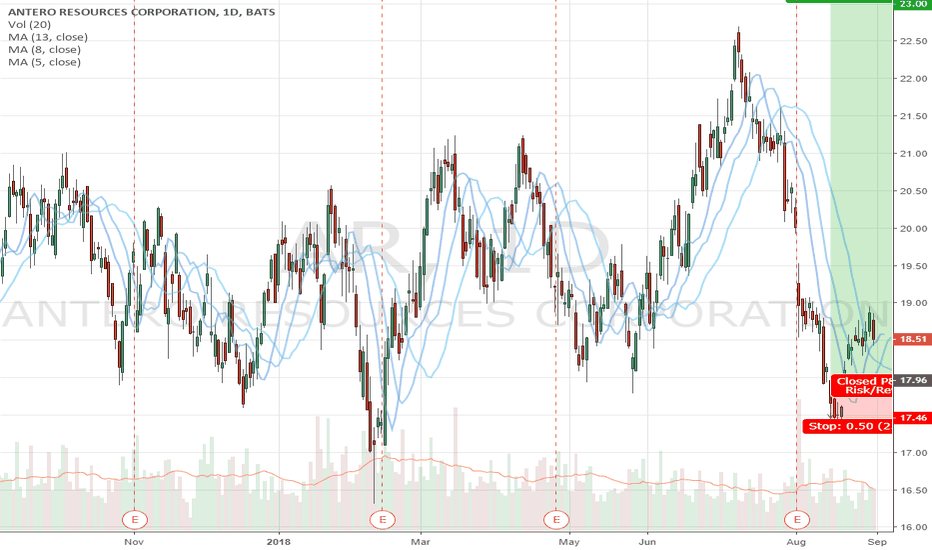

Antero Resources Corp Analyst warns Short Sellers.ANALYSTS WARNS OF SHORTING INTO EARNINGS

Antero Resources, Range Resources analyst commentary at Stifel Short-selling Antero into earnings 'could be quite risky,' says Stifel. Stifel analyst Jane Trotsenko said investors could be inclined to short Antero Resources (AR) and Range Resources (RRC) given that Mt. Belvieu, Texas NGL prices are down 15% per barrel quarter-over-quarter. However, the analyst, who is projecting a production beat and "very healthy natural gas price realizations" from Antero thinks short-selling the stock into the earnings "could be quite risky," she tells investors in a research note. Antero also plans to update guidance with its Q2 report, "which makes this quarter particularly tricky," added Trotsenko, who keeps a Buy rating on the stock

COMPANY PROFILE

Antero Resources Corp. is an independent oil and natural gas company, which engages in the exploration, development and acquisition of natural gas, natural gas liquids and oil properties located in the Appalachian Basin. It also focuses on unconventional reservoirs, which can generally be characterized as fractured shales formations. The company was founded by Paul M. Rady and Glen C. Warren, Jr. in June 2002 and is headquartered in Denver, CO.

