BBAI trade ideas

Can AI Weather the Storm of Volatility?BigBear.ai has captured the market's attention with its dramatic stock performance, navigating through a sea of volatility with recent gains fueled by significant contract wins and positive AI sector developments. The company's journey reflects a broader narrative in the tech industry: the high stakes of betting on AI innovation. With its stock soaring over 378% in the last year, BigBear.ai demonstrates the potential for rapid growth in an era where AI is increasingly central to strategic sectors like defense, security, and space exploration.

However, the narrative isn't without its twists. Analyst warnings about cyclical business patterns and valuation concerns introduce a layer of complexity to the investment thesis. BigBear.ai's ability to secure pivotal contracts with the U.S. Department of Defense showcases its technological prowess, yet the challenge lies in converting this into sustainable profitability. This scenario invites investors to ponder the delicate balance between innovation, market sentiment, and financial stability in the AI landscape.

The strategic acquisition of Pangiam and partnerships like the one with Virgin Orbit illustrate BigBear.ai's ambition to not only ride the wave of AI hype but also to steer it into new territories. These moves are about expanding market presence and redefining what AI can achieve in practical, real-world applications. As BigBear.ai continues to evolve, it challenges us to consider how far AI can go in reshaping industries and whether the market can keep pace with such rapid technological advancements. This saga of BigBear.ai is a microcosm of the broader AI investment landscape, urging us to look beyond immediate gains to the long-term vision and viability of AI-driven companies.

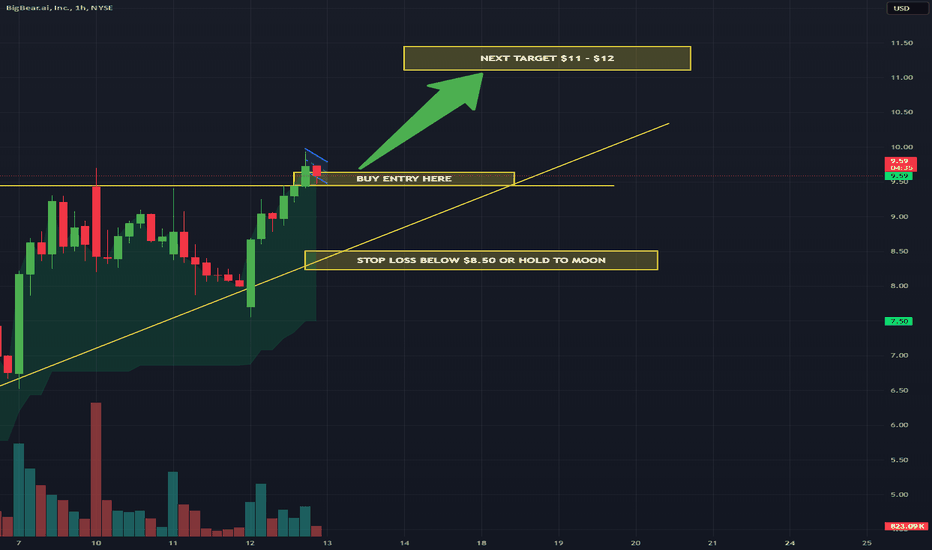

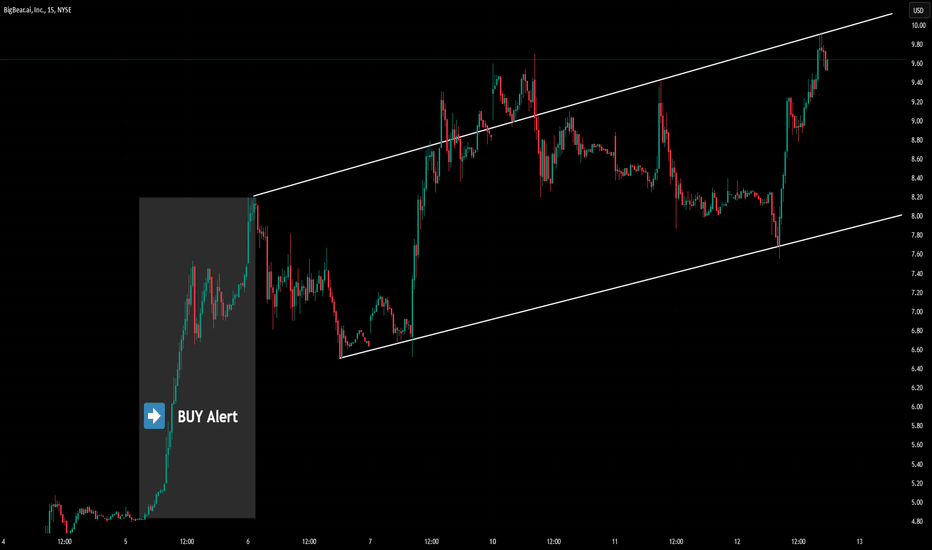

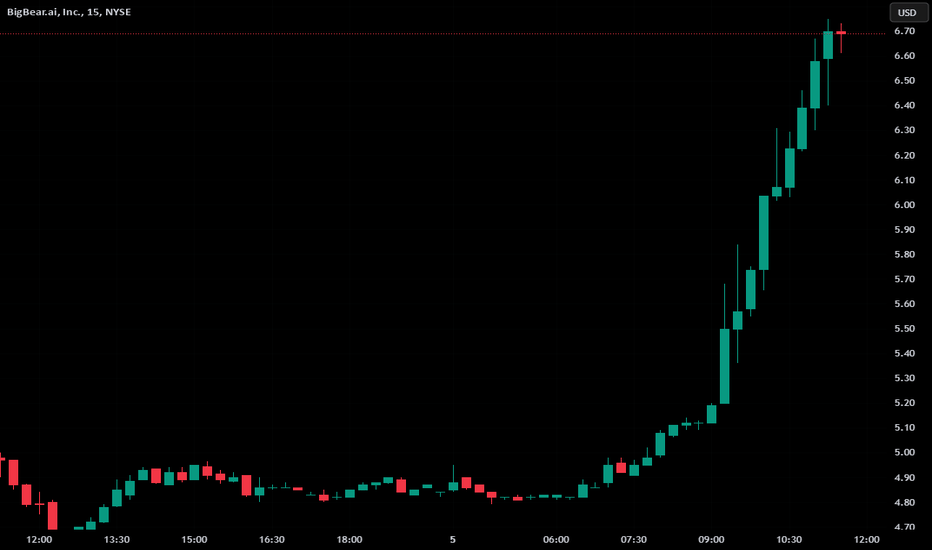

Ever seen a more beautiful uptrend than this? $BBAIEver seen a more beautiful uptrend than this 15 min gem? 💎📈

