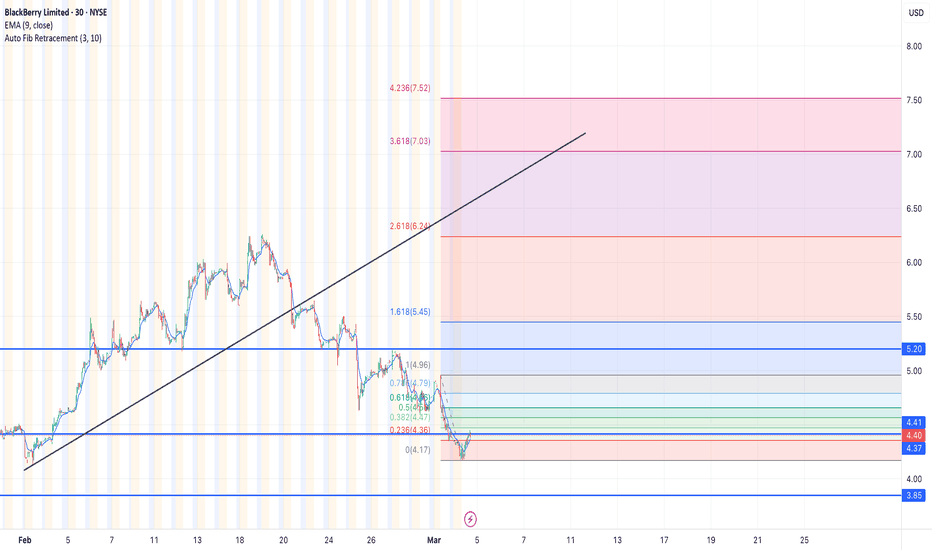

Is it a time for BlackBerry? Potential 30% profit - 5.20 USD

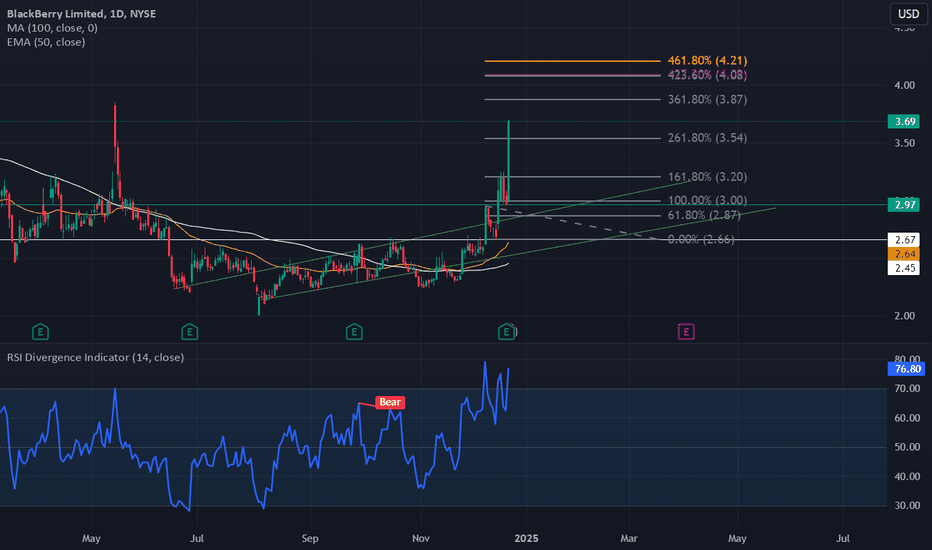

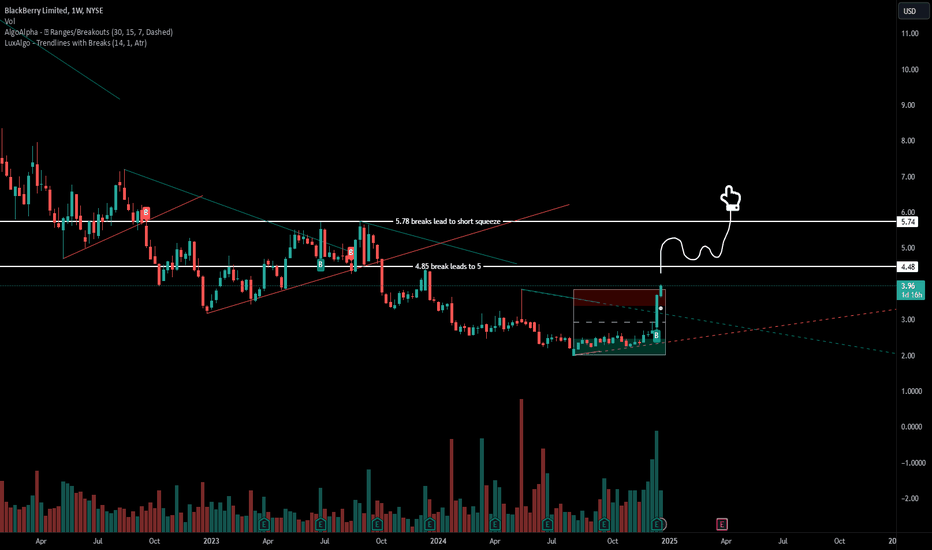

The analysis of the BlackBerry Limited (BB) chart suggests a potential price increase to the 5.20 USD level. The current price is approximately 3.91 USD, and the chart shows a recent bounce from support in the 3.70-3.80 USD range, which may indicate the start of a new upward trend. The moving averages (MA) point to a previous upward impulse, and the current levels could serve as a launchpad for further growth. If demand holds, the price may break through the resistance around 4.50 USD and head toward 5.20 USD, aligning with previous peaks. However, it’s important to monitor volume and the reaction at the 4.50 USD level to confirm the trend's strength. Additionally, in 2025, there have been speculations about the brand’s potential return to the mobile market with new smartphones featuring physical QWERTY keyboards and modern features such as AMOLED screens, 12 GB RAM, and 5G connectivity, sparking interest and hope among fans (information from March 2025). Furthermore, recent data indicates a rise in stock performance, with the price reaching 7.53 USD, reflecting a 36.66% increase since the beginning of the year (as of February 12, 2025).

