ADM trade ideas

ADMI like this company. They seem to have their hand in a little bit of everything.

1. We transform natural products into a complete portfolio of ingredients and flavors for foods and beverages, supplements, nutrition for pets and livestock and more. And with an array of unparalleled capabilities across every part of the global food chain, we give our customers an edge in solving global challenges of today and tomorrow.

2. We don’t own farms, but we work with growers, supporting them with personalized services and innovative technologies; partnering with them to develop and enhance sustainable practices; and transforming their bounty into products for consumers around the globe.

3. We do the same with animal nutrition products. Today, more people want to feed their pets the same kind of clean, healthy products they eat themselves and consumers expect livestock and poultry to be fed and raised humanely and sustainably.

4. has declared a cash dividend of 37.0 cents per share on the company’s common stock, an approximately 2.78% increase from last quarter’s dividend of 36.0 cents per share. The dividend is payable on March 2, 2021, to shareholders of record on Feb. 9, 2021. This is ADM’s 357th consecutive quarterly payment, a record of 89 years of uninterrupted dividends. As of Dec. 31, 2020, there were 556,104,261 shares of ADM common stock outstanding.

5. Before joining ADM, CEO Luciano had a successful 25-year tenure at The Dow Chemical Company, where he last served as executive vice president and president of the Performance division.

6. CFO Young joined ADM in 2010 following a 24-year tenure with General Motors Co., during which he held executive leadership positions in finance, general management, planning and operations on four continents. Young served in Shanghai as vice president of GM International Operations, and in 2008 and 2009, he was CFO of General Motors. Between 2004 and 2007, he was the president and managing director of GM do Brasil and Mercosur Operations, based in São Paulo. Young graduated in 1984 from The Ivey School of Business, Western University, in London, Canada, with a bachelor’s degree in business administration. He holds an MBA from the University of Chicago.

