ADM trade ideas

Wheat price hike in summerWorld wheat prices soared by 19.7% during March, while maize prices posted a 19.1% month-on-month increase, hitting a record high along with those of barley and sorghum. The FAO said these problems were likely to persist, leading to higher prices, lower stocks and uncertainty in the wheat market in the future.

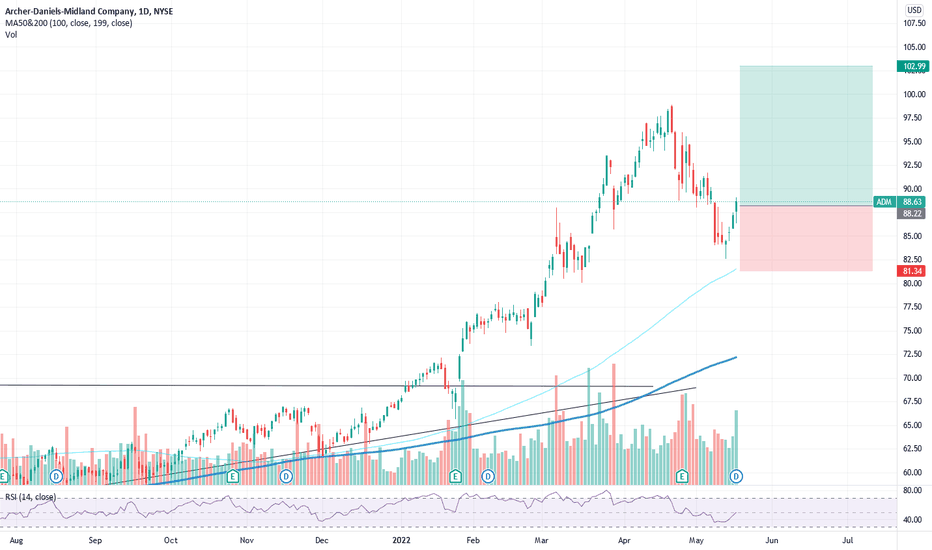

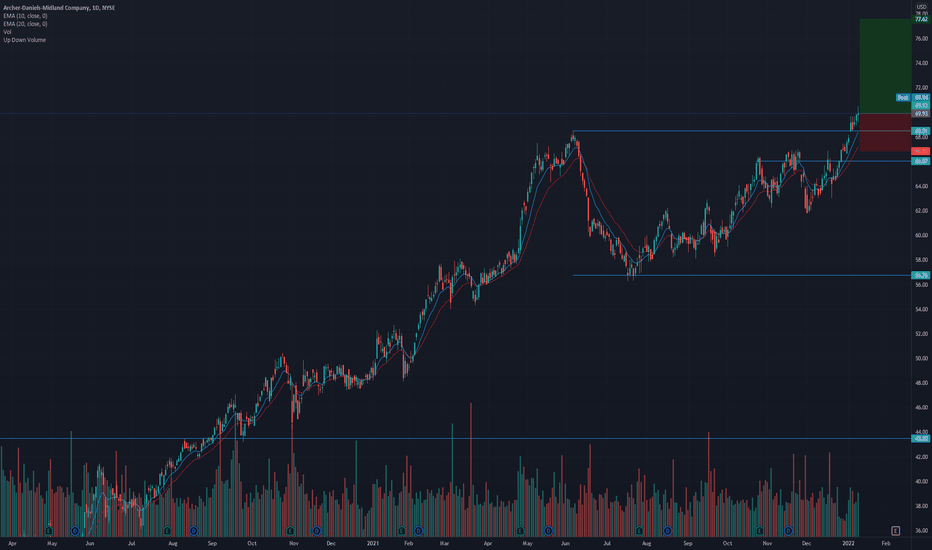

$ADM offering a pull-back recovery entry?Notes:

* Great earnings record in the past 2 years

* Very strong up trend in all time frames

* Offering a potential pull-back recovery entry

* Recovering with well above average volume

Technicals:

* Sector: Consumer Defensive - Farm Products

* Relative Strength vs. Sector: 4.42

* Relative Strength vs. SP500: 8.38

* U/D Ratio: 1.62

* Base Depth: 14.79%

* Distance from breakout buy point: 0.45%

* Volume 73.23% above its 15 day average.

Trade Idea:

* You can enter now as the price is recovering from the pull-back with higher than average volume.