Potential TP: 5.20 $

BB trade ideas

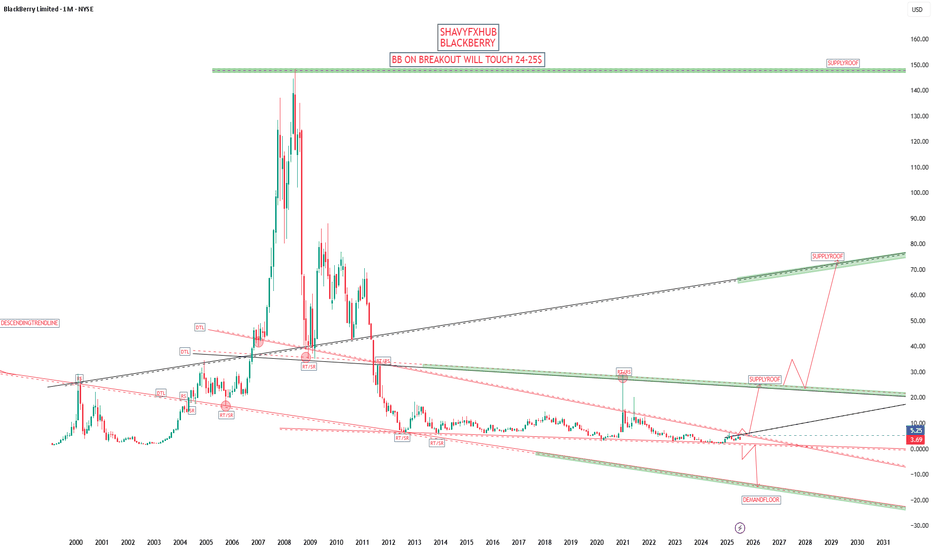

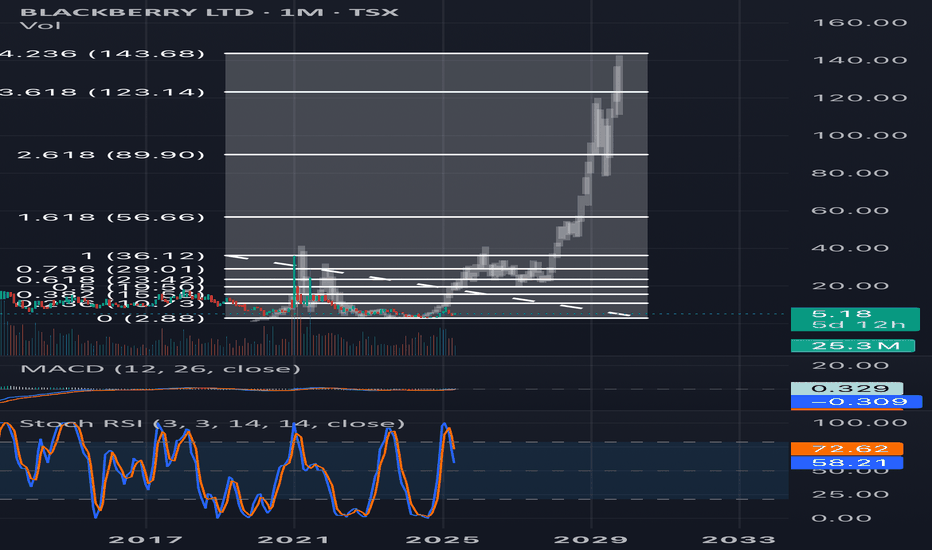

BLACKBERRY BBBREAKOUT OF DESCENDING TRENDLINE COULD SEE 22$-24$

BlackBerry today is a Canadian technology company specializing in cybersecurity software and Internet of Things (IoT) services for enterprises and governments worldwide. Formerly renowned as a mobile device manufacturer, BlackBerry Limited (formerly Research In Motion, RIM) exited the smartphone business in 2016 and now focuses on secure communications, endpoint management, and embedded systems, especially for industries like automotive, healthcare, and government.

Company Profile & Business

Headquarters: Waterloo, Ontario, Canada

Core products: Cybersecurity solutions, BlackBerry Unified Endpoint Management (UEM), QNX operating systems, secure messaging (BlackBerry Messenger Enterprise, BBMe), and automotive software platforms.

Global presence: Products and services are sold worldwide across the Americas, Europe, Middle East, Africa, and Asia-Pacific.

Recent Financials & Stock

Stock ticker: NYSE/TSX: BB

Recent price: As of July 30, 2025, BlackBerry closed at $3.74 per share, reflecting a decline from earlier in the month. Price targets for the company now range from $2.71 to $4.75, with analysts citing positive revenue growth and the company's first positive cash flow in three years after its recent quarterly results.

Business momentum: The company recently posted about 10% higher revenue compared to forecasts for the third quarter fiscal year 2025, with a shift to positive earnings and cash flow—highlighting improvements in its cybersecurity and IoT software businesses.

Notable News & Developments

End of smartphones: BlackBerry-branded mobile devices are officially discontinued. The company fully exited the hardware business by 2018 and stopped supporting BlackBerry 10 in 2022.

Nostalgia revival: In 2025, a separate company (Zinwa Technologies) is reviving classic BlackBerry devices (like the BlackBerry Classic and Passport) by retrofitting them with modern Android internals. These are not officially affiliated with BlackBerry Limited, but appeal to enthusiasts for the classic design and QWERTY keyboard, albeit with privacy caveats due to non-BlackBerry software.

Enterprise focus: BlackBerry remains a leader in secure software for businesses, including automotive OS (QNX), endpoint security, and secure messaging. Major clients include automotive OEMs, financial corporations, and government agencies.

