Related commodities

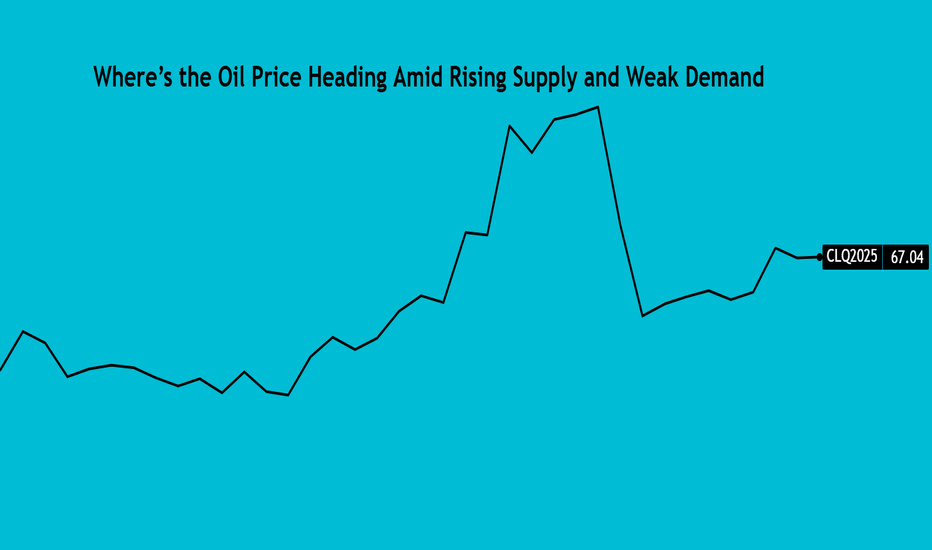

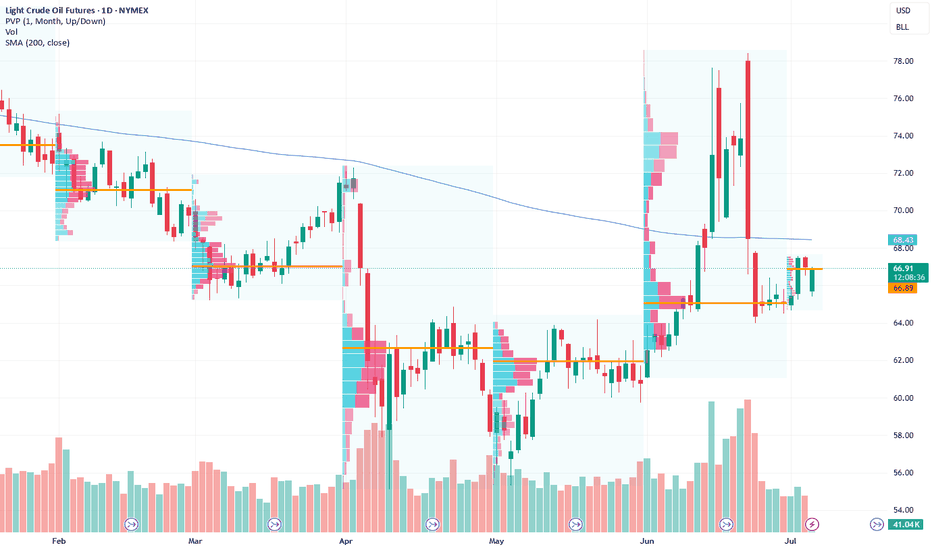

Where’s the Oil Price Heading Amid Rising Supply and Weak DemandThe eight oil-producing nations of OPEC+ agreed to raise output in August, opting for a larger-than-expected increase. OPEC+ cited a steady global economic outlook and healthy market fundamentals. The crude oil market remains under pressure from subdued prices, persistent supply growth, and uncert

