Crude Oil – Retesting Resistance | Possible Pullback Trade Setu

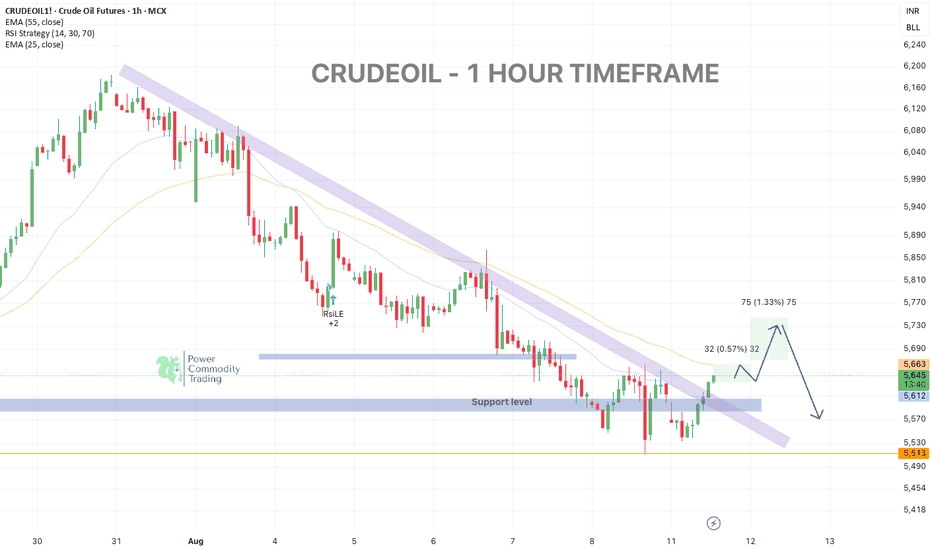

Crude Oil (1H timeframe)

broken out from its short-term downtrend channel and is now retesting key resistance near 5740.

Price is holding above the 5610 support, but upside is likely capped unless bulls sustain momentum.

🔹 Key Levels:

• Resistance: 5740 – 5770

• Support: 5610 → 5513

📊 Techni

Related commodities

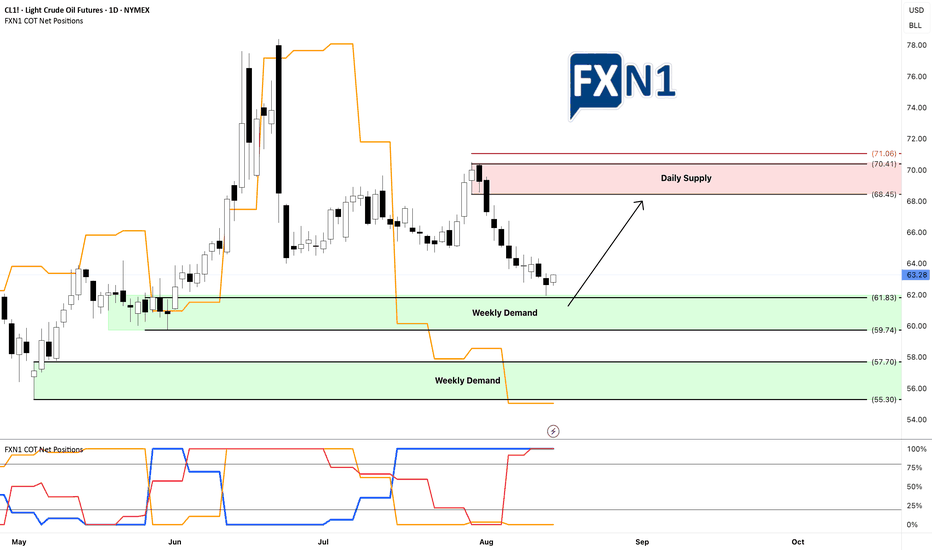

Oil Market Insights: Demand Zones and Future FundamentalsYesterday, CL1! oil tested and rebounded from my weekly demand zone without triggering my entry, resulting in a missed opportunity for several points. This suggests to me that there is buying interest at this level, regardless of the fact that non-commercial traders are short. I am now looking for a