Quick Facts Table

Aspect Details

Industry Cybersecurity, IoT software, enterprise services

Founded 1984 (as Research In Motion, Canada)

Consumer Phones Discontinued; brand revived unofficially by others

Current Stock Price $3.74 (July 30, 2025)

Latest Product Focus Automotive software, secure endpoint management

BlackBerry is no longer a phone maker, but remains a significant player in secure enterprise and automotive software, with stock prices and business outlook reflecting its transition into these fields.

Zinwa Technologies is a Chinese technology company that has gained attention in 2025 for its project to revive classic BlackBerry smartphones, specifically the BlackBerry Classic (also known as the Q20), under its own branding. Unlike BlackBerry Limited (which no longer makes hardware), Zinwa has purchased batches of old BlackBerry Q20 devices—both new-old-stock and used units from supply chains in Hong Kong—and is refurbishing them with entirely new internal components while retaining the iconic design features such as the physical QWERTY keyboard and 720x720 touchscreen.

Key Details on Zinwa Technologies’ BlackBerry Revival:

Project Name/Models: The updated phone is called the Zinwa Q25 (2025 is referenced in the model name). Zinwa is also planning to modernize other BlackBerry devices, including the KEYone (“K25”) and the Passport (“P25” or “P26”).

What’s Modernized?: The original shell, keyboard, notification LED, and display remain, but Zinwa installs a new motherboard with a MediaTek Helio G99 processor, 12GB RAM, 256GB storage (expandable), a 50MP rear camera, 8MP front camera, a new 3,000mAh battery, and global 4G LTE support. There is a USB-C port, headphone jack, microSD support, and the phone runs Android 13 (with no confirmed plans for updates to later Android versions).

How It’s Sold: Two options are offered—a fully assembled Zinwa Q25 smartphone for $400, or a $300 conversion kit for those who already own a BlackBerry Classic and want to upgrade themselves. Both are expected to ship in August 2025.

Nostalgia Meets Modern Tech: The initiative targets fans of physical keyboards and retro gadgets as well as a new wave of Gen Z users seeking “digital detox” devices. The device is positioned as a niche product for enthusiasts rather than a mass-market flagship.

No Connection to BlackBerry Limited: Zinwa Technologies has not acquired the BlackBerry brand or company; its project is independent and relies on recycling and upgrading old BlackBerry hardware.

Future Plans: Zinwa has stated it may refresh additional BlackBerry models based on demand and feedback, following the Q25 release.

In sum, Zinwa Technologies is bringing back the BlackBerry Classic as a refreshed, Android-powered device for technology enthusiasts and nostalgia seekers, reflecting a trendy intersection of retro design and modern smartphone capabilities in 2025.

#BB

BLACKBERRY BREAKOUT OF DESCENDING TRENDLINE COULD SEE 22$-24$

BlackBerry today is a Canadian technology company specializing in cybersecurity software and Internet of Things (IoT) services for enterprises and governments worldwide. Formerly renowned as a mobile device manufacturer, BlackBerry Limited (formerly Research In Motion, RIM) exited the smartphone business in 2016 and now focuses on secure communications, endpoint management, and embedded systems, especially for industries like automotive, healthcare, and government.

Company Profile & Business

Headquarters: Waterloo, Ontario, Canada

Core products: Cybersecurity solutions, BlackBerry Unified Endpoint Management (UEM), QNX operating systems, secure messaging (BlackBerry Messenger Enterprise, BBMe), and automotive software platforms.

Global presence: Products and services are sold worldwide across the Americas, Europe, Middle East, Africa, and Asia-Pacific.

Recent Financials & Stock

Stock ticker: NYSE/TSX: BB

Recent price: As of July 30, 2025, BlackBerry closed at $3.74 per share, reflecting a decline from earlier in the month. Price targets for the company now range from $2.71 to $4.75, with analysts citing positive revenue growth and the company's first positive cash flow in three years after its recent quarterly results.

Business momentum: The company recently posted about 10% higher revenue compared to forecasts for the third quarter fiscal year 2025, with a shift to positive earnings and cash flow—highlighting improvements in its cybersecurity and IoT software businesses.

Notable News & Developments

End of smartphones: BlackBerry-branded mobile devices are officially discontinued. The company fully exited the hardware business by 2018 and stopped supporting BlackBerry 10 in 2022.

Nostalgia revival: In 2025, a separate company (Zinwa Technologies) is reviving classic BlackBerry devices (like the BlackBerry Classic and Passport) by retrofitting them with modern Android internals. These are not officially affiliated with BlackBerry Limited, but appeal to enthusiasts for the classic design and QWERTY keyboard, albeit with privacy caveats due to non-BlackBerry software.

Enterprise focus: BlackBerry remains a leader in secure software for businesses, including automotive OS (QNX), endpoint security, and secure messaging. Major clients include automotive OEMs, financial corporations, and government agencies.

Quick Facts Table

Aspect Details

Industry Cybersecurity, IoT software, enterprise services

Founded 1984 (as Research In Motion, Canada)

Consumer Phones Discontinued; brand revived unofficially by others

Current Stock Price $3.74 (July 30, 2025)

Latest Product Focus Automotive software, secure endpoint management

BlackBerry is no longer a phone maker, but remains a significant player in secure enterprise and automotive software, with stock prices and business outlook reflecting its transition into these fields.

