Contract highlights

Related commodities

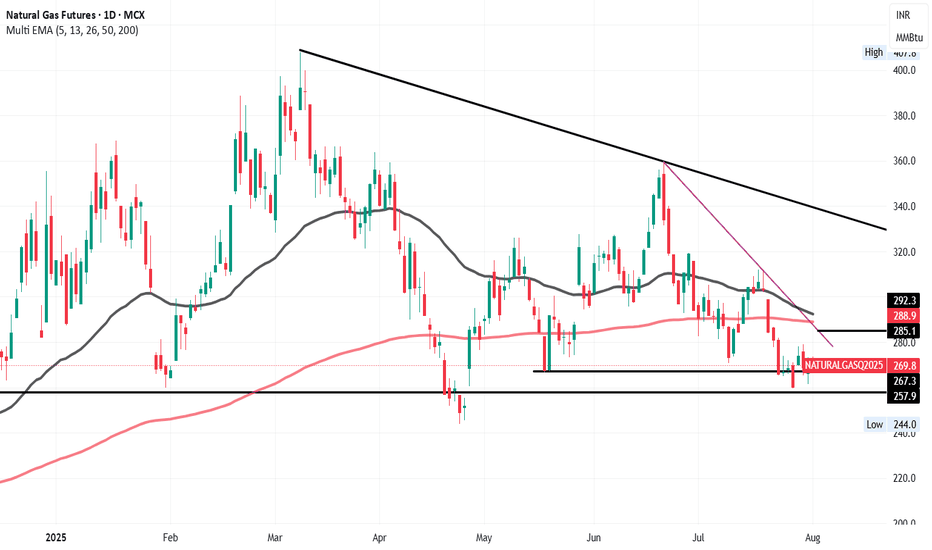

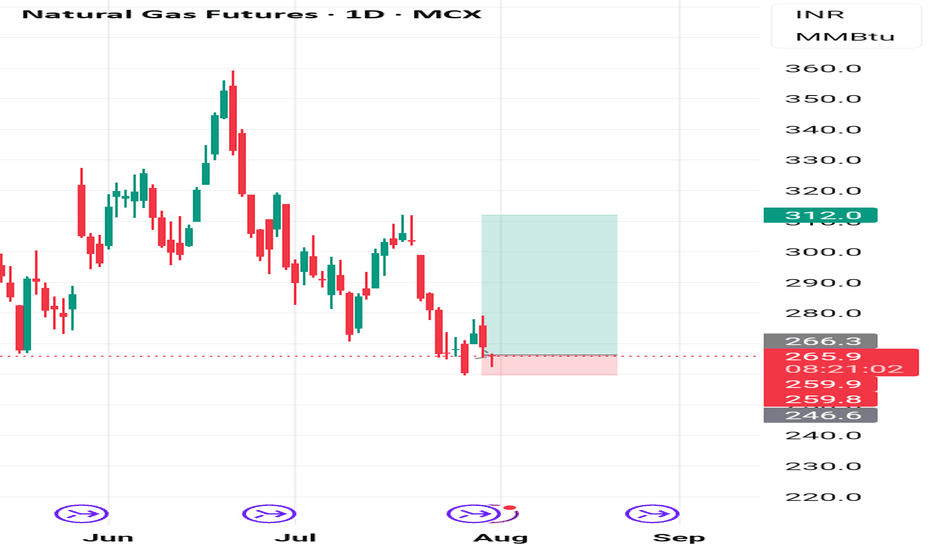

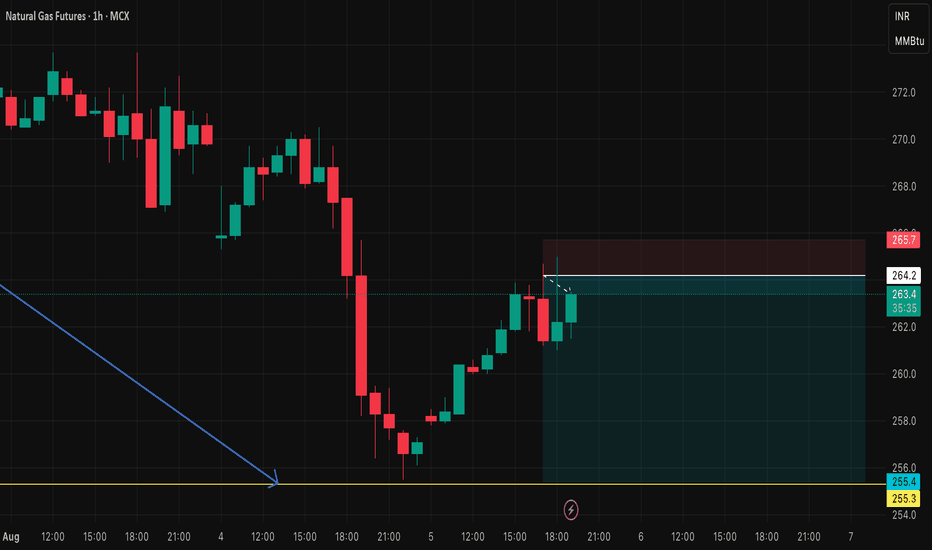

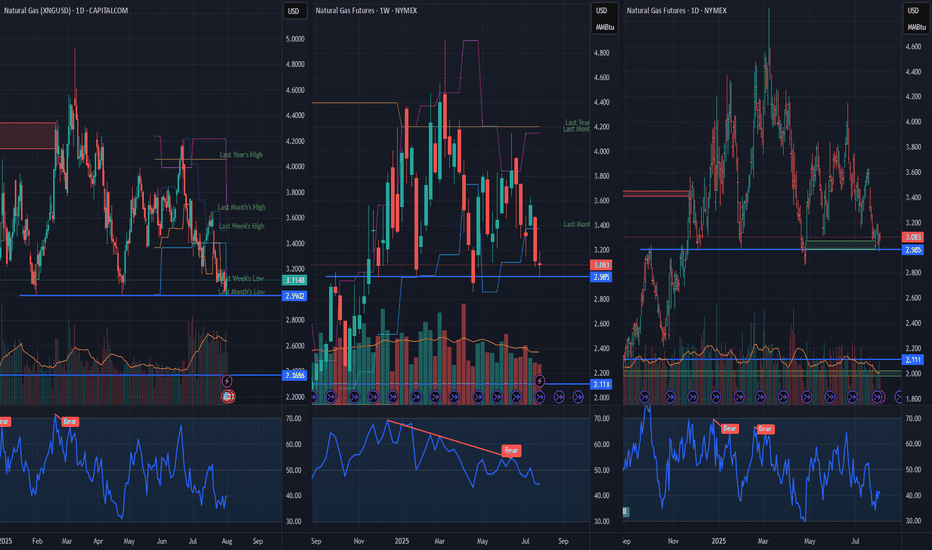

Natural Gas – Bullish Rebound Expected Towards 285–288Natural Gas is currently showing signs of a short-term bounce after testing key support around the 267–258 zone. My view remains bullish in the short term with potential upside toward 285–288, which aligns with the downward purple trendline and both the 50 EMA (around 292.3) and 200 EMA (around 288.

