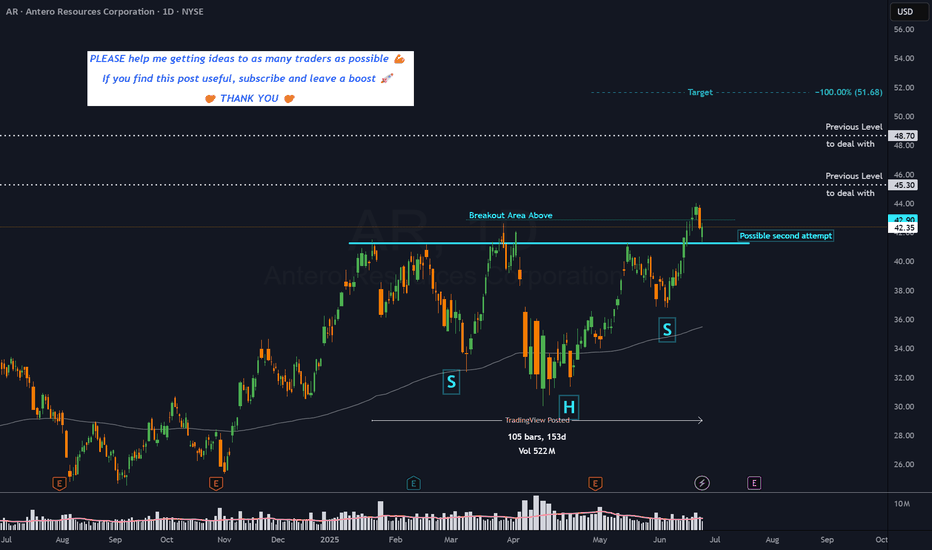

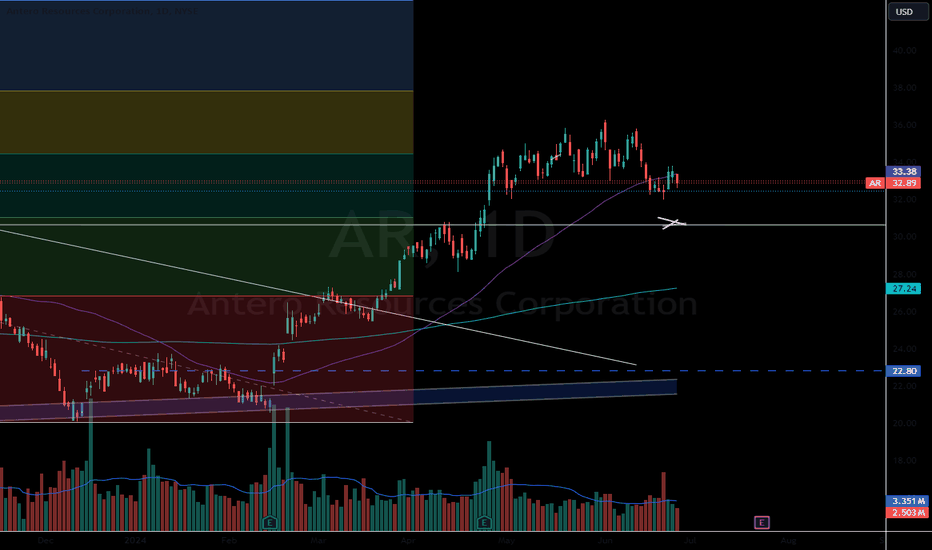

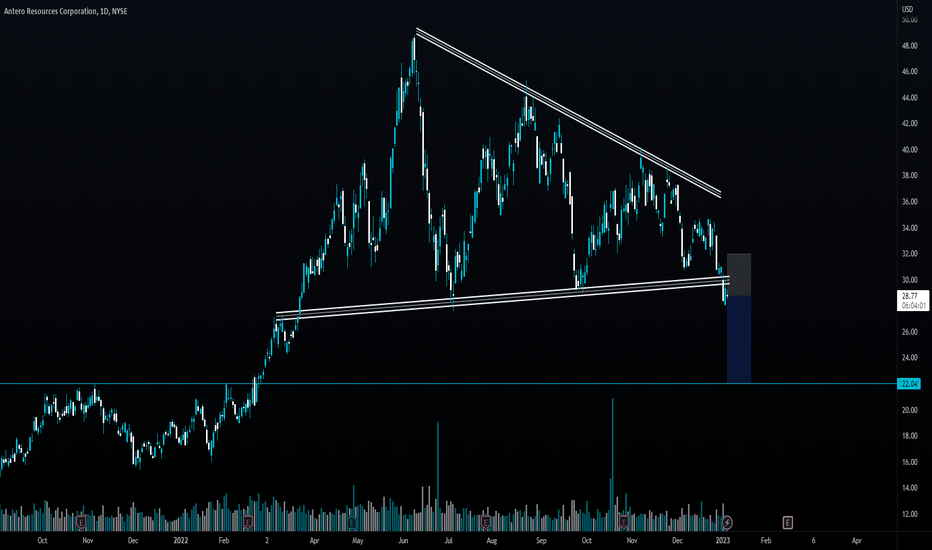

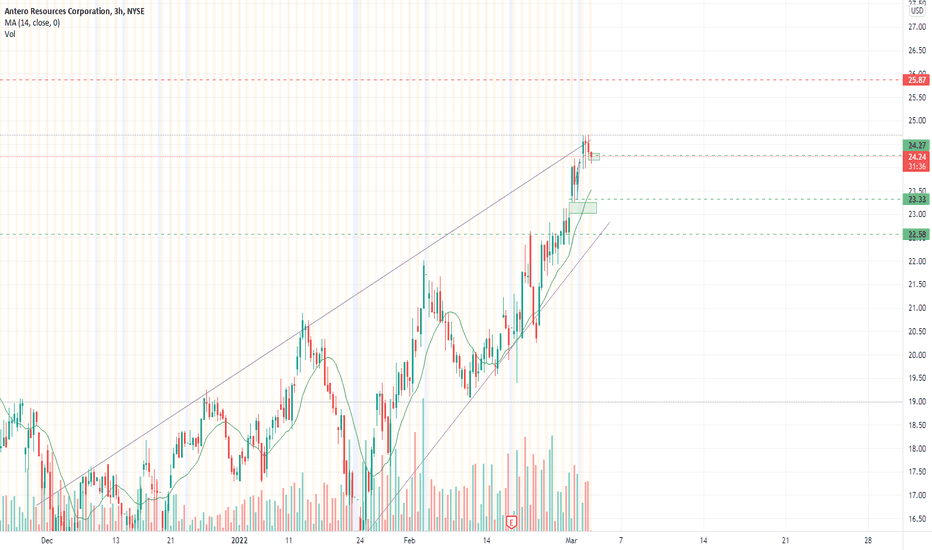

AR - 5 months HEAD & SHOULDERS CONTINUATION══════════════════════════════

Since 2014, my markets approach is to spot

trading opportunities based solely on the

development of

CLASSICAL CHART PATTERNS

🤝Let’s learn and grow together 🤝

══════════════════════════════

Hello Traders ✌

After a careful consideration I came to the conclusion that:

- it is crucial to be quick in alerting you with all the opportunities I spot and often I don't post a good pattern because I don't have the opportunity to write down a proper didactical comment;

- since my parameters to identify a Classical Pattern and its scenario are very well defined, many of my comments were and would be redundant;

- the information that I think is important is very simple and can easily be understood just by looking at charts;

For these reasons and hoping to give you a better help, I decided to write comments only when something very specific or interesting shows up, otherwise all the information is shown on the chart.

Thank you all for your support

🔎🔎🔎 ALWAYS REMEMBER

"A pattern IS NOT a Pattern until the breakout is completed. Before that moment it is just a bunch of colorful candlesticks on a chart of your watchlist"

═════════════════════════════

⚠ DISCLAIMER ⚠

Breakout Area, Target, Levels, each line drawn on this chart and any other content represent just The Art Of Charting’s personal opinion and it is posted purely for educational purposes. Therefore it must not be taken as a direct or indirect investing recommendations or advices. Entry Point, Initial Stop Loss and Targets depend on your personal and unique Trading Plan Tactics and Money Management rules, Any action taken upon these information is at your own risk.