And yes I alerted to buy it

And yes still holding and riding it for as long as uptrend continues to support 🤑

Simply doesn't get any better than being in fat profit already and continuing to stay PAYtience for as long as it wants to give more into uptrend

NYSE:BBAI

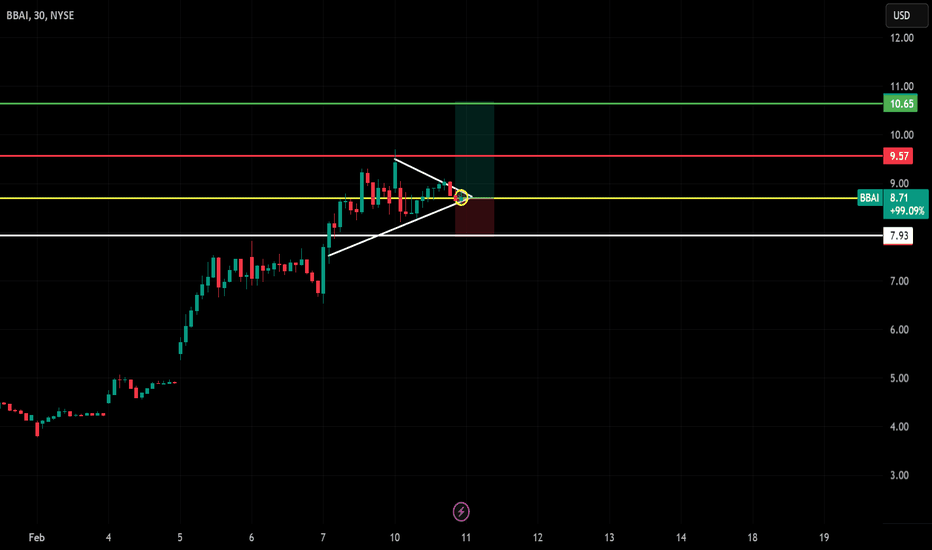

Trade Setup Breakdown for BBAI (30-Min Chart)!📊

🔹 Stock: BBAI (NYSE)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Symmetrical Triangle Breakout

🚀 Trade Plan:

✅ Entry Zone: $8.70 - $8.80 (Breakout Confirmation)

✅ Stop-Loss (SL): $7.93 (Below Key Support)

🎯 Take Profit Targets:

📌 TP1: $9.57 (First Resistance)

📌 TP2: $10.65 (Extended Target)

📊 Risk-Reward Ratio Calculation:

📉 Risk (Stop-Loss Distance):

$8.71 - $7.93 = $0.78

📈 Reward to TP1:

$9.57 - $8.71 = $0.86

💰 Risk-Reward Ratio to TP1: 1:1.10

📈 Reward to TP2:

$10.65 - $8.71 = $1.94

💰 Risk-Reward Ratio to TP2: 1:2.48

🔍 Technical Analysis & Strategy:

📌 Breakout Confirmation: Price holding above $8.80 with strong volume.

📌 Pattern Formation: Symmetrical Triangle Breakout, signaling potential continuation.

📊 Key Support & Resistance Levels:

🟢 $7.93 (Support / SL Level)

🟢 $8.71 (Breakout Zone)

🟢 $9.57 (First Profit Target / Resistance)

🟢 $10.65 (Final Target for Momentum Extension)

🚀 Momentum Shift Expected:

If the price holds above $8.80, an upside rally towards $9.57 and $10.65 is likely.

🔥 Trade Execution & Risk Management:

📊 Volume Confirmation: Ensure strong buying volume above $8.80 before entering.

📈 Trailing Stop Strategy: If the price reaches TP1 ($9.57), move SL to $8.80 to protect profits.

💰 Partial Profit Booking Strategy:

✔ Take 50% at $9.57, let the rest run to $10.65.

✔ Adjust Stop-Loss to Break-even ($8.80) after TP1 is hit.

⚠️ Fake Breakout Risk:

If the price fails to hold above $8.70, be cautious and avoid entering early.

🚀 Final Thoughts:

✔ Bullish Breakout Setup – If price sustains above $8.80, a strong move is expected.

✔ Momentum Shift Possible – Volume increase will confirm the trend.

✔ Favorable Risk-Reward Ratio – 1:1.10 to TP1, 1:2.48 to TP2.