AR trade ideas

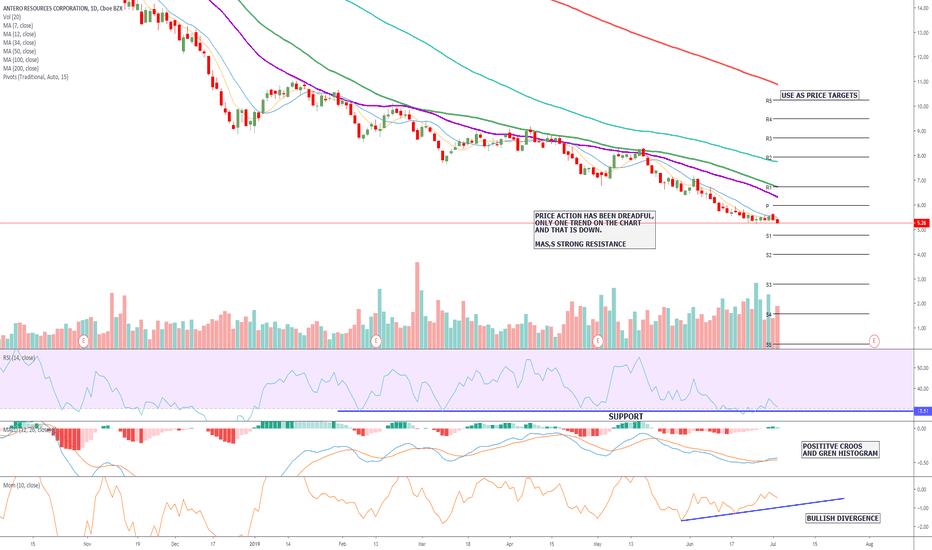

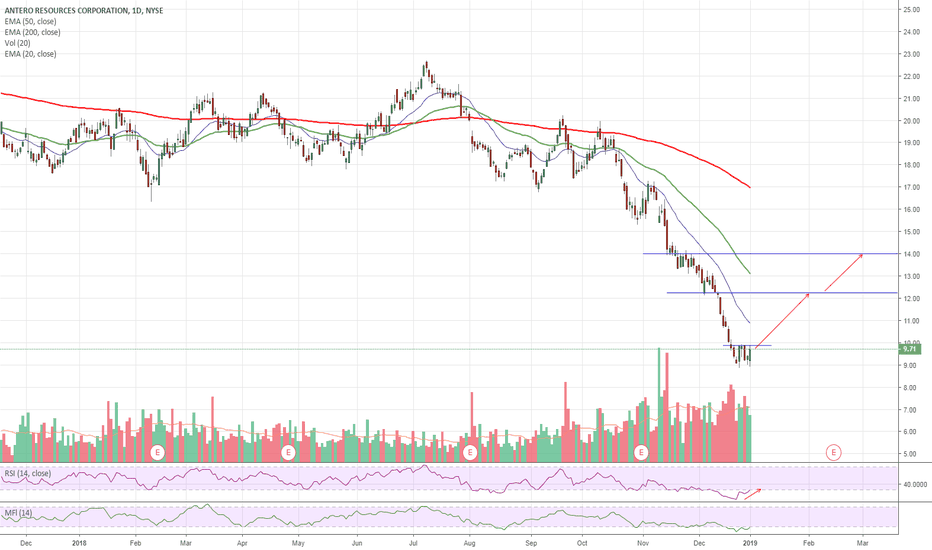

$AR RSI Trending Up - Bullish Unusual Options Activity$AR Antero Resources - Appears to have found a bottom around $9.00 in December. RSI is beginning to trend upward on the daily chart with price still moving relatively sideways. If oil can continue to recover as we move into 2019 I expect AR to bounce back well above $10 within a short period of time. Will monitor for a break above ~$9.90 resistance before entering. See chart for a couple medium term targets.

Additionally, there has been some bullish options activity today with over 38k Jan'2020 $15.00 strike (OTM lotto < $1) call options traded vs an OI under 200 for a total premium of $3M.

Note: Informational analysis, not investment advice.