═════════════════════════════

AR trade ideas

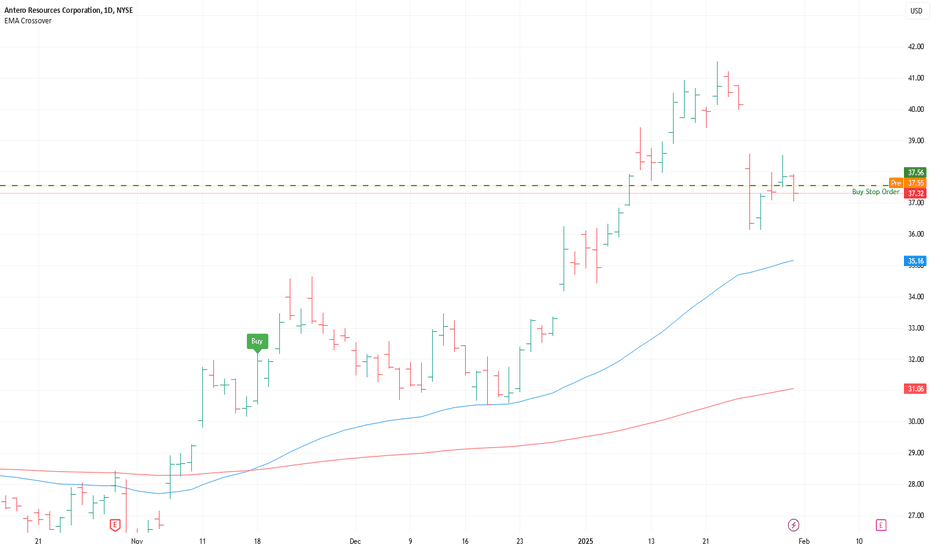

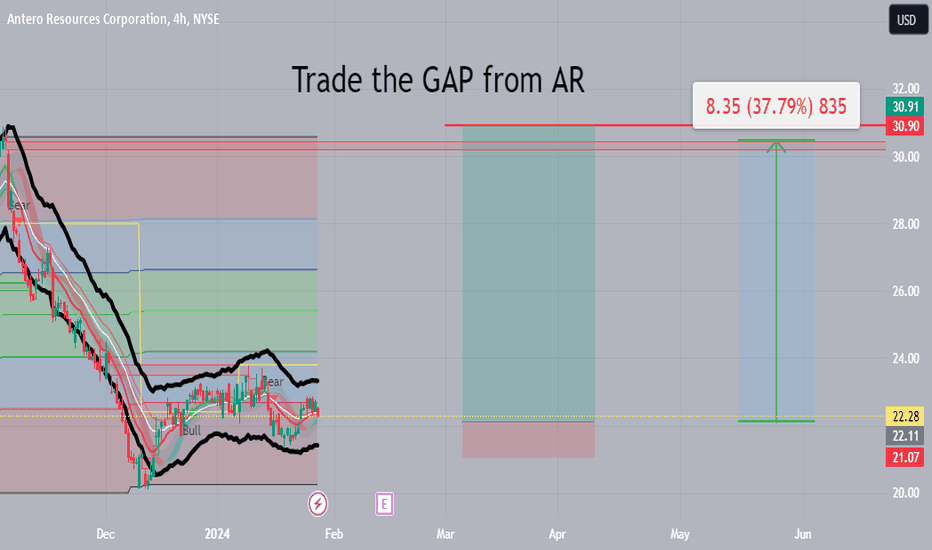

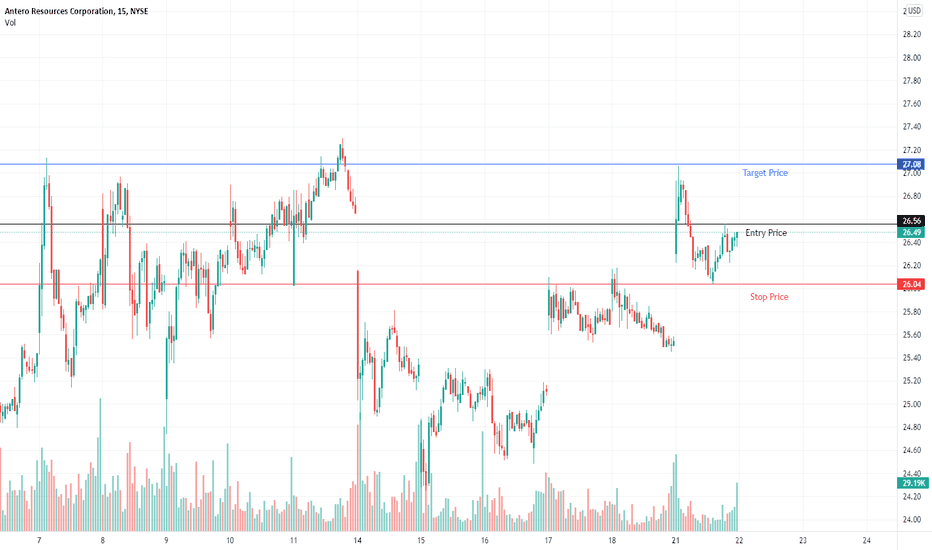

The 3 Step System + The #1 Catalyst In Stock TradingBuying is about positioning yourself

on a support level

when you look at this chart you

will notice that the price of

this stock NYSE:AR first crashed

I was listening to

commodity podcasts

And on this podcast, the experts kept talking about

the opportunity in the resources sector

and so I thought

I give it a shot and try to find

something

in the resources mining sector

just to test out my financial

skills in trading

and I have found

something

now what makes this one very good

is this #1 catalyst

Its called the earnings report

The earnings report is a very powerful catalyst

that you should consider

before you trade stocks

in the stock market

Because this report is a very powerful catalyst

that you can take advantage of

also I want you to look at the

rocket booster

strategy

which has 3 steps:

-The price has to be above the 50 EMA

-The price has to be above the 200 EMA

-The price should gap up

Now am looking at the pre-market price

and so you still have a chance to enter

your buy stop order

But you need to act fast fast

because once you miss this order the

price will react as step number 3

on the rocket boost strategy says

above

Rocket boost this content to learn more.