💡 Stick to the trade plan, manage risk, and trade smart! 🚀🏆

🔗 #StockMarket #BBAI #TradingSetup #TechnicalAnalysis #BreakoutTrade #DayTrading #MarketTrends #ProfittoPath

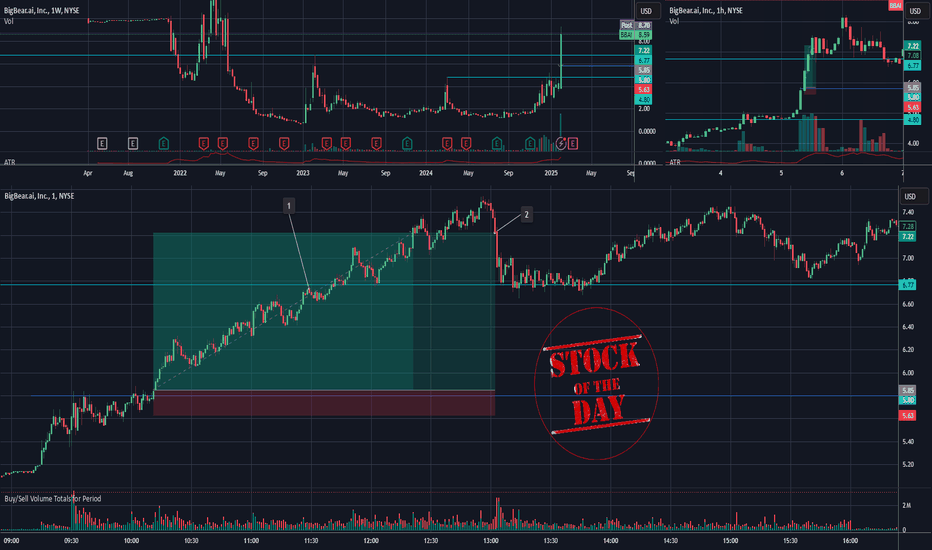

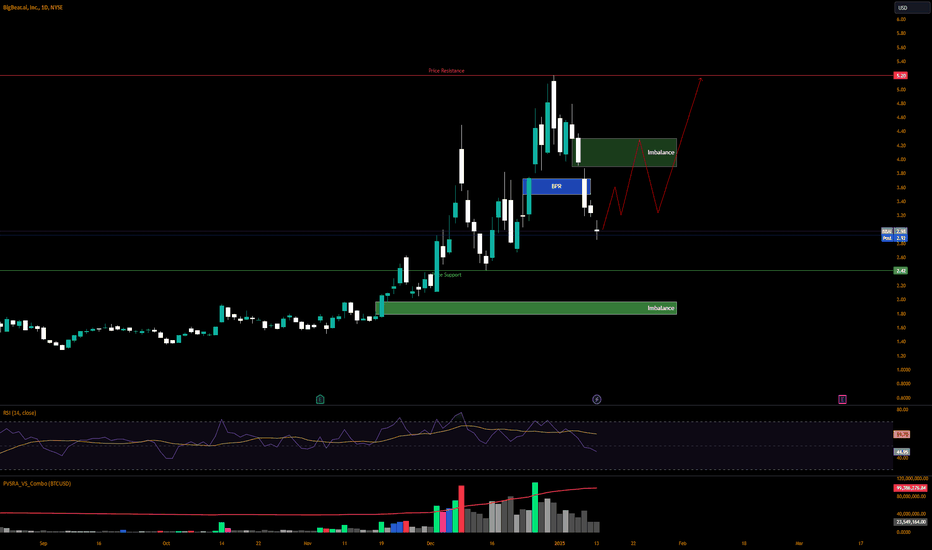

Stock Of The Day / 02.05.25 / BBAI02.05.2025 / NYSE:BBAI #BBAI

Fundamentals. The company signed a contract with the Department of Defense's chief digital and artificial intelligence office to develop an AI solution.

Technical analysis.

