Related commodities

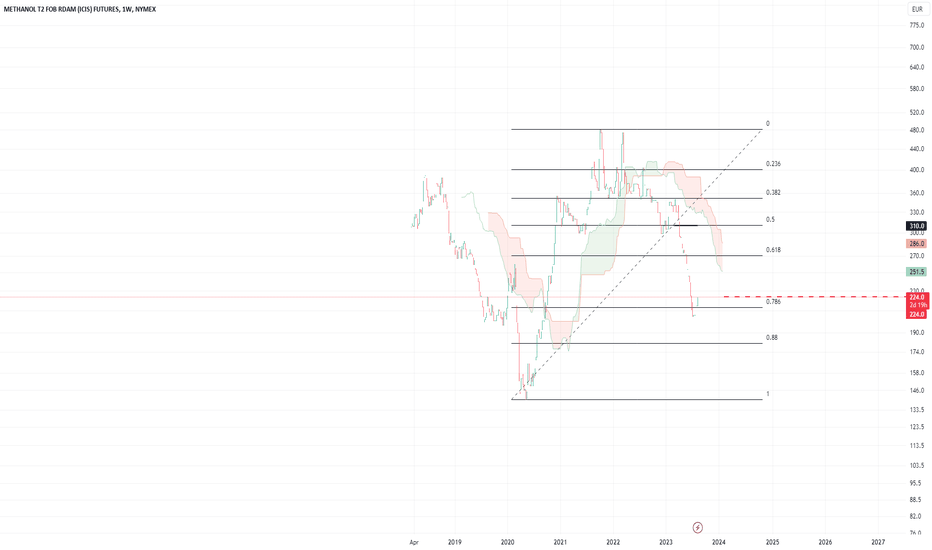

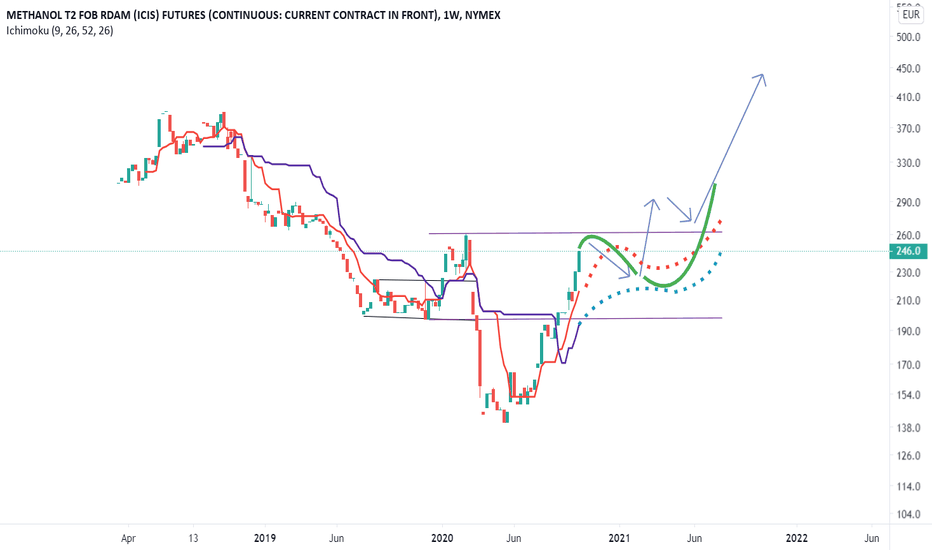

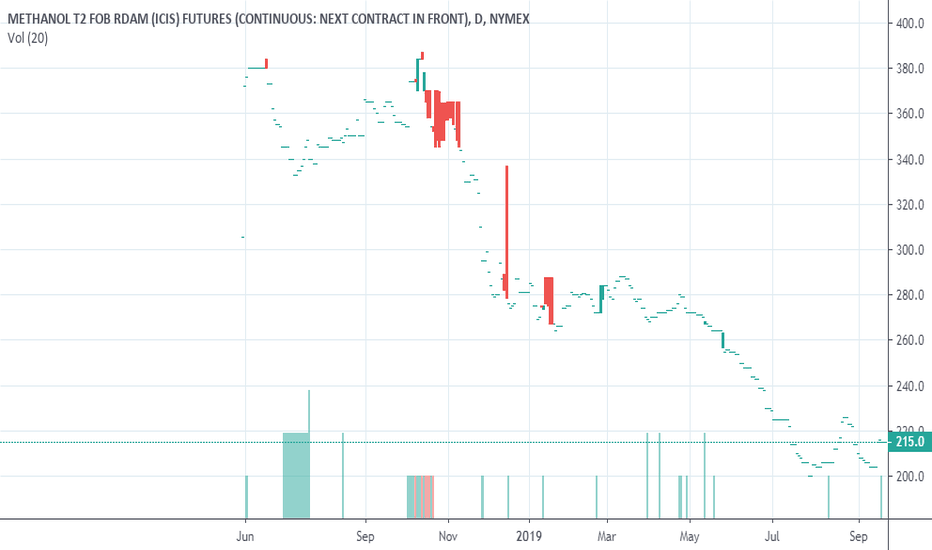

Methanex and Methanol - Upside aheadMethanex has a methanol monopoly, methanol has been gainining momentum for the past weeks, has gone up 3 weeks in a row (2.7% last week).

