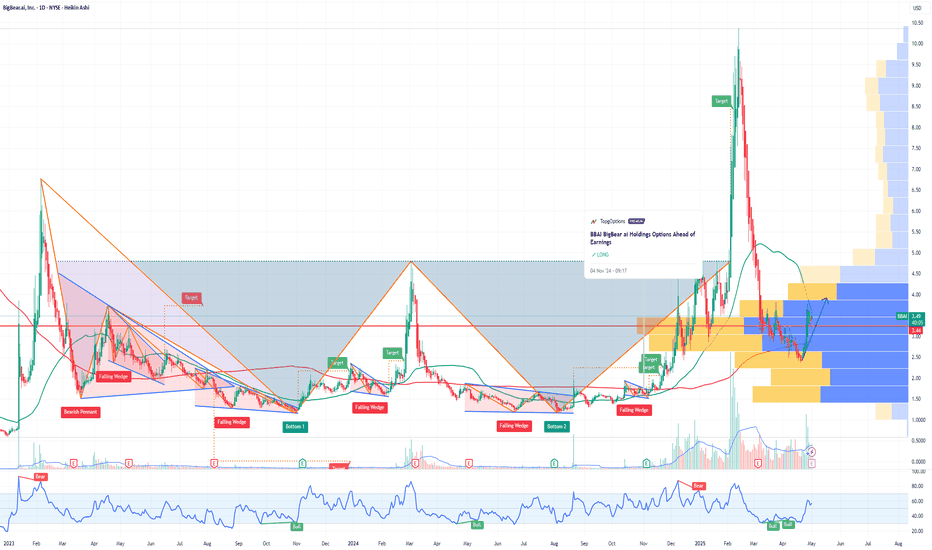

$BBAI BBAI is a high-growth, high-risk stock in the AI & defense-tech sector. The company is still unprofitable, with recent earnings showing wider-than-expected losses and cautious guidance. That said, significant volatility and key technical breakouts could present trading opportunities. It may appeal to investors looking for speculative plays tied to defense contracts and AI expansion, but it carries considerable risk.