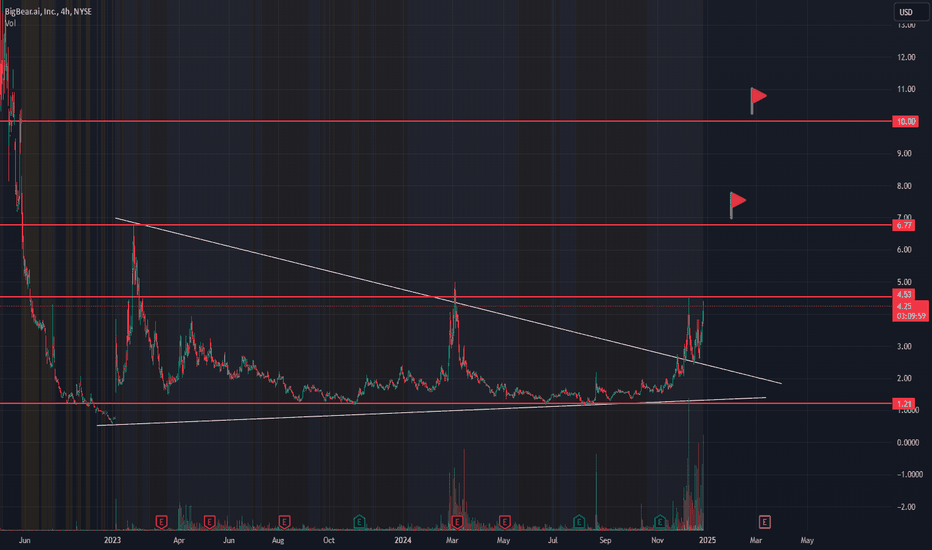

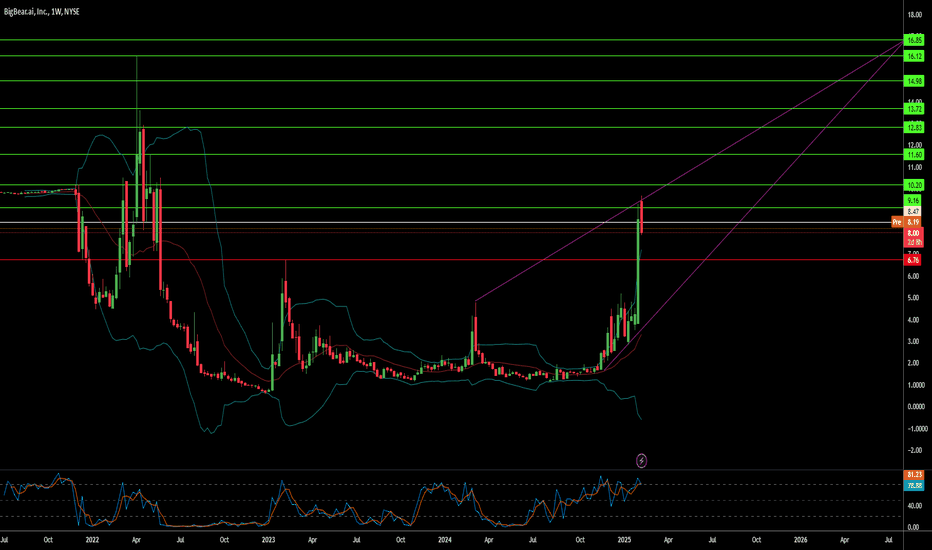

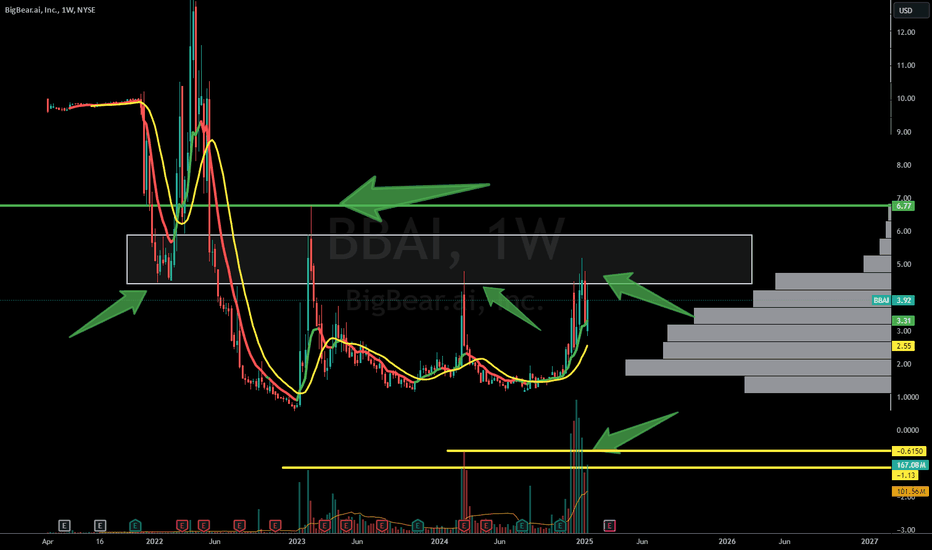

Daily chart: Uptrend. Exit from two-month accumulation. Level 6.77 formed by the trend break in February 2023 is ahead. The screenshot shows a more informative weekly chart.

Premarket: Gap Up on increased volume.

Trading session: The primary impulse from the opening was stopped at 5.80, after that the price began to tighten to this level, forming pullbacks, each subsequent one smaller than the previous one. We are considering a long trade when the 5.80 level is broken.

Trading scenario: #breakout (#tightening) of the 5.80 level

Entry: 5.85 aggressive entry into the breakout.

Stop: 5.63 we hide it behind the last pullback.

Exit: Close part of the position before the daily level of 6.77. Close the rest around 7.22 when the candle closed below the trend line.

Risk Rewards: 1/5

P.S. In order to understand the idea behind the Stock Of The Day analysis, read the following information .

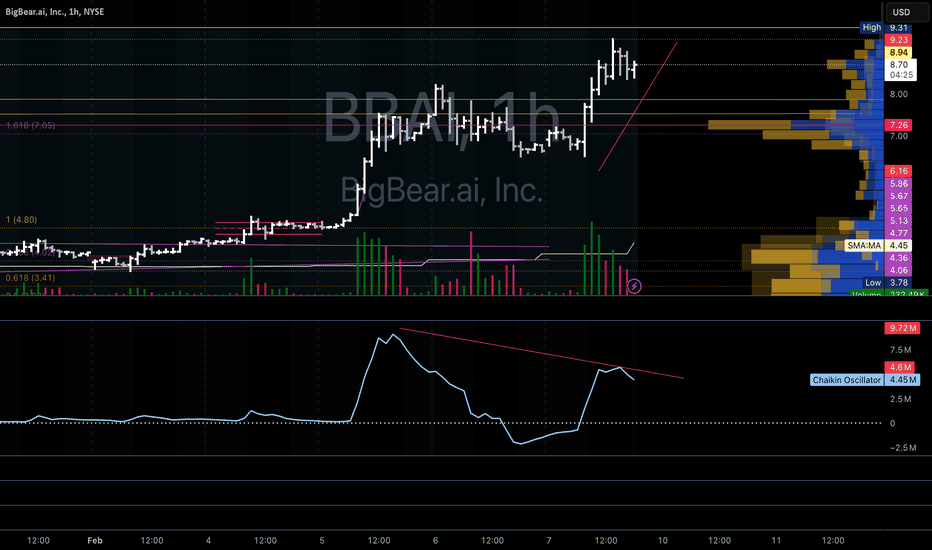

BBAI - Great Breakout, over 600% gain. Now its time for Puts!I would not short this with shares! Positive news about new or existing contracts and it will go towards 10$. Puts are safe with low cost and defined risk. They should give 600-1000% over the next week or two. More if the market tanks or PLTR dropping could take this with it as they move together somewhat. I always hedge and the Puts are paid for with some of the profits from calls and shares so no real money risk.

This is not advice, sharing what I am doing is not a recommendation. Always use risk management.

Good luck if you play.

BANGER $5 to $8+ on steadiest uptrend of 2025 so far!BANGER $5 to $8+ on steadiest uptrend of 2025 so far! 📈

Buy & Hold 💬

Told you about it in chat while it was still in $6's

Doesn't get any easier than this, just waiting for the money to pile as it keeps uptrending NYSE:BBAI

Everyone that listened got paid, it was the only stock bought and held yesterdy 1/1 for a fat win.