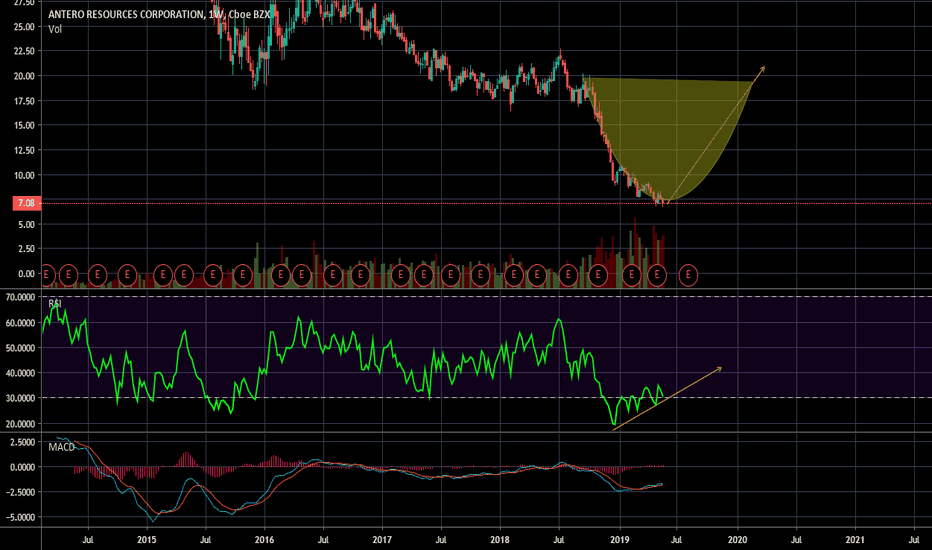

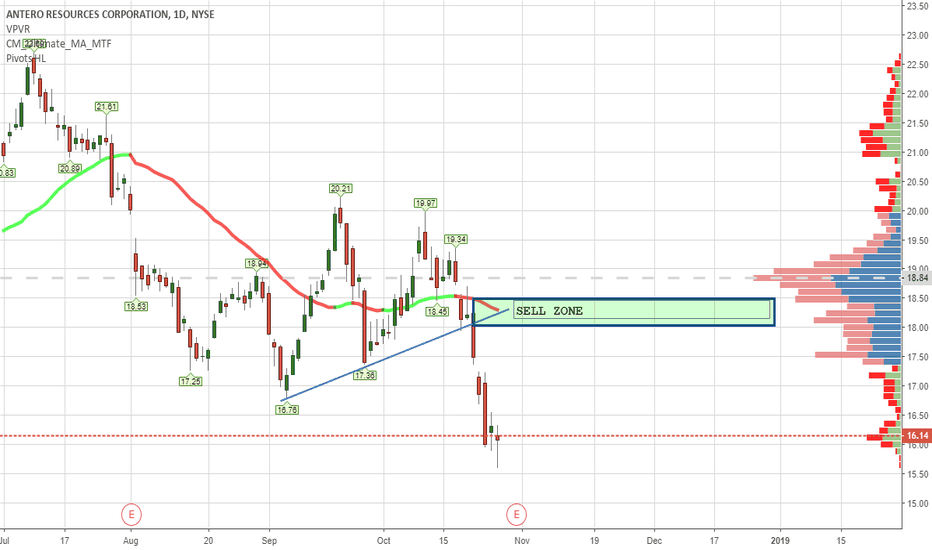

AR: adding to my positionThis is a follow up on my Jan. post (see link below) . Notice the recent rise in the daily chart exceeded the previous high and so far the current low is still above the previous low ( No NL = No new low). Have a nice bullish diverg. in the weekly RSI. Have (so far) a potential positive reversal in the daily RSI. Process your way. Have a great weekend.

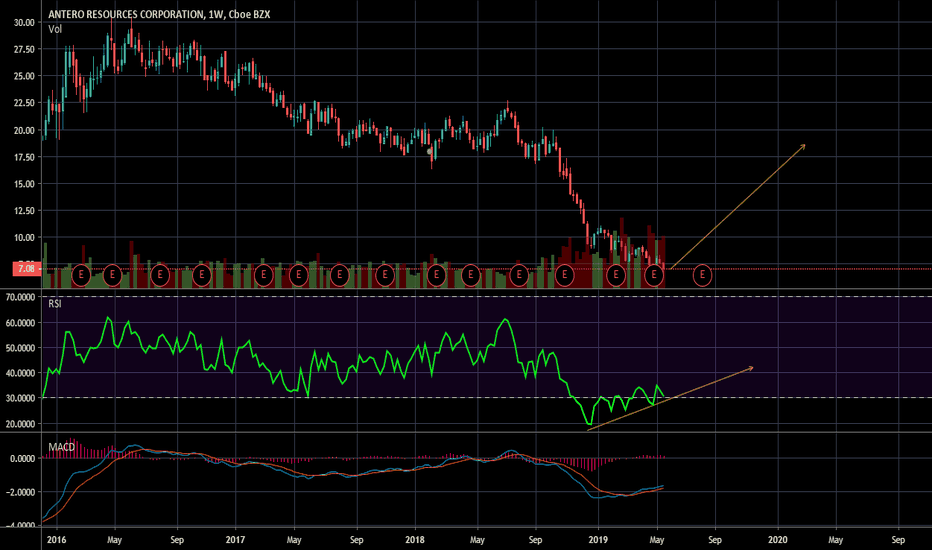

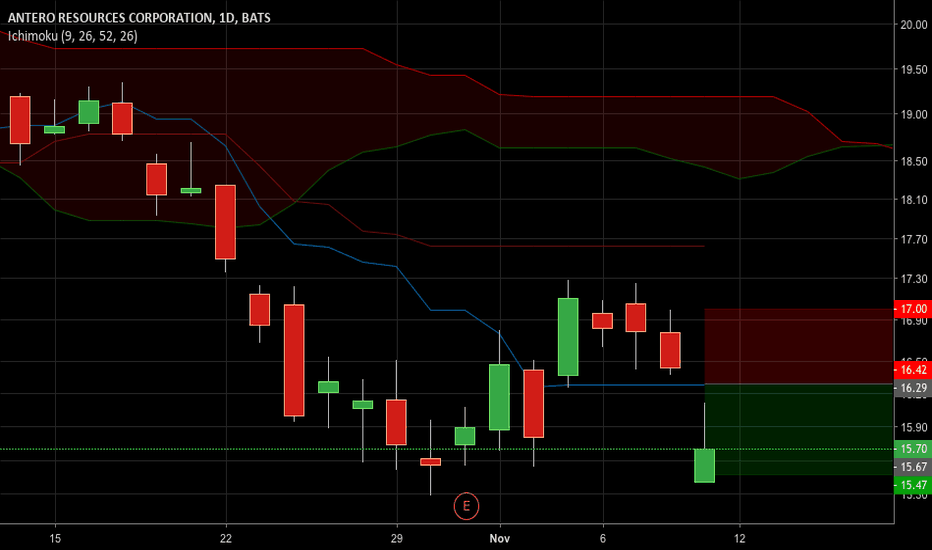

Another oil and natural gas play to consider and keep an eye onLong term down trend line broken with encouraging weekly candle (so far as week not over). If go long can use recent low as stop.

