CRM trade ideas

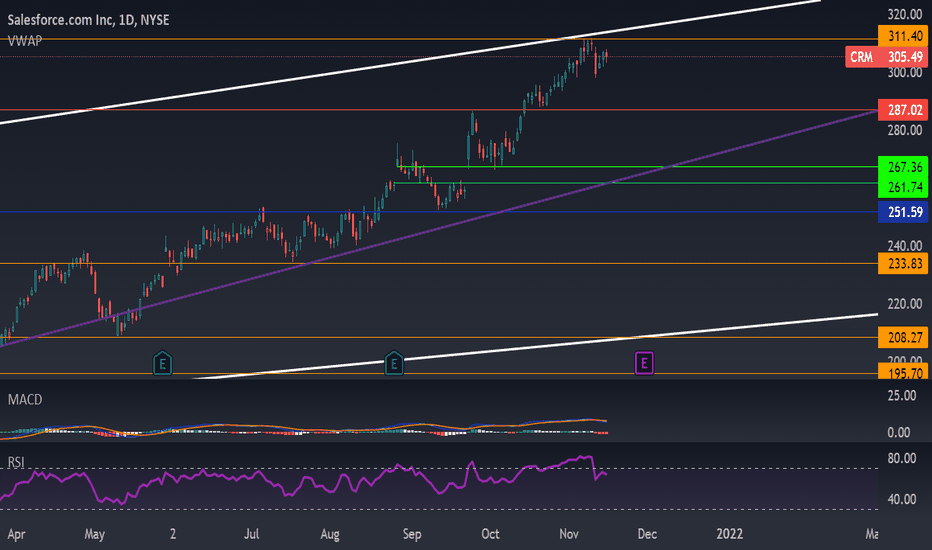

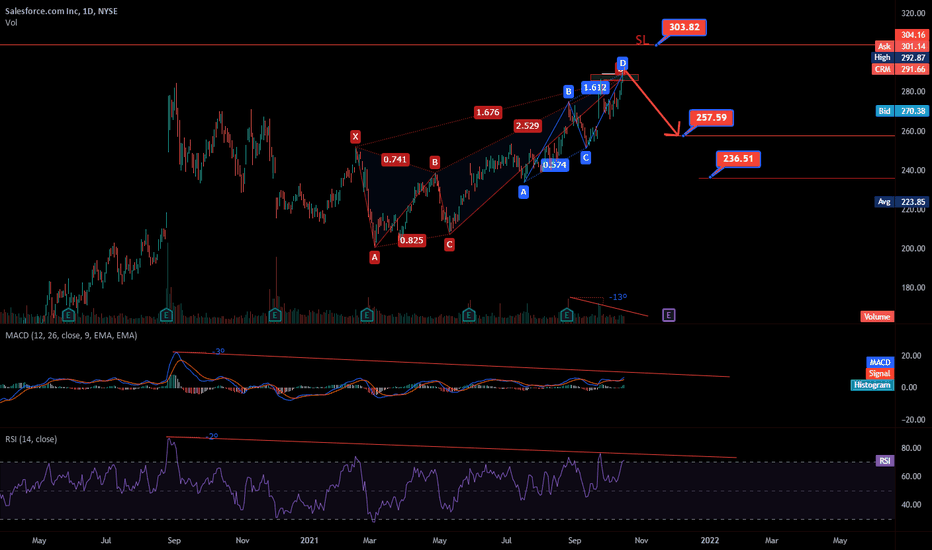

CRM Ready to Crash?CRM looks to have lost its bullish momentum. My guess is that it'll consolidate near the $312 resistance before ultimately falling to AT LEAST $287. My bold prediction is that it'll fall to $267 by Dec 10 and use the top of the gap as a support for a bounce but...Only Time Will Tell