Disclaimer: Trading is risky, please

risk management and profit-taking strategies

also, feel free to use a simulation trading

account before you trade with real money

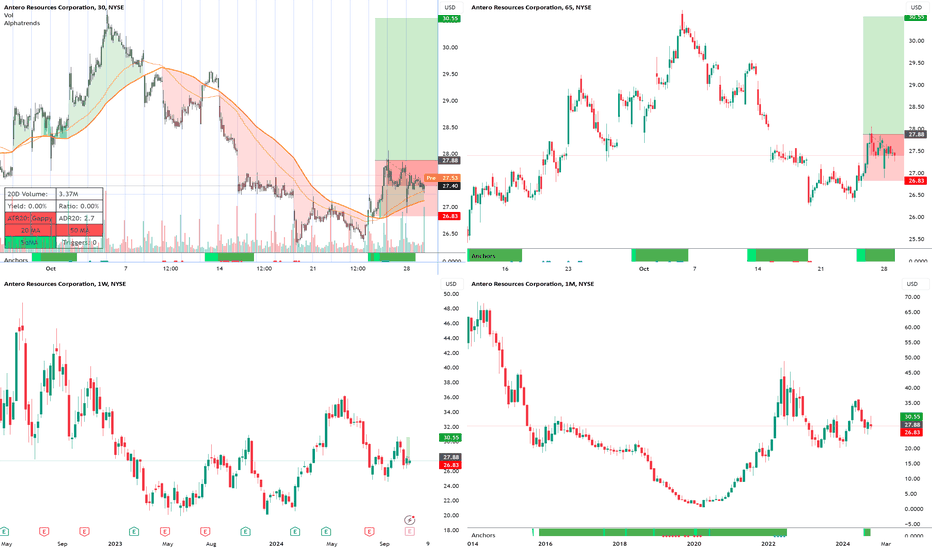

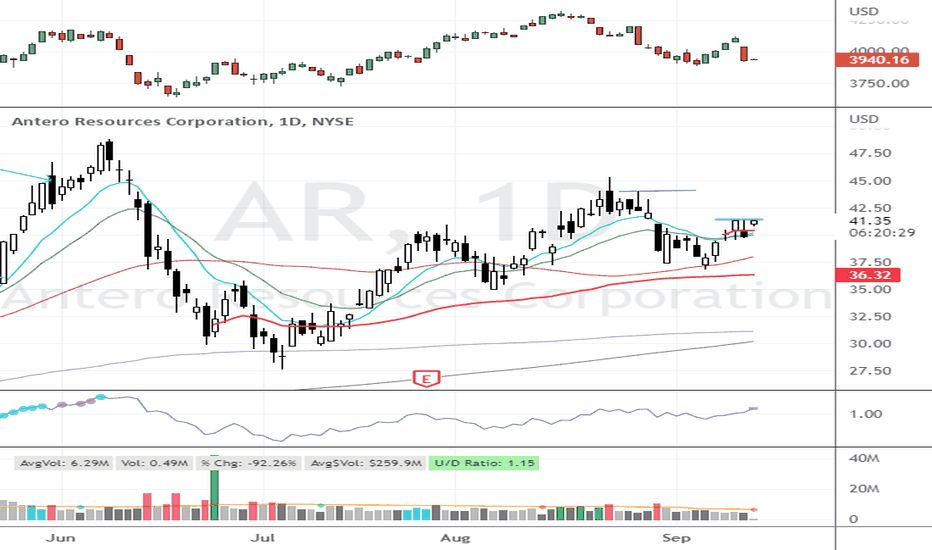

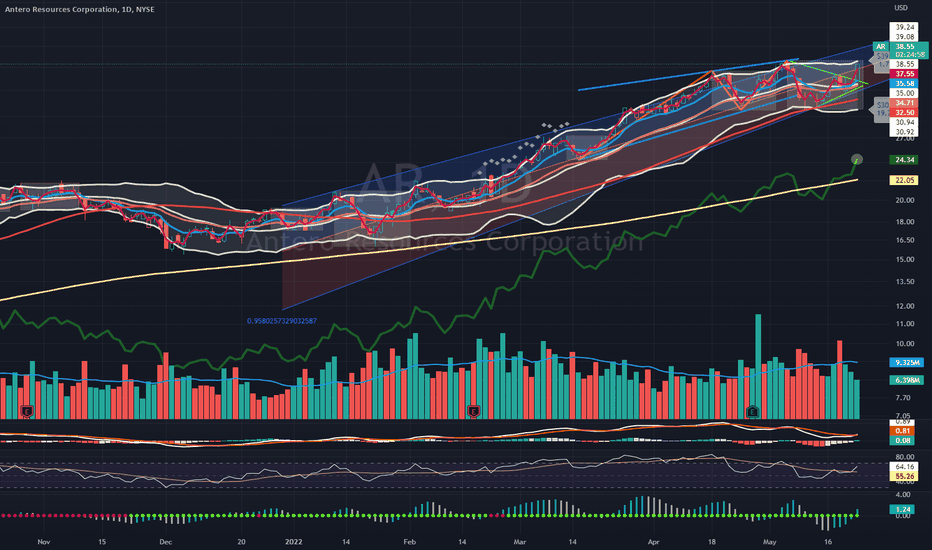

Swing longI'm deploying a multi-timeframe approach here, focusing on a swing trade setup that aligns with both trend and momentum indicators. Here's the core of the strategy:

Entry Criteria: I look to enter on a break above a recent higher high combined with a flat to rising 5-day moving average. Additionally, I’m observing the anchored VWAP from the most recent high (to the left on the chart); it should ideally be flat or rising to confirm sustained interest.

Volume and Price Requirements: Only trading stocks with at least 300,000 shares in daily volume and a price above $3, ensuring liquidity and relevance for momentum.

Trend Confirmation: On the daily timeframe, the stock must be making higher highs and fall within an early Stage 2 uptrend based on Stage Analysis, indicating the start of an uptrend.

Stop Loss: My stop is set just below a recent significant low (higher low) on the 30-minute chart to keep risk in check. If this low is penetrated before entry, I cancel the trade to avoid premature breakdowns.