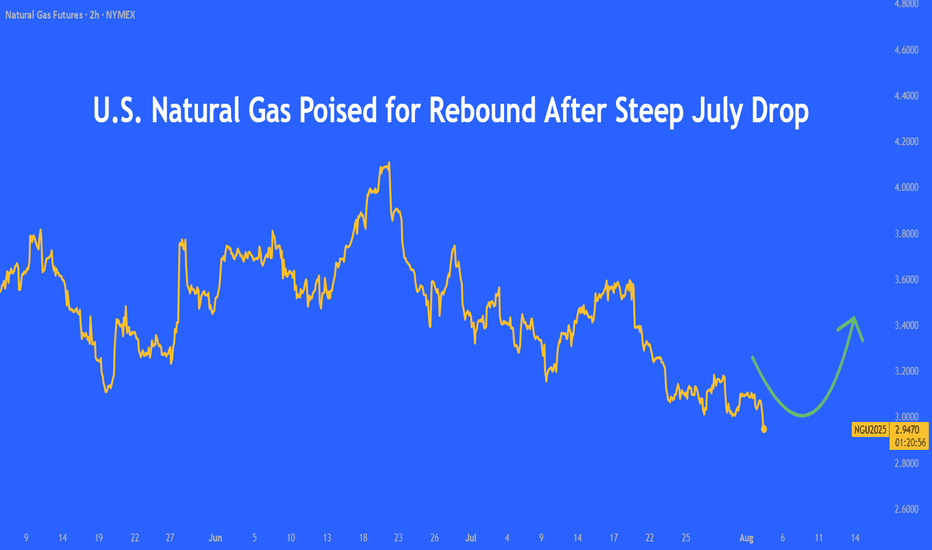

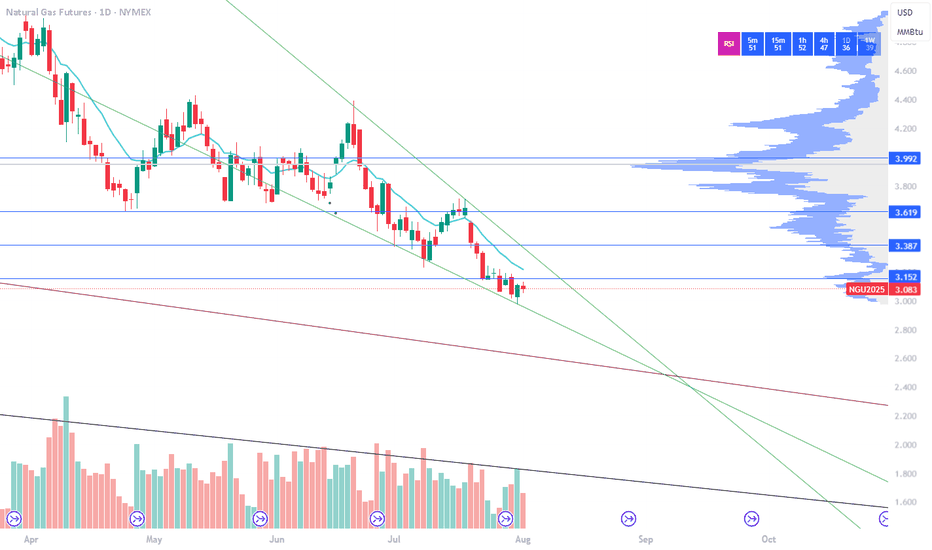

U.S. Natural Gas Poised for Rebound After Steep July DropU.S. natural gas prices sank in July due to mild weather, strong supply, and LNG export disruptions. The EIA cut its price outlook but expects a recovery by winter.

While technicals hint at a short-term rebound, oversupply