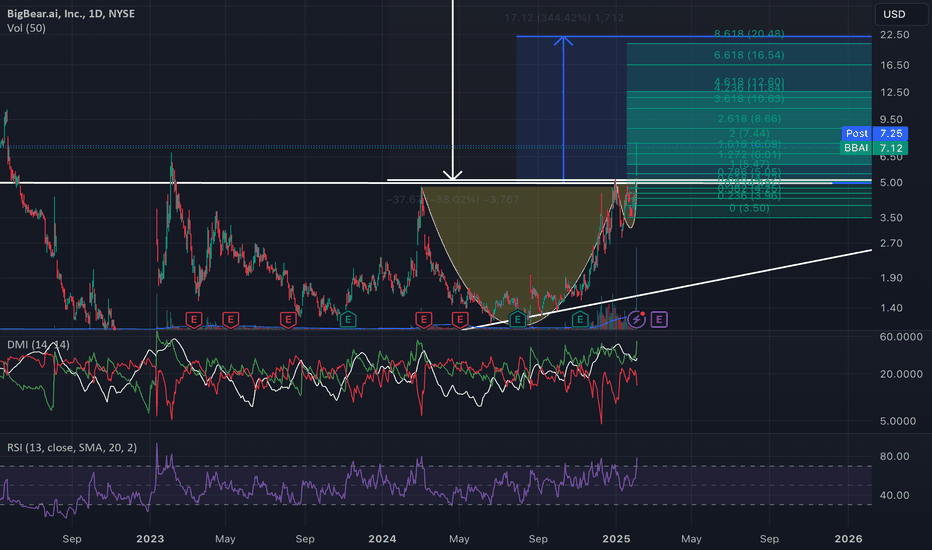

BBAI Breaksout!Brought onto my radar only yesterday, BBAI broke out appears to be on track for some huge bullish potential following three bullish patterns. The one that most interests me is the Cup and Handle pattern setting up for a target of $22. The market tends to like whole numbers for buying and selling so lets go with $20 here. Large timeframes suggest that target could be far exceed that value and supports a long term buy and hold on this one.

BBAI: The Next Big AI StockThe AI industry has captured alot of interest from many investors and traders alike. After the most recent massive rally on Sounhound , for a whopping 400% , we may potentially see a rotation into other AI players such as Big Bear.

BigBear.ai is a technology and analytics company specializing in artificial intelligence (AI) solutions for decision support and predictive analytics. The company focuses on providing AI-driven tools and insights to support data-driven decision-making, particularly in complex and high-stakes environments.

BigBear.ai serves industries such as defense, healthcare, manufacturing, and logistics, offering services that include:

Predictive Analytics: Helping organizations anticipate future scenarios by analyzing patterns and trends.

Data Integration: Combining data from multiple sources for a unified and actionable perspective.

AI-Driven Decision Support: Leveraging machine learning and advanced algorithms to guide strategic planning.

Simulation and Modeling: Creating virtual scenarios to test outcomes and optimize decision-making.

The company's solutions are designed to enhance operational efficiency, improve situational awareness, and enable smarter, faster decisions.

At the moment, we have several indicators pointing to potentially higher prices including the anchored vwap of the low, as well as a value area breakout and massive triangle breakout.

Lets see how it plays out

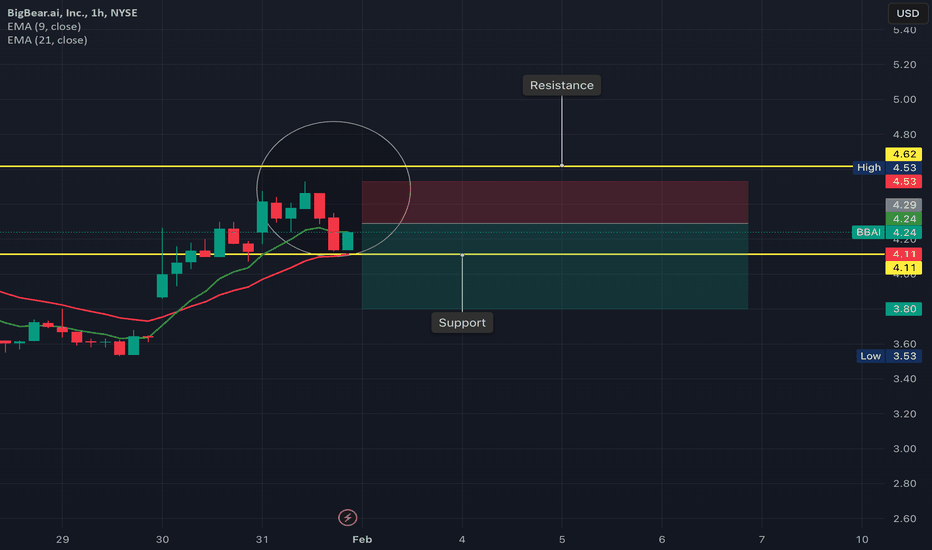

Bearish Outlook on BBAI – EMA Cross Signals ReversalStory Behind the Chart:

I’m taking a bearish position on BigBear.ai (BBAI), based on the technical signals visible on the chart. The recent price action suggests a potential downward movement due to the following reasons:

Bearish EMA Cross:

The EMA 9 (green) has crossed below the EMA 21 (red), signaling a shift in short-term momentum to the downside. This is a classic bearish signal, especially when combined with resistance levels.

Rejection at Resistance:

The price faced rejection near the €4.62 resistance level, indicating strong selling pressure. The presence of a bearish engulfing candle adds further confirmation to this resistance.

Support and Resistance Levels:

Resistance: €4.62, a critical level where sellers have dominated, is the top of the zone that limits further upside.

Support: €4.11 is the key level I’ll monitor. A breakdown below this could accelerate bearish momentum toward my take-profit target.