Analysts: 8 strong buys, 9 holds.

Antero Resources Corp. is an independent oil and natural gas company, which engages in the exploration, development and acquisition of unconventional oil and liquids-rich natural gas properties located in the Appalachian Basin in West Virginia, Ohio and Pennsylvania. It focuses on unconventional reservoirs, which can generally be characterized as fractured shales and tight sand formations. The company was founded by Paul M. Rady and Glen C. Warren, Jr. in June 2002 and is headquartered in Denver, CO.

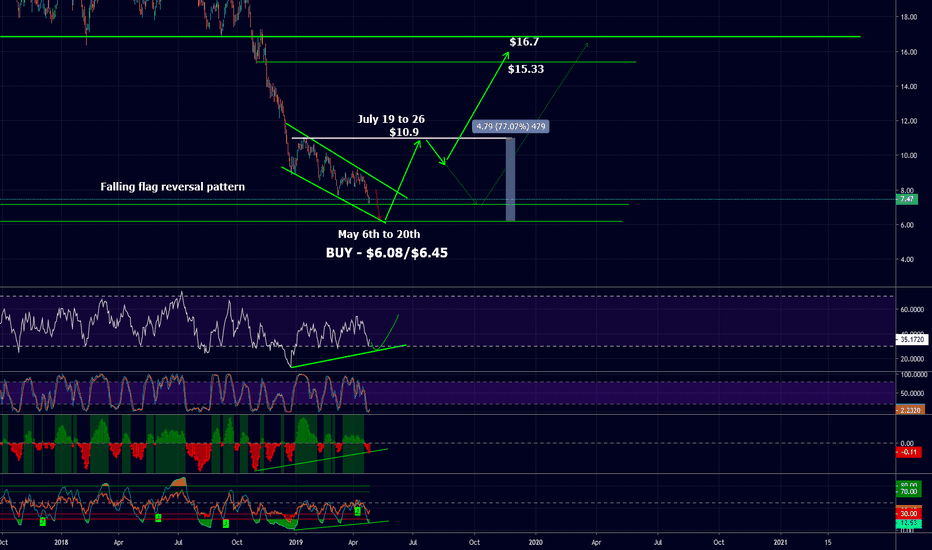

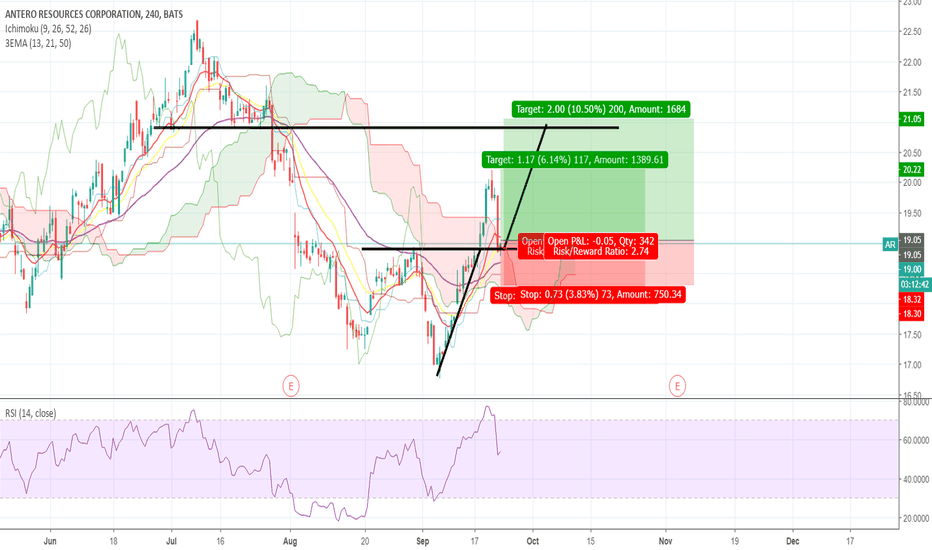

AR: Looking For Bullish Demand To Higher Highs #AnteroResCorpTraders,

Just an idea, legitimate bulls seem to be coming into the market after a slow down of the down trend. Expecting a break out of the lows and expecting to see a new paradigm as the year unfolds, but we will see.

--Interested in professional online trading tuition, or joining my professional signals group? Message me here on Trading View, or email me with the email address of my Trading View page. Thank you.---

Best of luck,

Tom