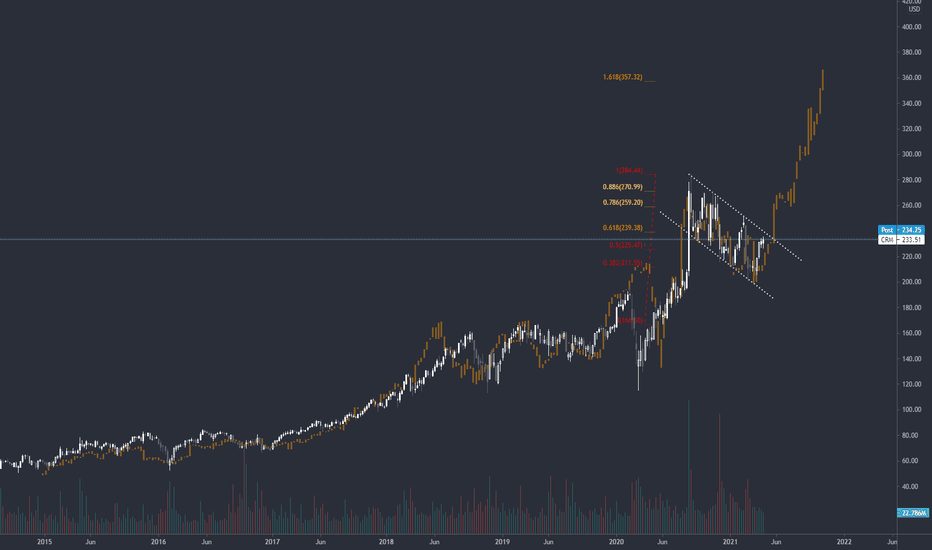

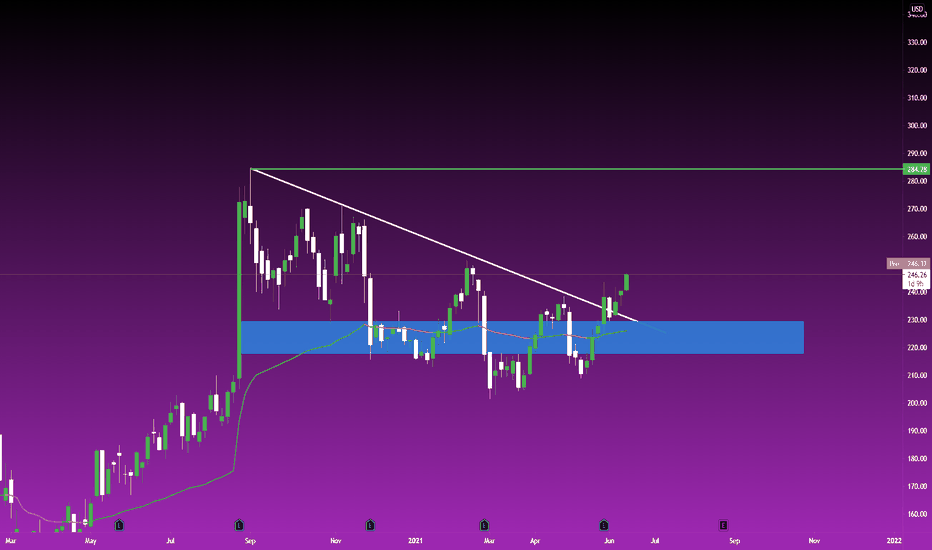

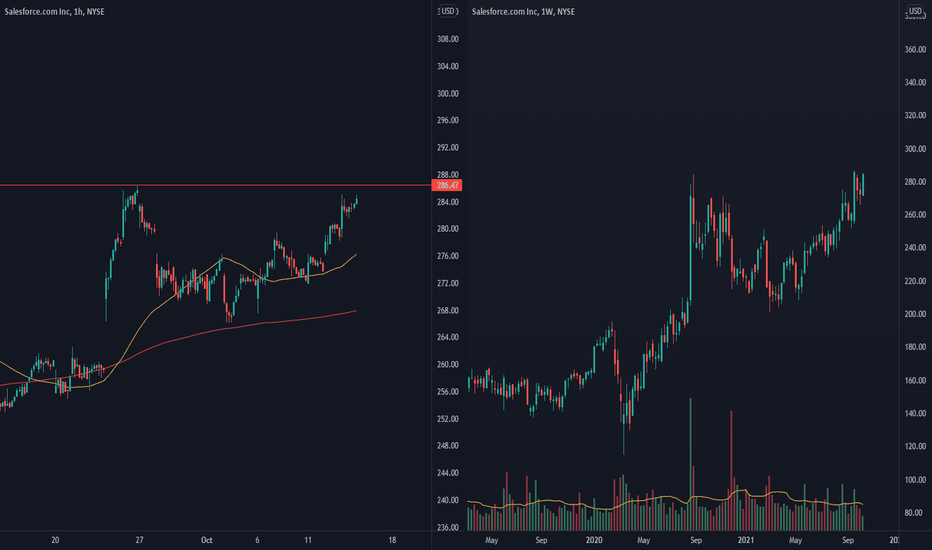

Let's all buy a metric shit ton of $CRM and get rich.This is a chart of $CRM. The bars pattern is of $FTNT. You can do this with $ADBE and a number of other tech stocks as well. You'll probably notice $ADBE is leading, I'm betting $CRM will follow. Both will catch up to $FTNT.