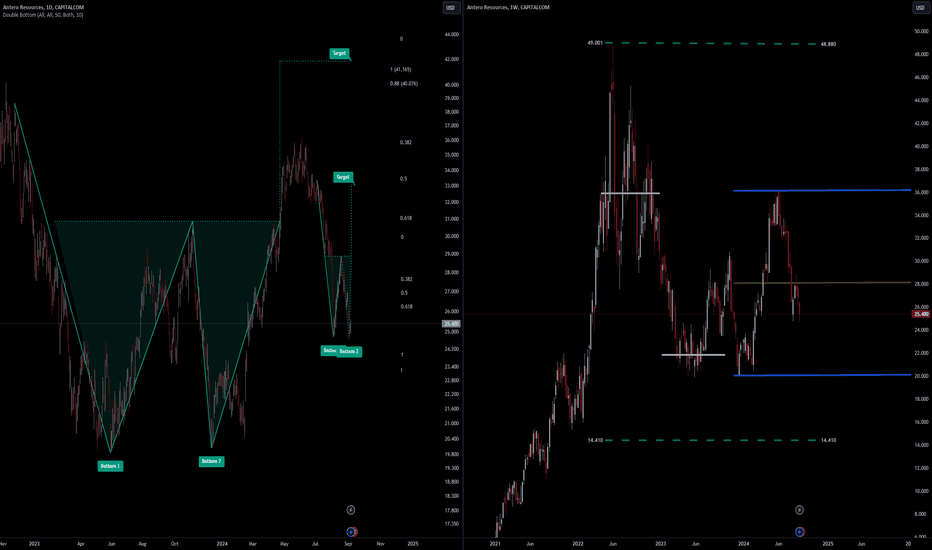

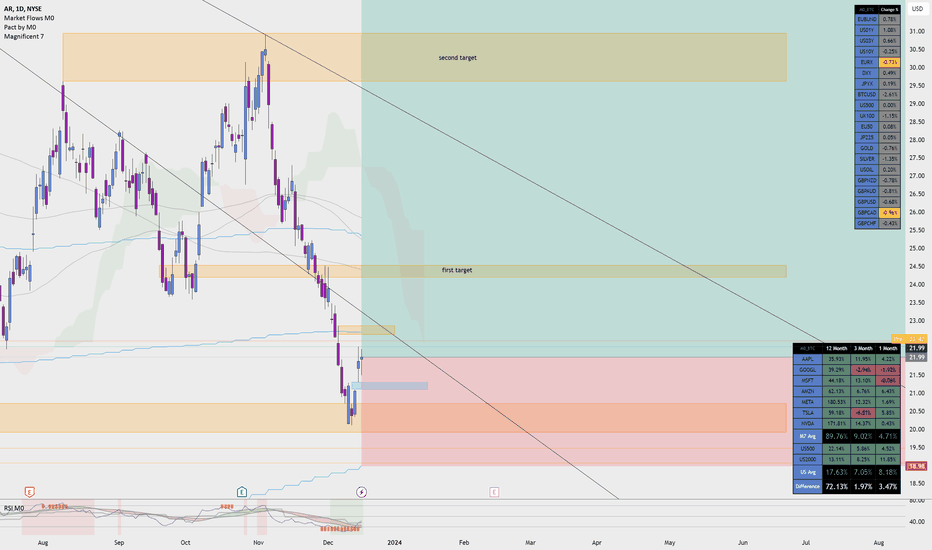

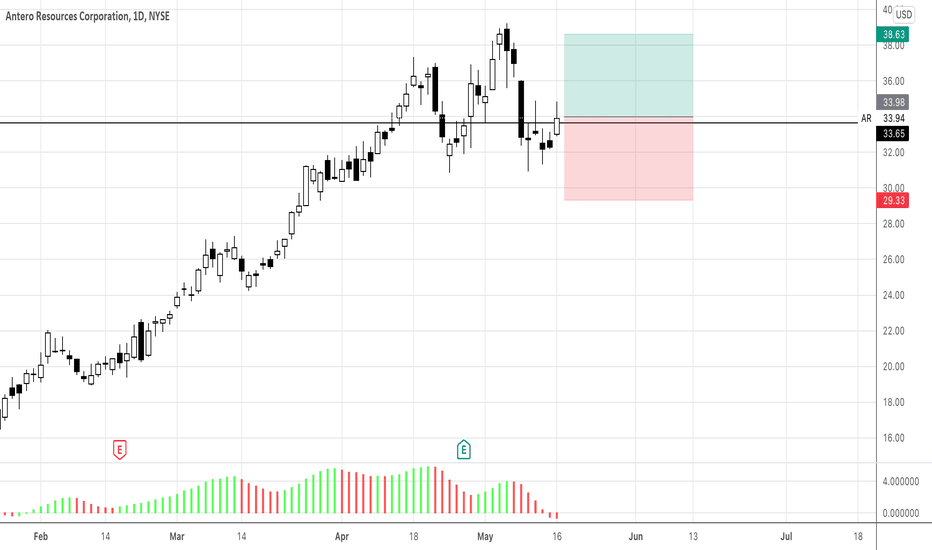

Antero Resources | Chart & Forecast SummaryKey Indicators on Trade Set Up in General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Active Sessions on Relevant Range & Elemented Probabilities;

* Asian(Ranging) - London(Upwards) - NYC(Downwards)

* Weekend Crypto Session

Trend | Time Frame Conductive | Weekly Time Frame

- General Trend

- Measurement on Session

* Support & Resistance

* Trade Area | Focus & Motion Ahead

# Position & Risk Reward | Daily Time Frame

- Measurement on Session

* Retracement | 0.5 & 0.618

* Extension | 0.88 & 1

Conclusion | Trade Plan Execution & Risk Management on Demand;