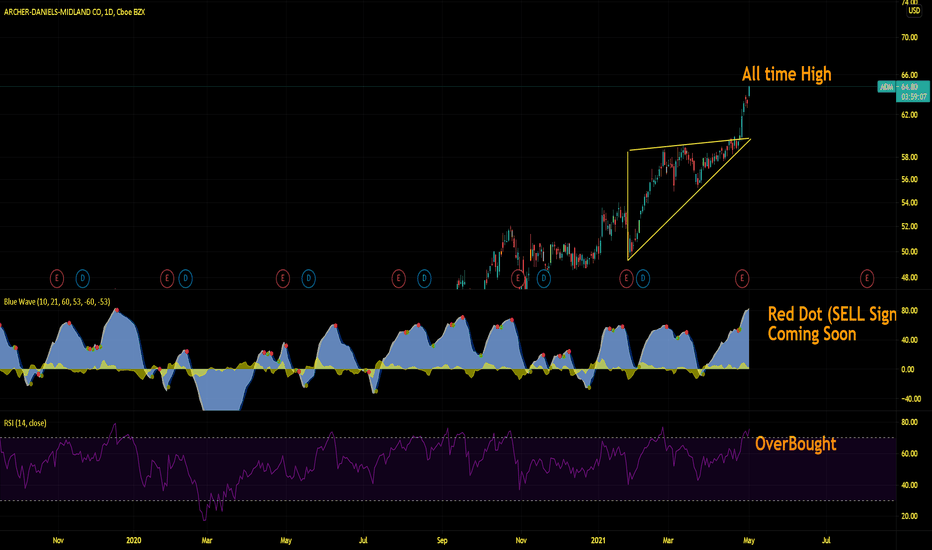

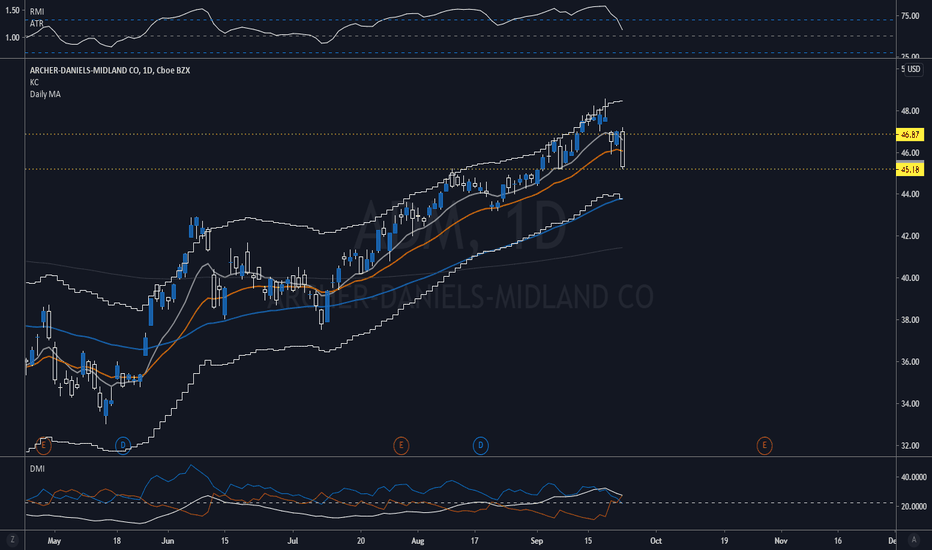

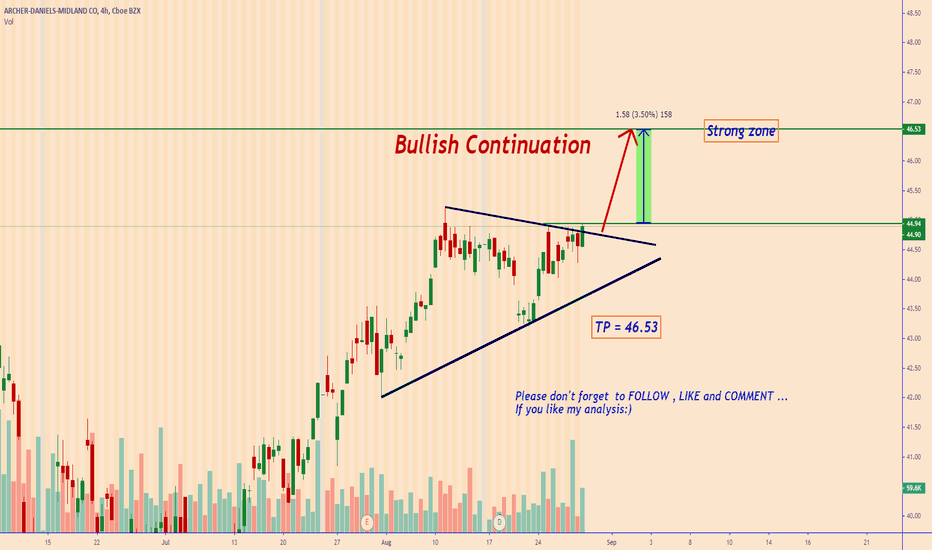

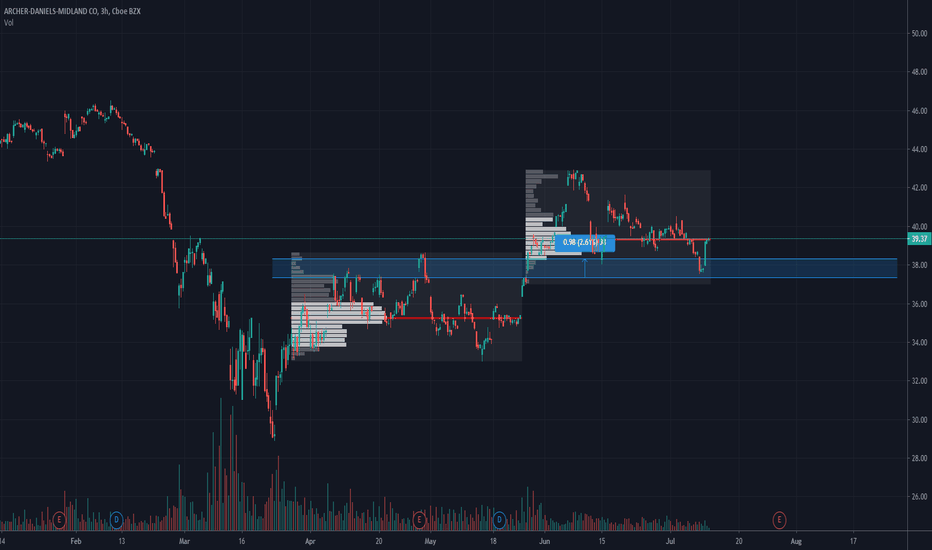

Details in Photo!