Take-Profit Target:

My target is set at €3.80, aligning with the next major support zone and matching the downward momentum expectations.

Position Details:

Entry Price: €4.29.

Stop-Loss: €4.54 (above resistance to manage risk).

Take-Profit Target: €3.80.

Risk-to-Reward Ratio: 1:2 (Risk €0.25 per share, Reward €0.49 per share).

Risk Management:

Risk per Share: €0.25 (Stop-loss at €4.54).

Reward per Share: €0.49 (Take-profit at €3.80).

Position Size: 400 shares (with a €10,000 capital allocation).

Maximum Risk: €100 (1% of capital).

Potential Reward: €196 (2% of capital).

Why I Believe It Will Go Down:

Technical Indicators: The bearish EMA crossover is a reliable signal that aligns with the rejection from resistance.

Market Context: Current news, while positive for the long term, has already been priced in. The price shows exhaustion at higher levels, creating an opportunity for a pullback.

Price Action: The bearish engulfing pattern, coupled with rejection at €4.62, confirms that sellers are gaining control.

My Expectations:

If the price breaks below €4.11, it could accelerate toward the €3.80 target.

However, if the price moves above €4.54, my stop-loss will limit losses, ensuring disciplined risk management.

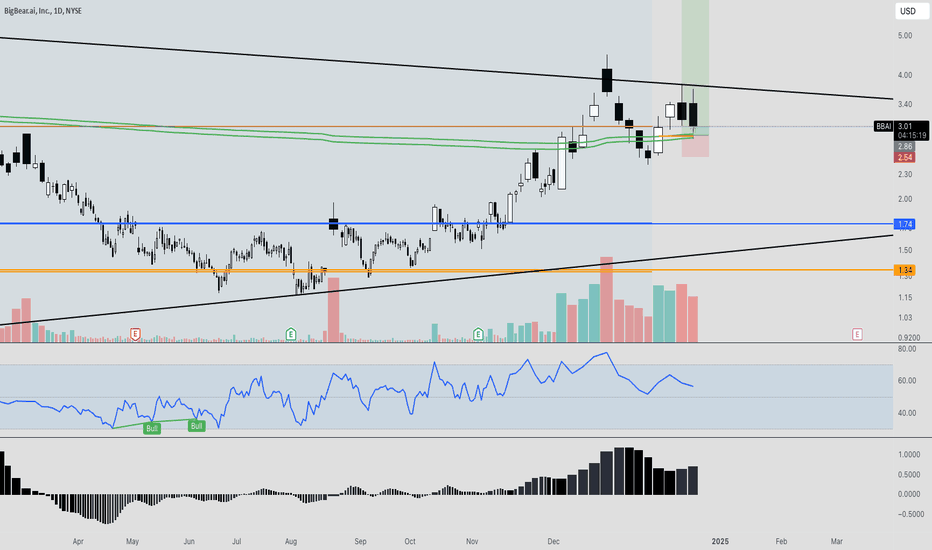

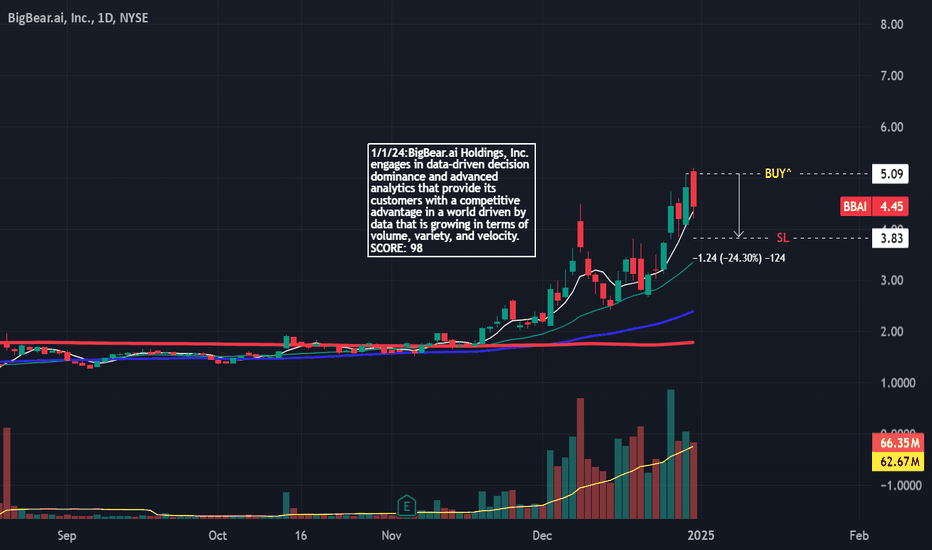

$BBAI Strong technical position.As of February 1, 2025, BigBear.ai Holdings Inc. (NYSE: BBAI) is trading at $4.24, with an intraday high of $4.53 and a low of $4.09.

Technical Analysis:

Over the past six months, BBAI has surged nearly 170%, driven by the growing interest in artificial intelligence. Technical indicators suggest further potential upside, with strong chart patterns and bullish moving averages.

The stock's technical rating is 9 out of 10, indicating a

Fundamental Analysis:

BigBear.ai provides AI-powered decision intelligence solutions across various sectors, including national security and supply chain management. The company has secured significant contracts, such as a $17.9 million extension with the U.S. Army.

Analysts have a median price target of $4.50 for BBAI, with a low estimate of $3.00 and a high estimate of $7.00, suggesting potential upside from the current price.

Recommendation:

Given the strong technical indicators and positive fundamental developments, BBAI presents a compelling investment opportunity. Investors should monitor the stock's performance and consider their risk tolerance before making investment decisions.