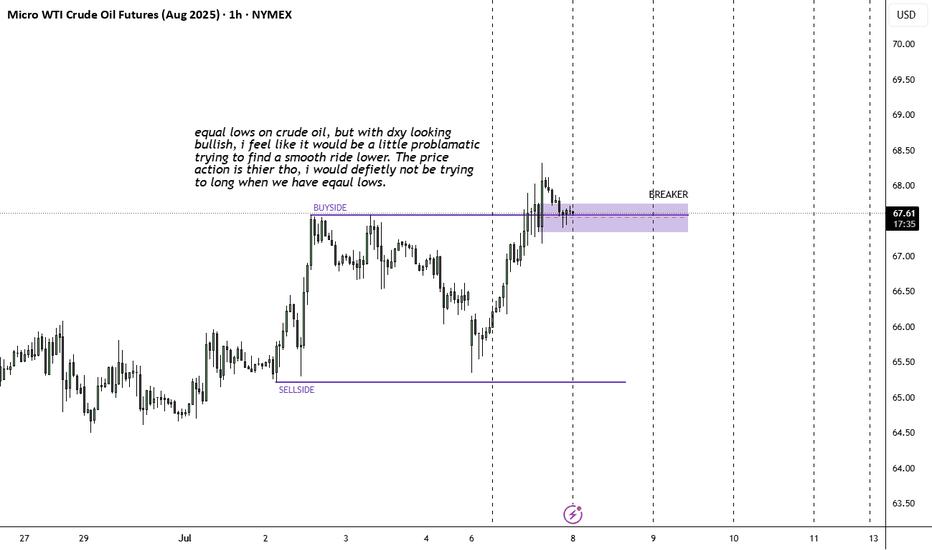

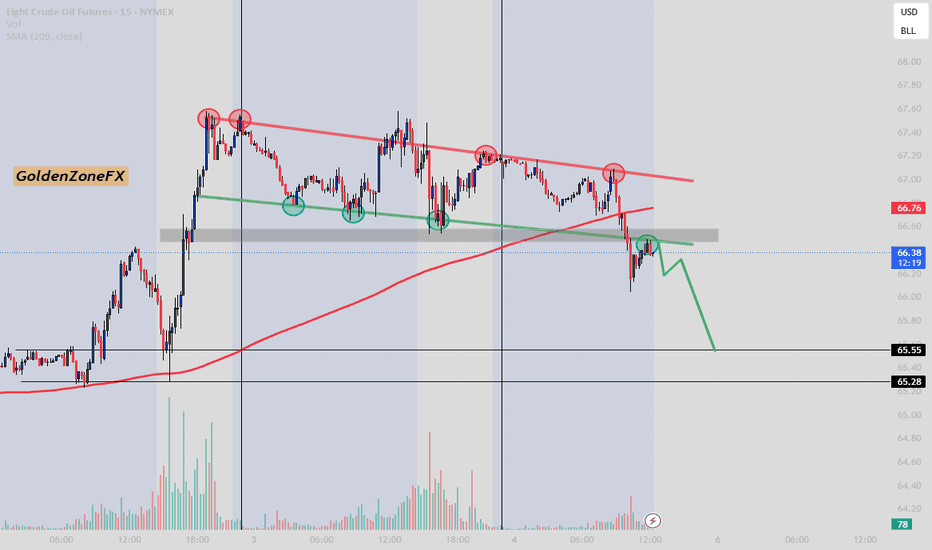

Crude Oil Trade Idea: Intraday mechanicsNYMEX:CL1! NYMEX:MCL1!

Bigger Picture:

Traders should note that news headlines do not always drive the price action. More often, news outlets look for narrative to align with the price action.

