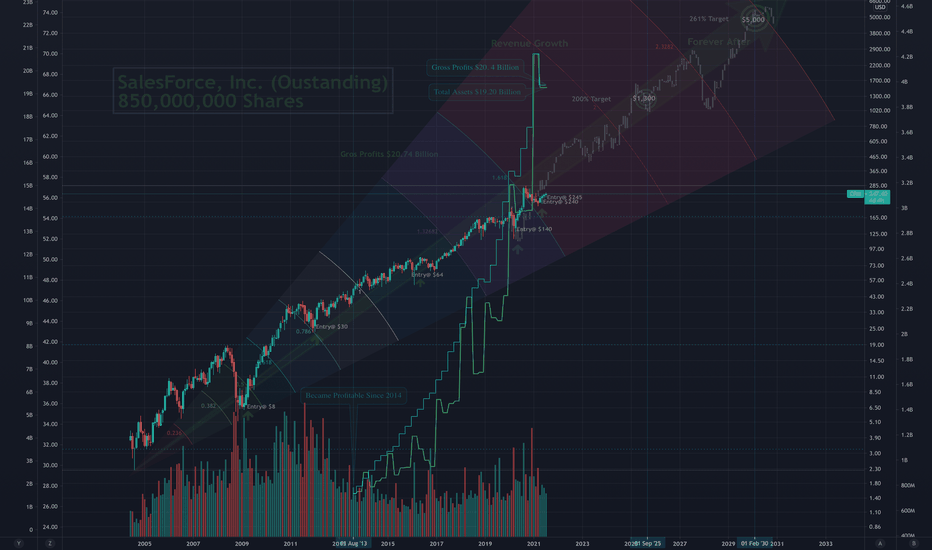

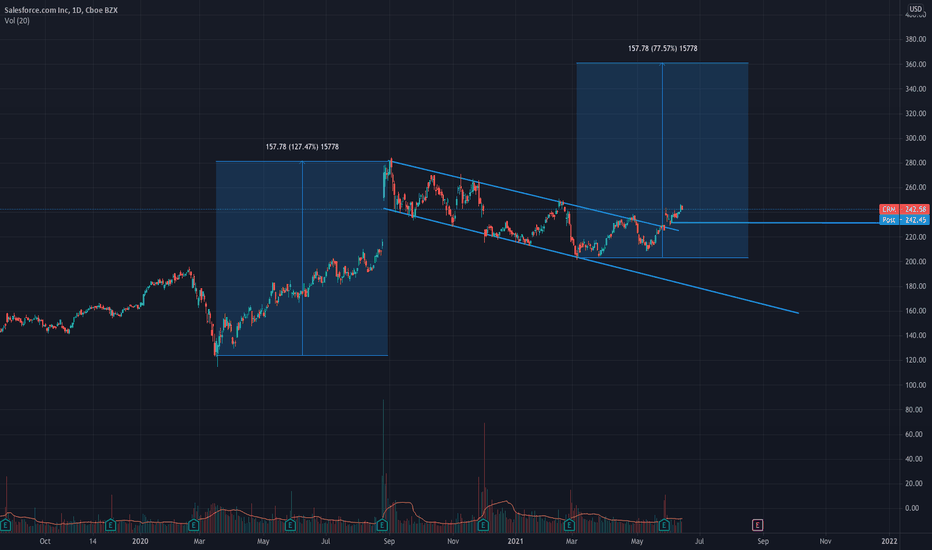

Entry CRM@ $245 Target@ $1,300 Sept 1, 2025 Value GrowthSalesForce, Inc . (CLOUD)