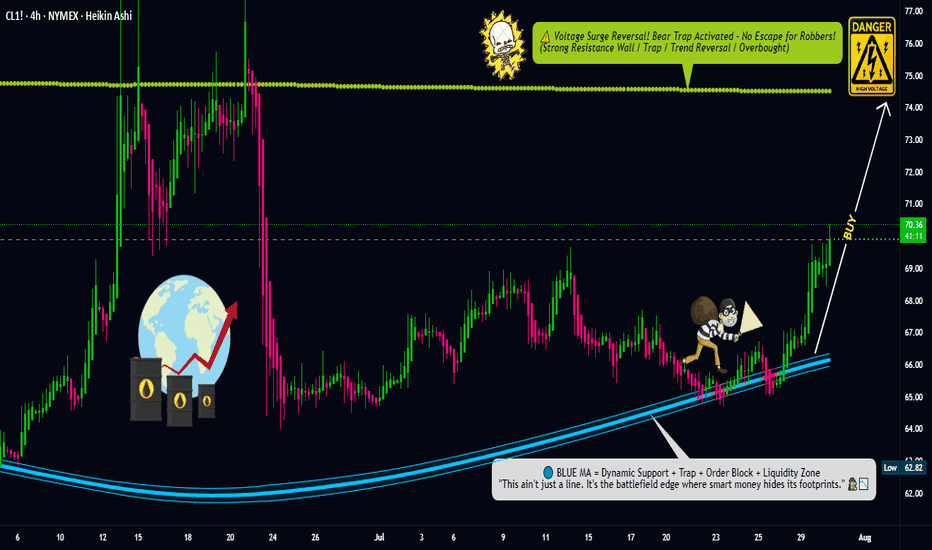

Oil Trap Activated – Limit Orders Set for the Big Score💥🛢️Crude Oil Vault Breach Plan – DCA Heist Begins!🧨💰

🚨Asset: CL1!

📈Bias: BULLISH RAID MODE ON

🎯Target: $74.50

🛡️Stop Loss: $67.50

🔑Entry: ANY LEVEL – Thief stacking limit orders like layers of gold bars 💼⚖️ (DCA Mode Activated)