* If you're looking for a better entry you can look for an opportunity around $93.5

* Or even $92.1 given the current market conditions

* Manage risk accordingly

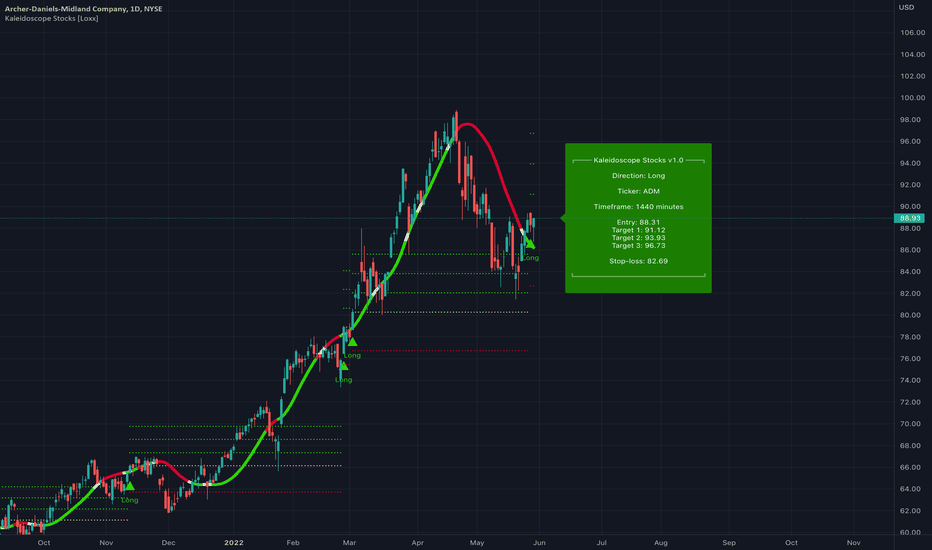

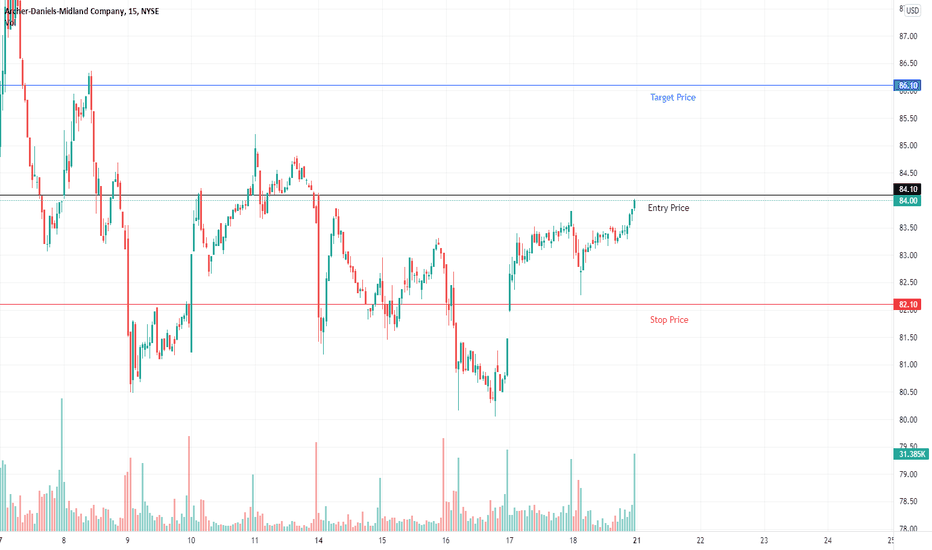

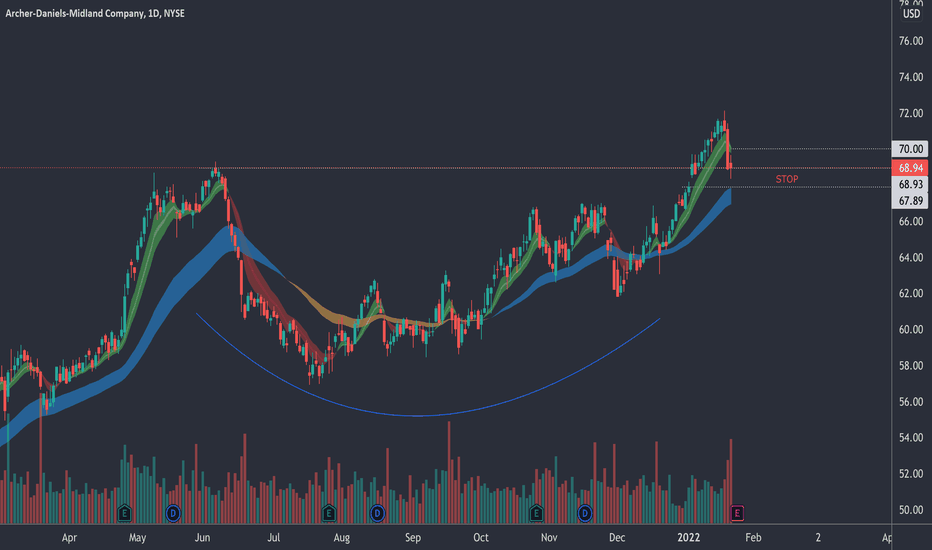