Overall Consensus | Buy

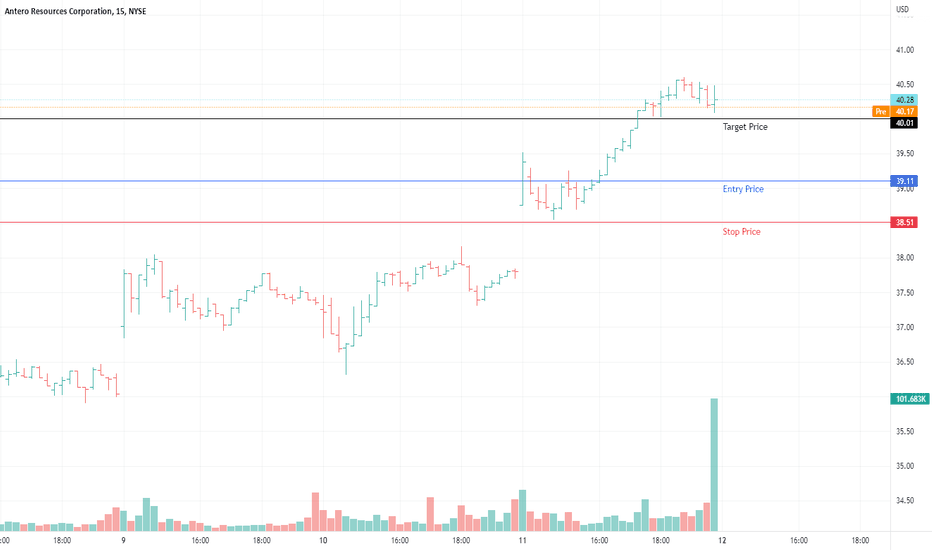

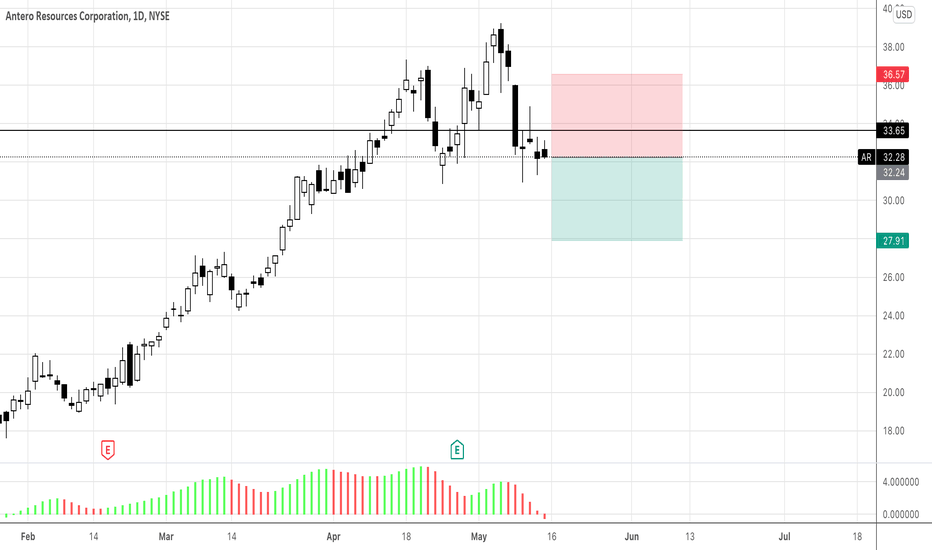

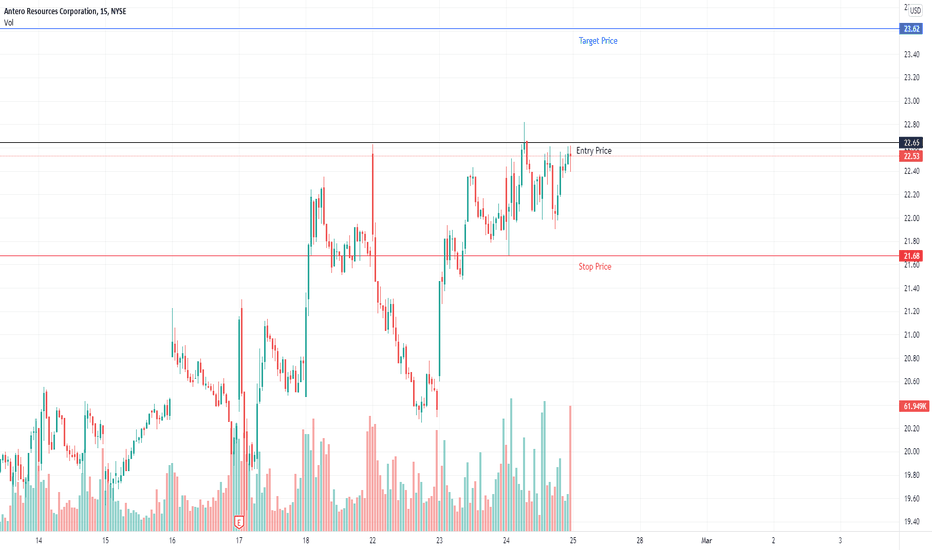

Antero Recources Trade the GAP LONGHello traders, I have found a long position. I currently see Antero Recources as a buy position. SL is safe, things continue to decline below that. Always look at the companies you invest in before buying, especially before selling. I can do a lot, but I'm not God and I can't foresee everything. Good luck