BBAI trade ideas

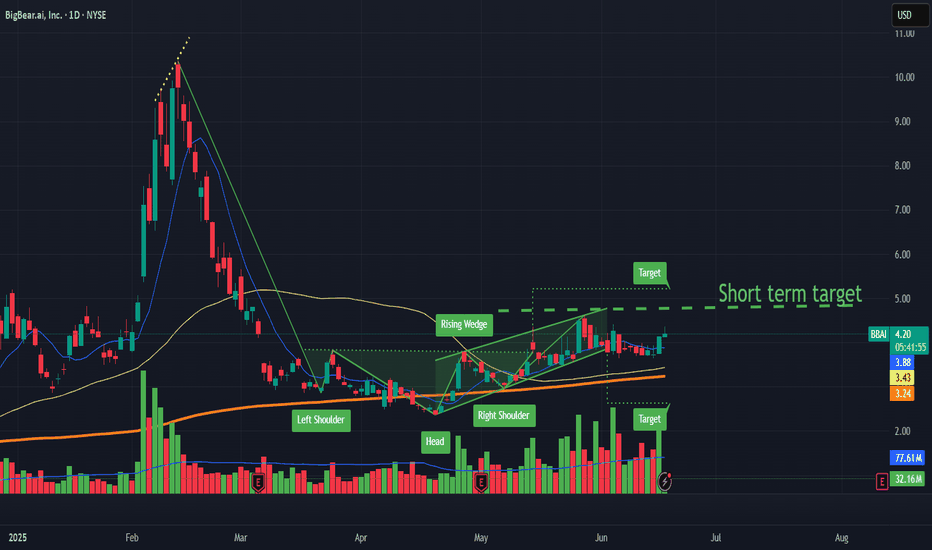

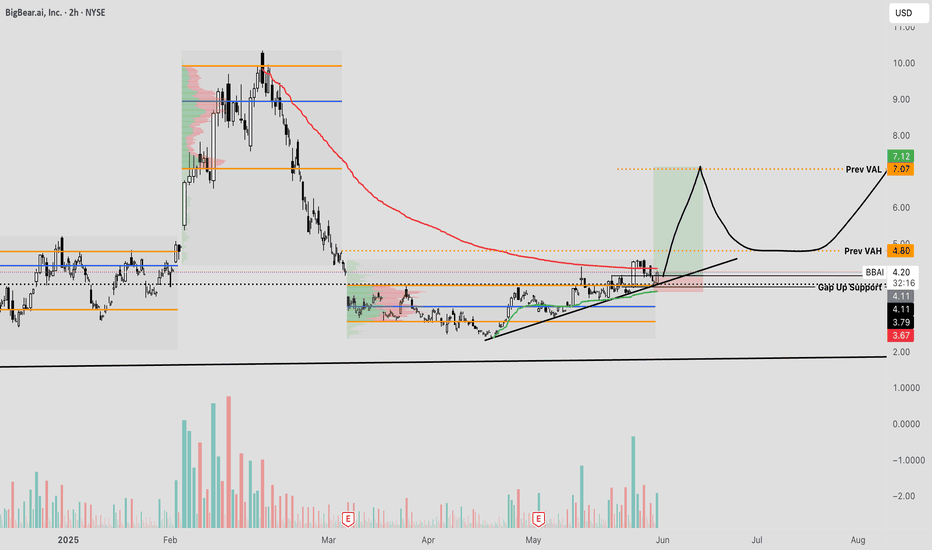

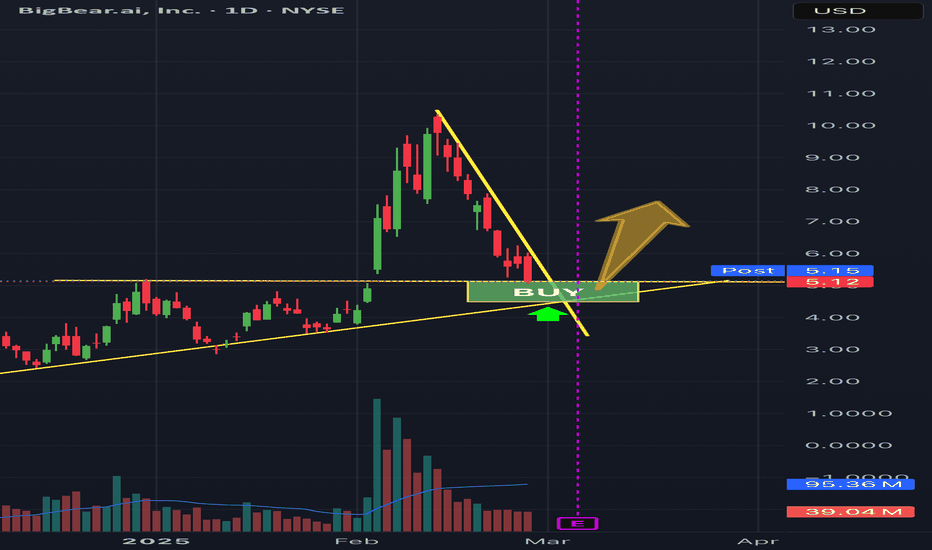

BBAI at breakout levelsBigBear.ai, Inc. (BBAI) is showing strong potential for a breakout based on the technical analysis presented in the stock chart. With the stock currently trading above the neckline—a key indicator of upward momentum. Additionally, the Rising Wedge pattern further supports the breakout scenario, as the stock has moved past resistance levels and is approaching the target price areas.

The recent increase in trading volume is another positive sign, as higher volume often accompanies strong price movements. The stock's price has also crossed above key moving averages, reinforcing the bullish trend. Investors should keep an eye on BBAI as it continues to gain traction in the market.

Recent Press Release

BigBear.ai recently announced a collaboration with Hardy Dynamics to advance AI orchestration for U.S. Army drone swarm operations under Project Linchpin. This partnership highlights the company's growing influence in defense applications and AI-driven solutions. Additionally, BigBear.ai reported its first-quarter 2025 financial results, affirming its outlook for the year. The company is also set to participate in the BASC Panama 2025 Forum, where it will discuss the future of secure trade and logistics.

These developments, combined with the bullish technical indicators, suggest that BigBear.ai is well-positioned for a breakout. Investors should monitor upcoming news and price movements closely.