🕵️♂️Thief Trader is not chasing, we're ambushing 🧠 — scaling in smart

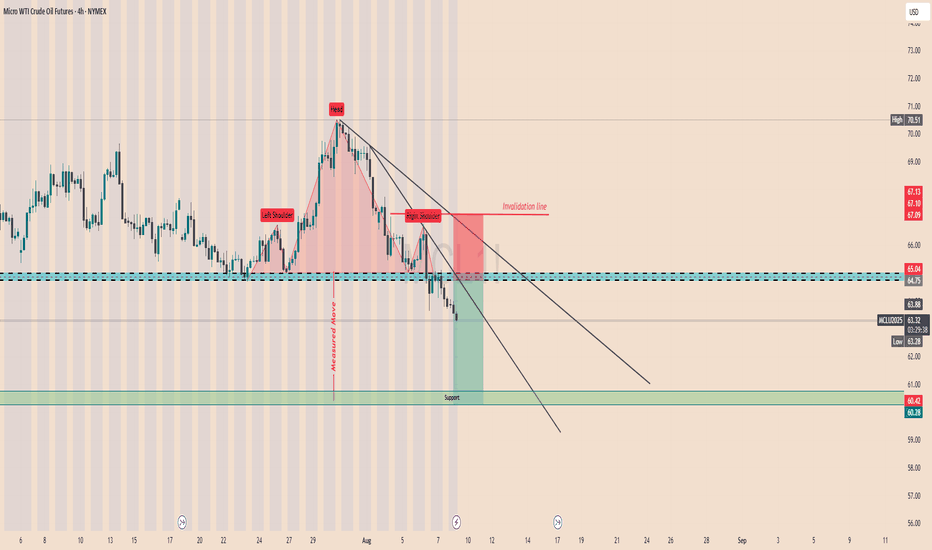

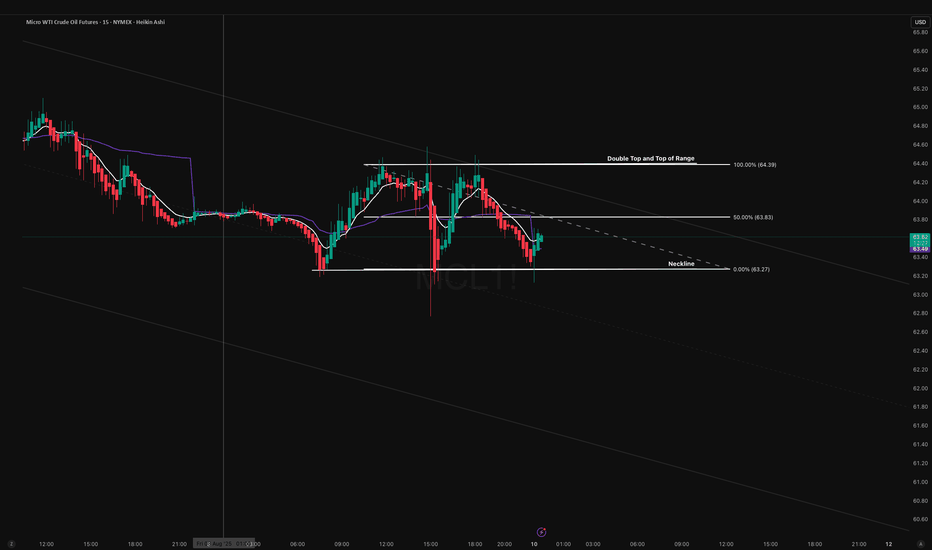

MCL About to Take the Express Elevator DownOn the 15-min chart, MCL has completed a clean double top at 64.50, with neckline support broken at 63.00. This pattern is forming within a broader descending channel, adding higher-timeframe confluence for further downside.

Bearish Scenario (Primary Bias – 70% Probability)

- Entry Zone: 63.80–64

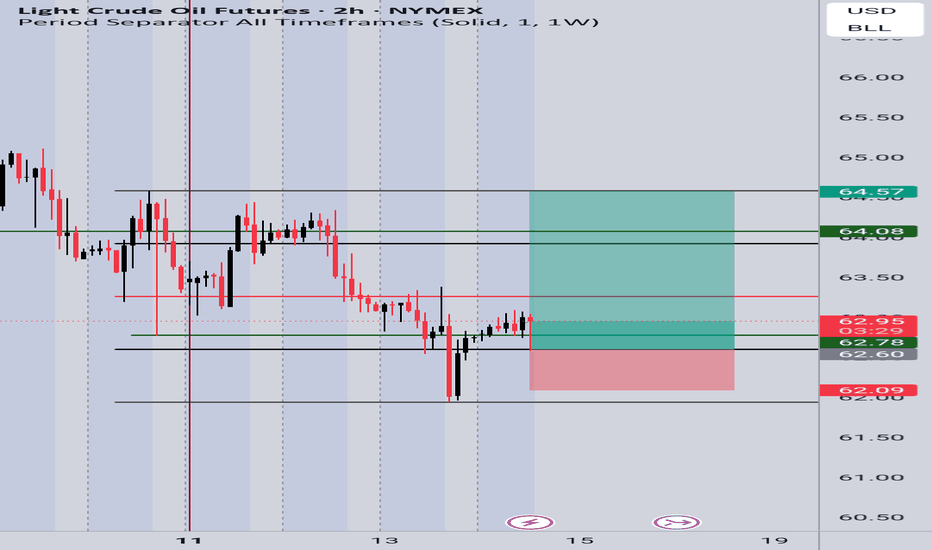

CL1! Long Setup – Recovery BounceBias: Bullish

Reasoning:

Demand zone respected – Price reacted strongly from the 62.00 – 62.20 support zone, forming a bullish rejection wick.