The structure is ready, we've been drawing this bull flag forever. We've lost all hope in stocks. Biden flushed everyone out that is scared of a little tax bump but only poors worry about taxes... they sold the bottom. It's time.

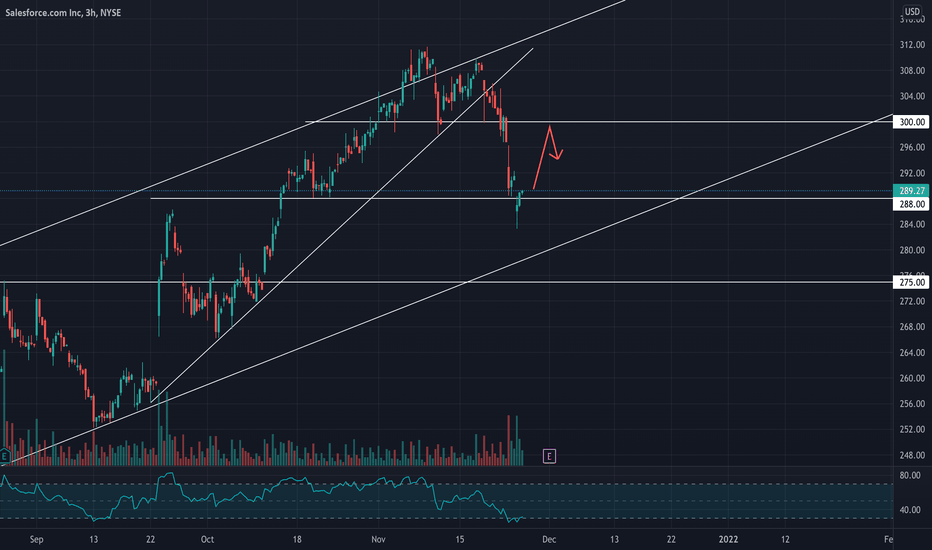

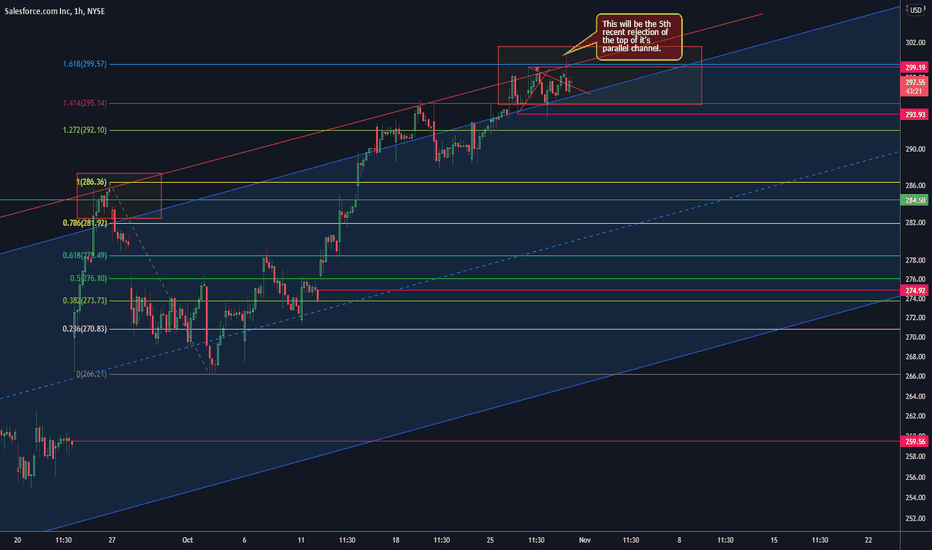

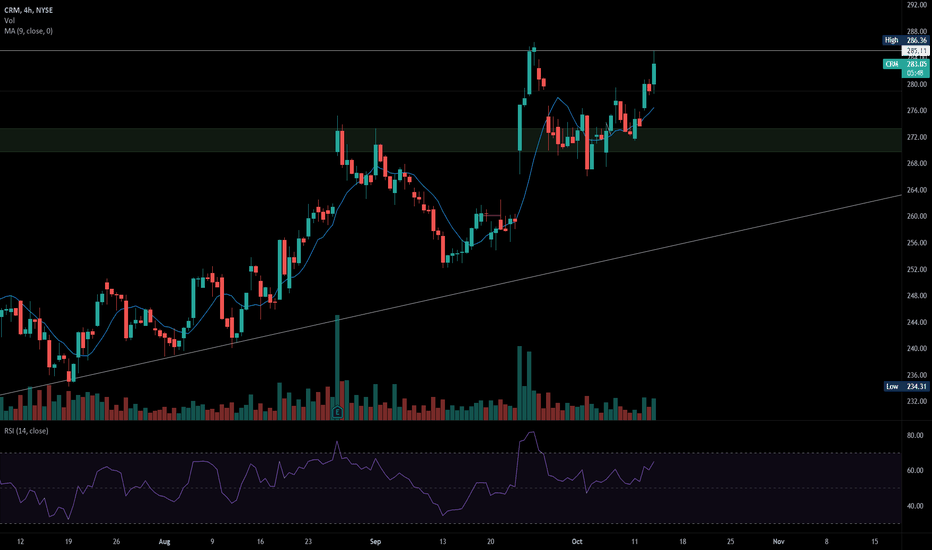

CRM Bearish DivergenceBeen expecting CRM to fall for a week or so yet the price continued to slowly rise, but it seems as though the time has come. CRM has created a bearish divergence at an all time high and it may get ugly. CRM created a six dollar gap on this previous uptrend - look for CRM to fill that gap.