Entry CRM@ $245 Target@ $1,300 Sept 1, 2025 Short Term

Entry CRM@ $245 Target@ $5,000 Feb 1, 2027 Long Term

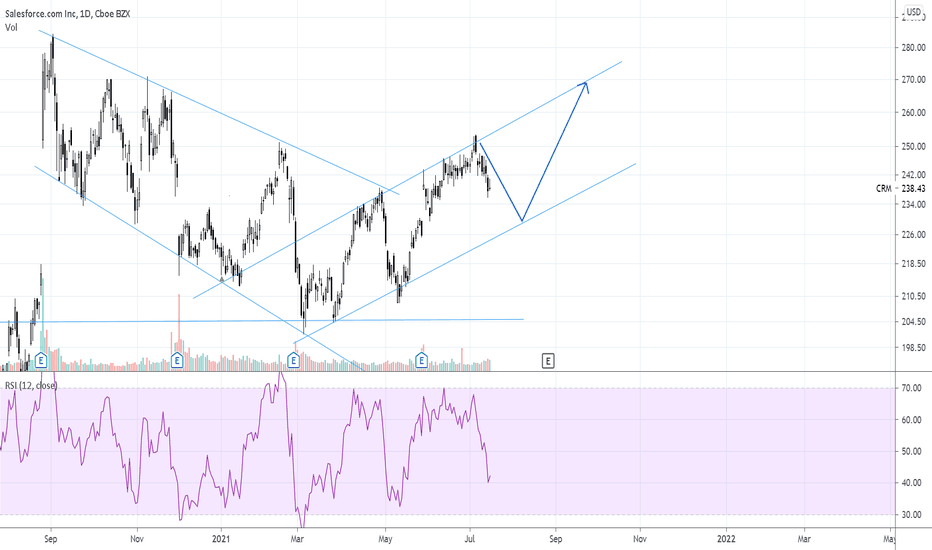

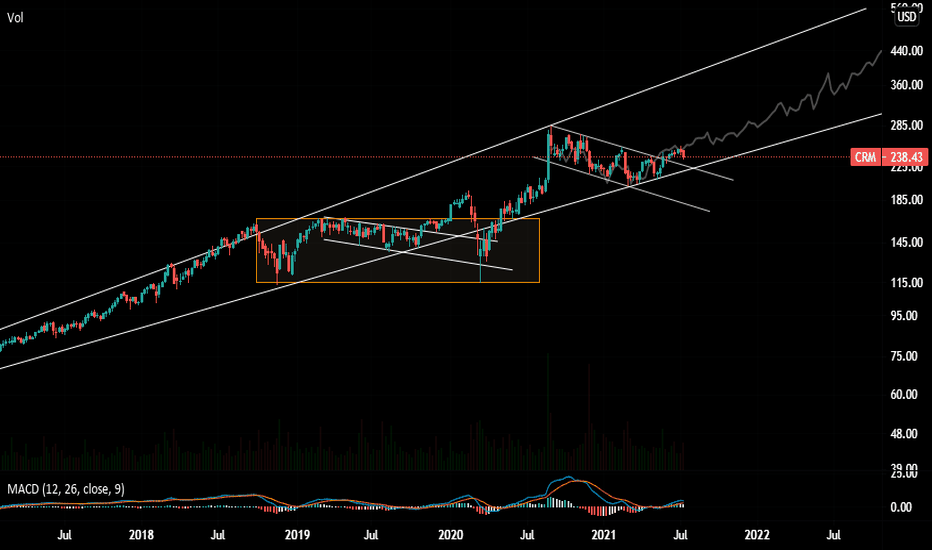

Technical Analysis Conditions:

1. Break-out of Channel $285

2. Pull-back towards $200

3. Ideal Entry $210 to $250

4. Target @ $1,300 to $5,000

5. Impressive Revenue Growth

Fundamental Assets Descriptions:

Sell smarter and faster with the world’s #1 CRM solution.

See how Salesforce is helping businesses of every size with:

Lead and contact management

Sales opportunity management

Customizable reports and dashboards

Align, manage, and motivate sales teams with collaboration tools

and built-in CRM insights. Drive growth in a virtual world with the

best in class sales solution. Learn more.