Liquidity sweep – The recent dip below support grabbed liquidity before reversing upward, signaling possible continuation.

Higher timeframe confluence – O

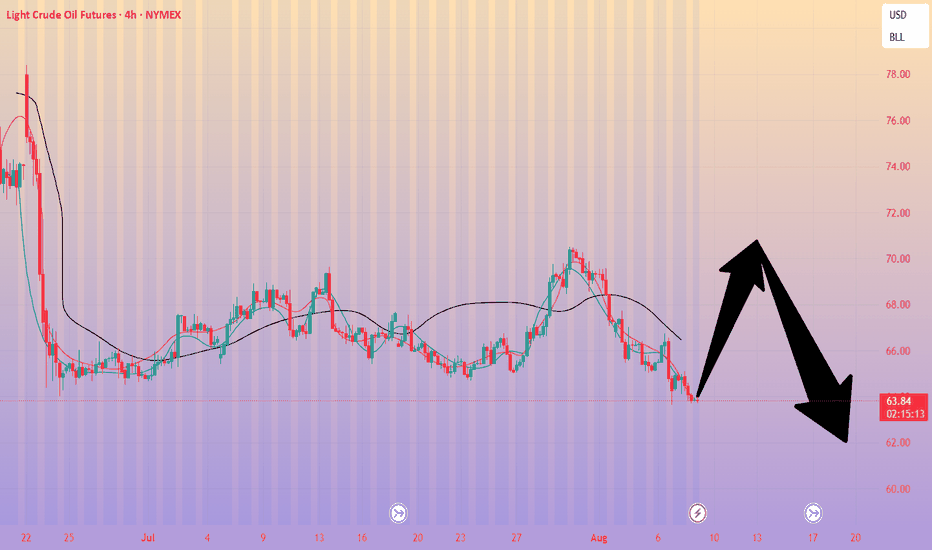

Crude oil: Sell around 66.50, targeting 63.00-60.00Crude Oil Market Analysis:

We've stated this dozens of times before: the overall trend of crude oil is bearish. As long as crude oil doesn't break above 70.00, we can maintain our bearish outlook. Today, we maintain our bearish outlook and continue to sell on any rebounds. Crude oil fundamentals do

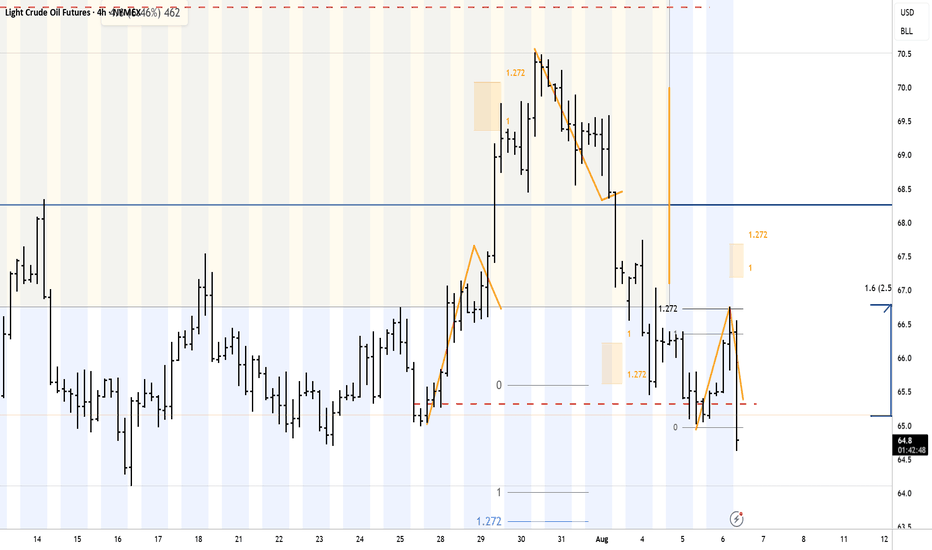

A look at multiple markets Eight six 25 that I looked at about 4 or 5 markets today including gold and a few other markets. I focused on 1.272 extensions which are very effective and getting you out of the market before you lose your profits. I talked a little bit about a stop in reverse approach to the market which can