#BB

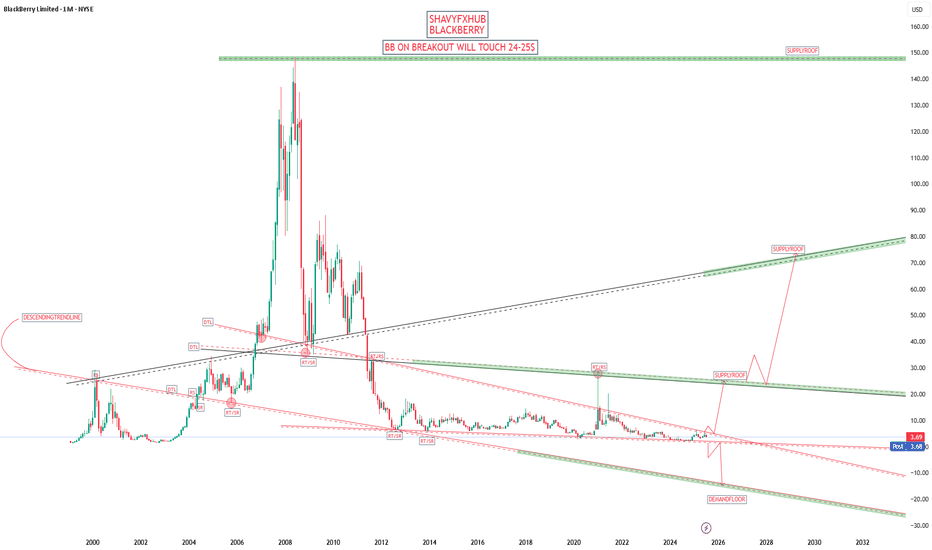

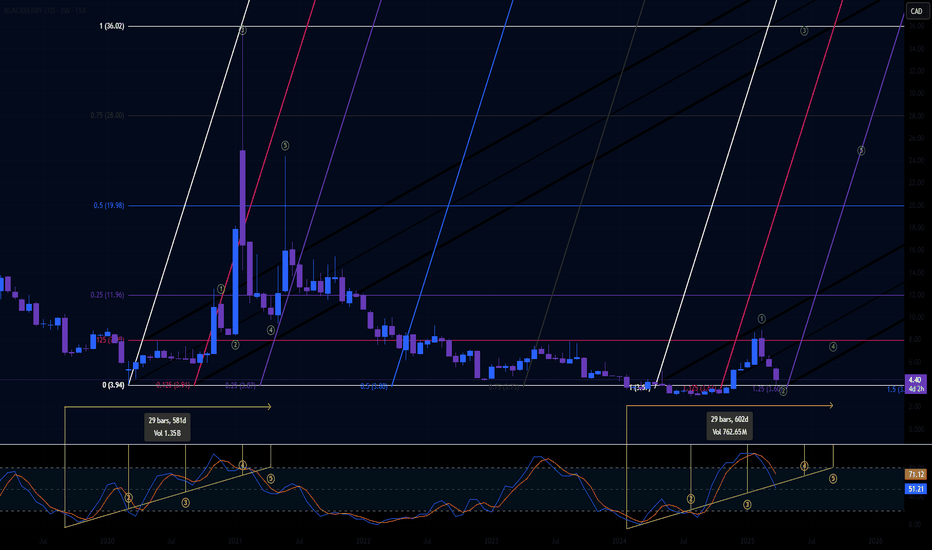

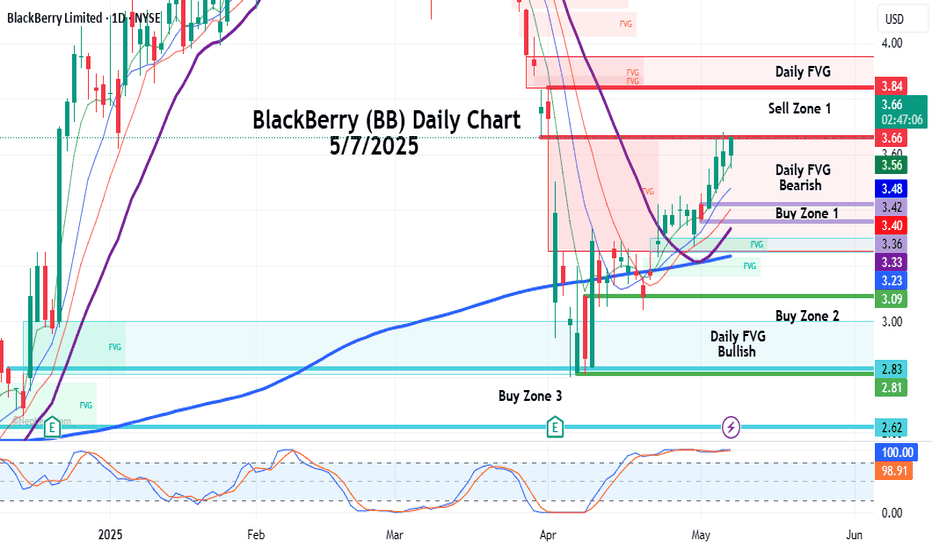

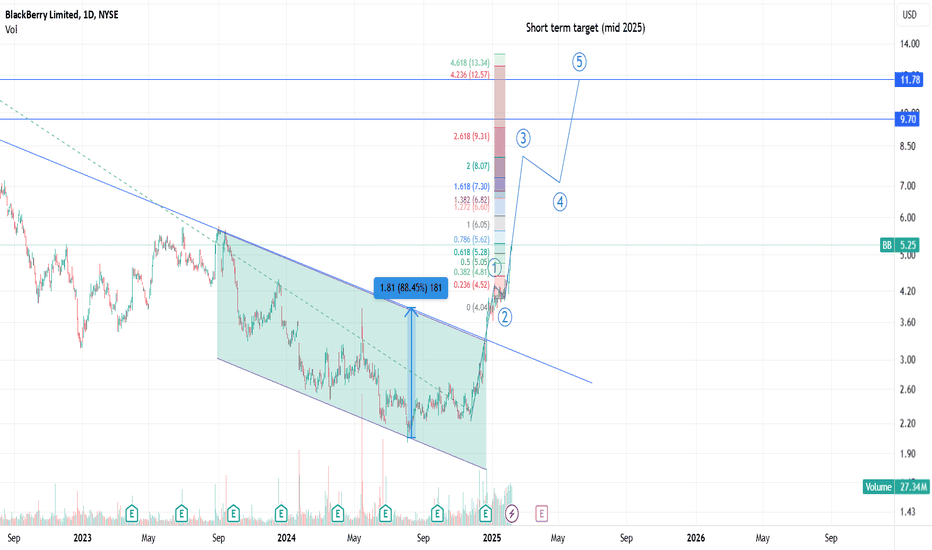

Quick BB updates - Minor MovementAs we've observed, it appears we're currently in a Minor Cycle at the end of the 4th wave, aligning closely with the Fibonacci target for this wave.