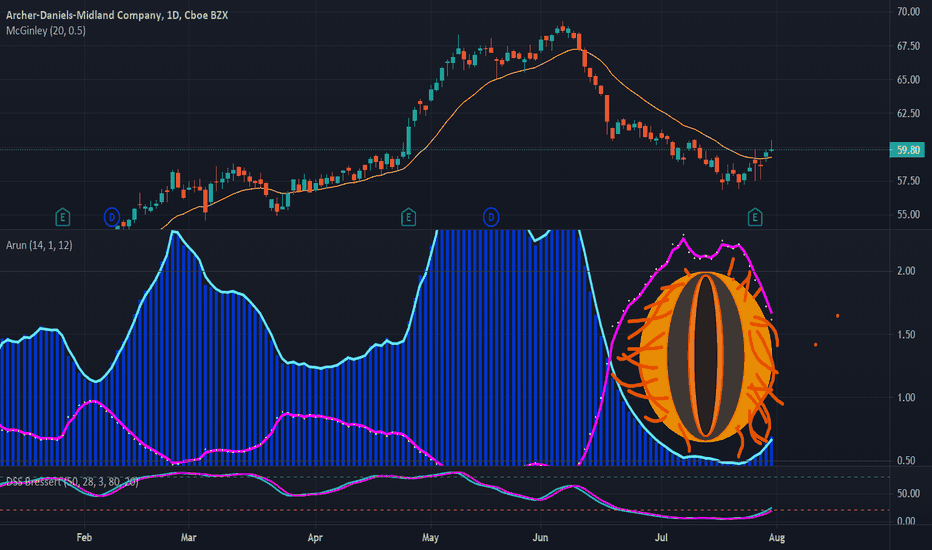

ADM - long - pullback - Keltner channelsPullback - daily

Lower timeframes are now bullish and showing signs of the trend turning.

Above the 200.

Account size - $50k

Position size - 1% = $500 = 5 shares

ATR - $2.60

SL - 2 ATRs

TP - 2 ATRs

deadline - 9 days (May 1st)