Aggressive Entry: $294.84 (look for rejection on a retest)

Conservative Entry: $289.32

Price Target One: $278.27

Price Target Two: $260.61

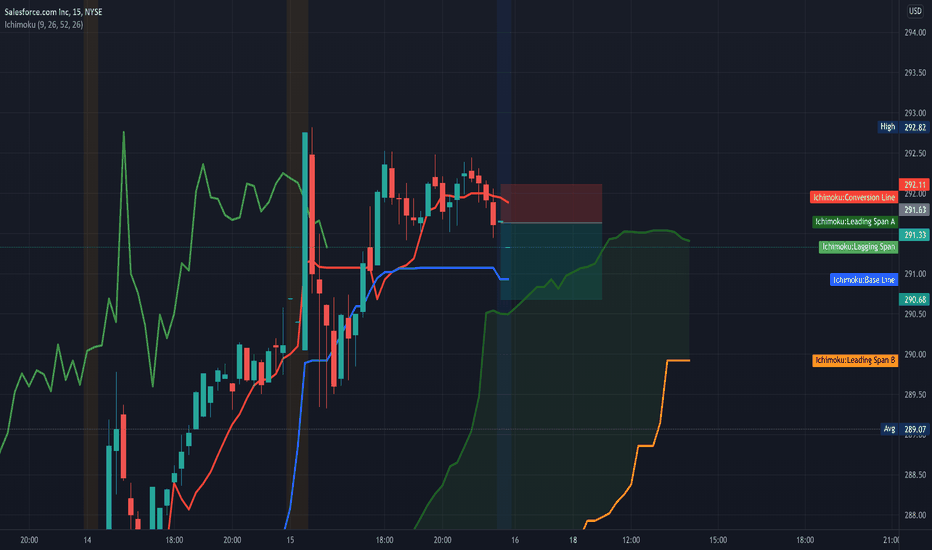

CRM Channel trade🐻Looking for a rejection off of resistance or 300$ today. Trendline support is at 296 , after that there's split channel support at 287 which is target 1.

Target 1 will be a tough area to short through as you can see the amount off touches and the 21ema is also in that area so look for a bounce there for a fall through to target 2