The last financial quarter delivered strong results, and I genuinely like the direction the company is heading. In my view, this could represent the most significant core business shift in the past 30 years.

As always, please do your own research before investing, this is not financial advice.

Have a blessed week!

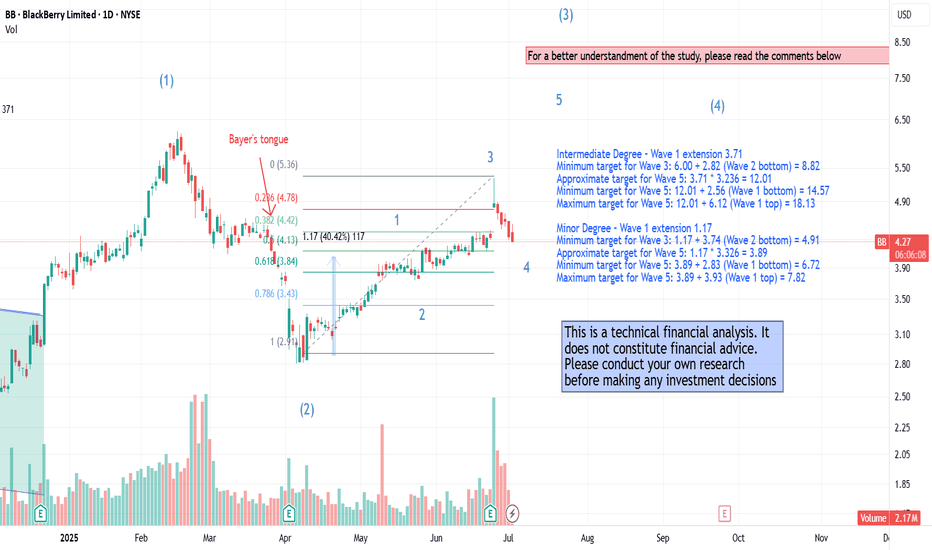

BB ready to ripWith QNX being the beating heart of the majority of smart-cars, the deal with VW, and BB shedding some dead weight when it comes to their security branch by selling Cylance, I feel it is finally time for BB's time to shine in the sun. Diamond formation off of a double bottom on the daily after finding support at $4.

I'm in with a $4 average and various 2027 calls. Targeting $6.8-$7 range before the end of 2026, but depending on the next few earnings, if there are big surprises, we may see one of the biggest comebacks in history.

(This is just my opinion not financial advice)