Current price: $90.97

SL - $5.20 = $90.97- $5.20 = $85.77

TP - $5.20 = $90.97 + $5.20 = $96.17

NYSE:ADM

Archer Daniels Mid Land USA Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

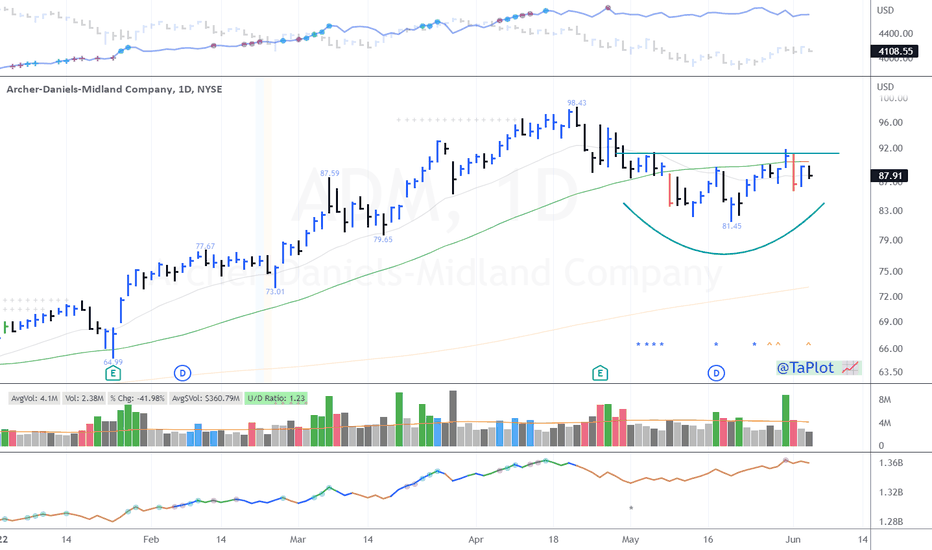

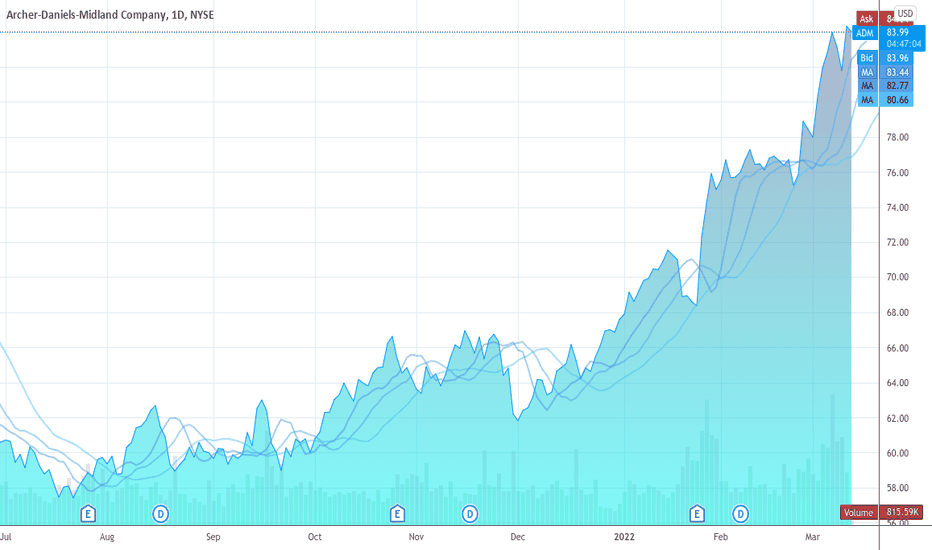

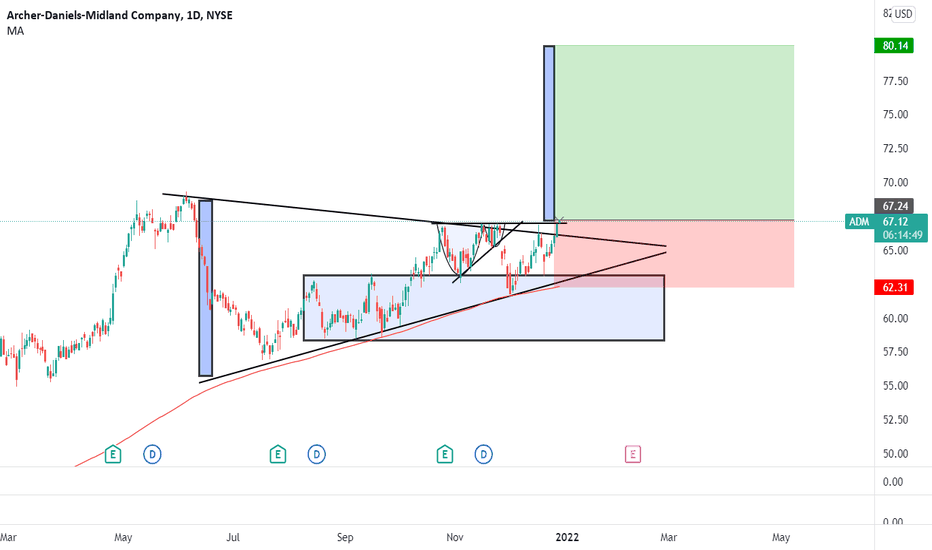

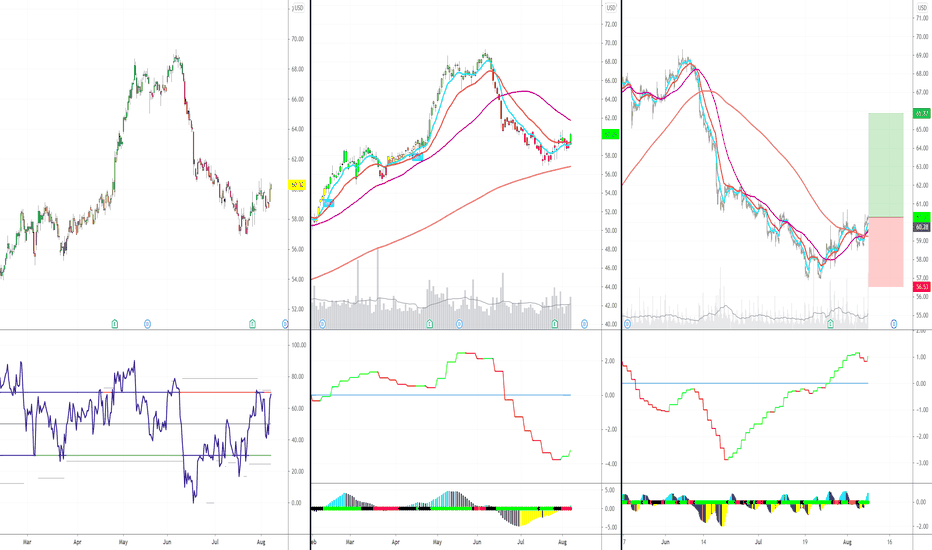

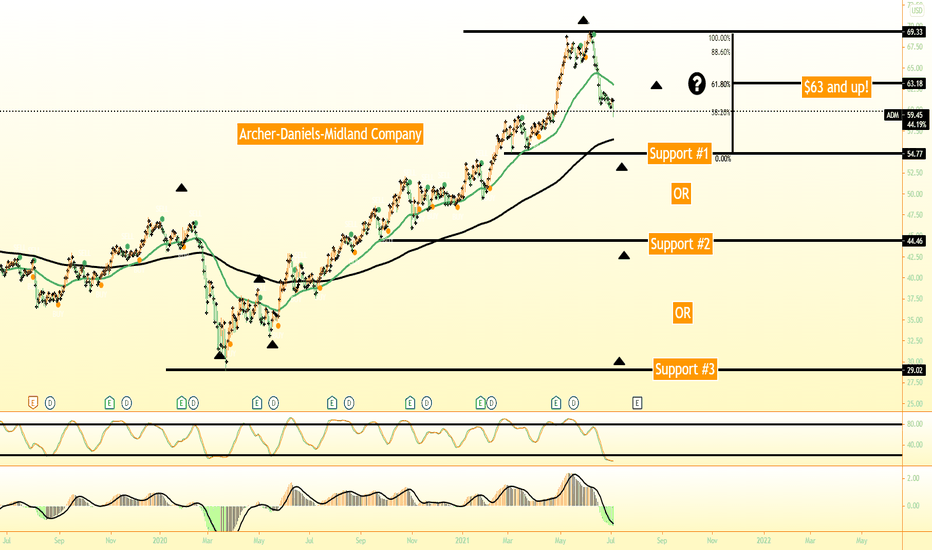

ADM looking to head higher?* Good earnings in the recent quarters

* Good general up trend in the long term

* High 3-month relative strength of 1.04 in the Consumer Defensive sector

* Breaking out of a 7 month base with higher than average volume

* Has a U/D ratio of 1.24 meaning it's under accumulation.

Trade Idea:

* Due to the market conditions I'd suggest you wait for a better entry around $68.51 if you do consider it.

* If you're willing to bare the volatility at the cost of getting into the stock, now's a great time to enter as the price is just breaking out and is only 2.07% away from the broken level.