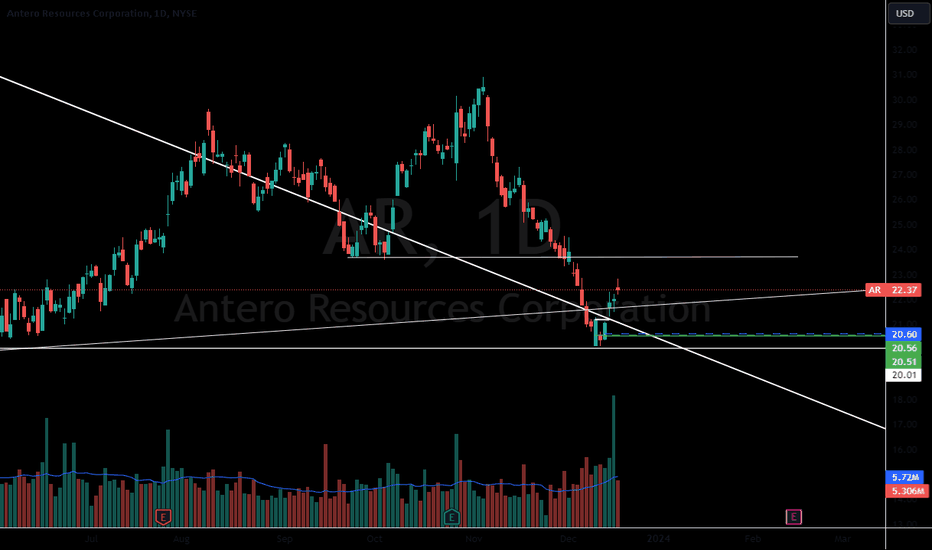

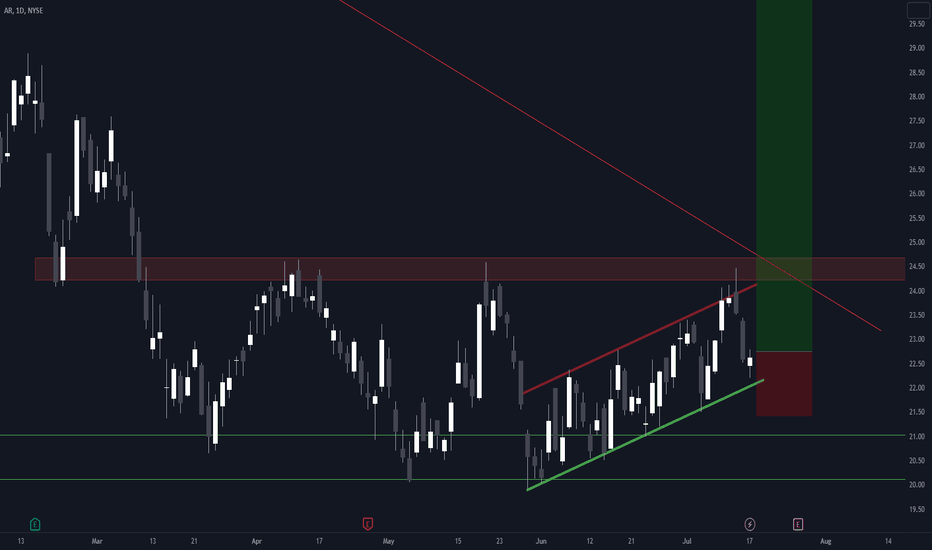

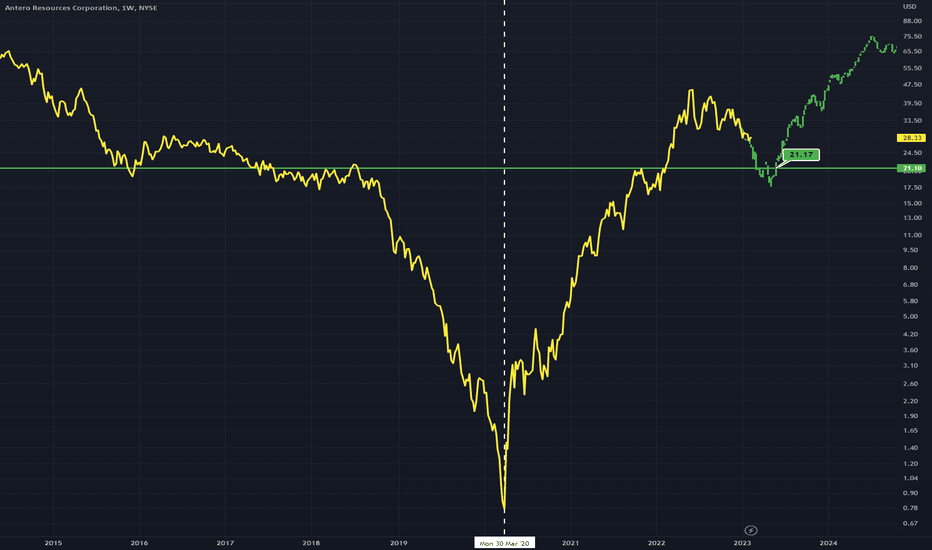

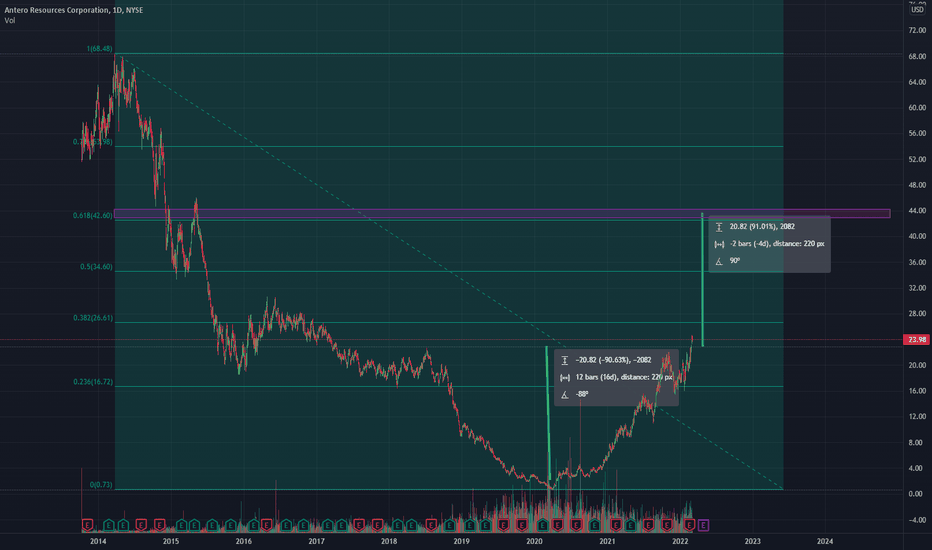

Long $AR Antero Resources (#tradingtheapocalypse)Fundamentals

This is a leveraged play on Natural Gas. Antero is one of the largest U.S. suppliers of gas to the global export market.