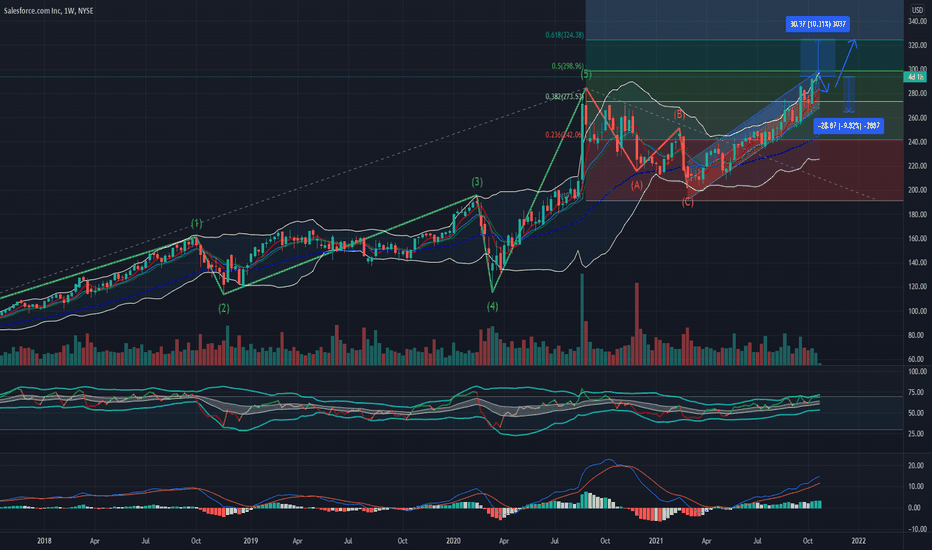

CRM in uptrend regression channelLooks like CRM could be in a uptrend regression channel.

If this is true, a possible price target might be 0.618 Fibonacci which is ~324$ or ~+10%

Stop loss: 269$ or -8.5%

==> risk/reward ratio a little bit better than 1:1 is not very tempting - so I don't recommend to enter the trade now.

If you're long already you might want to hold for more profit.

This is not financial advice.

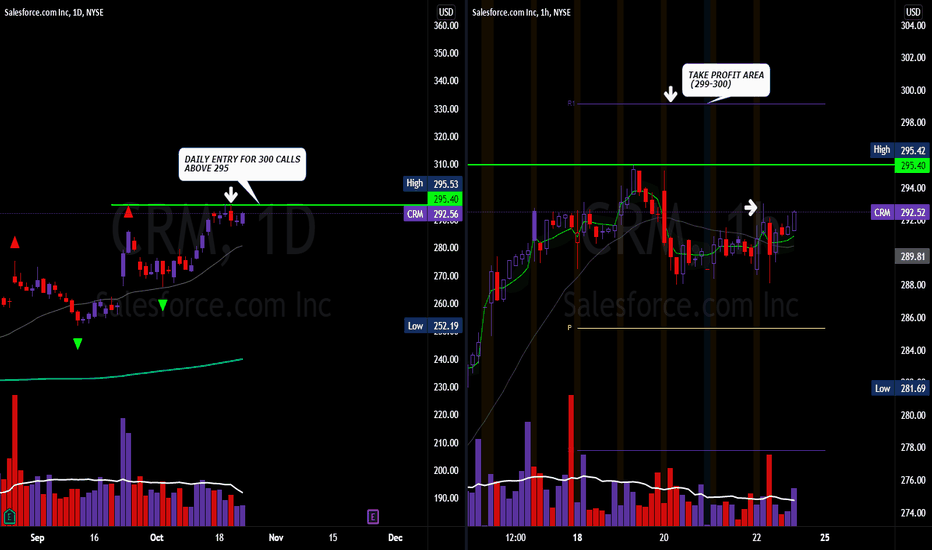

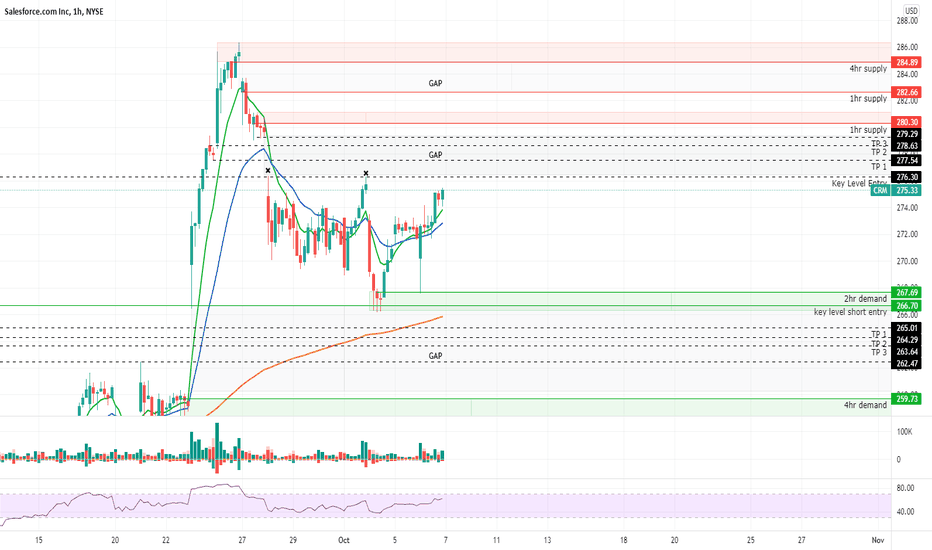

CRM POTENTIAL 5 POINT MOVECRM is showing a potential break on the Daily Chart for a short 5 point move to 300.