Company Website: www.salesforce.com

CRM trade ideas

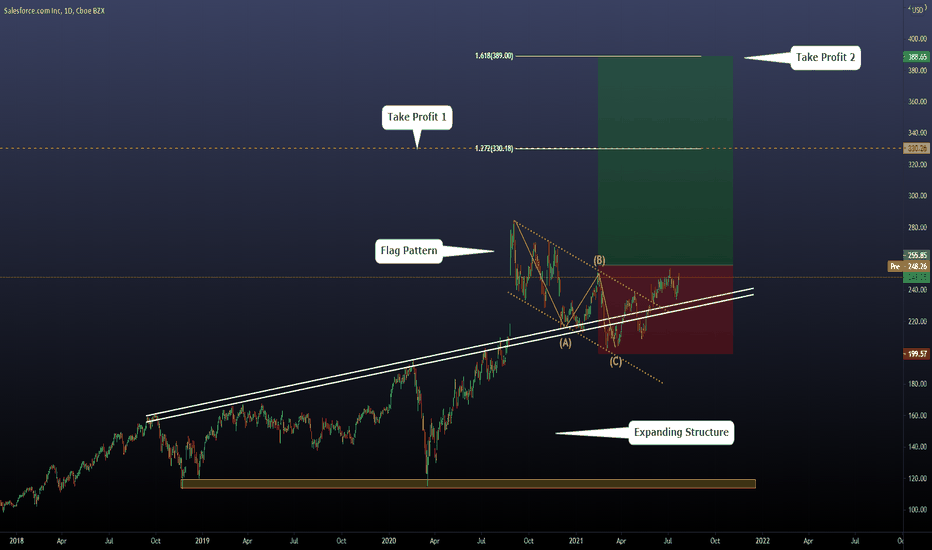

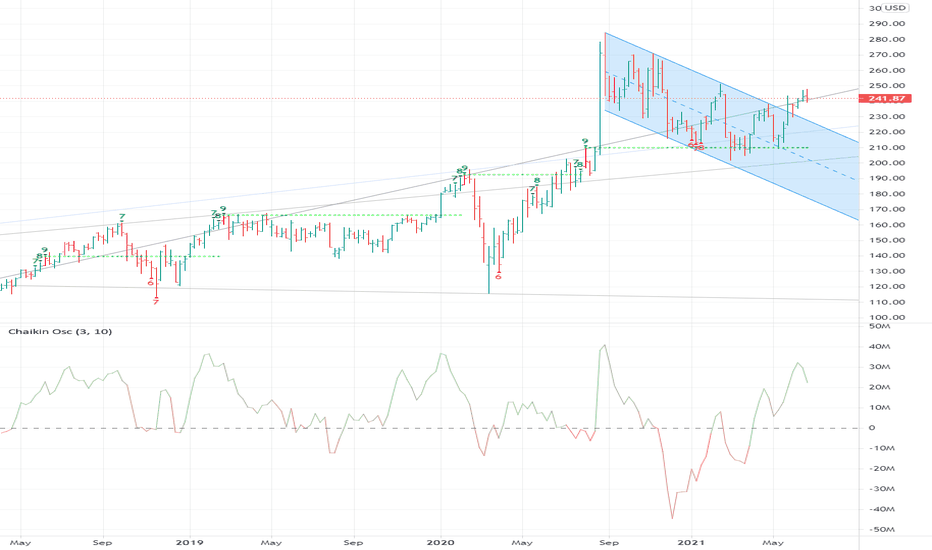

Trade Idea on CRM - Trading the Flag PatternHi! Today we will share with you a trade idea (real setup we will execute on CRM)

First, let's understand what we can see here from a technical perspective.

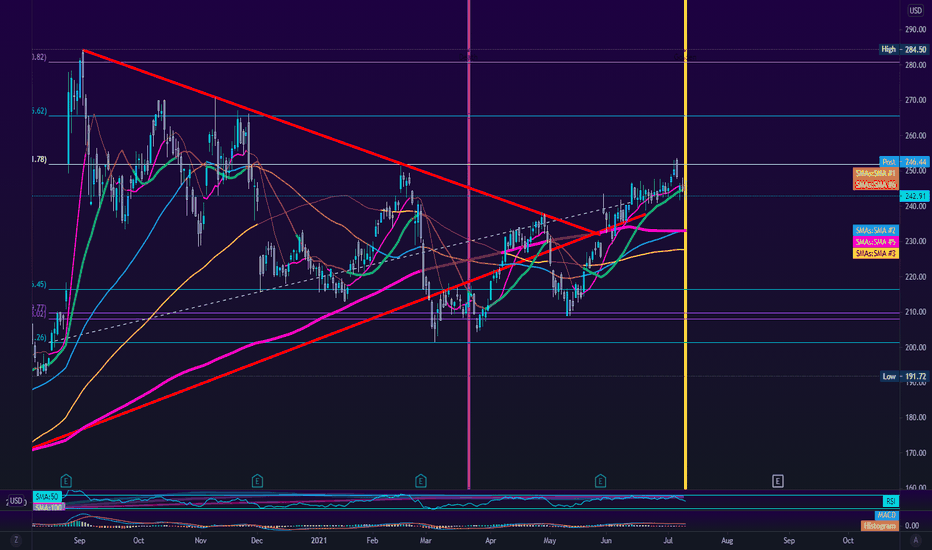

a) The price was inside an expanding structure defined by the dynamic support-resistance trendline (white line) and the support level.