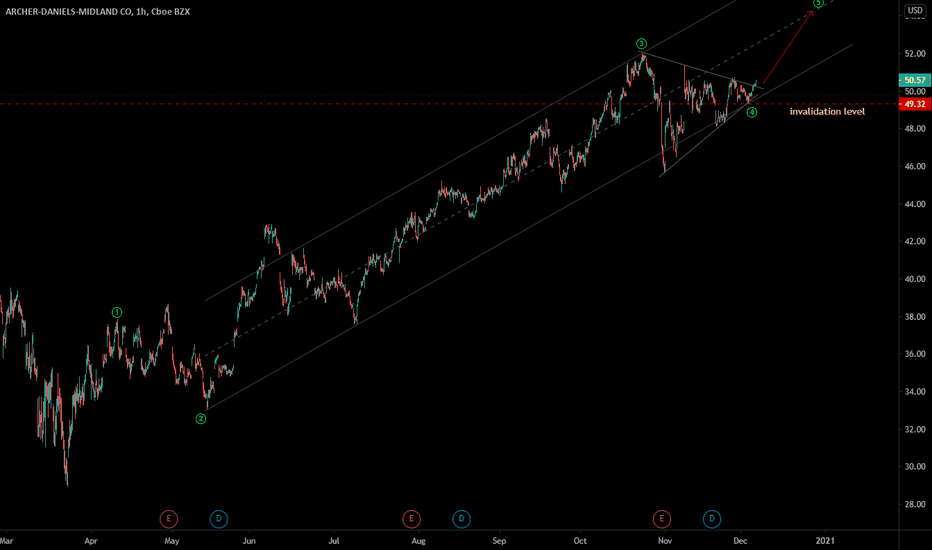

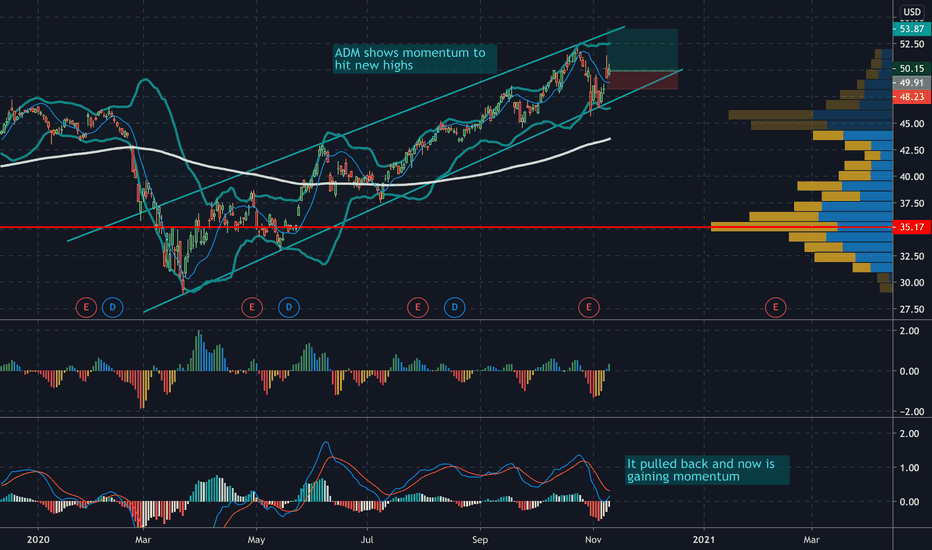

ADM - Elliottwave analysis 5th wave up after triangle break outADM - It is in strong up trend and impulse cycle from the major low on 4 hr time frame. The price just broken up the triangle 4th wave and moving higher in 5th wave up. So stay bullish with invalidation level below 49.30 for the target above 55.80. The trade is having high RR ratio with good entry. If price drops below 49.30 then it will extend the y of 4th wave down in wxy correction down and might go down below 45.50 or lower level.

Give thumbs up if you really like the trade idea.