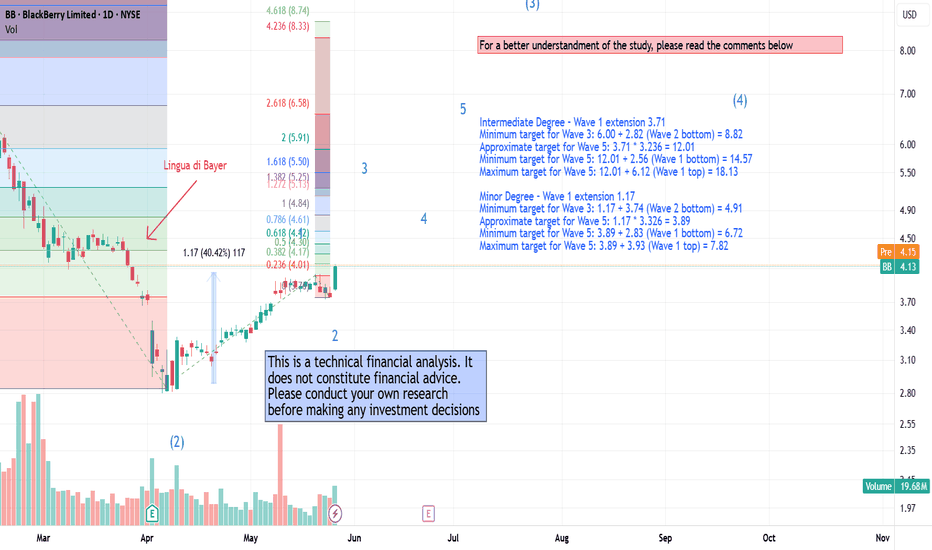

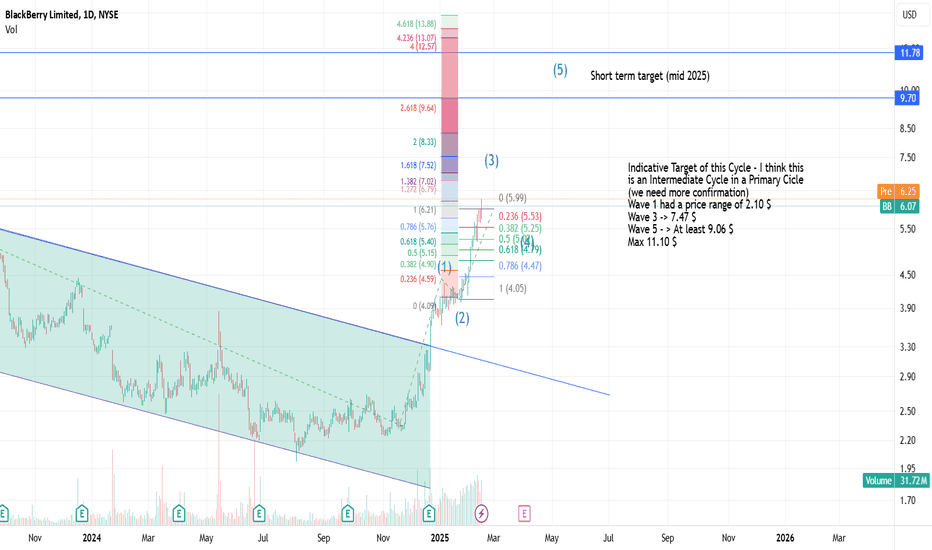

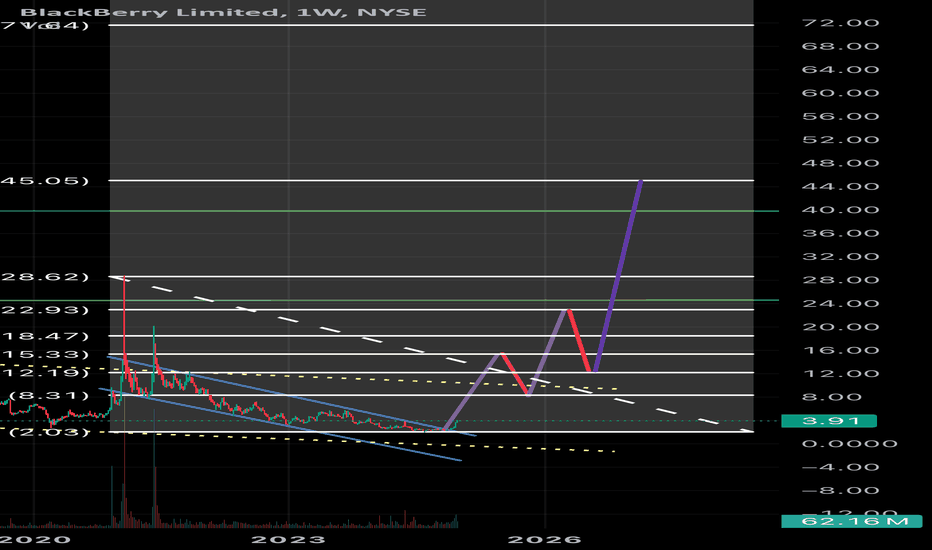

Blackberry Update-Review - Let the Bulls drive in !In the previous analysis, we observed the formation of an impulsive 1-2-3-4-5 structure of a cycle according to Elliott Wave Theory, which was invalidated by a downside breakout (caused by tariff-related uncertainties).

After a period of consolidation, during which trading was mostly driven by algorithms, it now appears that technical analysis has once again become relevant.

In this study, we examine the targets of an Minor-degree impulsive wave, typically lasting up to 6 months, as well as those of a Intermediate-degree wave, which can span 2–3 years and is considered to have started in November 2024.

These are probabilistic scenarios, and it is important to remember that Elliott Waves were originally developed for analyzing stock market indices.

Personally, I believe Blackberry is the most undervalued tech stock on the market!

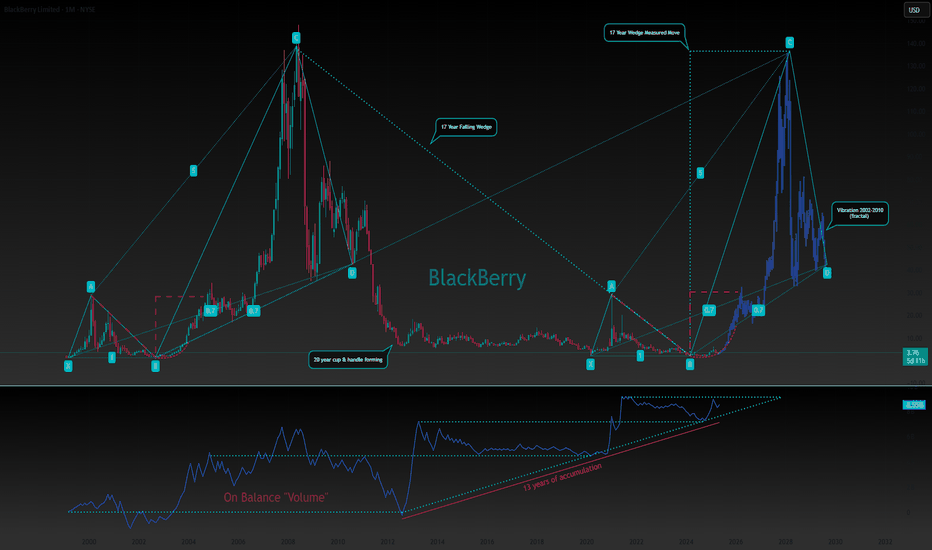

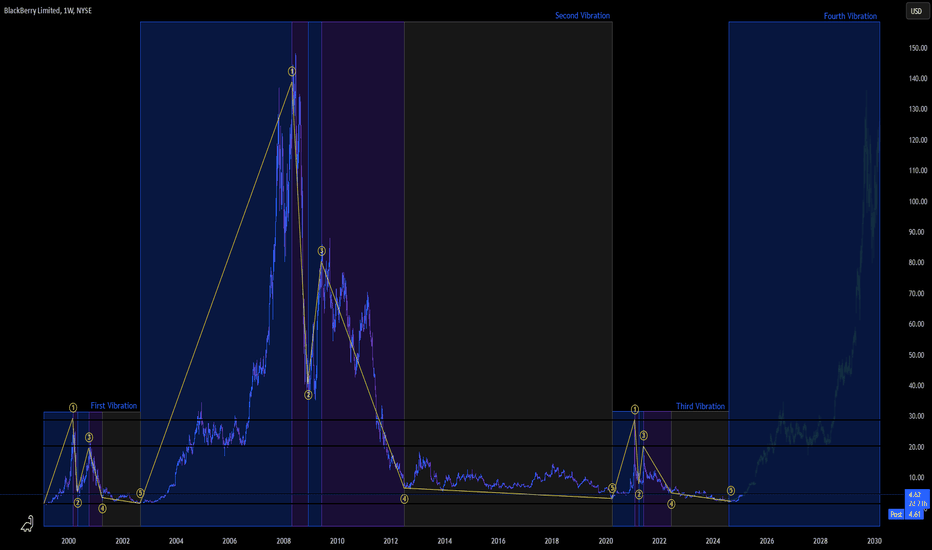

BlackBerry Crayon DrawingThis is yours to interpret.