b) After a huge GAP that broke the expanding structure, we observed a 270 days consolidation (Flag Pattern).

c) In June, we saw the breakout of the Flag Pattern that tends to anticipate the beginning of a new movement once the price reaches a specific confirmation level (ABOVE "B")

d) Based on the previous items, we have defined pending orders above "B" and stop loss below "C" the key idea of these levels is that they are on price levels that provide good confirmations in term of broken levels. This type of approach increases the possibility of success.

e) What about the target? We have used a principle developed by Elliott, "New Impulses have correlations with the previous ones." In this case, using the previous impulse (Before the Flag Pattern), we can draw Fibonacci Extensions (nothing more than fixed proportions) to define 2 targets.

f) How long can it take this movement if everything goes as expected? Between 200 and 350 days.

g) How much do you risk in a setup like this? ALWAYS 1% OF our capital, never more. What does it mean? If you have a 10.000USD balance, you want to have a maximum loss of 100USD if the price reaches the stop loss.

Is this a forecast? Not at all; this is a scenario that our system tells us, "Here you have a 50% chance of having a winning setup, with a risk-reward ratio of 2.36" With that clear, this is a bet we will take 100 times. The most probable thing is that we will be wrong 50 times and right other 50. Our main goal is developing a positive expectancy over the long term. In other words, "an edge."

Thanks for reading!