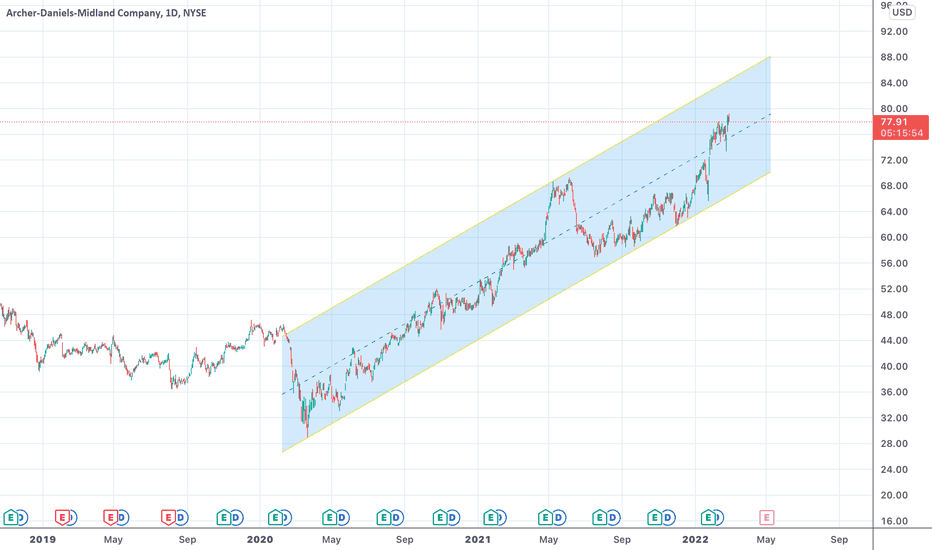

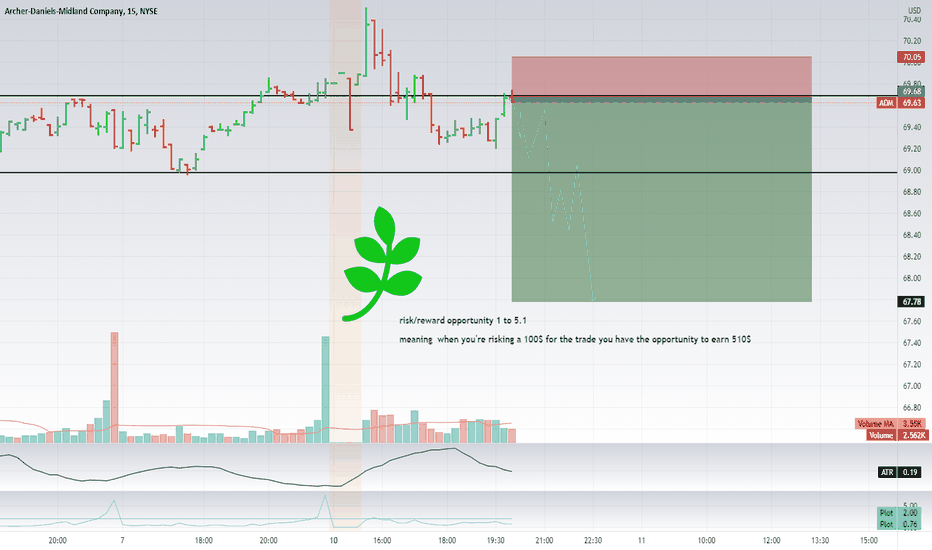

Trade from a book! So nice.Hi everyone, Yurii Domaranskyi here. Let's take a look at the chart:

1. Price levels are working well.

2. Globally uptrend locally uptrend.

3. The level 69.69$ is confirmed by many touches.

4. Near test, but we don't see an impulse.

5. Approached with big bars *open W1*

6. Approached with almost no rollbacks

7. There is accumulation for the last 5 days *open M5*

8. there was almost no rollbacks on the way up

9. yesterday there are was a close above the level, but today no impuls, and the instrument went down

10. an all-time high

11. there is enough room for a move 1 to 5.1

12. there is a model ascending lows *which is against short idea*

13. no news for the last 10 days

14. the price came from below

15. the stock has a good potential for a big move down

16. no report in the following 2 weeks

Potential risk/reward ratio = 1 to 5.1 meaning that potential risk 100$ with the possibility to make 510$

If you find my work valuable, please, press a thumb up! 👍

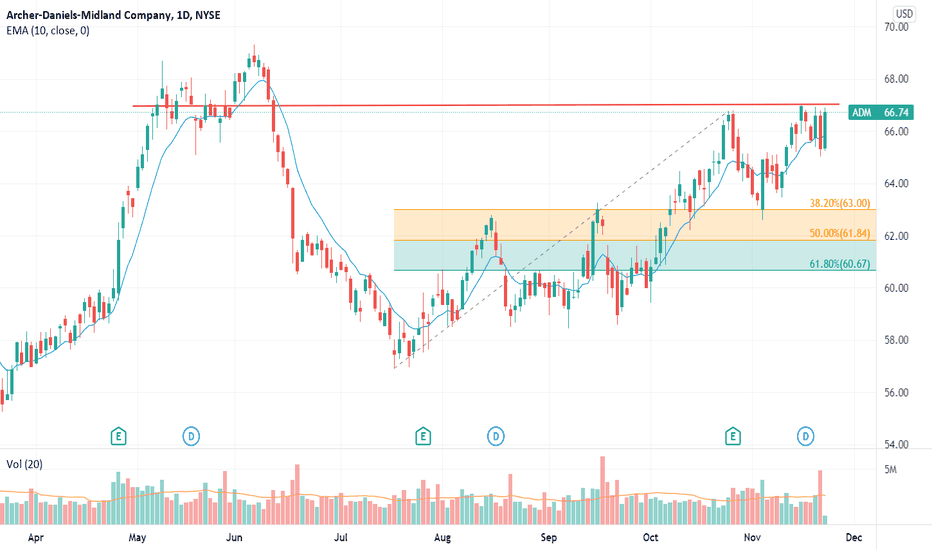

ADM climbing to the resistance level againADM is once climbing near the resistance level. Will it break out this round or it will break down like before? to answer this question, observing the volumes of this stock might help you reach your conclusion. If volumes increase, the chance for it to break out is high and vice versa. Another factor is we are in the Thanking giving rally now. Assuming no black swan, based on histories the market will usually go up around 3% until early Jan. next year. If you are buying in right now, a good approach is to buy 15% to 20% and set a loss limit. If it break out you add more at that time, if it goes south then let the loss limit execute. A little goes a long way. Happy trading and have a great thanksgiving.