Short term target is 4.8$

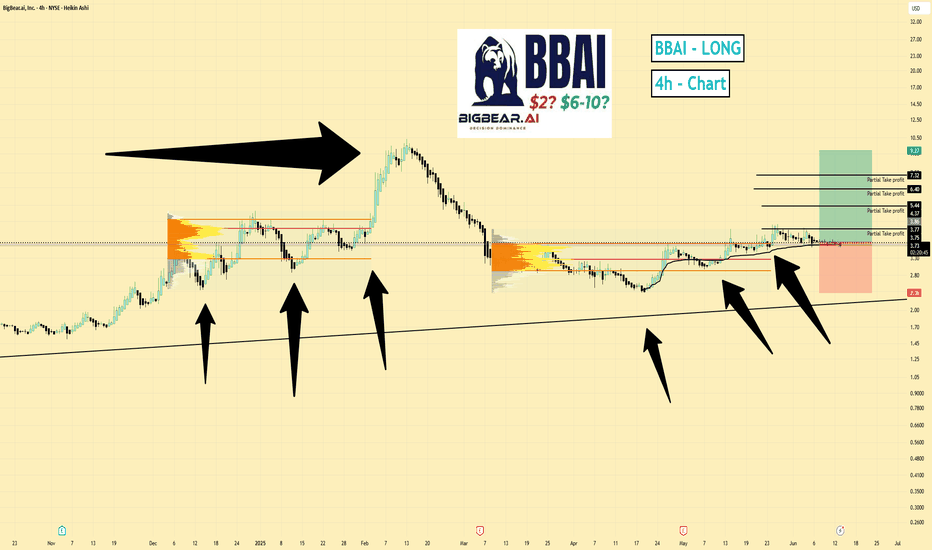

Title: BBI | Long | Post-Earnings Recovery | (June 2025)BBI | Long | Post-Earnings Recovery & Channel Support | (June 2025)

1️⃣ Short Insight Summary:

BBI is setting up for a potential bounce after recent earnings and a retracement into key support. Despite weak fundamentals, technicals show a possible move up if the support holds.

2️⃣ Trade Parameters:

Bias: LongEntry: Around $2.50 (current support level)Stop Loss: $2.36 (just below value area low)TP1: $4.37TP2: $5.44TP3: $6.47Final TP: $7.32

3️⃣ Key Notes:

BBI has had a tough fundamental track record, with overall financials declining since 2012 despite being founded in 2020. However, it experienced a recent price pump and is now pulling back into a strong technical support zone within an ascending channel.

Revenue is forecasted to grow slightly over the coming years, and the estimated Q2 earnings show a $401M revenue figure with $300M net income. Market cap sits at $1B with a 280M float. Volatility remains high, but that also offers opportunity.

✅ Watch for price action confirmation around the $2.50 level to validate a bounce setup.

4️⃣ Optional Follow-up Note:

I’ll continue tracking this trade and post updates as the setup develops, especially near the first and second take profit levels.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not a financial advise. Always conduct your own research. This content may include enhancements made using AI.