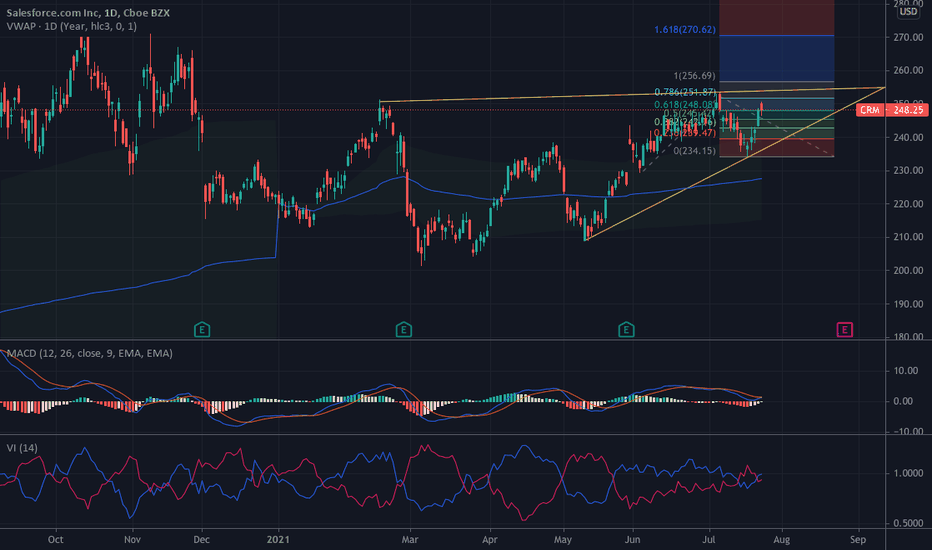

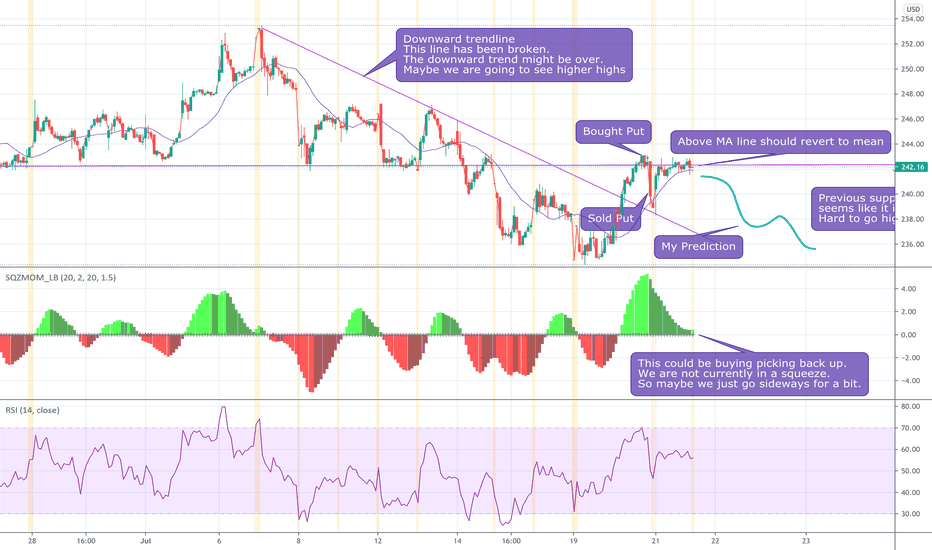

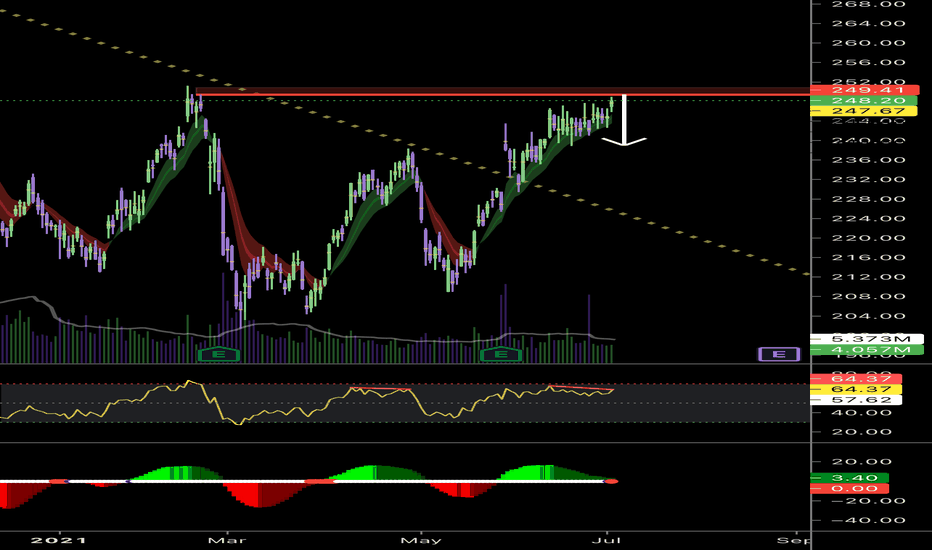

CRM MONSTER MOVE COMING!!!-We successfully closed above the 9-day ema and had a little pullback

- Now we have a clear pathway towards next level of resistance we can take a position here on monday once we see a clear trend starting to form

-you can also wait till we break that resistance level then take a safer position.

-Once we break levels there then we are gonna be sitting in deep profit already and this can go back to ATH from here.