NatGas got destroyed in 2022-23, and arguably is forming a long-term bottom.

Technicals

The weekly chart shows that NYSE:AR bounced from two-year-old support and printed bullish RSI divergence:

The daily chart that since the low, AR has been following a clear upward channel.

This trade is to buy within the bottom half of this channel, with a stop under the previous Low. This is a long-term trade. As for levels to exit or swing part of the trade, there are many, starting with strong resistance at the recent High at $24.50. I've arbitrarily chosen the absolute previous high as the end of this trade. Really, since it's a #tradingtheapocalypse trade, macro-economic conditions will determine when we exit.

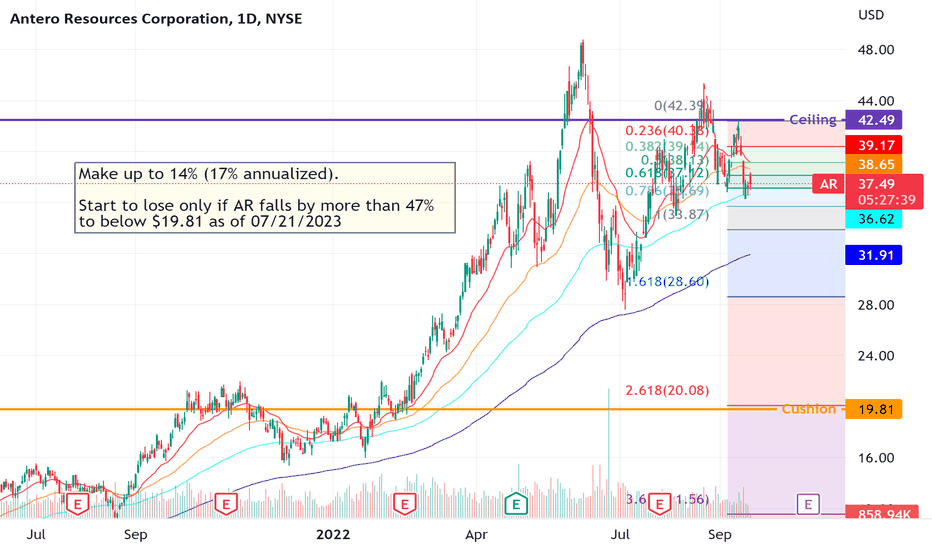

AR Hedged StrategyNatural gas producer and hydrocarbon exploration company Antero Resources has a market cap of $11.3B. Its stock followed the surge in energy prices this and last year, then corrected in June-July. With global shortages and an increased demand for natural gas (vs. oil), there's opportunity in energy long-term... but short-term uncertainty in this market.

Trading at 37.33 as of publication, we can take advantage of this possible low by setting the ceiling up to the 0 level and cushion all the way down to a bit below the 2.618 to minimize the chances of a loss while maintaining potential growth through expiration in July of next year. This will make up to 14.7% (17.9% annualized) but on the downside, also allow AR room to fall a generous 48% before breaking even.

Buy 1 $35 call

Sell 1 $40 call

Sell 2 $20 puts

Exp 7/21/23

Capital Required for the strategy: $3922.64

Probability of winning: HIGH

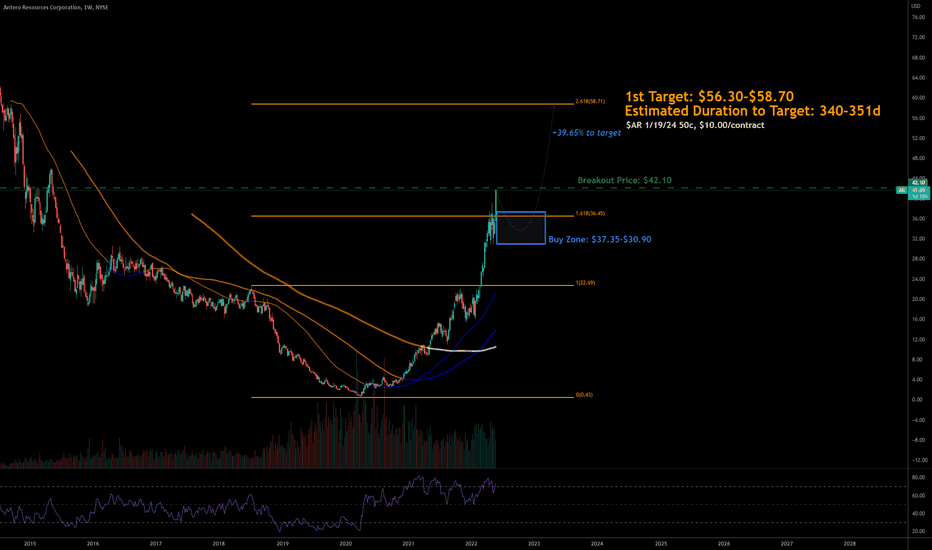

5/25/22 ARAntero Resources Corporation ( NYSE:AR )

Sector: Energy Minerals (Oil & Gas Production)

Market Capitalization: $12.969B

Current Price: $41.69

Breakout price: $42.10

Buy Zone (Top/Bottom Range): $37.35-$30.90

Price Target: $56.30-$58.70

Estimated Duration to Target: 340-351d

Contract of Interest: $AR 1/19/24 50c

Trade price as of publish date: $10.00/contract