BBAI Trade Setup – Key Levels !📊

SL (Stop-Loss): $3.95 🔴

Entry: $4.33 🟡

T1 (Target 1): $4.79 🟢

T2 (Target 2): $5.26 🟢

👉 Wait for a breakout confirmation with strong momentum and manage risk effectively! 💹

#BBAI #StockTrading #TechnicalAnalysis #BreakoutTrade #SupportAndResistance #TradingStrategy #StockMarket #SwingTrading #ChartPatterns #DayTrading #RiskManagement #MarketAnalysis

BBAI BigBear ai Holdings Options Ahead of EarningsAnalyzing the options chain and the chart patterns of BBAI BigBear ai Holdings prior to the earnings report this week,

I would consider purchasing the 2usd strike price Calls with

an expiration date of 2025-1-17,

for a premium of approximately $0.40.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

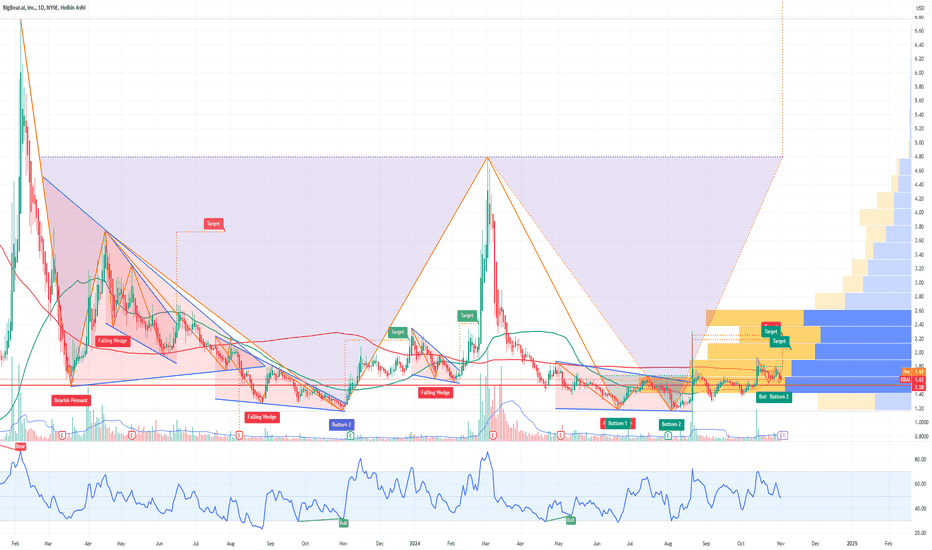

Bullish Outlook Based on Imbalances and Key LevelsHello traders,

Here’s my bullish perspective on BigBear.ai (BBAI) based on recent price action and technical analysis.

Key Observations:

Price Support: The $2.40 level has shown strong support, with price currently hovering near this area.

Imbalances: Two key zones of imbalance have been identified:

A lower imbalance near the support zone ($2.40).

An upper imbalance closer to the $4.50 level, indicating potential targets for upward movement.

BPR Zone: The Break of Price Range (BPR) at the mid-level suggests that the market may revisit this zone for confirmation before moving higher.

Resistance: The $5.20 level acts as major resistance and could be the final target of this bullish move.

Strategy:

Buy Entry: Near $2.40 support or upon confirmation at the lower imbalance zone.

Targets:

First Target: $4.50 (upper imbalance).

Second Target: $5.20 (major resistance).

Stop Loss: Below $2.20 to manage risk effectively.

Supporting Indicators:

RSI: The RSI shows a potential reversal from oversold conditions, supporting the bullish outlook.

Volume: A recent increase in volume signals growing interest in the stock, aligning with a potential move higher.

Outlook:

The chart suggests a bullish continuation, with the market likely filling imbalances and retesting resistance zones. This setup provides an excellent risk-to-reward ratio for long trades.

What are your thoughts on this analysis? Let me know your feedback or alternative perspectives in the comments!

Trade safe, and good luck! 🚀

#BBAI #TechnicalAnalysis #BullishOutlook #TradingPlan #SupportResistance #Imbalances

BBAI - Trying to fully BreakoutPrice has moved above Fib 1 at 4.80. If it can close above that today will be watching post and pre market. This is currently one of my larger trades using shares, calls, puts and LEAPS. If it breaks a big win. If not still a win but not the high 3-4 figure % return targeted. Good luck if playing.