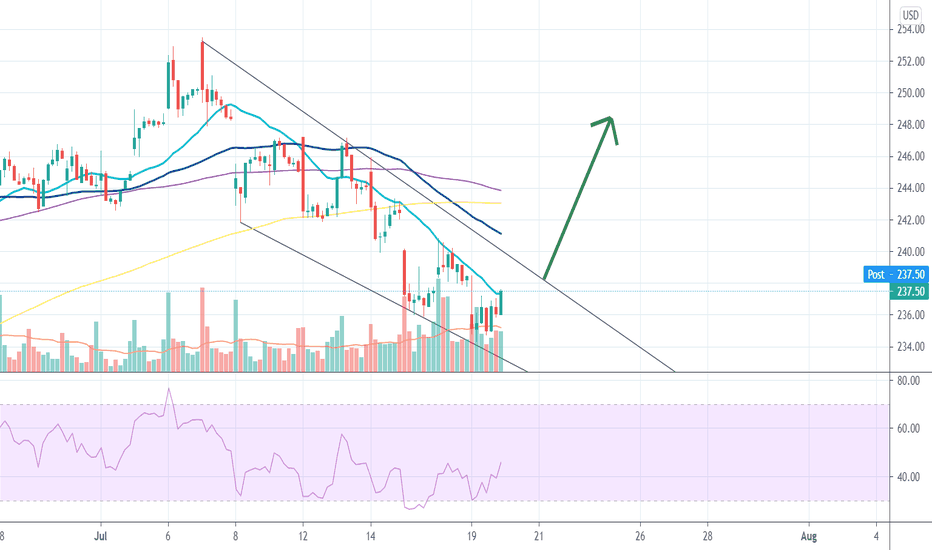

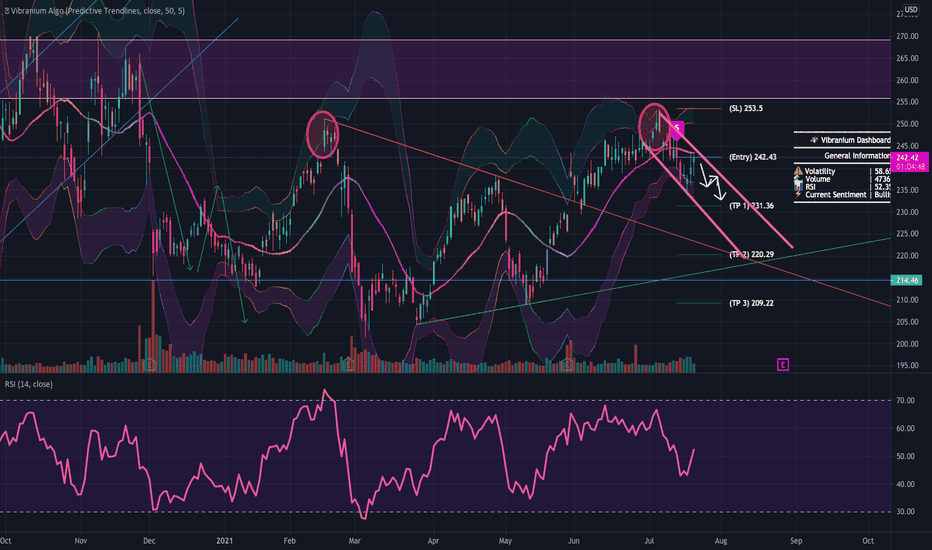

double top formed? i think so! lets see what happens.purple range was resistance from 2020, recently double topped/fake-out breakout from our FEB highs this year, potential short opportunity here if this small downtrend channel holds. I can see this bouncing back to the upside once we get close to our TP 2 of 220.29, very good risk reward there for longs. good luck :) like n follow for more.

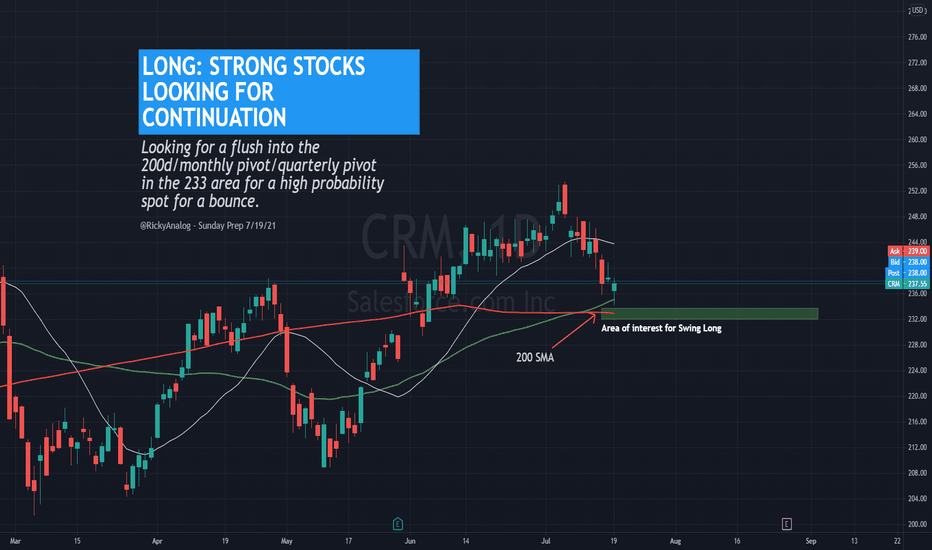

Sunday Prep 7/19 - $CRM Looking for a flush into the 200d/monthly pivot/quarterly pivot in the 233 area for a high probability spot for a bounce. Added bonus is that level is ALSO the 20sma on the weekly. I will also be starting a swing long down in that area in my longer term account. But will just nibble for now due to the early comments mentioned about the broader market.