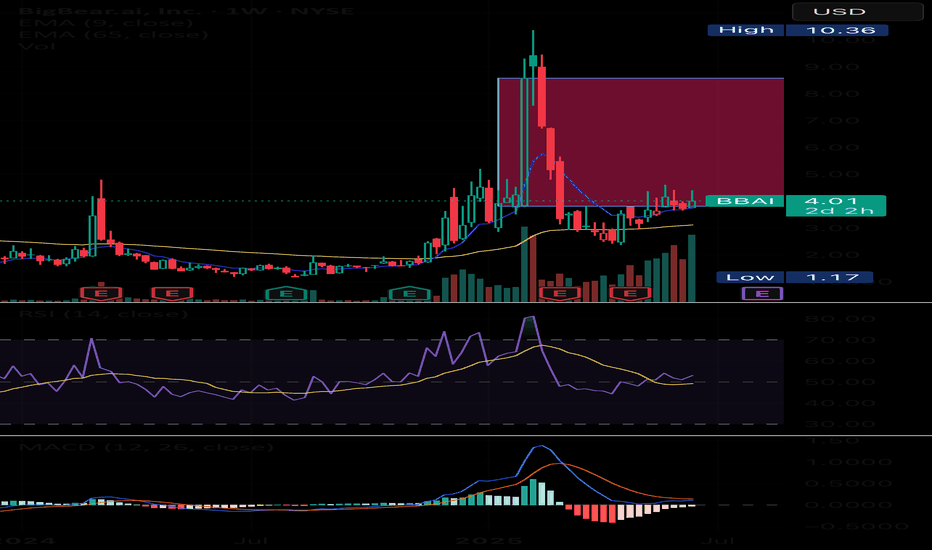

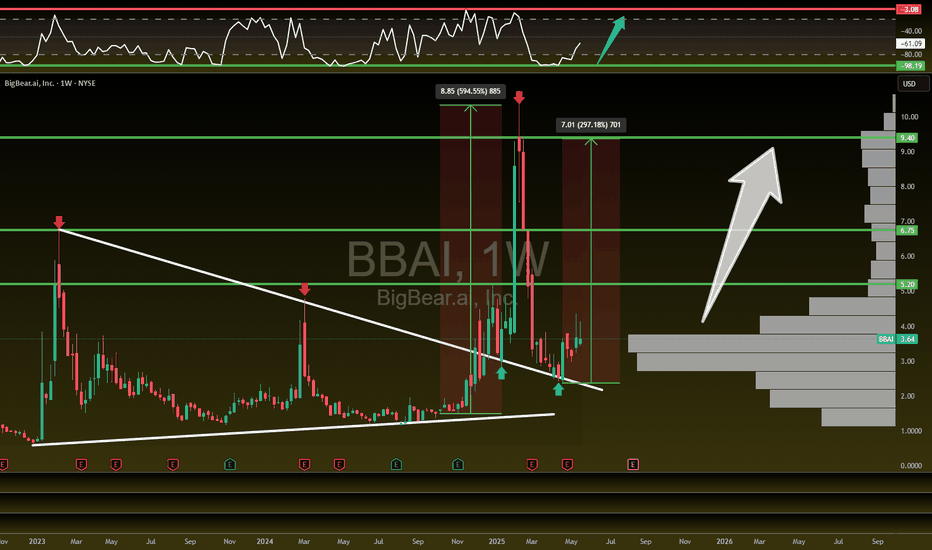

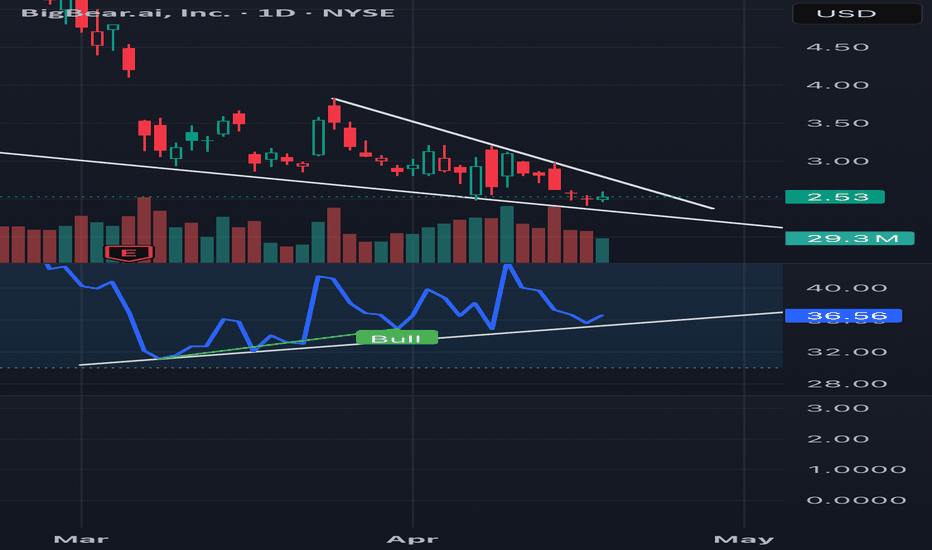

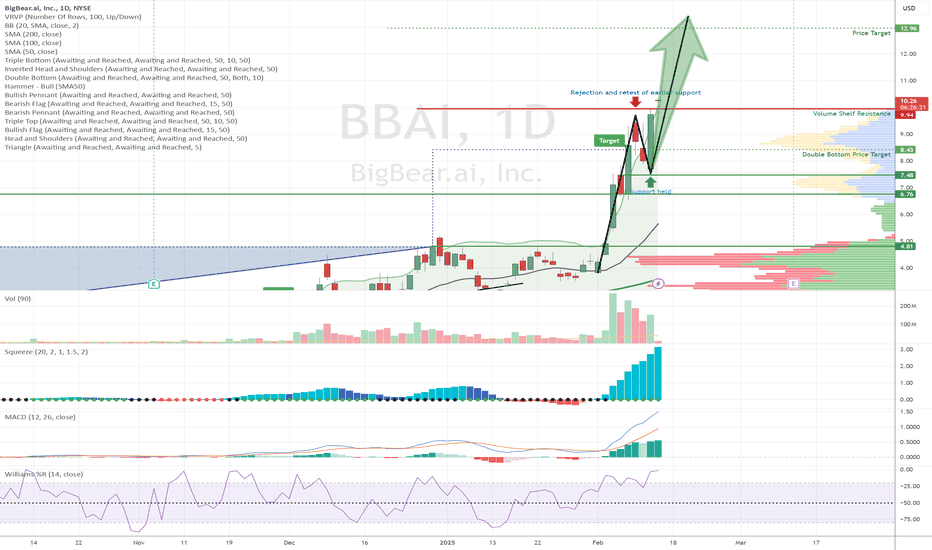

Long $BBAI, AVWAP pinchThe AVWAP pinch from the February high and the April low is getting very tight, suggesting a breakout of the range coming soon. Above the $4.5-$5 range, the volume profile shows price has spent very little time in the last 6ish months, suggesting price could move swiftly to $9 if we can hurdle over $5. The MACD, RSI and Stoch RSI are all lining up to suggest that this coiling action is more likely to break to the upside. With AI stocks hot and reigniting, I am long here

BBAI Round 2Big Bear AI is a military based AI company aimed at increasing productivity and efficiency for military endeavours in the USA.

Although this company is currently un-profitiable, it does seem to be providing a nice technical setup for a potential squeeze here after a previous breakout of the lower range volume profile.

I would like to take a long trade here as we break $4.20 and pump it up to approx $7.

Stoploss set to 3.70 in case this is a failed rally.

