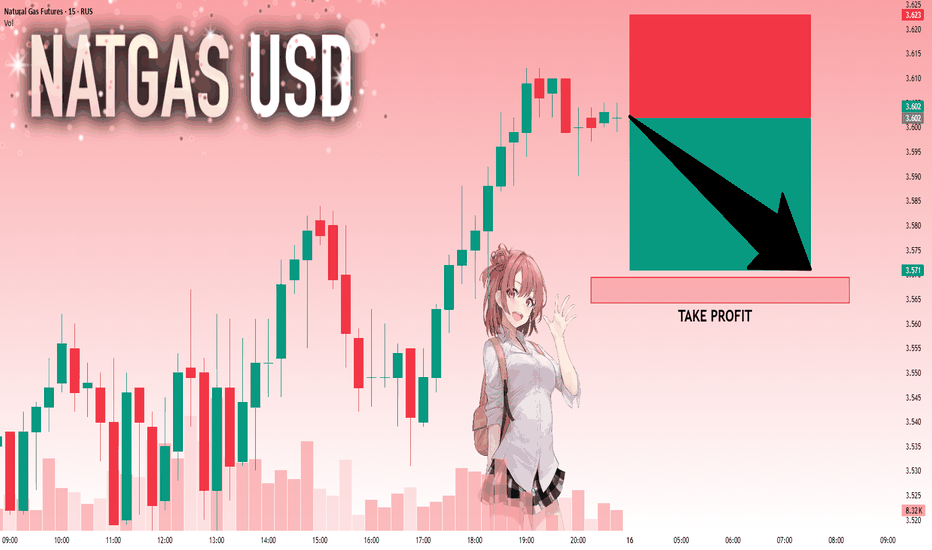

NG1!: Target Is Down! Short!

My dear friends,

Today we will analyse NG1! together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 3.602 Therefore, a strong bearish reaction here could determine the next move down.We will watch for a confirmation candle, and then target th

Will Middle East Flames Ignite Winter Gas Prices?The global natural gas market is currently navigating a period of profound volatility, with prices surging and defying typical seasonal trends. This significant upward movement is primarily driven by escalating geopolitical tensions in the Middle East, specifically the intensifying conflict between

Naturalgas long tradeNaturalgas is resisting downside movement as witnessed on chart.

If you see the downward movement of Naturalgas, it is with relatively high volume but it is not coming down as expected from sellers and bouncing back up again as seen 3 times.

Now naturalgas has reached short term resistance zone of 3

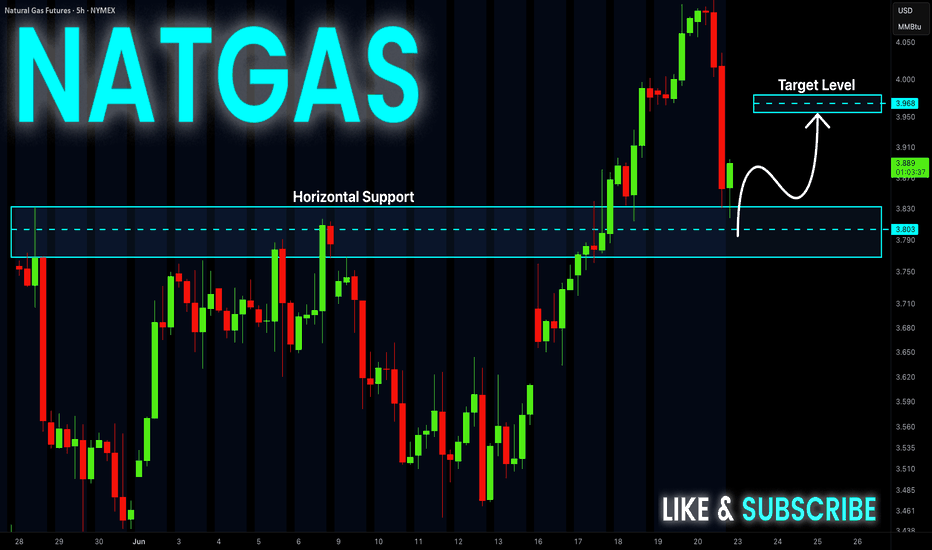

NATGAS Long From Support! Buy!

Hello,Traders!

NATGAS made a great

Bearish correction and

And then retested a

Horizontal support

Around 3.800$ from where

We are already seeing a

Bullish rebound so we

Are bullish biased and we

Will be expecting a

Further bullish move up

Buy!

Comment and subscribe to help us grow!

Check ou

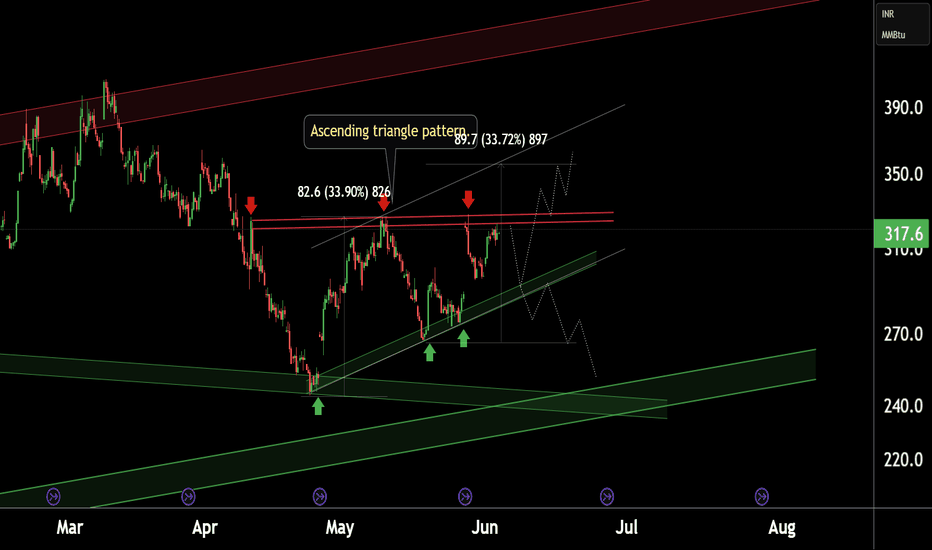

NATURAL GAS NEAR AT RESITANCE !!This is the 4 hour chart of NaturalGas1!.

Natural Gas is trading near the resistance of an ascending triangle pattern at 325-332 range.

If this level is sustain,we may see pattern support at 285-290 range

If Natural Gas breaks out above the resistance, it may lead to a new high with a potential

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of Natural Gas (Henry Hub) Last-day Financial Futures (Dec 2025) is 4.889 USD — it has fallen −1.41% in the past 24 hours. Watch Natural Gas (Henry Hub) Last-day Financial Futures (Dec 2025) price in more detail on the chart.

The volume of Natural Gas (Henry Hub) Last-day Financial Futures (Dec 2025) is 389.00. Track more important stats on the Natural Gas (Henry Hub) Last-day Financial Futures (Dec 2025) chart.

The nearest expiration date for Natural Gas (Henry Hub) Last-day Financial Futures (Dec 2025) is Nov 25, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Natural Gas (Henry Hub) Last-day Financial Futures (Dec 2025) before Nov 25, 2025.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Natural Gas (Henry Hub) Last-day Financial Futures (Dec 2025) this number is 21.82 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Natural Gas (Henry Hub) Last-day Financial Futures (Dec 2025) shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Natural Gas (Henry Hub) Last-day Financial Futures (Dec 2025). Today its technical rating is buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Natural Gas (Henry Hub) Last-day Financial Futures (Dec 2025) technicals for a more comprehensive analysis.