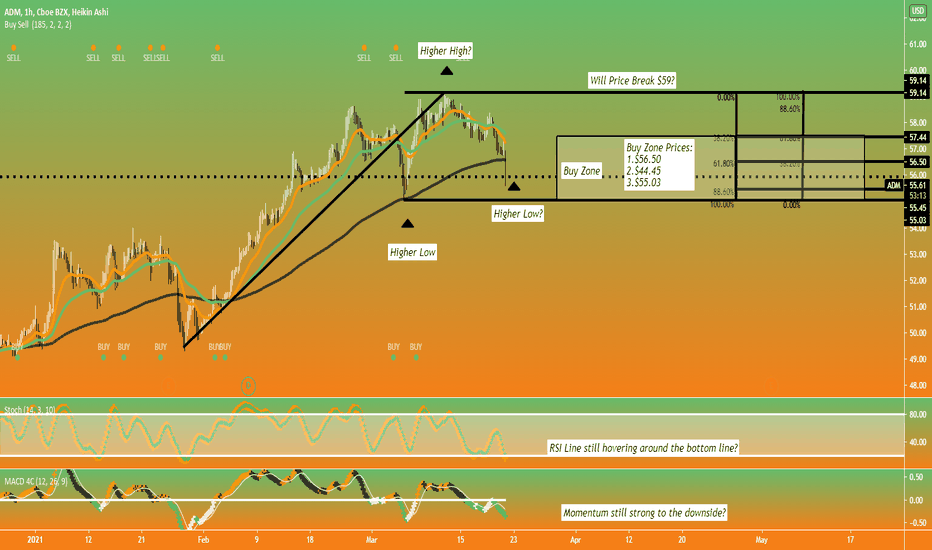

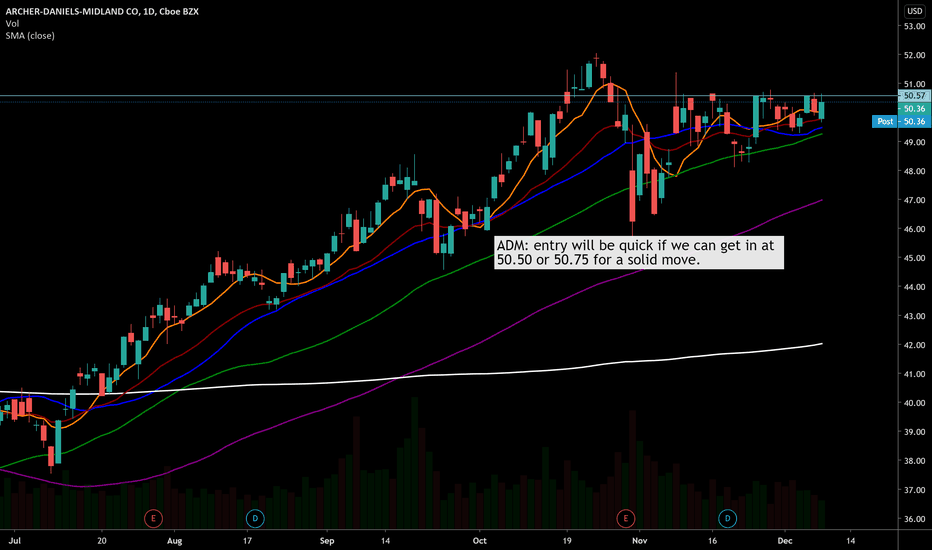

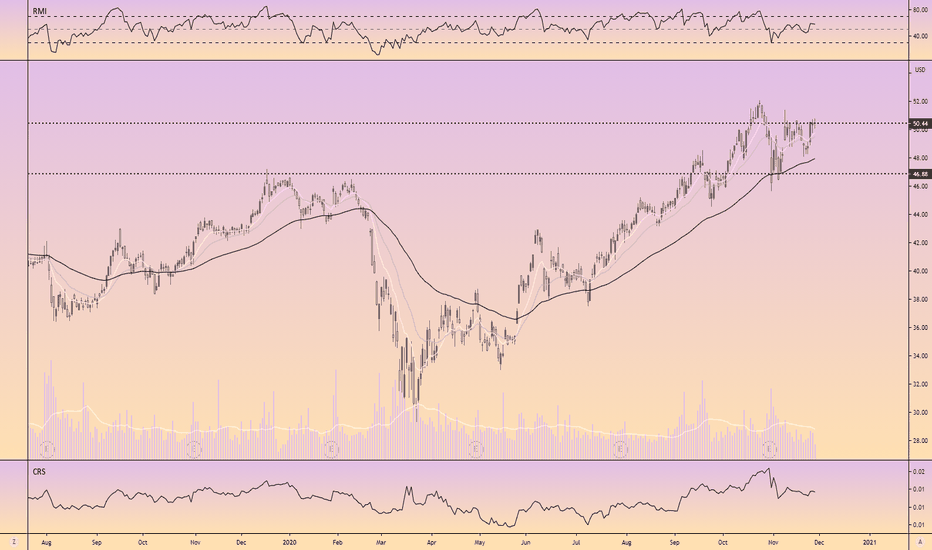

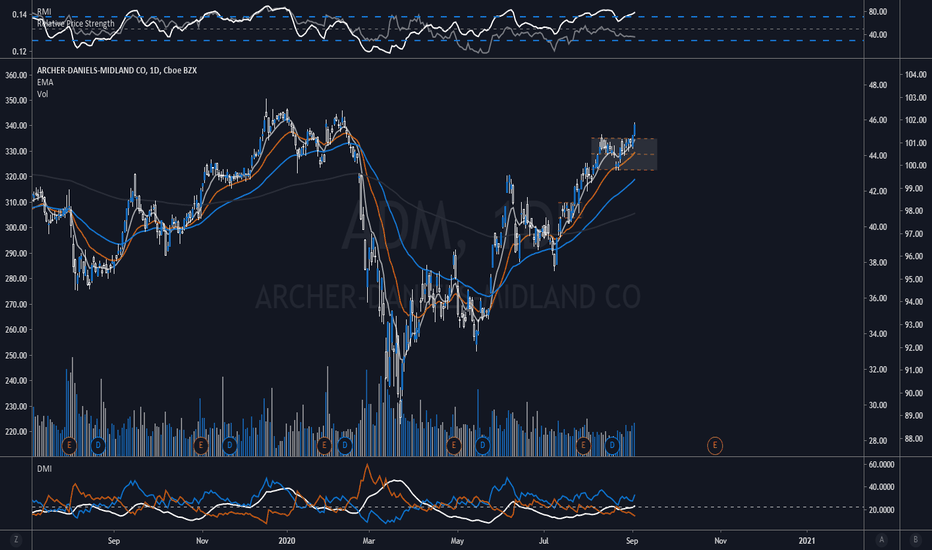

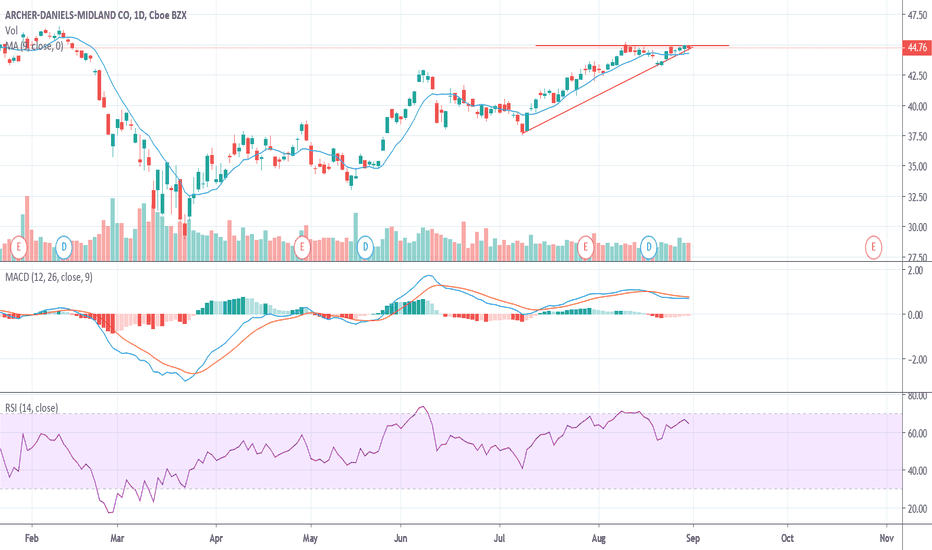

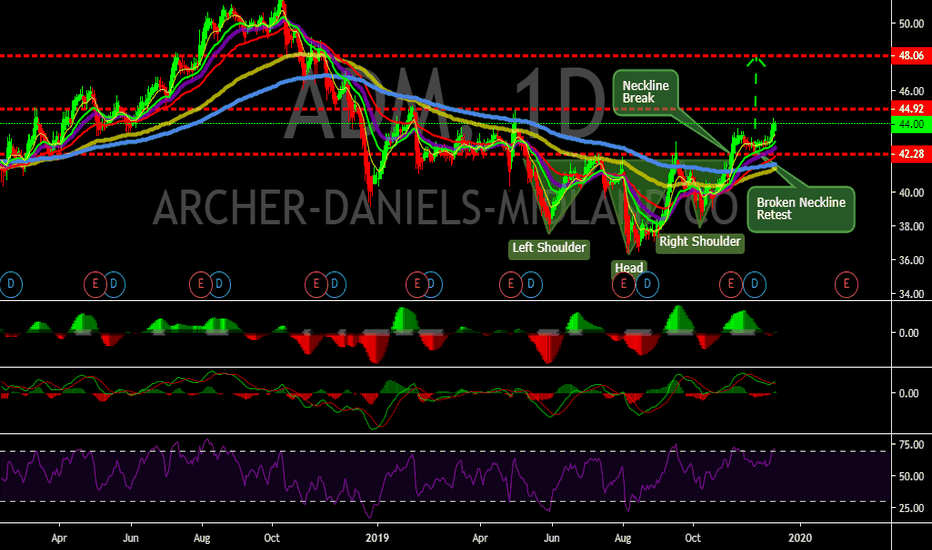

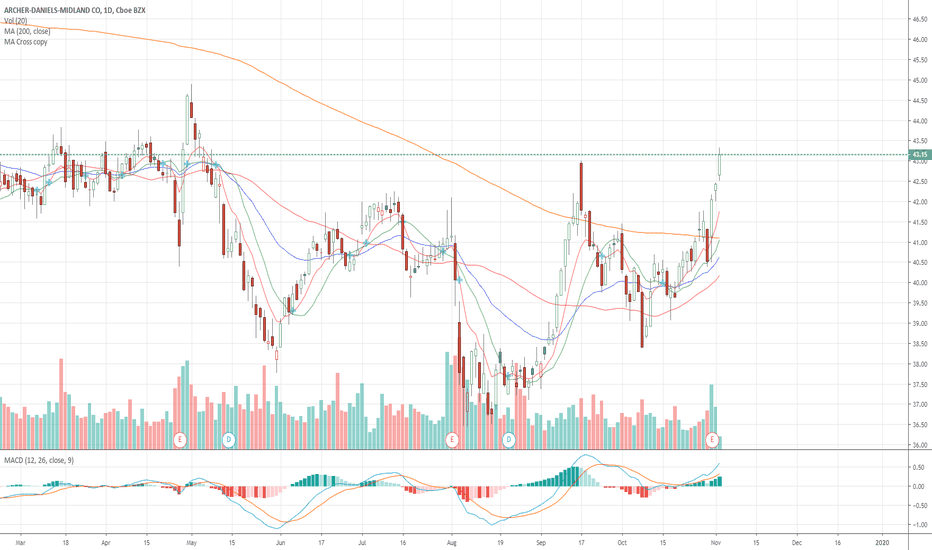

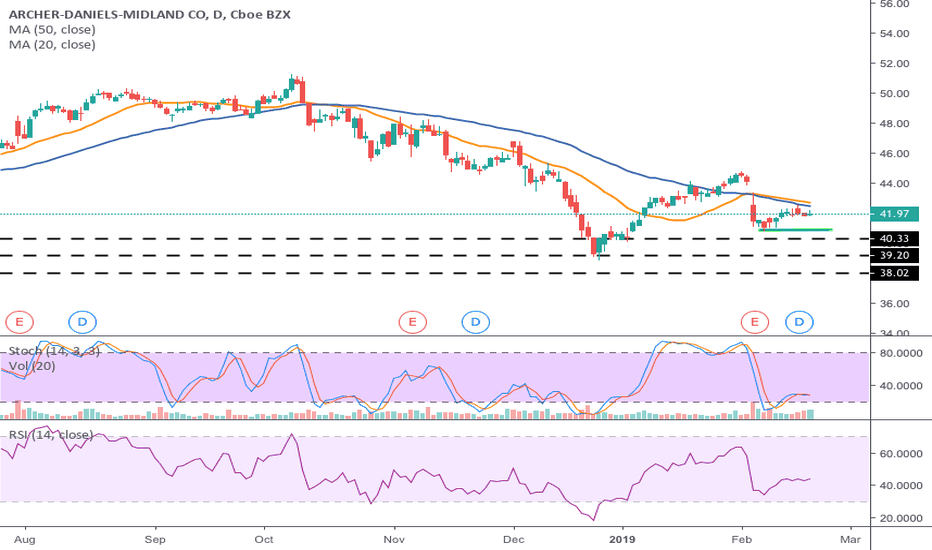

ADM - Tested top twice, a possibility of a breakthroughADM has tested the 44.99 mark two times and fell back. It is trading in a triangle formation. This is a set up I love for long options trades.