Too high to think of a good description.

So here is a quote by William Delbert Gann.

”Time is the most important factor in determining market movements and by studying the past records of the averages or individual stocks you will be able to prove for yourself that history does repeat and that by knowing the past you can tell the future. There is a definite relation between time and price. Now, by a study of the time periods and time cycles you will learn why tops and bottoms are found at certain times and why resistance levels are so strong at certain times and bottoms and tops hold around them. The most money is made when fast moves and extreme fluctuations occur at the end of major cycles.” W.D. Gann

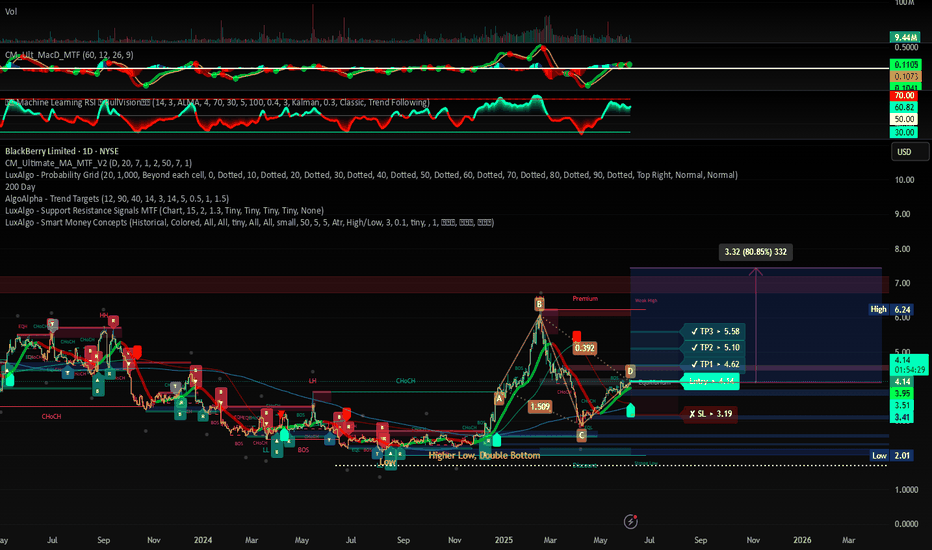

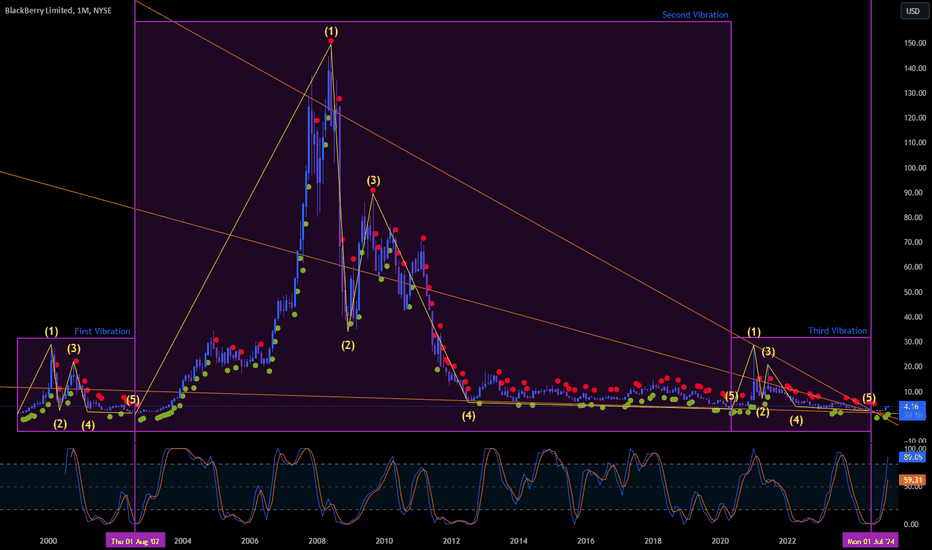

BlackBerry Law of VibrationNYSE:BB - Monthly Timeframe

Bollinger Bands - Real Tight.

On Balance Volume - Bullish.

Price Momentum Oscillator - Bullish.

Trade The Markets Squeeze - Bullish.

Monthly Volume - Above Averages.

”Time is the most important factor in determining market movements and by studying the past records of the averages or individual stocks you will be able to prove for yourself that history does repeat and that by knowing the past you can tell the future. There is a definite relation between time and price. Now, by a study of the time periods and time cycles you will learn why tops and bottoms are found at certain times and why resistance levels are so strong at certain times and bottoms and tops hold around them. The most money is made when fast moves and extreme fluctuations occur at the end of major cycles.” - W.D. Gann

Déjà vu.Hello old friend, it feels like we've been down this road before.

"After exhaustive researches and investigations of the known sciences, I discovered that the Law of Vibration enabled me to accurately determine the exact points to which stocks or commodities should rise and fall within a given time. The working out of this law determines the cause and predicts the effect long before the Street is aware of either" -- W.D. Gann

QNX Everywhere.”Every movement in the market is the result of a natural law and of a cause which exists long before the effect takes place and can be determined years in advance. The future is but a repetition of the past, as the Bible plainly states…” -- W.D. Gann

youtube.com

"Down just means, not up yet" -- Bathsalt

Backberry is up, still a good outlook at the Sell Zone!My first area of support is at my Buy Zone 1 which starts at $3.42 down to $3.36 where it hovered for days, and there's a bullish ICT Order block in that zone. It shot out of there and is at $3.67 now. I'm going to wait because my Sell Zone started at $3.66 so we may get some resistance in this area. However, long-term I'm Bullish on BlackBerry, because there's a chance that even a small pullback to my 1st buy Zone at $3.42 would potentially give a great entry to hold.