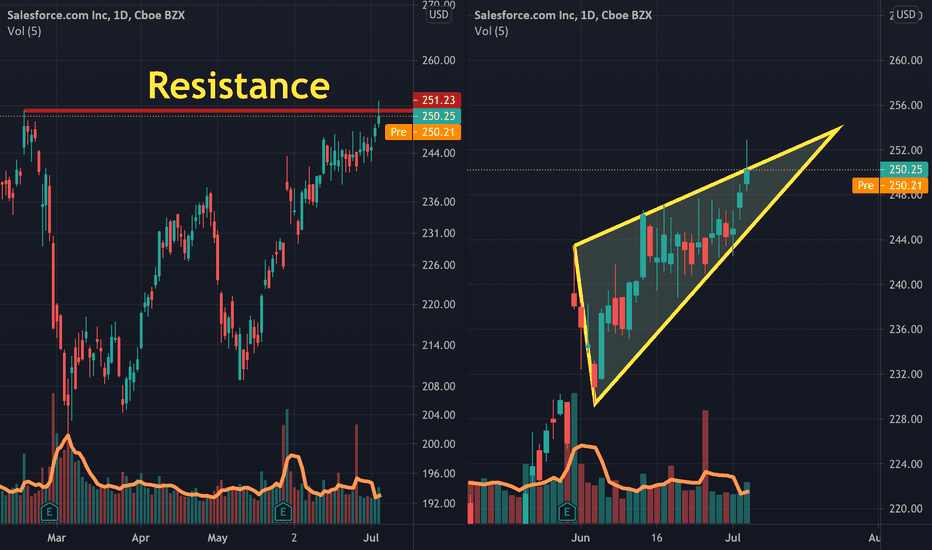

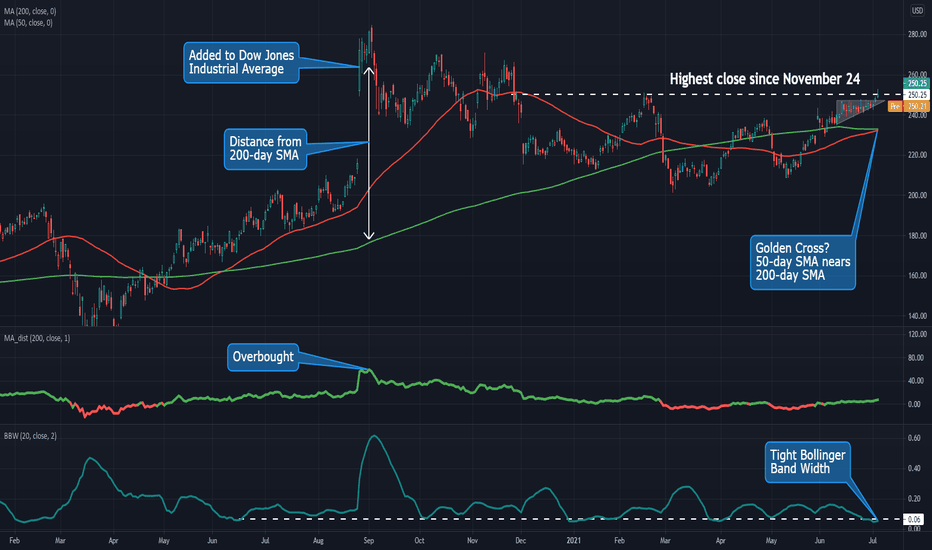

Salesforce.com Could Be Squeezing Toward a BreakoutSalesforce.com, like Amazon.com yesterday, has gone nowhere since spiking to new highs last summer. However now it’s showing signs of a breakout.

This chart includes the same custom Distance from MA script, showing that CRM traded 59 percent above its 200-day simple moving average (SMA) early last September. That last time it was that extended was 2006. However now it’s back to a much more typical reading below 10 percent.

Next, price action has been so quiet that Bollinger Band Width has slipped to its longer-term extreme around 5 percent. Also notice how the higher lows recently formed an ascending triangle that the cloud pioneer has escaped the last two sessions. These suggest price is ready to expand after compressing.

Additionally, the 50-day SMA is nearing a “Golden Cross” above the 200-day SMA.