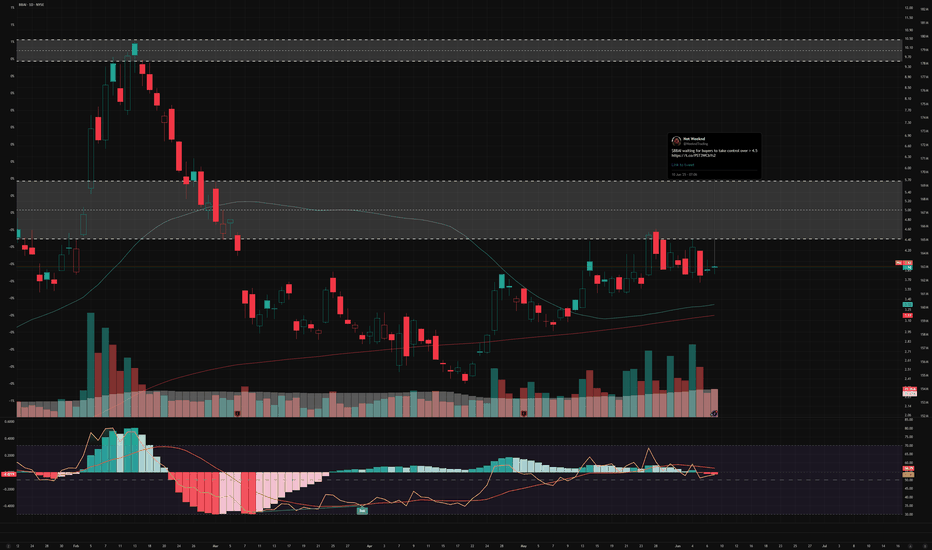

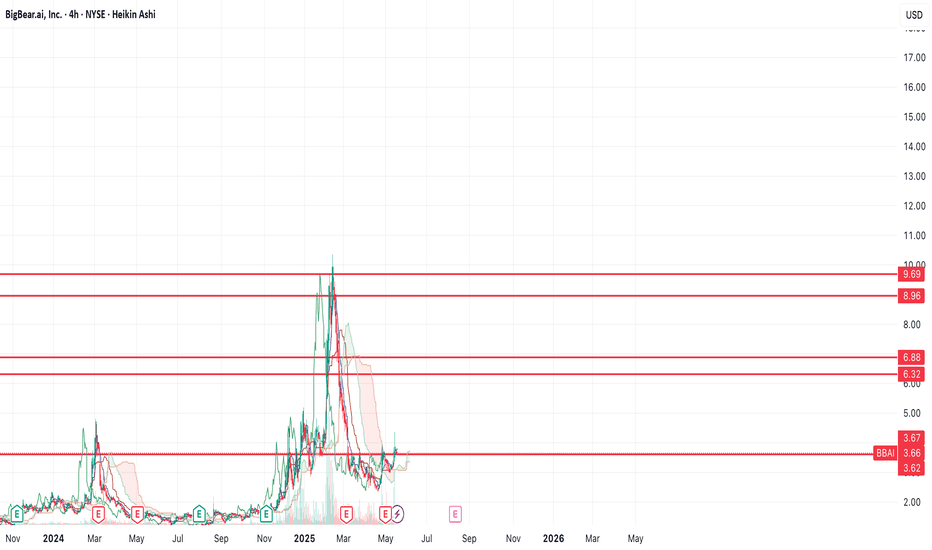

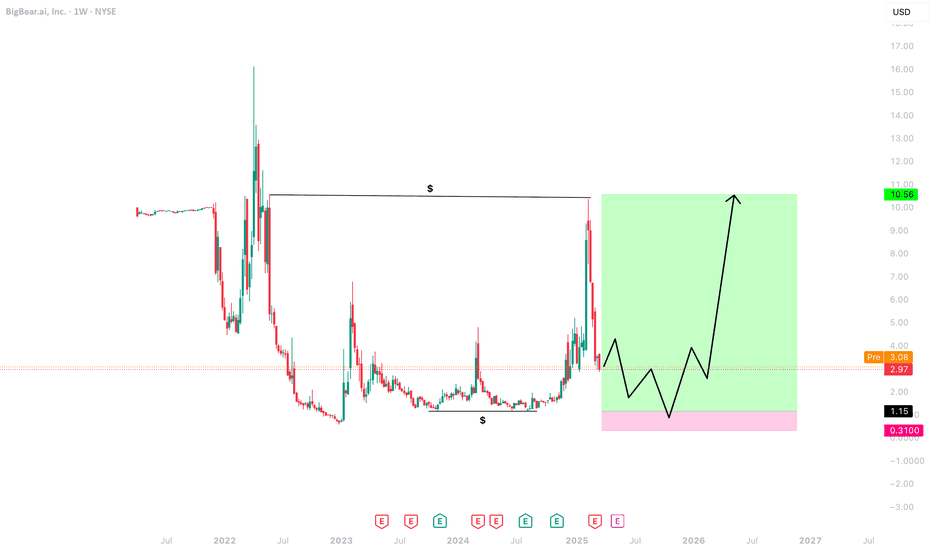

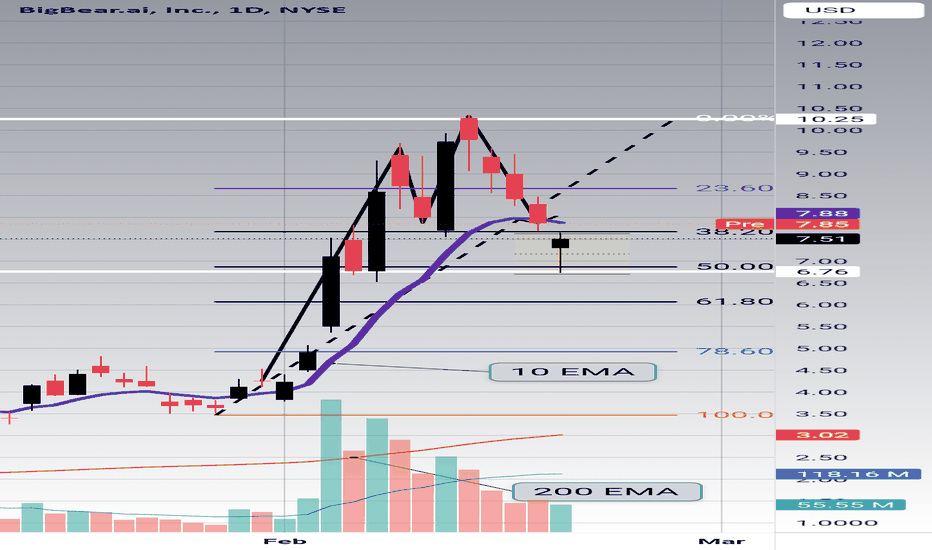

$BBAI upside targets $8-10?NYSE:BBAI looks set to run higher here. As you can see, we've broken out of the bottoming formation and have now retested support.

As long as we're able to stay above support, we should see a large move higher up to the two resistance levels.

Let's see how high we end up going. Think it's very likely that we end up going to the top of the range.

OptionsMastery: A potential swing on BBAI!🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

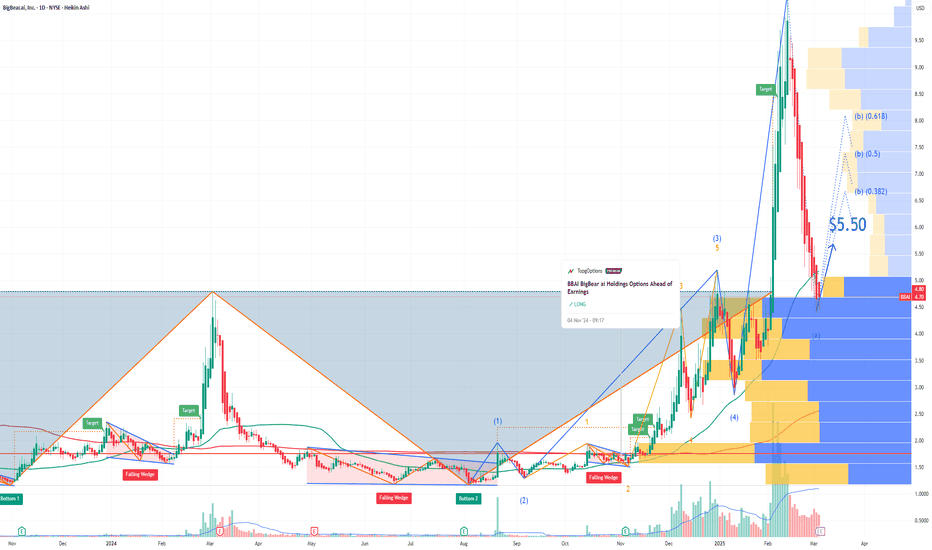

BBAI BigBear ai Holdings Options Ahead of EarningsIf you haven`t bought BBAI before the massive rally:

Now analyzing the options chain and the chart patterns of BBAI BigBear ai Holdings prior to the earnings report this week,

I would consider purchasing the 3usd strike price Calls with

an expiration date of 2025-12-19,

for a premium of approximately $1.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