Previously, it was about the supply glut and worsening demand due to an uncertain outlook. Now the

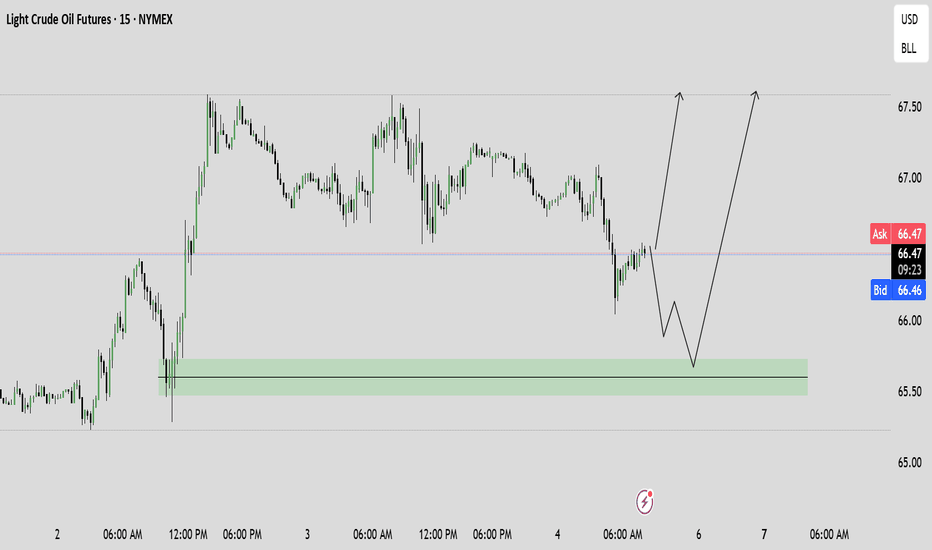

CRUDE OILPreferably suitable for scalping and accurate as long as you watch carefully the price action with the drawn areas.

With your likes and comments, you give me enough energy to provide the best analysis on an ongoing basis.

And if you needed any analysis that was not on the page, you can ask me with a

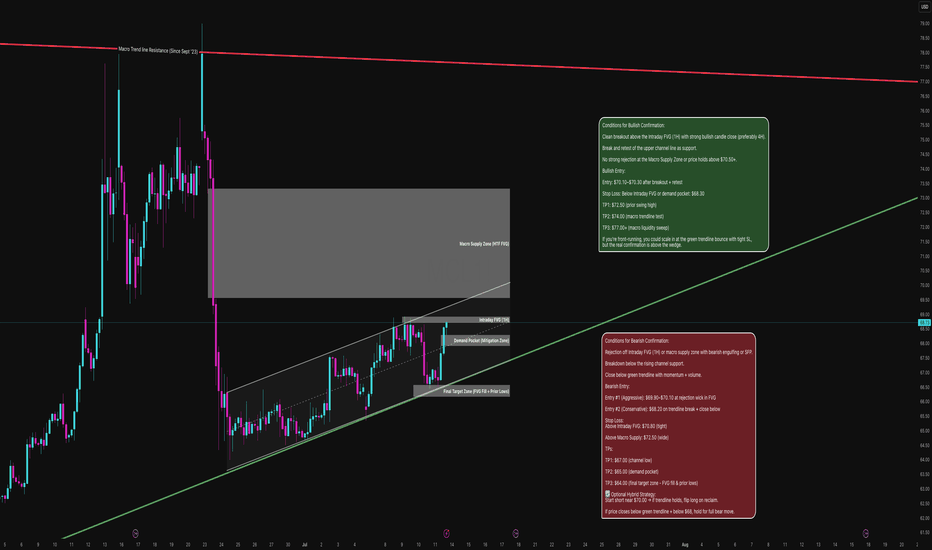

Crude Compression, Flagging Into Fire or FailureCrude Oil has been grinding higher within a clean rising wedge (bearish flag), forming within the aftermath of a strong sell-off. Price is now testing a key Intraday Fair Value Gap (1H FVG) inside a broader HTF Macro Supply Zone, while respecting a steep trend line of support.