and weak summer demand keep pressure on prices. A sustained recovery depends

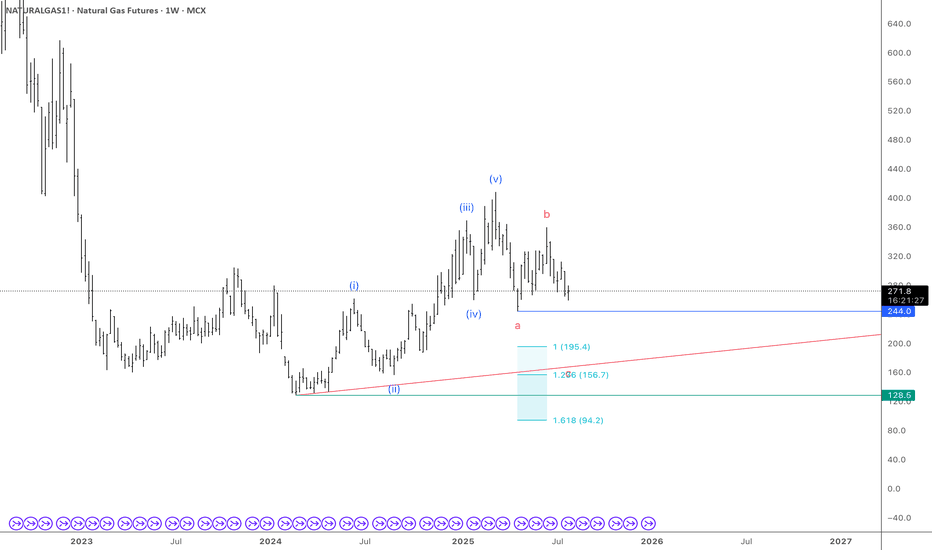

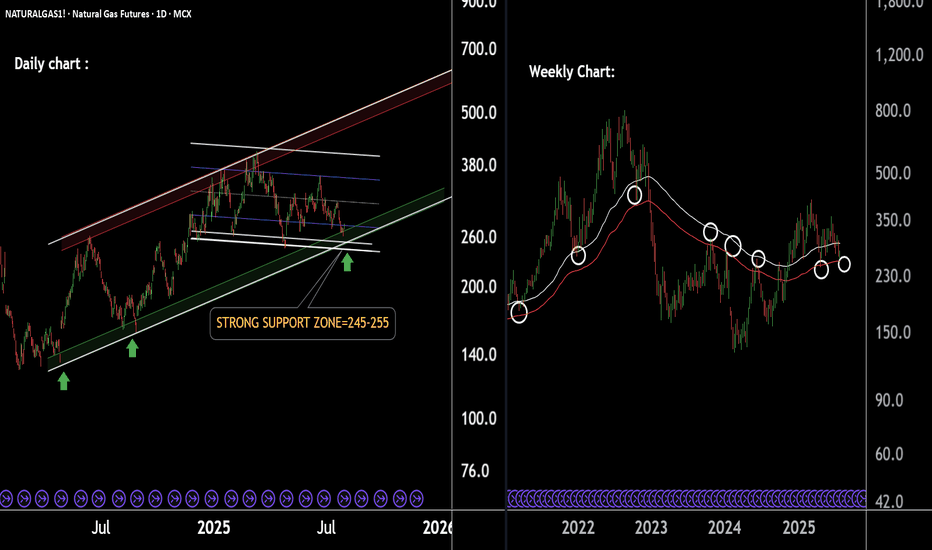

Natural Gas Cooling Near Support Zone – Bounce Ahead!Natural Gas Technical Overview (2-Chart Analysis):

Chart 1 – Parallel Channel Formation:

Natural Gas is moving within a well-defined parallel channel.