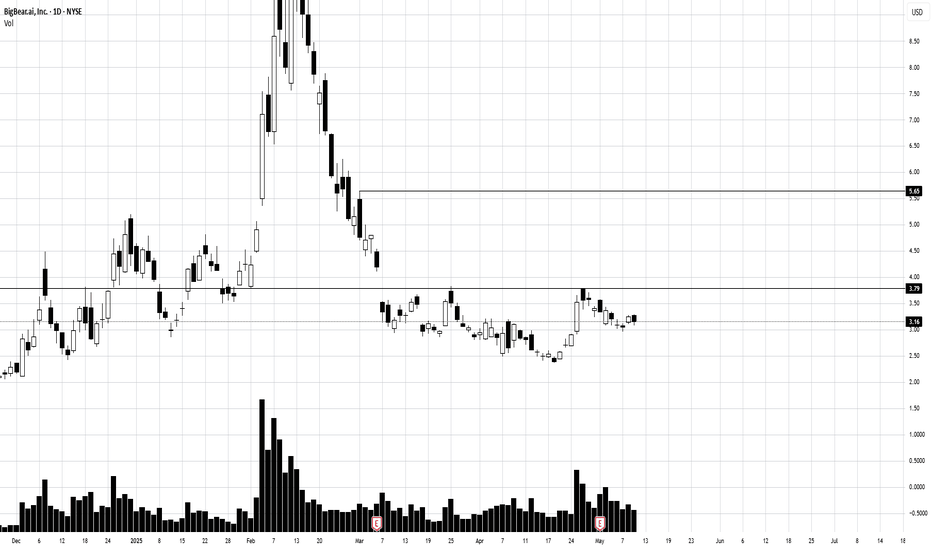

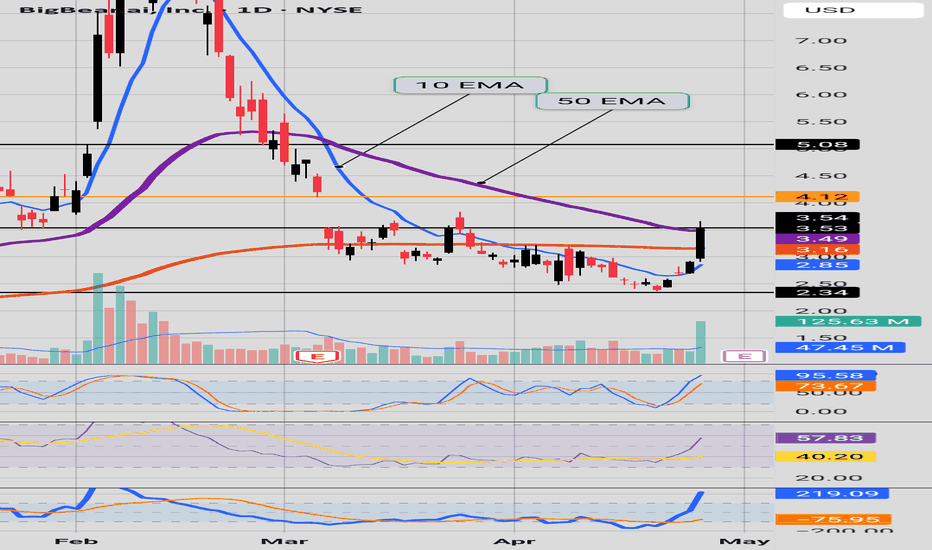

Edges of the GapPrice is testing the edges of a gap area and the 50 EMA and a key level the 3.54 price area. If we get an upward breakout price can possibly go to the 4.12 area, a bearish breakout can take price to the 10 EMA 2.85 price area; oscillators are strong CCI very overbought and Earnings this week. Please be very careful have a great day.

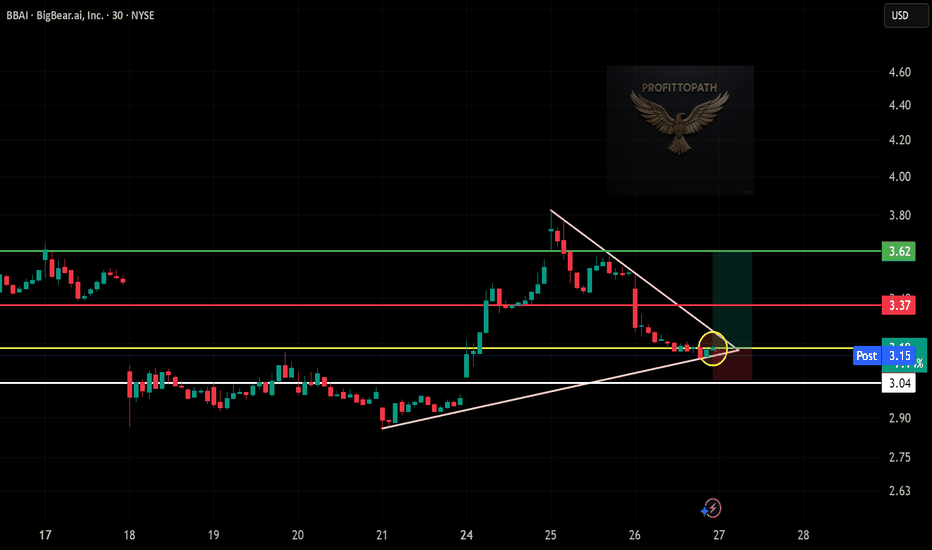

Bullish Breakout Setup BBAI!📊 B – Trendline Support + Wedge Squeeze 🚀

BBAI is forming a bullish wedge pattern with price respecting ascending support at $3.04. Momentum is compressing near the apex, hinting at a potential breakout. A clean breakout above $3.15 may trigger a strong upside move.