Given the strong correlation MEOH / MX.TO could be going up.

NASDAQ:MEOH

TSX:MX

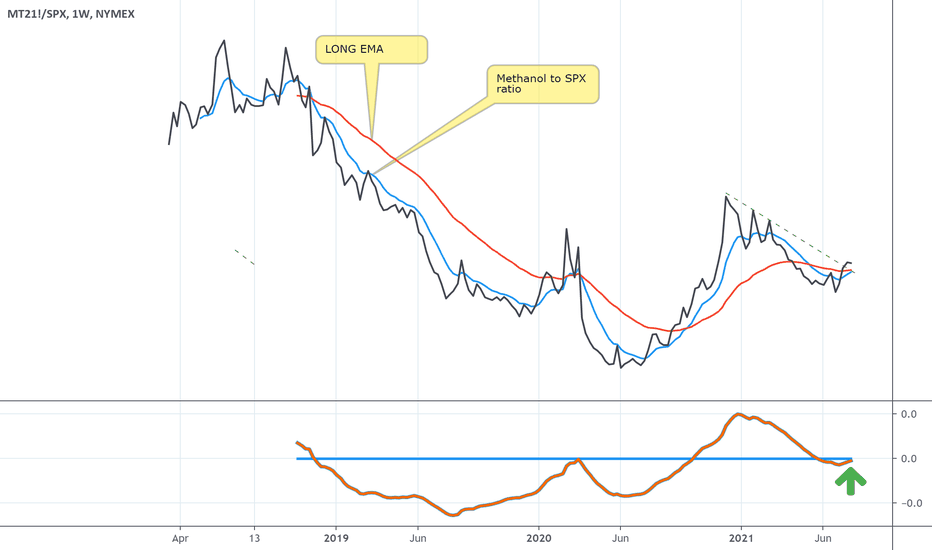

This chart is the relative strenght of the Methanol futures vs the SPX. It's

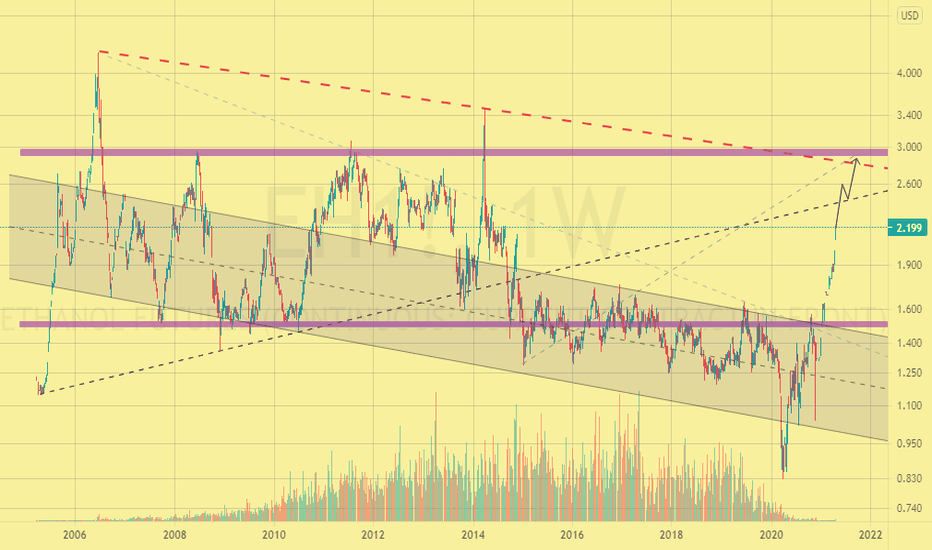

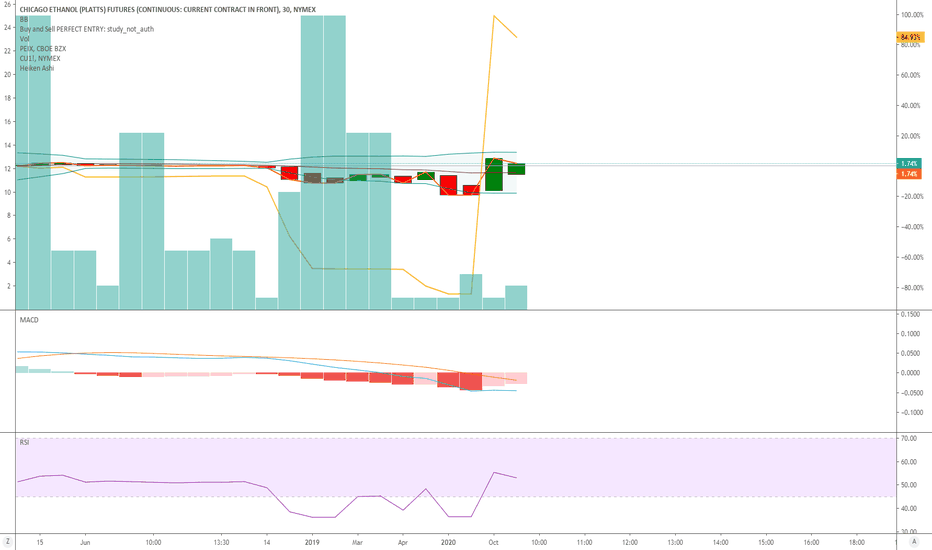

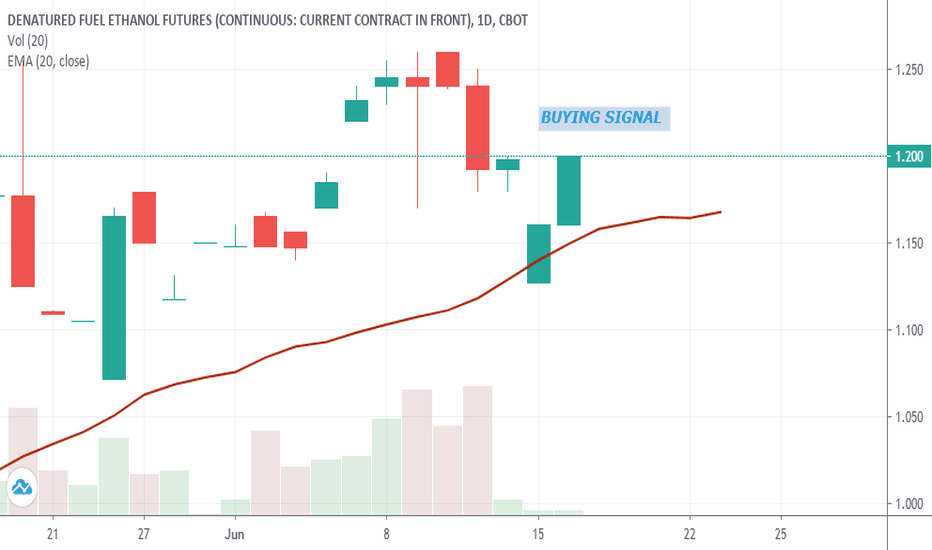

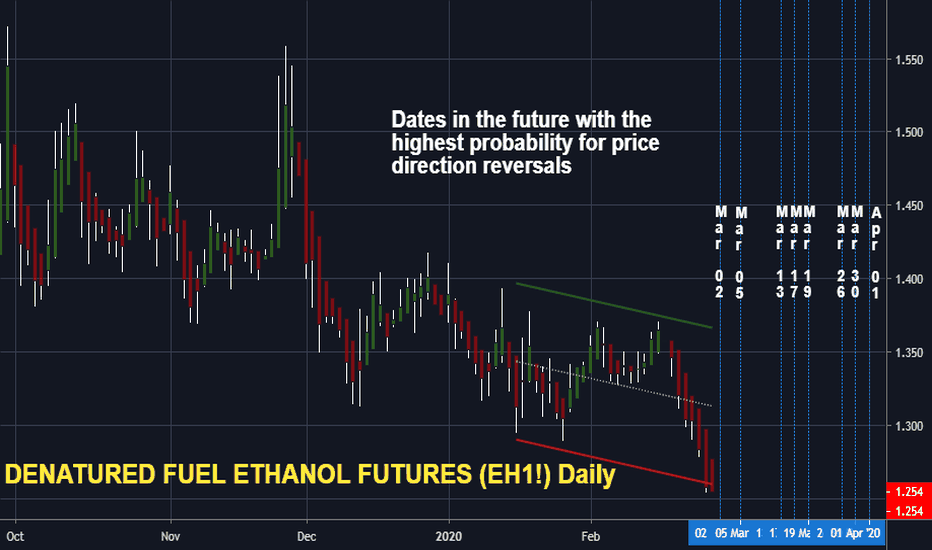

PEIX vs Ethanol Futures (Chicago)Pacific Ethanol doing a reversal up with COVID spike and Ethanol Futures change. Awaiting this going to target $10-11 on short term with another positive earnings and 3rd plant running more to market need. Announcement also selling into more profitable libations market of low calorie seltzers

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of RME Biodiesel FOB Rdam (Argus) (RED Compliant) Futures is 1,135.683 USD — it has risen 0.50% in the past 24 hours. Watch RME Biodiesel FOB Rdam (Argus) (RED Compliant) Futures price in more detail on the chart.

Track more important stats on the RME Biodiesel FOB Rdam (Argus) (RED Compliant) Futures chart.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For RME Biodiesel FOB Rdam (Argus) (RED Compliant) Futures this number is 0.00. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for RME Biodiesel FOB Rdam (Argus) (RED Compliant) Futures shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for RME Biodiesel FOB Rdam (Argus) (RED Compliant) Futures. Today its technical rating is sell, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of RME Biodiesel FOB Rdam (Argus) (RED Compliant) Futures technicals for a more comprehensive analysis.