The price is supported by the following:

1) The moving average

2) RSI is in the 60% area. I am okay with it as long as it stays over 50%. I would start to worry if I was in the trade and it drops.

3) The MACD shows stability. Still some buying power.

It had just now tested the top a 2nd time (to form a double top) I would personally wait to see if it goes back to the support at the bottom of the channel and then reverses for better confirmation and a more favourable options contract.

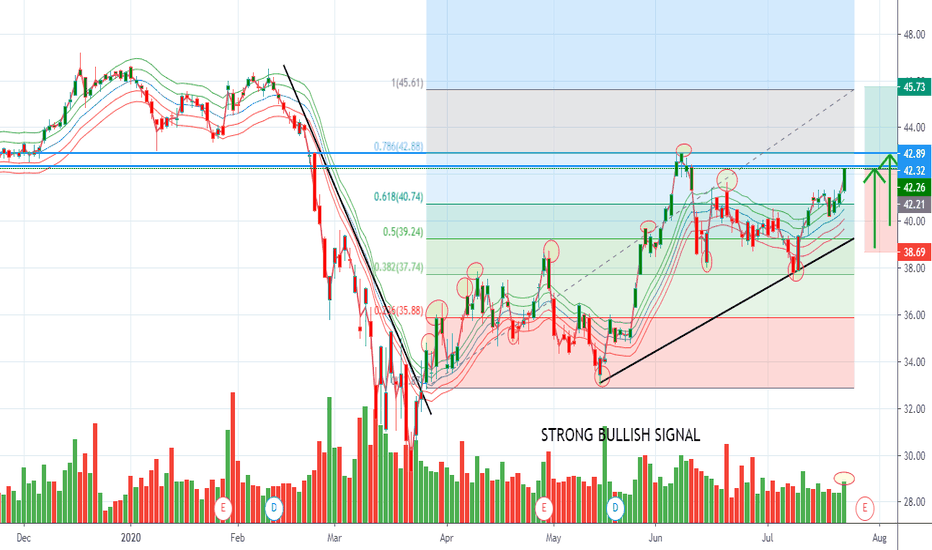

ARCHER-DANIELS-MIDLAND CO PlanHey my frends, ARCHER-DANIELS-MIDLAND CO is in a bullish configuration, large bullish force less purchase volume. We go in the direction of the last previous higher with the volume, great potential to get the 2nd higher at the limit of the fibonacci, if the buyers push their price with the force in presence.

Please LIKE & FOLLOW, thank you!