✅ Trade Plan (Long Position)

• Entry: Breakout confirmation above $3.15

• Stop-Loss: Below $3.04 (structure + rising trendline support)

🎯 Take Profit Targets:

• TP1: $3.37 (local resistance / breakout zone)

• TP2: $3.62 (major upside level)

• TP3: $3.80+ (extended potential zone)

📈 Risk-Reward Breakdown

• Risk: $3.15 - $3.04 = $0.11

• Reward to TP1: $0.22 → ~1:2

• Reward to TP2: $0.47 → ~1:4.3

• Reward to TP3: $0.65 → ~1:5.9

💡 High reward potential for a small, well-defined risk.

🔍 Technical Breakdown

✅ Falling Wedge Pattern: Classic bullish reversal setup

✅ Support Holding: Price bouncing from rising trendline

✅ Momentum Shift: Compression near apex = breakout potential

✅ Volume Watch: Awaiting surge on breakout for confirmation

🧠 Strategy & Risk Management

• Wait for a 30-min candle close above $3.15

• Move SL to breakeven after hitting TP1 at $3.37

• Book partial profits and trail stop toward TP2 & TP3

• Manage position with discipline, not emotions

📚 Trader Insight:

This pattern reflects accumulation at support following a short-term pullback. When price coils with higher lows and squeezes into a breakout zone, it creates a prime opportunity for momentum traders who understand structure and timing.

⚠️ Risk Checklist

❌ Weak volume = false breakout risk

❌ Loss of $3.04 = setup invalid

✅ Be patient. Let confirmation lead the entry.

🎯 Final Thoughts

Clean structure, solid trendline support, and a textbook bullish wedge. If it confirms, this trade could offer multiple reward levels with minimal risk. 💥

🔗 #BBAI #ProfittoPath #TradingView #BreakoutSetup #BullishChart #MomentumStocks #SmartTrading #StockEducation #TechnicalAnalysis 💰📊

BBAI BigBear ai Holdings Options Ahead of EarningsIf you haven`t bought BBAI before the massive rally:

Now analyzing the options chain and the chart patterns of BBAI BigBear ai Holdings prior to the earnings report this week,

I would consider purchasing the 5.50usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $1.10.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

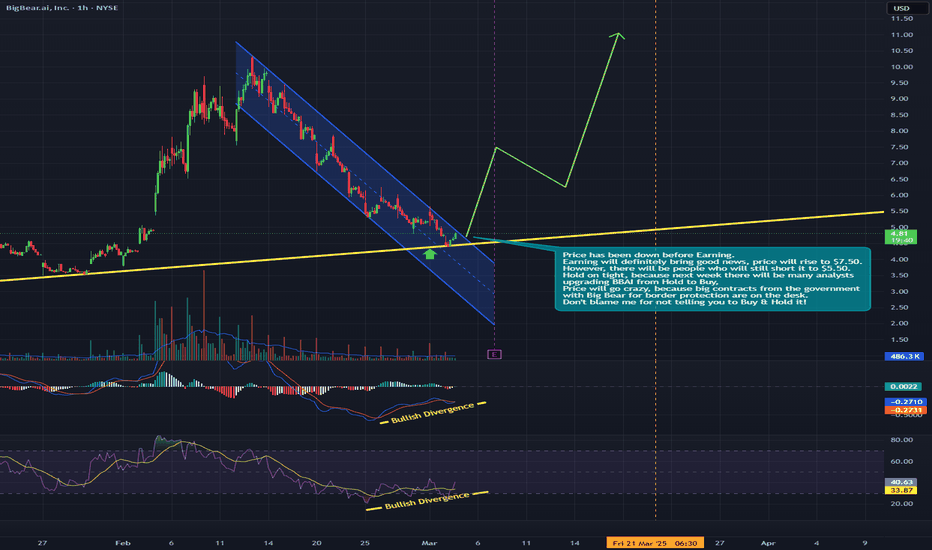

A ton of good news in Earning Call - Bull Rally is comingPrice has been down before Earning.

Earning will definitely bring good news, price will rise to $7.50.

However, there will be people who will still short it to $5.50.

Hold on tight, because next week there will be many analysts

upgrading BBAI from Hold to Buy,

Price will go crazy, because big contracts from the government

with Big Bear for border protection are on the desk.

Don't blame me for not telling you to Buy & Hold it!

Disclaimer

BBAI – 30-Min Long Trade Setup!📌

🔹 Asset: BigBear.ai, Inc. (BBAI)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Falling Wedge Breakout Long Trade

📌 Trade Plan (Long Position)

✅ Entry Zone: Above $6.07 (Breakout Confirmation)

✅ Stop-Loss (SL): Below $5.28 (Break of Support & Trendline)

🎯 Take Profit Targets

📌 TP1: $6.92 (First Resistance Level)

📌 TP2: $8.00 (Final Target – Extended Bullish Move)

📊 Risk-Reward Ratio Calculation

📈 Risk (SL Distance): $6.07 - $5.28 = $0.79 risk per share

📈 Reward to TP1: $6.92 - $6.07 = $0.85 (1.08 R/R)

📈 Reward to TP2: $8.00 - $6.07 = $1.93 (2.44 R/R)

🔍 Technical Analysis & Strategy

📌 Falling Wedge Breakout Setup: BBAI has been consolidating in a downward-sloping wedge, with a breakout expected at $6.07.

📌 Trendline & Support Bounce: The price is attempting to break out of the wedge, indicating buyer accumulation.

📌 Breakout Confirmation: A strong bullish candle above $6.07 with increasing volume would confirm momentum.

📌 Momentum Shift Expected: If price holds above $6.07, a rally toward $6.92 (TP1) and $8.00 (TP2) is likely.

📊 Key Support & Resistance Levels

🟢 $5.28 – Strong Support / Stop-Loss Level

🟡 $6.07 – Entry / Breakout Level

🔴 $6.92 – First Resistance / TP1

🟢 $8.00 – Final Target / TP2

🚀 Trade Execution & Risk Management

📊 Volume Confirmation: Ensure strong buying volume above $6.07 before entering.