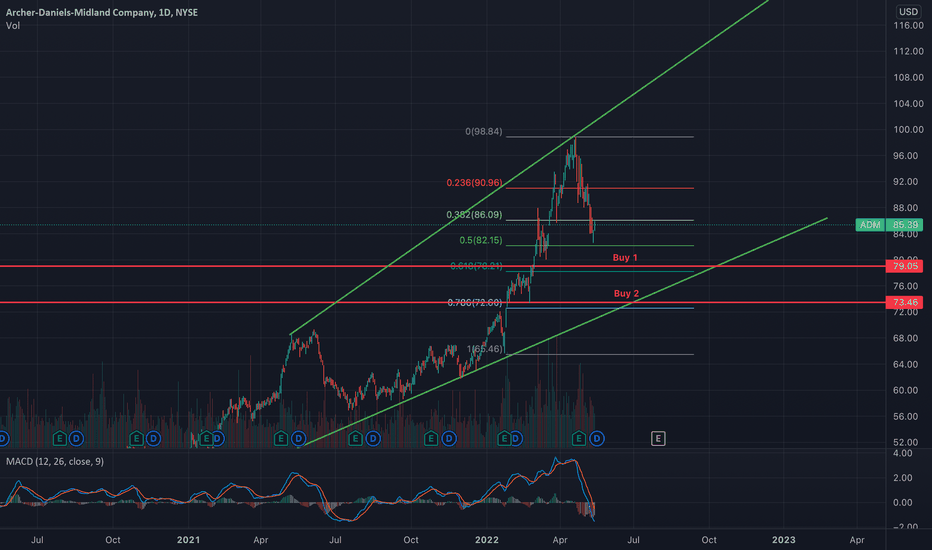

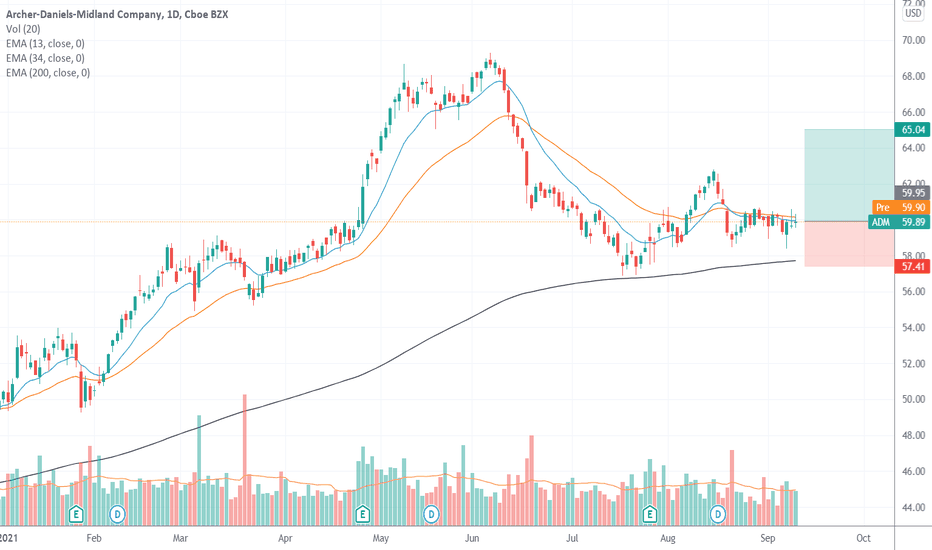

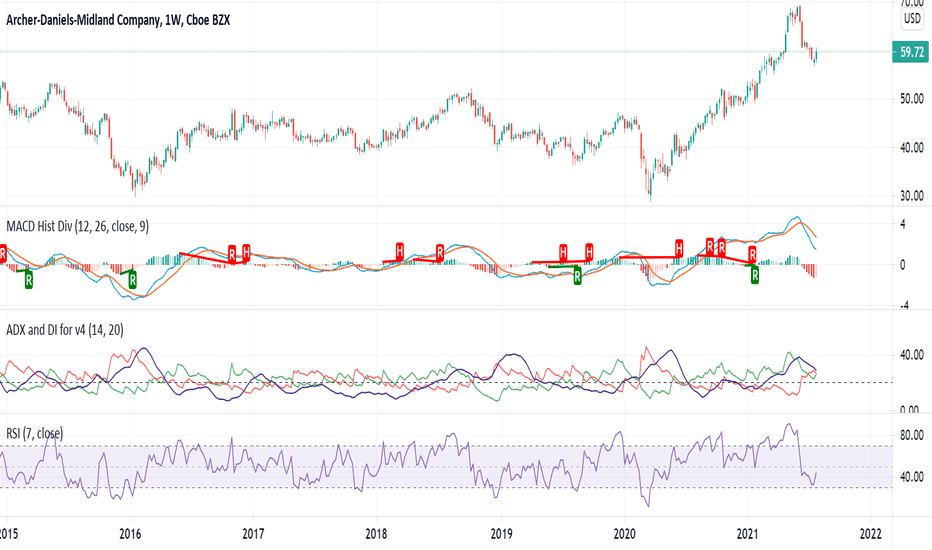

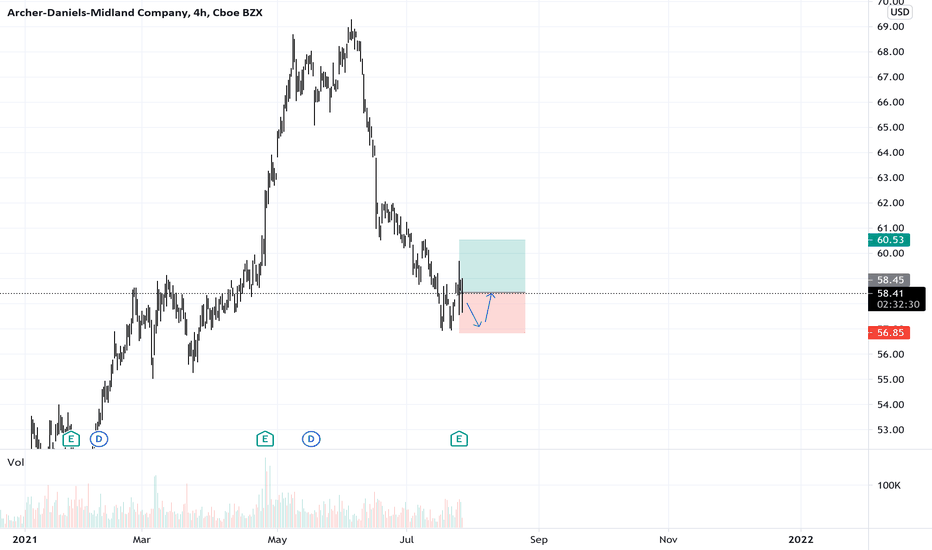

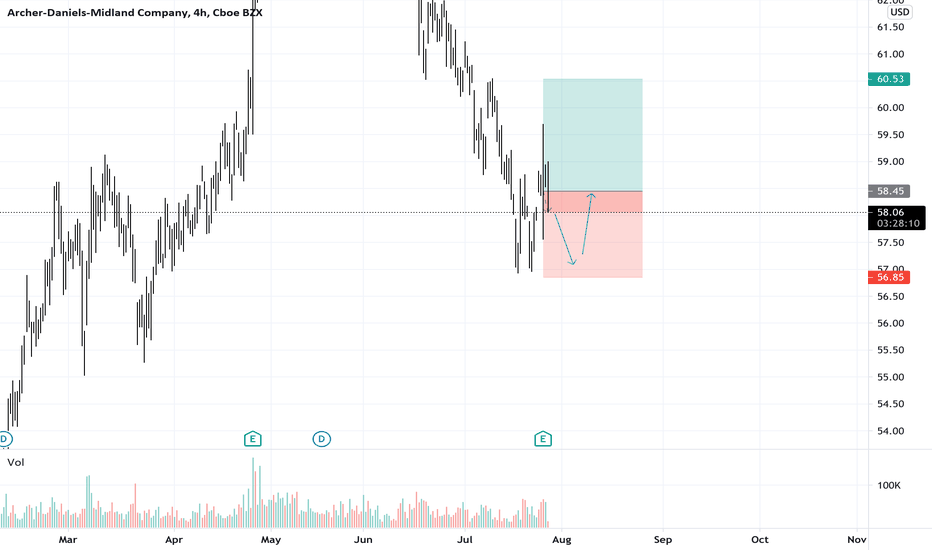

ADM Rebound OpportunityADM is coming down to the 1st Fib retracement level and it's major trendline from the March 2020 lows. RSI on the Daily is showing bullish divergence and the MACD is starting to curl upwards. This could be a good swing trade. I will buy around 59.72 as the Algos like to take out stop losses just below the trendline. Bearish scenario would be a break below 58.5 and this would take this down to the 2nd FIb retracement level.