The 1hr is already showing an entry with initial room to 295 first and if price breaks 295, it has room to 299-300.

Stop loss 289.50.

I like the consolidation back to the 21Ma on the daily chart and the weekly chart isn't bad either.

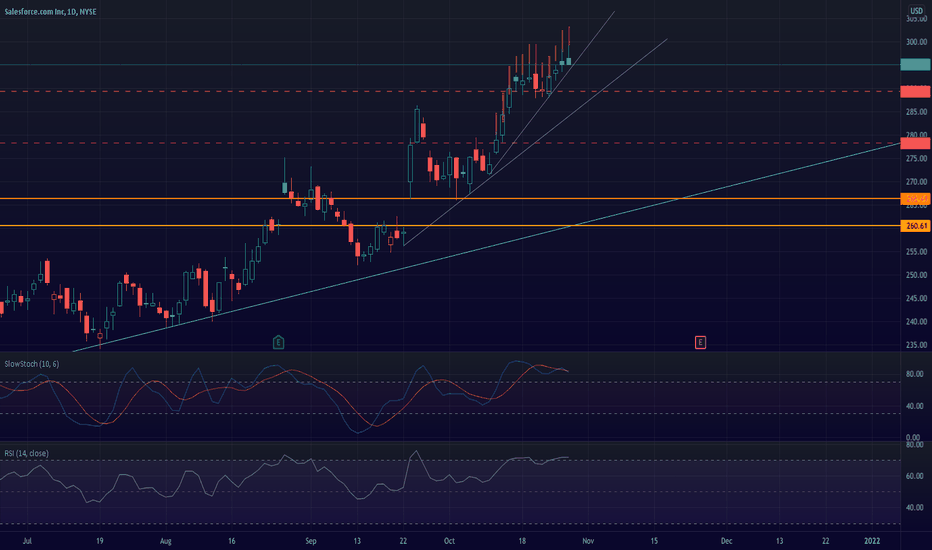

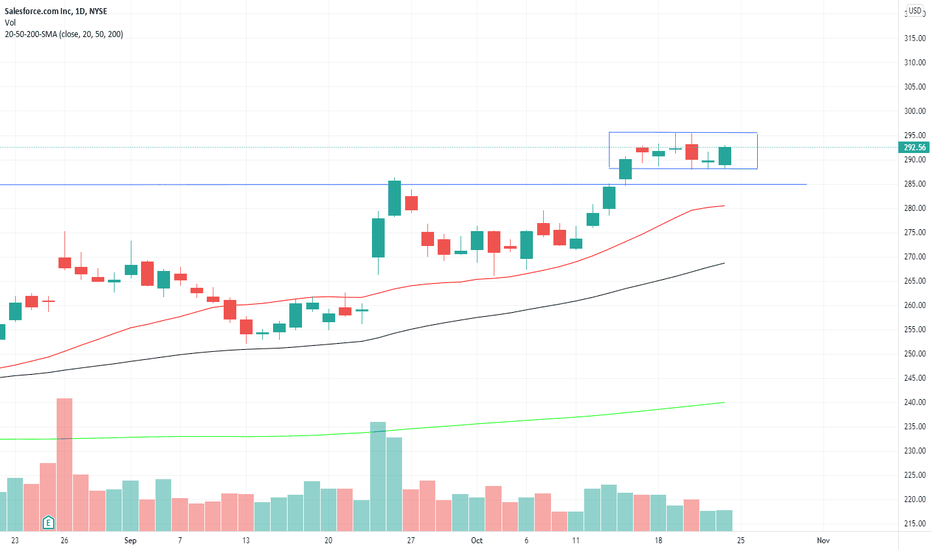

CRM BearishCRM has been trending up since last week and now it looks as though investors are getting ready to take profits.

- Slow Stochastic is curving down at the top of channel

+ Slow Stochastic is at 97

+ RSI overbought

+ MACD shows slight slowing

+ gravestone Doji at the top of uptrend (bearish)

October 19 CRM started to trend downwards around mid-day, so momentum is slowing.