Finally, consider the $250 level where CRM peaked in mid-February before knifing lower. Yesterday it challenged that area and registered its highest closing price since November 24. This suggests the market has come to accept the new price range.

TradeStation is a pioneer in the trading industry, providing access to stocks, options, futures and cryptocurrencies. See our Overview for more.

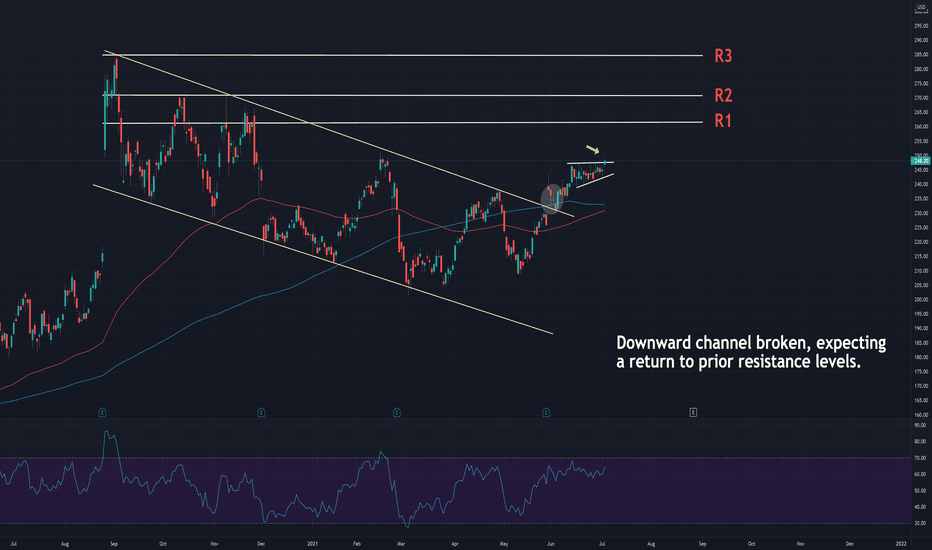

CRM - Time for Calls!After a successful acquisition of #Slack by July 31st (per their regulatory filing ), #CRM is poised to return to previous resistance levels.

I like ~ $261 (R1) as the next clear direction for the stock. If broken, watch for a return to ~ $270 (R2) as well.

With data provided by MarketBeat.com , the average consensus price target from analysts is $278.65, indicating a possible short-term upside of 12.27%.

[Trade Review]How I traded $SQ,$ROKU, $HD, $ROKu again.. HUGE FIn this video I will reviewing trades I took on July 1 & 2nd , 2021 which were $SQ, $ROKU, $HD, After taking a massive hit we recovered well with patience and some time to clear our mind and a little bit of backdating we made a huge comeback on the small account! Traded these tickers using my knowledge of technical Analysis , sharing my levels: Support & Resistance , my trendlines , Fibs, Waves, Price Action, Channels , Emma's, and prior experienced , while providing both bullish & bearish scenarios for you to be able to understand my analysis and wait for confirmation as always!

Want to see more content like this? Make sure to Like and Subscribe!

Salesforce - Strong Buy!-Salesforce's (NYSE:CRM) stock recently popped after the cloud services company posted its earnings report for the first quarter of fiscal 2022. Its revenue rose 23% year-over-year to $5.96 billion, beating estimates by $70 million, and grew 20% on a constant currency basis.

-Its non-GAAP earnings increased 73% to $1.21 per share, which cleared expectations by $0.33, as its GAAP earnings more than quadrupled to $0.50 per share. Gains from its strategic investments boosted its non-GAAP and GAAP earnings by $0.24 and $0.23 per share, respectively.

-Salesforce's revenue growth accelerated from its 20% growth in the fourth quarter of fiscal 2021. It also surpassed its own guidance for about 21% growth, which had already been raised in the fourth quarter. Its revenue increased by the double digits across all four of its core businesses.

-Salesforce's operating cash flow jumped 76% year-over-year to $3.2 billion during the first quarter, while its free cash flow soared 99% to $3.1 billion. It usually generates its strongest cash flow growth in the fourth and first quarters, since that's when it usually collects its annual fees.

-Nonetheless, Salesforce's year-over-year growth remains robust, and indicates it can still easily fund new investments and acquisitions. Its cash, cash equivalents, and marketable securities climbed 53% year-over-year to $15 billion during the quarter.