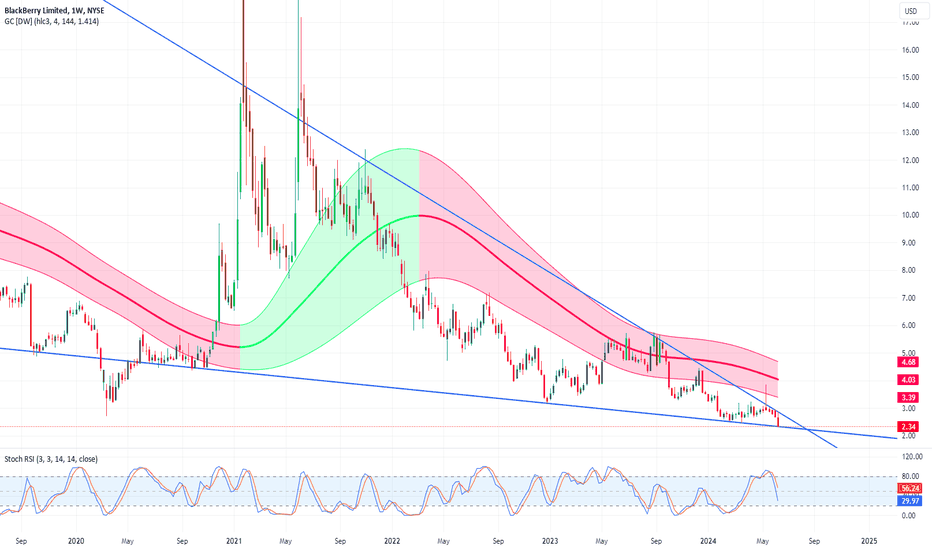

We may be at the precipice of something great.RSI cross over on multiple longer term time frames.

Massive falling wedge.

Now there seems to be a lot of talk about the bankruptcy of Blackberry and that it has no future.

Between Blackberry IVY a 50/50 collaboration with Amazon. Another collaboration with AMD to advance precision and control for robotics. Lets not forget the partnership with NVDA to have QNX run on all of their next gen Thor chips. Its probably safe to say that we have a very bright future.

A few earning reports ago Chen said that a major player was pushing them to release QNX 8.0 fast as possible because of demand that they are seeing. Its pretty obvious that this major player is NVDA.

“The combination of our DRIVE Thor centralized computer and the new QNX OS will serve as a powerful foundation on which OEMs can build next-generation automotive systems that offer the highest levels of safety and security,” said Ali Kani, Vice President of Automotive at NVIDIA.

Also from this job listing.

nvidia.wd5.myworkdayjobs.com

Ways to stand out from the crowd:

Experience working with QNX and Arm-based hardware platforms.

There are many more job listings that are starting to have knowledge of QNX as a way to stand out from the crowd. Almost too many to want to post here. Just go check for yourself.

Before Andy Jassy became CEO of Amazon. There is a interview where he is asked what the most promising new product that they are working on that has the most potential. He says its probably IVY. Now sadly I can't for the life of me find this interview again and don't have the energy or care to find it. But you can choose to believe that this interview exists or not. If you find it please post below.

On another note. Lets talk about the Software Defined Vehicle. Before Chen got the boot they would talk about the fabled 20$ car. We have been seeing very small revenue from QNX due to the fact that vehicles of the past did not use as many ICUs inside them to work. Today with all the new EVs rolling off the line its safe to say that the 20$ car is already here, and soon will be the only vehicles coming off the line. We are talking about going from about 5$ per vehicle to now 20$+ a wonderful 4x+ increase.

People have been saying that the "next" earnings will be the most important. I believe that the time has finally come and this very next one will define what's going to happen to the share price. 6 month RSI could & should cross over starting July 1st.

Stay tuned.

BB - Hit The Road Jack! BullishThe image is for illustrative purposes only; the Elliott wave levels need confirmation and are currently just indicative of a possible movement. This is not financial advice.

As I mentioned in my previous post, BlackBerry is showing bullish momentum in the short term, and in my opinion, this could be the beginning of a broader long-term uptrend. It’s a fractal movement, like a matryoshka doll. Over the past few months, many institutions have acknowledged the profound shift in BlackBerry’s business model, which is now centered around IoT and secure communications. In my view, it remains one of the most undervalued companies today—but that’s just my opinion. Time will tell what the future holds.

BB Short Term Target - Bullish! (and also long term..)Many people are unaware of the transformation BlackBerry has undergone since selling its phone licensing rights in 2023. Over the past few years, the company has shifted its focus from hardware to software and cybersecurity. Recently, it sold Cylance, its AI-driven cybersecurity division, to Arctic Wolf. Today, BlackBerry's core business is centered on the Internet of Things (IoT) and secure communications. Its QNX software is already widely used by major companies such as BMW, Toyota, Mercedes-Benz, Honda, Audi, Siemens, General Electric, Cisco, and Lockheed Martin. Additionally, Stellantis has partnered with BlackBerry QNX and AWS to develop a virtual cockpit, revolutionizing in-vehicle software engineering.

The market is starting to recognize this transformation, and the company’s profit margins have improved. The recent breakthrough of the psychological $5 threshold will likely trigger algorithms to turn long, attracting both institutional and retail investors. Another key psychological level in the coming months will be the $10 mark.

BB- road to 45$ The first rejection is major resistance , and would align with a financial crisis around Q2-Q3 of 2025 . So a significant pull back , but being a cybersecurity leader . This woul give it ‘ in my opinion ‘ a head start to start climbing again . Since , cybersecurity remains a top priority for institutions to allocate money towards .