Price Target One: $284.54

Price Target Two: $275.44

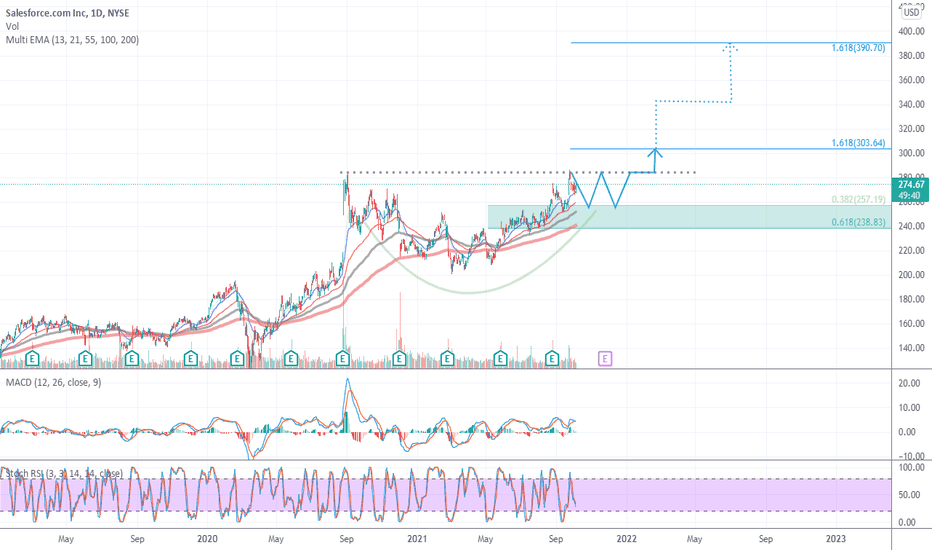

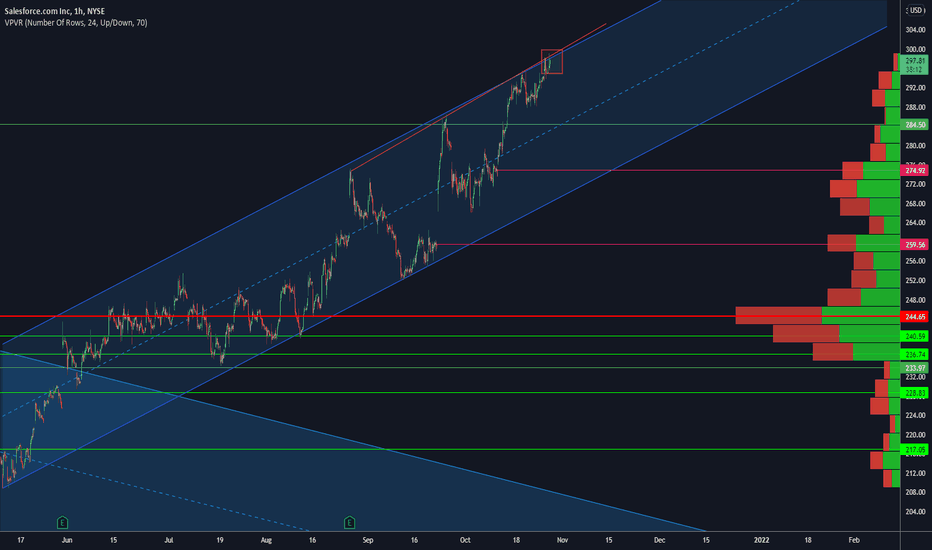

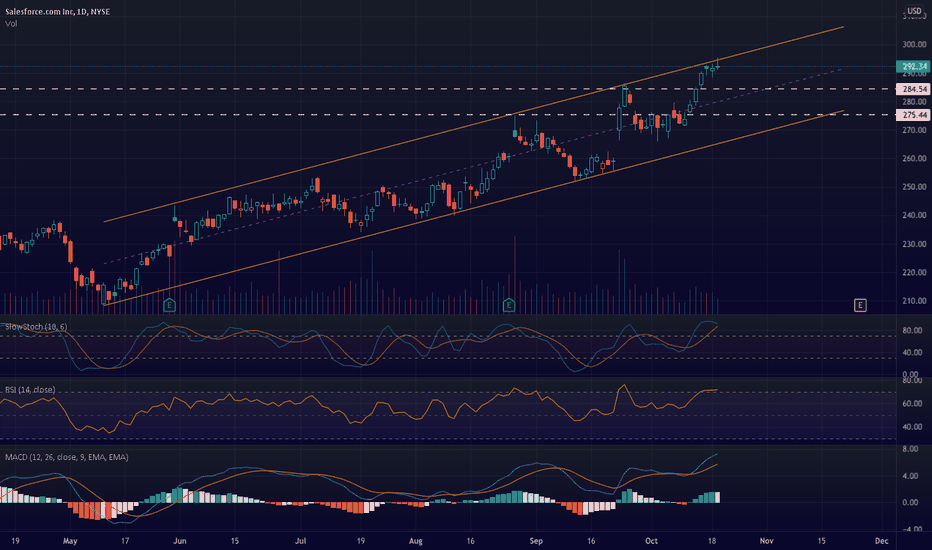

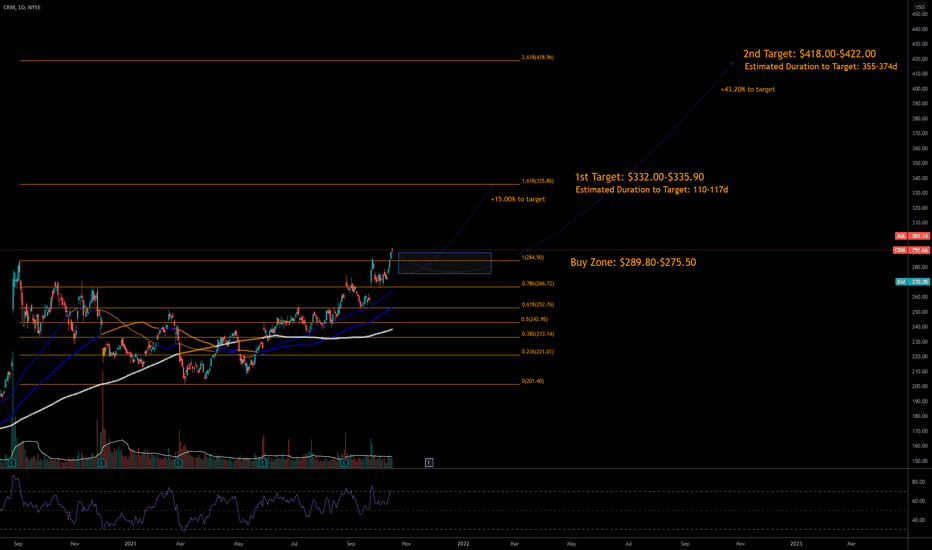

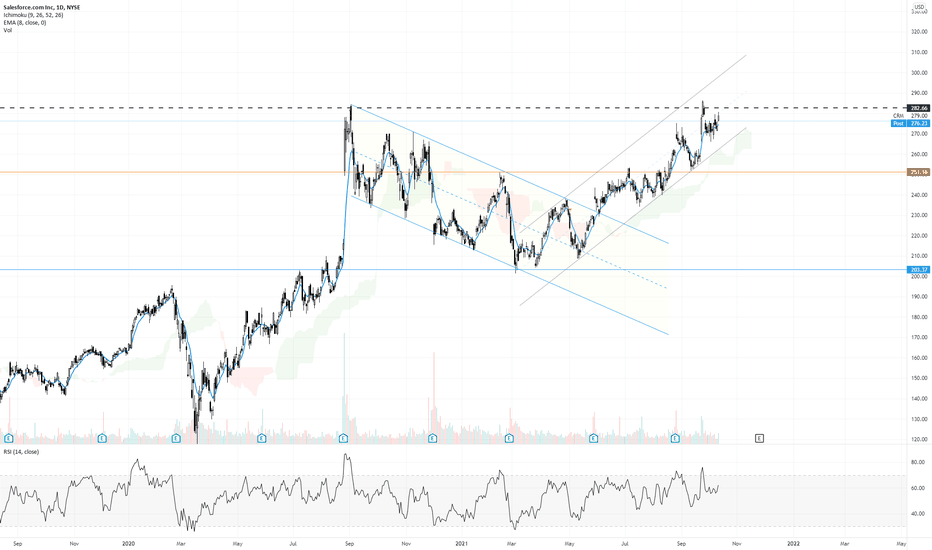

10/17/21 CRMSalesforce.com Inc. ( NYSE:CRM )

Sector: Technology services (Packaged Software)

Current Price: $291.66

Breakout price trigger: $284.50 (hold above)

Buy Zone (Top/Bottom Range): $289.80-$275.50

Price Target: $332.00-$335.90 (1st), $418.00-$422.00 (2nd)

Estimated Duration to Target: 110-117d (1st), 335-374d (2nd)

Contract of Interest: $CRM 1/21/22 300c, $CRM 1/20/23 400c

Trade price as of publish date: $12.50/cnt, $9.85/cnt