This structure sets u

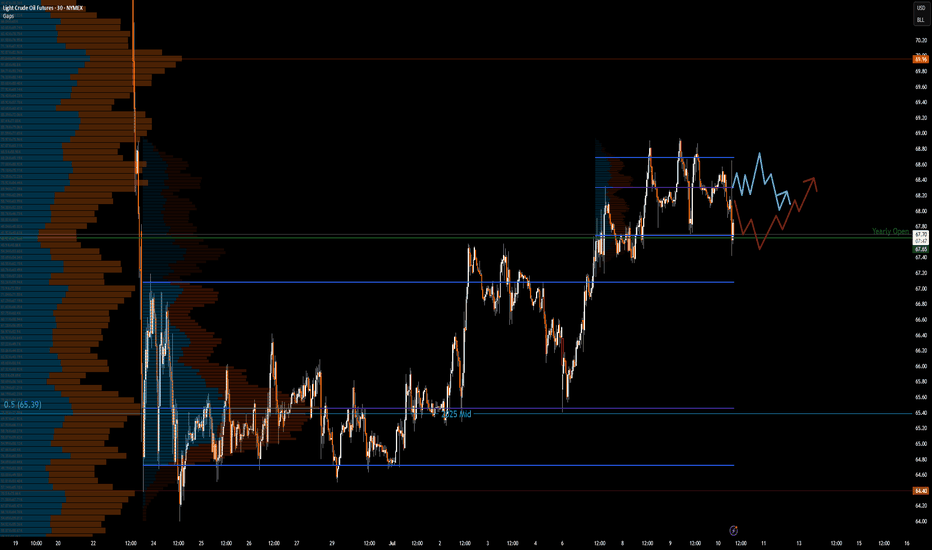

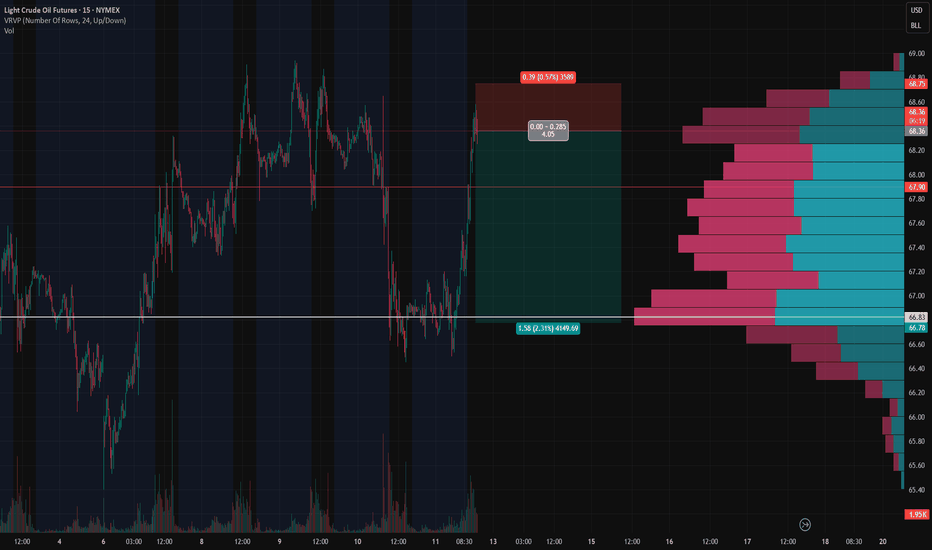

CL1! Short Setup – Fading Into Volume Shelf📉 CL1! Short Setup – Fading Into Volume Shelf

🔹 Context:

Price just tapped into a heavy upper volume shelf (68.35–68.50) — the exact area where the prior breakdown started. This zone aligns with rejection highs and the upper edge of the VRVP profile.

📌 Setup Logic:

🔺 Entry: 68.36–68.50 (in

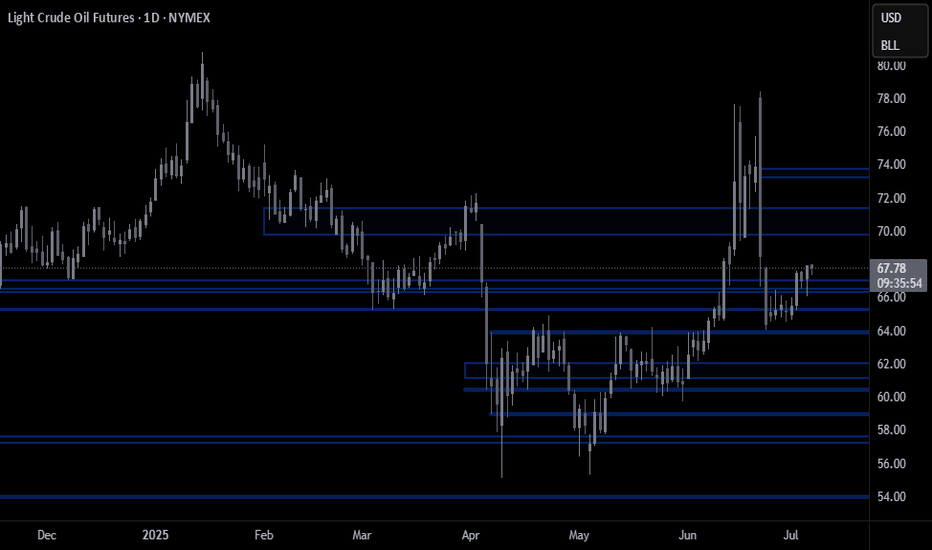

Crude Oil: Key Breakout Levels Suggest Bullish MomentumCurrent Price: $65.81

Direction: LONG

Targets:

- T1 = $67.45

- T2 = $69.30

Stop Levels:

- S1 = $64.20

- S2 = $62.50

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identif

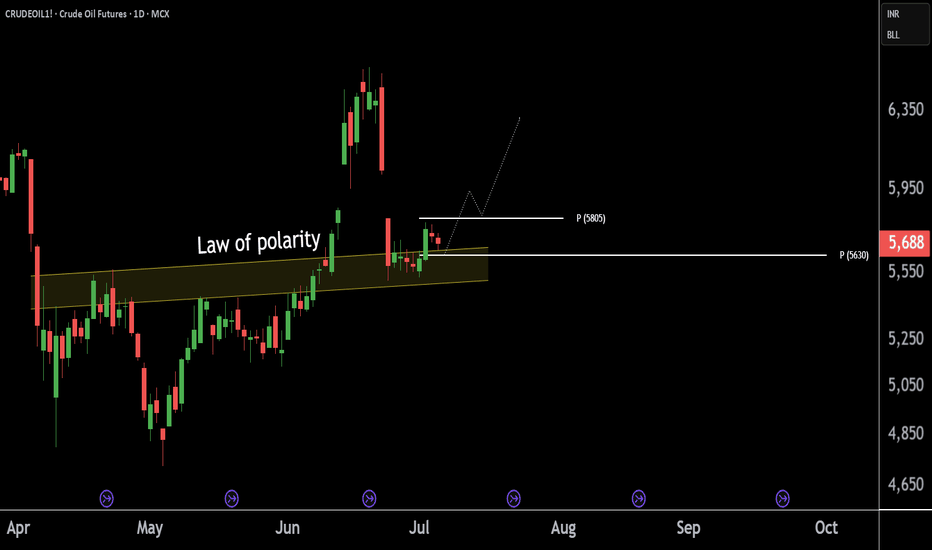

CRUDEOIL1! at Best Support Zone !!This is the Daily Chart of CRUDEOIL1!.

CRUDEOIL1! having a good law of polarity at 5500-5600 level .

CRUDEOIL1! is currently trading between its quarterly pivot 5603 level and monthly pivot 5805 levels , indicating a range-bound movement."

Once the Crudeoil1! sustains above the monthly pivot, it

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of WTI Midland (Argus) Trade Month Futures is 75.63 USD — it has fallen −0.96% in the past 24 hours. Watch WTI Midland (Argus) Trade Month Futures price in more detail on the chart.

Track more important stats on the WTI Midland (Argus) Trade Month Futures chart.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For WTI Midland (Argus) Trade Month Futures this number is 0.00. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for WTI Midland (Argus) Trade Month Futures shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for WTI Midland (Argus) Trade Month Futures. Today its technical rating is strong sell, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of WTI Midland (Argus) Trade Month Futures technicals for a more comprehensive analysis.