The lower support boundary of this channel is observed near 250, indicating a potential bounce zone.

Chart 2 – EMA-Based Support Structure:

Pric

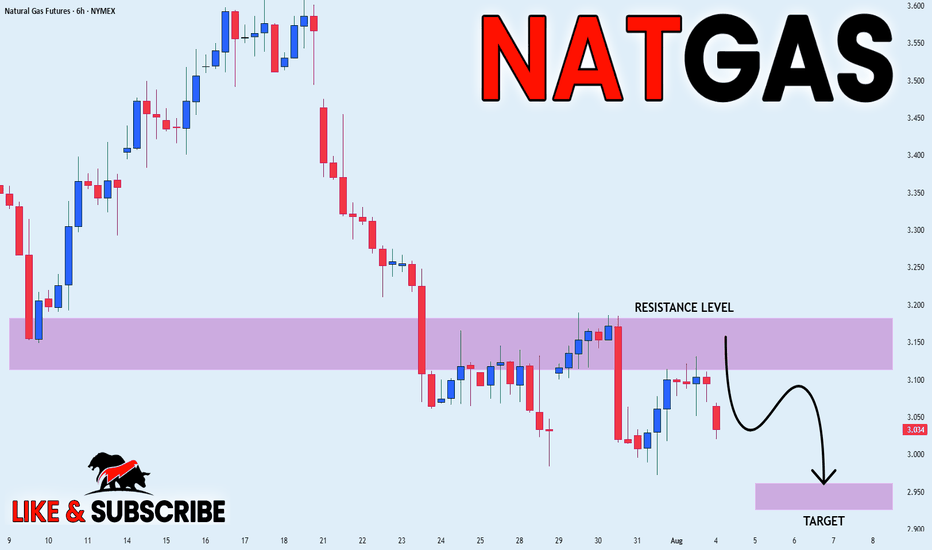

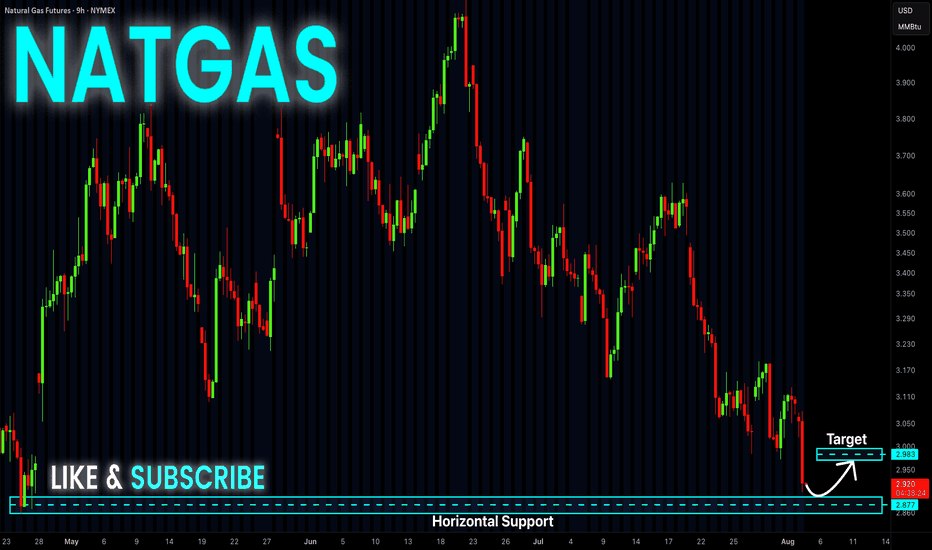

NATGAS Risky Long! Buy!

Hello,Traders!

NATGAS keeps falling down

In a strong downtrend

And Gas is locally oversold

So after the price hits the

Horizontal support of 2.860$

We will be expecting a

Local bullish correction

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosur

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of E-mini Natural Gas Futures (Feb 2030) is 4.215 USD / MMBTU — it hasn't changed in the past 24 hours. Watch E-mini Natural Gas Futures (Feb 2030) price in more detail on the chart.

Track more important stats on the E-mini Natural Gas Futures (Feb 2030) chart.

The nearest expiration date for E-mini Natural Gas Futures (Feb 2030) is Jan 28, 2030.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell E-mini Natural Gas Futures (Feb 2030) before Jan 28, 2030.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for E-mini Natural Gas Futures (Feb 2030). Today its technical rating is sell, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of E-mini Natural Gas Futures (Feb 2030) technicals for a more comprehensive analysis.