📈 Trailing Stop Strategy: Move SL to entry ($6.07) after TP1 ($6.92) is hit.

💰 Partial Profit Booking Strategy:

✔ Take 50% profits at $6.92, let the rest run to $8.00.

✔ Adjust Stop-Loss to Break-even ($6.07) after TP1 is reached.

⚠️ Fake Breakout Risk

❌ If price fails to hold above $6.07 and breaks back down, it could indicate a false breakout—exit early.

❌ Wait for a strong candle close above $6.07 for confirmation before entering aggressively.

🚀 Final Thoughts

✔ Bullish Setup – Holding above $6.07 could lead to higher targets.

✔ Momentum Shift Possible – Watch for volume confirmation.

✔ Favorable Risk-Reward Ratio – 1:1.08 to TP1, 1:2.44 to TP2.

💡 Stick to the plan, manage risk, and trade smart! 🚀🏆

🔗 #StockTrading #BBAI #BigBearAI #BreakoutTrade #TechnicalAnalysis #MarketTrends #ProfittoPath #DayTrading #MomentumStocks #SwingTrading #TradingView #LongTrade #TradeSmart #RiskManagement #StockBreakout #Investing #StockAlerts #ChartAnalysis 🚀📈

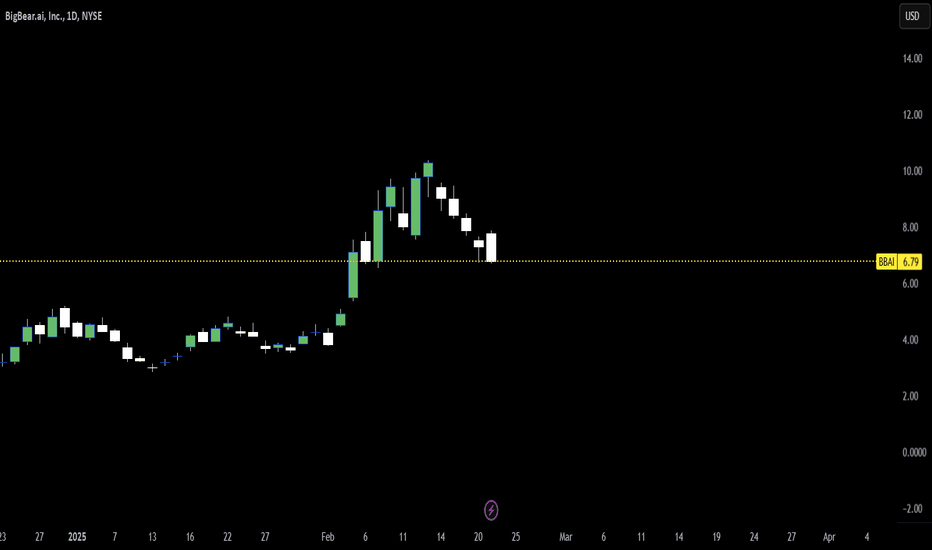

$BBAI back on track to break the $10.00 resistanceAfter the crash in sync with PTLR yesterday due to Trump's Defense spending cuts. If you don't cut losses, and still hold tight, even DCA to load more share below $8.00, especially the $6.80 - $7.00 area. Congratulations! Profits are in sight.

Most of the popular indicator is

Option trading ideas:

Buy Call $10, exp 3/21

Buy Call $11 and $12, exp 4/17

Most popular indicators are supporting this bullish momentum. BUT!!! Watch out for profit-taking pressure near the upcoming ER 3/6. BBAI's valuation is already too high compared to its projected earnings, so be careful!

Disclaimer

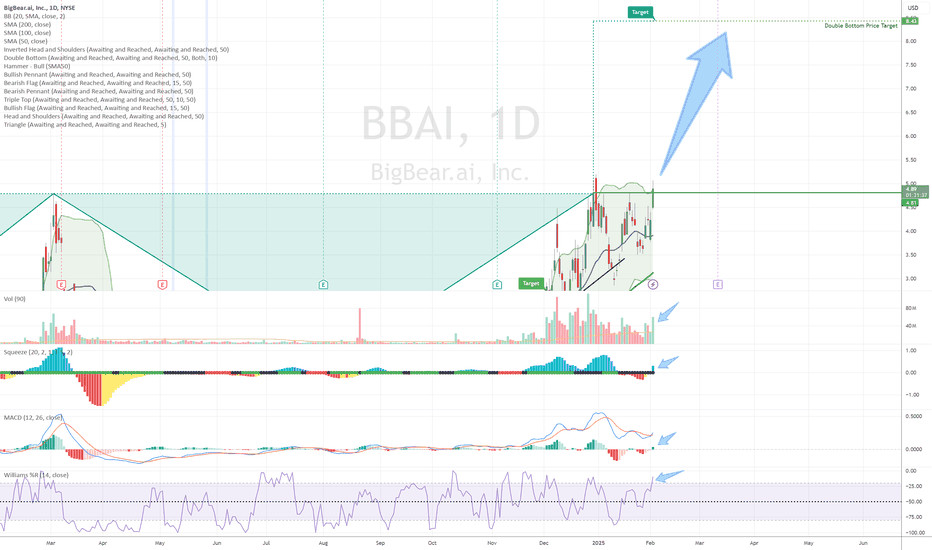

$NYSE:BBAI 72% Upside - Breaking double bottom resistanceLooks like NYSE:BBAI is finally breaching the double bottom resistance line.

Volume is respectable, relatively higher.

Squeeze is starting to expand

MACD and Williams %R are also flowing in the right direction.

Entry point - anything after the stock closes above $4.81

Initial Price target is ~$8

72% Upside