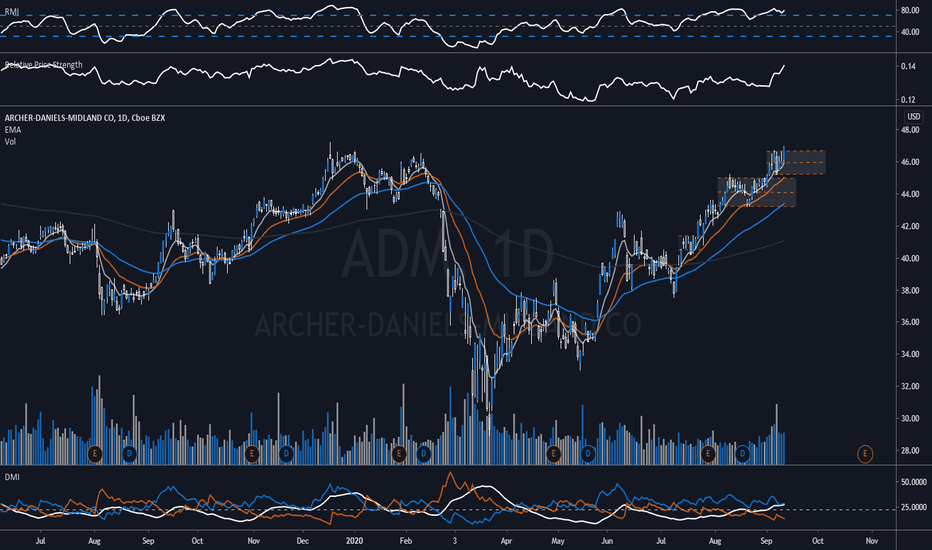

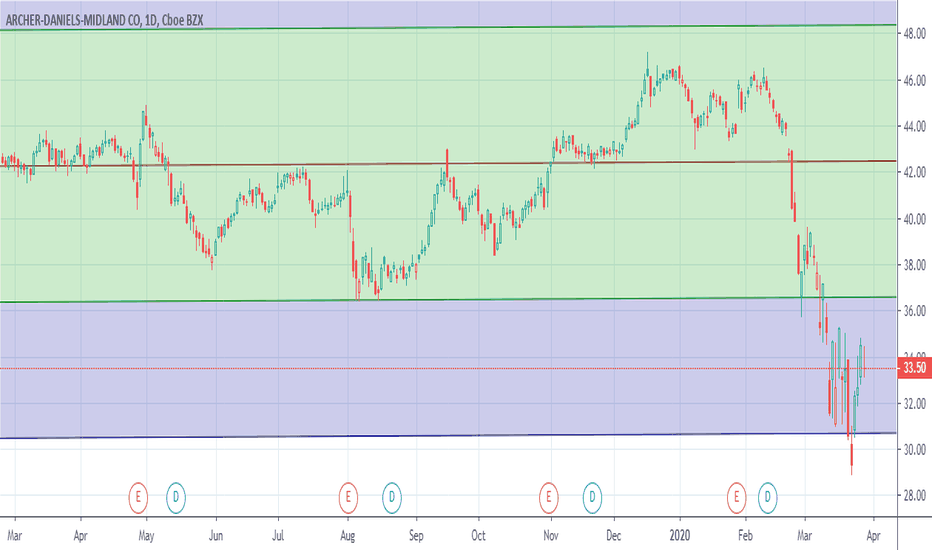

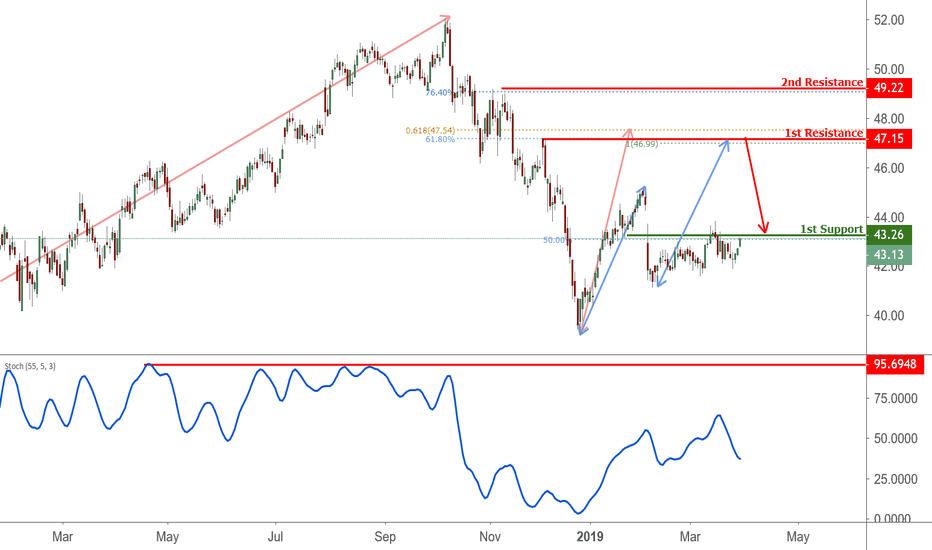

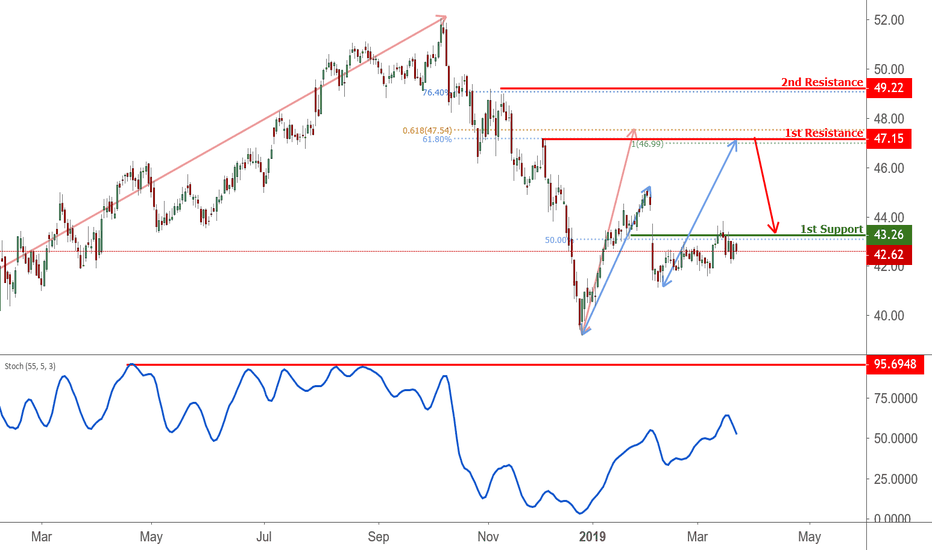

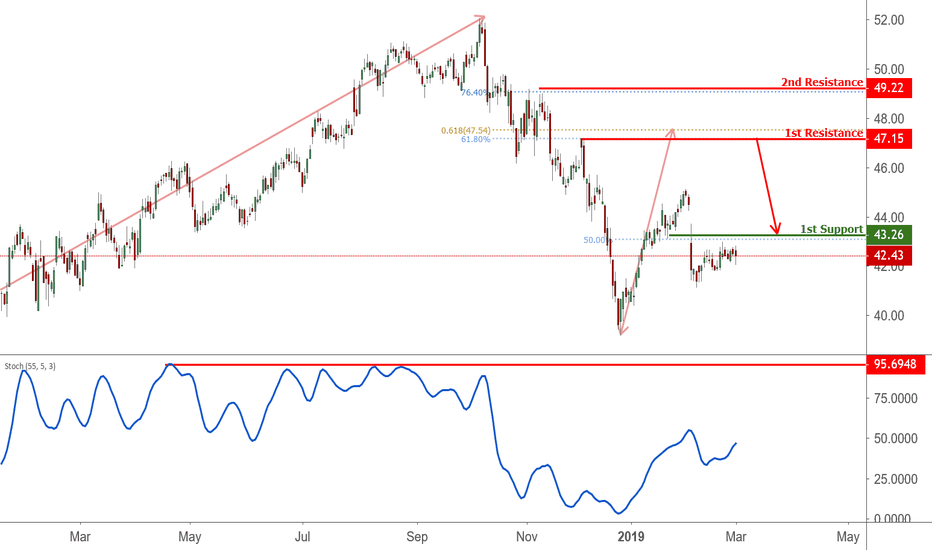

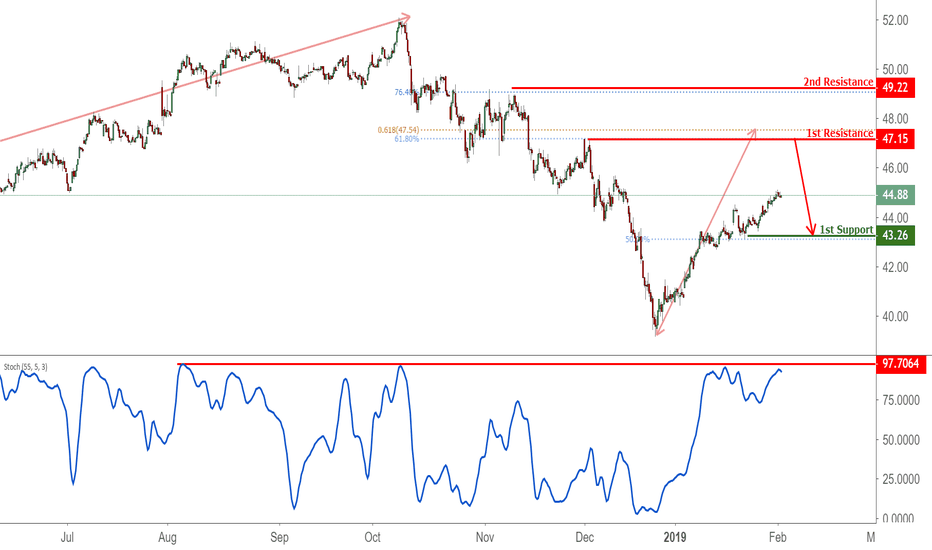

ADM approaching resistance, potential drop! ADM is approaching our first resistance at 147.15 (61.8% fibonacci retracement, 61.8%, 100% fibonacci extension) where a strong drop might occur below this level to our first support at 43.26 1(50% fiboancci retracement).

Stochastic is also approaching resistance.

ADM appraoching resistance, potential drop! ADM is approaching our first resistance at 47.15 (horizontal overlap resistance, 61.8% fibonacci extension, 61.8% fibonacci retracement) where a strong drop might occur pushing price down to our first support at 43.26 (horizontal overlap support,50% fibonacci extension).

Stochastic (89,5,3) is also approaching resistance where we might see a corresponding drop below this level.

SHORT ADM Approaching Resistance, Potential Drop!ADM is approaching our first resistance at 47.15 (horizontal swing high resistance, 61.8% Fibonacci extension , 61.8% Fibonacci retracement ) where a strong drop might occur below this level pushing price down to our major support at 43.26 (50% Fibonacci retracement ).

Stochastic (55,5,3) is also approaching resistance where we might see a drop below this level.