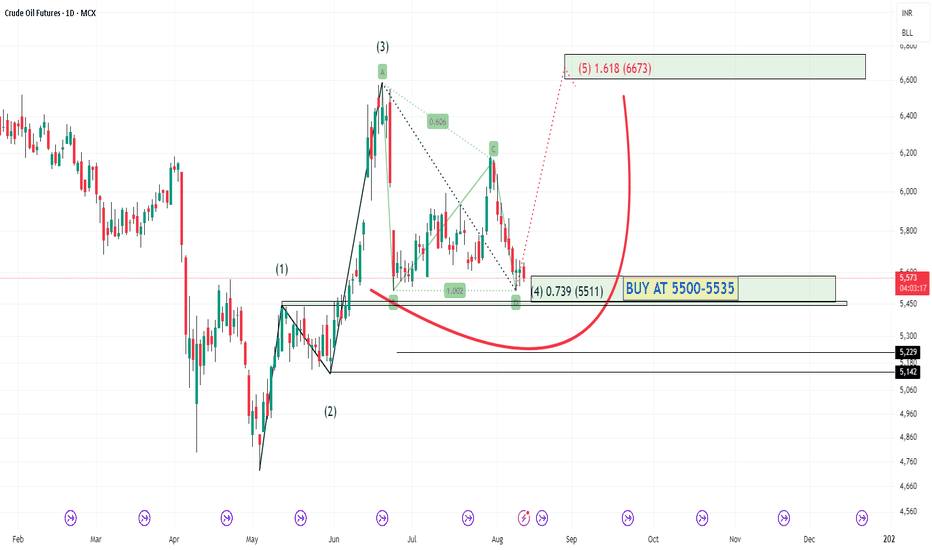

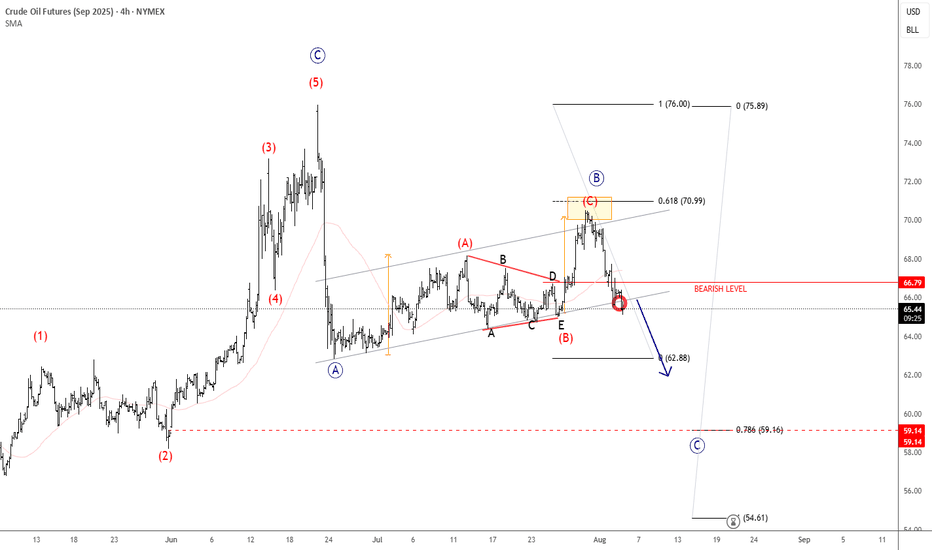

Crude Oil Resumes Its WeaknessCrude oil rised and then fell sharply from above 78 dollars back in June, after tensions in the Middle East. The drop unfolded as an impulse into wave A, so even if this is just a counter-trend move down from 78, it still appears incomplete. After we recently spotted a corrective rally in wave B tha

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The nearest expiration date for WTI Midland (Argus) Trade Month Futures (Sep 2023) is Aug 29, 2023.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell WTI Midland (Argus) Trade Month Futures (Sep 2023) before Aug 29, 2023.