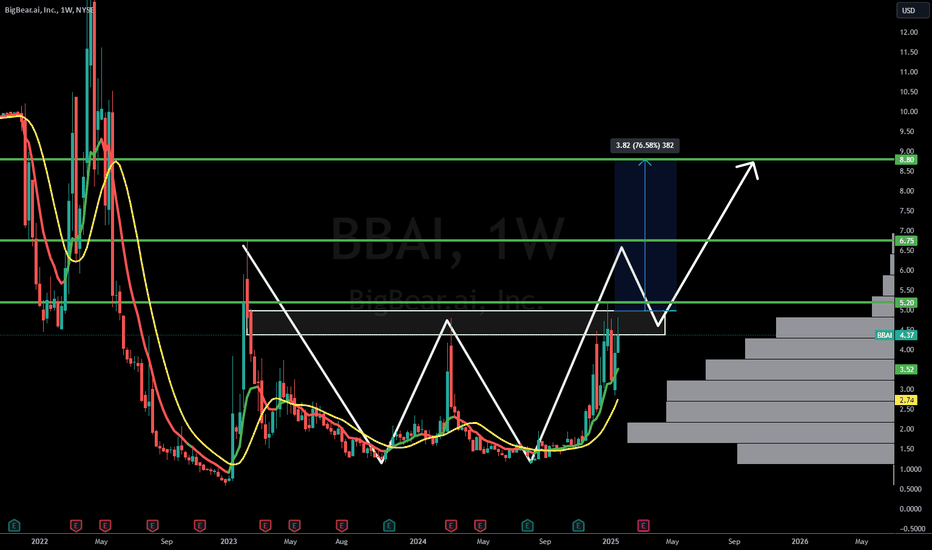

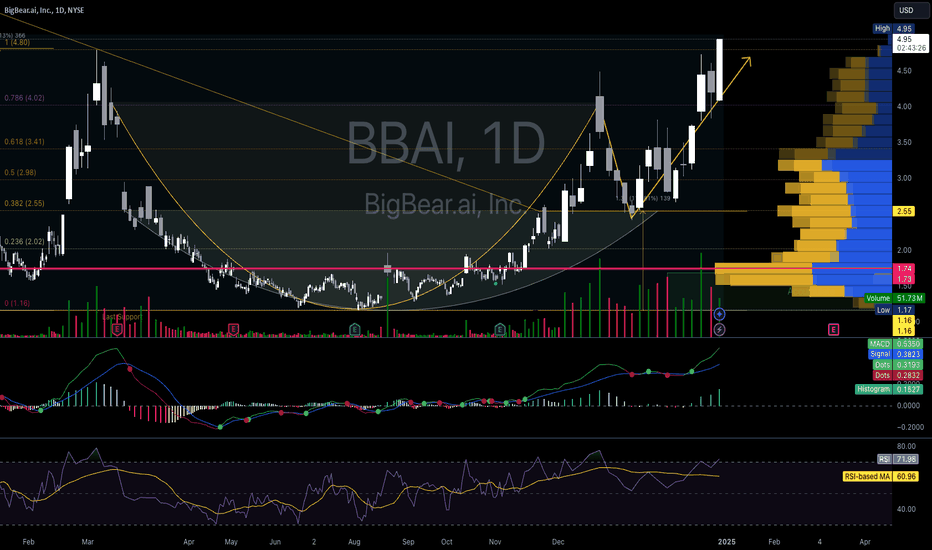

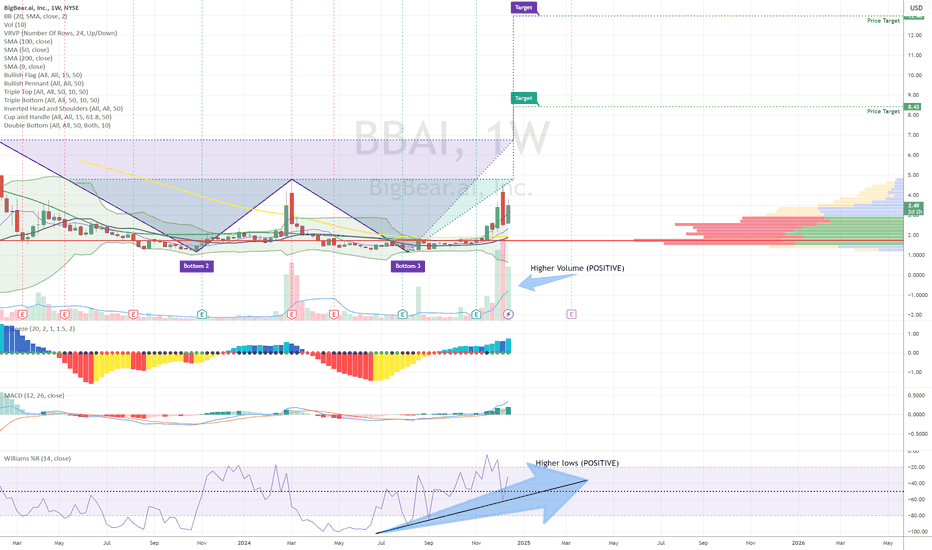

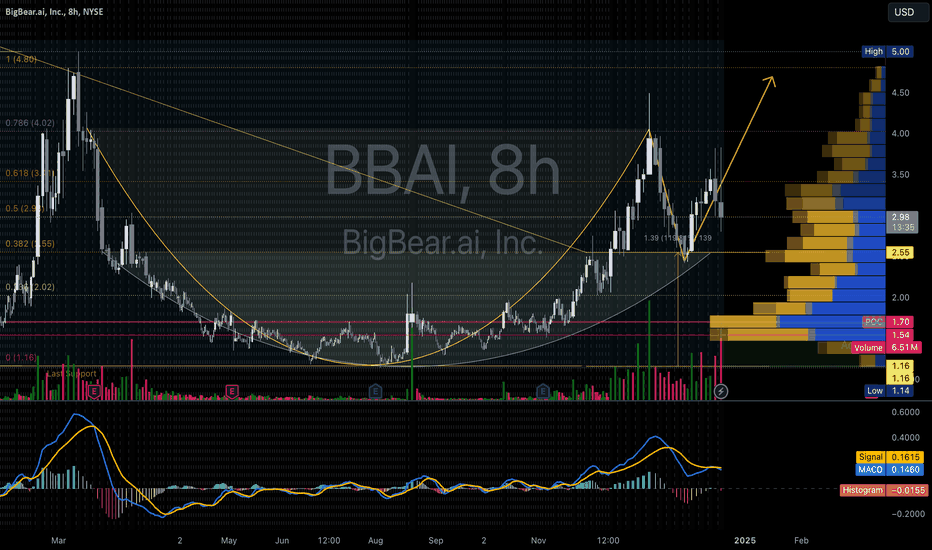

$NYSE:BBAI Double and Triple Bottoms with positive indicatorsThanks to @Money_Wins_Honey for getting this on my radar.

NYSE:BBAI is showing double and triple bottoms in the weekly as well as daily chart. The price targets are $8.43 and $12.96.

Here are my positives that support this trade:

The volume has been really going through the roof

Williams %R it tracking higher lows

It's in the AI space so it's HOT right now

Entry Points:

Higher Risk - Now, and place a stop below $3.00 (that's the current shelf that's being formed)

More conservative - wait until after breaking the double bottom resistance line (closing above $4.81)

Exits:

Double Bottom PT - $8.43

Triple Bottom PT - $12.96

Good Luck!